Emerging Market Funds: Same, Same, but Different?

Divergent factor exposures

May 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Emerging markets offer divergent factor exposures across and within regions

- Smart beta ETFs do not necessarily offer high factor exposures

- It is all about fund selection

INTRODUCTION

We highlighted previously that the case for exposure to emerging markets (“EM”) stocks is not as clear as frequently highlighted by the marketing materials of asset managers (read The Case Against EM Equities). Sure, perhaps some of these markets have higher economic growth rates than Europe or the US, but there are also multiple concerns.

The MSCI Emerging Market Index notes at the same level as in 2007, despite all the growth of emerging economies over the last 16 years. The index’s largest constituent country with a 32% weight is China, where lately the political regime has been anything but investor friendly. Worse, the medium to long-term outlook for its economy is not particularly rosy given record levels of debt, and a population that is expected to shrink by 400 million people until 2100.

We could further emphasize the high correlation of emerging market stocks and US high-yield bonds, which implies limited diversification benefits, or that EM stocks mostly outperform when the USD is becoming cheaper, and therefore represent a currency bet, but this would be just nit-picking.

Let’s assume an investor still wants exposure to EM equities, should he go for mutual funds or ETFs? Buy a global emerging markets index or multiple country indices? Select a smart beta or plain-vanilla product?

Although these asset allocation questions can be quite challenging, we will attempt to answer some of these using factor exposure analysis in this article.

DIVERGENCE ACROSS REGIONS

We define our universe of possible investment opportunities as emerging market mutual funds and ETFs that have at least five years of track record and are available to US investors, which results in approximately 240 funds that manage almost $400 billion of assets. These can be differentiated by geographies, which includes global, regions, and countries, and by investment styles.

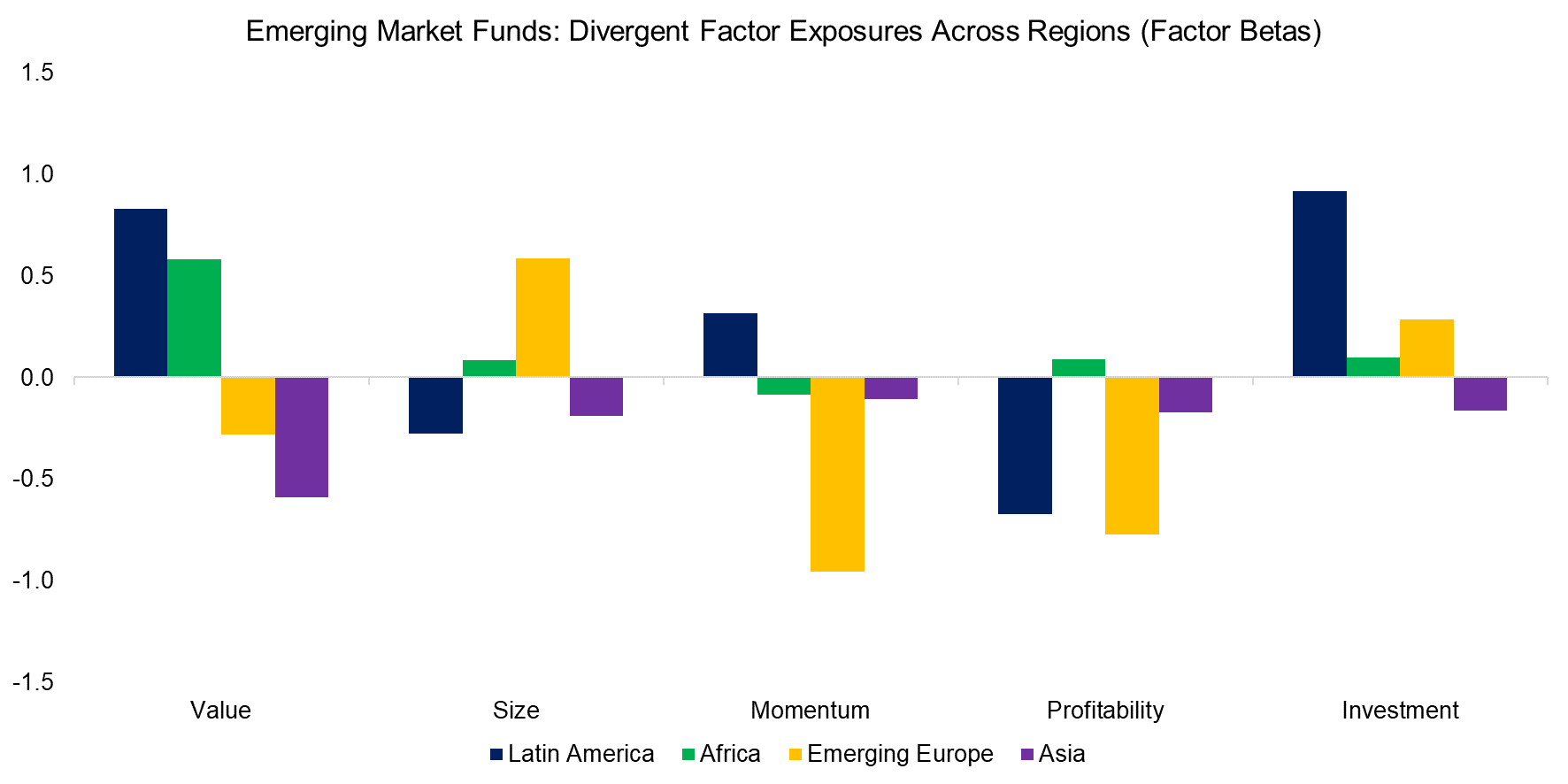

First, we run a factor exposure analysis on four regions using monthly returns for emerging market factors from the Kenneth R. French data library and a five-year lookback. We observe that the factor betas were highly divergent, eg Latin America and Africa had positive exposure to the value factor, ie stocks were cheaper than elsewhere in emerging markets, while emerging Europe and Asia feature negative exposure. Every region offers a different multi-factor exposure combination.

Source: Finominal

DIVERGENCE WITHIN REGIONS

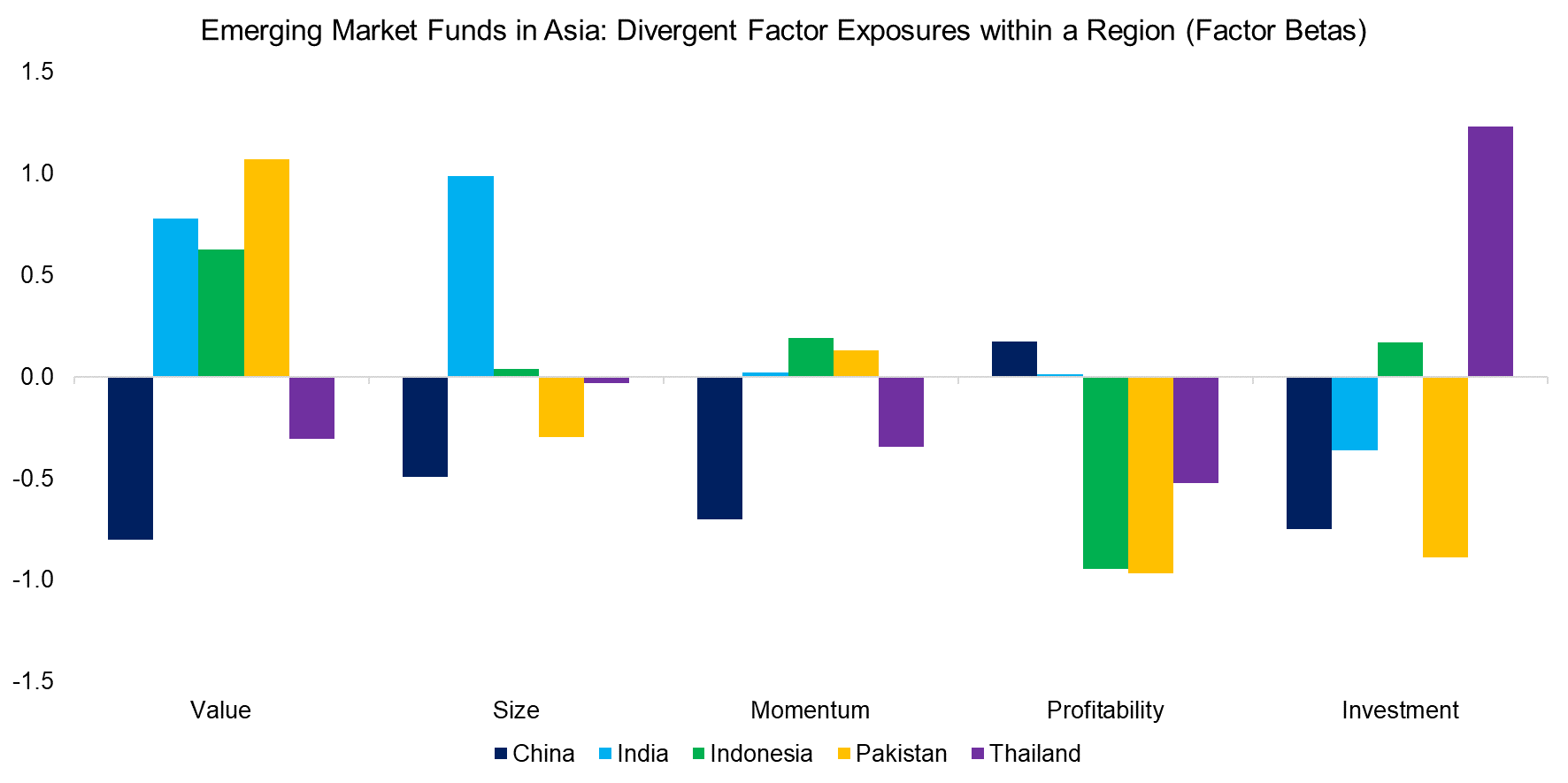

However, the factor exposures are not only divergent across regions, but also within them. For example, the factor betas for emerging market funds in Asia are all over the place. China and Thailand have negative exposure to the momentum factor, ie stocks have been underperforming, compared to positive betas for India, Indonesia, and Pakistan. None of the five factors used in this analysis shows the same direction for all five countries, which simply highlights structural differences of their economies and capital markets.

Source: Finominal

SMART BETA VERSUS MUTUAL FUNDS

Factor investing had a comeback in 2022 as most factors generated positive returns and some investors might be intrigued to pursue factor investing in emerging markets. Intuitively, it could even be more attractive than in developed markets given less sophisticated investors (read Factor Investing in Emerging Markets).

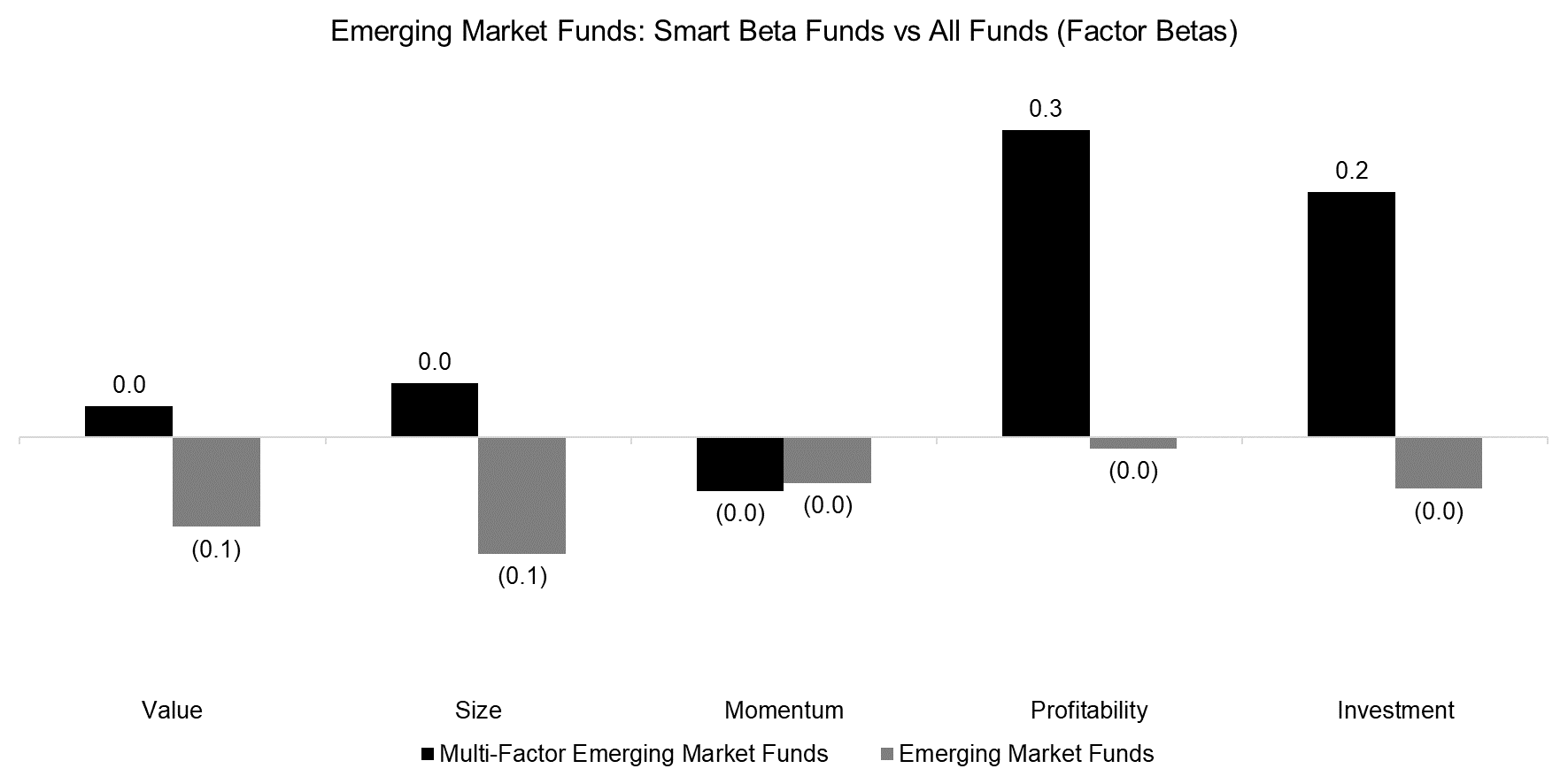

There are about 40 funds that provide exposure to single and multiple factors for global emerging market funds, which manage slightly more than $30 billion of assets. Some of these are ETFs, which explains why the median management fee is 0.89%, compared to 0.99% for general EM funds.

However, if we compare the ones that provide exposure to multiple factors, then the median betas to the five factors are not significantly higher than for plain-vanilla EM funds. There is minor positive exposure to the profitability and investment factors, but essentially none to the value, size, and momentum factors, which investors would have likely expected.

Source: Finominal

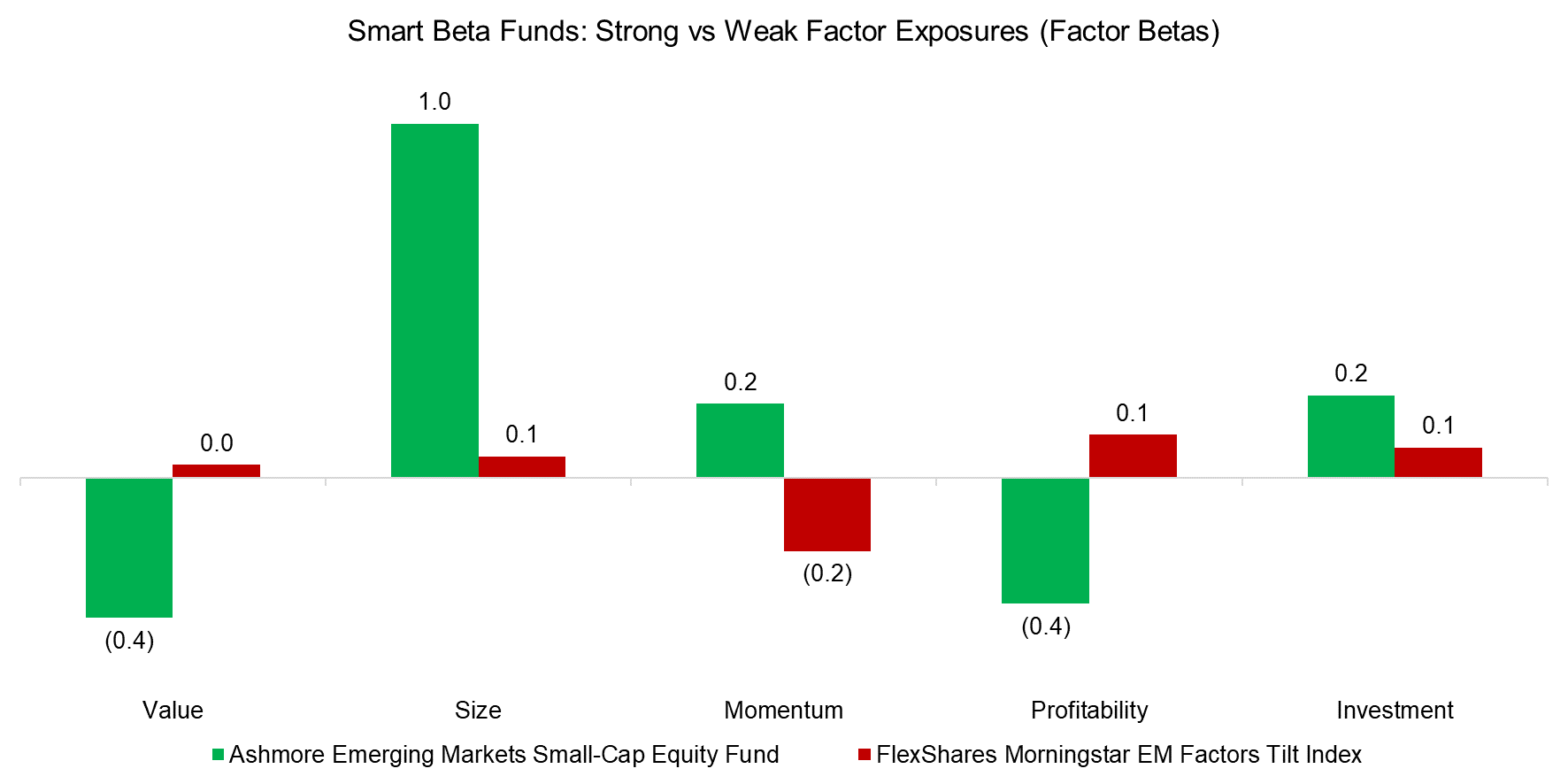

To be fair to fund management companies, the factor exposures depend on the product and some offer meaningful exposures. For example, the Ashmore Emerging Markets Small-Cap Equity invests in expensive and unprofitable small caps, which is debatable in terms of investment strategy, but at least offers something different than the MSCI EM Index. In contrast, the FlexShares Morningstar EM Factors Tilt Index, which is significantly cheaper at 0.59% per annum versus 1.52% for the mutual fund, has factor tilts that are insignificant and make this fund essentially an index hugger.

Source: Finominal

FURTHER THOUGHTS

What have we learned from this analysis?

It seems that emerging markets are complex and offer different factor exposures across as well as within regions. Mutual funds are not necessarily worse than ETFs, albeit more expensive on average. Most investors will invest in emerging markets based on thematic views, but this should be complemented with a quantitative assessment. As usual, Alpha Analyzer.

RELATED RESEARCH

Momentum in Emerging Markets

The Case Against EM Equities

Factor Investing in Emerging Markets

EM Equities vs Debt: Same, Same, but Different?

EM Debt: To Hold or Not to Hold?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.