Factor Exposure Analysis 118: Factor-based Return Attribution Analysis

Measuring asset allocation and selection decisions

January 2026. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Traditional attribution analysis is sector-based

- However, this is not helpful for fixed income or quant strategies

- A factor-based approach is universally applicable

INTRODUCTION

Most sophisticated investors seek to understand the drivers of both risk and return in their portfolios. Traditionally, they conduct performance attribution analysis to compare the portfolio’s returns against a benchmark index. The typical output decomposes performance into allocation, selection, and interaction effects, illustrating the impact of investment decisions.

However, few investors using tools such as the Bloomberg Terminal realize how dated the underlying methodologies are. The foundational work by Brinson and Fachler, who introduced sector-based performance attribution, was published back in 1985 – four decades ago. Since then, financial research has advanced considerably, and the analytical focus has shifted from sectors to factors.

In this research article, we explore factor-based performance attribution analysis, which offers a more modern and insightful view of portfolio performance.

CONTRIBUTION ANALYSIS

We construct five portfolios composed of U.S. equities and fixed income, with a fixed allocation of 60% to stocks and 40% to bonds. The fixed income allocation is consistently invested in U.S. investment-grade bonds, while the equity portion is allocated across several strategies: the S&P 500 (market capitalization-weighted and equal-weighted), small-cap stocks, momentum stocks, and energy stocks.

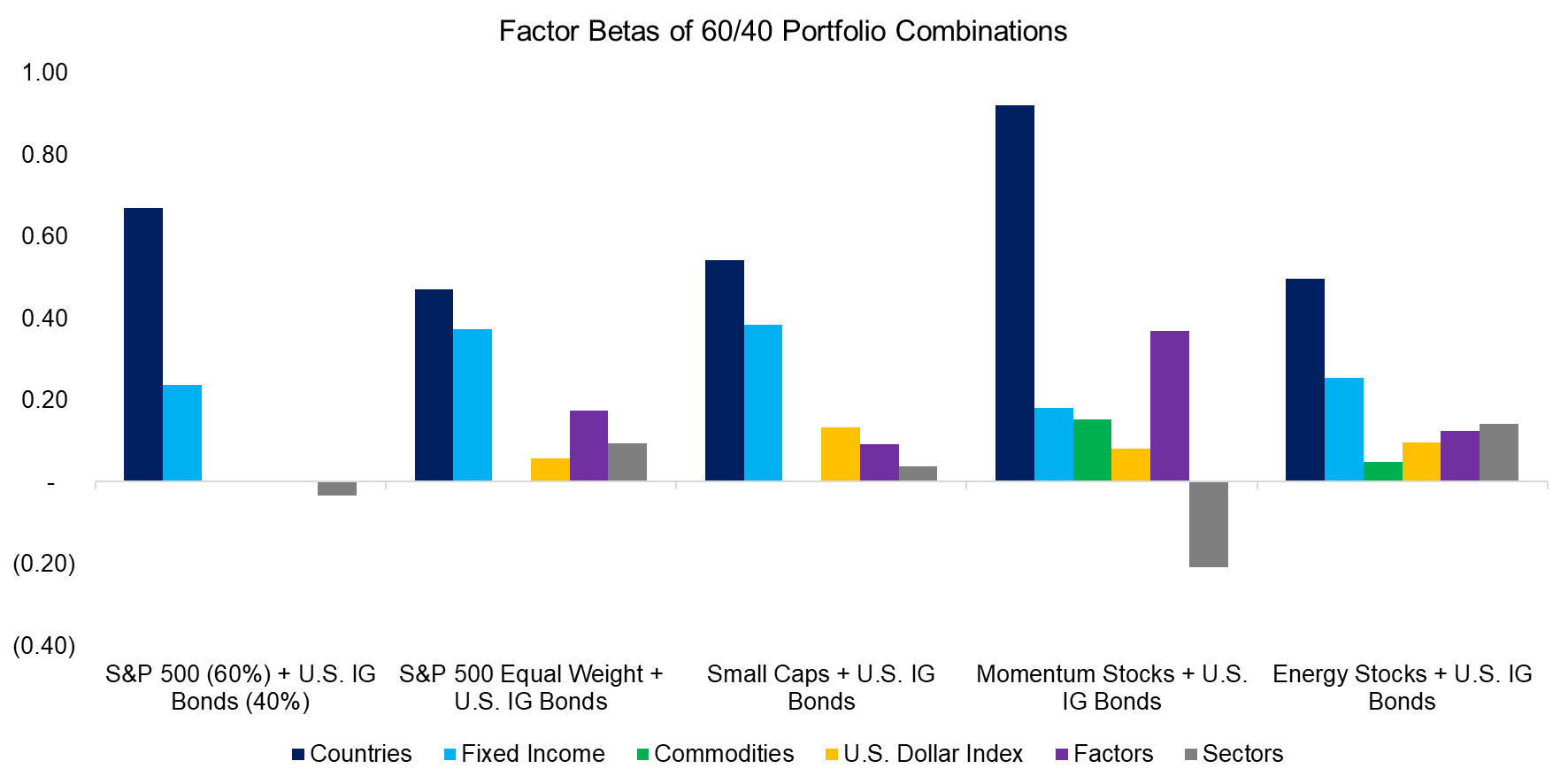

We then conduct a regression analysis using an elastic net model with a broad set of indices representing asset classes, sectors, and factors using daily returns of 2024. Importantly, we employ raw indices rather than residualized ones, as our previous research indicates that residualization often produces outputs that are more difficult to interpret (read Factor Exposure Analysis 116: Residualized Indices).

The regression results confirm that all five portfolios exhibit high betas to U.S. equities and fixed income, as expected. However, we also observe some unexpected patterns – for example, the small-cap portfolio shows a relatively low beta to common style factors, including the size factor, which appears to result from offsetting exposures among those factors.

Source: Finominal

RETURN CONTRIBUTION ANALYSIS

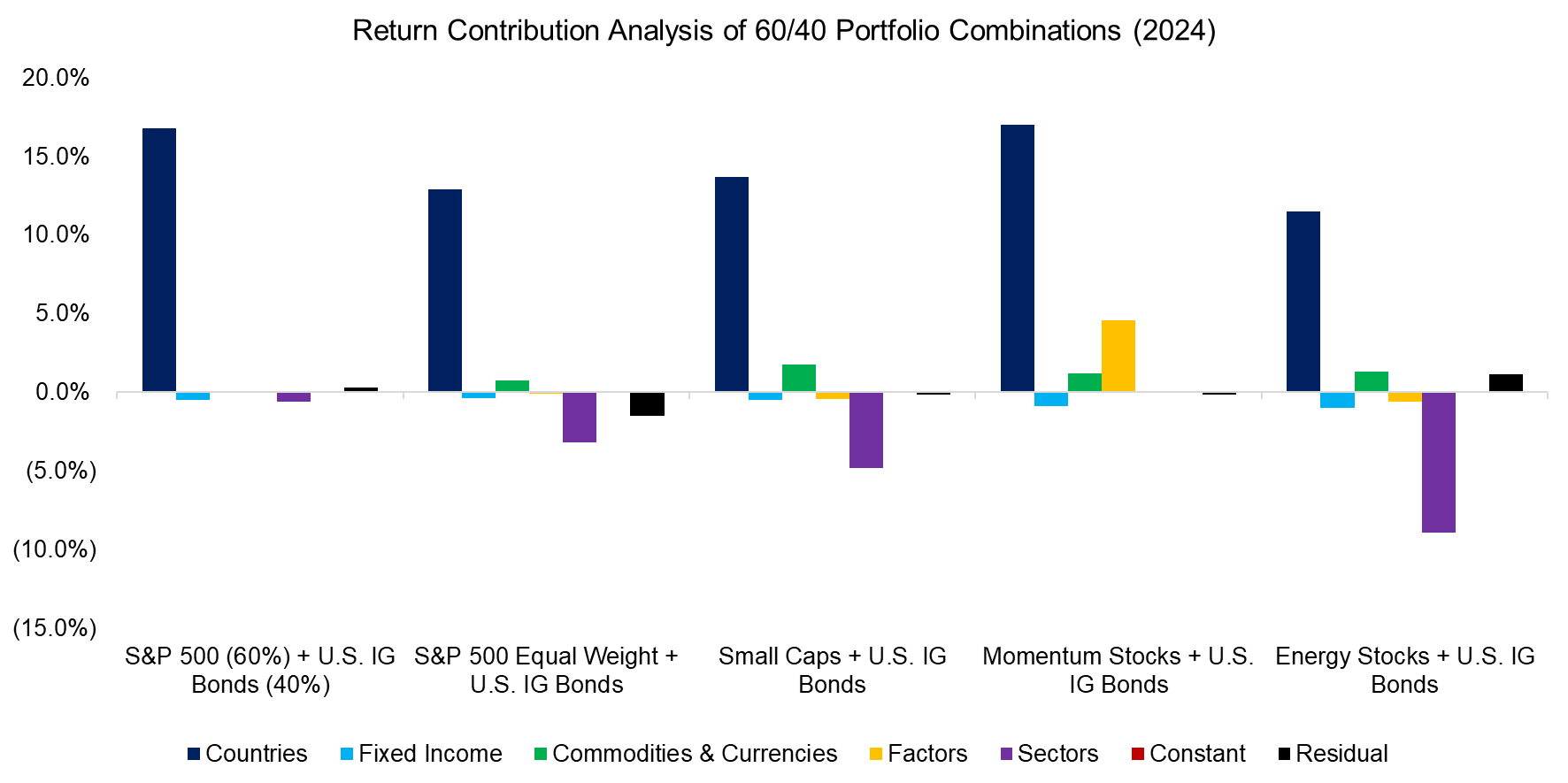

We use the betas derived from the risk contribution analysis to calculate return contributions, which reveal that country exposure, i.e. primarily the U.S. stock market, was the dominant source of returns. However, some of the return contributions appear counterintuitive – for example, the sector contribution for the energy-stock portfolio was negative in 2024.

In this case, the portfolio had a positive beta of 0.6 to the energy sector, but also a negative beta of -0.2 to the technology sector. In 2024, the energy sector gained only 3.6%, while technology stocks surged by 35.0%. As a result, the negative exposure to the outperforming tech sector more than offset the modest gains from energy, leading to an overall negative sector contribution.

Source: Finominal

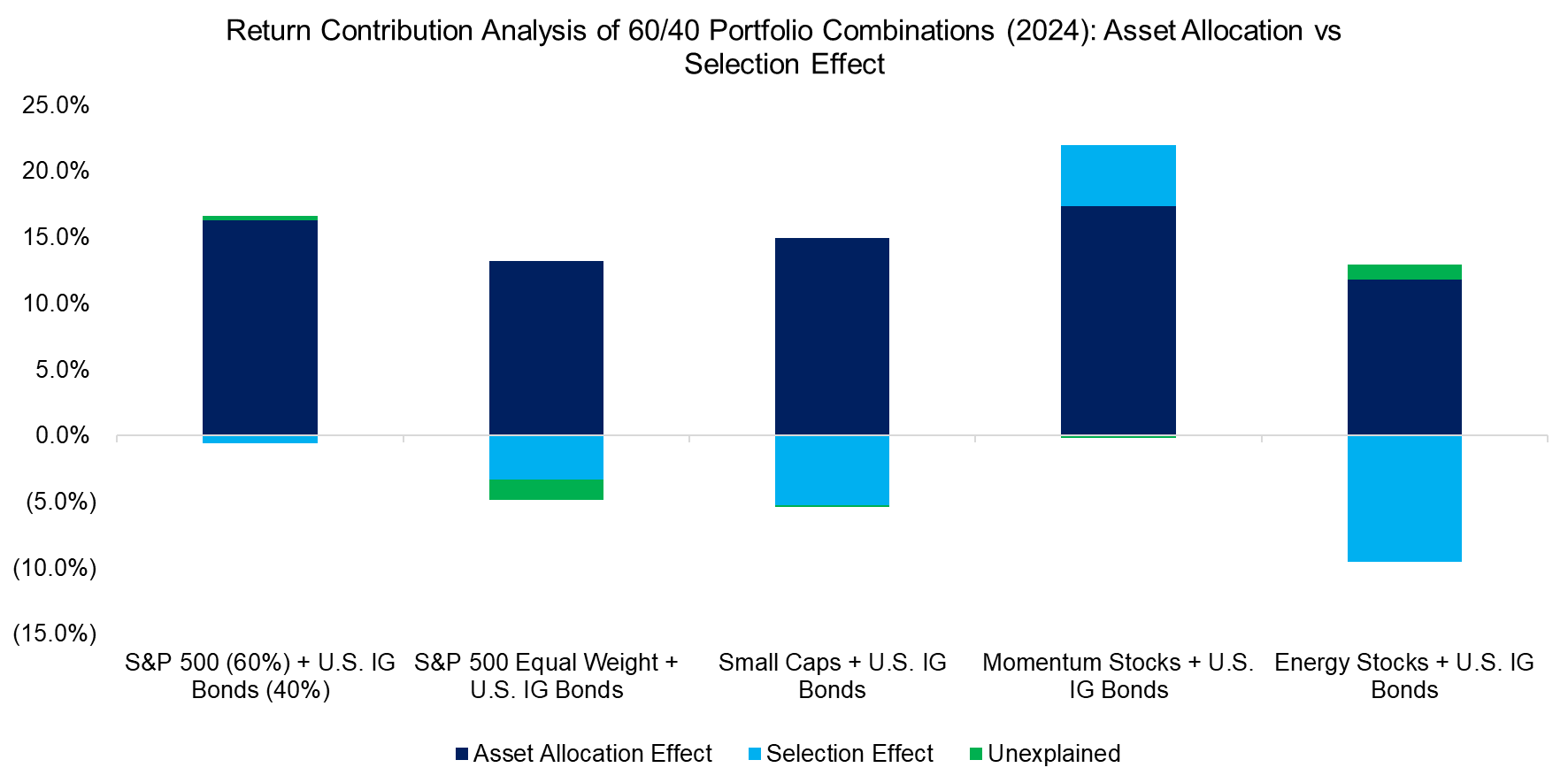

Next, we aggregate the return contributions from country, fixed income, commodity, and currency exposures to compute the asset allocation effect, while the selection effect is derived from sector and factor contributions.

Since these portfolios are primarily equity-focused and stock markets performed strongly in 2024, the asset allocation effect was positive and substantial across all five portfolios. In contrast, the selection effect was smaller, with only the momentum-stock portfolio showing a positive selection contribution. The residual and constant terms from the regression, which we combined into an unexplained category, were insignificant.

Source: Finominal

RETURN ATTRIBUTION ANALYSIS

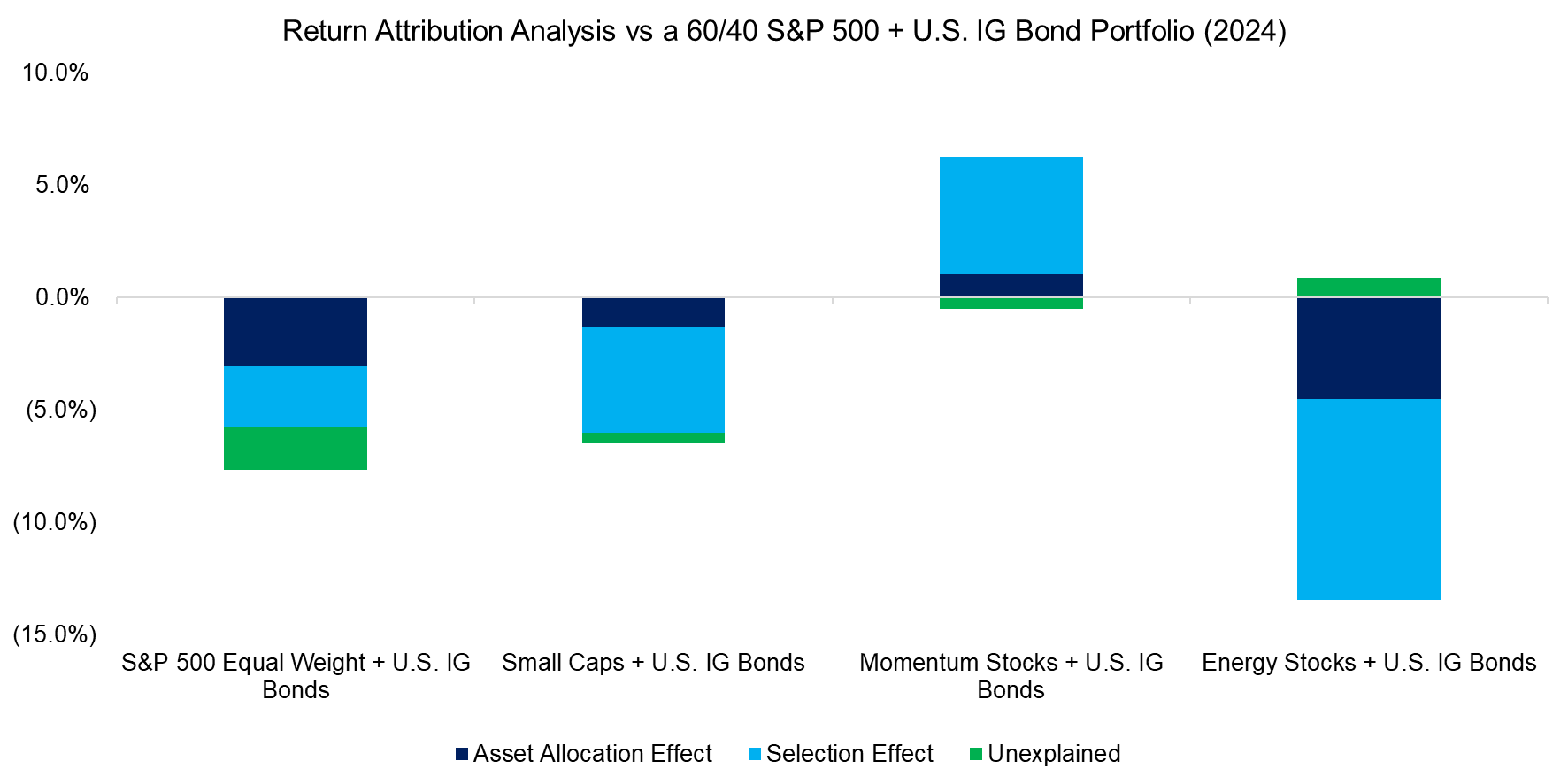

Finally, we use the return contributions to produce a performance attribution analysis against a benchmark composed of 60% market-cap-weighted S&P 500 and 40% U.S. investment-grade bonds. The analysis shows that both asset allocation and selection effects were negative for the equal-weighted S&P 500, small-cap, and energy-stock portfolios. It was difficult to beat the S&P 500. Only the momentum-stock portfolio delivered positive results, indicating that selecting momentum stocks was the correct call in 2024.

Source: Finominal

FURTHER THOUGHTS

This analysis demonstrates how a factor-based approach to performance attribution can be applied to portfolios across different asset classes, as well as those with sector and factor tilts. Unlike traditional sector-based methods, which are less effective for explaining fixed income or quantitative strategies, the factor-based approach offers a clear advantage.

However, there are also limitations. Using factors requires selecting a universe of indices, deciding whether to adjust or residualize them, choosing a lookback period, and selecting a regression methodology. Because regression analysis relies on a sufficient number of data points for statistical significance, this approach is less suitable for explaining short-term manager performance. Given that the foundational studies are now decades old, there remains considerable room for innovation in this area.

RELATED RESEARCH

Factor Exposure Analysis 117: Risk Contribution Analysis

Factor Exposure Analysis 116: Residualized Indices

Factor Exposure Analysis 115: Measuring International Exposures

Factor Exposure Analysis 114: Factor Offsetting

Factor Exposure Analysis 113: Profitability vs Leverage Factors

Factor Exposure Analysis 112: Quality vs Growth Factors

Factor Exposure Analysis 111: What is Alpha?

Factor Exposure Analysis 110: Long-Short vs Long-Only Factors

Factor Exposure Analysis 109: Linear vs Lasso vs Elastic Net

Factor Exposure Analysis 108: Fixed Income Factors II

Factor Exposure Analysis 107: Fixed Income Factors

Factor Exposure Analysis 106: Macro Variables

Factor Exposure Analysis 105: Sectors versus Factors

Factor Exposure Analysis 104: Fixed Income ETFs

Factor Exposure Analysis 103: Exploring Residualization

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.