Factor Investing in Emerging Markets

Is It Worth It?

November 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The trends in factor performance are similar in emerging and developed markets

- Factor returns were higher in emerging than in developed markets

- However, higher transaction costs need to be considered carefully

INTRODUCTION

Capital markets of developed countries like the US are highly efficient and mutual fund managers have struggled to generate any alpha, at least after fees. Theoretically, fund management firms could have decreased costs and created more attractive products years ago, but chose not to do so and subsequently were disrupted by the ETF industry.

Given this, most mutual fund managers in developed markets are facing a bleak future as ETFs are consistently capturing market share in investment products. Perhaps less efficient markets like in emerging economies offer more opportunities to generate alpha. Emerging markets tend to feature more retail investors, which are less sophisticated and can potentially be exploited profitably. After all, someone has to pay for lunch.

However, the S&P SPIVA Scorecards for 2018 highlight that more than 80% of mutual funds in emerging markets like Mexico, Brazil, Chile, and South Africa have underperformed their benchmarks. The underperformance is partially explained by high management fees, which means that investors are better served by allocating to emerging market index products than active fund managers.

Investors can alternatively allocate to smart beta strategies, which also offer the opportunity to outperform markets, but have lower fees than mutual funds. However, it is questionable if factor investing generates the same excess returns in emerging as in developed markets.

In this short research note, we will analyse classic factor investing strategies in emerging markets.

METHODOLOGY

We use publicly available data from the Kenneth R. French library and focus on the Value, Size, and Momentum factors. Value is defined by sorting stocks by their price-to-book multiples, Size by market capitalization, and Momentum by the 12-month performance, excluding the most recent month. The portfolios are constructed dollar-neutral, include small cap companies, and exclude transaction costs. Developed markets are comprised of 23 and emerging markets of 26 countries.

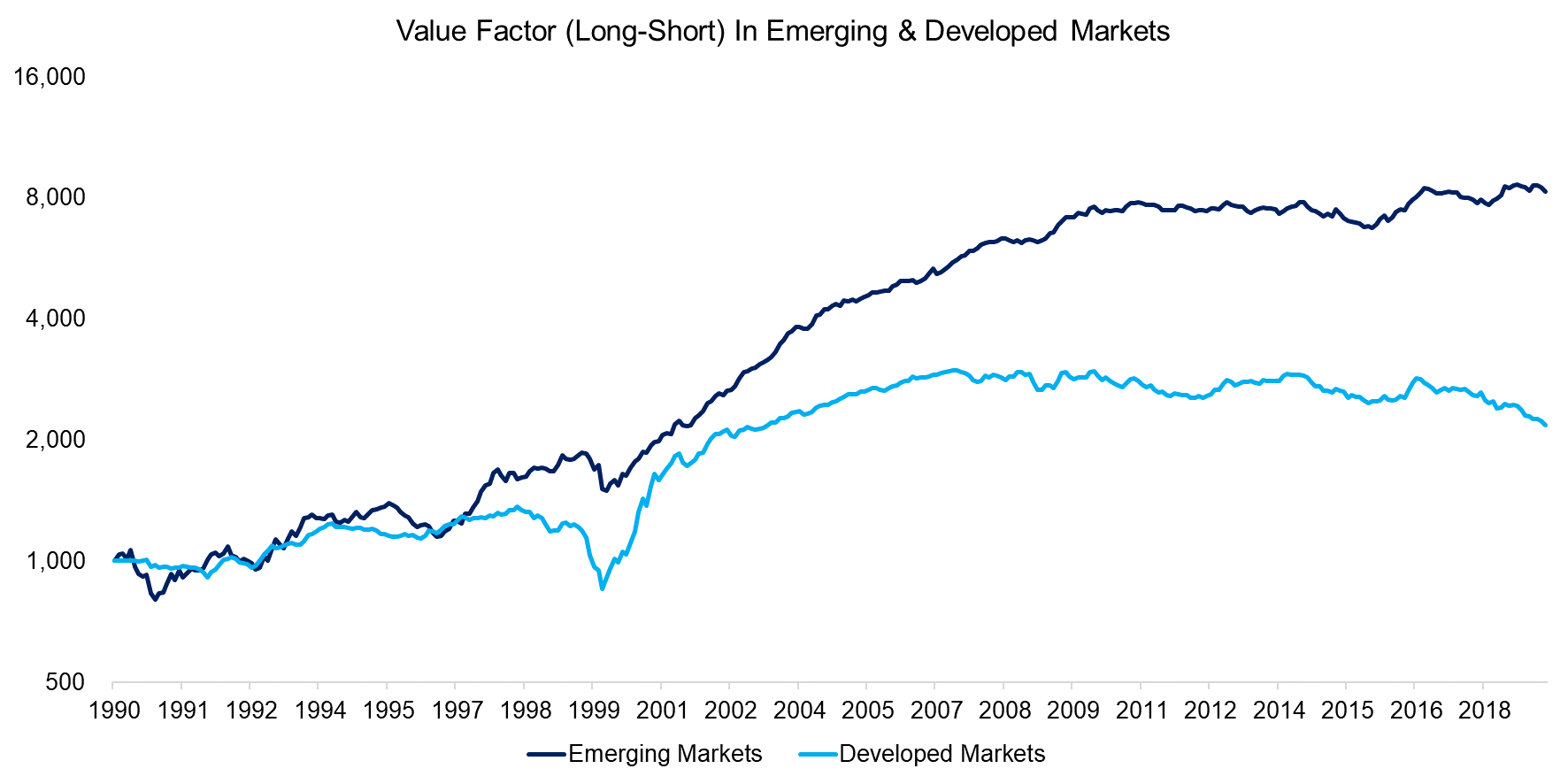

VALUE FACTOR IN EMERGING MARKETS

Buying a good or service below its intrinsic value brings joy to most people, regardless if they are purchasing a carpet on a bazaar or a stake in a company on the stock market. The Value strategy, which consists of buying cheap and selling expensive stocks, is popular across stock markets globally (read Mapping My Mind: Value Factor).

However, it is somewhat surprising how similar the Value factor has performed in emerging as in developed markets. We observe that the factor has generated a higher return in emerging markets from 1990 to 2019, but the trends in performance were almost identical, which indicates common performance drivers. Investors seem to be buying cheap and selling expensive stocks at approximately the same time, irrespective if they are based in Italy or Indonesia.

Source: Kenneth R. French data library, FactorResearch

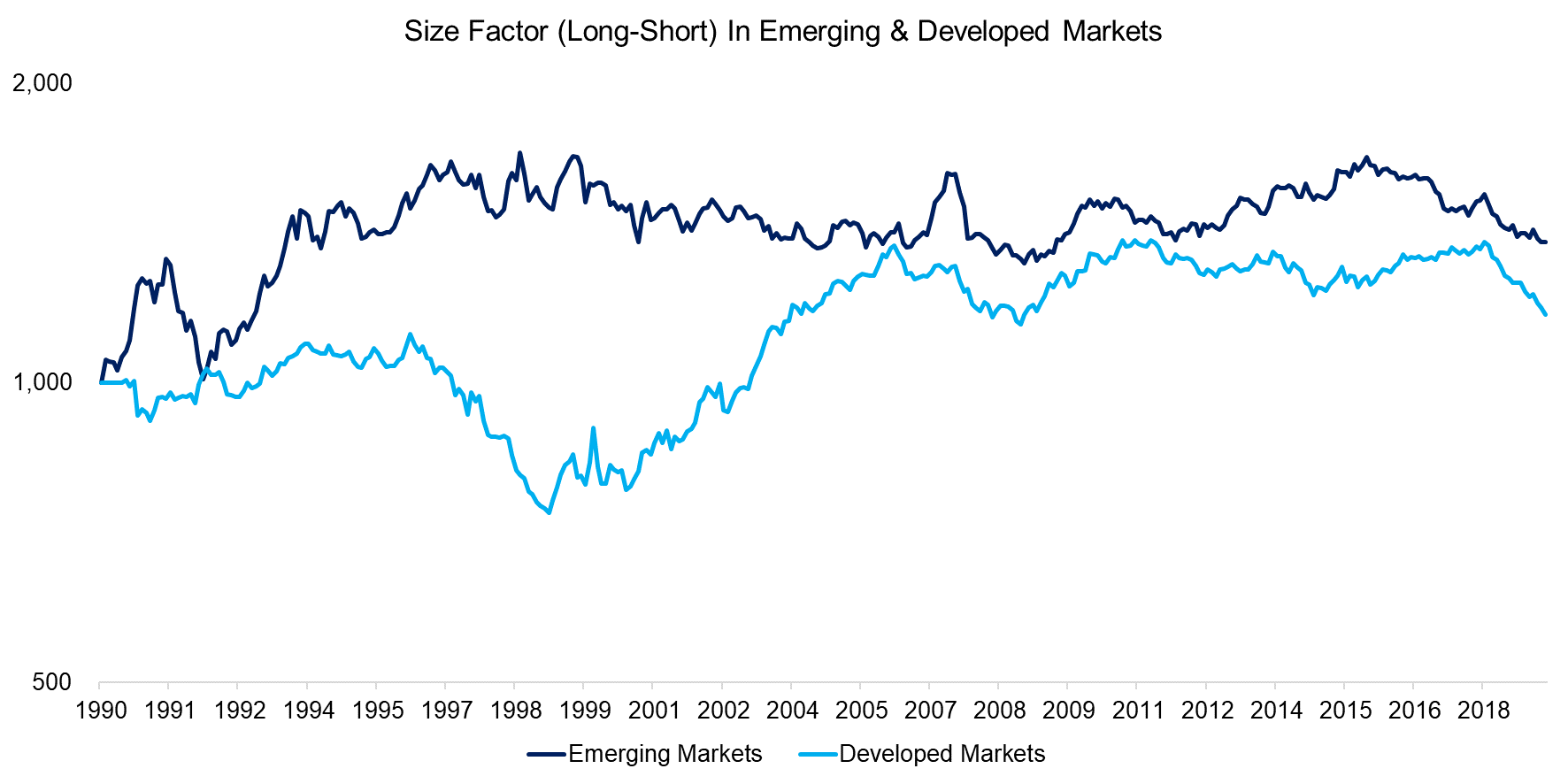

SIZE FACTOR IN EMERGING MARKETS

In contrast to the Value factor, we observe that the Size factor has performed markedly different in emerging and developed markets. The difference is especially pronounced during the tech bubble between 1997 to 2000, where large cap stocks significantly outperformed small cap stocks in developed markets, but hardly at all in emerging markets. Perhaps this reflects that there were far fewer technology companies in emerging markets than today, where companies like Tencent or Alibaba from China battle developed market players for technology leadership.

It is worth noting that post the global financial crisis the trends in the Size factor have become slightly more similar, which is likely explained by emerging economies having become more integrated into the global economy as well as having more diversified stock markets.

Source: Kenneth R. French data library, FactorResearch

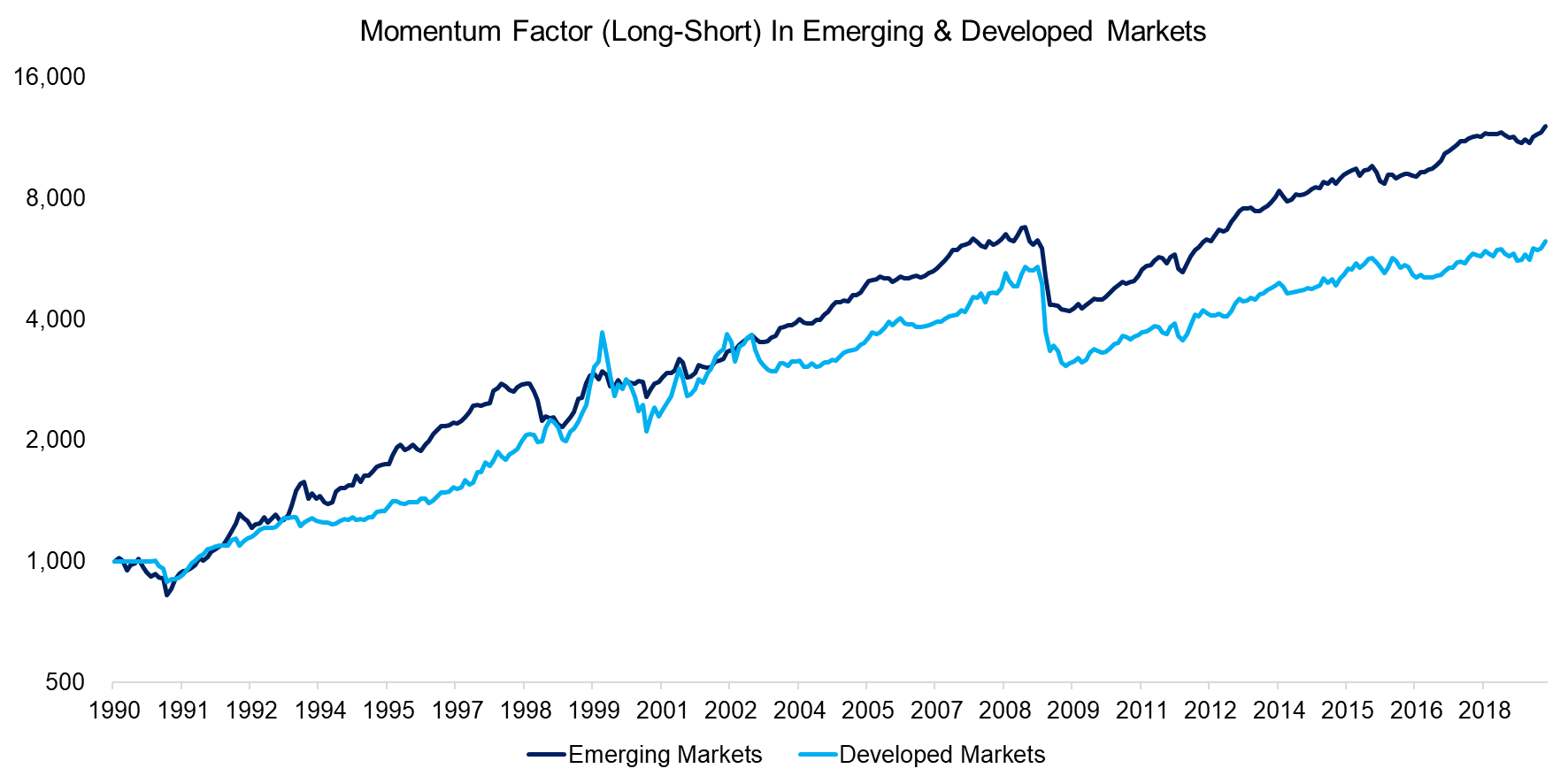

MOMENTUM FACTOR IN EMERGING MARKETS

Retail investors play a larger role in emerging than in developed markets and are frequently characterized as performance chasing. The herd mentality is one of the explanations for the existence of the Momentum factor, which consists of buying winners and shorting losers. And indeed, we observe that the factor has generated attractive performance in emerging markets, although very similar in trend to that in developed markets (read Sector versus Country Momentum).

Source: Kenneth R. French data library, FactorResearch

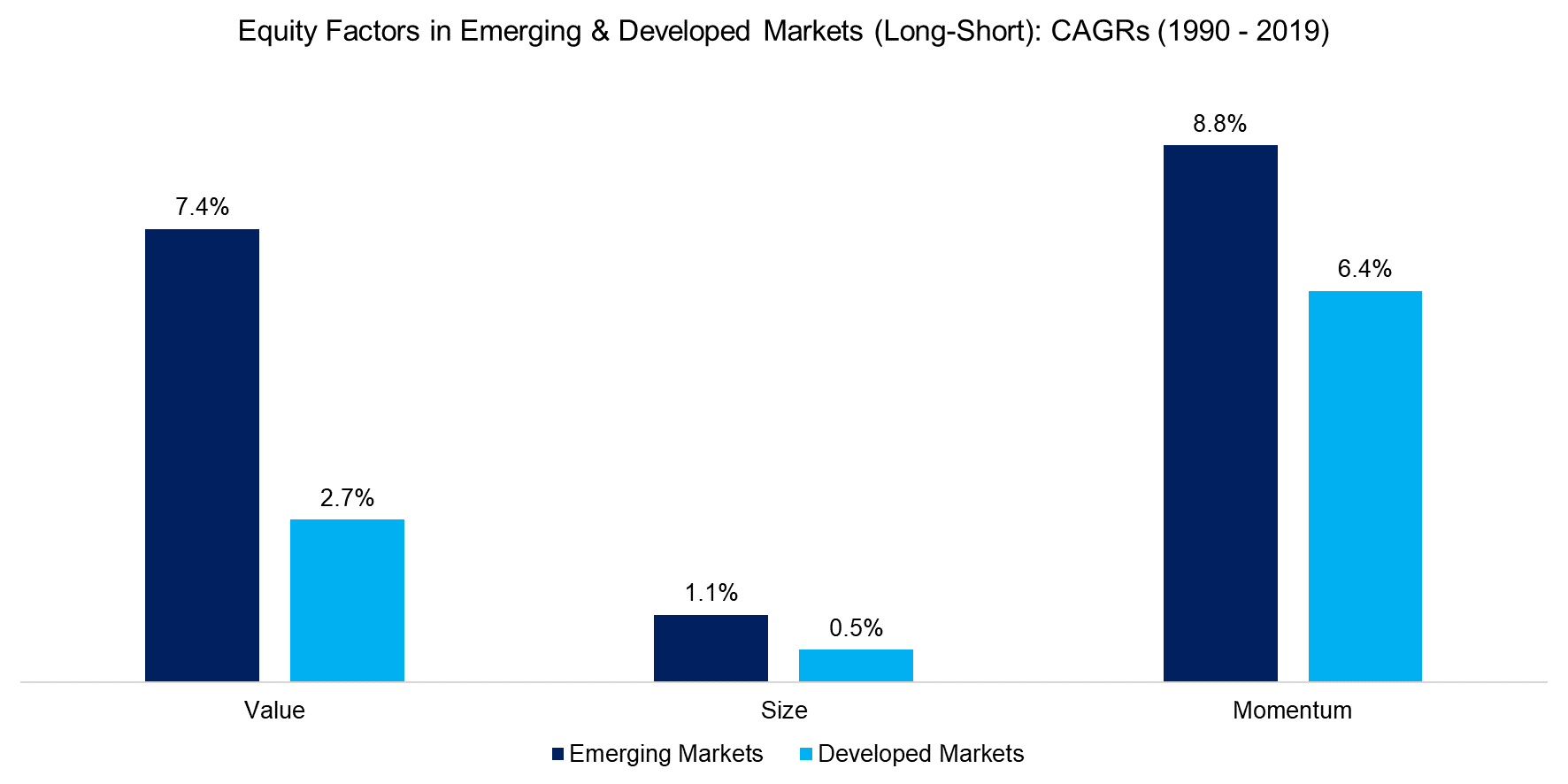

FACTOR STRATEGIES IN EMERGING MARKETS

Aggregating the results of the Value, Size, and Momentum factors highlights that each generated a higher return per annum in emerging than in developed markets in the period from 1990 to 2019. Naturally this makes a strong case for including emerging market exposure in factor-focused portfolios as well as for investors seeking to outperform emerging market benchmarks.

Source: Kenneth R. French, FactorResearch

However, the data from the Kenneth R. French library excludes transaction costs, which need to be considered. An institutional investor will pay less than 2 basis points (bps) of commission for trading large cap stocks in the US, but there are also market impact costs that can increase the total transaction costs to approximately 10 bps. Commissions in emerging markets are higher and market impact costs even more so, which can lead to transaction costs of more than 100 bps. Furthermore, some countries impose stamp duty and others like Saudi Arabia are difficult to trade.

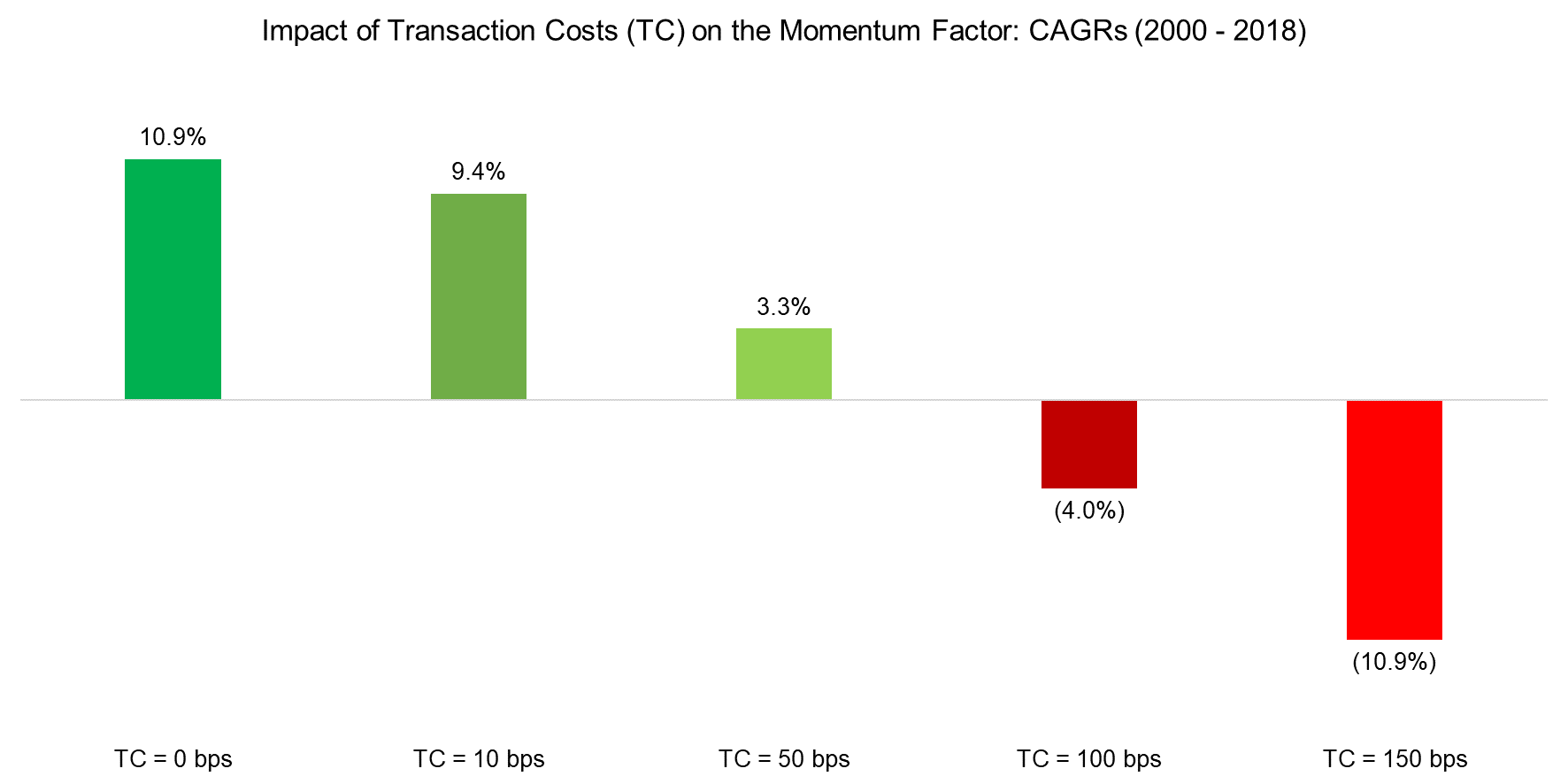

We can demonstrate the impact of transaction costs by taking the Momentum factor in Australia as case study. Naturally Australia is not an emerging market, but that is not relevant for this scenario analysis and the country features a similarily small set of investible companies like some of the emerging markets.

We observe that return per annum before transaction costs was highly attractive over the last two decades, but would have turned negative between 50 and 100 bps of transaction costs, which are not unusual for emerging markets.

Investors should be especially cautious about harvesting returns from the Momentum factor, regardless if in emerging or developed markets, as the factor features the highest turnover of all common equity factors.

Source: FactorResearch

FURTHER THOUGHTS

Emerging market equities are usually sold to investors by arguments about most humans living in these parts of the world and strong economic growth. Partially this true, but investors should also consider that some countries are highly indebted and have shrinking populations.

For example, China is expected to lose close to 400 million people until 2100 and its debt-to-GDP ratio is already larger than 250%. It is challenging to see how this combination, which is mirrored in some other emerging economies, provides fertile grounds for strong equity returns.

Similarly, factor investing in emerging markets seems attractive, until costs are considered. There is still a case for harvesting factor returns from emerging markets, but it requires thoughtful implementation. Investors need to consider which factors are sensible, how turnover can be reduced, and which markets are unattractive from a transaction costs perspective.

RELATED RESEARCH

Factor Investing Made in China

Value, Momentum, and Carry Across Asset Classes

Equity Factors: Reducing Portfolio Turnover

REFERENCED RESEARCH

S&P SPIVA Score Cards

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.