Factor Exposure: Smart Beta ETFs vs Mutual Funds

Do Active Managers Provide Higher Factor Exposure than ETFs?

August 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Investors can express factor views via smart beta ETFs or mutual funds

- Some mutual funds offer higher factor exposure than smart beta ETFs

- Given higher fees, strong views on expected factor performance are required

INTRODUCTION

Similar to wind and water eroding the strongest mountains over time, passive fund management has been gradually capturing market share from active managers globally. The recent announcement of Fidelity, which a decade ago represented the symbolic leader of active fund managers, to launch two index funds with zero fees, highlights the dramatic changes in the fund management industry. However, at the same time, some providers of passive products like WisdomTree are enhancing their product suite by adding actively managed ETFs. It seems that both worlds are partially integrating and that active management will continue to play an important role in the future.

We previously analysed the factor exposure of smart beta ETFs (please see ETFs, Smart Beta & Factor Exposure) and noted their relatively low exposure to common equity factors. In this short research note we will compare the factor exposure of smart beta ETFs and mutual funds, initially by focusing on the Value factor and then expanding to other common equity factors.

METHODOLOGY

We focus on six factors namely Value, Momentum, Low Volatility, Quality, Growth and Dividend Yield in the US stock market. The factor performance is calculated by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks ranked by the factor definitions, which are in line with academic and industry standards. Only stocks with a minimum market capitalisation of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

Factor exposure is measured by factor betas derived from a one-year regression analysis utilising daily data and the six equity factors as well as the market as independent variables.

SMART BETA VALUE ETFS VS VALUE MUTUAL FUNDS

Mutual funds were less popular in recent years as investors became more aware of the perpetual underperformance of funds against their benchmarks. Research such the S&P SPIVA Scorecards highlights that across markets and time periods only a small fraction of active managers outperform their benchmarks, which is typically explained by high fees and a low active share.

Although active managers can not compete on fees with ETFs, they do have flexibility in stock selection and portfolio construction as they are not tracking rules-based indices. Naturally this comes with some career risk, but the free lunch of closet indexing is rapidly disappearing. Given that passive fund management is steadily gaining market share, active managers need to differentiate themselves to survive.

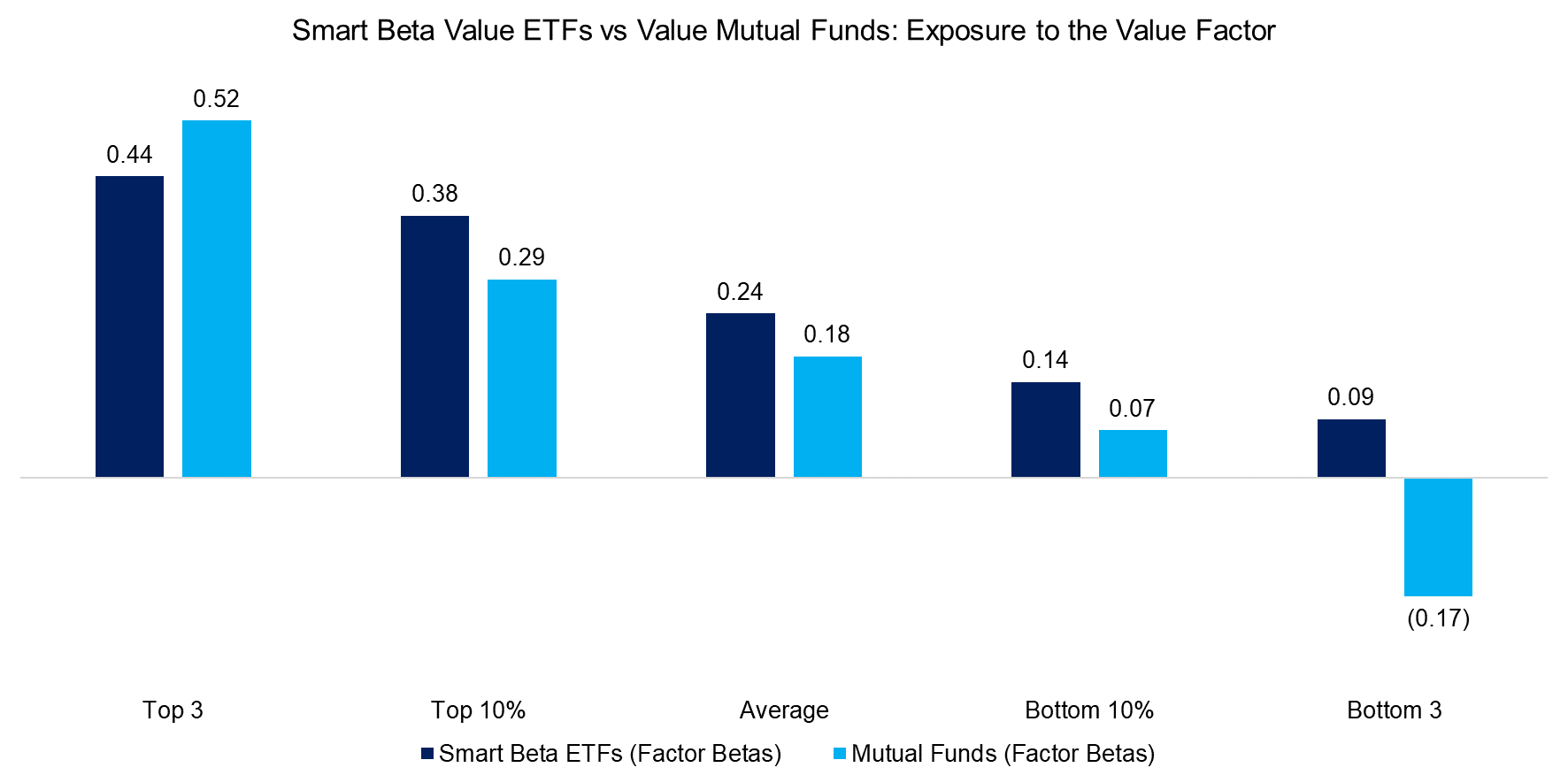

The chart below compares the exposure of smart beta Value ETFs and Value-focused mutual funds to the long-short Value factor. The metrics shown are the factor betas that represent the sensitivity to the factor, i.e. the closer the beta to 1, the more the ETF or fund approximates the behaviour of the factor.

We observe that investors seeking exposure to the Value factor are in general better served with smart beta ETFs as these offer higher factor exposure on average, except when comparing the three ETFs or funds with the highest exposure. It is worth noting that the number of mutual funds with a Value focus vastly exceeds the number of smart beta Value ETFs, therefore these results have to be taken with caution.

Source: FactorResearch

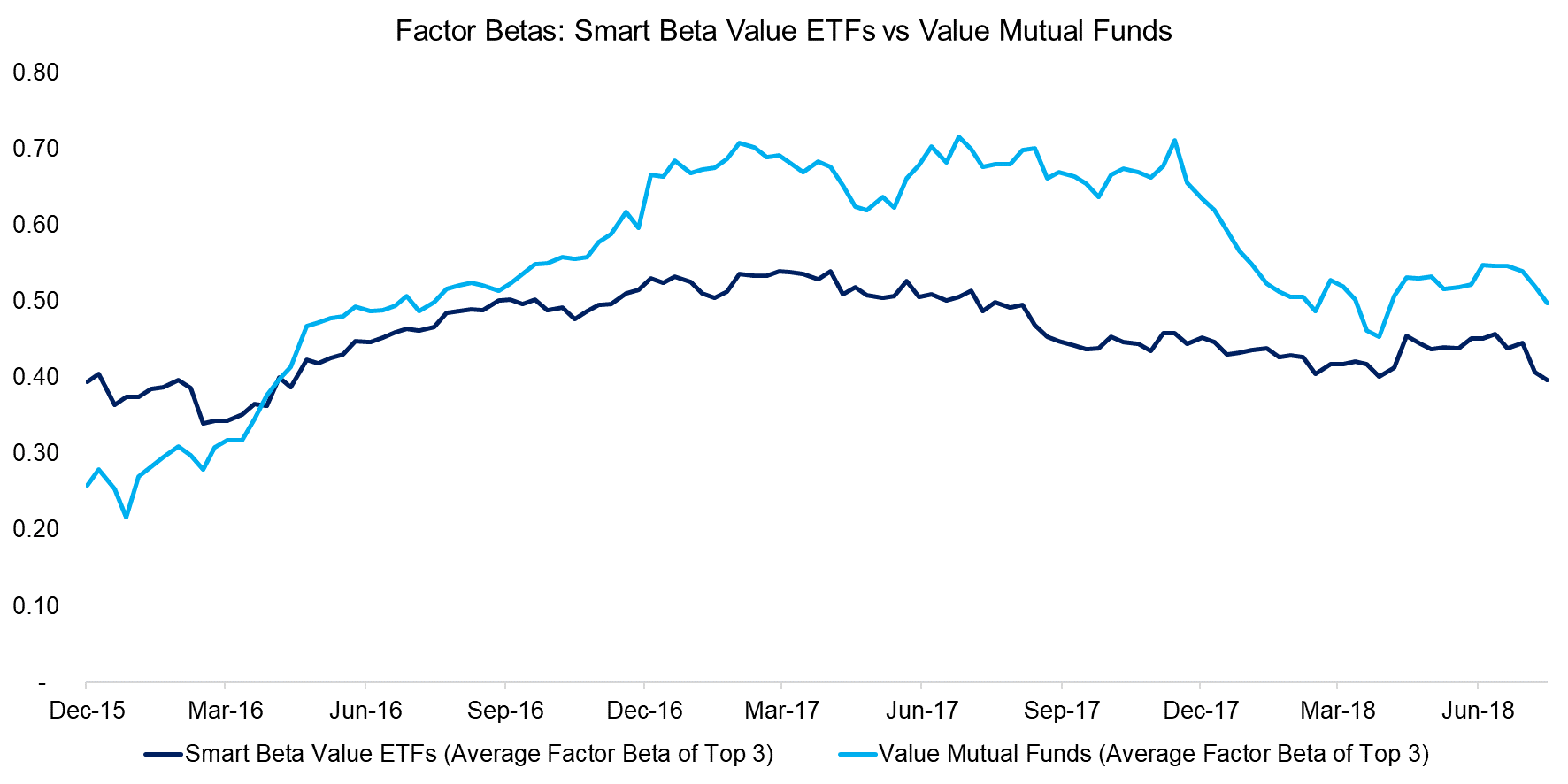

The analysis might be challenged by arguing that the factor betas of the top three mutual funds are random and not consistently higher than those of smart beta ETFs. The chart below compares the average factor betas of the top three smart beta ETFs and mutual funds from 2015 to 2018. We can observe that the factor betas of the smart beta ETFs seem less volatile, which is to be expected given that these follow a systematic portfolio construction process. The factor exposure of the mutual funds has been consistently high, except for the end of 2015, which might indicate style drift and warrants further investigation.

Source: FactorResearch

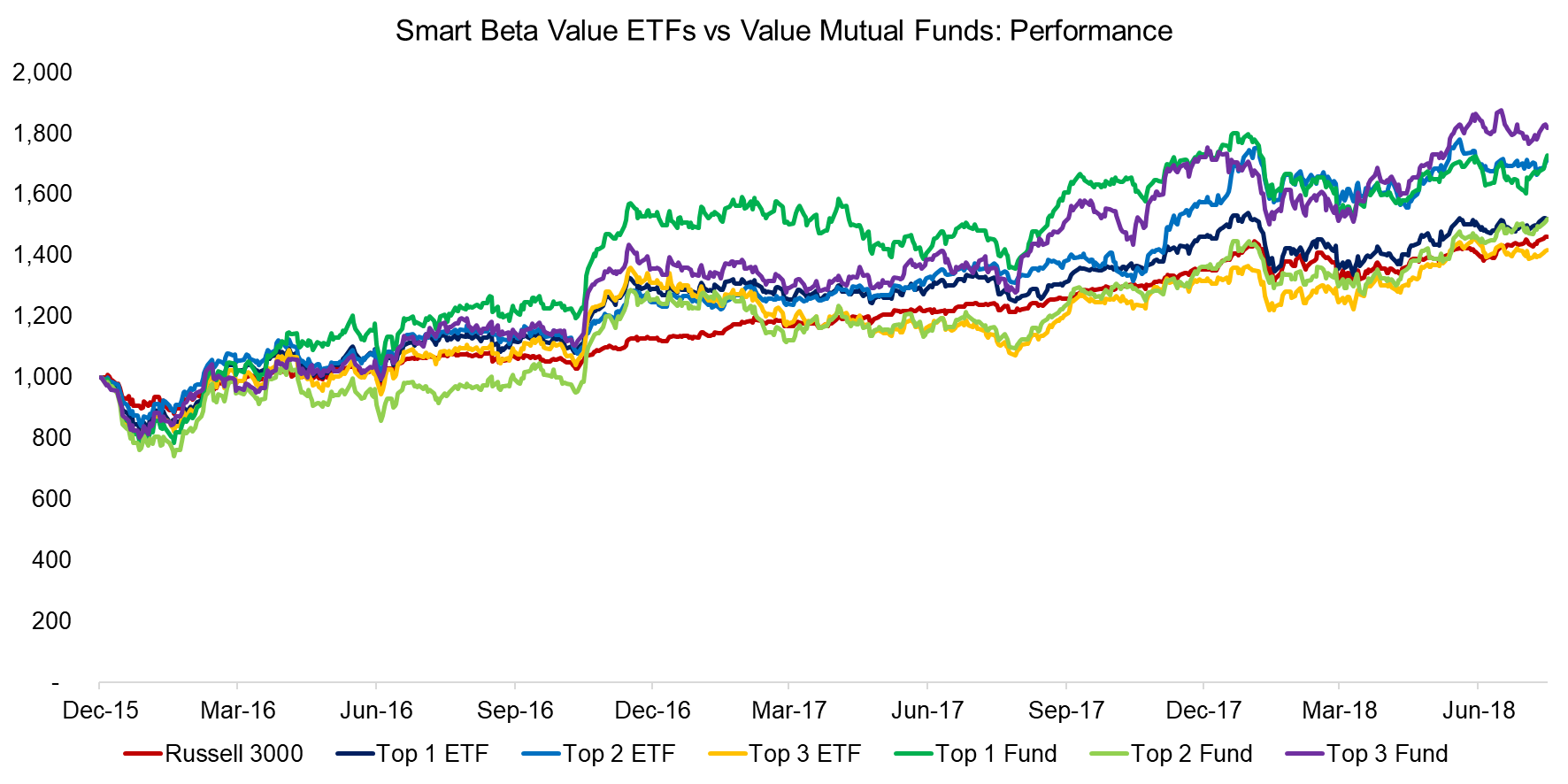

Finally, we compare the performance of the same top 3 smart beta Value ETFs and mutual funds, which we benchmark against the Russell 3000 (read Smart Beta & Factor Correlations to the S&P 500). We observe similar trends, albeit with meaningful differences in performance. Some ETFs and funds exhibit higher volatility than others, which likely indicates more concentrated portfolios. The significant increase in performance in November 2016 can be attributed to the US election, which led to a change in market sentiment and rally in the Value and Size factors.

Source: FactorResearch

SMART BETA ETFS VS MUTUAL FUNDS: FACTOR EXPOSURE

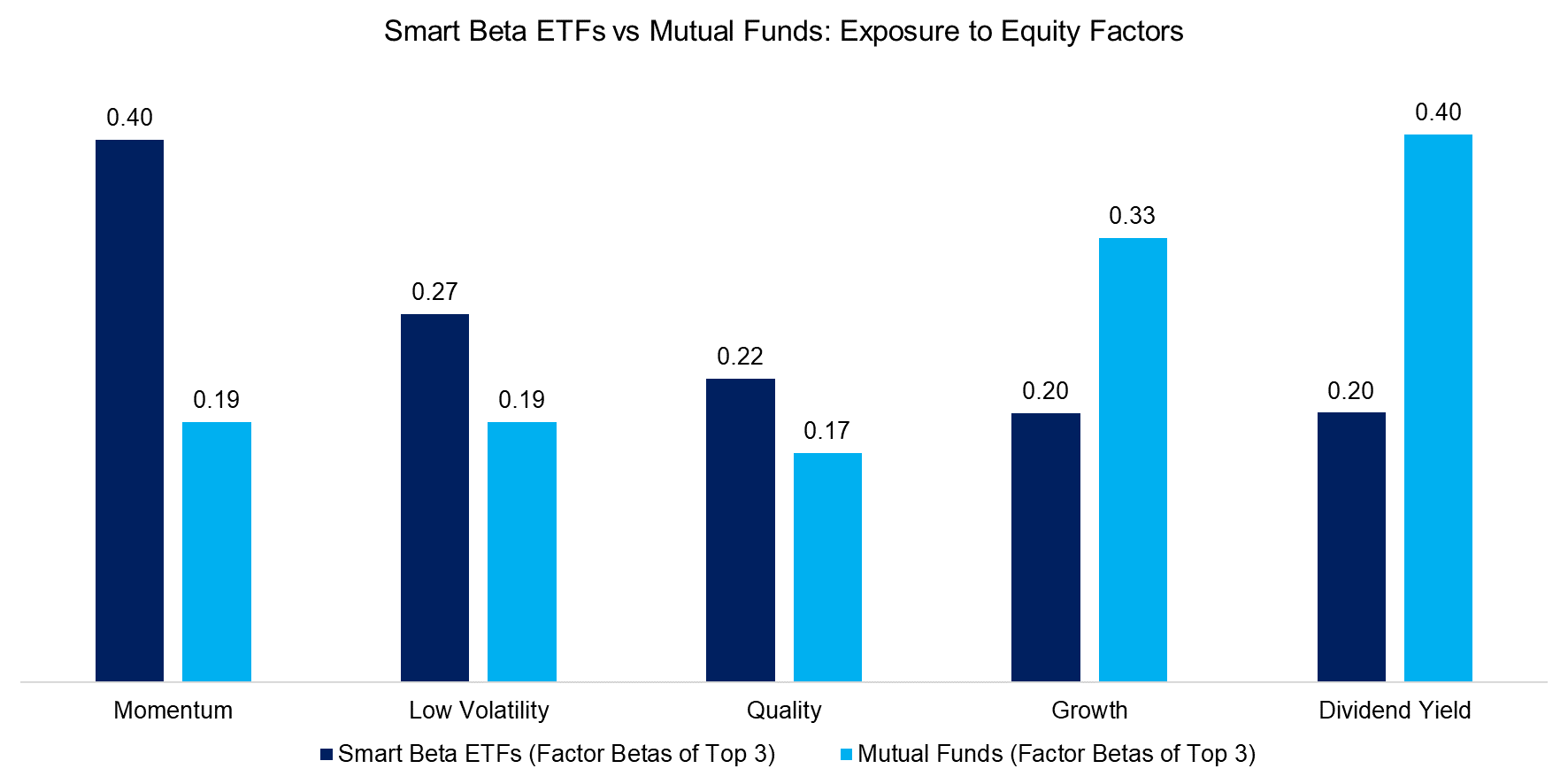

We expand the analysis to other common equity factors and continue to focus on the top three ETFs and funds. The chart below highlights large differences in exposure across the various factors. It is worth noting that there are relatively few mutual funds focused on Momentum and Low Volatility as these represent quantitative strategies where active managers are less likely to create value. In contrast, there are many funds focused on Value, Growth and Quality as these provide more opportunities for fundamental analysis, which is the core skillset of most active managers.

Source: FactorResearch

SMART BETA ETFS VS MUTUAL FUNDS: FEES

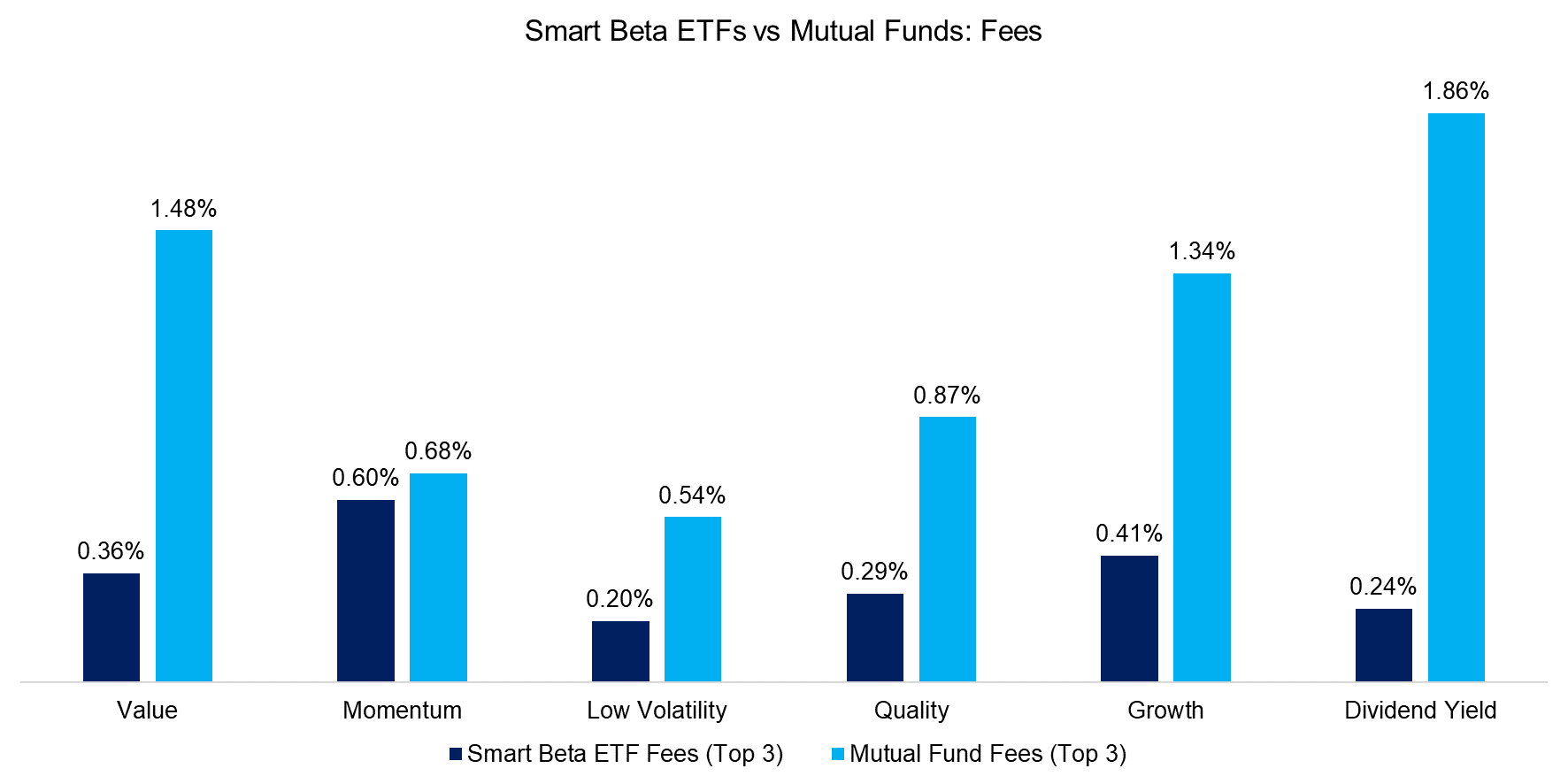

The comparison indicates that the choice between smart beta ETFs and mutual funds somewhat depends on the factor. However, the analysis would be incomplete if we would not highlight the fees for both product families, which are significantly lower for ETFs. Investors can select mutual funds based on high factor exposure, but need to consider the price they are paying for it.

Source: FactorResearch

FURTHER THOUGHTS

This short research note contrasts the factor exposure of smart beta ETFs and mutual funds. Despite active managers being in the defensive in recent years, investors may utilise mutual funds to capture higher exposure to certain factors than with ETFs. However, given the higher costs associated with funds, investors need strong views on the expected factor performance to justify these.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.