Factor Exposure Analysis 113: Profitability vs Leverage Factors

What quality and growth factors should investors be using in a factor exposure analysis?

March 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Funds’ factor betas change when using multiple quality and growth factors

- It does not necessarily improve the explanatory power of the regression analysis

- Yet, it is useful to have more factors as it makes the analysis clearer

INTRODUCTION

In our latest article, Factor Exposure Analysis 112: Quality vs Growth Factors, we emphasized that selecting independent variables for a factor exposure analysis is inherently subjective, given the vast array of potential equity and macro factors. Our findings showed that quality metrics such as leverage and profitability have low correlations, suggesting the need for multiple quality factors, whereas growth metrics like sales and earnings growth are highly correlated.

In this research article, we explore the impact of using different quality and growth factors when analyzing smart beta ETFs.

QUALITY & GROWTH FACTOR PERFORMANCE

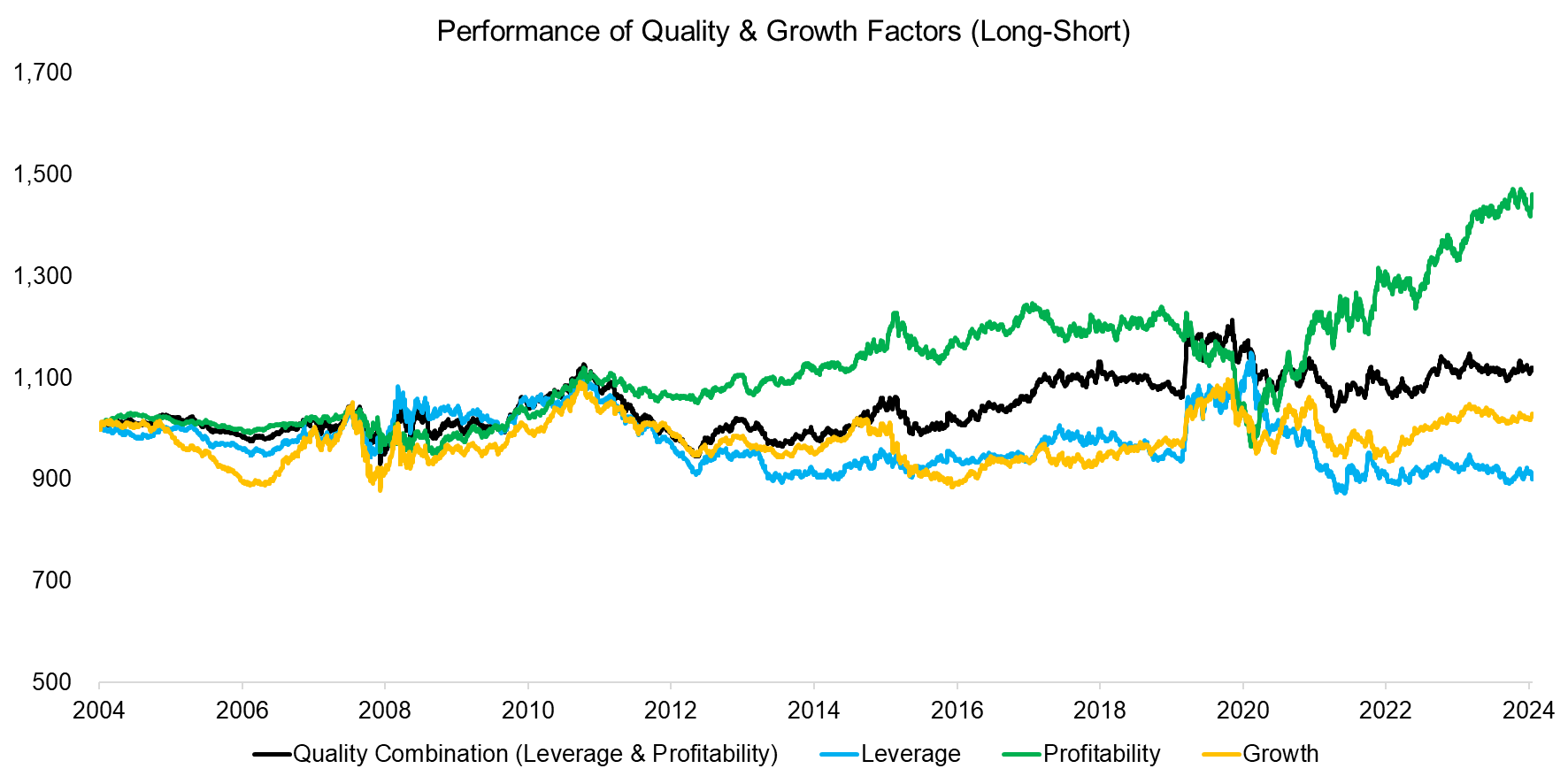

We examine two key quality metrics – leverage (debt-to-equity) and profitability (return-on-equity) – along with growth, defined as a combination of sales-per-share and earnings-per-share growth.

Constructing a beta-neutral portfolio using the top and bottom 30% of U.S. stocks ranked by these metrics shows no excess returns for leverage or growth over the past 20 years. While profitability has generated positive returns, the majority of these gains have occurred in the last three years.

Source: Finominal

FACTOR EXPOSURE ANALYSIS SCENARIOS

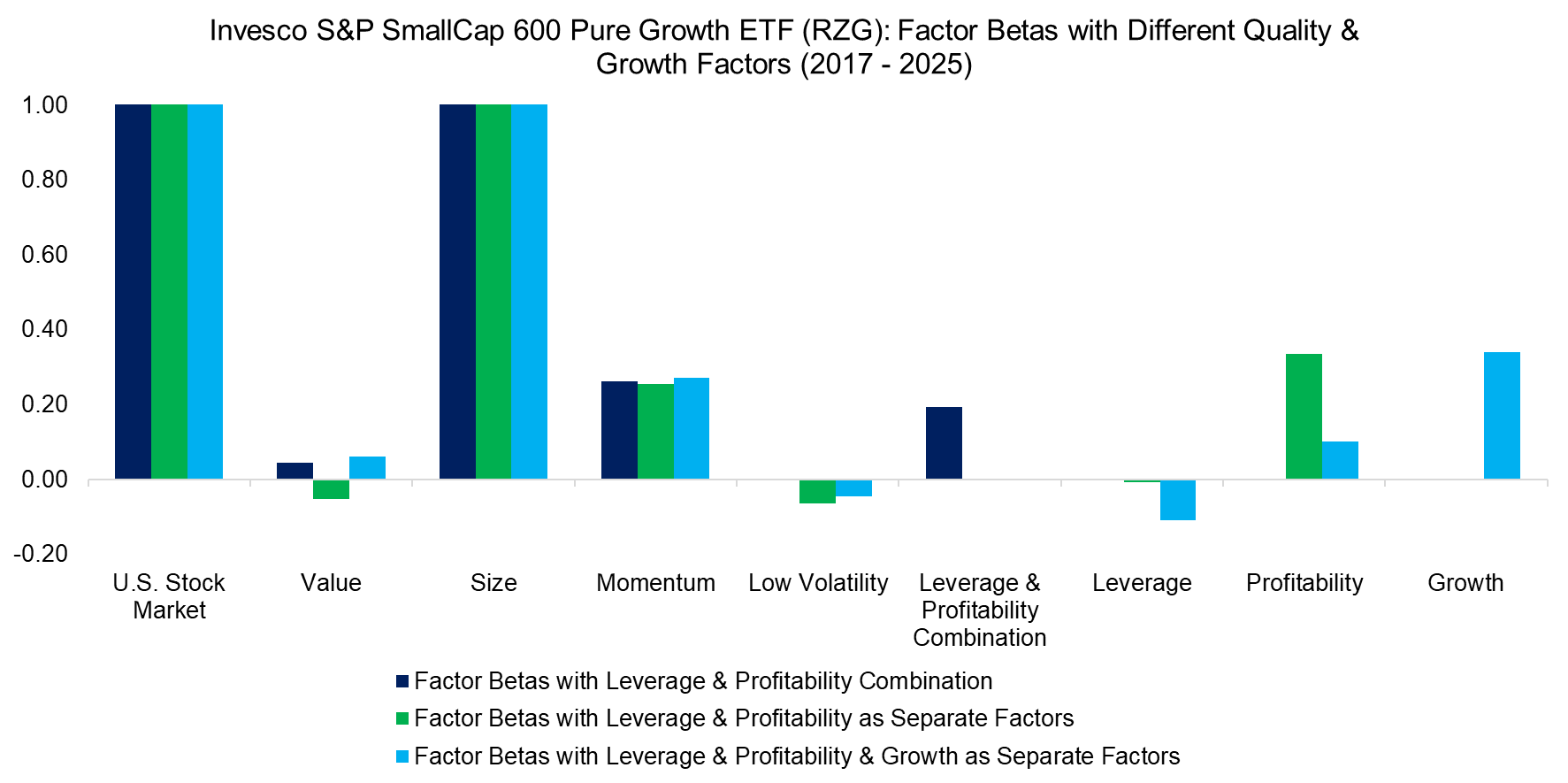

We analyze the Invesco S&P SmallCap 600 Pure Growth ETF (RZG) by conducting three factor exposure analyses: one using a combined leverage & profitability factor, another treating leverage and profitability as separate factors, and a third including growth. While we observe only minor differences in factor betas to value, size, momentum, and low volatility, the most notable insights come from quality exposure.

When leverage & profitability are combined, the beta to this factor is positive and large. However, when separated, the ETF exhibits a zero beta to leverage but a positive beta to profitability. In other words, the growth stocks selected by Invesco feature high profitability and but average debt levels. When the growth factor is added, then most of the beta to profitability shifts to growth.

Separating quality factors provides a clearer picture of the fund’s characteristics compared to using a single quality factor that blends uncorrelated metrics, and adding growth leads to further transparency.

Source: Finominal

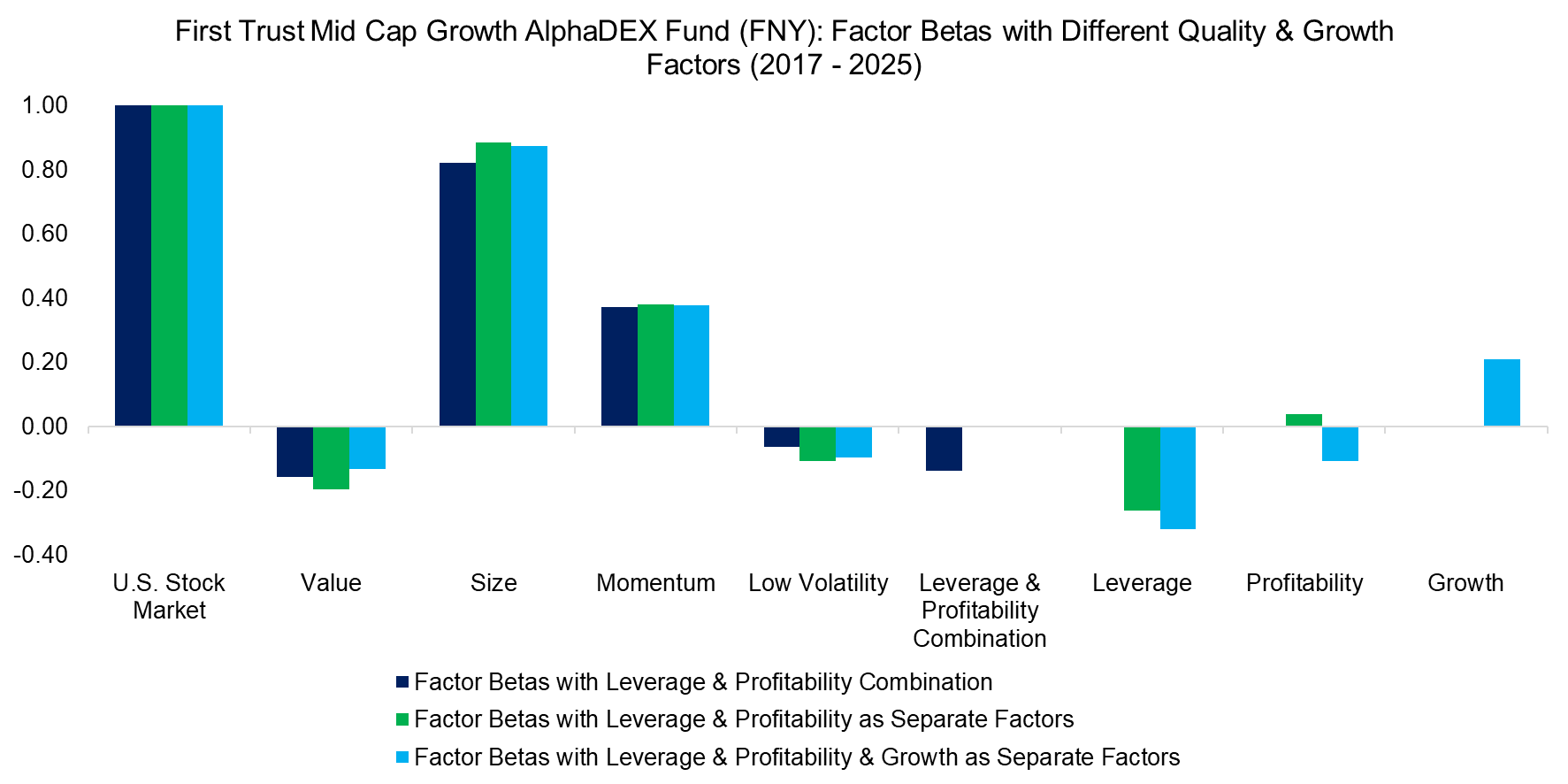

Next, we conduct the same analysis on the First Trust Mid Cap Growth AlphaDEX Fund (FNY). Once again, we find that separating quality metrics provides a clearer insight. However, the most notable takeaway is the fund’s positive beta to the growth factor.

Source: Finominal

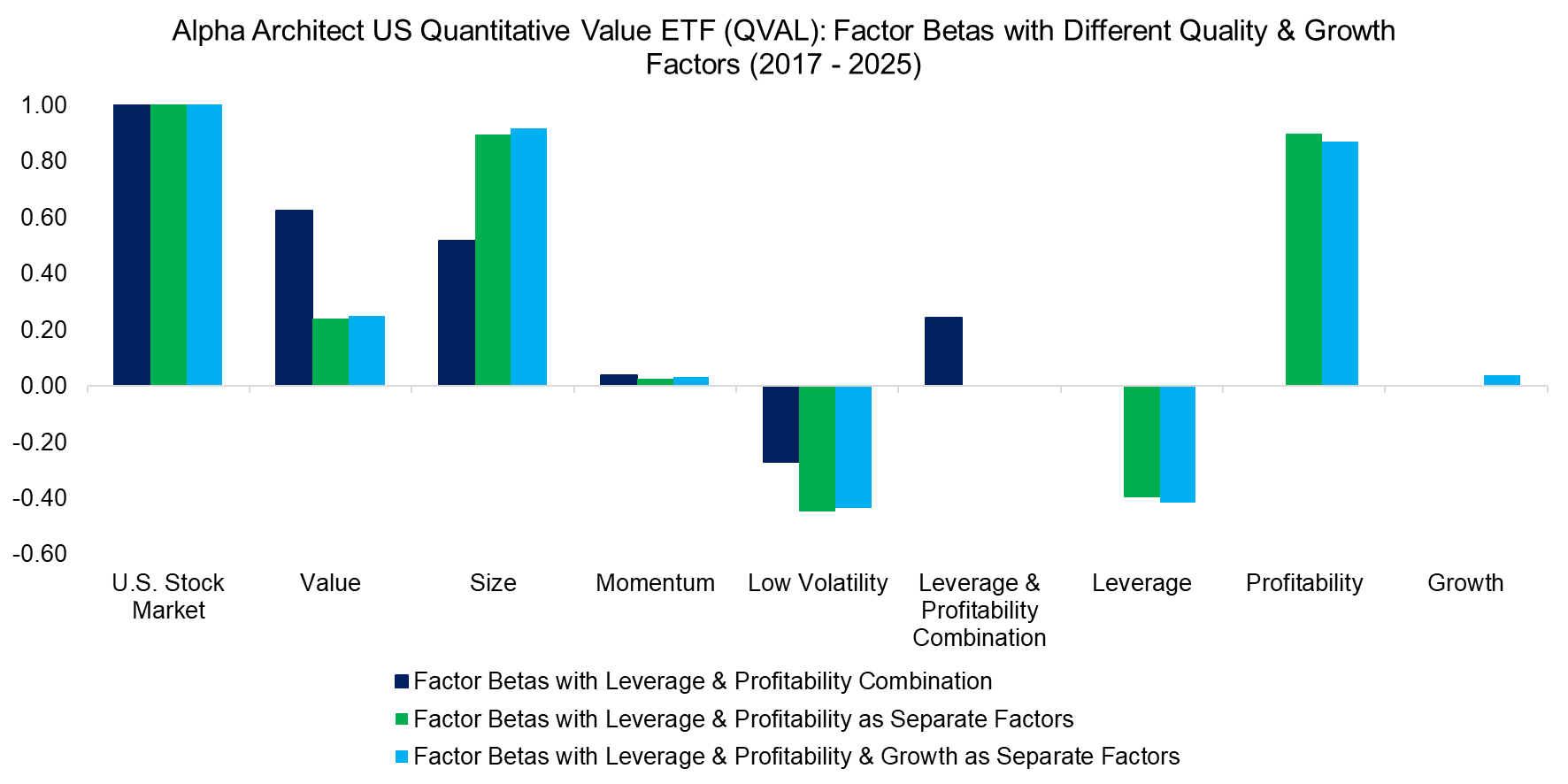

So far, we’ve found that separating quality metrics and the growth factor has had little impact on betas to other factors. However, when analyzing the Alpha Architect US Quantitative Value ETF (QVAL), we observe a significant shift – the fund’s exposure to the value factor drops by nearly half when using distinct quality metrics.

Alpha Architect evaluates stock cheapness using the EV/EBIT ratio, a valuation metric more closely linked to profitability than price-to-book or price-to-earnings ratios. However, stocks trading at low valuations often have underlying risks, and these stocks carry above-average leverage.

Source: Finominal

THE EFFECTIVENESS OF FACTOR EXPOSURE ANALYSIS

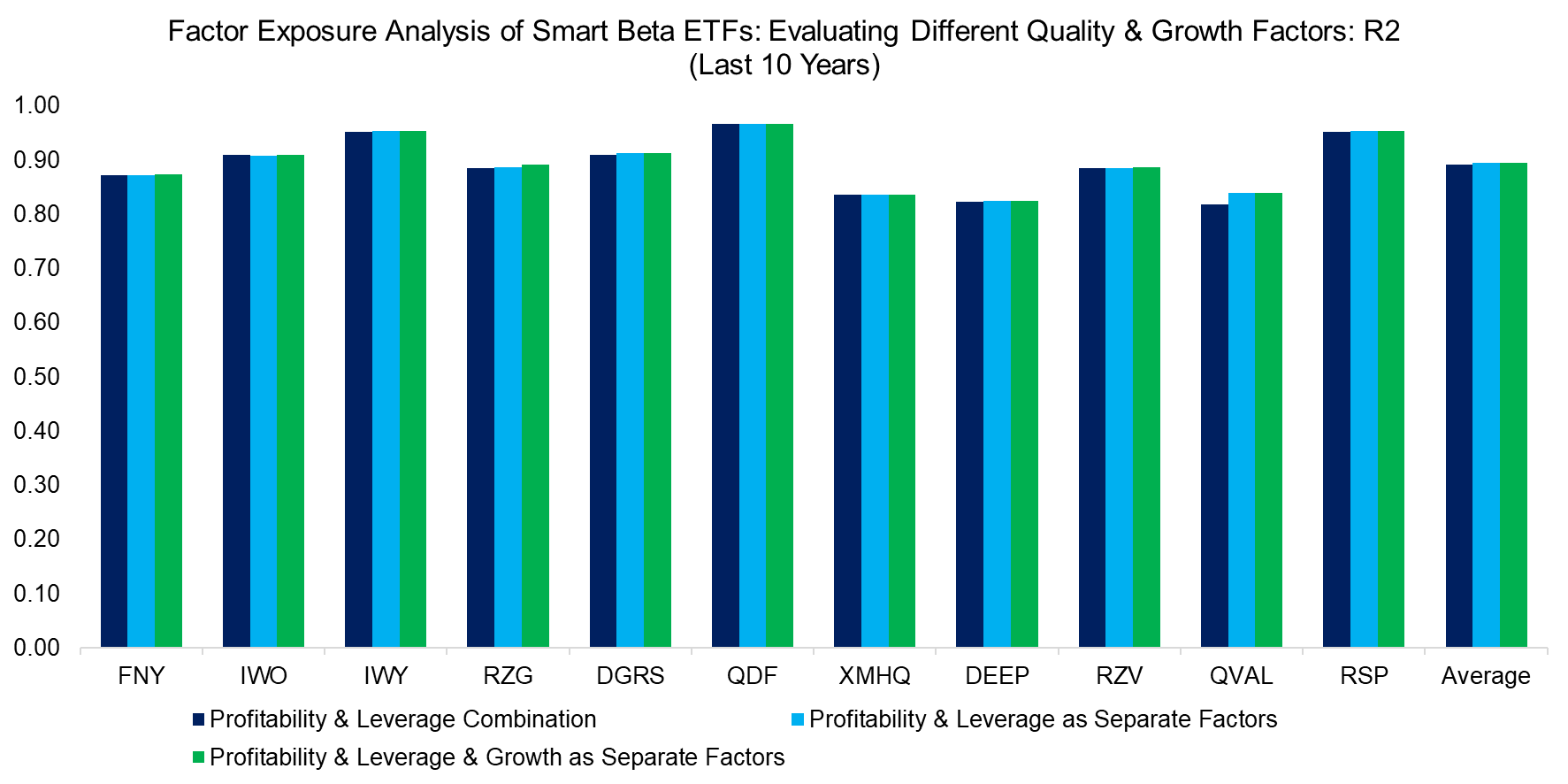

Finally, we assess whether separating quality metrics and the growth factor enhances the effectiveness of factor exposure analysis. Using ten U.S.-traded smart beta ETFs, we run the three factor exposure scenarios. However, we find no increase in R2, indicating no improvement in the model’s explanatory power.

This lack of effectiveness is likely due to these adjustments having little impact on the primary driver of returns – the broader U.S. stock market. While these funds offer factor exposures, most of their risk stems from overall market movements rather than individual factors.

Source: Finominal

FURTHER THOUGHTS

Should investors ignore variables that don’t improve a factor exposure analysis?

In practice, applying a Lasso regression would automatically remove variables that don’t enhance explanatory power. However, there is still value in separating distinct quality metrics and including a growth factor, as it provides a clearer and more intuitive picture for investors.

For instance, analyzing a growth-focused fund without explicitly including a growth factor could result in a negative beta to the value factor, simply due to the negative correlation between value and growth. Investors would then need to recognize and interpret this as implicit growth exposure.

Investing is already complex – any opportunity to simplify the analysis makes the process more effective.

RELATED RESEARCH

Growth ETFs: Performance & Factor Exposures

What Are Growth Stocks?

Quality Factor: Zero Alpha for Most Investors?

Quality in Small versus Large-Cap Stocks

The Odd Factors: Profitability & Investment

Factor Exposure Analysis 112: Quality vs Growth Factors

Factor Exposure Analysis 111: What is Alpha?

Factor Exposure Analysis 110: Long-Short vs Long-Only Factors

Factor Exposure Analysis 109: Linear vs Lasso vs Elastic Net

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 107: Fixed Income Factors

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 105: Sectors versus Factors

Factor Exposure Analysis 104: Fixed Income ETFs

Factor Exposure Analysis 103: Exploring Residualization

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.