The ETF Crusades

Investing powered by higher powers

February 2023 Reading Time: 10 Minutes. Author: Rodolfo Martell

This research note is a guest post from Rodolfo Martell, PhD, Head of Portfolio Strategy, of Pluribus Labs LLC, a San Francisco-based systematic active equity manager that is part of Exos Financial.

SUMMARY

- Religious-themed ETFs have increased their AUM to roughly $1 billion

- 3 / 4 products outperformed their benchmarks since 2020

- The outperformance can be attributed to their factor exposures

INTRODUCTION

Before ESG investing became fashionable (and subsequently unfashionable, depending on your views and/or current market trends), there was values-based investing. In its simplest form, values-based investment allows an investor to express religious beliefs through financial instruments, albeit in the crudest of forms: via exclusions.

Exclusionary investing uses, as the name suggests, filters based on cultural, religious, or spiritual beliefs to exclude companies or entire industries from an investment portfolio. Some of the oldest operating funds of this type focus on simple specific exclusions, for instance, eliminating guns, oil and fossil fuels, nuclear power, and / or no sin stocks (tobacco, alcohol, gambling) (read ESG Investing: Too Good to be True?). While their simplicity (in objective and method) made for very appealing marketing, investment professionals quickly pointed out the main objection to an exclusions-based approach: their inherent inefficiency since a foundational tenet of modern portfolio theory is that more assets in an investment universe is preferred to fewer. Further, active managers have an even cleaner argument in the fundamental law of active management (Grinold and Kahn, 2000).

In this note, we will focus on a narrow set of exclusionary funds constructed according to religious beliefs. Specifically, we will look at the performance and popularity of Catholic values and Islamic values ETFs. Catholic funds follow indices like the S&P 500 Catholic Values Index, which are constructed following the Responsible Investment Guidelines of the Conference of Catholic Bishops, including screens for weaponry and child labor. Islamic funds, on the other hand, offer exposure to stocks from a benchmark that comply with Shariah investment principles.

Source: Finominal

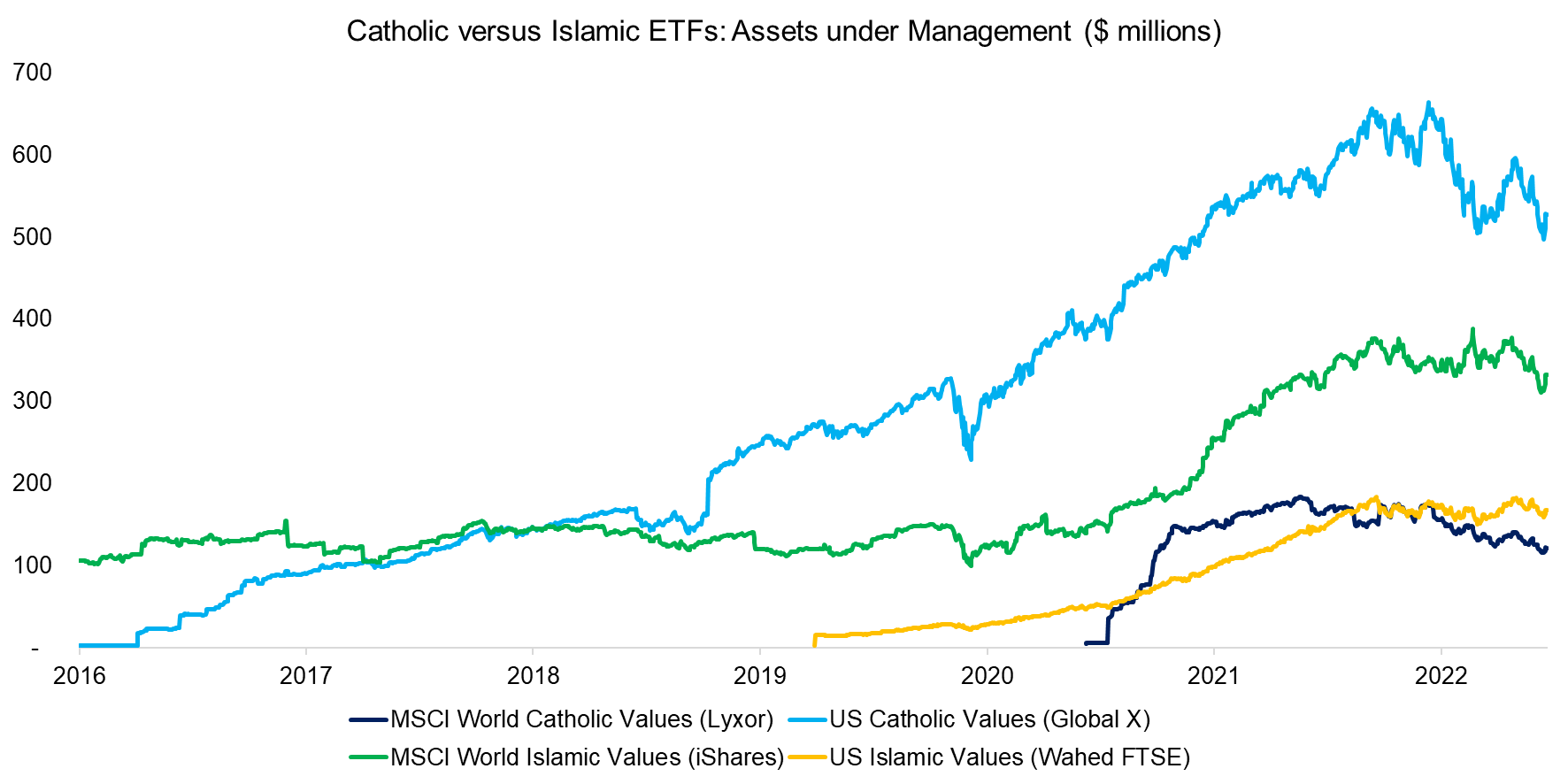

Figure 1 shows the evolution of assets under management (AUM) for the four most popular ETFs in these categories. Religious funds took a long time to become popular with investors. The longest track record goes back to December 2007; it took about eight years for that fund to raise and maintain $100 million in AUM. Starting in 2016, though, demand for these funds increased consistently, from $100m combined ($3m in a Catholic fund and $103m in an Islamic one) in 2016 to over $1.1 billion in 2022 (approximately 56% in Catholic funds and 44% in Islamic funds).

PERFORMANCE

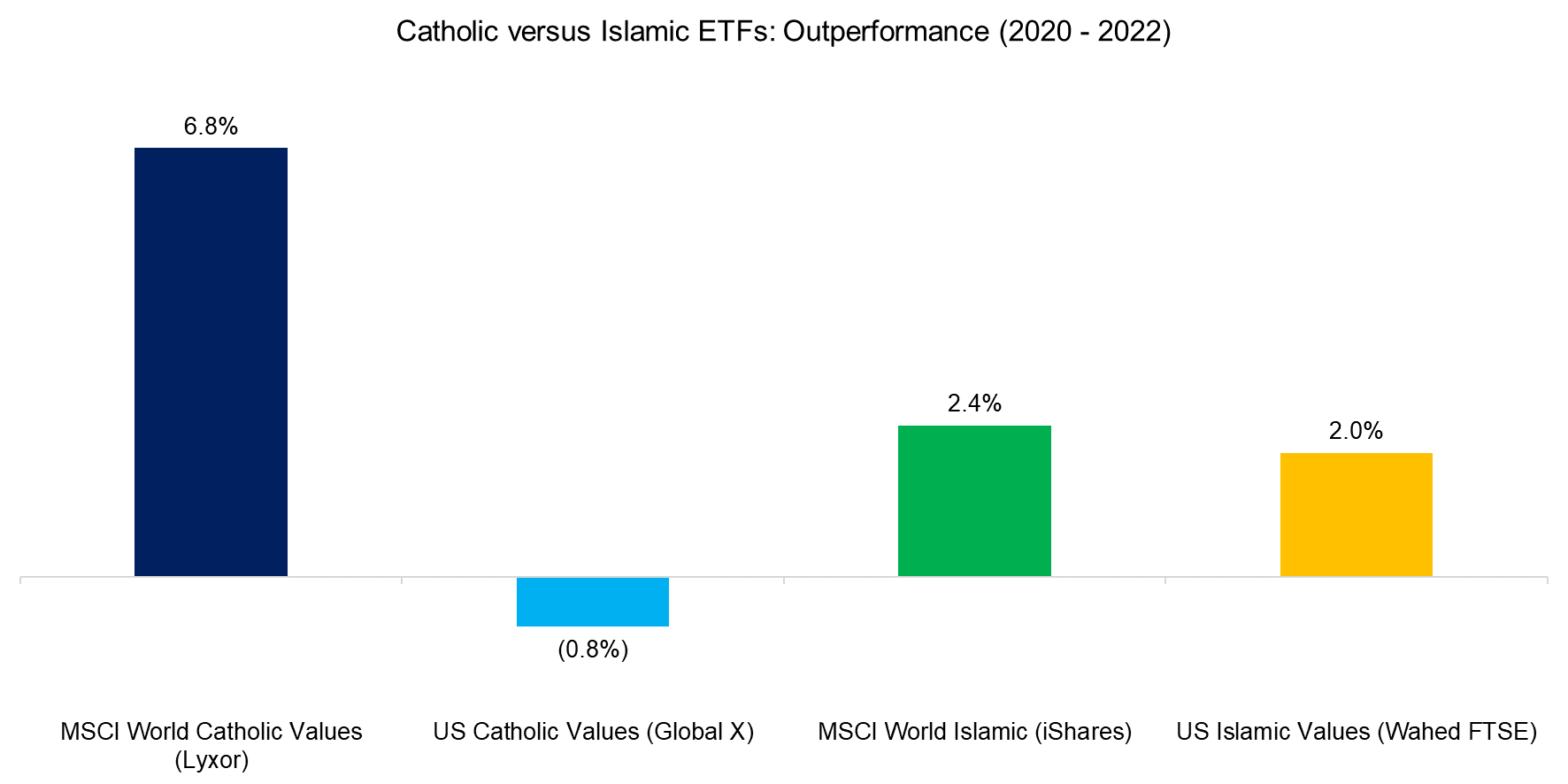

Figure 2 shows the recent performance of these funds for the 2020 – 2022 period, during which four funds raised assets. Over the period, both Islamic funds outperformed their benchmark. On the Catholic side, one fund significantly outperformed its benchmark while the other did not.

Source: Finominal

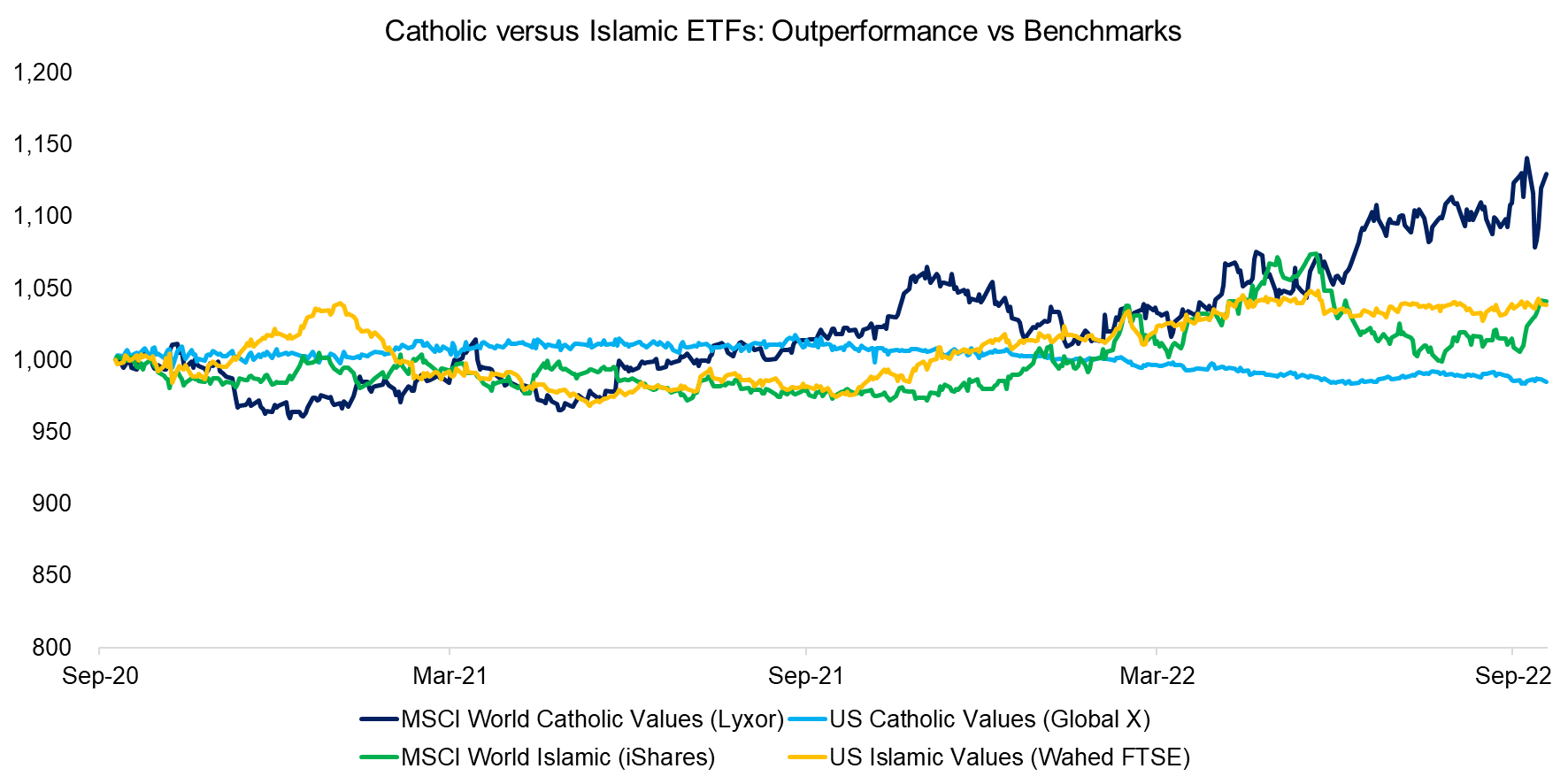

Because averages can be deceiving, Figure 3 looks at the time series behavior of the returns of the funds. From this chart, it is evident the different return profiles of the Catholic funds (dark blue and light blue lines). The Islamic funds (green and yellow lines), while much closer in cumulative returns at the end of the period, also have noticeable differences. Both sets of differences are somewhat puzzling given that their respective prospectuses have very similar objectives, according to their fund descriptions.

Source: Finominal

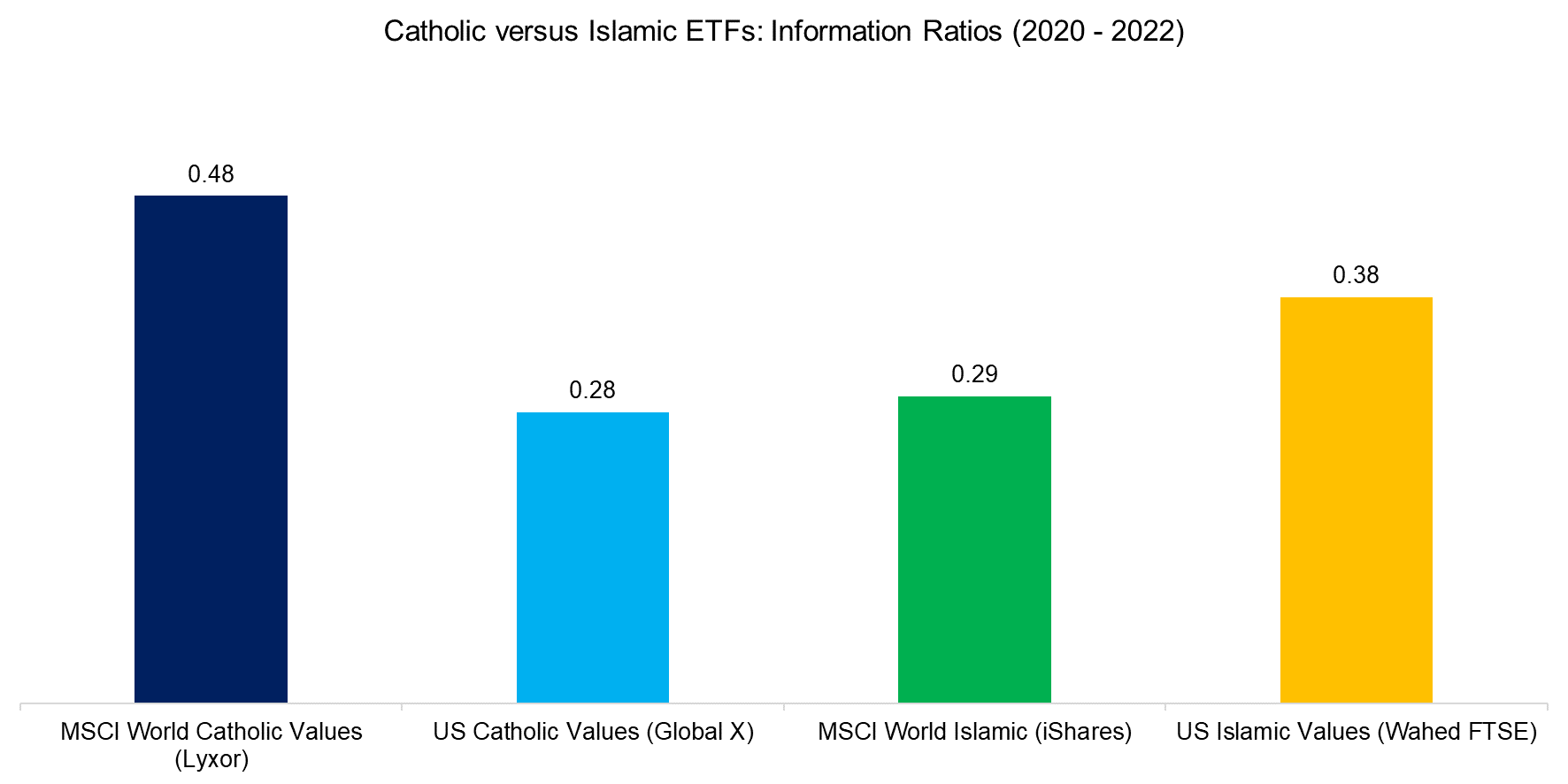

Figure 4 looks at the information ratios of these funds. There are no surprises here based on Figure 3, with the MSCI World Catholic fund delivering the best volatility-adjusted returns. In the case of the Islamic funds, the US Islamic Wahed ETF has a slight advantage in IR, given its less volatile return profile.

Source: Finominal

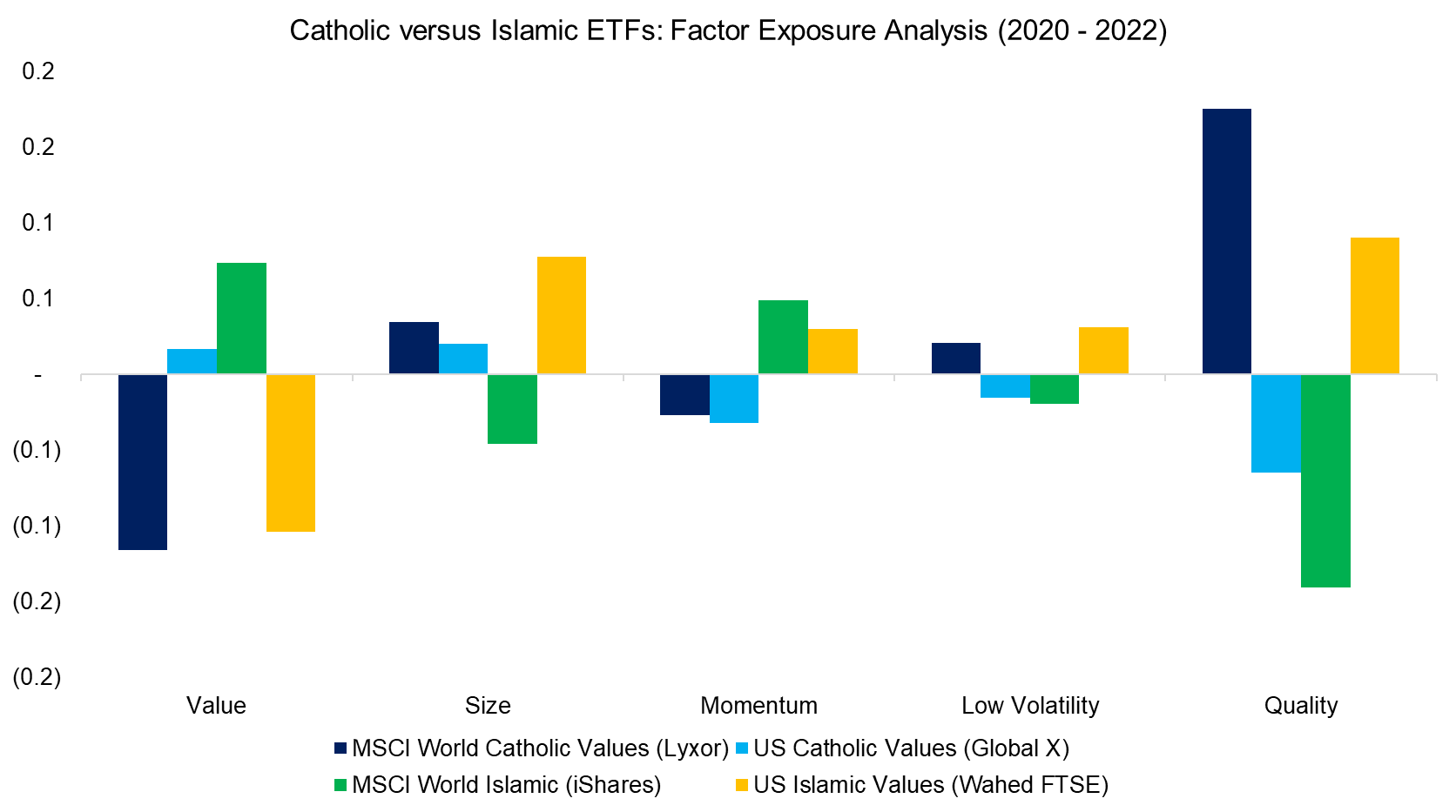

FACTOR EXPOSURE ANALYSIS

We finally look at factor exposures in Figure 5. These are more interesting, telling a nuanced story. Consistent with the data, the US Catholic Values fund has the least volatile returns and the smallest factor exposures. The MSCI World Catholic fund does have substantially larger exposures, particularly to Value (negative) and to Quality (positive). In other words, the fund was exposed to good quality albeit expensive companies. Somewhat unexpectedly, both Catholic funds have opposite exposure to Value and Quality.

Equally puzzling is that both Islamic funds have opposite exposures to every factor, except Momentum. Finally, we find that the MSCI World Islamic fund has qualitatively similar exposures as the MSCI World Catholic fund, except for Momentum. From a factor perspective, MSCI World Catholic and MSCI World Islamic funds are very similar. While religious scholars might not find the result surprising, investment professionals might be a bit confounded given the fact that the different nature of the exclusions produced a remarkably similar set of factor exposures.

Source: Finominal

FURTHER THOUGHTS

We looked at the returns and factor exposures of four religious-based exclusions ETFs, two Catholic and two Islamic. Although the prior would be for both sets to behave similarly given the sets of beliefs governing their respective exclusions, we find significant differences in returns and factor exposures within each pair of funds (read Thematic vs Momentum Investing). In the end, it seems the investment universe has a larger effect on factor exposures than the religious exclusions being implemented.

RELATED RESEARCH

Uncovering Disruptive Forces to Stocks using NLP

Thematic vs Momentum Investing

An Anatomy of Thematic Investing

Thematic Indices: Looking at the Past or the Future?

Thematic Investing: Thematically Wrong?

ESG Investing: Too Good to be True?

Smart Money, Crowd Intelligence, and AI

Carbon ETFs: Making Money from Air

ABOUT THE AUTHOR

Rodolfo Martell is the Head of Portfolio Strategy at Pluribus Labs LLC. He previously worked at AQR as a Managing Director in the Global Stock Selection Group. Before that, he was employed by QMA, a PGIM company, as a global strategist and co-chair of the ESG Committee. He started his investment career at BlackRock, where he ultimately worked as a senior portfolio manager in the Scientific Active Equities Group. He has been a lecturer at UC Berkeley and an Assistant Professor at Purdue University. He holds a PhD in finance from the Ohio State University.

Connect with me on LinkedIn.