ETFs, Smart Beta & Factor Exposure

Do Smart Beta ETFs Provide the Desired Factor Exposure?

July 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Factor exposure analysis can be used to derive factor themes

- Smart beta ETFs offer relatively low factor exposure

- It is all about how factors are defined

INTRODUCTION

The Austrian energy drinks company Red Bull advertised for almost two decades that Red Bull “gives you wings” and improves a consumer’s concentration and reaction speed. Consumers in the US sued the company successfully in 2014 as they had not developed flying capabilities or improved their mental powers. Red Bull was forced to pay a fine of $13 million and reimburse $10 to every consumer who bought the drink since 2002. Unfortunately false advertisement is not limited to consumer products, but also widespread within the financial industry. Investors frequently discover that the names of financial products are not accurate descriptions for the underlying portfolios. In this short research note we will investigate the factor exposure of smart beta ETFs, initially by focusing on the Value factor and then expanding to other factors (read Smart Beta or Smart Marketing).

METHODOLOGY

We focus on seven factors namely Value, Size, Momentum, Low Volatility, Quality, Growth and Dividend Yield in the US stock market. The factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks ranked by the factor. The factor definitions are in line with academic and industry standards. Only stocks with a minimum market capitalisation of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

Factor exposure is measured by factor betas derived from a one-year regression analysis utilising daily data and the seven equity factors as well as the market as independent variables.

ETFS WITH VALUE FACTOR EXPOSURE

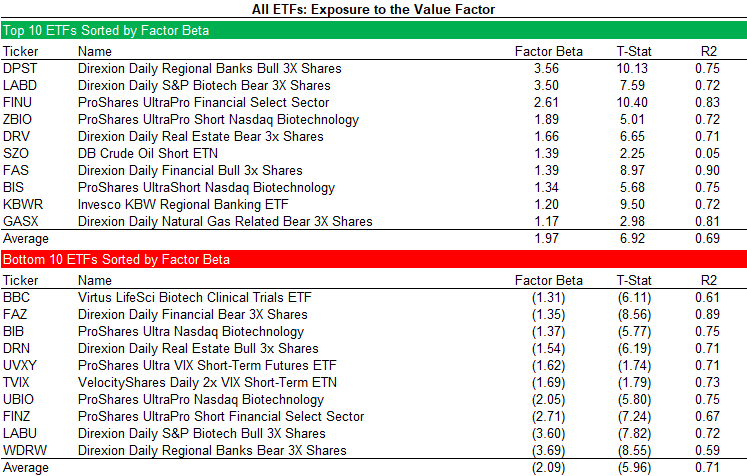

As a first step, we measure the exposure to the long-short Value factor of all tradable ETFs in the US. Interestingly, the resulting list of ETFs with the highest Value factor exposure as measured by the factor beta does not contain any smart beta Value ETFs, but represents a rather diverse universe. The chart below shows the top and bottom 10 funds and we can identify ETFs for different equity sectors, both long (“Bull”) and short (“Bear”), the VIX, and even commodities.

Source: FactorResearch

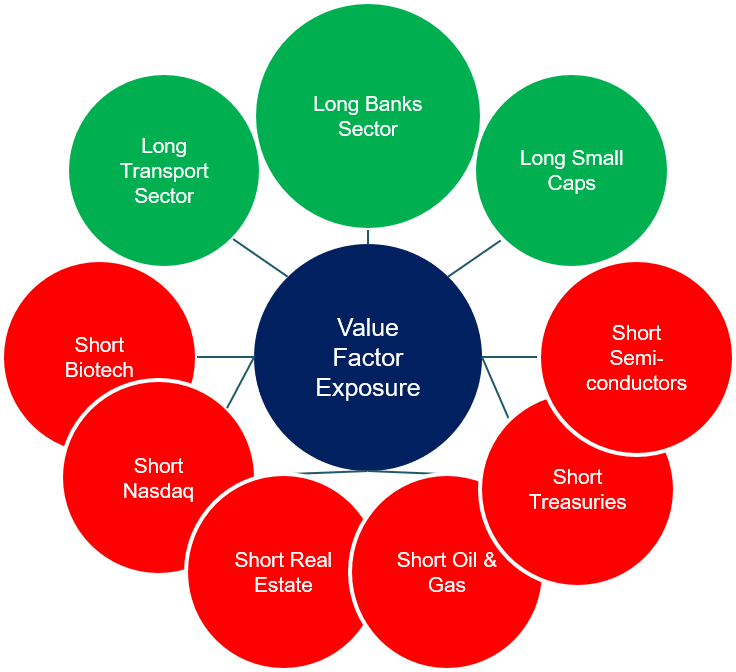

Although the top 10 ETFs might not be appealing for investors seeking exposure to the Value factor, the analysis highlights the thematic exposure of the factor, which is displayed in the graphic below. We can observe that the Value factor is long the transport sector, banks and small caps, while being short biotech, the Nasdaq, real estate, oil & gas, treasuries and semiconductors. The Value factor is defined as a combination of price-to-book and price-earnings multiples, which explains some of the exposure, e.g. banks are structurally cheap on price-to-book ratios while real estate stocks are consistently expensive on price-earnings multiples.

Source: FactorResearch

SMART BETA ETFS WITH VALUE FACTOR EXPOSURE

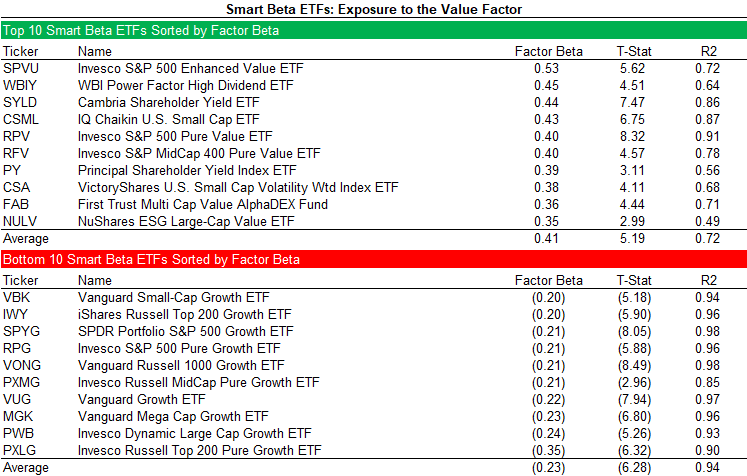

Next we reduce the universe of tradable ETFs in the US to include only smart beta ETFs. The chart below highlights the top and bottom smart beta ETFs with the highest and lowest exposure to the Value factor. The analysis reveals several Value smart beta ETFs with high factor exposure as well a few dividend and shareholder yield strategies. The bottom 10 smart beta ETFs, i.e. with the least Value factor exposure, are exclusively Growth-focused funds.

Source: FactorResearch

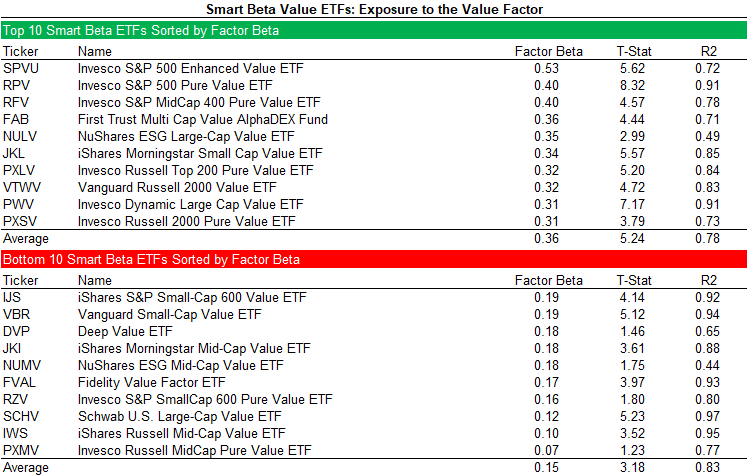

VALUE SMART BETA ETFS WITH VALUE FACTOR EXPOSURE

As a third step, we limit the analysis to include only smart beta ETFs that include “Value” in the product name. The ETF with the highest exposure is the Invesco S&P 500 Enhanced Value ETF (SPVU), which might be explained by Invesco using a definition of the Value factor that is similar to the one used for this analysis. However, the ETF with the lowest Value factor exposure is from the same provider, namely the Invesco Russell MidCap Pure Value ETF (PXMV). This result is somewhat perplexing as we would have expected the provider to use the same or at a least similar methodology for defining the factor, which should result in both ETFs to exhibit similar exposure levels, regardless of focusing on different market capitalisations. An analysis of the index replicated by PXMV reveals a factor-weighting, which oddly results in the ETF exhibiting higher exposure to the Low Volatility than to the Value factor. The implication is that investors should conduct a thorough due diligence on ETFs as product names may be misleading.

Source: FactorResearch

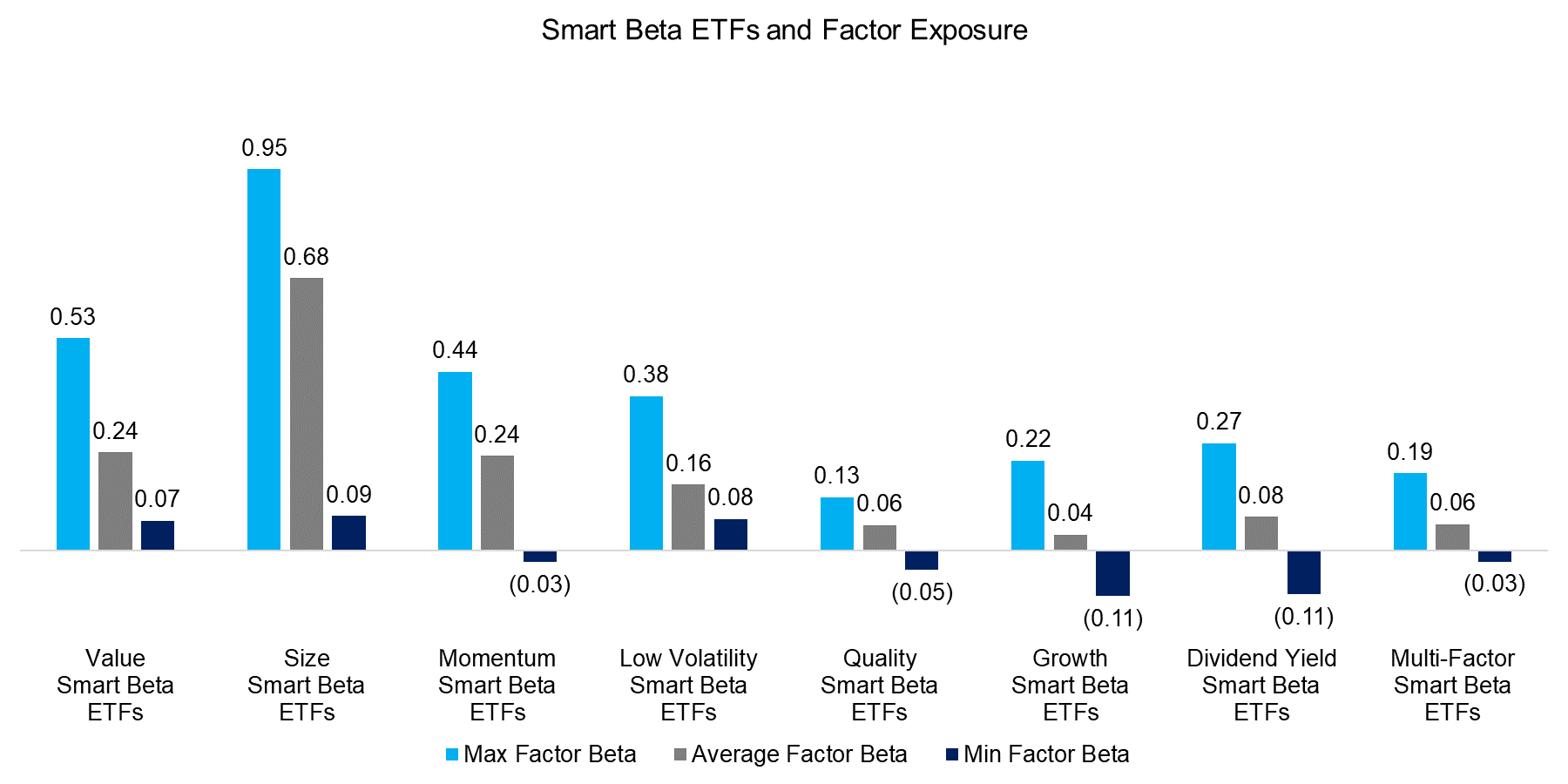

SMART BETA ETFS AND FACTOR EXPOSURE

Finally, we expand the exposure analysis to other factors and respective smart beta ETFs, which highlights a relatively low average factor exposure for most ETFs. One of the reasons for the low factor exposure is that smart beta ETFs represent long-only funds with factor tilts that are mostly market cap-weighted while factors are created as long-short portfolios of the top and bottom stocks, which are equally-weighted. Investors should be aware that expected returns and risks of smart beta ETFs are not comparable with factors seen in academic research (please see our report Smart Beta or Smart Marketing?).

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights the factor exposure of smart beta ETFs, which is relatively low across various different categories. The results of this analysis need to be taken with caution as they highly depend on the factor definitions, which can vary significantly for some factors, e.g. surveying 10 investors on how to define Quality stocks likely results in 10 different responses. However, there is much less flexibility in defining Dividend Yield, which also reflects low factor exposure. Like consumers, investors beware.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.