Does the Equity Market Lead the Currency Market?

Market timing should be impossible

October 2021. Reading Time: 10 Minutes. Author: Kaushik Ganesan.

SUMMARY

- Past equity market returns seem to predict currency returns

- Such a currency timing strategy may be interesting as a diversifier

- However, it is difficult to rationalize the results

INTRODUCTION

Bloomberg TV at 08:30 am EST: “The S&P 500 futures are trading lower as the US Dollar depreciated against G10 currencies overnight.”

CNBC at 9:45 am EST: “The USD appreciated given a strong opening in the S&P 500 due to better economic data.”

Stocks, bonds, currencies, and commodities are all interrelated and it is difficult to answer what variable is leading and which is lagging. Considering the starting and ending points of this complex multi-dimensional system of relationships is like asking, “Which came first, the chicken or egg?”.

However, despite this conundrum, financial analysts and journalists are constantly outlining feedback loops when discussing markets. In this research note, we will follow such a feedback loop and hypothesize that the performance of the equity market determines the direction of the currency market.

METHODOLOGY

Investing in currencies is like security selection in any other asset class and investment decisions can be based on discretionary or systematic signals. The largest trade is likely the carry trade, where currencies of countries with high interest rates are bought and ones from low-interest rate countries are shorted (read Don’t Get Carried Away by Carry).

Instead of using the interest rate to choose a currency pair, we are going to use the trailing 12-month equity market returns for each country to decide on the currency pair, i.e. use equity market momentum as a signal. If the difference between the 12-month equity return is positive, then buy the forward one-month contract of that currency pair, else short the currency pair. In-line with momentum research we ignore the most recent month of the last 12 months and rebalance the portfolio on a monthly basis.

We will refer to the strategy as the currency timing strategy.

EUR/USD PORTFOLIO

The Euro against the US Dollar is the most traded currency pair in the world. As explained in the methodology section we will be taking the returns of the European and US stock markets as a basis for selecting either the EUR/USD or the USD/EUR (read Equity Factors & The Mighty US Dollar).

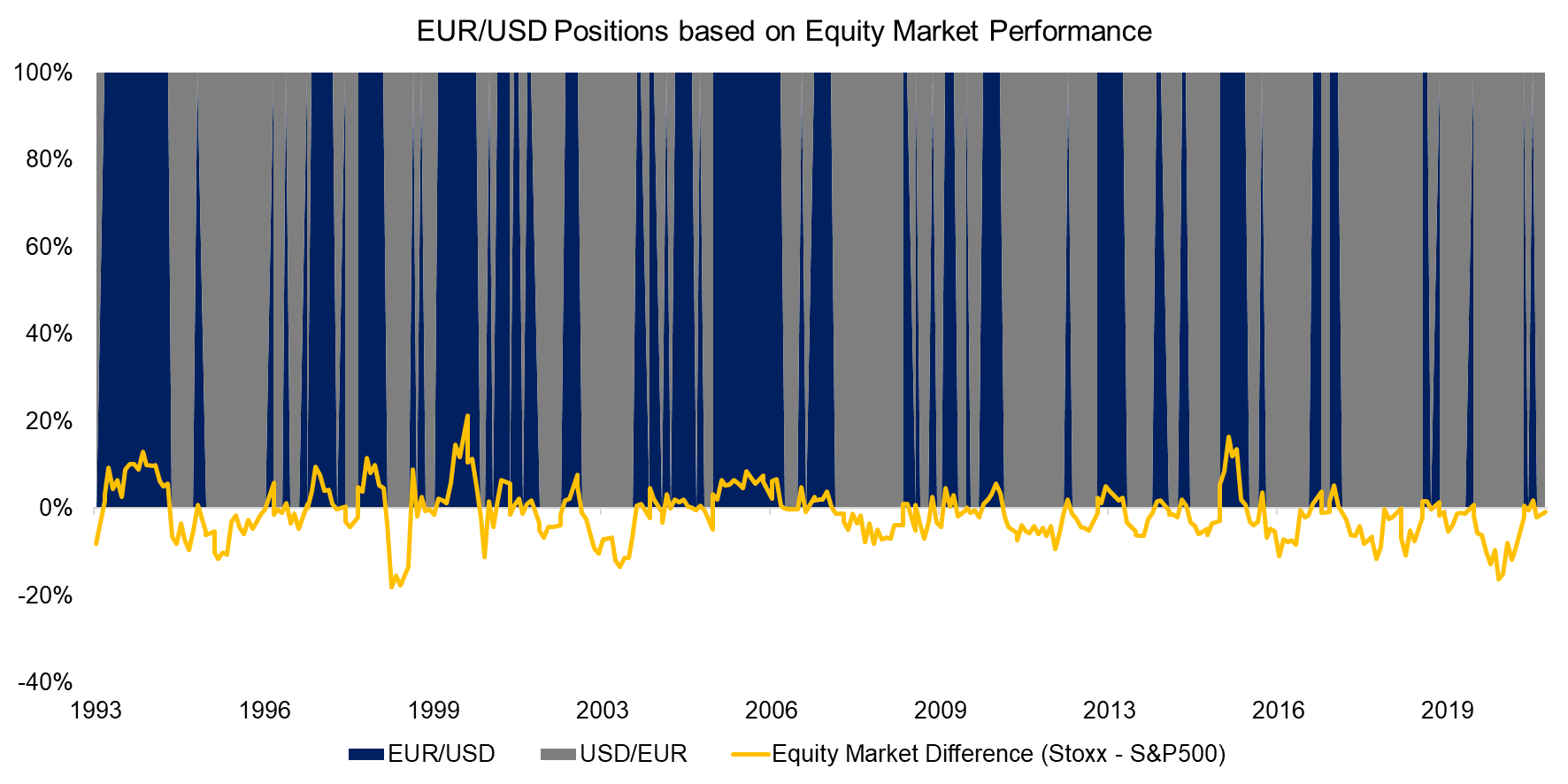

We go long on the one-month forward contract of EUR/USD if the difference between the 12-month return of Europe stock index (STOXX Europe 600) and the US stock index (S&P 500) is positive, otherwise long on the one-month forward contract of the inverse of the pair, i.e. the USD/EUR.

Backtesting this strategy in the period from 1993 to 2021 highlights that there was significantly more exposure to the USD/EUR than to the EUR/USD, which is explained by the S&P 500 outperforming the Stoxx Europe 600 most of the time during the observation period.

Source: FactorResearch

In contrast to stock markets, currencies represent zero-sum games. If one currency goes up, another one goes down proportionally. The EUR/USD exchange ratio is essentially unchanged in the period from 1993 to 2021, although there were many cycles in between.

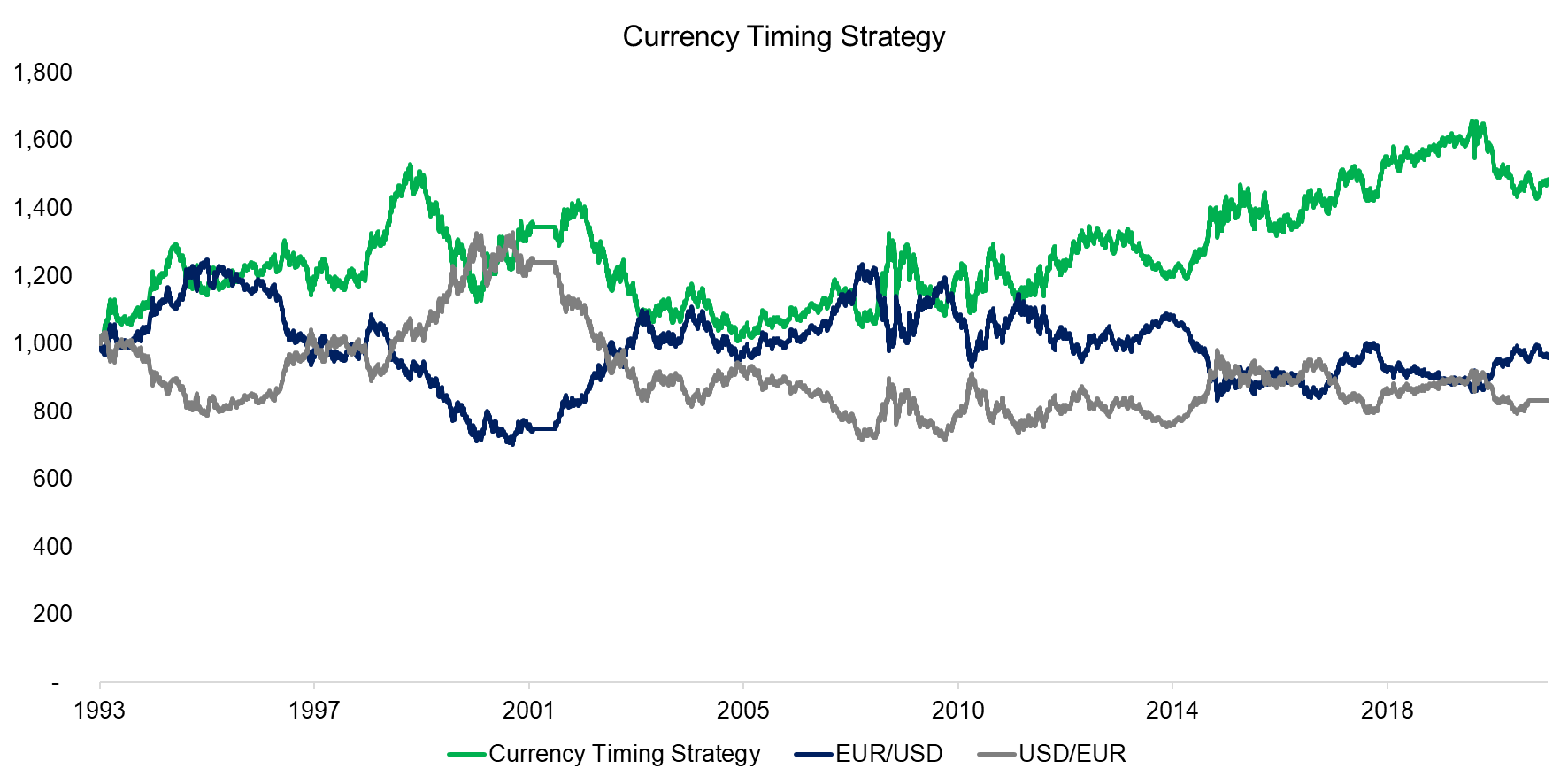

Looking at the performance of the currency timing strategy we observe two things:

- The performance mirrors more the USD/EUR than the EUR/USD, which is explained by the higher exposure to the former given that the US stock market has outperformed the European one more frequently since 1993

- The strategy did not manage to generate significant excess returns until 2005, where thereafter the performance was moderately positive

Source: FactorResearch

EQUAL-WEIGHTED G10 CURRENCY PORTFOLIO

Next, we apply the currency timing strategy to the G10 currencies, which includes the USD, EUR, CAD, JPY, GBP, SEK, NOK, AUD, CHF, and NZD. Specifically, we take the USD against the other nine currencies.

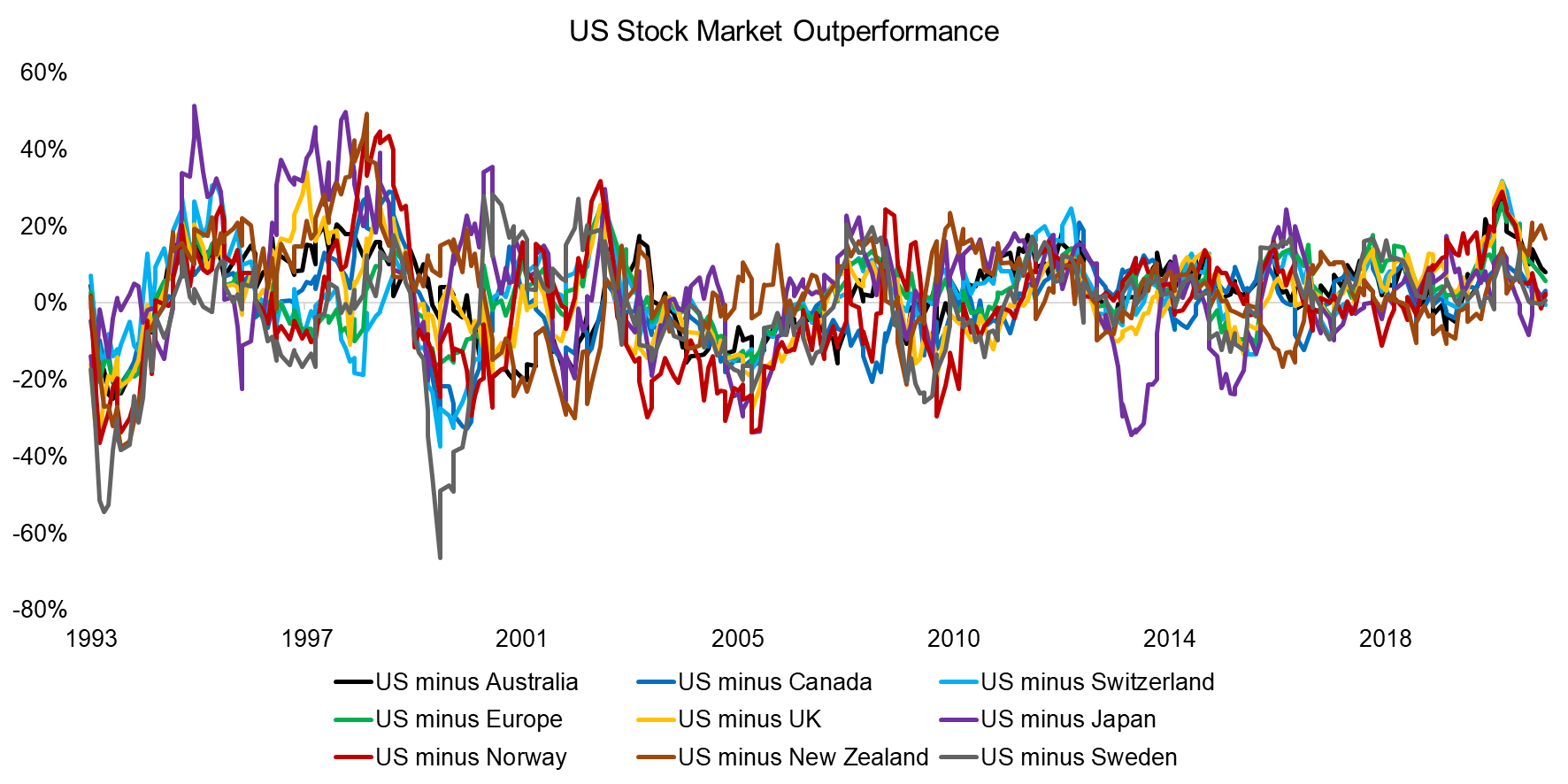

In order to select the currency pairs, we compute the outperformance of the US versus the other nine stock markets. As expected, this provides a diverse picture as equity markets performed differently across the globe. However, the portfolio turnover was relatively low and positions changed less frequently than perhaps expected from a momentum-based signal.

Source: FactorResearch

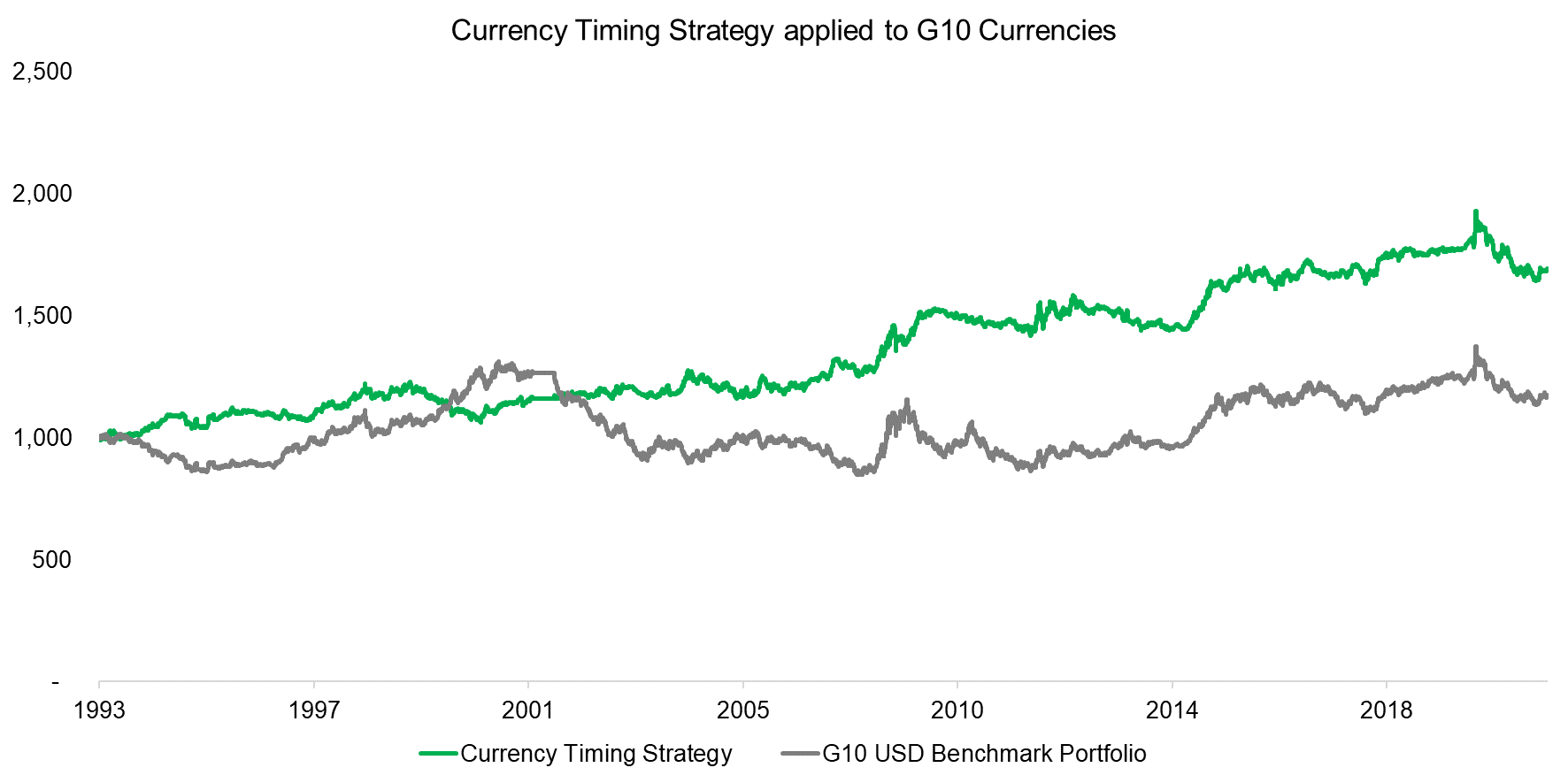

We create an equal-weighted portfolio of the currencies, which is the reference index and the equivalent of the US Dollar index. Similar to the EUR/USD time series, there has been also no substantial over-or underperformance of the US Dollar against this broader set of currencies over the almost 30 years since 1993.

Applying the currency timing strategy to G10 currencies would have generated relatively consistent returns. Again, there is some resemblance to the G10 portfolio given that partially it is the identical positions.

Source: FactorResearch

A contribution analysis of single currencies reveals that almost all of the excess returns can be attributed to three currencies: NZD, AUD, and GBP. However, it is difficult to say if this is structural or rather random.

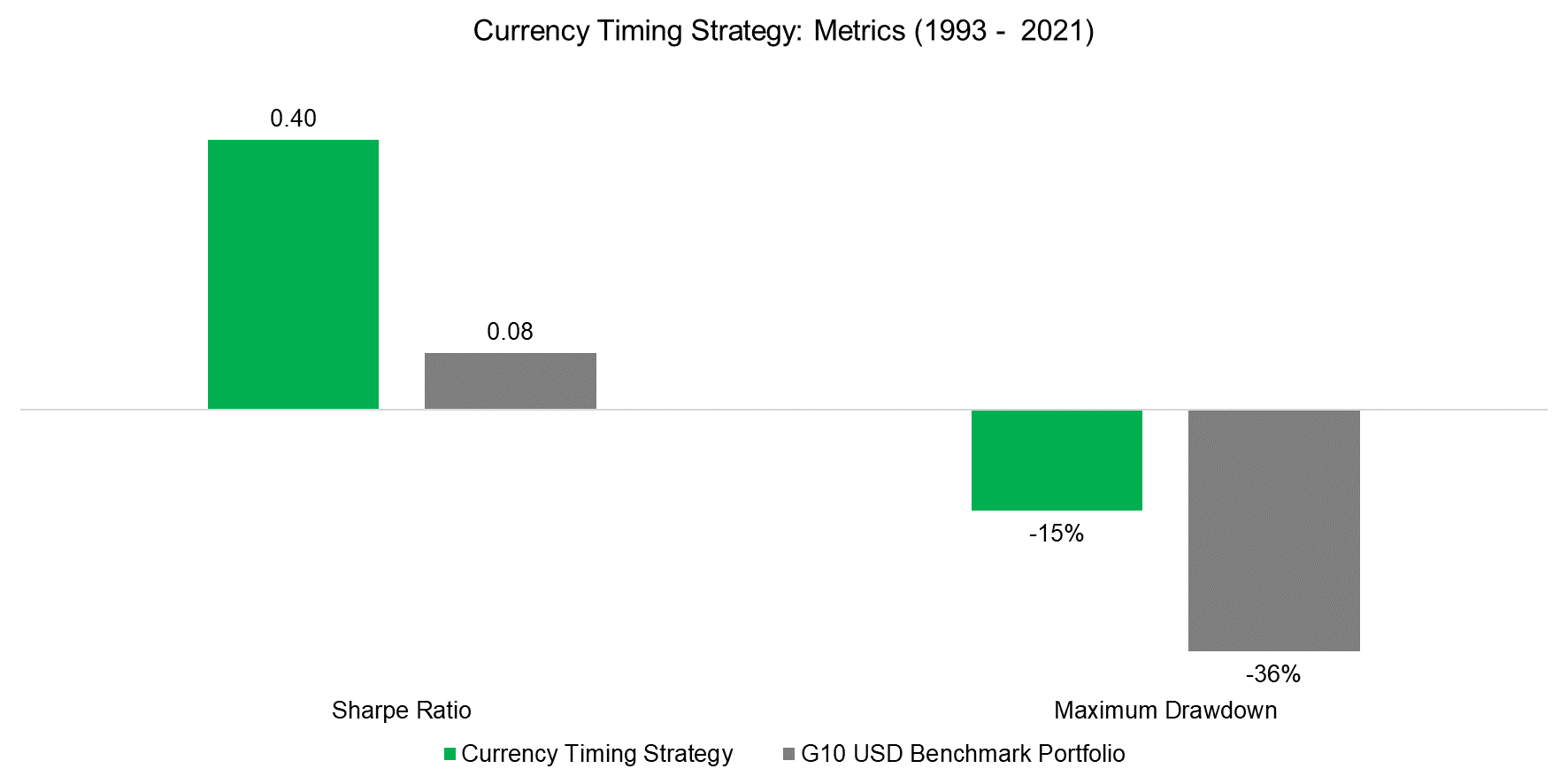

Finally, we calculate the Sharpe ratios and maximum drawdowns of the G10 and currency timing strategy. Although the risk-adjusted returns of the equity strategy were not particularly high with a Sharpe ratio of 0.4, the strategy is uncorrelated to traditional assets and therefore can be considered an attractive diversifier.

Source: FactorResearch

FURTHER THOUGHTS

The results of the currency timing strategy indicate that equity markets can be used to time currency markets, which should be regarded skeptically as information is disseminated equally in these markets. It is difficult to rationalize why there should be excess returns.

Our analysis can be challenged as it excludes transaction costs, but these should be minimal given that the portfolio comprises exclusively currencies with a low turnover.

It is worth highlighting that David Turkington and Alireza Yazdani found similar results using a larger set of currencies, which they published in an article in the Financial Analysts Journal and provides some support for our analysis. Given the attractive diversification benefits of such a strategy, it is certainly worth researching further.

RELATED RESEARCH

Market Timing versus Risk Management

Are Stock Markets becoming more Correlated?

Volatility, Dispersion & Correlation – Friends or Foes?

REFERENCED RESEARCH

The Equity Differential Factor in Currency Markets

ABOUT THE AUTHOR

Kaushik Ramnath Ganesan is a Senior Quantitative Analyst at Finominal. He completed a Bachelor’s in Computer Science at SRM University and the CQF (Certificate in Quantitative Finance) program. He previously worked as a quantitative intern at a New York-based start-up. At Finominal, he applies mathematics and computer science to bring transparency to investors’ portfolios, where his role comprises quantitative research as well as product management.