Factor Exposure Analysis 116: Residualized Indices

Orthogonalizing independent variables

November 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

- Most country and sector indices are highly correlated

- Residualization can be used for a better risk contribution analysis

- However, residualized indices are abstract and counterintuitive

INTRODUCTION

Although artificial intelligence and machine learning have advanced rapidly in finance, most portfolio risk and return analysis still relies on traditional linear regression. The underlying math has not changed much, but the frameworks and factor sets have evolved significantly.

For instance, MSCI’s risk attribution model separates contributions from currency, market timing, and residuals. Within residuals, it further distinguishes between specific and common factors such as industry, country, global, and risk indices – allowing for quite granular analysis.

Other providers, including Bloomberg, Northfield, and Venn by Two Sigma, employ comparable frameworks, but with meaningful differences. Venn, for example, relies on just 18 independent variables, in contrast to MSCI’s 200+ factors. Still, a common thread across these approaches is the residualization of variables used in regression.

We introduced residualization in Factor Exposure Analysis 103: Exploring Residualization, and this article will build on that foundation with a deeper investigation.

COUNTRY AND SECTOR CORRELATIONS

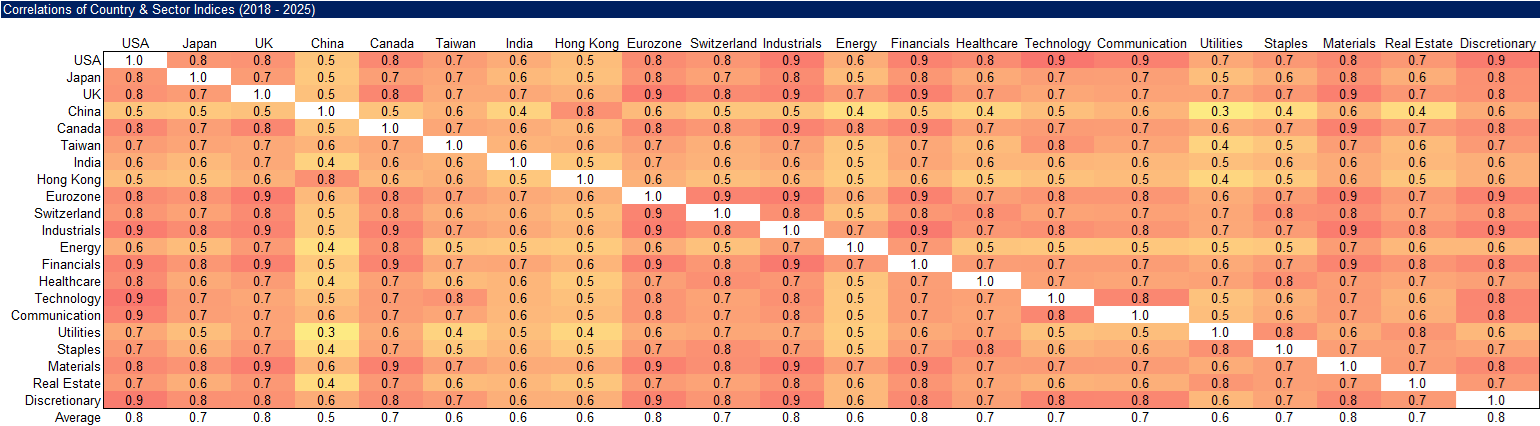

The purpose of linear regression is to explain the behavior of a dependent variable – such as a portfolio – using a set of independent variables. However, when those independent variables are highly correlated, the regression results can lose statistical significance. For instance, country and sector indices often move together because the global economy and financial markets are deeply interconnected. A disruption in Taiwan, for example, can quickly ripple into the U.S. economy through the semiconductor supply chain.

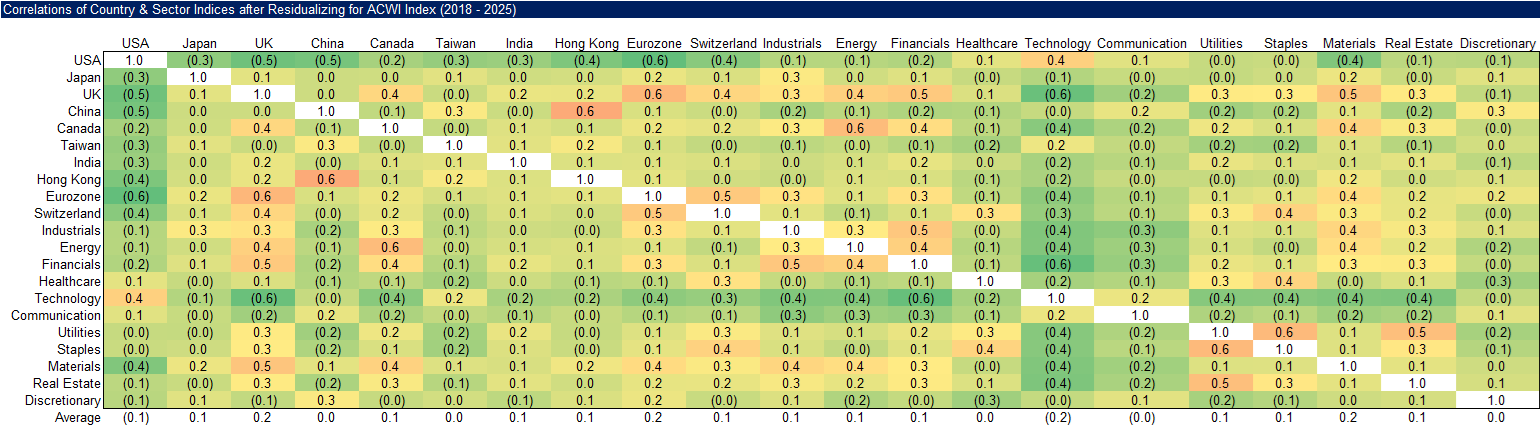

The first step in orthogonalizing financial variables is to remove the influence of the overall equity market, often represented by proxies such as the MSCI World or ACWI indices. Once this adjustment is made, the residualized country and sector indices exhibit lower correlations than their raw counterparts. Still, meaningful relationships remain – for example, the UK and Eurozone indices often show a strong positive correlation of around 0.6, while technology and financials may be negatively correlated at roughly -0.6.

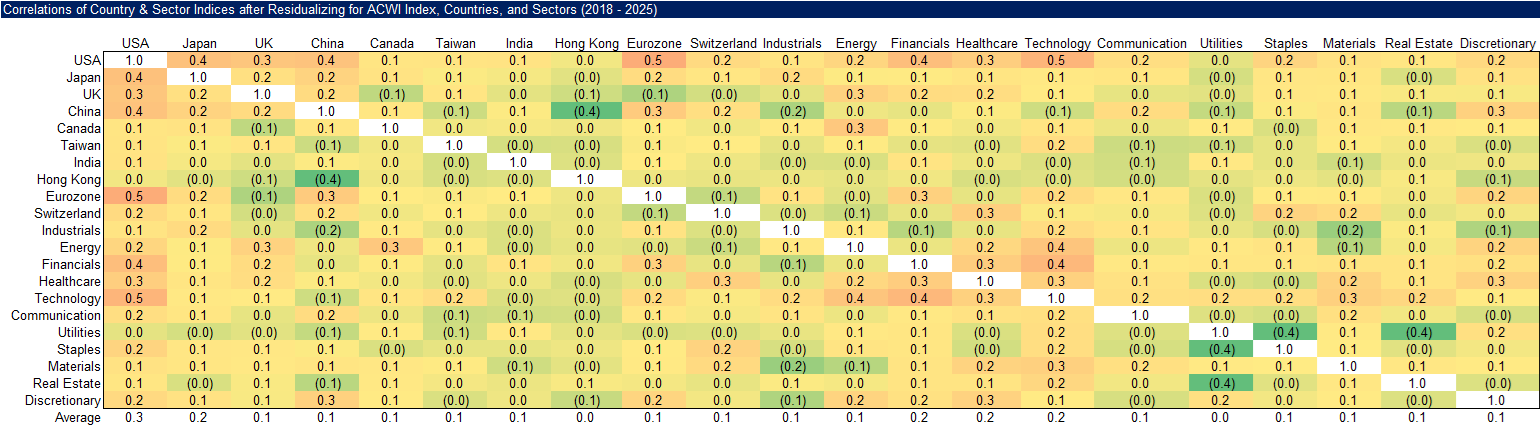

The process for further reducing correlations among independent variables varies across providers, with some applying multiple rounds of residualization in a strict hierarchical structure. Typically, country indices are residualized against one another, and the same approach is applied to sector indices. This yields a set of variables that are significantly less correlated than the originals, with no pairwise correlations exceeding 0.5.

Residualized indices offer a concise view of how countries, sectors, and factors contribute to a portfolio’s risk and return. However, these indices can become abstract and counterintuitive.

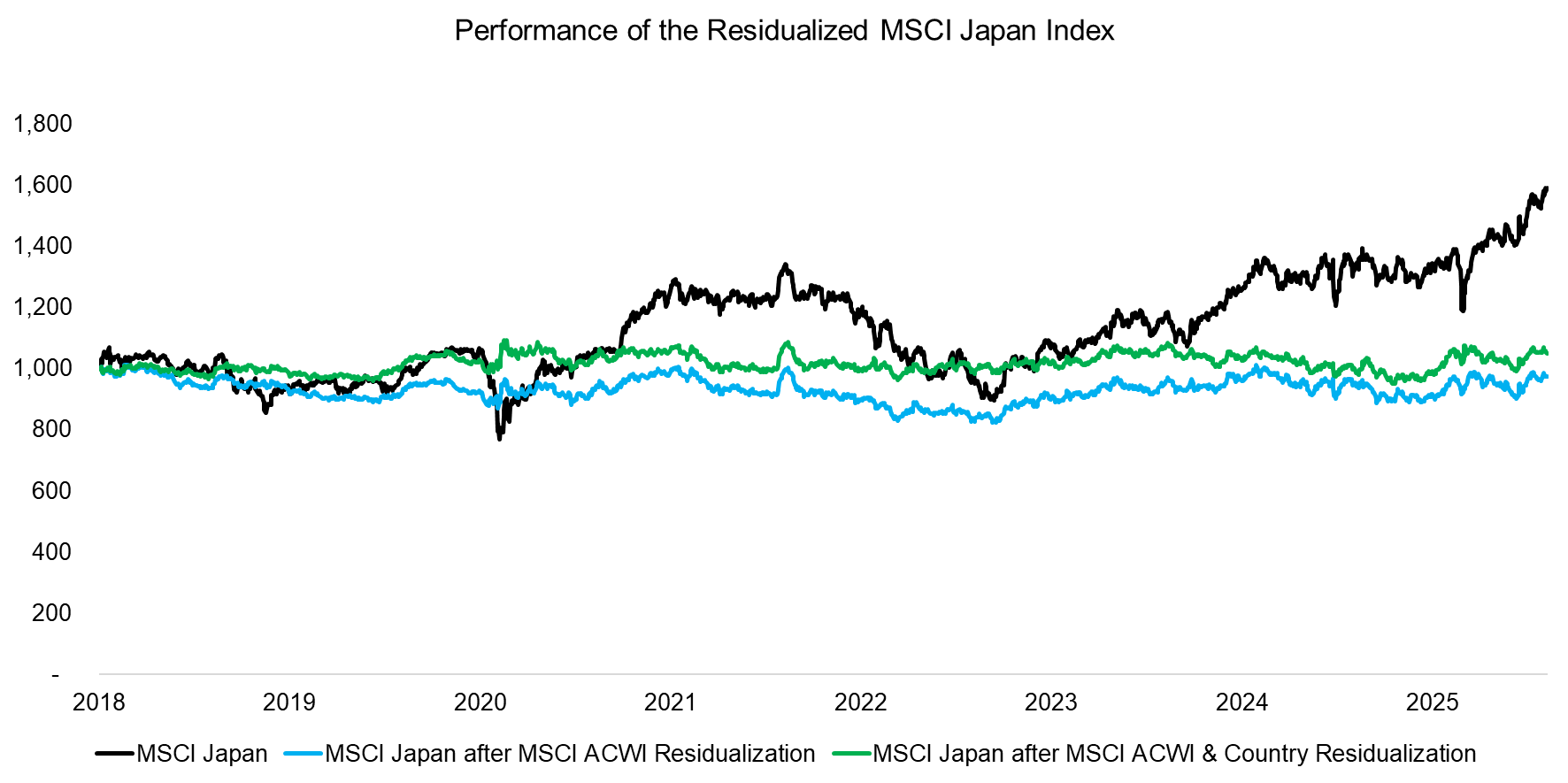

For instance, the MSCI Japan index has delivered a CAGR of 6.3% since 2018, which market commentators might attribute to Japanese economic reforms and a gradual exit from the ultra-low inflation environment. Yet, once the influence of the global stock market is removed, the residualized CAGR drops to -0.4%, indicating that the performance of Japanese stocks largely reflects the global market’s momentum rather than unique, idiosyncratic factors. Adjusting the index relative to other countries only slightly raises the residualized CAGR to 0.6%. Such a perspective is unlikely to resonate with Japanese investors or the general public.

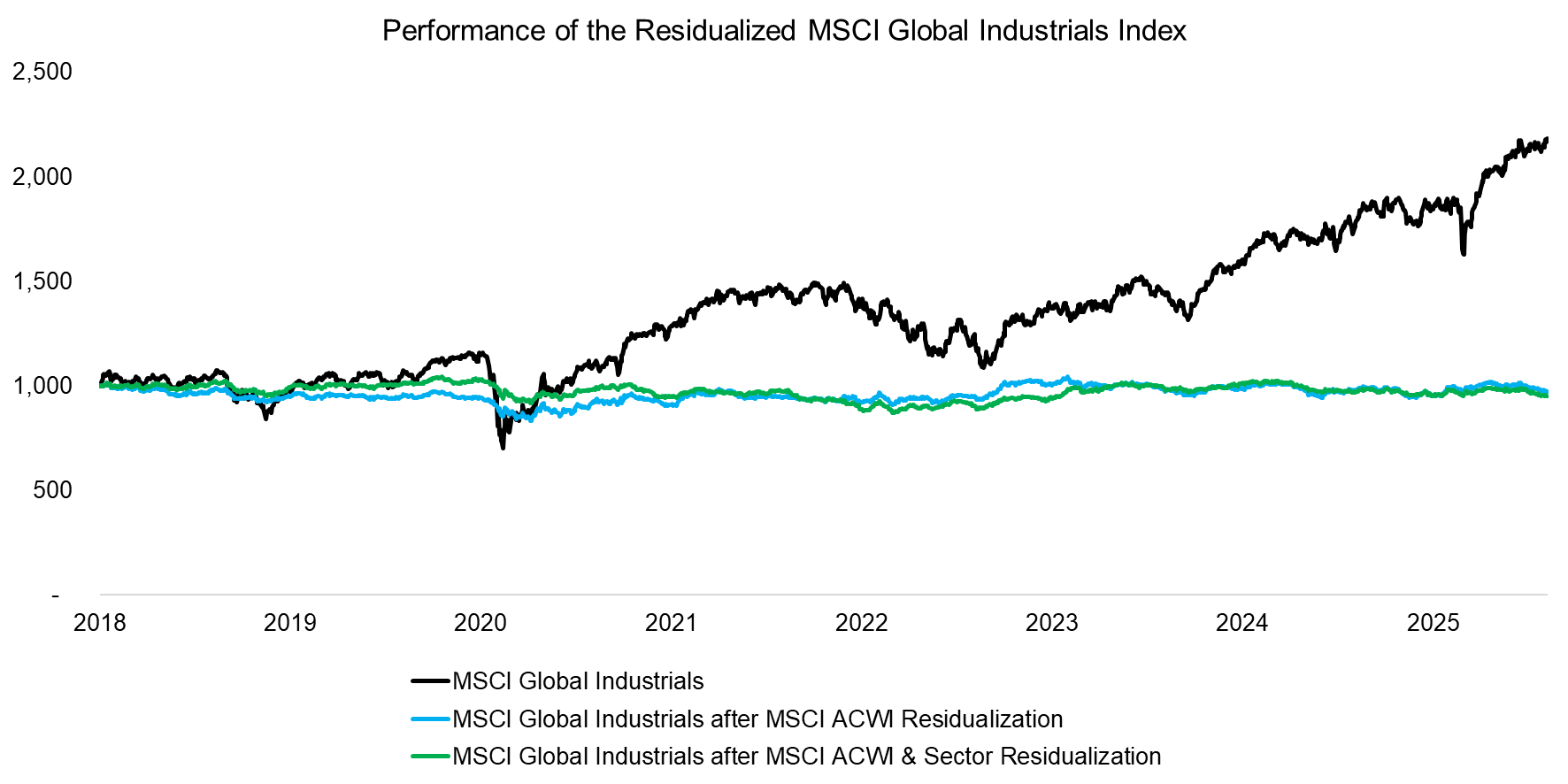

A similar pattern emerges when comparing the residualized MSCI Global Industrials Index with the unadjusted index: the CAGR drops from 10.8% to -0.4% after accounting for the MSCI ACWI, and to -0.7% after adjusting for the influence of other sectors.

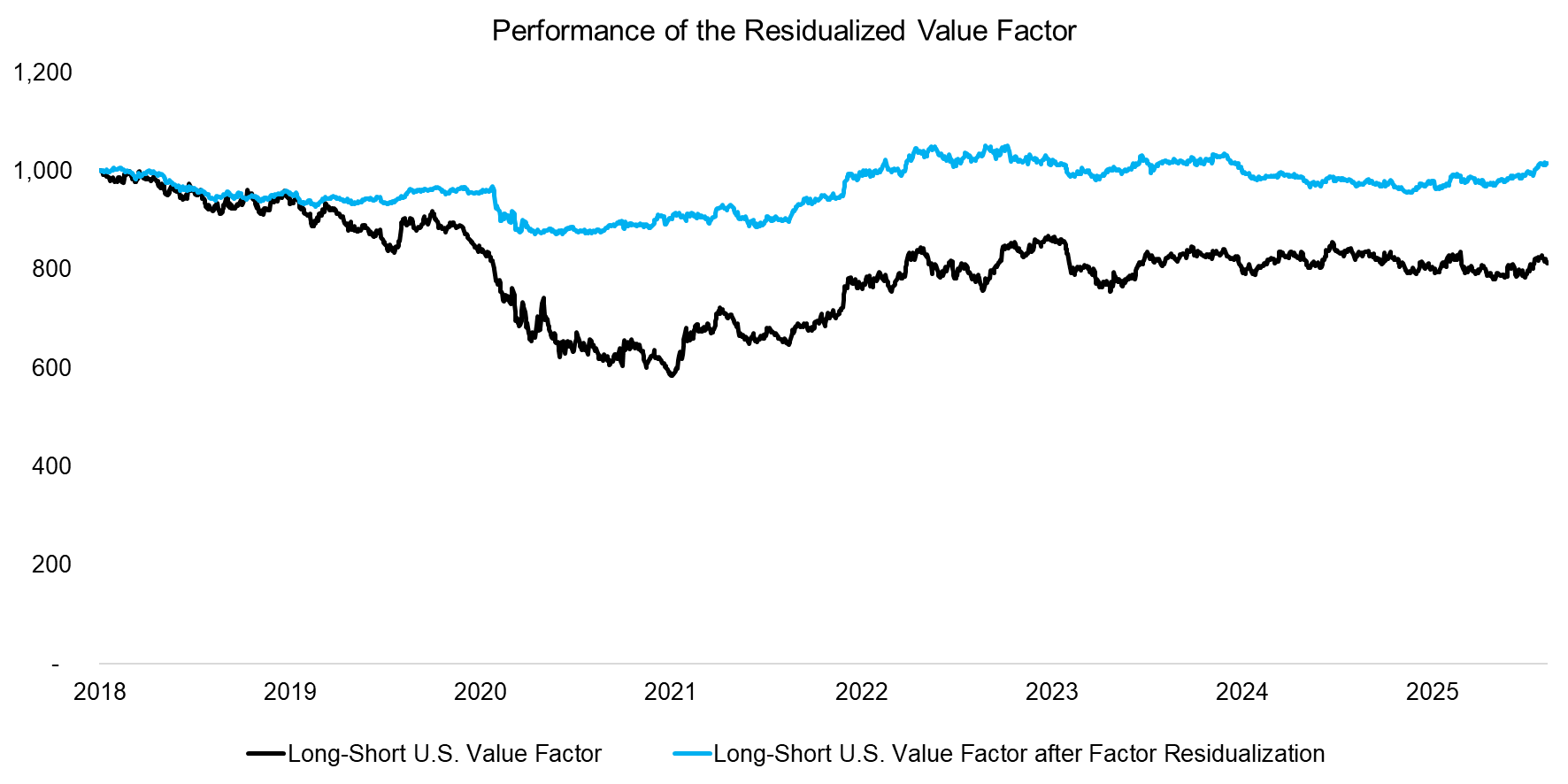

Comparing the raw and residualized MSCI Japan and MSCI USA Industrials indices generally shows lower returns after residualization; however, adjusting for other factors can also enhance performance. For example, removing the influence of other factors on the long-short value factor in the U.S. would have increased its CAGR from -2.7% to 0.2% since 2018. One notable drag on the value factor has been the size factor, as small-cap stocks have underperformed over the past two decades. Reducing exposure to this factor improved overall factor performance.

Source: Finominal

FURTHER THOUGHTS

Investors seek to understand the drivers of risk and return in their portfolios. Residualization enables a more granular perspective by incorporating a broad set of variables, but this comes at a cost: the resulting indices can become more abstract, and excessive variables make interpretation difficult. Fortunately, modern techniques such as Lasso and Elastic Net regression help address these challenges (read Factor Exposure Analysis 109: Linear vs Lasso vs Elastic Net).

RELATED RESEARCH

Factor Exposure Analysis 115: Measuring International Exposures

Factor Exposure Analysis 114: Factor Offsetting

Factor Exposure Analysis 113: Profitability vs Leverage Factors

Factor Exposure Analysis 112: Quality vs Growth Factors

Factor Exposure Analysis 111: What is Alpha?

Factor Exposure Analysis 110: Long-Short vs Long-Only Factors

Factor Exposure Analysis 109: Linear vs Lasso vs Elastic Net

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 107: Fixed Income Factors

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 105: Sectors versus Factors

Factor Exposure Analysis 104: Fixed Income ETFs

Factor Exposure Analysis 103: Exploring Residualization

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.