Don’t Convert to Convertible Bonds

Equity exposure in disguise

September 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Convertible bonds are typically viewed as debt rather than equity instruments

- However, these are highly correlated to equities

- The diversification benefits are limited as these just represent diluted equity proxies

INTRODUCTION

Let’s say you’re the CEO of a small listed company that isn’t doing well. The stock price of your company is depressed, so issuing equity would be highly dilutive. The debt rating is below investment grade, so you could only sell high-yield bonds, which will be another drag on the cash flow. Mezzanine debt means dealing with shark-like private equity professionals, so is not a great option either.

What about issuing convertible bonds? The yield on these would be low compared to high-yield bonds, and they can be recalled and swapped for traditional debt when the company’s outlook has improved. Let’s do it!

On the face of it, convertible bonds seem to be more attractive for the issuer than the investor. Is that true?

In this research article, we will evaluate the investment case for convertible bonds.

CONVERTIBLE BOND ETFS

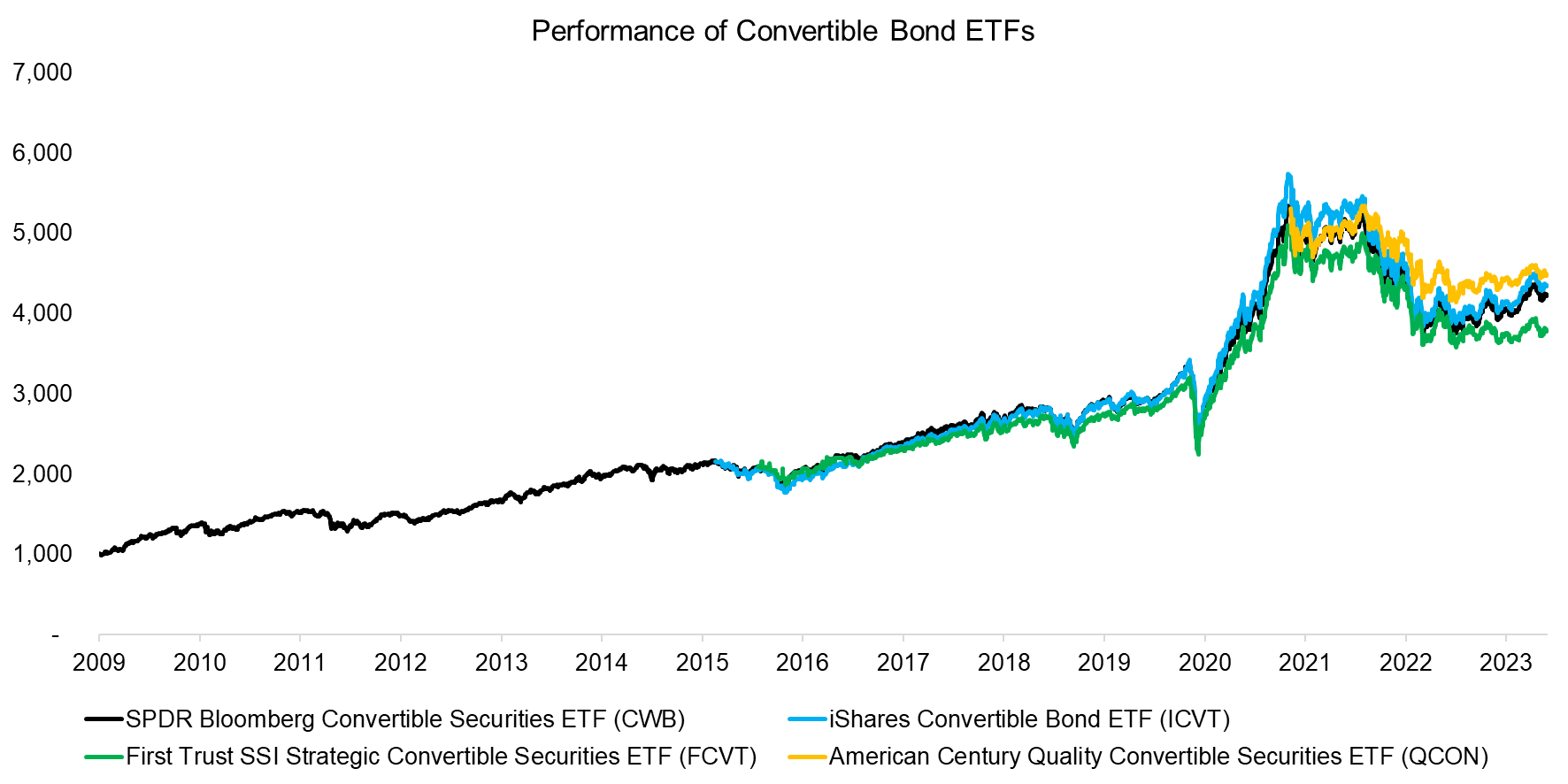

First, we review the performance of convertible bonds in the US ETF space, where there are only four products with meaningful assets under management.

The SPDR Bloomberg Convertible Securities ETF (CWB) has been trading since 2009, manages $4.6 billion, and charges 0.4% per annum. BlackRock launched the iShares Convertible Bond ETF (ICVT) in 2015 with a 0.2% management fee and gathered $1.5 billion of assets. The First Trust SSI Strategic Convertible Securities ETF (FCVT) and American Century Quality Convertible Securities ETF (QCON) have negligible market shares with $93 million respectively $24 million of assets.

FCVT and QCON are actively managed funds, while CWB and ICVT track convertible indices calculated by Bloomberg. These indices focus on convertible bonds that are liquid and have raised at least $250 million from investors.

We observe that the performance of these four ETFs was comparable, with QCON outperforming and FCVT underperforming the passive products. Convertible bonds had a drawdown larger than 30% during the COVID-19 crisis in 2020, but then generated significant performance thereafter.

Source: Finominal

FACTOR EXPOSURE ANALYSIS

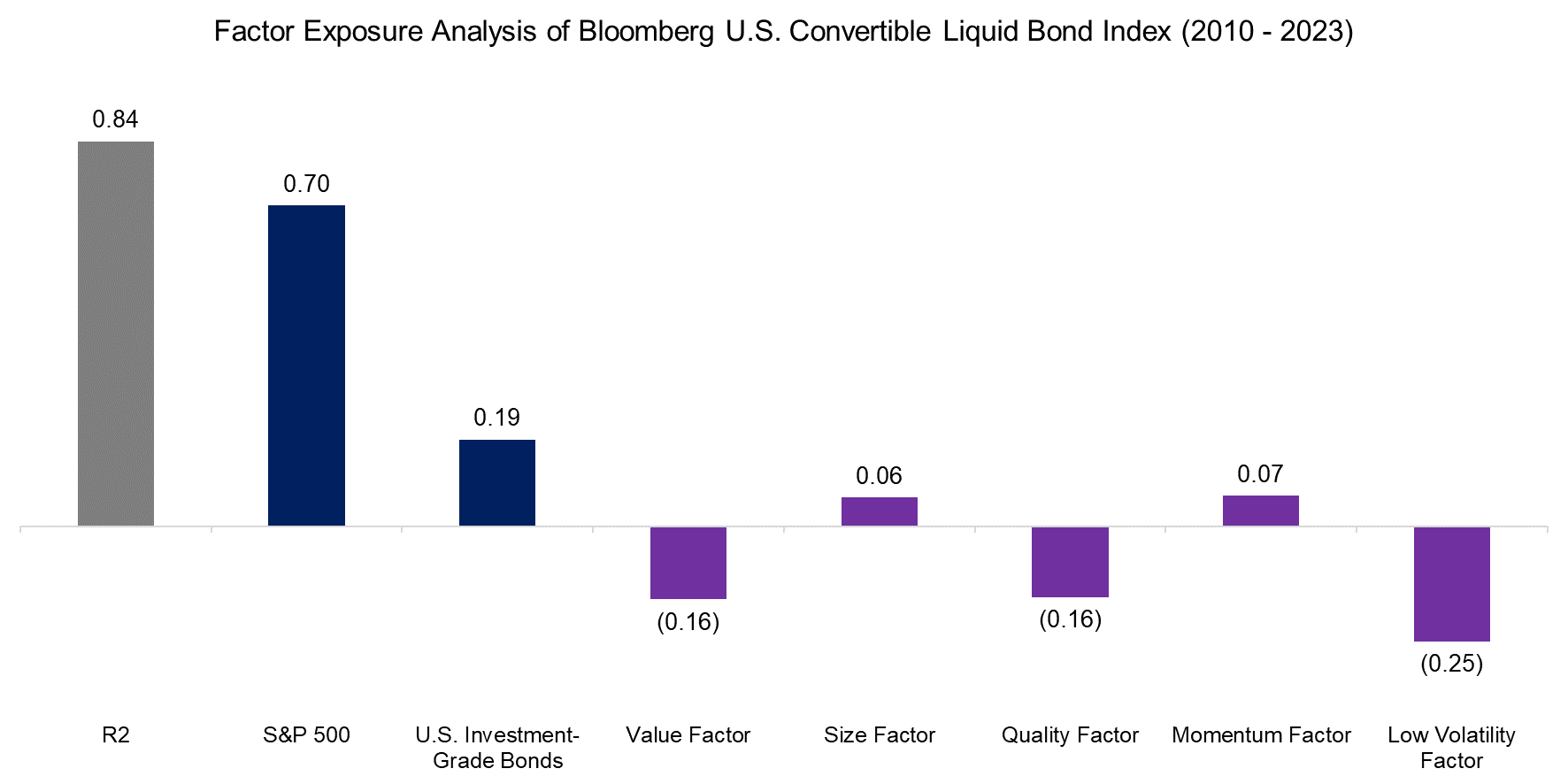

Next, we run a factor exposure analysis on the Bloomberg U.S. Convertible Liquid Bond Index to get a better understanding of what drives the performance of convertible bonds. We observe that the R2 was moderately high at 0.84 for the period between 2015 and 2023, and that the highest exposure was to the S&P 500. The beta to U.S. investment-grade bonds was relatively low, which may be surprising given that convertible bonds are positioned between equity and debt in the capital structure.

The exposure to equity factors was low, but the negative betas value, quality, and low volatility factors are not surprising. Convertible debt issuers tend to be small cap growth companies that feature poor quality characteristics and volatile stock prices.

Source: Finominal

CORRELATION ANALYSIS

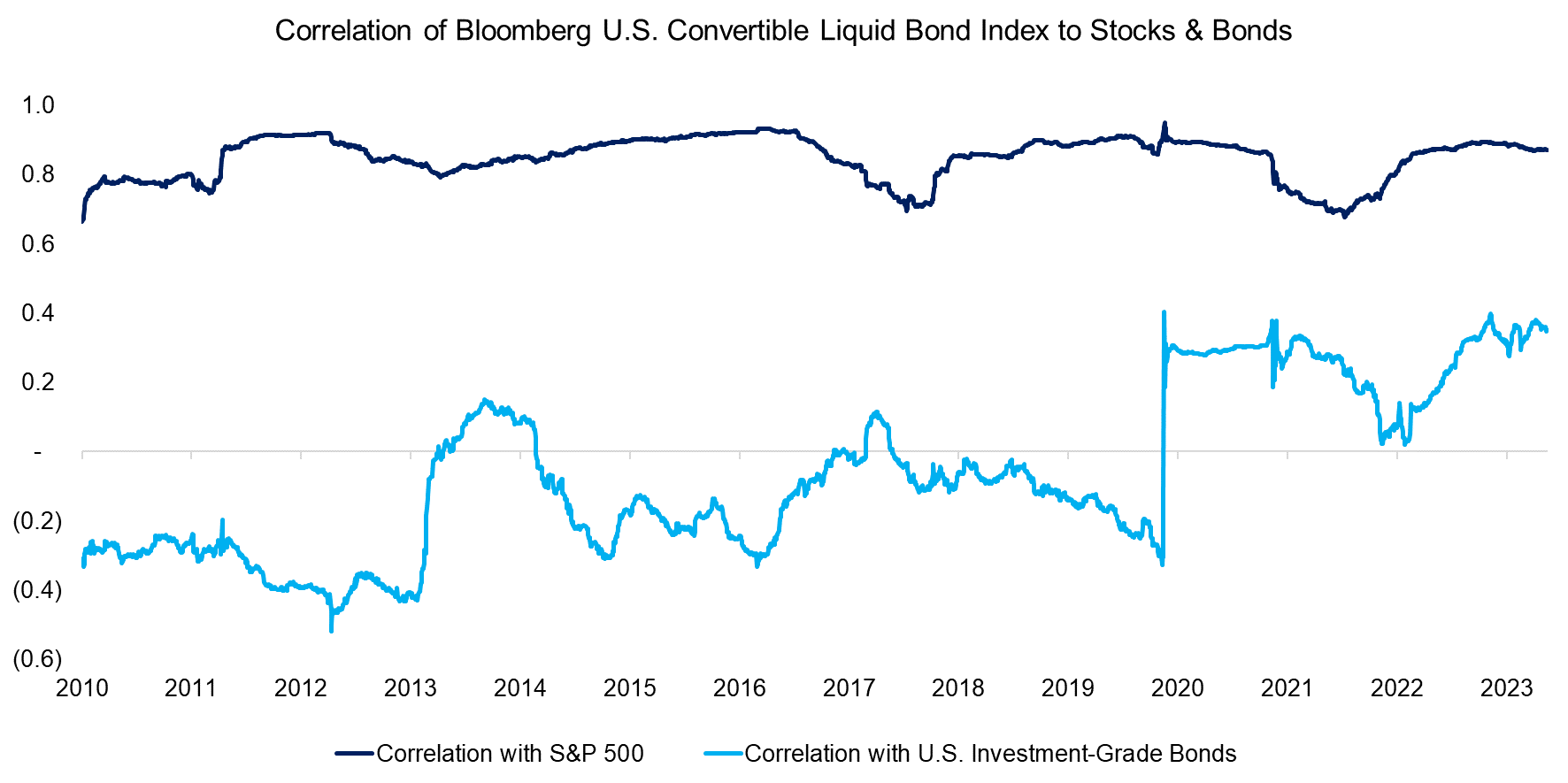

Computing the rolling 12-month correlation of the convertible bond index to the S&P 500 confirms that this type of instrument largely represents an equity proxy as the correlation ranged between 0.7 and 0.9 through the period between 2010 and 2023. The correlation to U.S. investment-grade bonds was negative on average between 2010 and 2020, but then turned positive, mirroring the general increase in correlation between stocks and bonds.

Blackrock highlights on the website of the iShares Convertible Bond ETF (ICVT) that “convertible bonds have demonstrated low correlations to traditional bond markets”, which is true, but so have equities for most of their time during the last four decades. Given this, the additional statement of “and can potentially provide attractive diversification benefits within a broad portfolio.” is highly doubtful.

Source: Finominal

QUANTIFYING DIVERSIFICATION BENEFITS

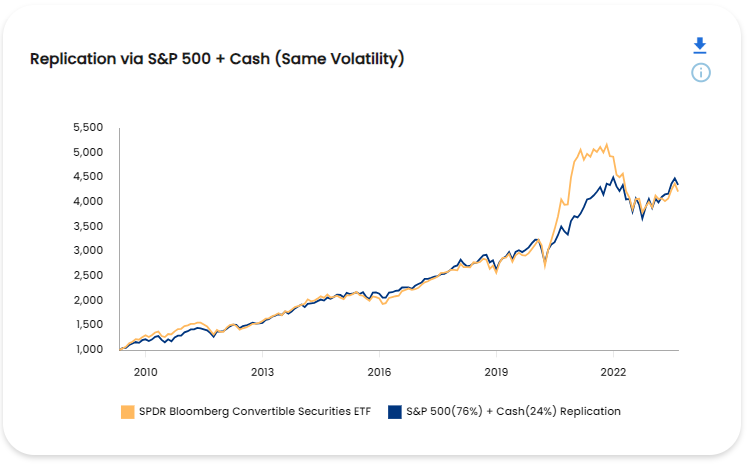

We can highlight the lack of diversification benefits from convertible bonds by replicating the convertible bond index by simply using the S&P 500 and cash, assuming the same volatility. A 76% allocation to the S&P 500 and 24% allocation to non-interest-bearing cash would have resulted in the same total return since 2010. The performance was almost identical throughout this period, except for a short period post the COVID-19 crisis.

Source: Finominal

FURTHER THOUGHTS

Most alternative or exotic strategies we analyze tend to reveal equity in disguise and do not create meaningful value for investors by offering diversification benefits. However, the asset management business is lucrative and therefore these products exist and continue to be launched. Few asset managers have the integrity to review their products and liquidate ones that have no utility for their clients.

Vanguard seems to be one of the exceptions as evidenced by the liquidation of the Vanguard Convertible Securities Fund in 2019, which managed close to $1 billion of assets. The firm reviewed its product offering and simply concluded that convertible bonds provide the same exposure as stocks and bonds, and therefore should not be offered to their clients. Kudos to Vanguard!

RELATED RESEARCH

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Analyzing Floating Rate ETFs

Inflation-Linked Bonds for Inflationary Periods?

Covered Call Strategies Uncovered

BDCs: Better Don’t Choose?

Preferential Times for Preferred Income Strategies?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 108: Fixed Income Factors II

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.