Duration of U.S. Equities

How sensitive are stocks to changes in interest rates?

January 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Sectors and factors were not very sensitive to changes in interest rates on average

- However, the averages are misleading as the sensitivity varies significantly over time

- The duration of factors was more dispersed than that of sectors

INTRODUCTION

If equity investors are from Mars, then fixed-income investors are from Venus. Despite nearly all investors holding various combinations of stocks and bonds, the terminology of the asset class specialists seems as if they are from different planets. Equity investors talk about valuation multiples, sectors, and factors, while fixed-income investors discuss yield, credit spreads, and time to maturity.

Naturally, some concepts are being applied to both asset classes, and occasionally some terminology migrates from one domain to the other. Duration is a traditional fixed-income concept that has been applied to stocks on a regular basis. For bond investors this simply means the sensitivity of a bond to a change in interest rates, but how is this applied to stocks?

Theoretically, the price of a stock is determined by its cash flows and its terminal value, which are discounted back to the present by the cost of capital. The more value is attributed to the future, the greater the sensitivity to a change in the cost of capital, where interest rates are one of the key drivers.

Given this, growth stocks that generate little cashflow currently, but have the potential to generate a windfall down the road, should be more sensitive than value stocks that feature high dividend yields.

In this research article, we will evaluate the duration of U.S. equities.

DURATION OF U.S. SECTORS

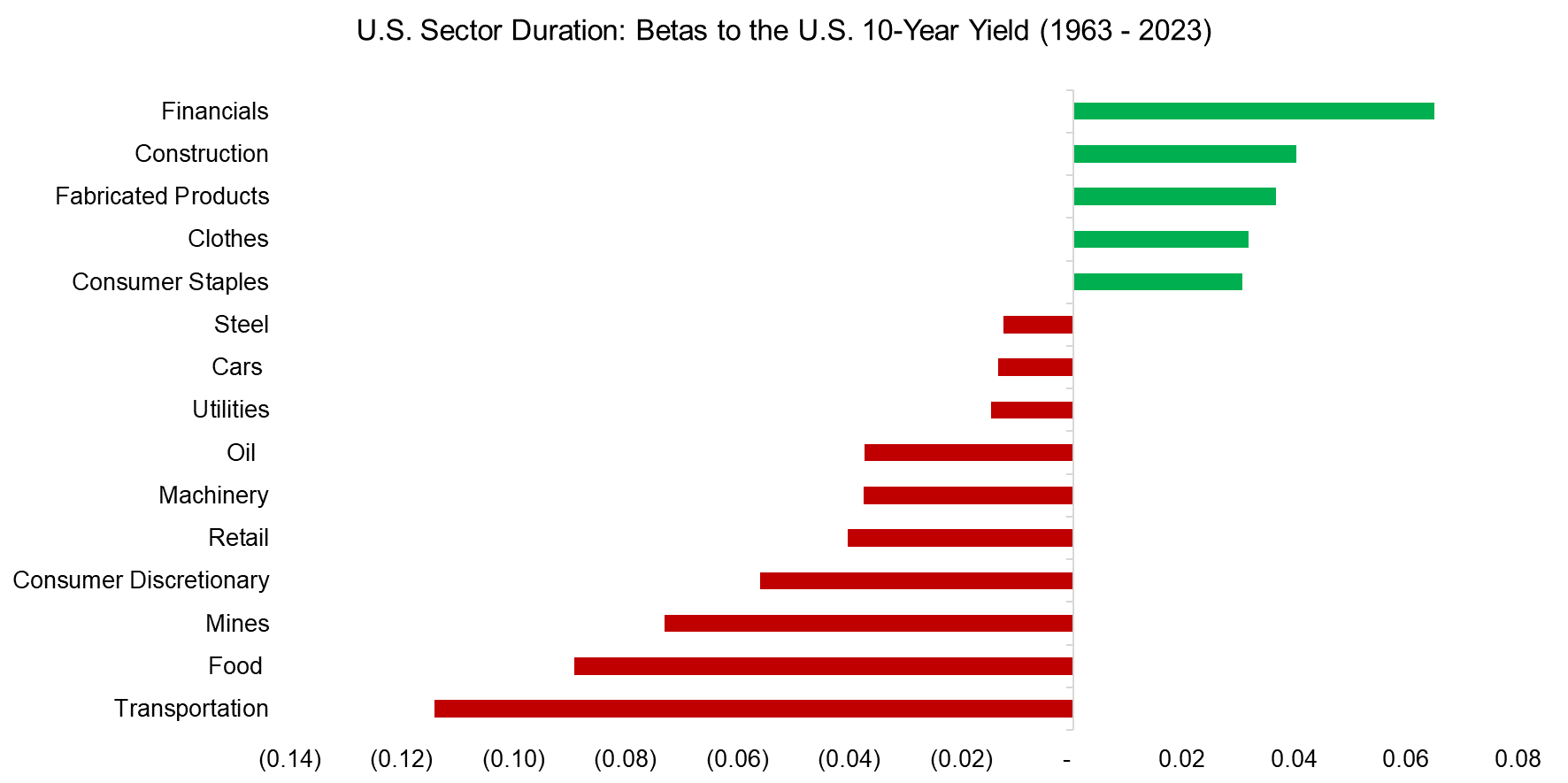

First, we focus on measuring the duration of U.S. sectors, where we utilize data for 17 sectors from the Kenneth R. French data library. We calculate the betas using monthly returns and a 10-year lookback, where the yield of the U.S. 10-Year Treasury Note is taken as the independent variable (read Factor Exposure Analysis 106: Macro Variables). Naturally, there are more sophisticated models for measuring duration, but this one is easy to understand and allows us to go back far in time.

We observe that sectors like financials, construction, and fabricated products featured the most positive betas to the yield of the U.S. 10-Year Treasury Note in the period between 1963 and 2023, while mines, food, and transportation had the most negative betas. Partially these results are self-explanatory, eg banks benefit from a rising yield as they tend to charge more on loans than they pass on to depositors. However, in other cases like food it is less obvious why these sectors were sensitive to changes in interest rates.

Source: Kenneth R. French Data Library, Finominal

DURATION OF U.S. FACTORS

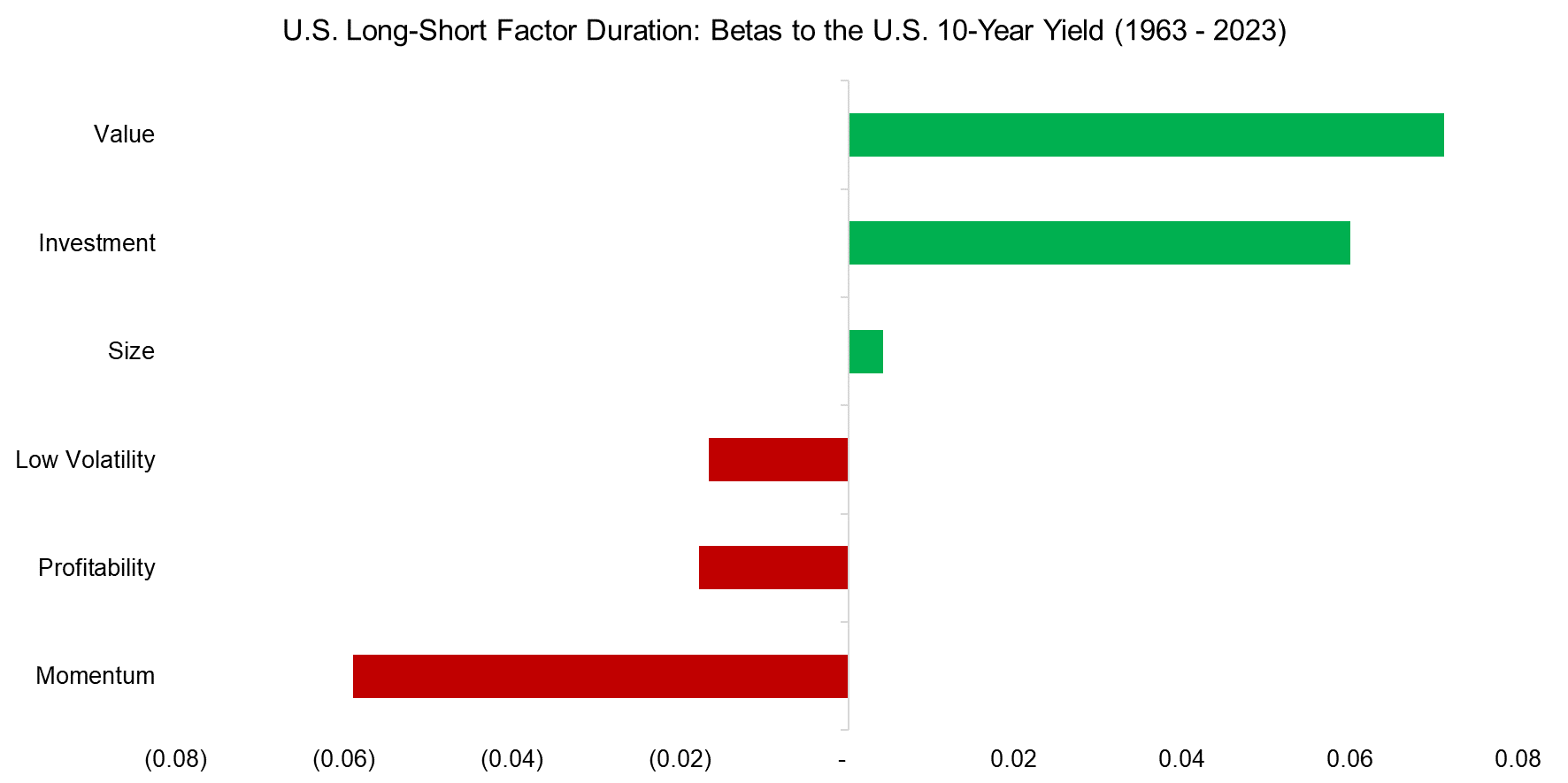

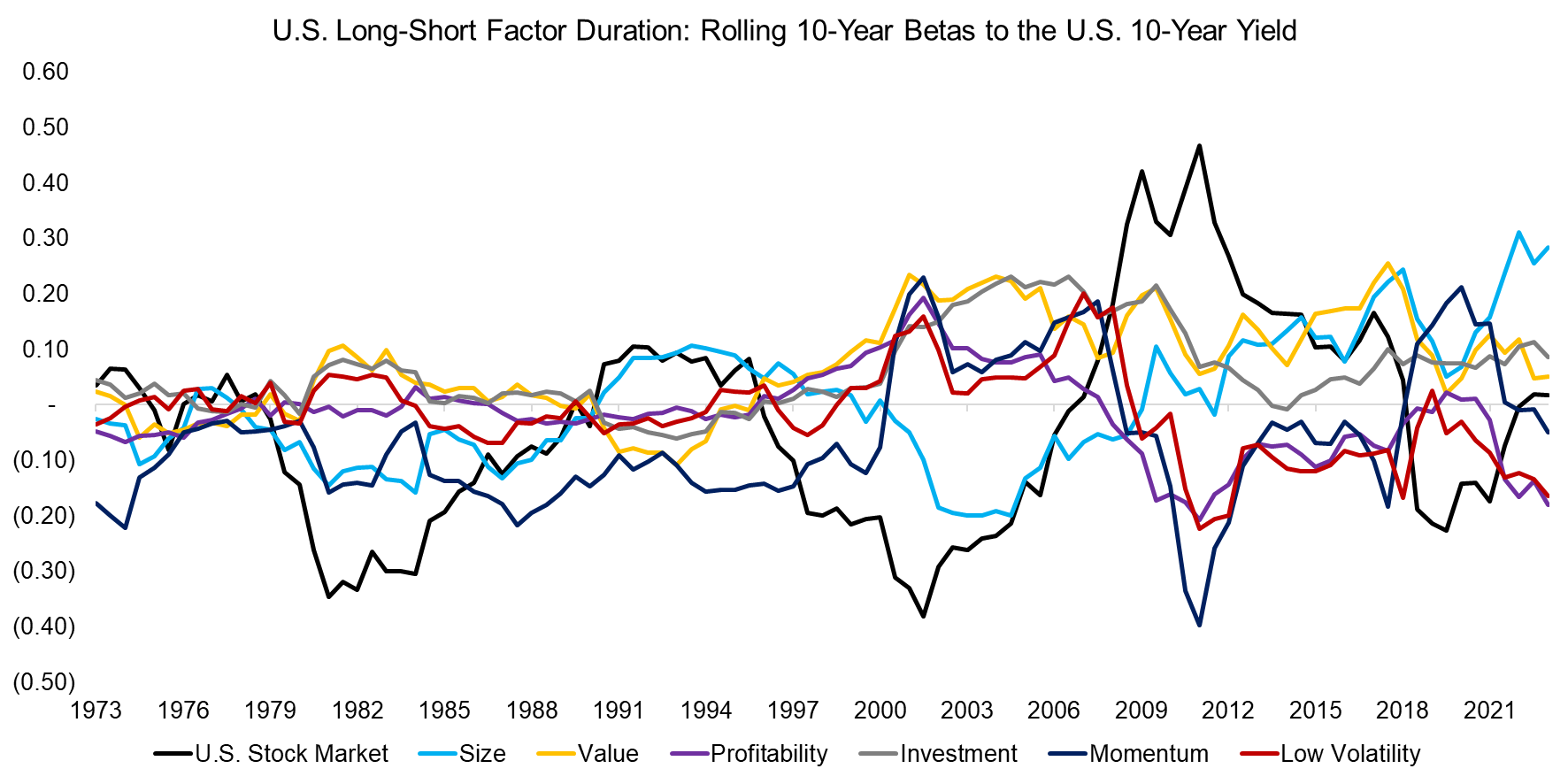

Next, we evaluate the sensitivity of long-short factors to the changes in the yield of the U.S. 10-Year Treasury Note (read Factors & Interest Rates).

We observe that the value factor benefitted while the momentum factor suffered from rising interest rates. Cheap stocks are primarily driven by risk sentiment and rising interest rates tend to be a sign of strong economic growth, which explains the positive relationship with interest rates (read Improving the Odds of Value Investing).

In contrast, when the economy is heading into a recession, investors tend to overweight low-risk and high-quality stocks. However, there is no intuitive relationship between interest rates and the momentum factor.

Source: Kenneth R. French Data Library, Finominal

DURATION OF THE U.S. STOCK MARKET

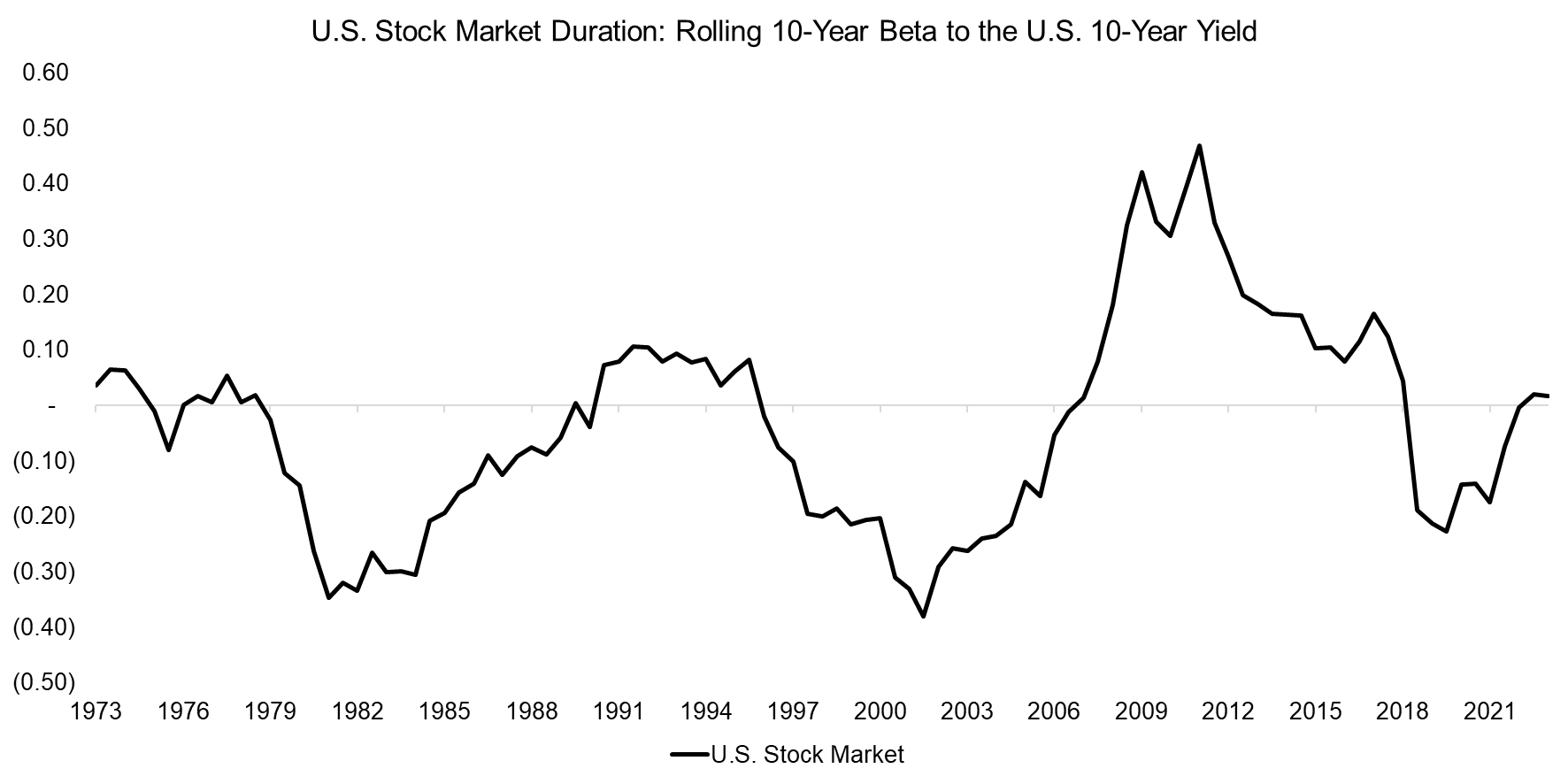

The betas of sectors and factors to a change in interest rates ranged only from -0.11 to 0.07, which would indicate that stocks are not particularly sensitive to central bank policies. However, these represent averages over a 60-year period, which can be deceiving.

Given this, we calculate the 10-year rolling betas of the entire U.S. stock markets to changes in the yield of the U.S. 10-Year Treasury Note, which highlights that the beta ranged from -0.4 to 0.5 and does indicate that interest rates can impact stock returns. However, there does not seem to be any obvious explanation for why the beta fluctuated over time.

Source: Kenneth R. French Data Library, Finominal

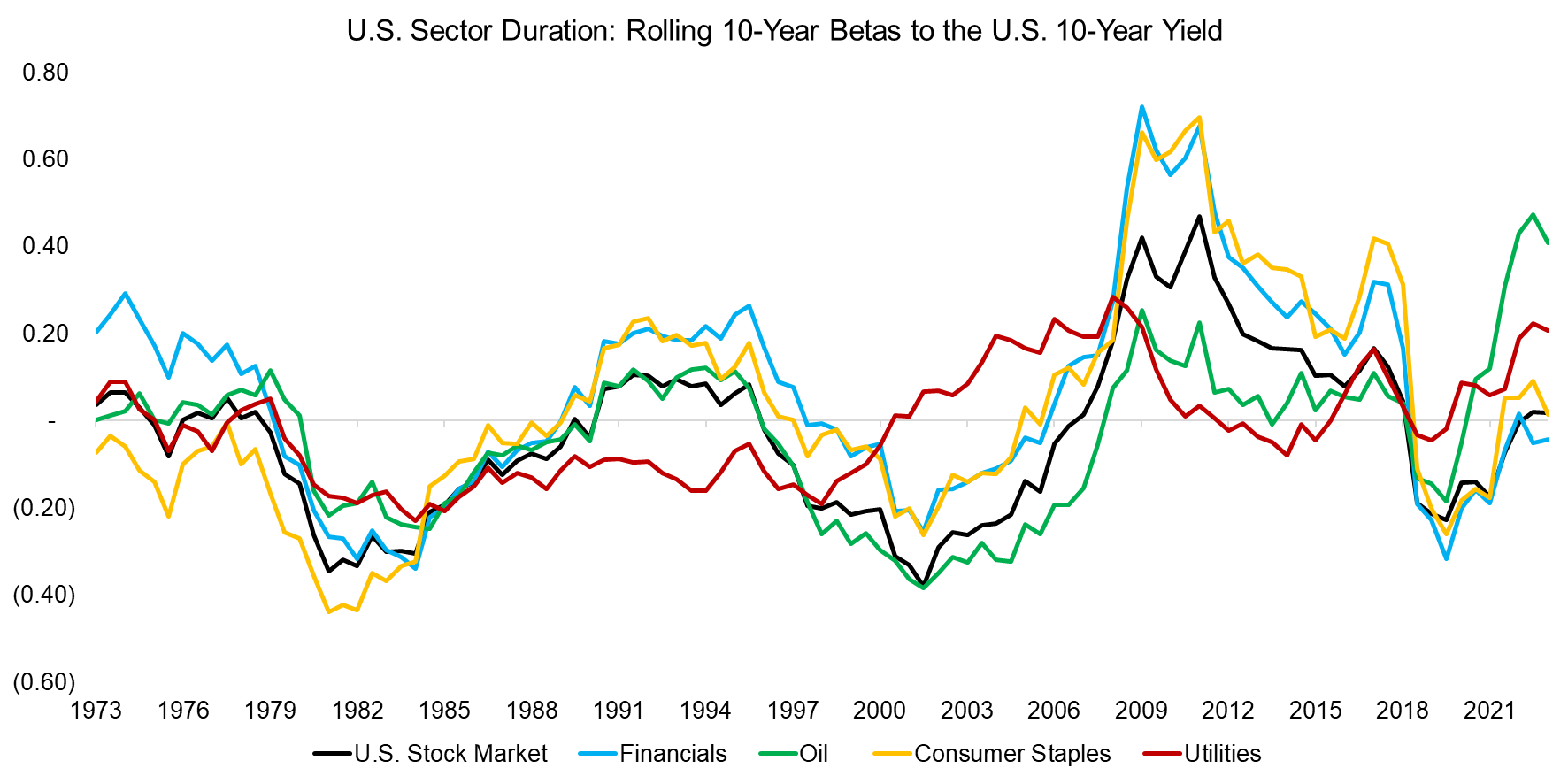

Next, we review the 10-year rolling betas of four sectors to the change in interest rates, where three sectors featured the same trends as the broad U.S. stock market. In contrast, the utilities sector exhibited slightly different trends and a lower sensitivity on average, which is surprising given that utility companies tend to be highly leveraged given stable cashflows, which should make them more sensitive to changes in interest rates.

Source: Kenneth R. French Data Library, Finominal

In contrast to sectors, the 10-year rolling betas of long-short factors to the U.S. 10-Year Treasury yield did not exhibit similar trends, which makes sense given that these represent largely uncorrelated variables.

Source: Kenneth R. French Data Library, Finominal

FURTHER THOUGHTS

Should investors care about the duration of their equity portfolio?

Naturally, it is always sensible to measure and understand the drivers of stock and portfolio returns, but given that the sensitivity of the entire stock market to changes in interest yield varies across time, any exposure should be viewed cautiously. Furthermore, even if a portfolio has strong duration characteristics, it is questionable how investors should react to this insight as no one is particularly good at forecasting interest rates.

RELATED RESEARCH

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 107: Fixed Income Factors

Factors & Interest Rates

Factor Exposure Analysis 104: Fixed Income ETFs

Smart Beta Fixed Income ETFs

Equity vs Bond Indices

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.