Downside Betas vs Downside Correlations

Quantifying the diversification benefits of alternative strategies

April 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Investors typically use correlation to identify diversifying strategies, but the metric can be misleading

- Upside and downside betas and correlations provide a better perspective

- Common hedge fund strategies failed to provide attractive diversification benefits

INTRODUCTION

Are investors as rational as portrayed in the finance literature?

For example, when Lehman Brothers collapsed in October 2008, investors dumped almost all assets, regardless of their nature. The mantra was to shoot first, and ask questions later. Was that rational behavior?

Tough to say, but it did highlight that there were few pockets of safety when markets go haywire. Correlations spiked and many diversifying strategies didn’t provide diversification benefits, eg mergers failed to complete and hedge funds lost money with merger arbitrage.

Typically investors use correlations for selecting diversifying strategies, but this does not necessarily lead to diversified portfolios as we have recently shown (read Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios). In this article, we will evaluate the same hedge fund strategies using downside betas and downside correlations as metrics.

DOWNSIDE BETA VS DOWNSIDE CORRELATIONS

There are multiple methodologies for computing downside betas and downside correlations. We take a simple approach and differentiate the daily returns of the S&P 500 by their sign. The goal is to identify investment strategies that are not sensitive to stock market declines.

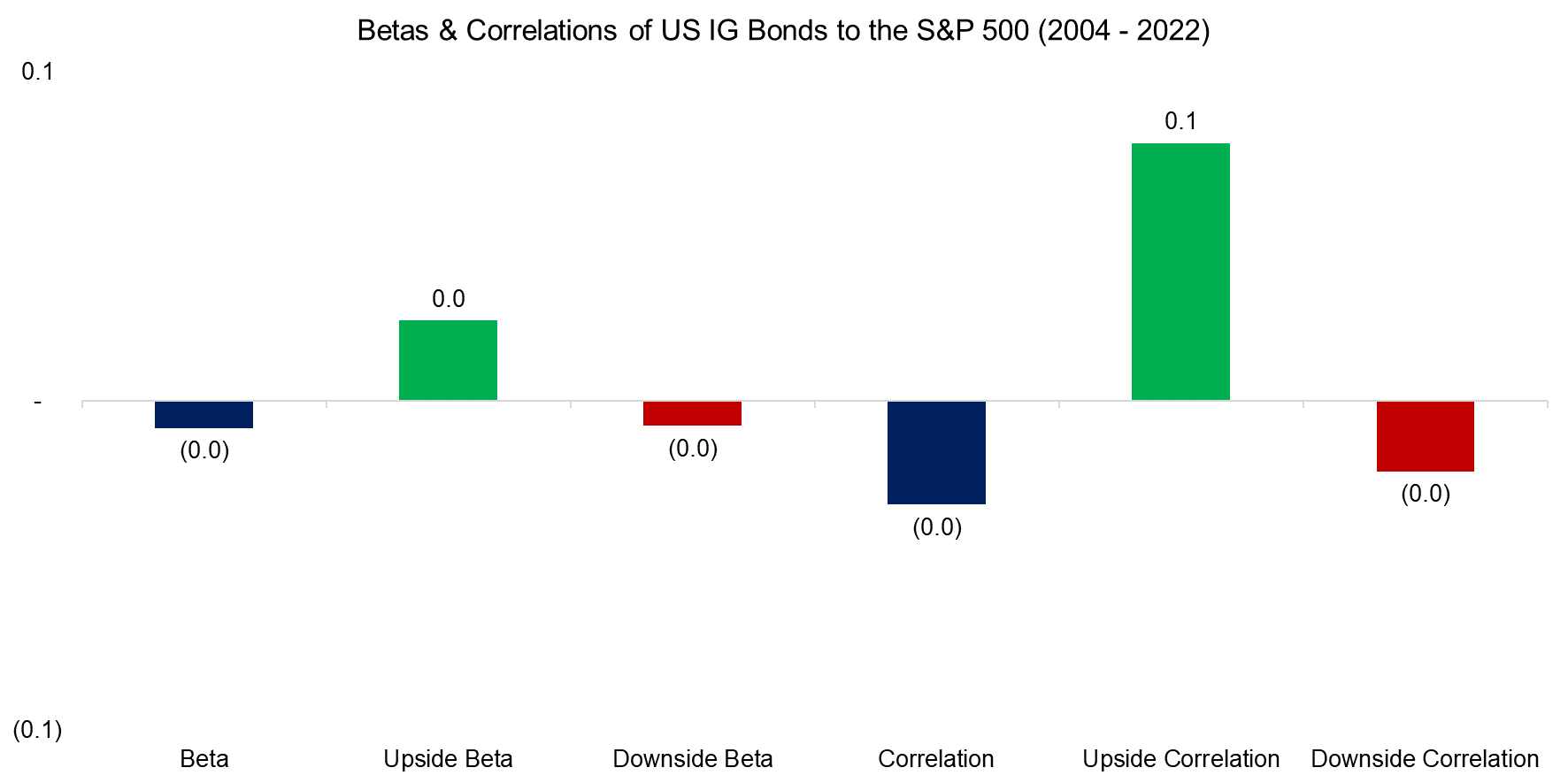

We use a US investment-grade (IG) bond index as an example and calculate betas and correlations to the S&P 500 for the period from 2004 to 2022. We observe that the beta and correlation were approximately zero, which provides a first indication that bonds might have been a good instrument for diversifying an equities portfolio.

The downside beta and downside correlation of US IG bonds to the S&P 500 were negative, which means that bonds increased in value when stocks declined. Stated differently, they provided attractive diversification benefits.

Source: Finominal

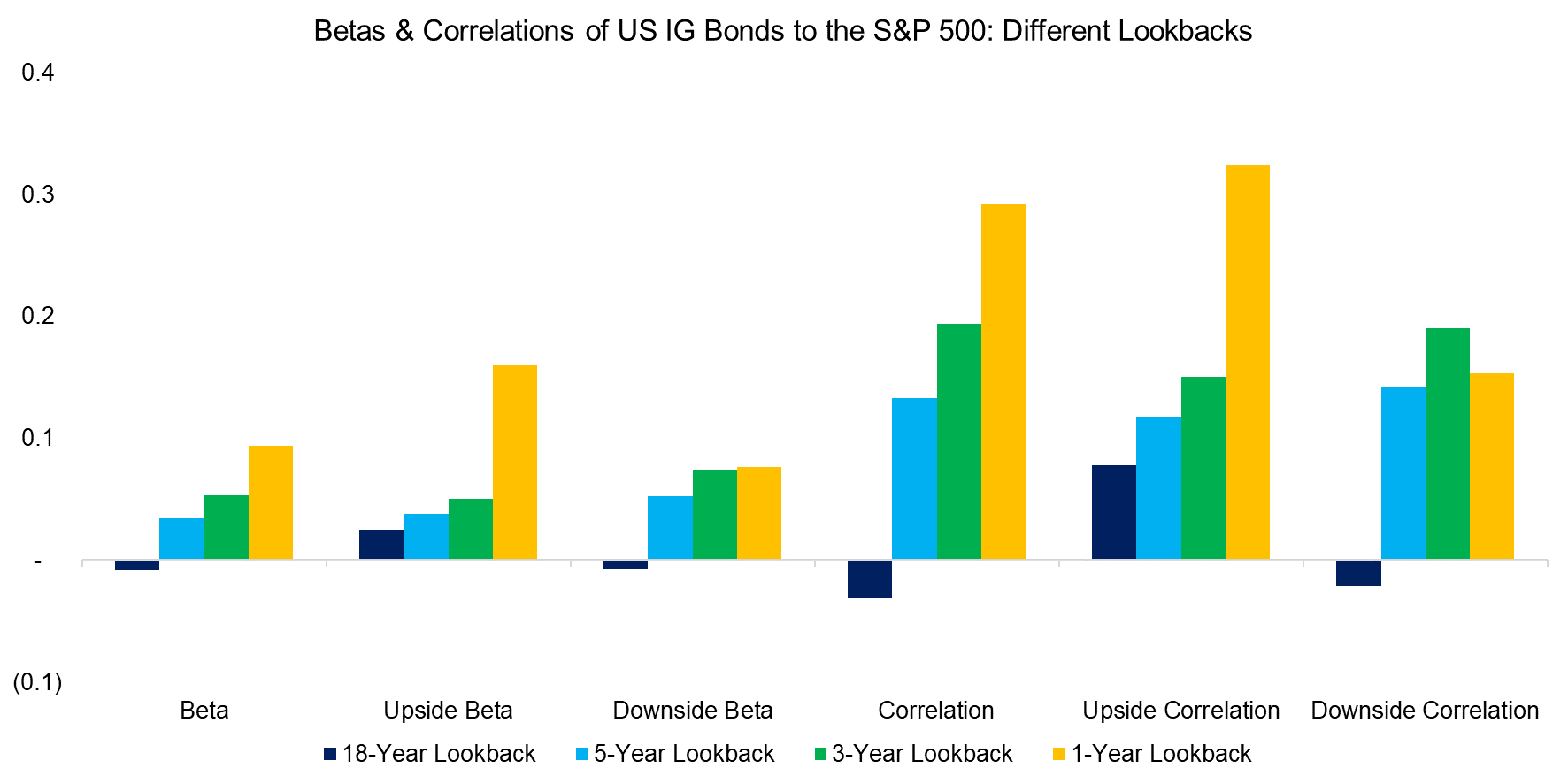

Next, we evaluate the stability of betas and correlations across time by varying the lookback periods used in their computations, which highlights that these slightly increased when the time horizon is decreased. The betas and correlations of bonds and stocks were essentially zero over the last 18 years, but betas and correlations were slightly positive in the most recent history. As the data shows, bonds have provided lower diversification benefits in 2022 (read How Much Can You Lose with Bonds?).

Source: Finominal

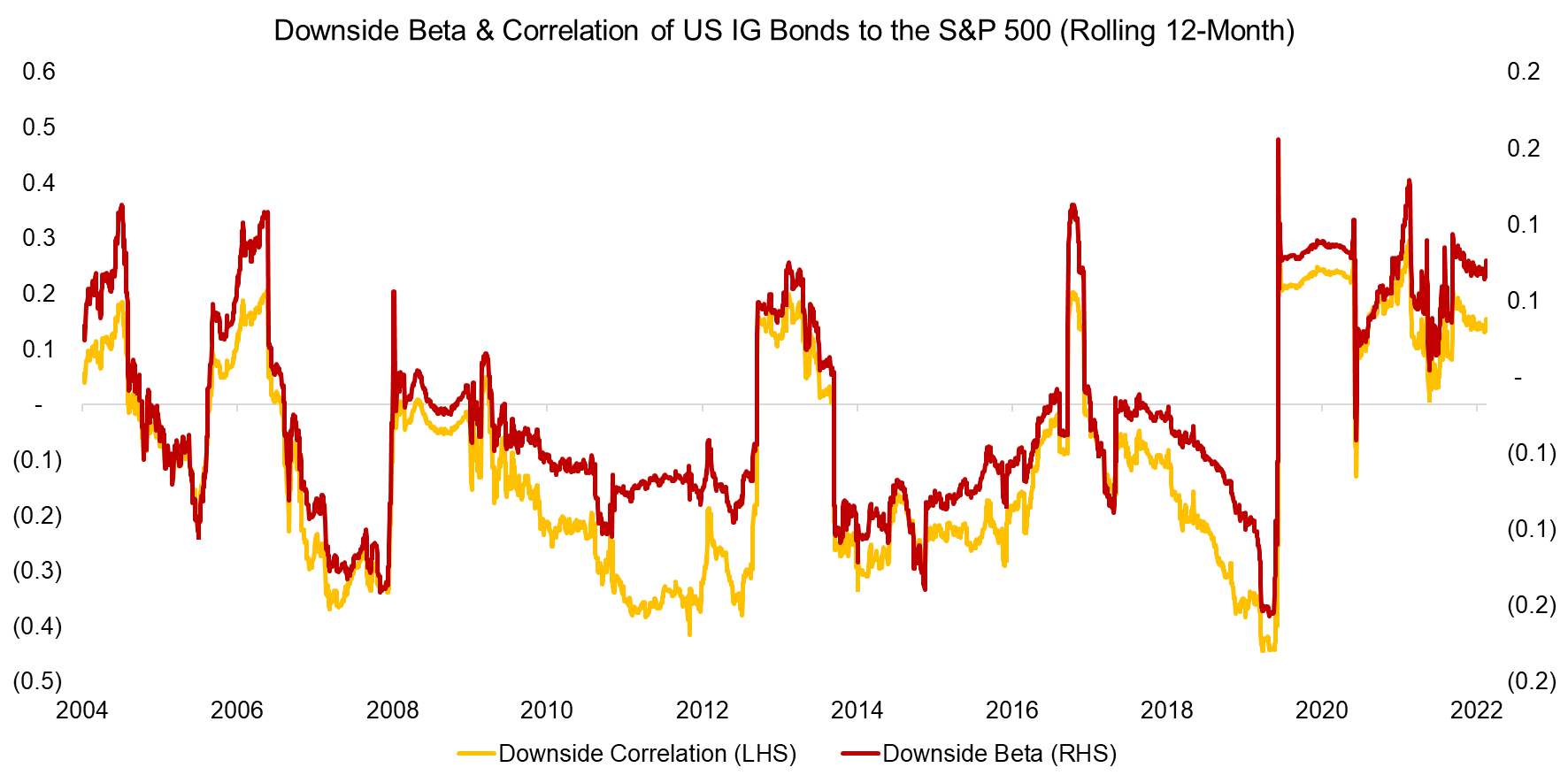

Should investors prefer downside betas or downside correlations when evaluating alternative strategies?

We calculate the rolling 12-month downside betas and downside correlations for US IG bonds to the S&P 500 for the period between 2004 and 2022, which highlights the same trends in these two metrics across time. Naturally, this is to be expected given that beta and correlation are related concepts.

Practically this means that both metrics will provide the same insight into the diversification potential of a strategy. For simplification, we will use betas in the remainder of this analysis.

Source: Finominal

UPSIDE & DOWNSIDE BETAS OF HEDGE FUND STRATEGIES

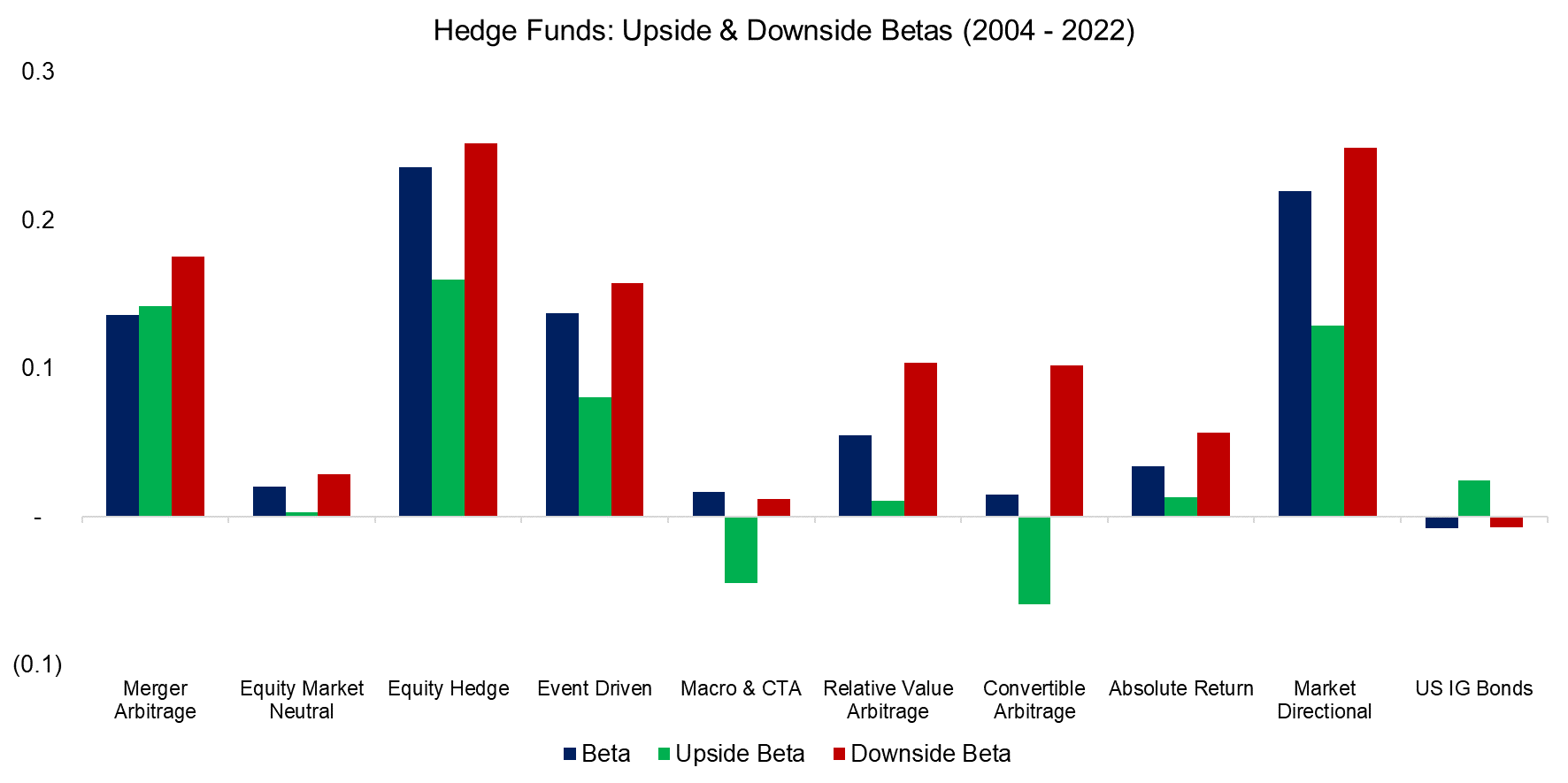

We compute the upside and downside betas of nine well-known hedge fund strategies where daily returns are sourced from HFRX. Investors should expect low betas to equities for diversifying strategies. Furthermore, the upside beta should be larger than the downside beta. At first glance, all of these strategies seem diversifying for an equities portfolio as they offer low betas to the stock market.

Source: Finominal

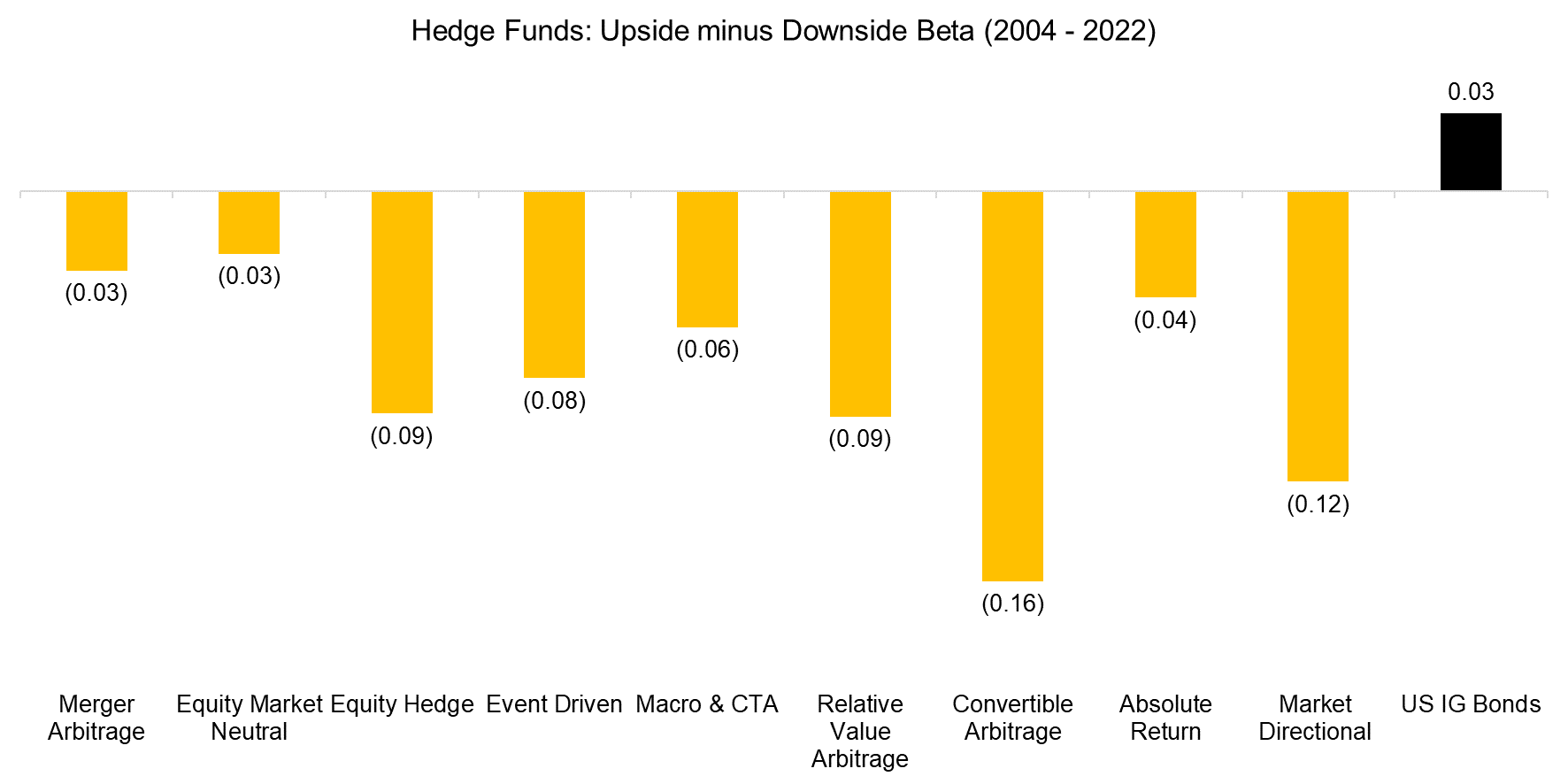

Finally, we calculate the difference between the upside and downside betas of the hedge fund strategies and US IG bonds. We observe that all hedge fund strategies had smaller upside than downside betas. Stated differently, these strategies offer to participate less in the upside and more in the downside of stock markets, which is a highly undesirable characteristic.

In contrast, bonds exhibited a low upside beta to equities, but a negative downside beta, thus creating a positive difference and significant diversification benefits for an equities portfolio in the period from 2004 to 2022.

Source: Finominal

FURTHER THOUGHTS

We calculated downside betas and correlations based on the negative returns of the S&P 500, but this can be challenged as there are down days in bull markets as well.

An alternative approach is to define bear markets as investors are less interested in strategies that go up when stocks decline on a single day, and more interested in ones that offer positive returns when stocks decline many consecutive days, eg during the global financial crisis in 2008. However, there is no standard definition for bear markets, which then requires assumptions and increases the model risk.

Although the lunch from diversification may be free, it certainly is not easy to get to.

RELATED RESEARCH

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Are Alternative ETFs Good Diversifiers?

Market Neutral Funds: Powered by Beta?

Merger Arbitrage: Arbitraged Away?

Hedge Fund ETFs

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.