Equity Factors & The Mighty US Dollar

How Sensitive Are Factors to Changes in the USD?

April 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The US dollar had a slightly negative relationship with the stock market since 1996

- Some equity factors are more sensitive to changes in the US dollar than others

- On average the sensitivity is zero, but as often averages are misleading

INTRODUCTION

The Economist’s Big Mac Index measures if currencies are over- or undervalued by comparing the implied versus actual exchanges rates of foreign currencies to the US dollar based on the cost of a McDonald’s Big Mac burger. As of January 2019, this unique measure of currency valuation highlighted that out of 55 currencies, only three were overvalued: Switzerland, Norway, and Sweden.

Given that the majority of currencies are undervalued to the US dollar, this makes most countries attractive for investment from US-domiciled investors, assuming they believe in purchasing-power parity (PPP) based on burger prices. The current fortune of US investors is partially based on the strength of the US dollar, which is supported by the US economy and the unwinding of the quantitative easing programme by the US Fed. Higher interest rates make the US dollar attractive in the current low interest rate environment (read Factors & Interest Rates).

Investors have historically focused on analyzing the impact of the US dollar on stock market sectors like energy or materials. Given the rise of factor investing in recent years, it is interesting to investigate the influence on factors, which is the focus of this short research note.

METHODOLOGY

We utilize six factors namely Value, Momentum, Size, Low Volatility, Growth, and Dividend Yield in this analysis. The long-short, beta-neutral factors are created by selecting the top and bottom 10% of stocks in the US stock market ranked by the factor definitions, which are in line with academic research. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

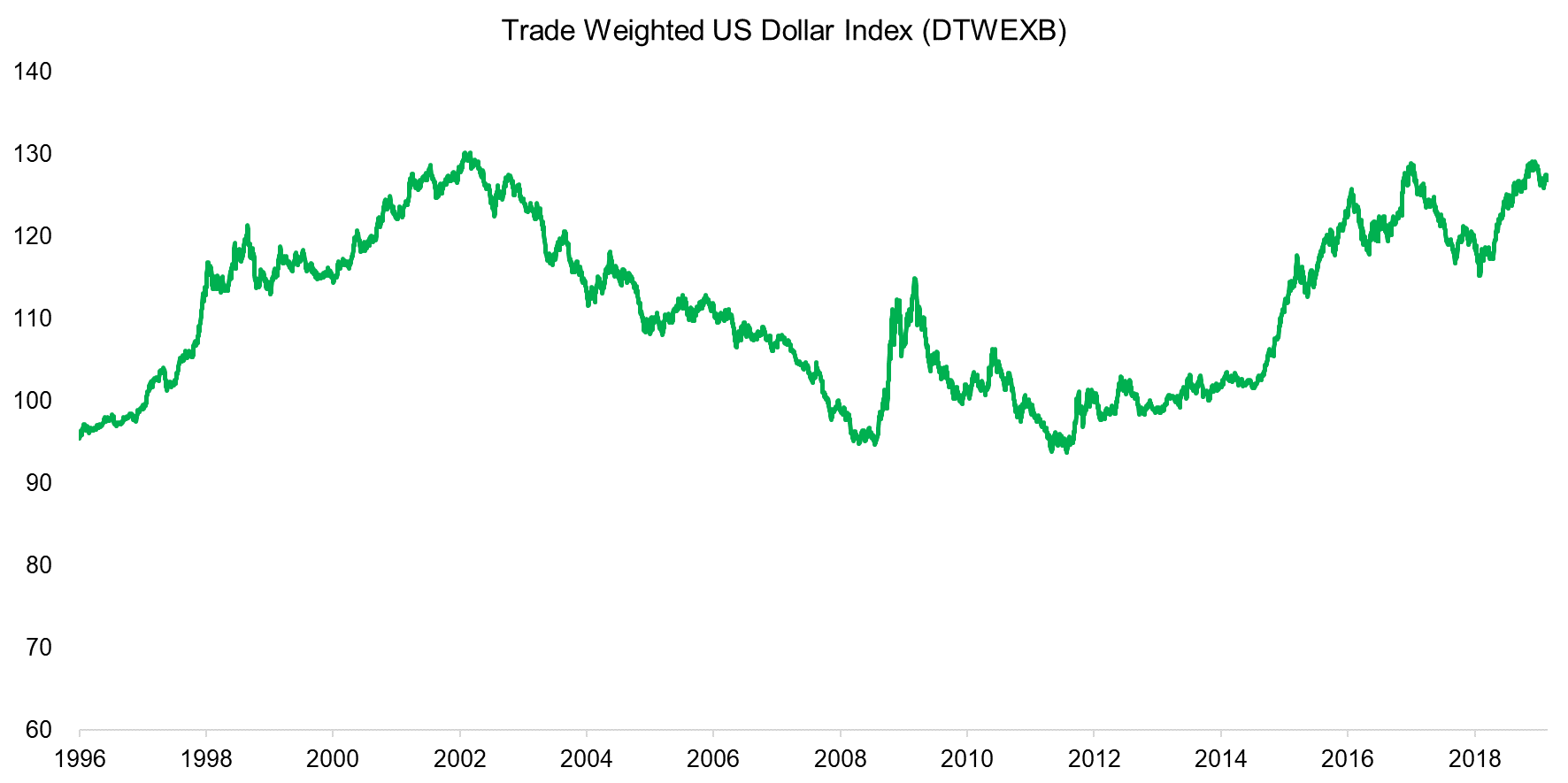

THE US DOLLAR INDEX

The US dollar index of the St. Louis Fed (DTWEXB) is trading at the highest levels since 2002, reflecting a strength of the US dollar against a broad basket of other currencies. Major central banks like the ECB and BOJ are still conducting quantitative easing programmes that tend to weaken currencies. In contrast, the US Fed has started raising interest rates, which has led investors to allocate capital to the US and explains the US dollar appreciation in recent years.

Source: St. Louis Fed, FactorResearch

SENSITIVITY OF EQUITY FACTORS TO THE US DOLLAR

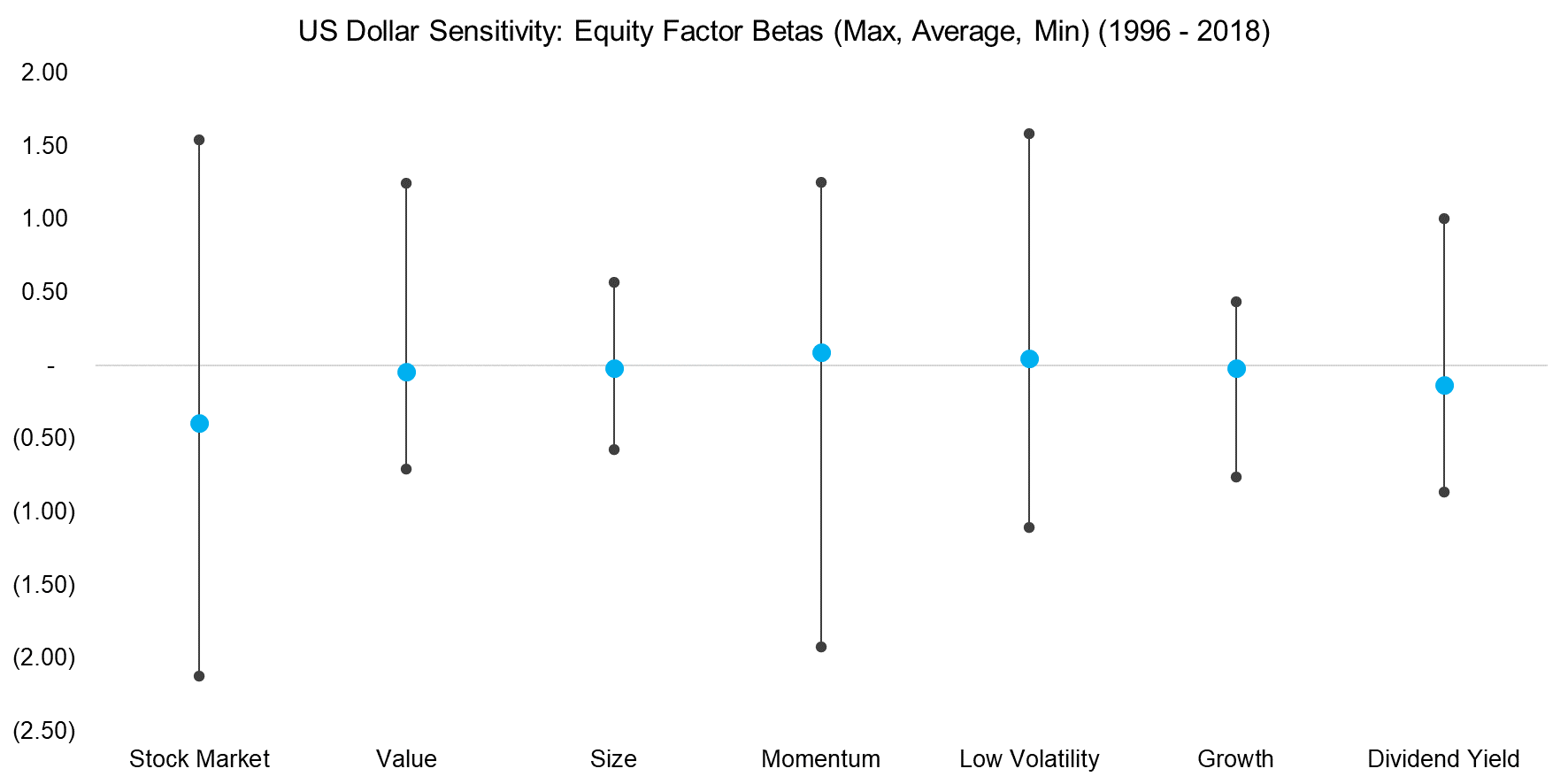

We measure the sensitivity of common equity factors and the stock market to the US dollar index via a regression analysis using weekly returns and a one-year lookback. The factor betas highlight that the US dollar on average had a negative relationship with the stock market, albeit was unimportant for equity factors on average.

However, we observe that in the period from 1996 to 2018 the factor betas were time-varying with significant differences between the average, maximum, and minimum betas. Furthermore, some factors were more sensitive than others.

Source: FactorResearch

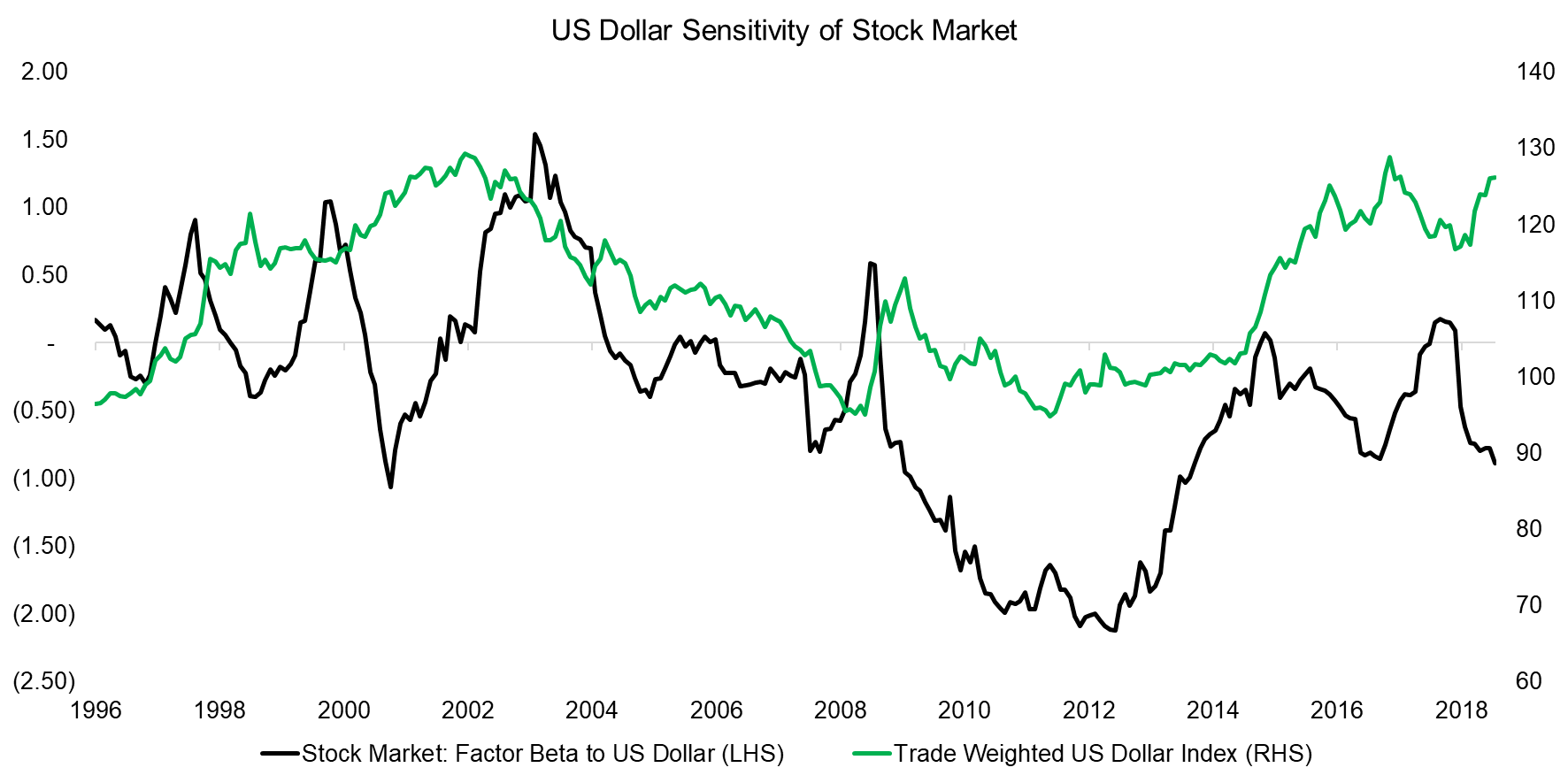

US DOLLAR SENSITIVITY OF THE STOCK MARKET

The regression analysis highlights that the US dollar showed a negative relationship with the US stock market on average, which basically implies that historically a rising US dollar was negative for equity returns. We observe that this was especially pronounced after the global financial crisis in 2008, where the factor beta was quite negative. During that period the US dollar weakened due to the Fed’s aggressive quantitative easing programme, but the stock market recovered from the low point in 2009 and began its multi-year bull market.

It is worth noting that there seems to be a broad relationship between the strength of the US dollar and stock market sensitivity to it, i.e. the stronger the dollar, the more positive the factor beta, and vice versa.

Source: St Louis Fed, FactorResearch

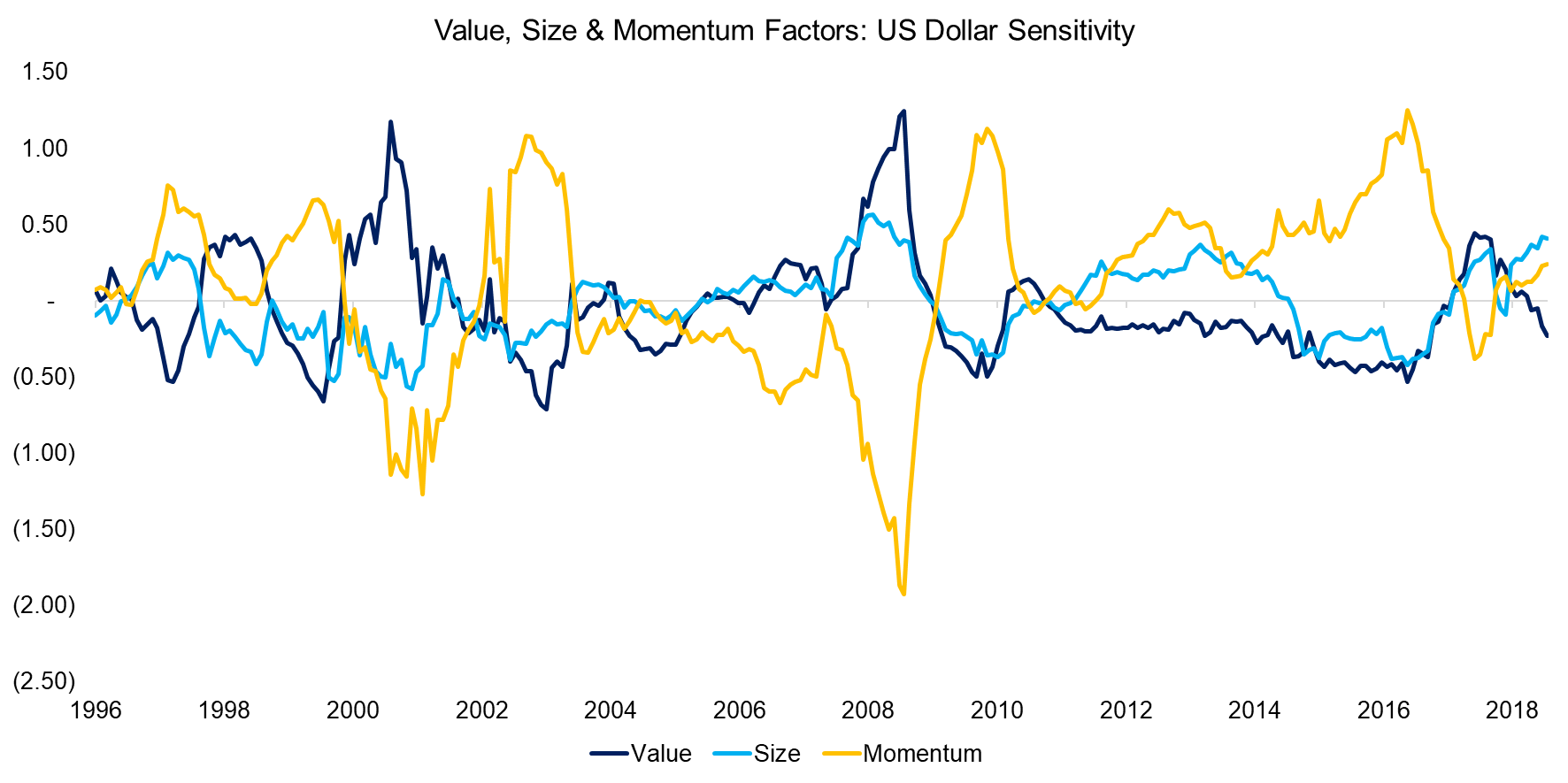

US DOLLAR SENSITIVITY OF COMMON EQUITY FACTORS

Next, we analyze the US dollar sensitivity of common equity factors. The Value and Size factors were not particularly sensitive to changes in the US dollar, except for turbulent periods like the tech bubble in 2000 and the global financial crisis in 2008 and 2009.

In contrast, the Momentum factor was significantly more sensitive and was mostly showing an inverse sensitivity to the Value and Size factors, which can be explained by a low or negative correlation between the Momentum and the other two factors (read Factors: Correlation Check).

Source: FactorResearch

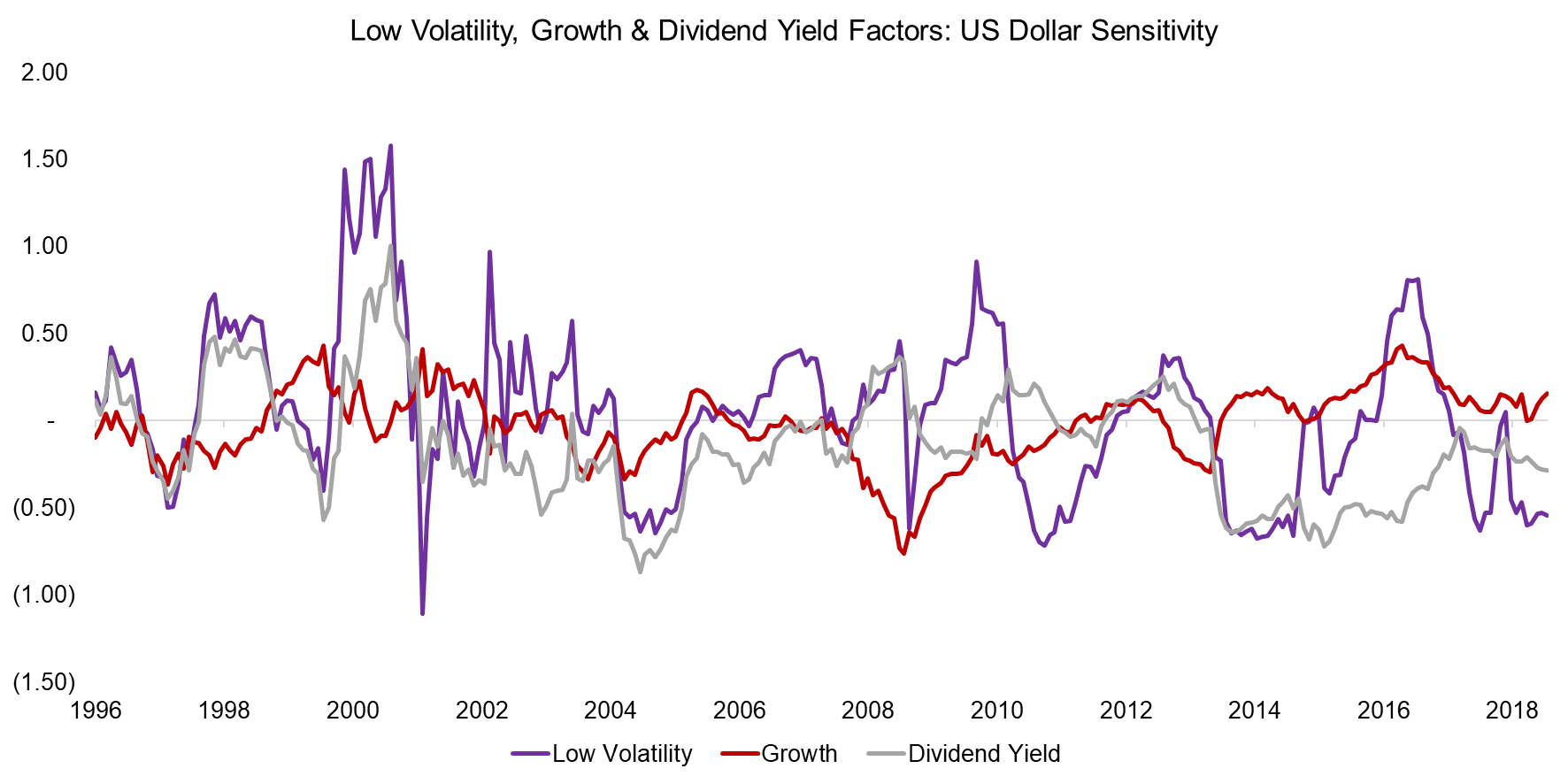

The Low Volatility and Dividend Yield factors exhibited a highly similar relationship with the US dollar across time, albeit one that was slightly stronger before the global financial crisis. Both factors are influenced by interest rates as low-risk and dividend-yielding stocks are frequently considered as proxies for bond investments. A stronger US dollar fuelled by higher interest rates is likely to be negative for these factors.

The Growth factor had a lower sensitivity to the US dollar, which is intuitive as Growth stocks like the FAANGs tend to be less influenced by the macro environment and more by firm-specific risks.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that some factors like Momentum were more sensitive to changes in the US dollar than others, although this was highly time-dependent. The analysis can be challenged as the higher sensitivity is partially explained by higher factor volatility, e.g. the Momentum and Low Volatility factors are more volatile than the Growth and Size factors. However, adjusting the factor betas for volatility does not change the direction of sensitivity.

Measuring the US dollar sensitivity of a portfolio is not only interesting from a risk management perspective, but it also potentially empowers investors to identify the underlying performance drivers, which are still often unclear when it comes to factor investing.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.