Factor Investing: Gross to Net Returns

From Theory to Reality

January 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Long-short multi-factor portfolios generate attractive returns before fees

- Returns are much less attractive post fees charged historically

- However, some fees in the long-short space are likely justified given higher complexity

INTRODUCTION

Reality is the murder of a beautiful theory by a gang of ugly facts (Robert Glass, 2002). Factor investing can be considered one of the beautiful theories of the investment world as it is backed by a significant amount of empirical research and can be implemented by investors across markets and asset classes. The gang of ugly facts is that most of the research is based on backtesting, which is full of inherent biases, and investors get charged a variety of fees for accessing the returns from factor investing. In this short research note we will analyse the path from gross to net returns for a long-short multi-factor portfolio.

METHODOLOGY

We focus on four factors namely Value, Momentum, Low Volatility and Quality in the US stock market. The multi-factor portfolio is created via the intersectional model, i.e. by ranking the stock universe by the four factors simultaneously (please see our white paper Multi-factor Models 101 for further details). The portfolio is constructed from the top and bottom 10% of the ranked stocks, is adjusted to achieve beta-neutrality, only includes companies with a market capitalisation above $1 billion and is rebalanced monthly.

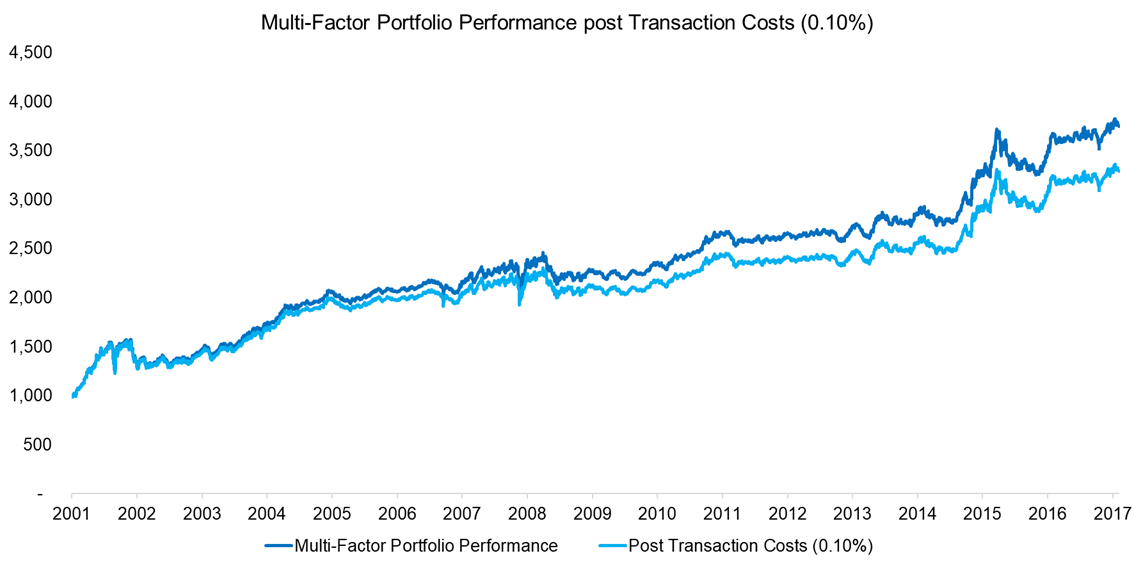

MULTI-FACTOR PORTFOLIO PERFORMANCE POST TRANSACTION COSTS

The chart below shows the performance of the long-short multi-factor portfolio before and after transaction costs, which are assumed to be 10 basis points per transaction. Institutional investors can trade for less than 1 basis point per transaction, but the impact costs of executing orders are often multiples of that and should be reflected as well. The portfolio rebalances monthly, but given that the stock selection is based on the ranking of several factors, the turnover is relatively low.

Source: FactorResearch

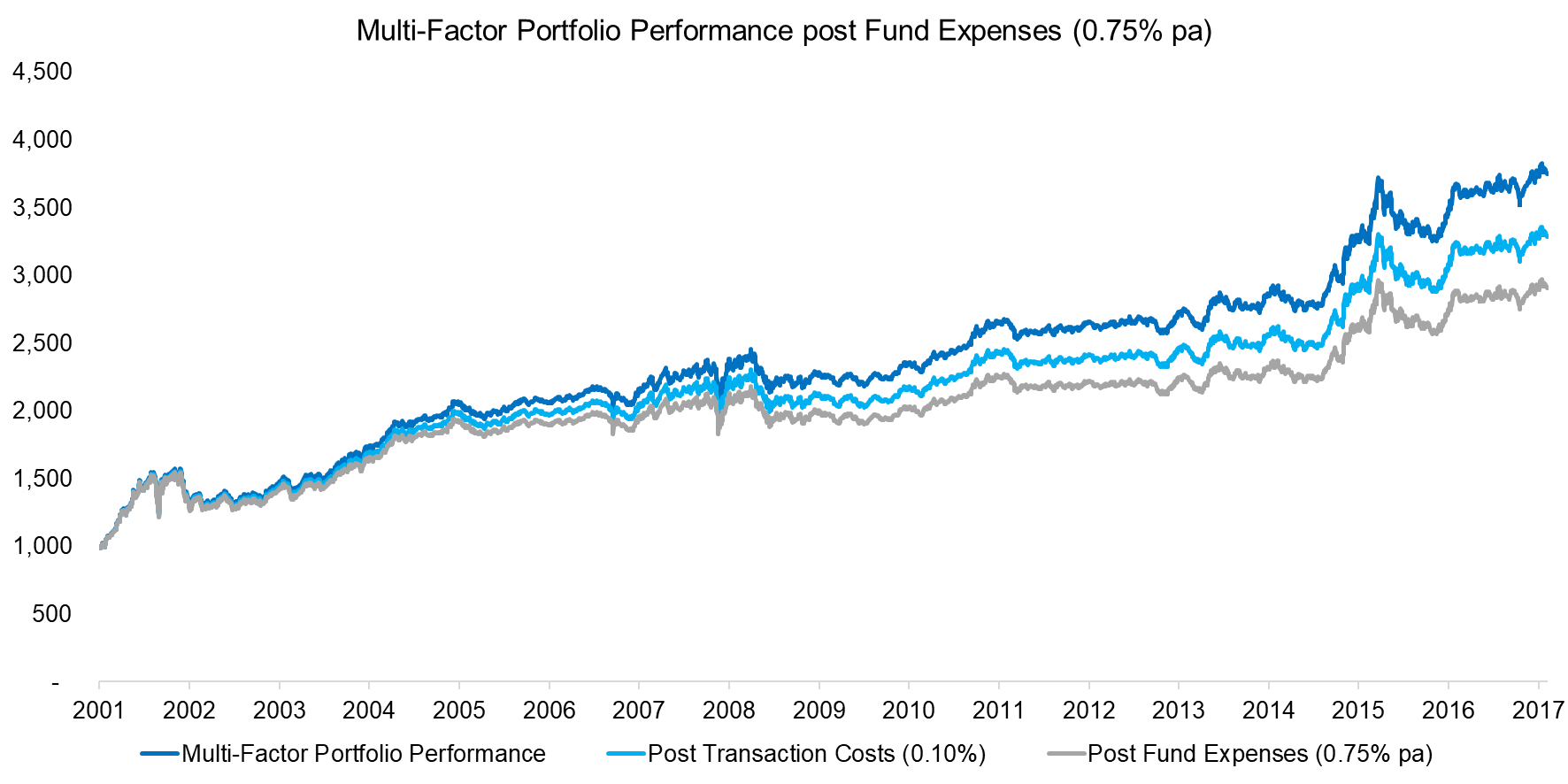

MULTI-FACTOR PORTFOLIO PERFORMANCE POST FUND EXPENSES

In addition to transaction costs there are a variety of fund and operating expenses. In order to short stocks, borrowing fees need to be paid. If investors gain access to the portfolio via a fund structure, then there will be fees for the fund administrator, custodian, transfer agent, amongst others. Recent regulations in Europe and the US have also imposed new reporting requirements, which have increased the compliance costs. We have assumed 0.75% per annum for fund and operating expenses, which further decrease the performance of the multi-factor portfolio.

Source: FactorResearch

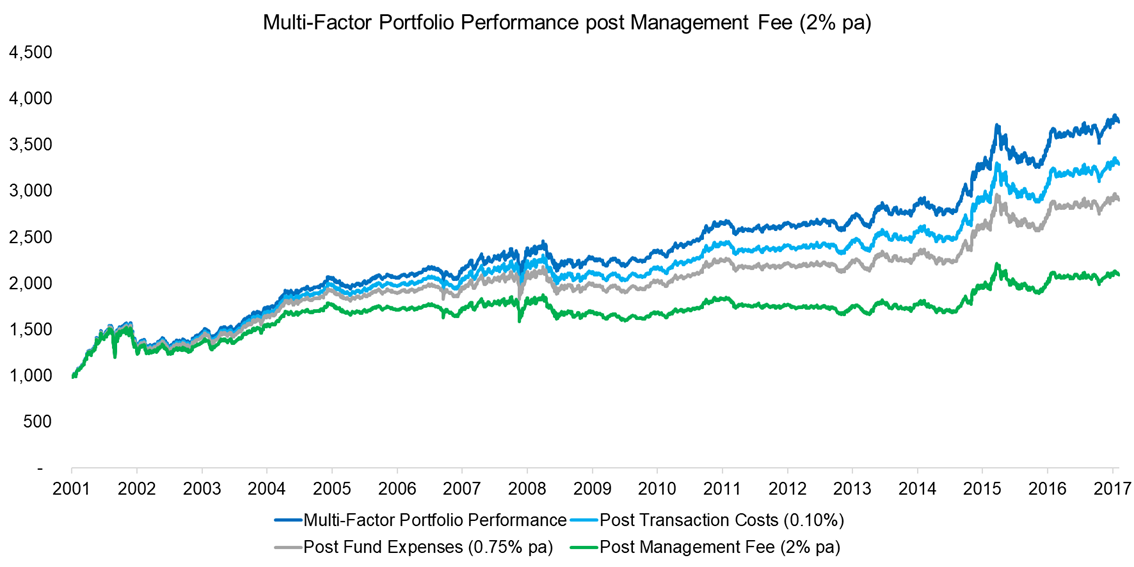

MULTI-FACTOR PORTFOLIO PERFORMANCE POST MANAGEMENT FEE

Given that we are analysing a long-short multi-factor portfolio, this would most likely be managed by a hedge fund manager. The traditional management fee was 2.0% per annum, although that has started to decrease in recent years and absolute return-focused UCITS funds are more likely to charge 1.5%. We can observe that the management fee has a significant impact on the performance of the multi-factor portfolio.

Source: FactorResearch

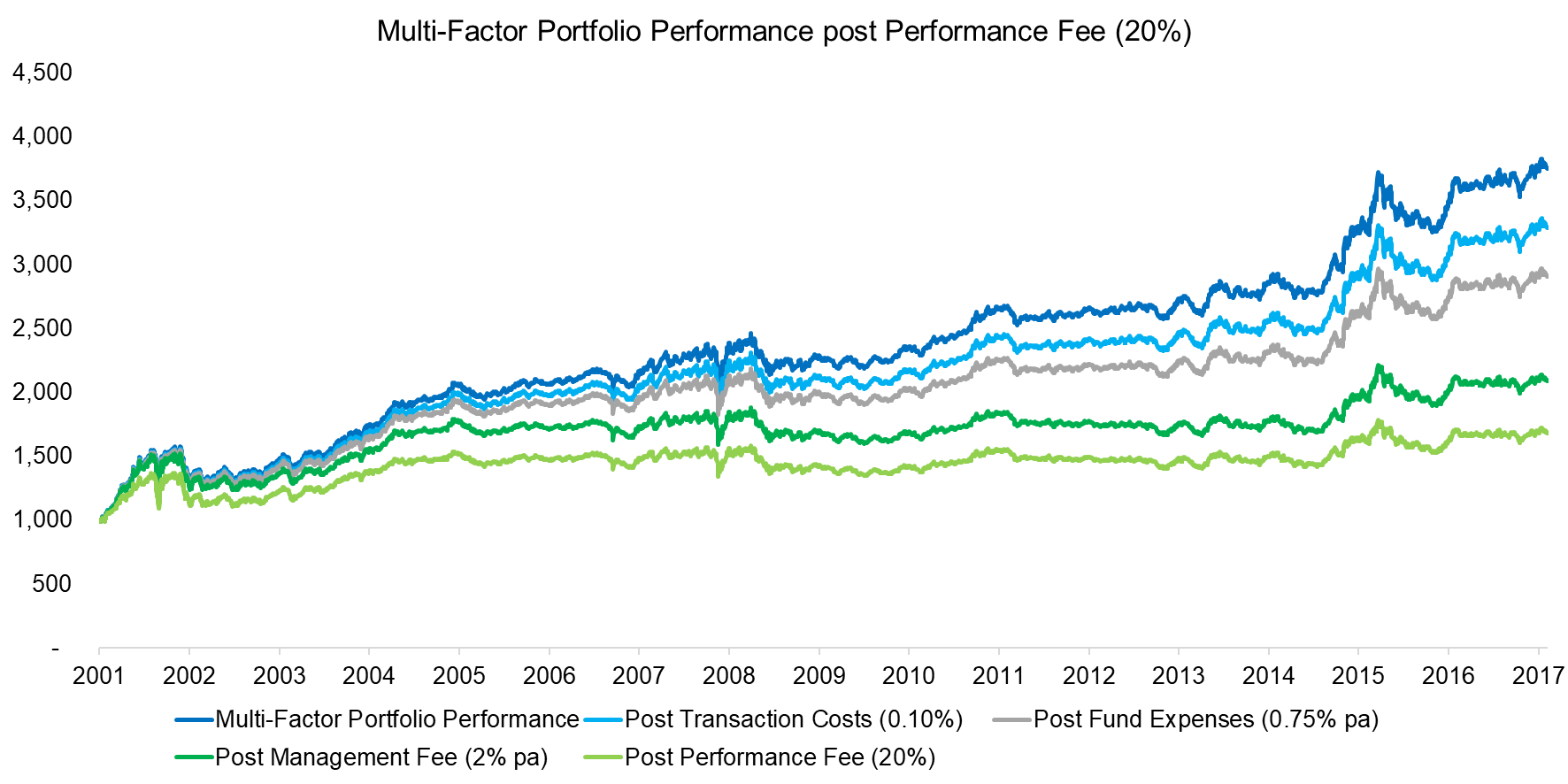

MULTI-FACTOR PORTFOLIO PERFORMANCE POST PERFORMANCE FEE

Hedge fund managers also tend to charge a performance fee in order to ensure an alignment of interests with investors (read Hedge Fund Factor Exposure & Alternatives). Historically the performance fee was 20% of profits above a high watermark, although this has also started to decrease in recent years. However, investors seem to be more interested in decreasing the management than the performance fee, which is rational given that the performance fee is only charged when investors and the hedge fund manager earn returns. The chart below highlights the significant difference between the gross and net returns for the long-short multi-factor portfolio.

Source: FactorResearch

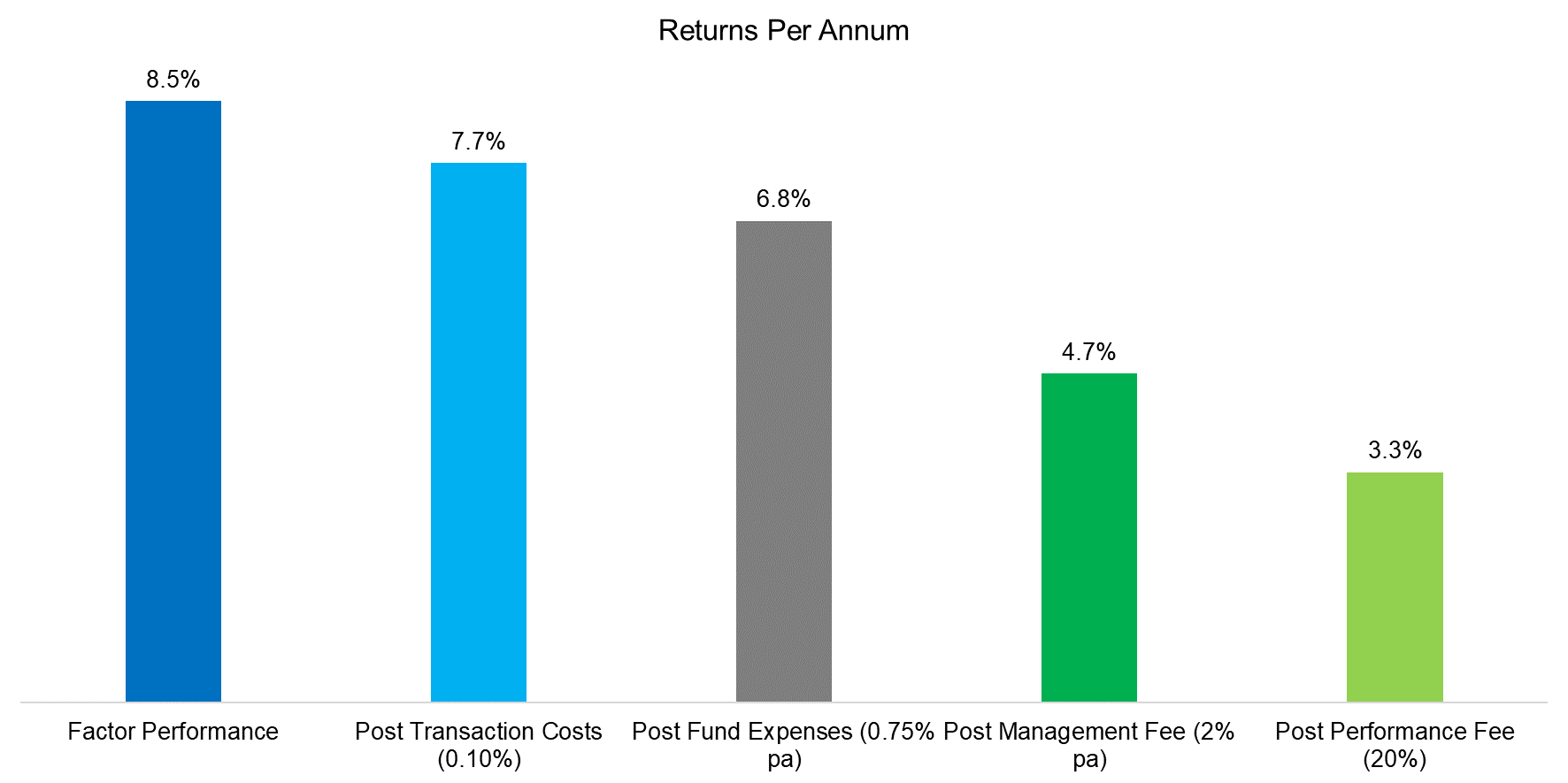

RETURNS PER ANNUM

The chart below shows the returns per annum for the various scenarios. The net return of 3.3% per annum post all fees can still be considered attractive for a product that has zero correlation with equity markets and therefore is an interesting addition to an equity-centric portfolio from a diversification perspective. Having said this, the other ugly fact, i.e. the analysis is based on backtesting, also needs to be considered by taking a healthy discount on the results.

Source: FactorResearch

FURTHER THOUGHTS

This research note highlights that the returns from a long-short multi-factor portfolio are attractive, but are severely reduced by various types of fees. The costs for accessing these kinds of products have been too high historically as reflected in the low alpha generation of equity hedge funds over time and need to reduce further. However, we don’t believe that fees should decrease to almost zero like in the ETF space as long-short products are much complex given factor selection, factor construction and portfolio management, which offer fund managers opportunities for value creation.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.