Factor Exposure Analysis 114: Factor Offsetting

Better to bet on fewer rather than many factors

April 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Many factors feature structural negative correlations to others

- Combining smart beta strategies often leads to factor offsetting or doubling up

- Broad multi-factor products are not a solution, investors should take fewer factor bets

INTRODUCTION

JP Morgan’s Strategic Asset Allocation model included allocations to both global value and global technology funds as of the end of 2024. At first glance, this may seem like a balanced approach. However, a closer look reveals that these allocations represent opposing investment styles.

Value stocks are often struggling companies with declining sales and earnings, typically from traditional industries with high debt levels. In contrast, technology stocks tend to exhibit strong growth, low leverage, and high future potential.

Blending these two opposing styles can dilute their individual strengths – much like mixing hot and cold water results in lukewarm temperature. Yet, this approach is not unique to JP Morgan; many investors unknowingly combine strategies that cancel each other out, particularly in factor investing.

In this research note, we explore how popular smart beta strategies can lead to unintended factor offsetting.

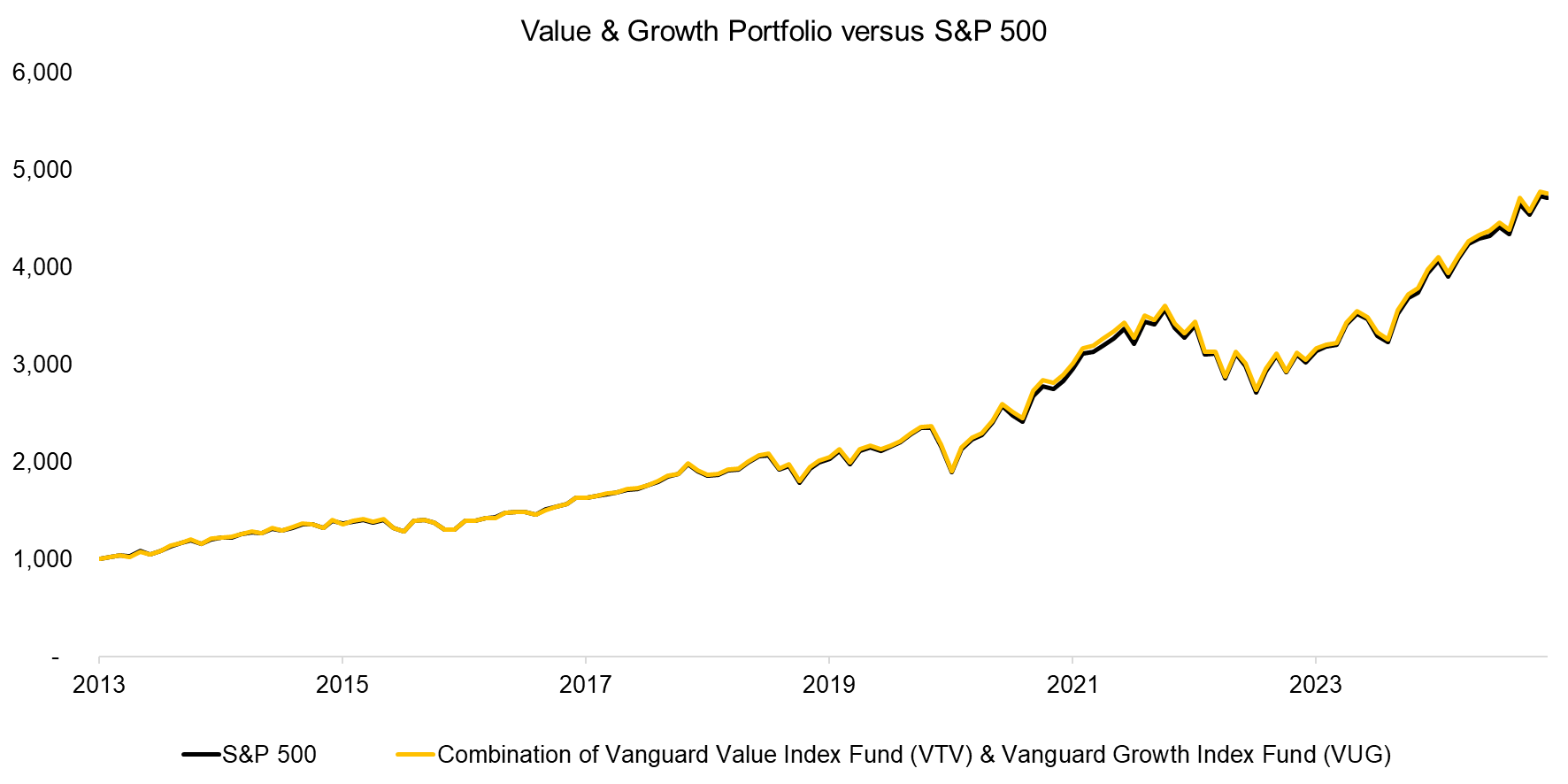

VALUE VERSUS GROWTH FUNDS

We conducted a factor exposure analysis on Vanguard’s Value Index Fund (VTV) and Growth Index Fund (VUG) using a Lasso regression. These two funds together manage nearly $300 billion in assets. VTV selects undervalued stocks, while VUG focuses on growth stocks within the large-cap U.S. market. As a result, VTV shows a strong positive exposure to the value factor but a significant negative exposure to the quality factor – while VUG exhibits the opposite pattern.

Source: Finominal

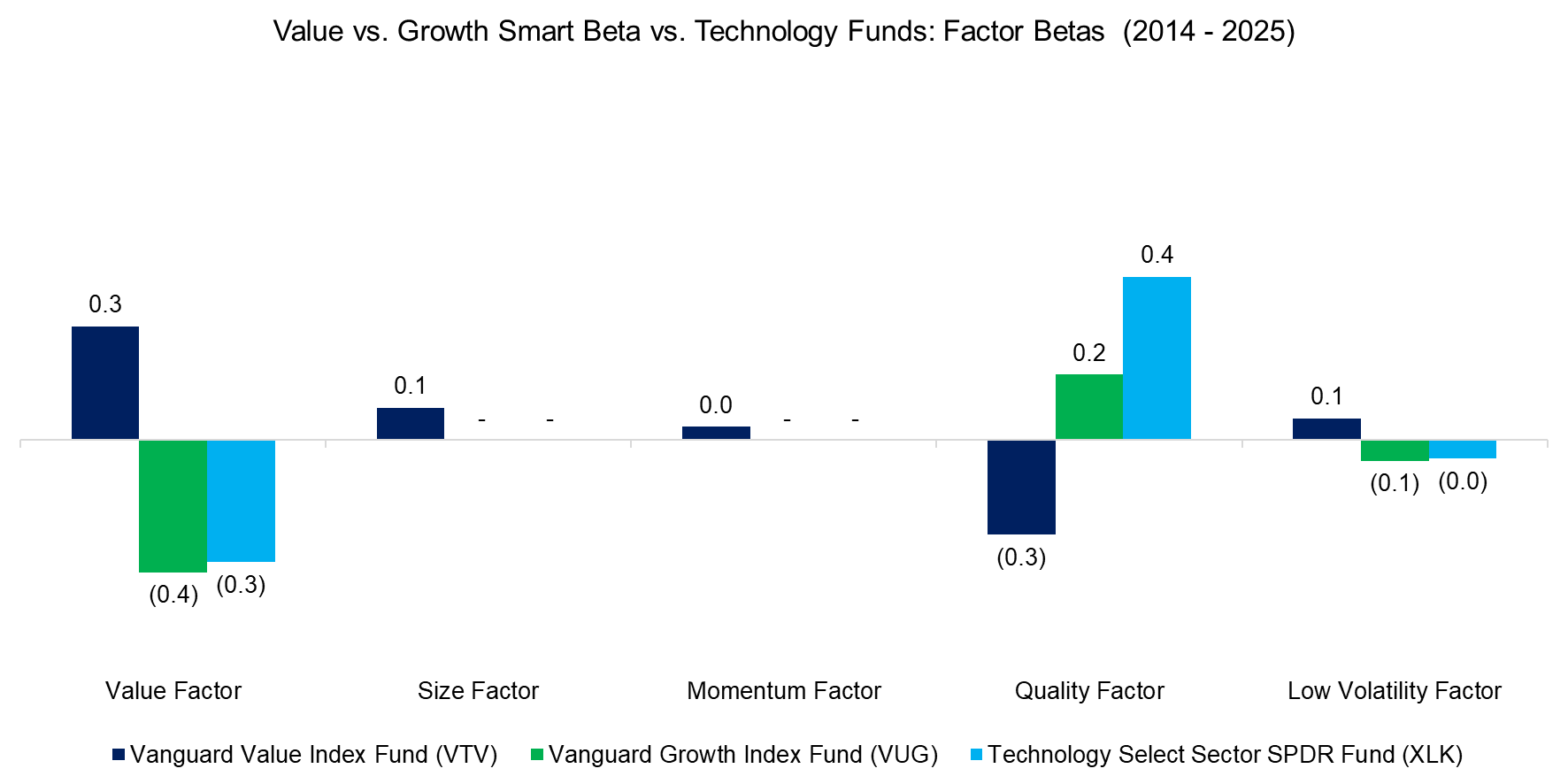

FACTOR OFFSETTING

Given the contrasting factor exposures, allocating to both value and growth funds doesn’t add value, as their characteristics effectively cancel each other out. This can be demonstrated by creating an equal-weighted portfolio of VTV and VUG, which essentially mirrors the S&P 500. Between 2013 and 2025, the returns of this combined portfolio were almost identical to those of the S&P 500.

Source: Finominal

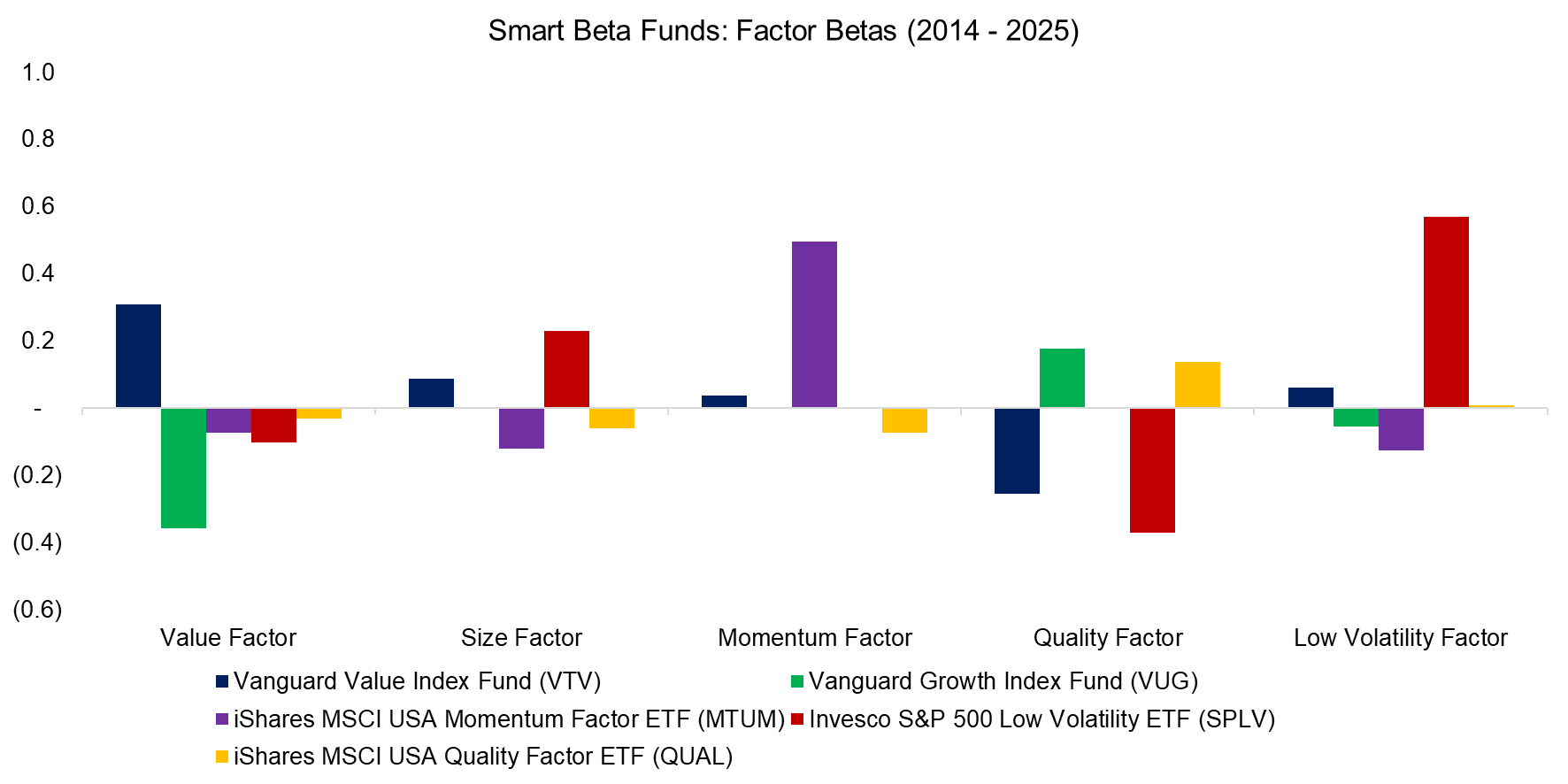

SMART BETA VERSUS SECTOR FUNDS

Investors often view factor and sector funds as separate investment strategies, but they are inherently linked. For example, a technology fund shares similar characteristics with a growth fund. As a result, pairing it with a value fund leads to factor offsetting, while combining it with a growth fund amplifies exposure to the same risks.

Source: Finominal

SMART BETA FACTOR EXPOSURES

We extend our factor exposure analysis to include the iShares MSCI USA Momentum Factor ETF (MTUM), Invesco S&P 500 Low Volatility ETF (SPLV), and iShares MSCI USA Quality Factor ETF (QUAL). While adding momentum and quality strategies results in minimal factor offsetting, the low volatility fund (SPLV) has a significant negative exposure to the quality factor. As a result, it should not be combined with growth or quality-focused funds.

Source: Finominal

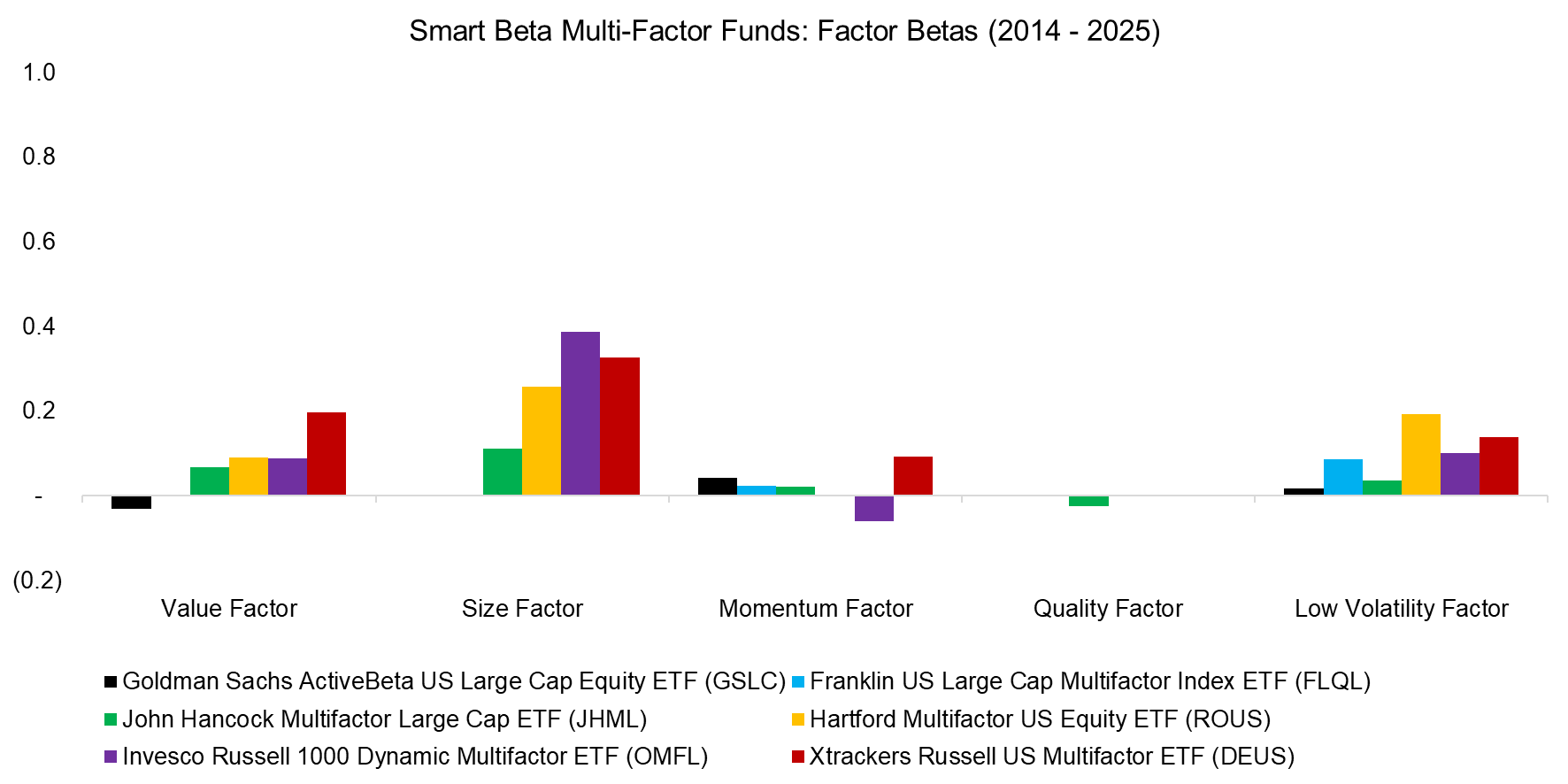

MULTI-FACTOR PRODUCTS

Given the risk of doubling up on factor exposures or canceling them out, why not entrust stock selection to an experienced asset manager and invest in a multi-factor product?

Most asset managers construct portfolios using multiple factors – typically value, momentum, quality, and low volatility. However, as our analysis of individual smart beta products has shown, these factors are often structurally negatively correlated. As a result, many large multi-factor smart beta ETFs exhibit only weak factor exposures due to the effects of factor offsetting.

Source: Finominal

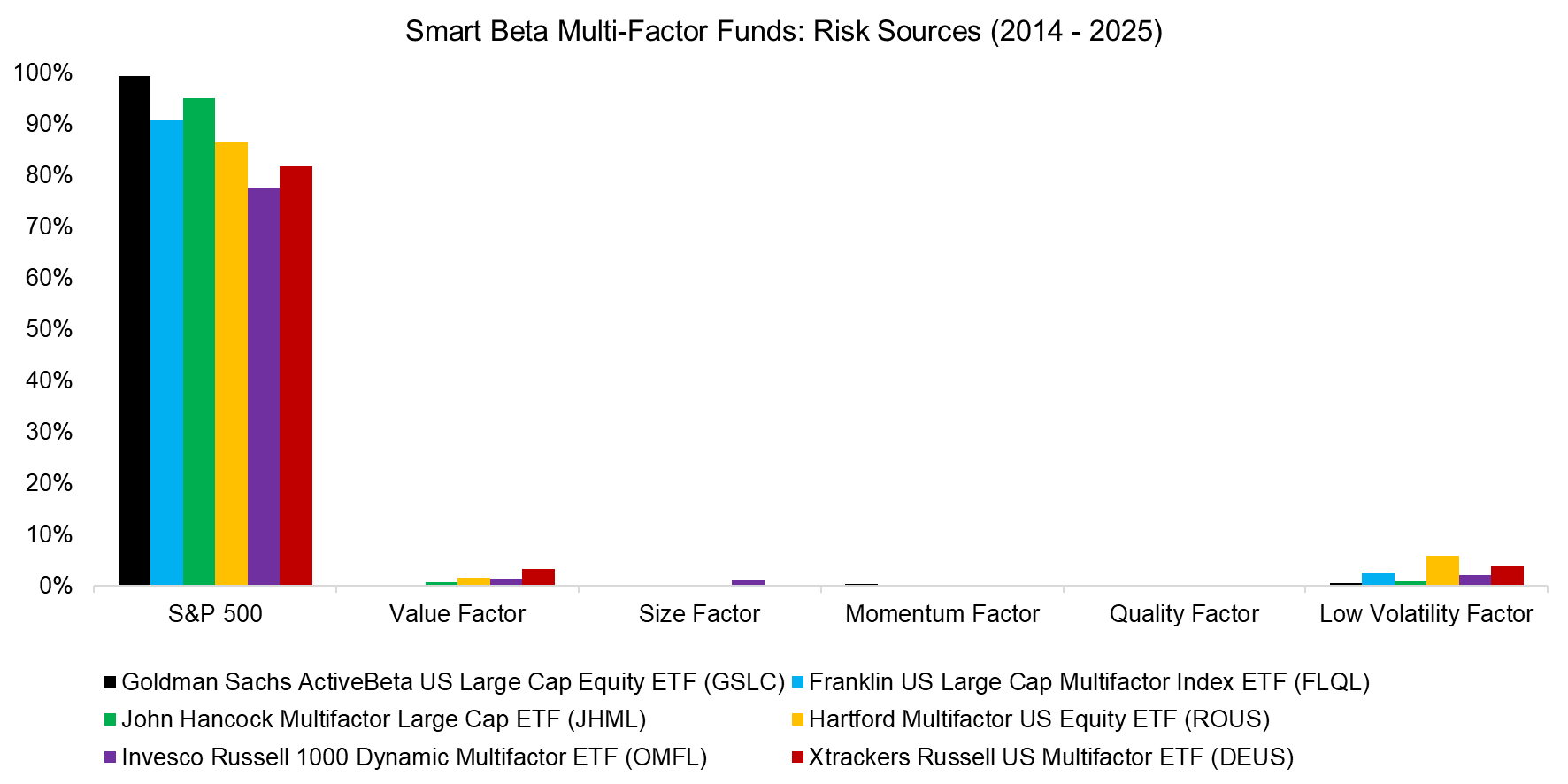

RISK SOURCES OF MULTI-FACTOR ETFS

Another way to demonstrate that most multi-factor products don’t justify high fees is through a risk sources analysis. This reveals that nearly all risk can be attributed to the S&P 500 – particularly in the case of Goldman Sachs’ ActiveBeta US Large Cap Equity ETF (GSLC), which appears to be hardly active at all.

Naturally, portfolio construction skills play a crucial role in selecting the right multi-factor model, metrics, and portfolio concentration to optimize factor exposures.

Source: Finominal

FURTHER THOUGHTS

Investors should carefully assess the factor exposures of all funds to avoid unintended offsetting or excessive concentration. This analysis should also include fixed income and alternative products, which often appear distinct but may only provide diluted equity and equity factor exposures.

A more intentional approach focused on only one or two factors would result in fewer holdings, simplifying asset allocation decisions. However, the challenge remains: determining which factor bets to take – a decision that is far from easy.

RELATED RESEARCH

Factor Exposure Analysis 113: Profitability vs Leverage Factors

Factor Exposure Analysis 112: Quality vs Growth Factors

Factor Exposure Analysis 111: What is Alpha?

Factor Exposure Analysis 110: Long-Short vs Long-Only Factors

Factor Exposure Analysis 109: Linear vs Lasso vs Elastic Net

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 107: Fixed Income Factors

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 105: Sectors versus Factors

Factor Exposure Analysis 104: Fixed Income ETFs

Factor Exposure Analysis 103: Exploring Residualization

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.