Factor Investing in Financials, Real Estate & MLPs

Do Unique Sectors Offer Attractive Alpha Opportunities?

February 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Beating benchmarks is challenging for fund managers, even in unique sectors

- Factor performance in financials, REITs, and MLPs is comparable to the cross-sector factor returns

- Classic factor investing strategies are likely more attractive than industry expertise

INTRODUCTION

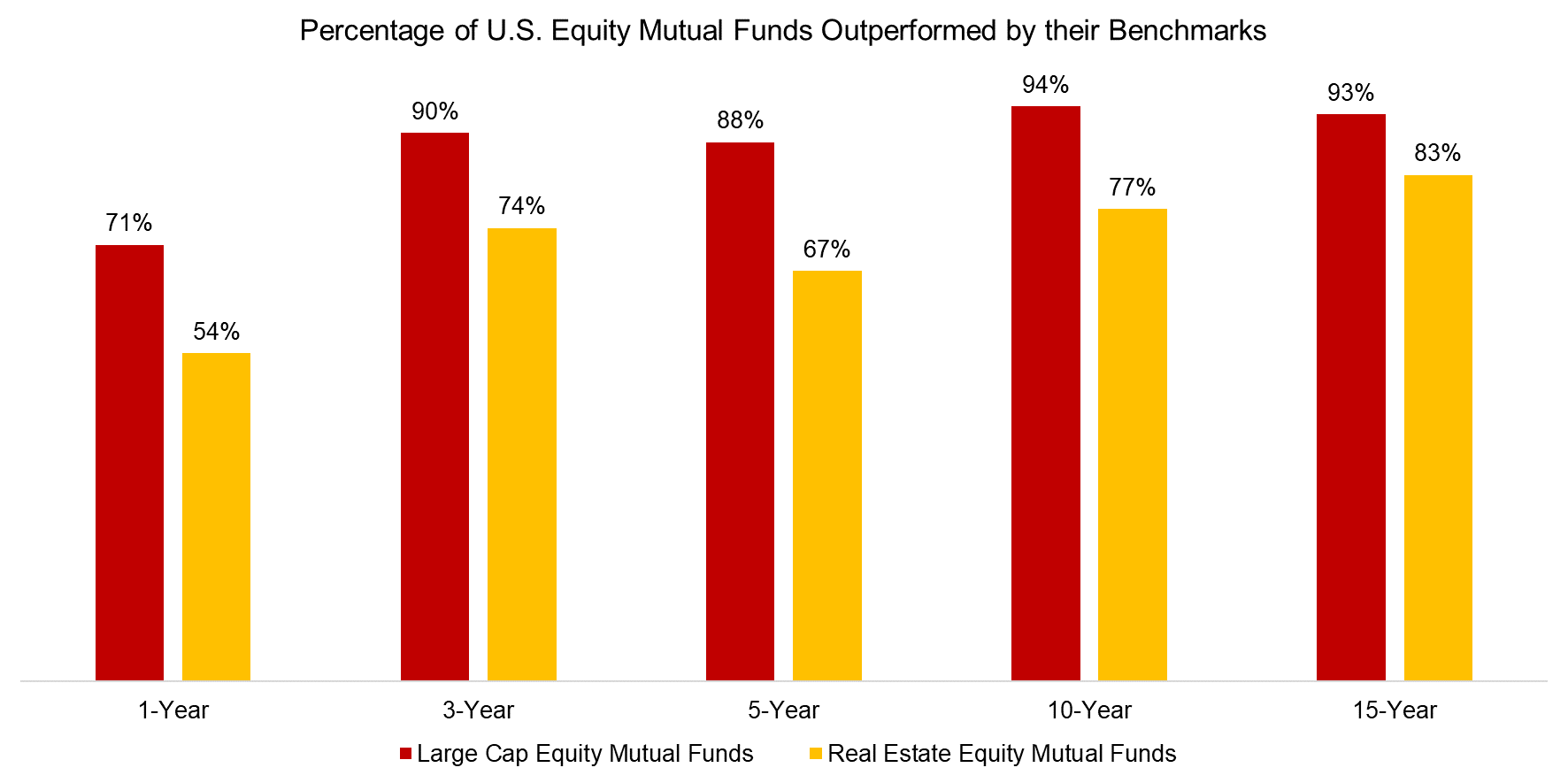

Stating that active managers have a performance problem would be a slight understatement, especially if the benchmark is a large liquid index like the S&P 500. The SPIVA scorecard from S&P Dow Jones highlights that U.S. large cap equity fund managers dramatically underperform their benchmarks, regardless over which time frame this is measured.

Perhaps markets have become too efficient for fund managers to generate any alpha, at least after fees. However, some sectors require more industry knowledge than others and might provide more opportunities to create alpha. Analyzing banks, insurance companies, real estate investment trusts (REITs), and master limited partnerships (MLPs) typically involves using unique metrics like funds from operations and renders other standard metrics, like EBITDA in the case of financials, redundant.

Although the SPIVA scorecard does not have data for financials or MLP fund managers, it does for the real estate sector. The scorecard shows that real estate equity fund managers underperform almost as dramatically as their large cap brethren. More than 80% fail to beat their benchmark over a 15-year timeframe.

Source: S&P Dow Jones SPIVA Mid-Year 2018 Scorecard.

Real estate fund managers accumulate industry knowledge by physically visiting properties, engaging with corporate management, and analyzing private and public real estate markets. However, the lack of outperformance does not support that this industry expertise creates much of a competitive advantage to other investors, which likely applies to all sectors.

Perhaps pedestrian factor investing strategies are more successful at creating value for investors. In this short research note, we will investigate factor investing in financials, REITs, and MLPs.

METHODOLOGY

We focus on U.S. stocks from four sectors: banks, insurance, real estate investment trusts (REITs), and master limited partnerships (MLPs) and three factors: Value, Momentum, and Quality. The factor performance is calculated by constructing long-short beta-neutral portfolios of the top and bottom 30% of stocks ranked by the factor definitions. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

PERFORMANCE OF UNIQUE SECTORS

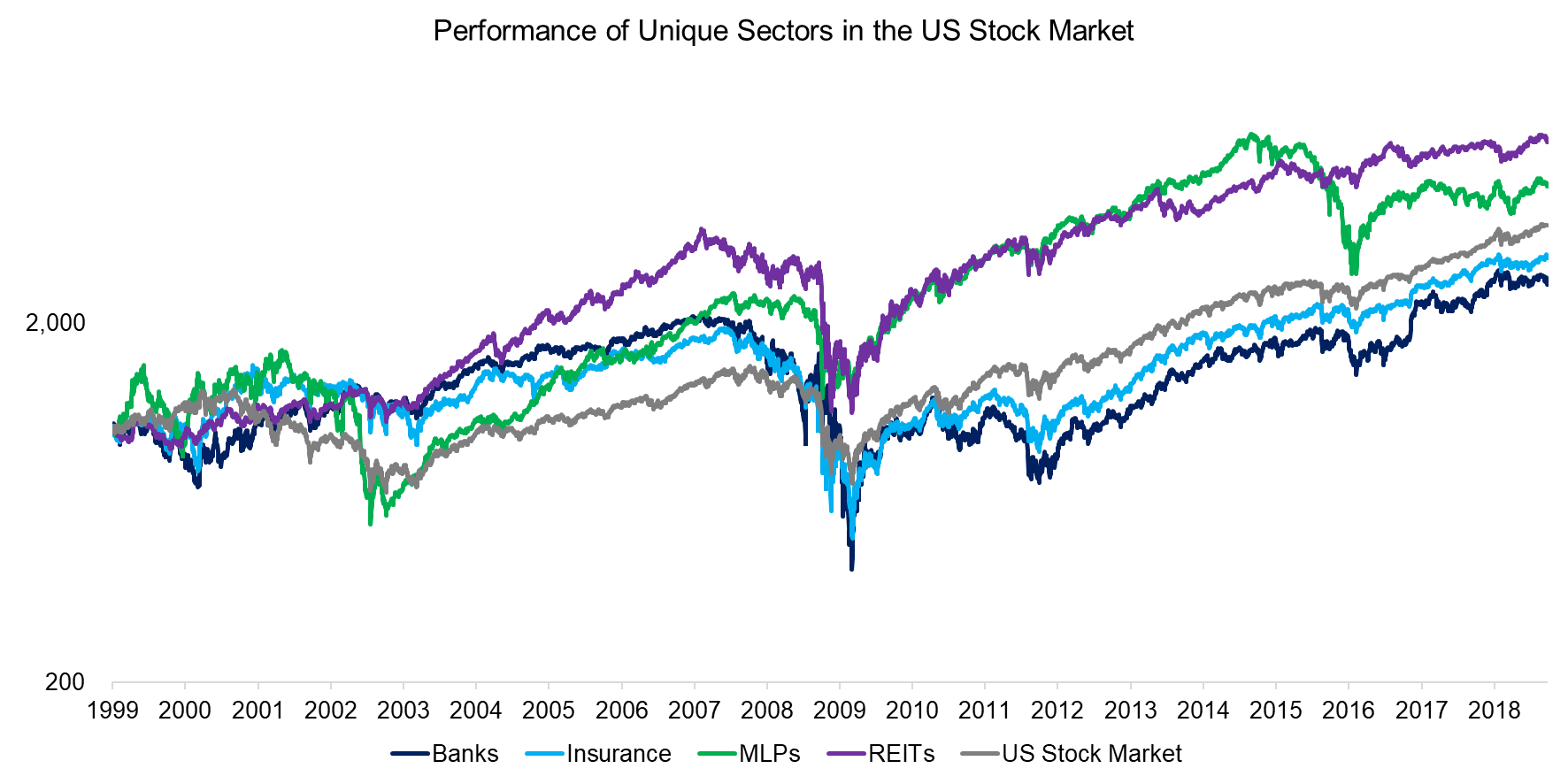

Given the unique nature of these sectors, the performance was quite divergent over time. The bank and insurance sectors include stocks with large market capitalizations, so trade in line with the U.S. stock market. MLPs are in the business of refining and transporting oil and gas, and are therefore influenced significantly by energy prices. REITs manage real estate portfolios, which is an asset class that is mainly driven by inflation and interest rates (read Factors & Interest Rates).

Source: FactorResearch

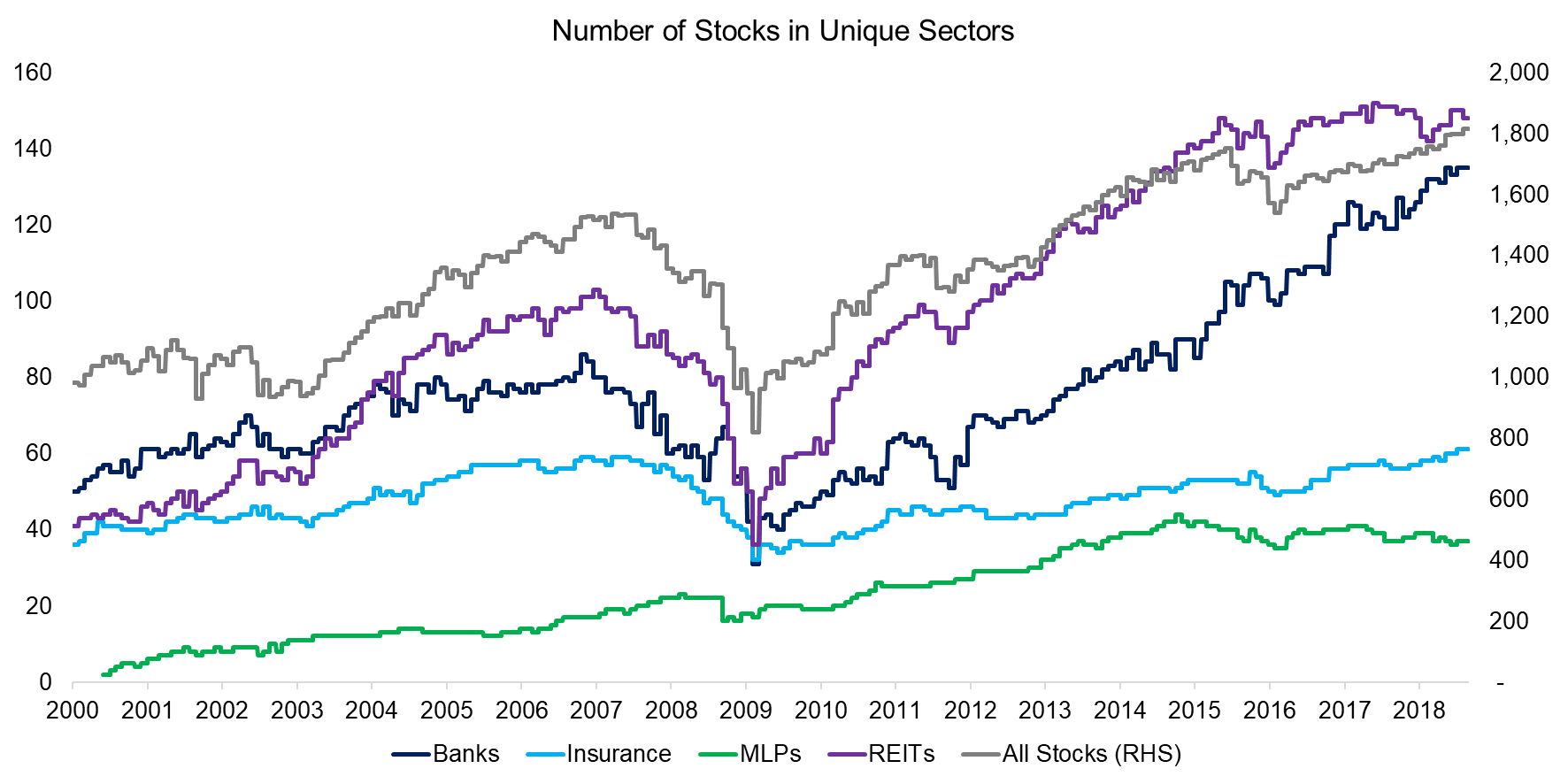

In addition to highlighting the performance, it is worth noting the number of stocks in each of these four unique sectors. The universe of U.S. stocks with a market capitalization above $1 billion as of the end of 2018 comprised slightly more than 1,800 stocks. While there were approximately 140 REITs in our universe, there were only slightly more than 20 MLPs, which needs to be considered when reviewing this analysis.

Source: FactorResearch

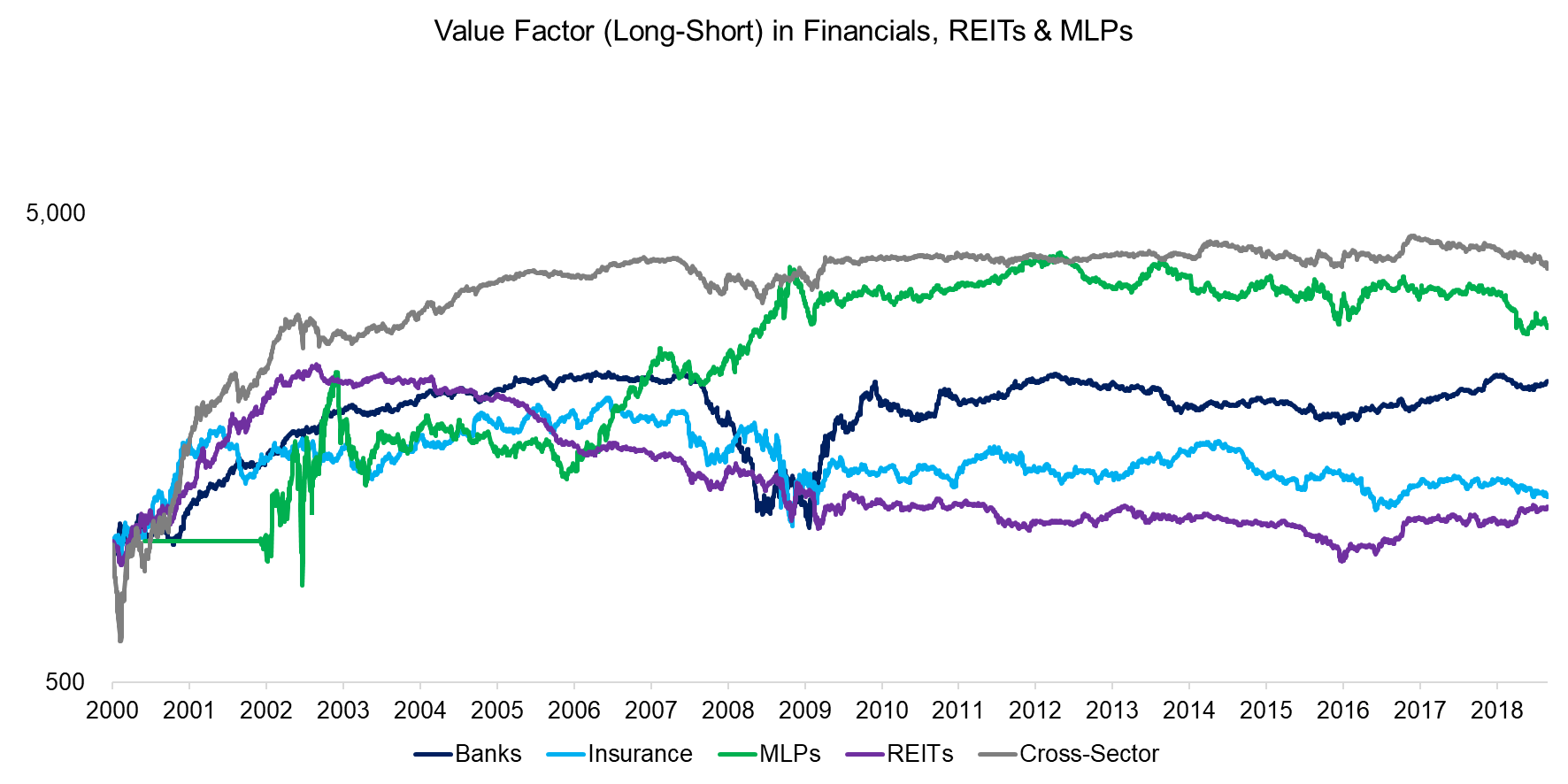

THE VALUE FACTOR IN FINANCIALS, REITS & MLPS

First, we analyse the performance of the long-short Value factor in the four unique sectors as well across all sectors. Value is defined as a combination of price-to-book and price-to-earnings multiples, which can be applied to all sectors from a generalists perspective (read Improving the Odds of Value).

Although the factor performance is divergent in the period from 2000 to 2018, there are some common trends. Value in these four sectors generated attractive returns when the Tech bubble deflated from 2000 to 2003, but was essentially flat or declining thereafter. Given similar trends, this indicates that the Value factor has a common driver that permeates sectors.

Source: FactorResearch (MLP data only meaningful after 2002 due to a limited number of stocks)

CLASSIC MULTI-FACTOR PORTFOLIO IN FINANCIALS, REITS & MLPS

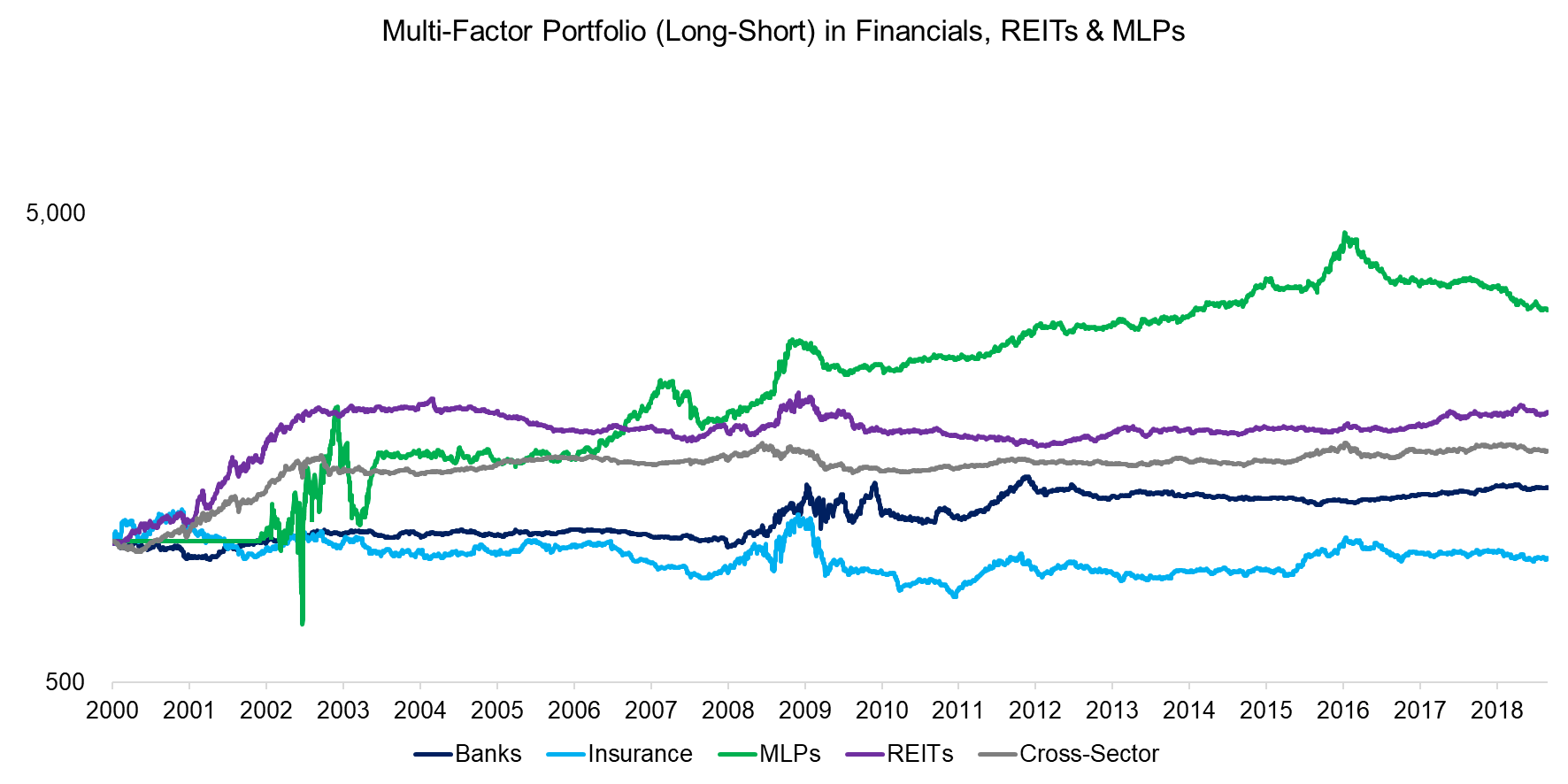

As a next step, we create a classic long-short multi-factor portfolio that allocates equally to the Value, Momentum, and Quality factors. The Momentum factor is created by selecting stocks based on their performance over the last 12 months, excluding the most recent month, and the Quality factor by ranking stocks on a combination of return-on-equity and debt-over-equity.

Similar to the Value factor on a stand-alone basis, we observe that the multi-factor portfolios generated different returns across time, but with similar trends. All sectors generated positive returns from 2000 to 2018, except for the insurance sector. However, most of the positive returns can be explained by the performance of the Value factor during the Tech Bubble implosion and by the performance of the Quality factor during the Global Financial Crisis. Between those two periods, performance was essentially flat and not particularly attractive for investors.

Source: FactorResearch

INCREASING LONG-ONLY SECTOR RETURNS WITH FACTOR TILTS

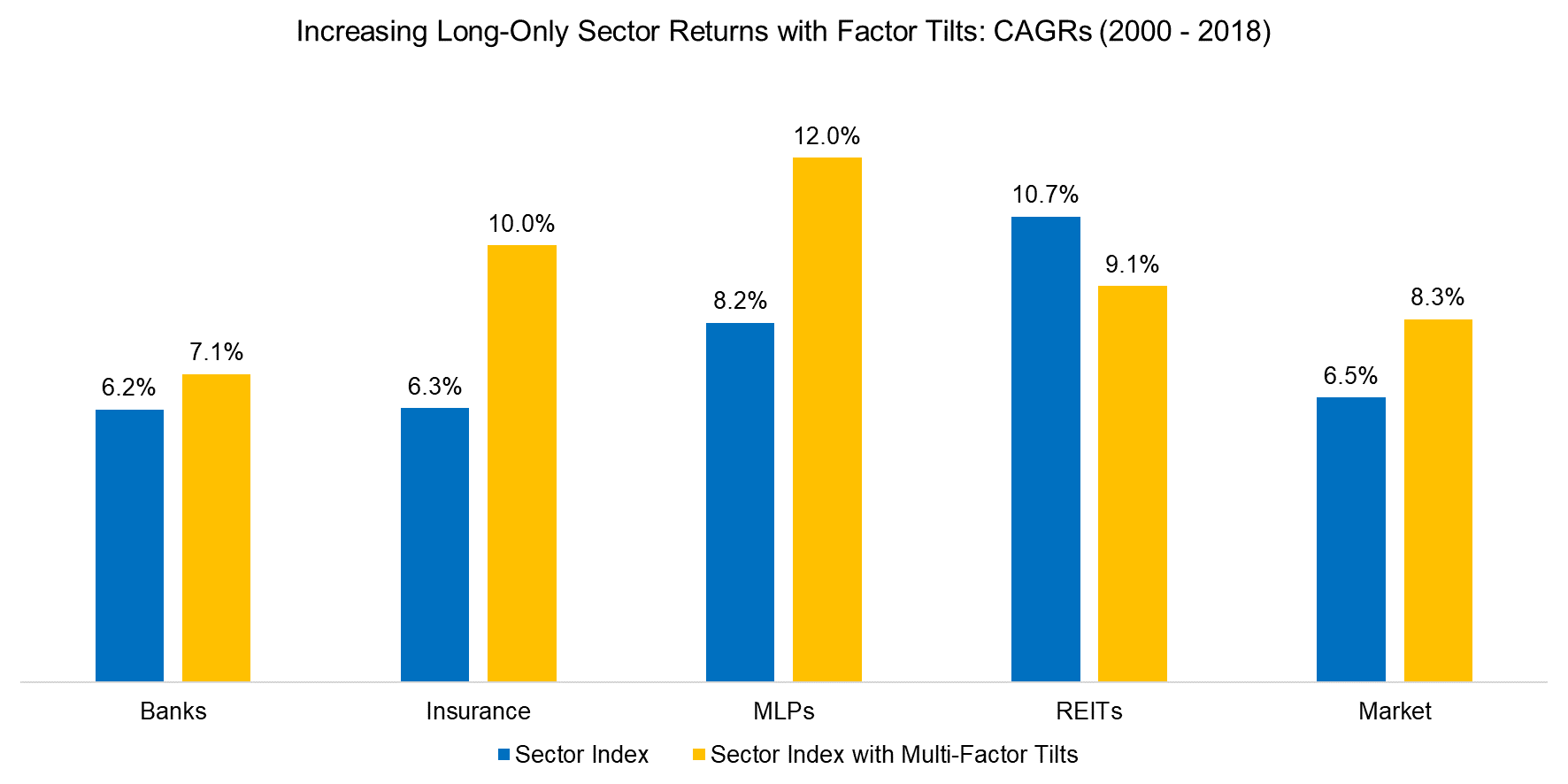

The majority of investors manage long-only and not long-short portfolios, therefore it is interesting to investigate if the multi-factor approach would have improved the performance of the long-only sector indices, i.e. allow investors to beat their benchmarks. We create market cap-weighted sector indices with factor tilts by ranking for stocks with cheap valuations, high-quality and momentum characteristics.

Multi-factor tilts would have improved the returns for all sectors except real estate as well as for the market. These results may seem to conflict with the somewhat flat returns of the long-short multi-factor portfolios, but can be explained by the following:

- The short portfolio did not generate positive excess returns for the long-short portfolio, therefore excluding short positions in the long-only sector indices was accretive for returns

- Long-short factor portfolios are created equal-weight while long-only indices are weighted by market capitalization

- The multi-factor tilts reduced volatility and drawdowns. Reducing risk has a significant impact on the long-term returns given the power of compounding

Source: FactorResearch

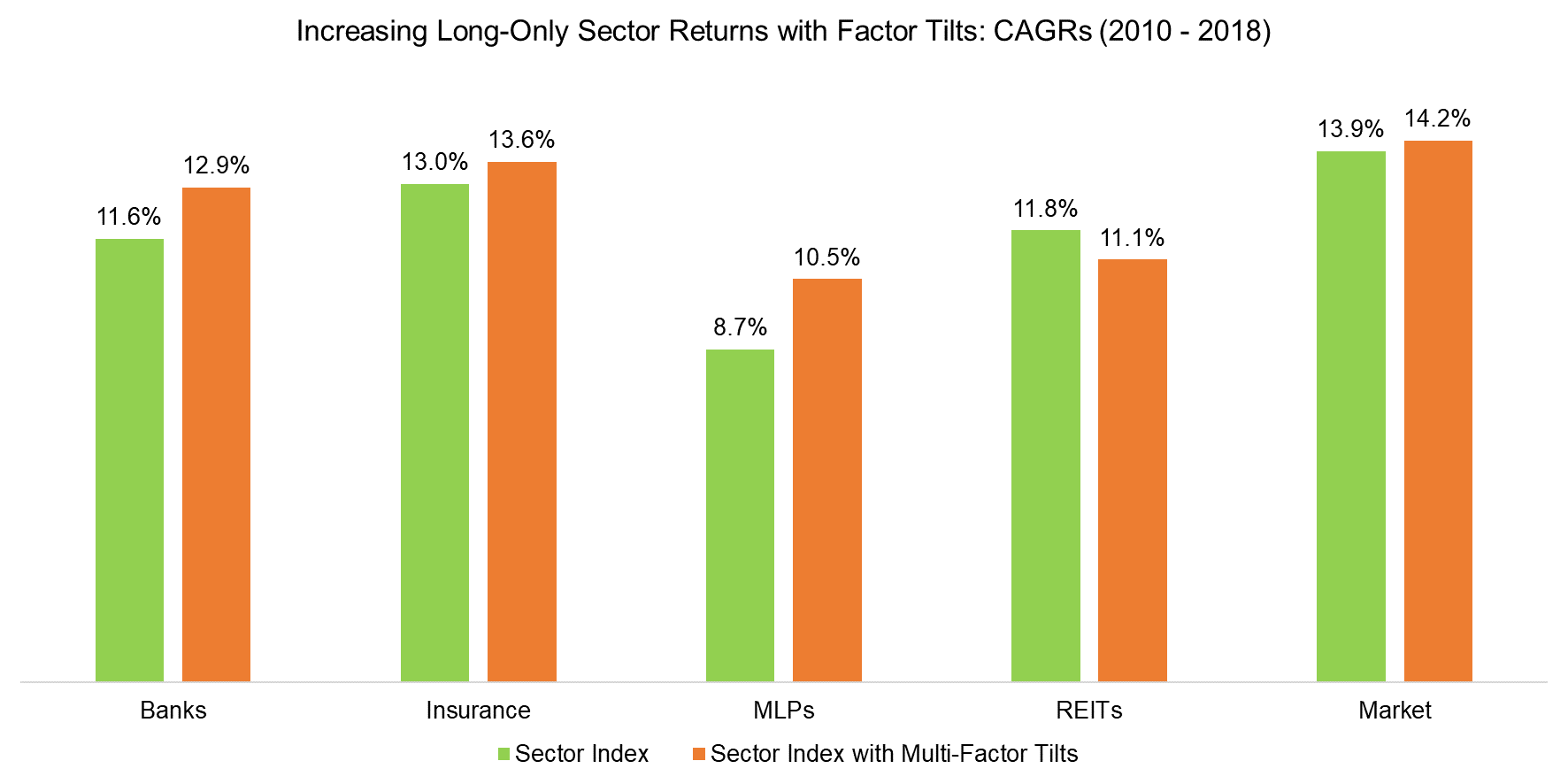

The analysis can be challenged by the starting point in 2000, which is when the Value factor rebounded strongly after a drawdown in the Tech bubble. However, even if the results are rebased on a different date, e.g. 2010, then the factor tilts would have improved returns.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that fund managers struggle to beat their benchmarks in large cap equities as well as in unique sectors like real estate. Industry-specific expertise seems to be less valuable than investors might expect.

Utilizing classic factor investing strategies, which are available at very low fee levels, might be a better solution for investors seeking exposure to certain sectors. However, the factor performance in unique sectors seems driven by the same forces as cross-sector factors. Investors who already have factor exposure need to be aware of likely getting more of the same.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.