Factor Investing Is Dead, Long Live Factor Investing!

Portfolio construction and implementation matters

April 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Market-neutral multi-factor products have reached all-time highs

- However, long-only multi-factor products have consistently underperformed

- Portfolio construction and implementation matters

INTRODUCTION

Investors have been style investing since the inception of stock markets. Some chase trends, while others focus on quality or cheap stocks. Factor investing is not new, but it did experience a significant boom after the global financial crisis in 2009 when asset managers like BlackRock made these strategies available to all investors via low-cost ETFs.

The popularity was supported by plenty of new research indicating that investors should look at their portfolios with a factor lens, where the influential paper from Andrew Ang, William Goetzmann, and Stephen Schaefer on analyzing the track record of the $350 billion Norwegian Government Pension Fund played a key role.

However, from 2017 onwards, the most popular factors like value and momentum started generating negative excess returns, which led to factor investing’s popularity waning and many funds being liquidated. Some market participants started calling this the factor investing winter, while others became more morbid and declared factor investing dead. One common narrative was that too many smart beta ETFs have arbitraged the factor premia away.

Jumping to 2024, it seems that these concerns have been overstated and factor investing is alive and well, but portfolio construction and implementation matter, which we will outline in this article.

FACTOR INVESTING RETURNS

We will use AQR’s Equity Market Neutral Fund (QMNIX) as a proxy for the state of factor investing as it constitutes a market-neutral multi-factor portfolio that is constructed in line with academic research. The fund selects stocks from a global universe based on value, quality, and momentum metrics. The long and short portfolios contain approximately 1,000 stocks each, and leverage is used to achieve beta-neutrality so that the returns are uncorrelated to the stock market.

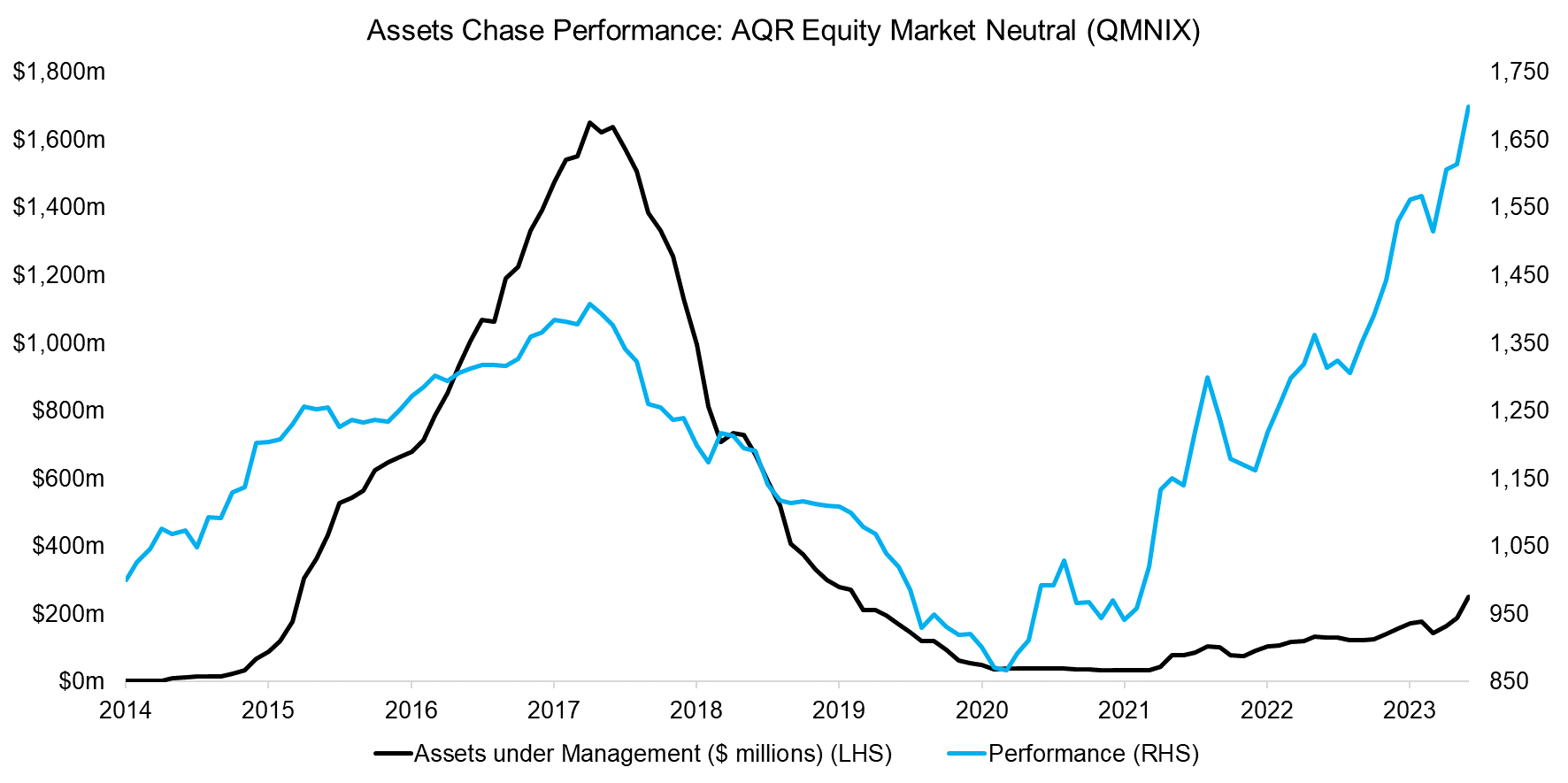

The fund was launched in 2014 and had strong returns until 2017, when it gave up all gains over the next three years, and then recovered and achieved an all-time high in 2024. Vanguard’s Market Neutral Fund (VMNIX) provides similar factor exposures, and also reached a record high recently.

Although QMNIX’s performance does highlight that factor investing is as cyclical as stock markets, it also indicates that investors can generate significant excess returns with factors like value and momentum. However, we also see the dark side of investing, namely that investors tend to chase performance. The assets in the QMNIX share class grew from essentially zero to $1.7 billion when returns were great, then plummeted to $50 million as investors lost their faith in factor investing when performance was poor.

Source: Finominal

REPLICATING A QUANT FUND

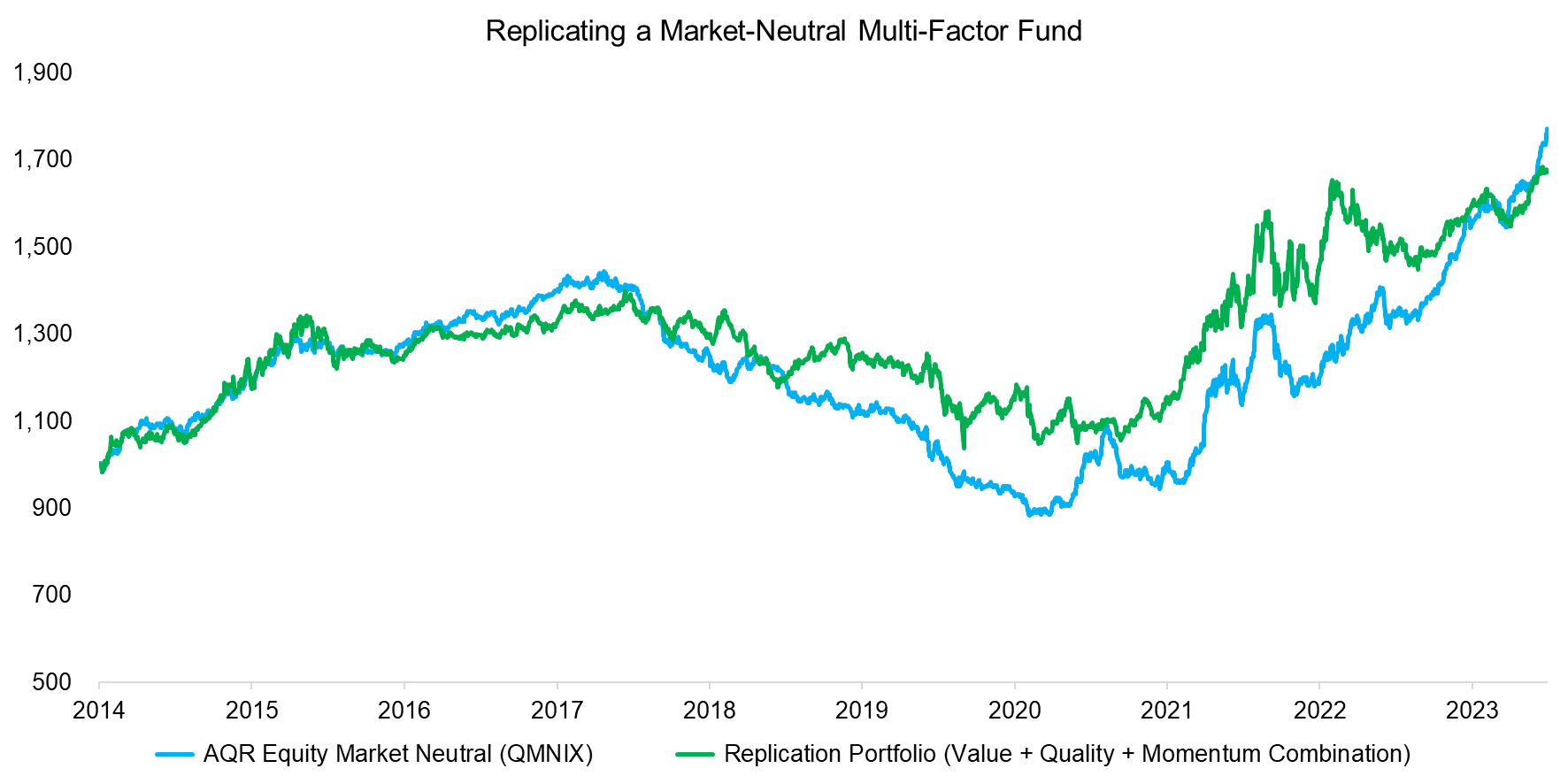

AQR’s Equity Market Neutral Fund has a large portfolio of more than long and short 2,000 positions in stocks from around the world, but is not complicated. If we simply combine three long-short portfolios where stocks were selected on value (PB & PE), quality (ROE & DOE), and momentum (LTM) metrics, then we derive a replication portfolio that approximately offers the same returns as QMNIX. It’s worth highlighting that the replication portfolio is constructed most simplistically and this could be enhanced significantly to achieve a closer replication.

Investors might take the view that AQR is not offering something particularly unique with QMNIX, but we would argue that they are offering exactly what is described in the factor investing literature, but is unattainable for most investors as they can’t operate such complex portfolios themselves.

Source: Finominal

EXCESS RETURNS FROM MULTI-FACTOR ETFS

Given that long-short factor investing has generated strong positive excess returns since 2020 as demonstrated by QMNIX, let’s evaluate how the long-only implementations, which are also often called smart beta funds, have performed.

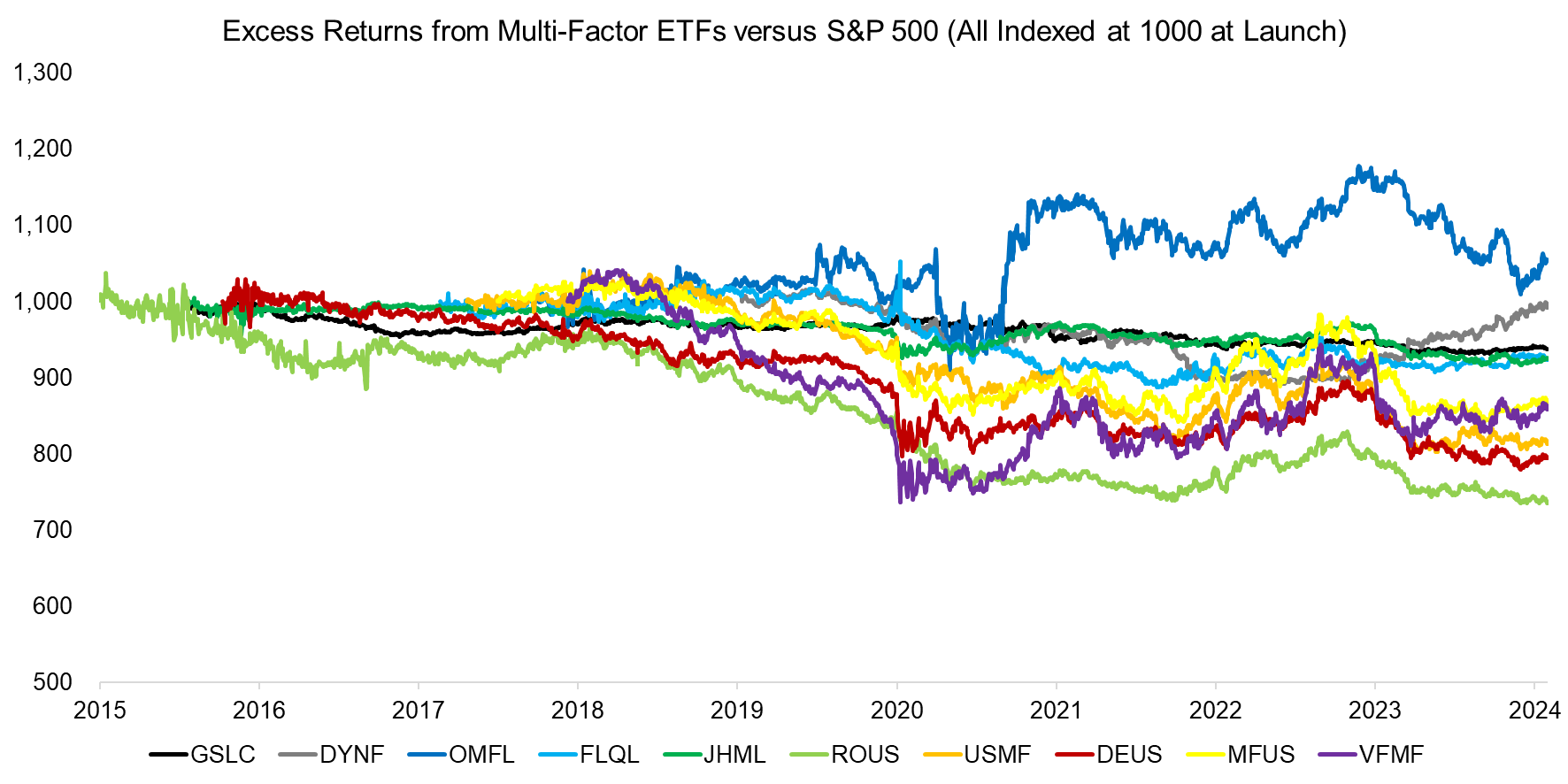

We will use the 10 largest multi-factor ETFs trading in the U.S. stock market that have at least a five-year track record, which are the Goldman Sachs ActiveBeta US Large Cap Equity ETF (GSLC), BlackRock US Equity Factor Rotation ETF (DYNF), Invesco Russell 1000 Dynamic Multifactor ETF (OMFL), Franklin US Large Cap Multifactor Index ETF (FLQL), John Hancock Multifactor Large Cap ETF (JHML), Hartford Multifactor US Equity ETF (ROUS), WisdomTree US Multifactor Fund (USMF), Xtrackers Russell US Multifactor ETF (DEUS), PIMCO RAFI Dynamic Multi-Factor US Equity ETF (MFUS), and the Vanguard US Multifactor ETF (VFMF). These 10 ETFs manage $29 billion cumulative, but GSLC dominates with $13 billion, which can be partially attributed to the fund offering exceptionally low fees at 0.09% (read Multi-Factor Smart Beta ETFs).

All of these ETFs focus on mid- and large-cap U.S. stocks, where the S&P 500 or Russell 1000 are the appropriate benchmarks. These two indices are almost identical, and therefore we select the S&P 500 as the benchmark and calculate the excess returns since 2015, which highlights that only one fund, namely OMFL, generated outperformance since its launch. Some like ROUS have produced consistently negative returns.

Source: Finominal

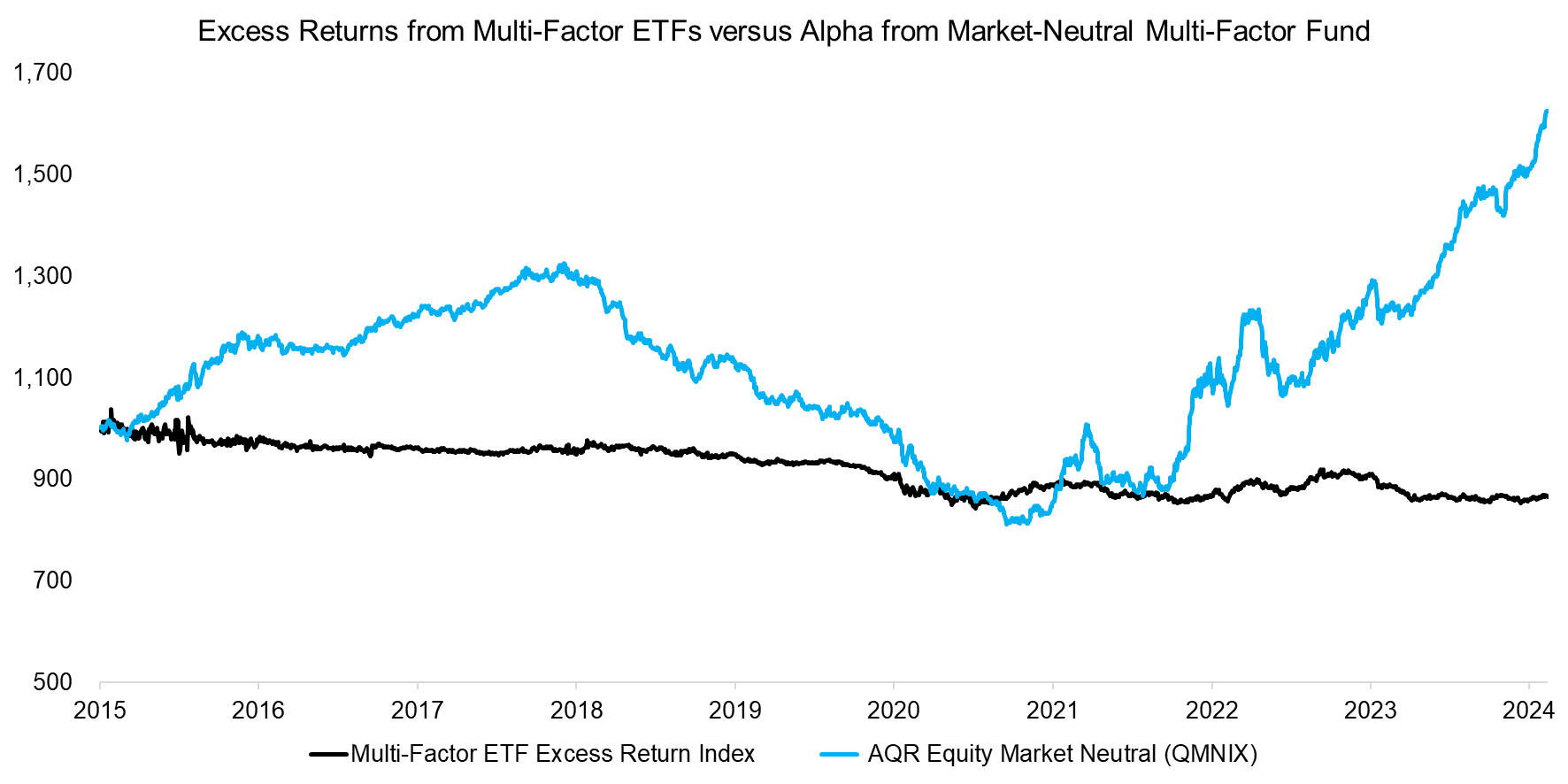

We can contrast the performance of the long-only multi-factor ETFs to that of the market-neutral multi-factor fund (QMNIX) by creating an equal-weighted index of the ETF’s performance. Unfortunately, this highlights almost consistent losses in the period from 2015 to 2024, and bears little resemblance of the performance of QMNIX, which in turn simply offers the returns of a value-quality-momentum combination.

Source: Finominal

How do we explain the significant difference in returns from long-short versus long-only factor investing?

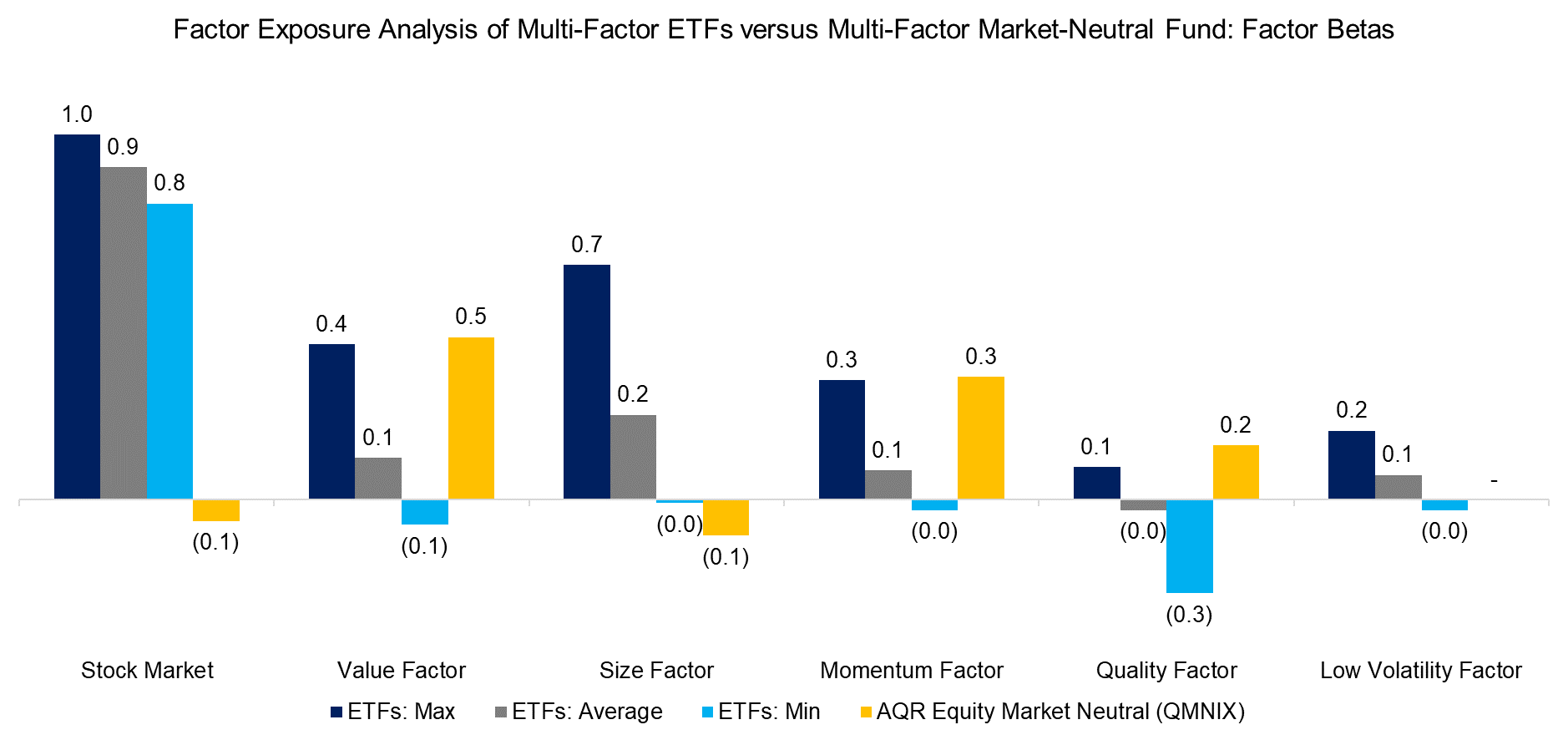

Naturally, the portfolio construction matters as QMNIX takes long and short positions in stocks, and uses leverage to achieve market neutrality, while multi-factor ETFs only offer a portfolio of long positions, which are typically weighted by their market capitalization. As a result, the average exposure to factors is low compared to QMNIX. If factor exposures are too low, then the ETF will essentially represent an index-hugger, and often underperform on a post-fee basis (read Smart Beta: Broken by Design?).

Furthermore, the ETFs’ average beta to the stock market was 0.9, but the stock market has been largely in a bullish state over the last decade, so this will also have contracted continuously from the performance versus the S&P 500.

Source: Finominal

FURTHER THOUGHTS

It seems that the calls for the death of factor investing have been premature and it still represents the most viable path for investors seeking to outperform stock markets. However, factors are as cyclical as stock markets, and portfolio construction and implementation matters.

Ideally, all factor investing should be carried out via long-short products as that leads to higher diversification benefits than using long-only products (read Smart Beta vs Alpha + Beta), but that is wishful thinking.

RELATED RESEARCH

Multi-Factor Smart Beta ETFs

The Case Against Factor Investing

Warren Buffett: The Greatest Factor Investor of All Time?

Smart Beta vs Alpha + Beta

How Painful Can Factor Investing Get?

Smart Beta: Broken by Design?

The Illusion of the Small-Cap Premium

The Value Factor’s Pain: Are Intangibles to Blame?

REFERENCED RESEARCH

Andrew Ang et al, Evaluation of Active Management of the Norwegian Government Pension Fund – Global, 2009.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.