Factor Exposure Analysis 115: Measuring International Exposures

Should correlated independent variables be avoided?

May 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Variables used in a factor exposure analysis should be uncorrelated

- However, adding correlated equity indices can increase the explanatory power

- Also, provides clearer insights on the performance & risk contributors

INTRODUCTION

India’s economy stands out as a strong performer, supported by a pro-business government, a manageable public debt-to-GDP ratio of 80%, and a youthful population with an average age of 30. In contrast, China faces challenges with a less business-friendly environment, soaring public debt exceeding 300% of GDP, and an aging population with an average age of 39.

Investors looking to gain exposure to India’s stock market can do so through ETFs like the iShares MSCI India ETF (INDA) listed on U.S. exchanges. However, since Indian and U.S. trading hours do not overlap, questions arise about how these Indian funds perform when the Indian stock market is closed (read Diversifying via Time Zones).

When evaluating the risk and returns of Indian funds trading in the U.S. market, should investors rely solely on U.S. equity indices or also consider international benchmarks? In theory, regression analysis variables should be independent to minimize multicollinearity.

In this research article, we will examine the impact of using correlated equity indices in a factor exposure analysis.

U.S. VS GLOBAL EX U.S. EQUITY INDICES

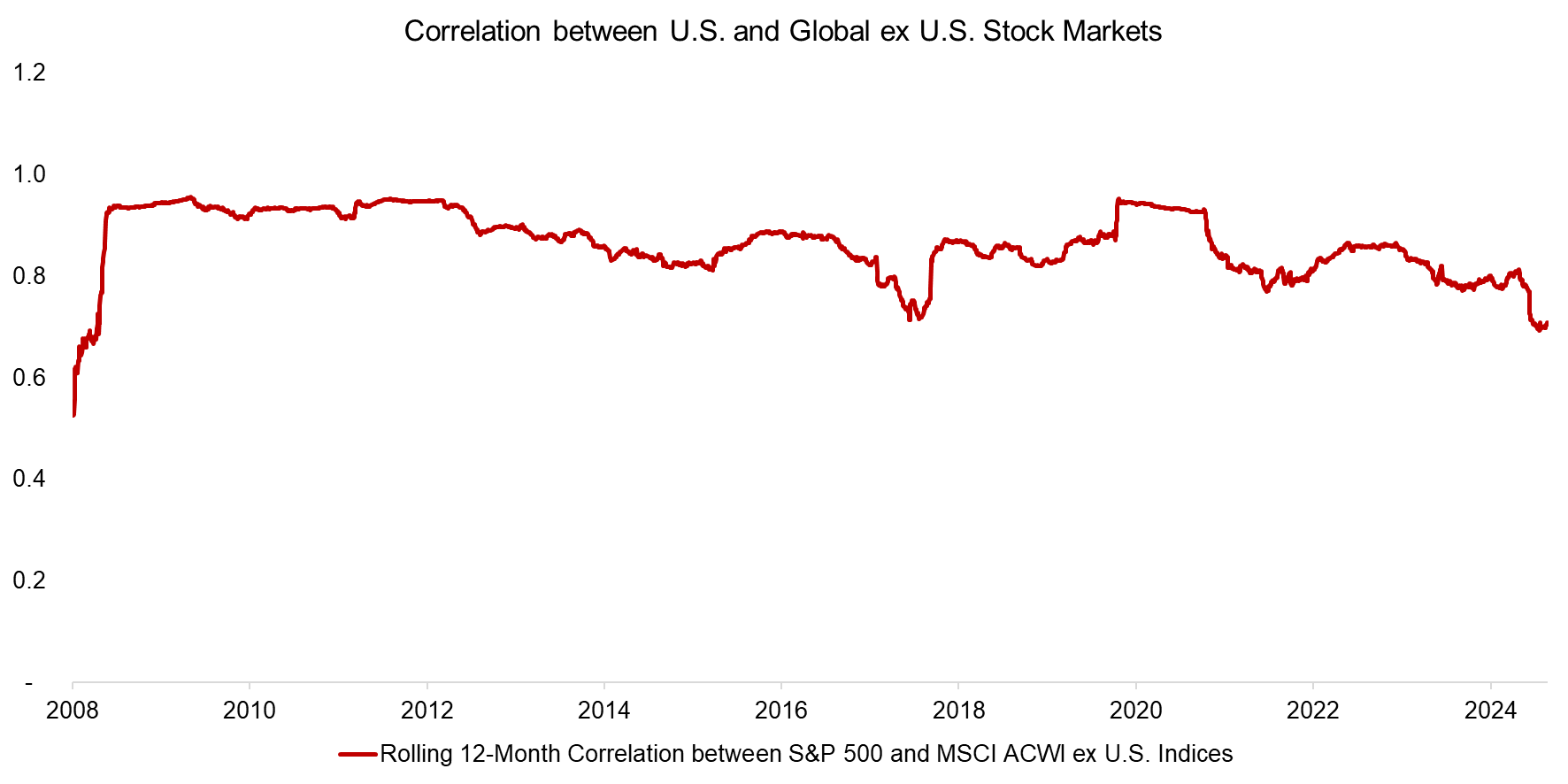

With the globalization of the economy and advancements in technology making trading more accessible, global stock markets have become increasingly correlated. For instance, the correlation between the U.S. market (represented by the S&P 500) and international markets (measured by the MSCI ACWI ex U.S.) was 0.89 from 2008 to 2025.

Source: Finominal

RISK CONTRIBUTION ANALYSIS

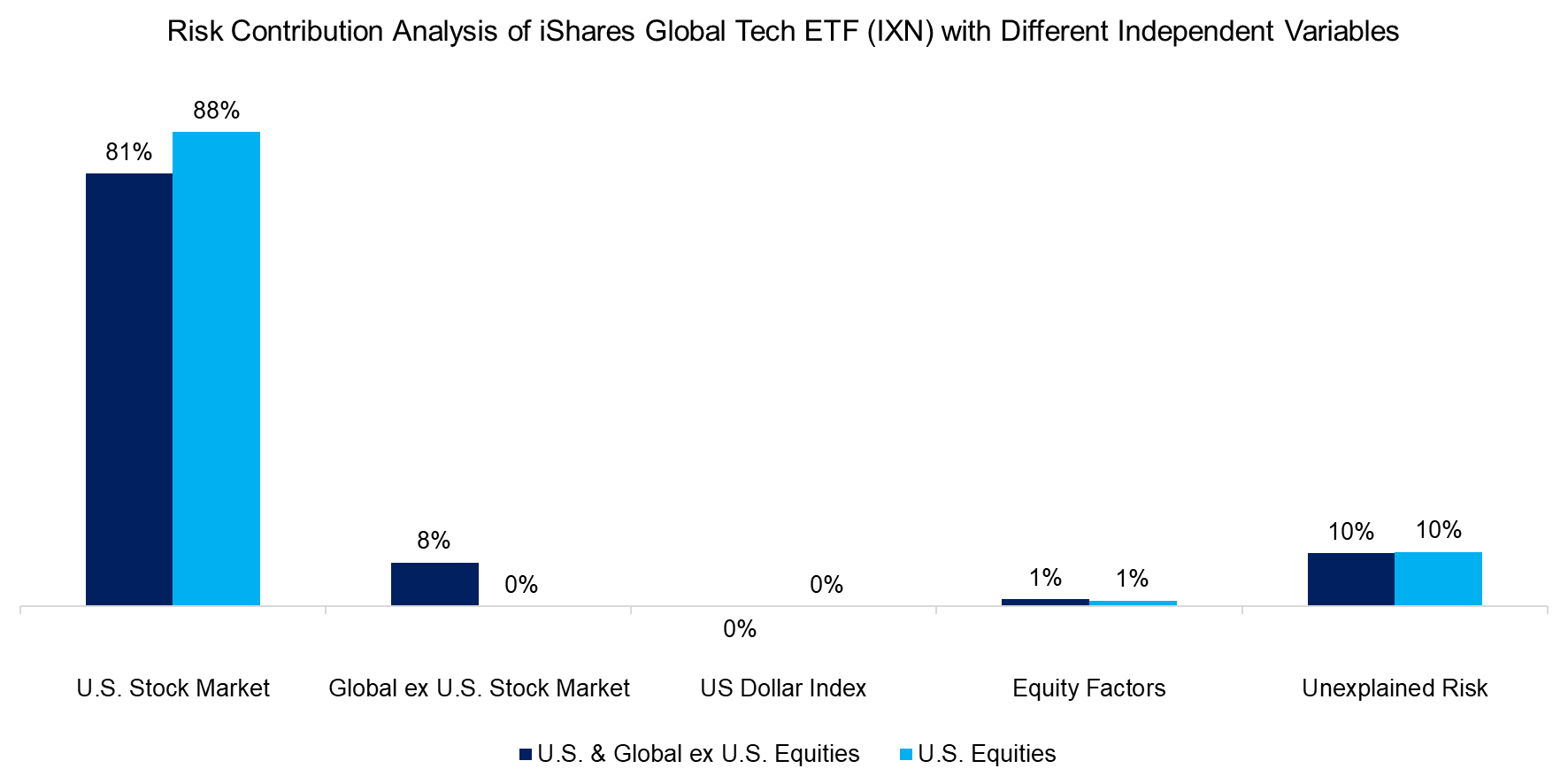

We begin by conducting a factor exposure analysis of the iShares Global Tech ETF (IXN) using two sets of independent variables, which include equities, the U.S. Dollar Index, and equity factors such as value, momentum, size, quality, and low volatility. In one scenario, we use only the U.S. stock market for equities, while in the other, we incorporate both the U.S. and global (ex-U.S.) stock markets. Our findings indicate that including global equities has only a minor impact on the risk contribution analysis.

Source: Finominal

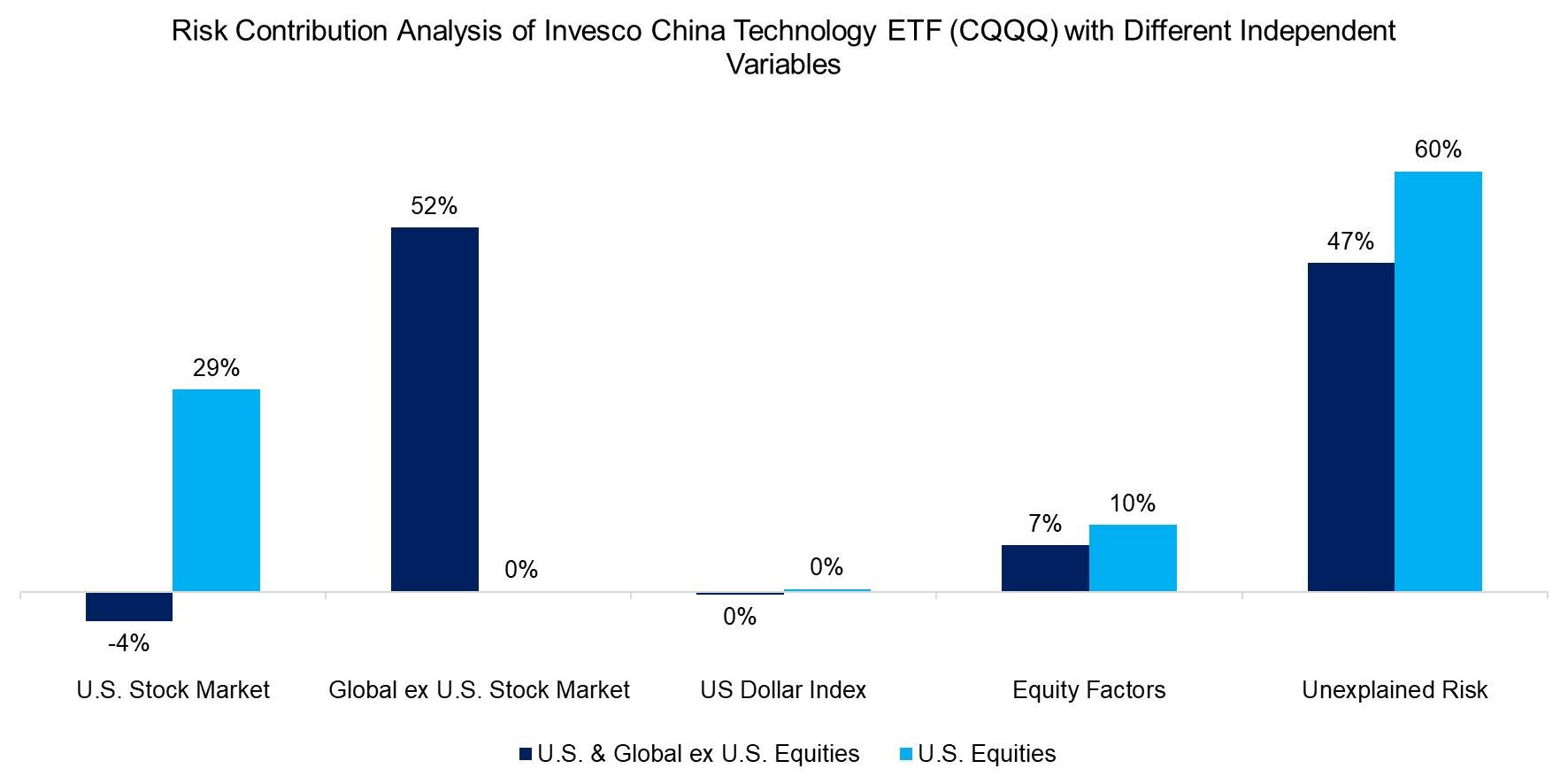

Next, we analyze another technology-focused fund, but one focused exclusively on China, namely the Invesco China Technology ETF (CQQQ). This ETF holds exclusively Chinese tech stocks like Tencent and Baidu. Although the ETF is traded on a U.S. exchange, the underlying stocks should be primarily driven by the changes in the Chinese rather than U.S. economy.

And indeed, we see that including a global equity index does shift the risk contributions from the U.S. to the Global ex U.S. stock market, and also reduces the unexplained risk, which will be primarily the exposure to the Chinese economy.

Source: Finominal

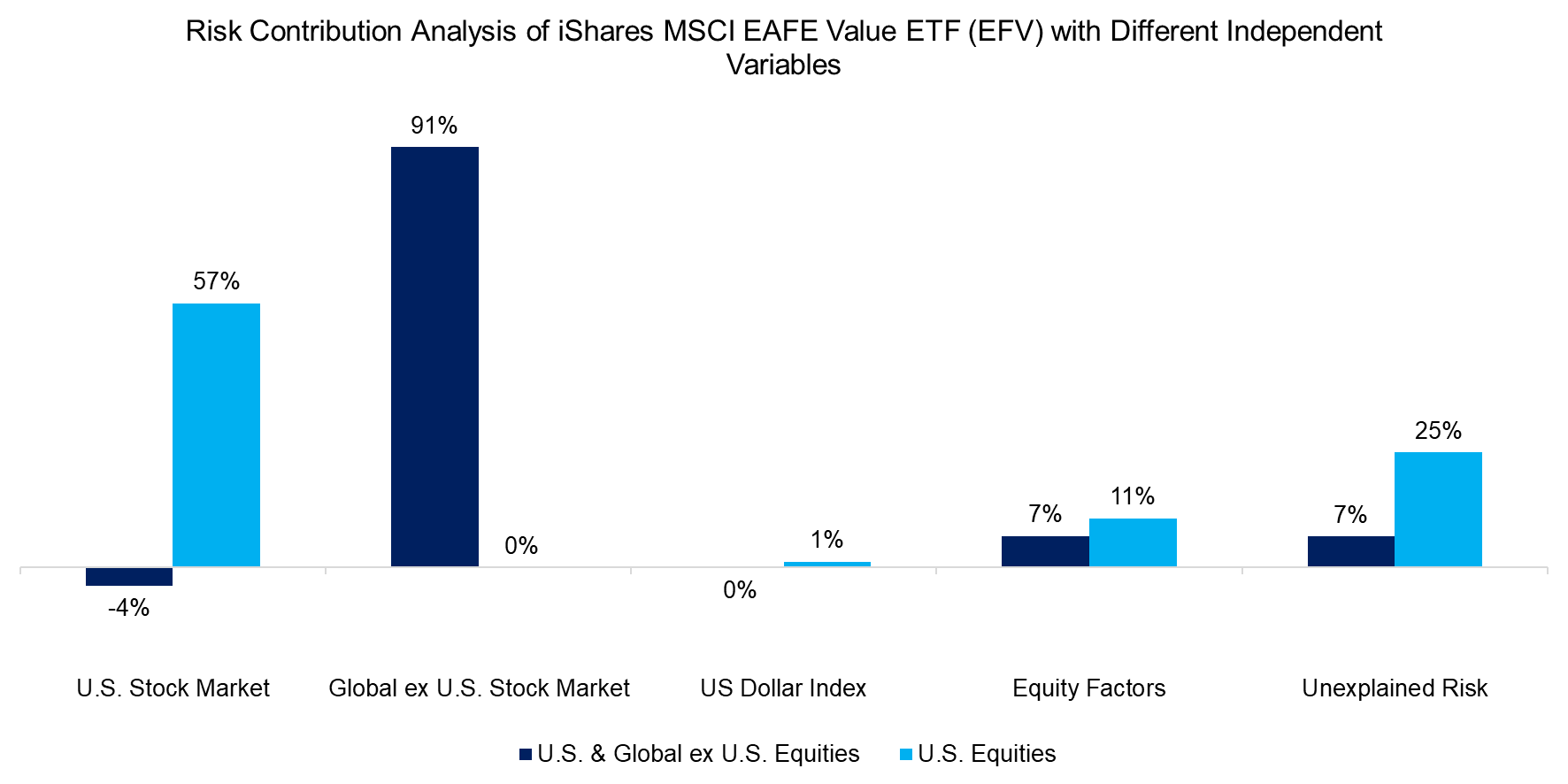

Calculating the risk contributions for the iShares MSCI EAFE Value ETF (EFV) further underscores the advantages of including a global equities index, as it significantly reduces the unexplained risk.

Source: Finominal

EFFECTIVENESS OF FACTOR EXPOSURE ANALYSIS

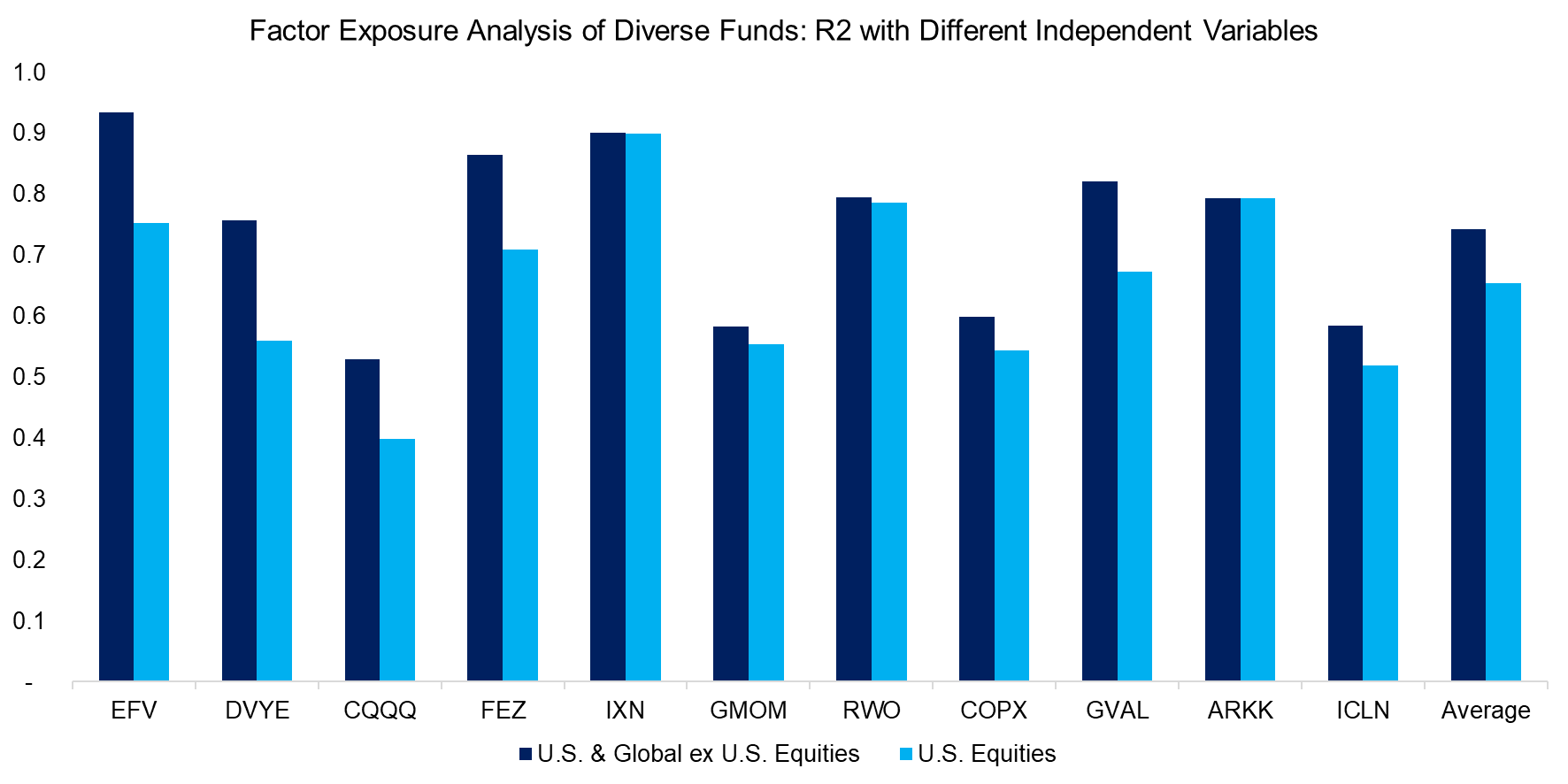

Finally, we compare the R2 values of 11 ETFs that provide exposure to various sectors, factors, and geographies, using both U.S. equity indices and a combination of U.S. and global equity indices. We observe an increase in R2 for all ETFs, with the average improving from 0.65 to 0.74, which makes a strong case for including multiple equity indices, even if they are highly correlated.

Source: Finominal

FURTHER THOUGHTS

Based on the results of this analysis, it’s worth considering which other variables could be valuable additions. For example, why not separate Global Equities ex U.S. into international and emerging markets? Or break down commodities into key markets like oil and gold? Or even split the U.S. Dollar Index into the U.S. Dollar against the Euro, British Pound, and Japanese Yen?

While adding more variables may enhance the explanatory power of the regression in some cases, it also makes the analysis more challenging to interpret. In investing, complexity is friend and foe.

RELATED RESEARCH

What’s My International Exposure?

Factor Exposure Analysis 114: Factor Offsetting

Factor Exposure Analysis 113: Profitability vs Leverage Factors

Factor Exposure Analysis 112: Quality vs Growth Factors

Factor Exposure Analysis 111: What is Alpha?

Factor Exposure Analysis 110: Long-Short vs Long-Only Factors

Factor Exposure Analysis 109: Linear vs Lasso vs Elastic Net

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 107: Fixed Income Factors

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 105: Sectors versus Factors

Factor Exposure Analysis 104: Fixed Income ETFs

Factor Exposure Analysis 103: Exploring Residualization

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.