Factor Exposure Analysis 110: Long-Short vs Long-Only Factors

Long-short versus long-only factors

January 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The belief in factor investing is based on research featuring long-short factors

- However, almost all funds pursue long-only factor investing

- Smart beta ETFs should be analyzed using long-only rather long-short factor indices

INTRODUCTION

Investors´ belief in factor investing is based on hundreds of academic research articles that demonstrate that factors like value or momentum can be used to outperform markets. Intuitively, investors should simply invest in products that are as close to the research as possible, however, in reality, they do not.

Take the value factor, which is defined as buying cheap and shorting expensive stocks. Close to 300 ETFs are trading in the U.S. capital markets that provide exposure to cheap stocks, but that is just one side of the factor. In contrast, there is not a single ETF that provides exposure to the long-short factor as seen in academic research (read Market-Neutral versus Smart Beta Factor Investing).

Naturally, this makes no sense but simply highlights that we are anything but rational investors (read Smart Beta vs Alpha + Beta). It also raises the question of what should be the independent variables when analyzing the returns of a factor-focused strategy.

In this research article, we will compare long-short and long-only factor indices for factor exposure analysis.

LONG-SHORT VERSUS LONG-ONLY FACTOR INDICES

Factor indices are created by selecting the top and bottom percentiles of stocks sorted on certain metrics, e.g. the price-to-book ratio is often used for the value factor, where the cheapest stocks represent the long and the most expensive stocks the short portfolio. If we only consider the cheapest stocks, then we derive a long-only portfolio that is typically marketed as a smart beta strategy. However, this portfolio´s risk will be dominated by the stock market rather than the factor.

We create long-short and long-only indices for the value, size, quality, momentum, and low volatility factors in the U.S. by selecting the top and bottom 30% of stocks, equal weighting stocks, rebalancing monthly, and including 10 basis points for transaction costs. The long-short portfolios are constructed beta-neutral and we deduct the market returns from the long-only index to make these indices comparable.

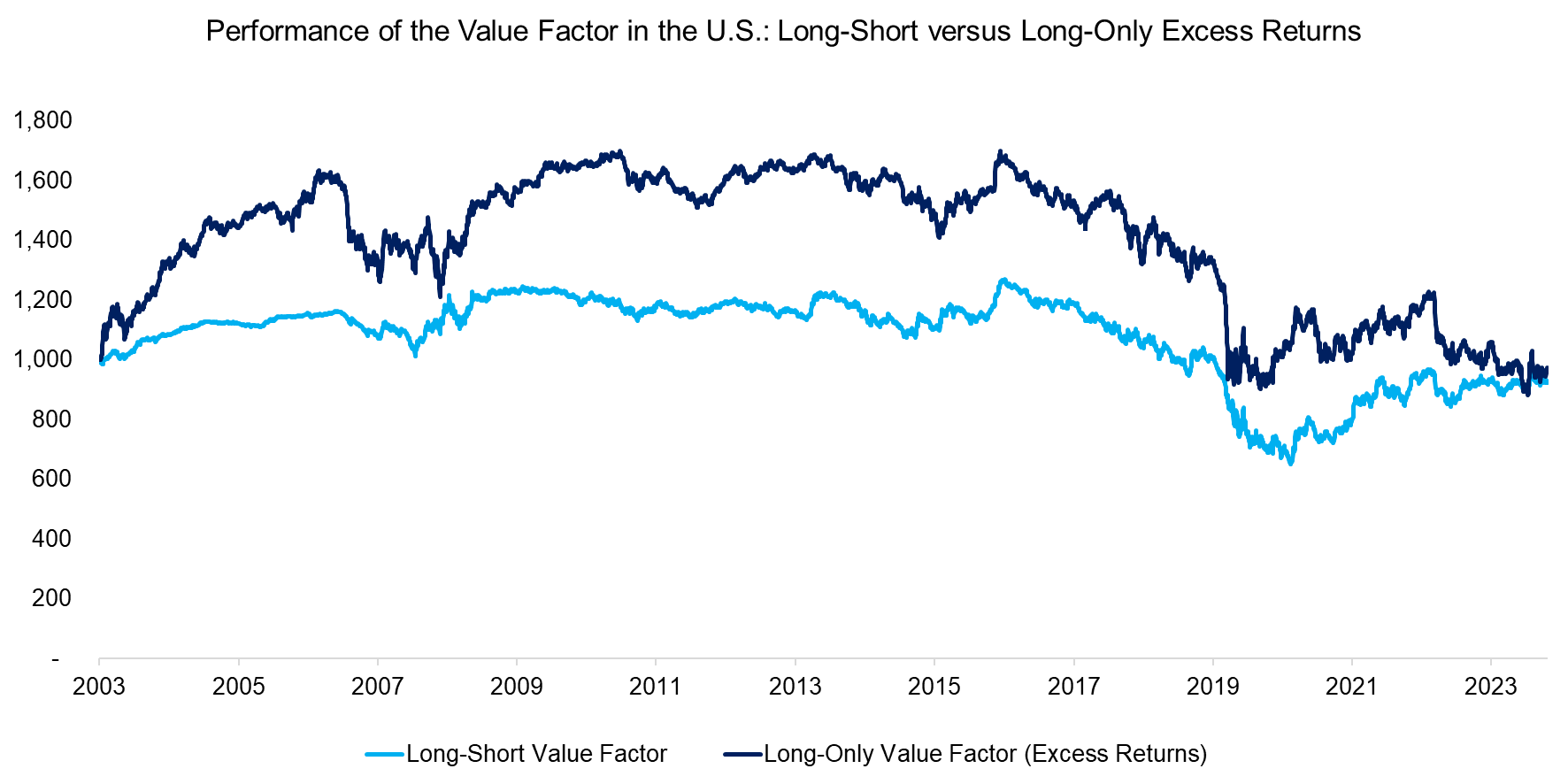

We observe that the long-short value factor has not generated any positive returns in the period from 2003 to 2024. The long-only value factor shows similar trends in performance and also highlights that investors did not generate any positive excess returns by buying cheap stocks over the last 20 years (read Factor Investing Is Dead, Long Live Factor Investing!).

Source: Finominal

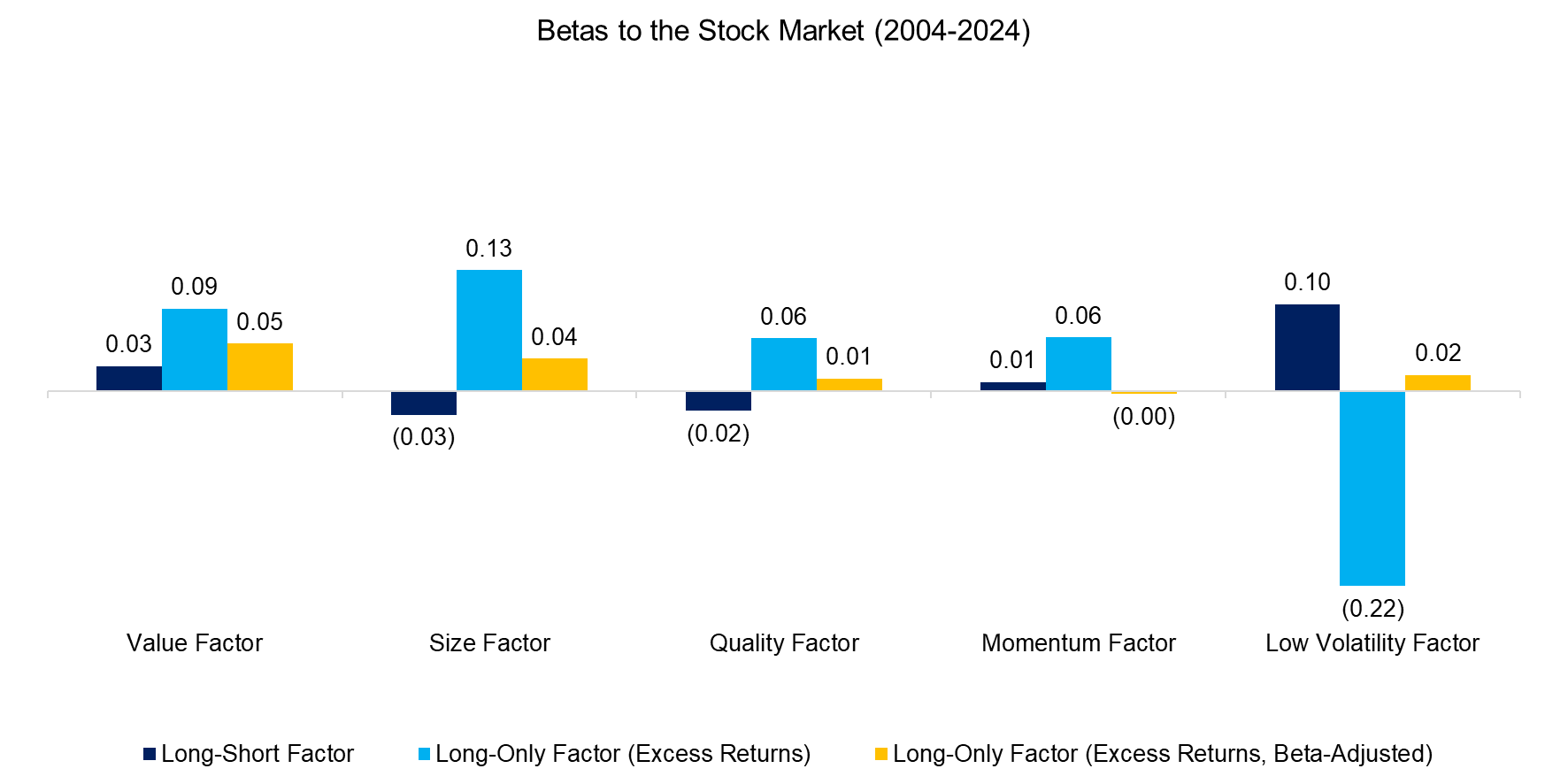

Long-short factor indices are typically constructed beta-neutral so that they represent returns uncorrelated to the market, which makes them suitable as independent variables in regression analysis. However, long-only factor indices feature betas to the stock market of close to one, e.g. momentum stocks tend to be more sensitive (beta above one), and low-volatility stocks are less sensitive (beta below one) to changes in the market.

Given this, we beta-adjust the excess returns of long-only factor indices, so that the exposure to the stock market is reduced, which makes these more comparable to the long-short factor indices.

Source: Finominal

However, it is worth highlighting that the average correlations between long-short (beta-neutral) and long-only (excess returns, beta-adjusted) factors are not particularly high, and ranged between 0.1 for quality to 0.8 for size in the period from 2004 to 2024. We can attribute this to the short portfolio, which is excluded in the long-only factor indices.

Source: Finominal

Furthermore, the correlations between long-short and long-only factors (excess returns, beta-adjusted) are not stable across time. For example, the correlation for the quality factor ranged between -0.4 to 0.7 over the last 20 years, which implies that the short portfolio had a large impact on returns in some and little impact in other periods.

Source: Finominal

FACTOR EXPOSURE ANALYSIS

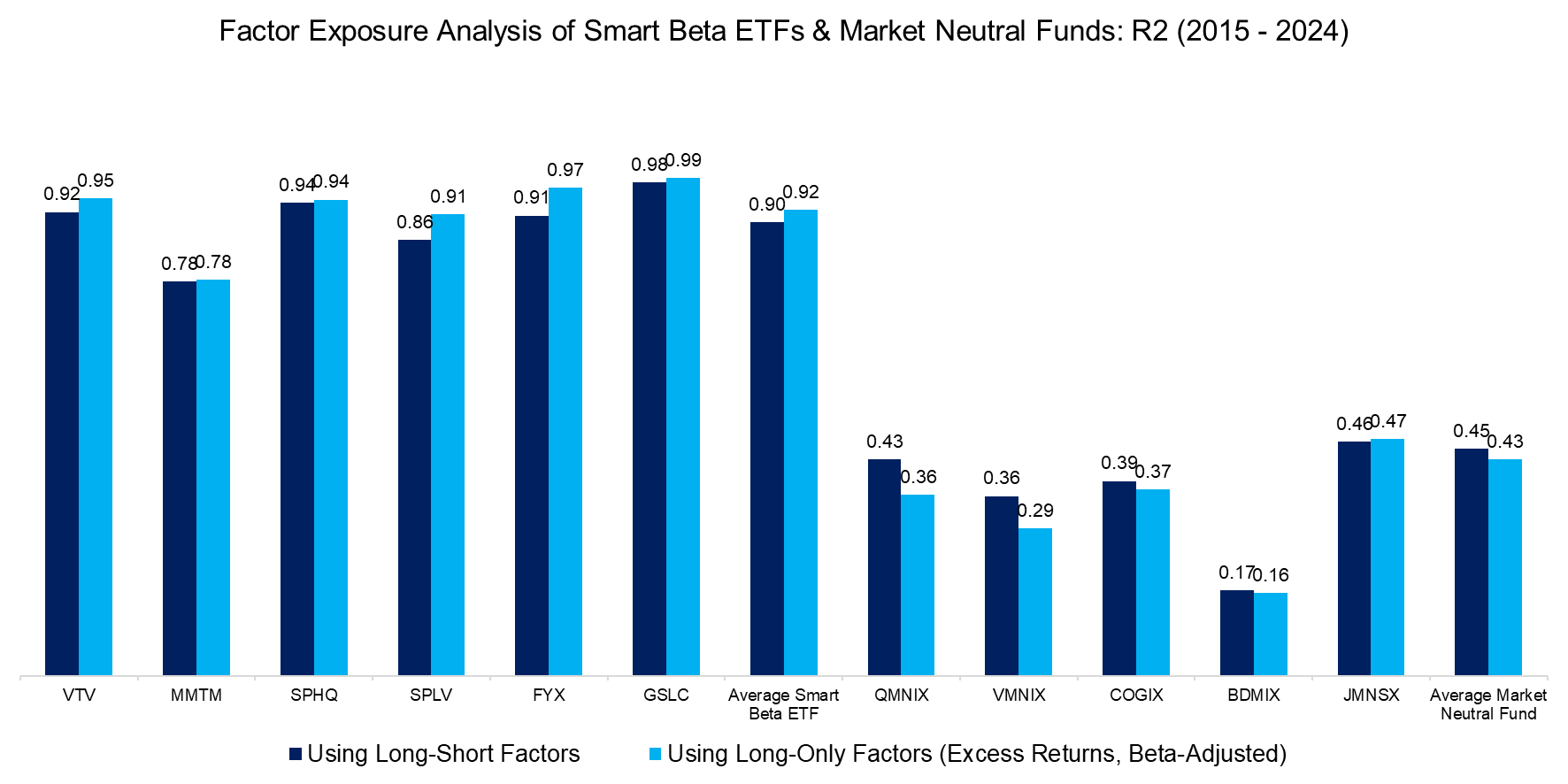

Finally, we test long-short and long-only (excess return, beta-adjusted) factor indices as independent variables in a regression analysis. The first set of funds represents smart beta ETFs that provide exposure to a single factor (VTV, MMTM, SPHQ, SPLV) and multiple factors (FYX, GSLC), while the second fund set provides long-short multi-factor exposure (QMNIX, VMNIX, COGIX, BDMIX, JMNSX).

We observe that the R2 was higher when using long-only factor indices for the smart beta ETFs and long-short factor indices for the market-neutral funds, albeit the differences were marginal.

Source: Finominal

FURTHER THOUGHTS

Should asset managers offering long-only factor investing strategies benchmark their excess returns to the performance of long-short factors?

No, as the differences in portfolio construction between the long-short and long-only factor portfolios are too large. These are cousins, rather than twins.

However, this implies that investors need to be careful when allocating to long-only factor investing strategies as their investment thesis is based on research that is only partially relevant.

RELATED RESEARCH

Market-Neutral versus Smart Beta Factor Investing

Factor Exposure Analysis 109: Linear vs Lasso vs Elastic Net

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 107: Fixed Income Factors

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 105: Sectors versus Factors

Factor Exposure Analysis 104: Fixed Income ETFs

Factor Exposure Analysis 103: Exploring Residualization

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

Factors: Shorting Stocks vs the Index

Factor Investing Is Dead, Long Live Factor Investing!

The Case Against Factor Investing

Smart Beta vs Alpha + Beta

Outperformance Ain’t Alpha

How Painful Can Factor Investing Get

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.