EM Equities vs Debt: Same, Same, but Different?

Evaluating the Lure of Emerging Markets

July 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Some EM asset classes are highly correlated, to the point they can almost be considered interchangeable

- EM equities and hard-currency government debt are highly correlated to US equities and bonds

- In crisis times, all EM exposure is sold off and fails to provide meaningful diversification benefits

INTRODUCTION

Dreaming of vacationing in Europe conjures images of towns and villages rich in architecture and history, delicious food and delicate wines, high mountains and sandy beaches, and an unparalleled depth in music and art. Some Europeans, notably the French, primarily stay in their own countries as they see little need to go elsewhere. For tourists across the globe, Europe is the best option for experiencing so much in a short amount of time.

In stark contrast with its success as a tourist destination, European equity and fixed income markets create far less excitement for global investors. Bonds can almost be disregarded as their yields are either negative (Germany) or do not seem to reflect country risks (Italy). Stocks require economic growth, but that growth is challenging to achieve when demographics are turning negative. The US seems better positioned from an economic perspective, although stocks trade at high valuations that give rise to a different concern.

Some investors are therefore turning to emerging markets (“EM”) equities and debt. The typical on-going arguments for EM are that two-thirds of the world’s population is living there and that China and India will be the twin growth engines of the global economy in the 21st century. Well-respected publications like The Economist regularly feature this theme on their cover page:

- Is China Winning? (April 2020)

- The New Scramble for Africa (March 2019)

- Planet China (July 2018)

- Can Anyone Stop Narendra Modi? (April 2014)

- Brazil Takes Off (November 2009)

- The Rise of the Gulf (April 2008)

- Surprise! The Power of the Emerging World (September 2006)

However, investing in emerging markets remains a complex task. EM countries span a wide range of political regimes from capitalist to communist, EM equities are dominated by a single nation, and EM debt comes in a variety of forms, issued both by governments and corporates, in hard and local currency.

In this short research note, we will investigate how appealing EM equities and debt are from the perspective of a US-based investor (read Factor Investing in Emerging Markets).

THE LURE OF HIGHER YIELDS

Most of humanity is living in peace and prosperity, aside from the occasional crisis. Only a small percentage of the world’s population have actually experienced war. However, a large proportion of those crises or war episodes frequently take place in emerging countries, which has either slowed or stopped their progress. Some have even regressed.

Unfortunately, most of these problems can not be attributed to external influences like volcanoes or viruses, but rather to incompetent and/or corrupt politicians. For example, Venezuela has the world’s largest oil reserves, but the policies of the former president Hugo Chavez and his successor Nicolas Maduro have led the citizens of its capital Caracas to plunder its zoo for animal meat in order to avoid starvation.

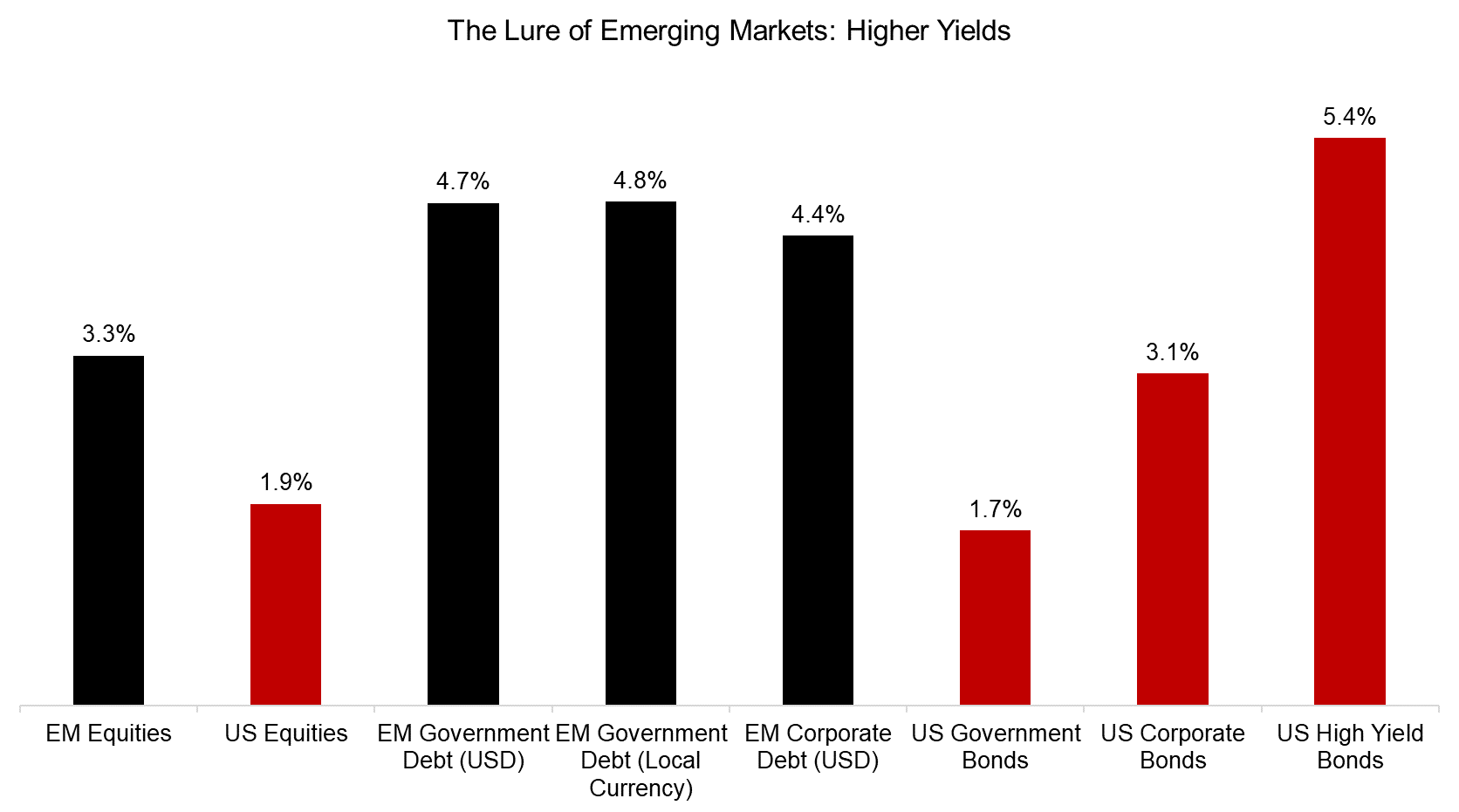

Given better institutions, laws, and education, developed markets are less risky than emerging markets, which reflects in higher dividend yields of stocks and bond yields compared to equivalent US securities. Only US high yield bonds, which per definition are the riskiest type of debt, are higher yielding.

Source: FactorResearch. Yields are 12-month trailing yields.

EM EQUITIES VS DEBT

The complexity of investing in emerging markets is partly due to the choice of instruments and their inclusion in portfolio construction, which can be defined along the following characteristics:

- Single country exposure versus a diversified portfolio of countries

- Stocks versus bonds

- Corporate versus government debt

- Hard, usually USD, versus local currency-denominated debt

- Equal versus weighting by market capitalization or outstanding debt

In this analysis, we will focus exclusively on standard benchmark indices like the MSCI Emerging Markets Index for stocks that are accessible to all investors via affordable ETFs.

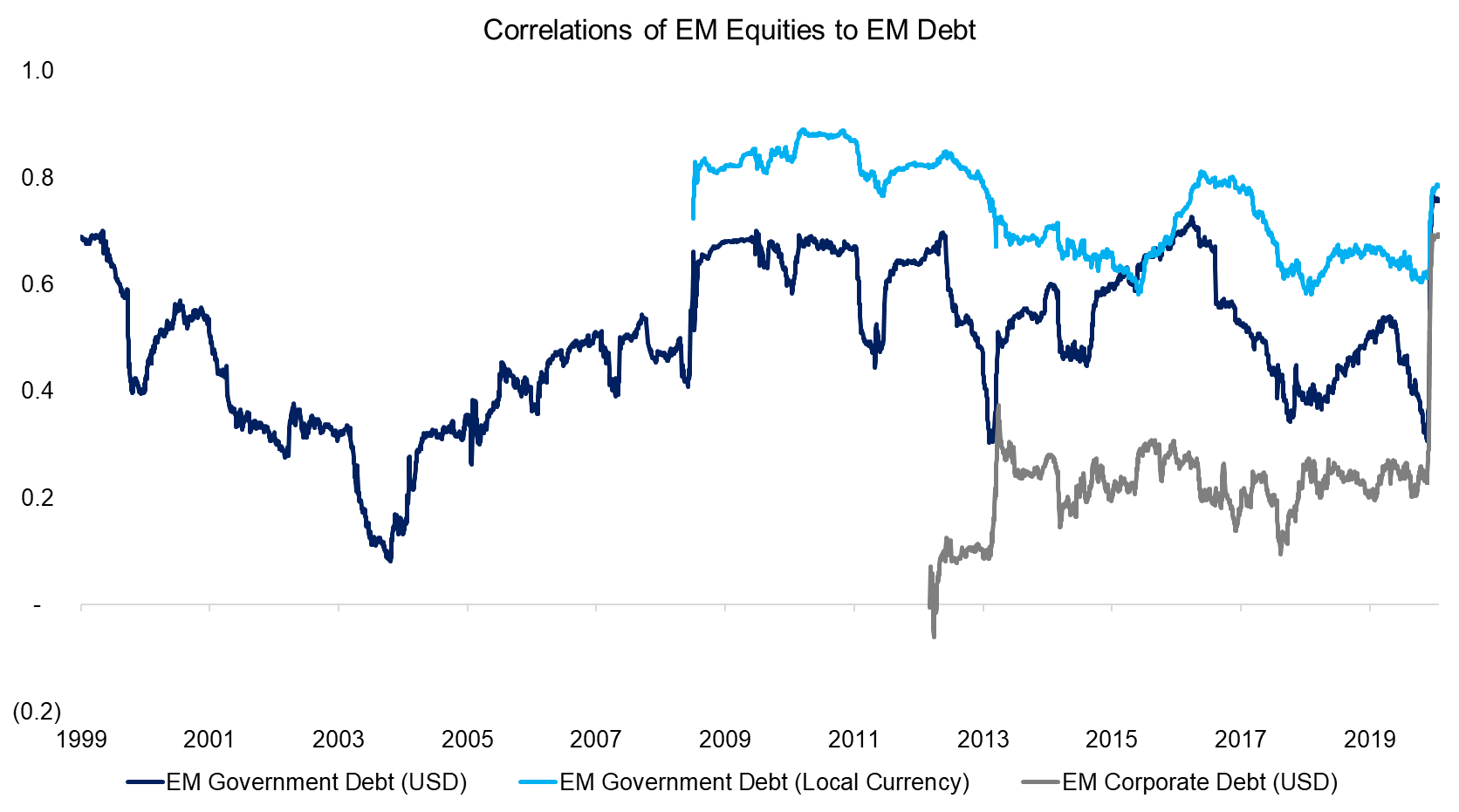

In order to reduce the magnitude of the problem at hand, a reasonable first step is to analyze the correlations between the various types of instruments. Over the 2009 to 2020 period, we observe that EM equities displayed the highest correlation to local currency-denominated government debt and was least correlated to corporate debt. Furthermore, correlations spiked dramatically during the COVID-19 crisis in 2020, which is typical for almost all asset classes in times of extreme market stress (read EM Debt: To Hold, or Not to Hold?).

Source: FactorResearch.

EM EQUITIES VS LOCAL CURRENCY GOVERNMENT DEBT

It is interesting to explore why EM equities and local currency-denominated government debt were highly correlated between 2009 and 2020 as stocks and bonds in the US displayed substantially and significantly lower correlations, which offered attractive diversification benefits from an asset allocation perspective.

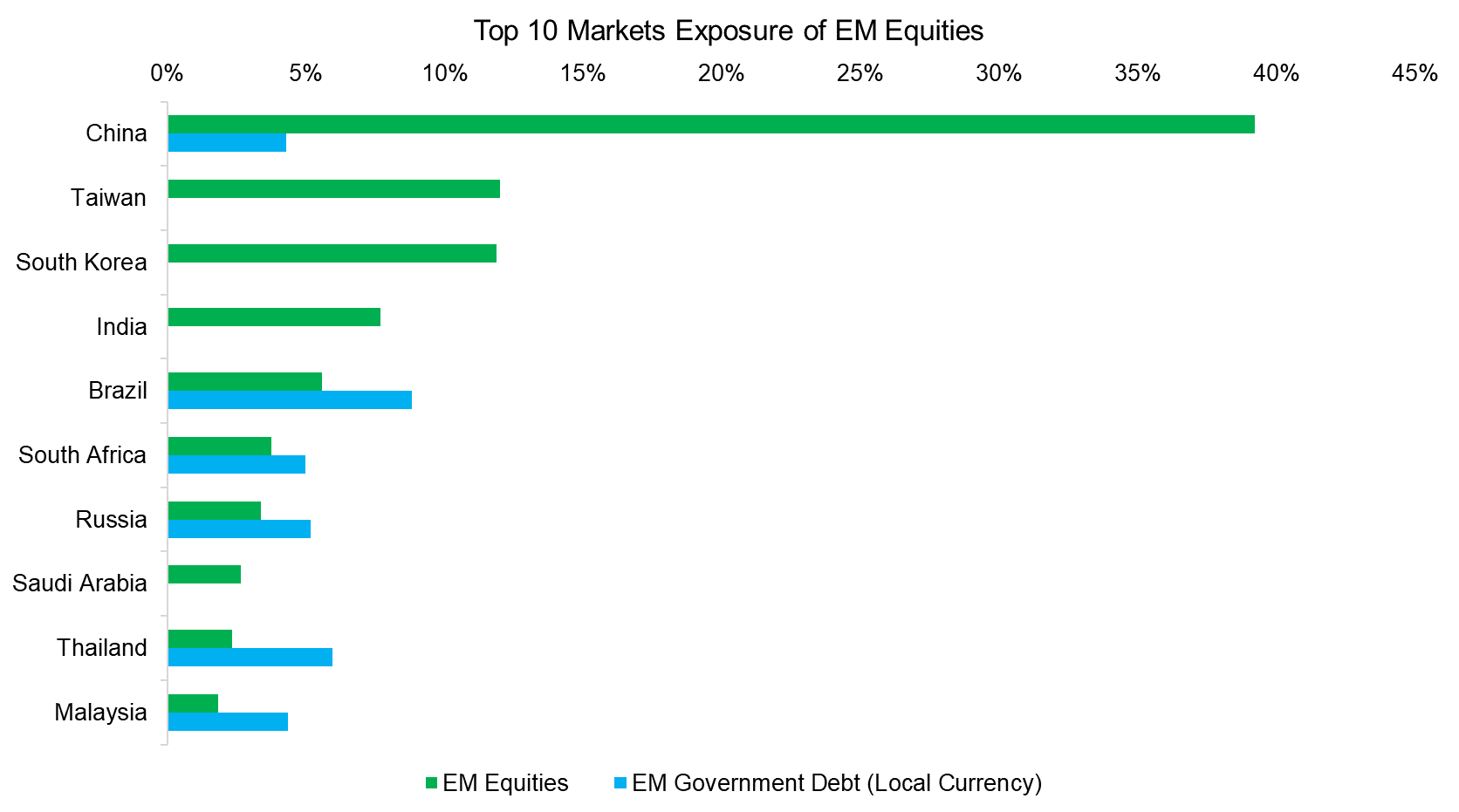

Ranking EM equities by their country of exposure highlights that currently 39% of the stocks are domiciled in China and 63% in three markets (China, Taiwan, and South Korea). In contrast, there is no exposure to either Taiwan or South Korea in local currency-denominated government EM debt and only minor exposure to China.

It is worth noting that the composition of EM indices depends on somewhat arbitrary criteria from index providers like MSCI. This criteria includes of course important characteristics like the size and liquidity of capital markets. The weight of Chinese stocks has increased in benchmark indices for equities in recent years and bonds are undergoing a similar process in indices like the JP Morgan Emerging Market Bond Index.

Source: FactorResearch

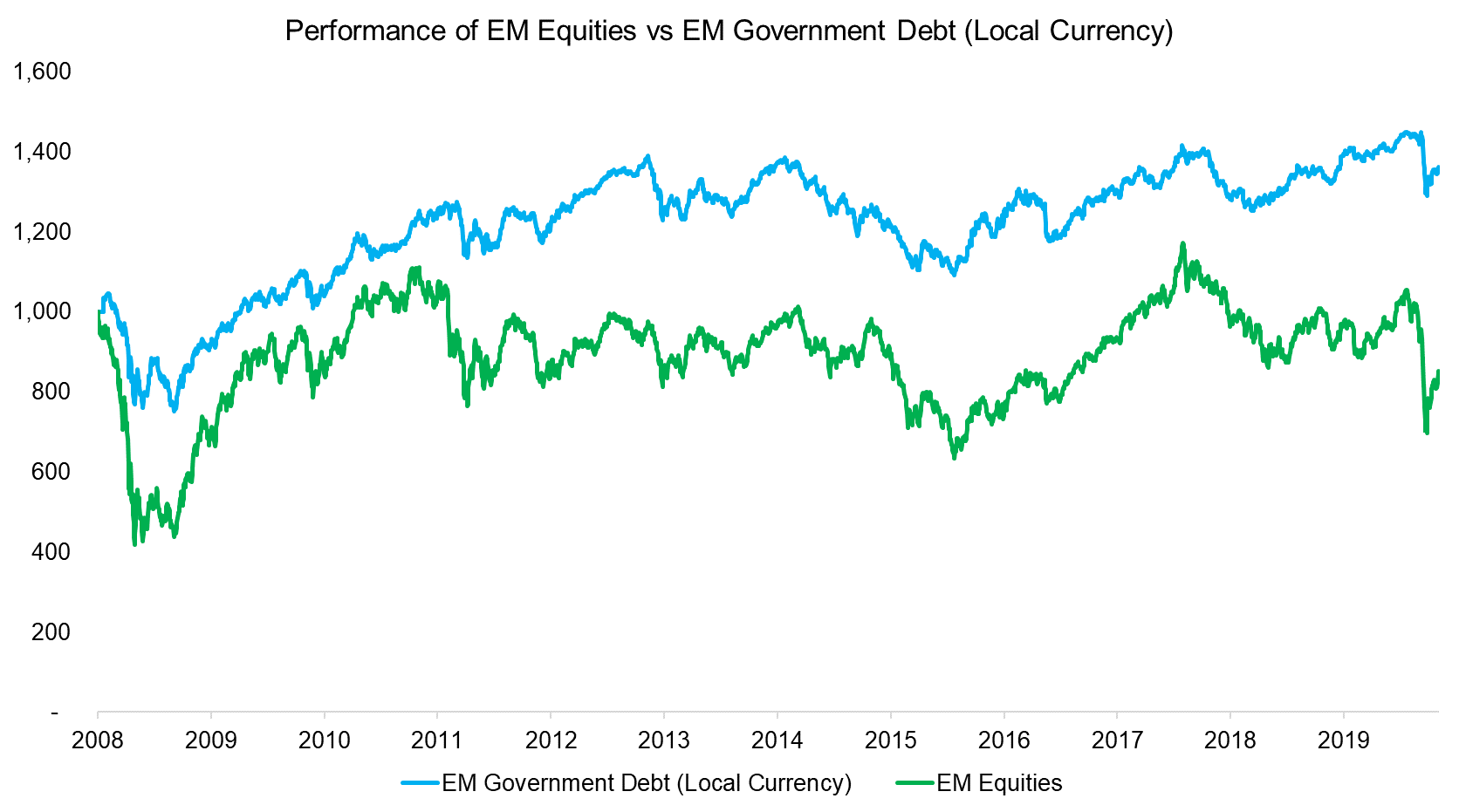

However, despite EM equities indices and local currency-denominated government bonds indices having substantially different country exposures, the performance from 2008 to 2020 was fairly similar in terms of trends, which explains the observed high correlation among them. Given that stocks and government bonds represent different claims, the former on the earnings of companies and the latter on obligations of sovereign states to repay capital with interest, this high correlation is somewhat surprising.

The similarity in performance is due to common factors governing the movements of both asset classes, for instance, foreign investors that dominate capital flows in and out of emerging markets. One explanation for these flows is a perception of government debt, when not dominated in a hard currency like the USD, as risky as the equity of companies. EM countries default on their debt on a regular basis, e.g. Argentina in 2014 or Lebanon in 2020, also see their stock markets take substantial hits, in many cases being demoted from emerging to frontier economies.

Source: FactorResearch.

EM EQUITIES AND DEBT FROM THE PERSPECTIVE OF A US INVESTOR

Considering asset classes within an allocation framework should be based on these providing positive expected returns and representing different bets, e.g. investing in US small, mid, and large-cap equities is not a good diversification exercise because they provide essentially the same exposure and offers few diversification benefits.

From the menu of possible EM instruments, equities and corporate debt were the least correlated and might represent the best option for an investor seeking exposure to a diversified emerging markets portfolio. However, from the perspective of a US investor, correlations to US markets should also be low for an EM allocation to be attractive.

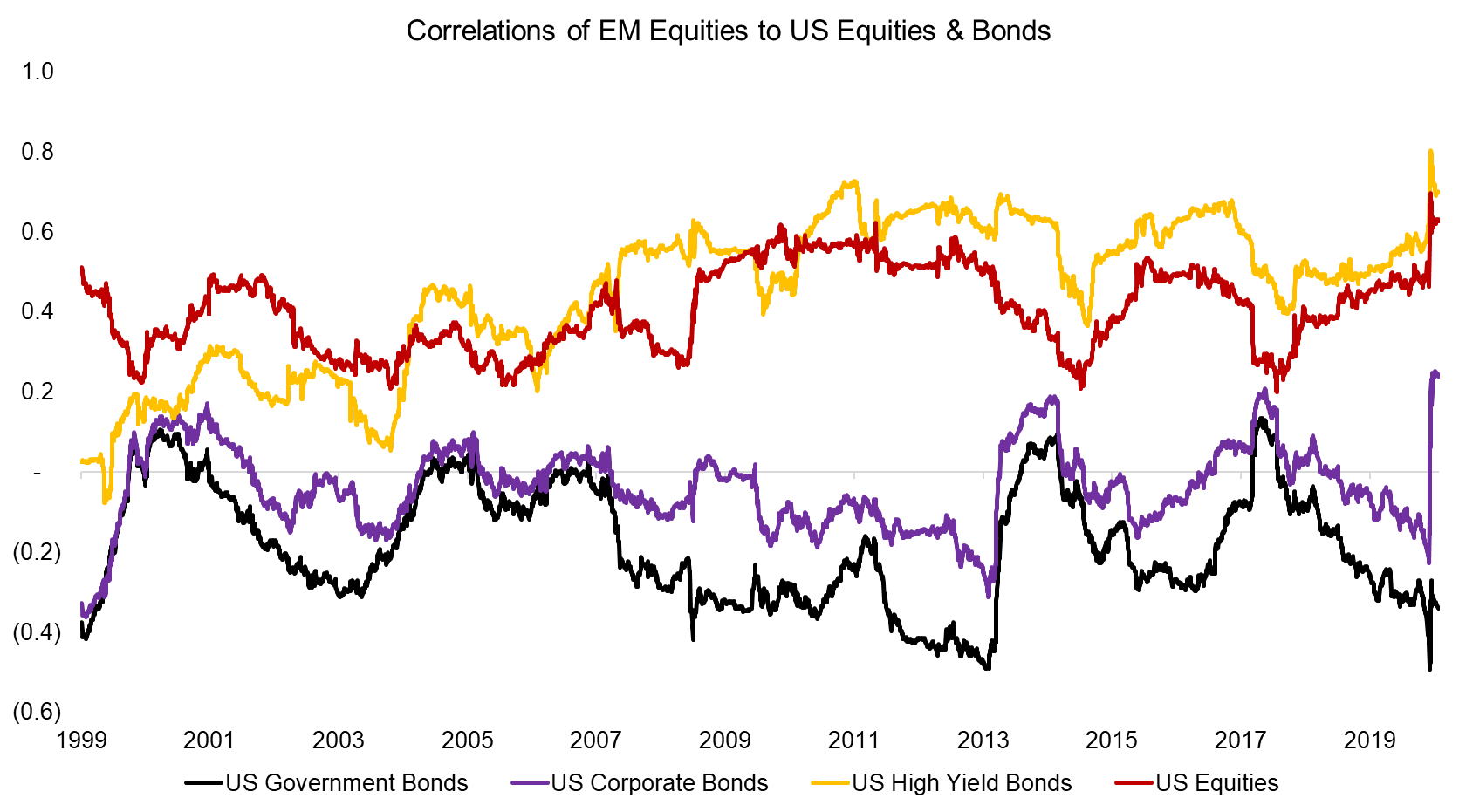

We observe that EM equities were moderately correlated to US equities and high yield bonds over the last 20 years. Given this, EM equities seem somewhat less attractive to US investors.

Source: FactorResearch.

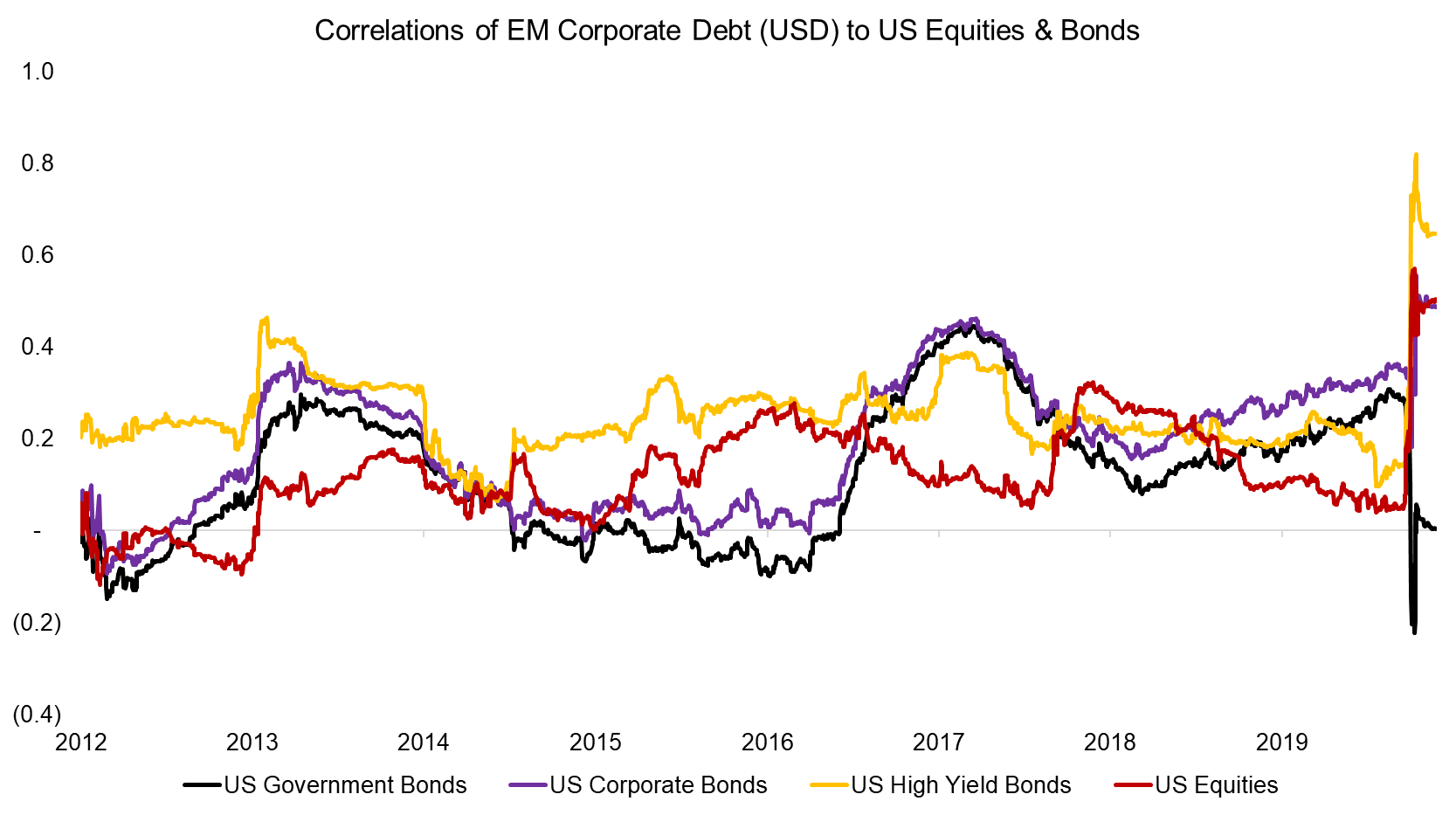

In contrast to EM equities, USD denominated debt from companies in emerging markets has lower correlations to US stocks and bonds between 2014 and 2020, except during the recent COVID-19 crisis, where correlations increased significantly for all asset classes, except to US government bonds.

Source: FactorResearch.

EM EQUITIES AND DEBT COMBINATIONS

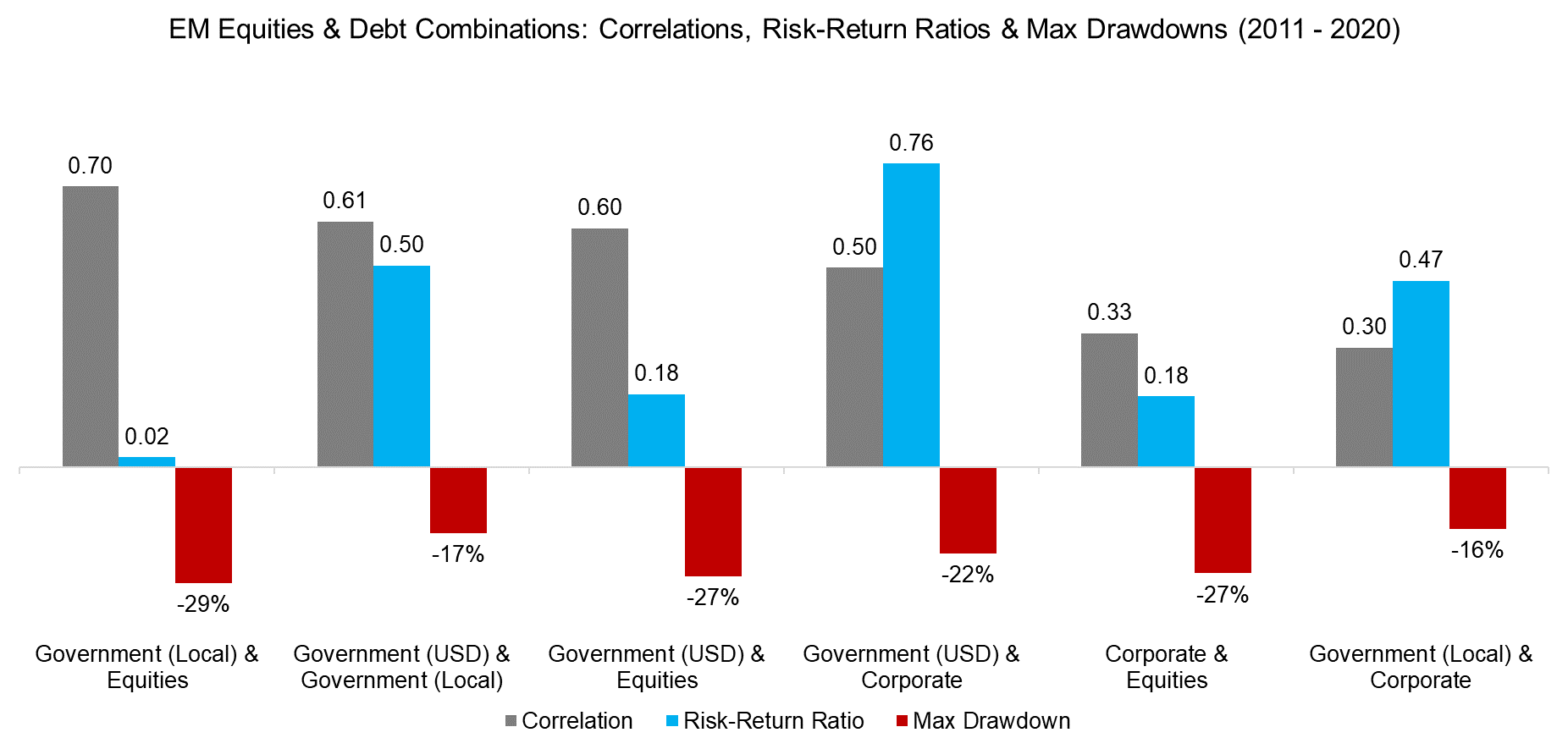

Classic asset allocation frameworks emphasize selecting asset classes with low correlations to generate diversification benefits. An investor seeking exposure to EM equities and debt could, therefore, combine stocks and corporate bonds as they featured low correlations in emerging markets historically. The focus in such optimization scenarios is typically on maximizing risk-adjusted returns and minimizing drawdowns.

However, correlations do not say much about returns and EM stocks generated a CAGR of -1.3% from 2011 to 2020, compared to positive returns for EM bonds, which resulted in low risk-adjusted returns for any combination including equities.

Furthermore, although EM equities and corporates were lowly correlated on average, they became highly correlated when stock markets crashed in 2020, which is reflected in this combination generating the largest maximum drawdown. Naturally, this highlights the danger of being overly reliant on statistical measures and disregarding fundamentals as well as common sense, e.g. equities and corporate debt in EM are subject to common risks that affect both types of claims on a companys’ cashflows.

Source: FactorResearch

FURTHER THOUGHTS

We set out to evaluate EM equities and bonds from the perspective of a US investor, however, forming a conclusion is somewhat challenging given the complexity of the field. What have we learned?

- EM hard and local currency-denominated bonds were highly correlated to EM equities, providing investors with similar exposure

- EM corporate debt was least correlated to EM equities, perhaps providing the best combination if exposure to bonds and stocks is desired

- EM equities was moderately correlated to US equities and high yield bonds

- EM corporate debt was least correlated to US stocks and bonds

- In crisis times, investors sell all types of EM instruments and correlations spike

It is worth noting that this analysis focused on benchmark indices and not individual countries, which would have introduced even more complexity. Emerging market specialists likely will point out that significant value could be created via country selection given unique knowledge acquired of studying developing countries for many years.

However, the same case could be made for picking sectors in the US or countries in Europe, where few investors have established attractive long-term track records. Beating benchmarks is tough.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.