Factor Investing on Country Level

Away with Stocks?

August 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Investors can harvest returns from common equity factors on country level

- Returns are consistent when combined into a multi-factor portfolio

- Performance of some factors is comparable to those on single stock level, indicating common drivers

INTRODUCTION

Factor investing strategies like Value are relatively easy to explain, but complex in implementation. Creating long-short factor portfolios requires investors to define the universe of stocks, portfolio size, weighting methodology, metrics for ranking the stocks, and the rebalancing frequency. The stocks in the short portfolio need to be available for borrowing, which requires the availability from a stock lending desk.

Theoretically, the portfolio needs little maintenance once it is live, but corporate actions like mergers or spin-offs frequently require attention and changes from portfolio managers. Managing a diversified factor portfolio of single stocks is like caring for a child, work never stops.

Investors can contemplate leaving the somewhat messy world of stocks behind and migrate to country level, where futures and ETFs might lighten some of the burdens of portfolio management. However, it is questionable if common equity factors generate abnormal returns on country level.

In this short research note, we will analyze common equity factors on country level as well as evaluate combining these in a multi-factor portfolio.

METHODOLOGY

We focus on four common equity factors namely Value, Momentum, Low Volatility, and Quality, in a universe of 25 developed stock markets. The factor definitions are in line with academic and industry standards. Fundamental data is aggregated from company to country level for all stocks with a market capitalization of above $1 billion. Long-short portfolios are created by selecting the top and bottom 30% of countries ranked by the factor definition. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

EQUITY FACTORS ON COUNTRY LEVEL

The theoretical foundations that explain abnormal returns from factor investing on stock level should also hold on country level. For example, it is likely as emotionally painful to hold a cheap stock like GE as buying a cheap country like Russia. Either service should be rewarded with excess returns from investors with a lower pain threshold.

However, although this argument applies to most common equity factors, there is less rationale for excess returns from the Size factor on country level. In contrast to stocks, small countries such as Switzerland or Norway are not necessarily riskier than large countries like the US or Japan.

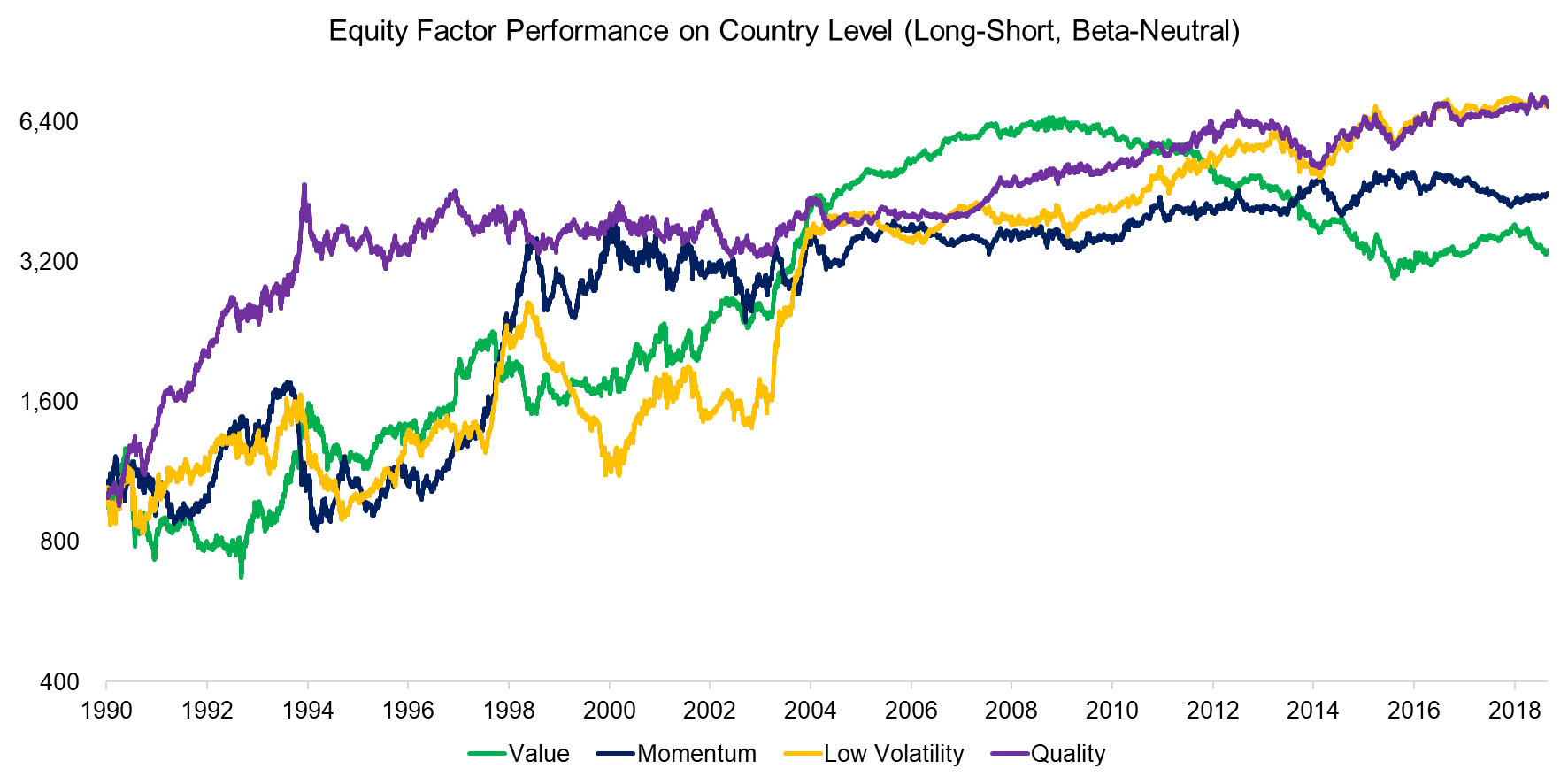

We observe that all factor generated positive returns since 1990, which is encouraging for harvesting factor returns from countries. Somewhat unusual, the Momentum, Low Volatility, and Quality factors frequently share the same trends, which is challenging to explain.

Source: FactorResearch

It is worth noting that the performance of the Value factor on country level is similar to that on single stock level. In both universes, the factor experienced a significant boom-and-bust cycle over the last 30 years. Investors have been buying cheap and selling expensive stocks as well as countries at approximately the same time periods. Please see our research note Cheap versus Expensive Countries for further details.

PORTFOLIO CONSTRUCTION

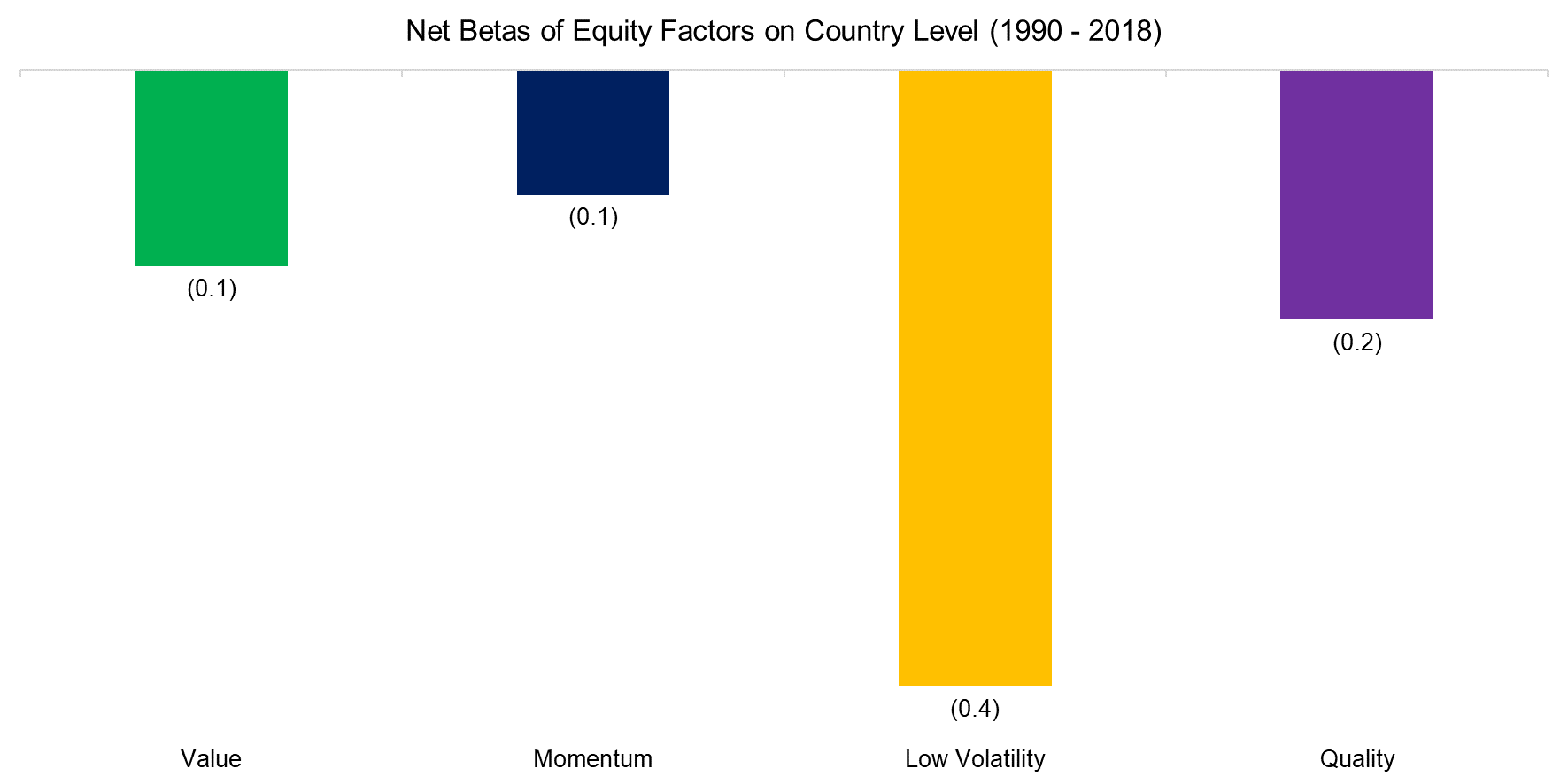

Investors intrigued by the possibility of factor investing on country level should be aware that this does require leverage in portfolio construction as the long and short portfolios have different betas. The difference is especially large for the Low Volatility factor, which is defined as buying the countries with the lowest stock market volatility and shorting the countries with the highest volatility.

Source: FactorResearch

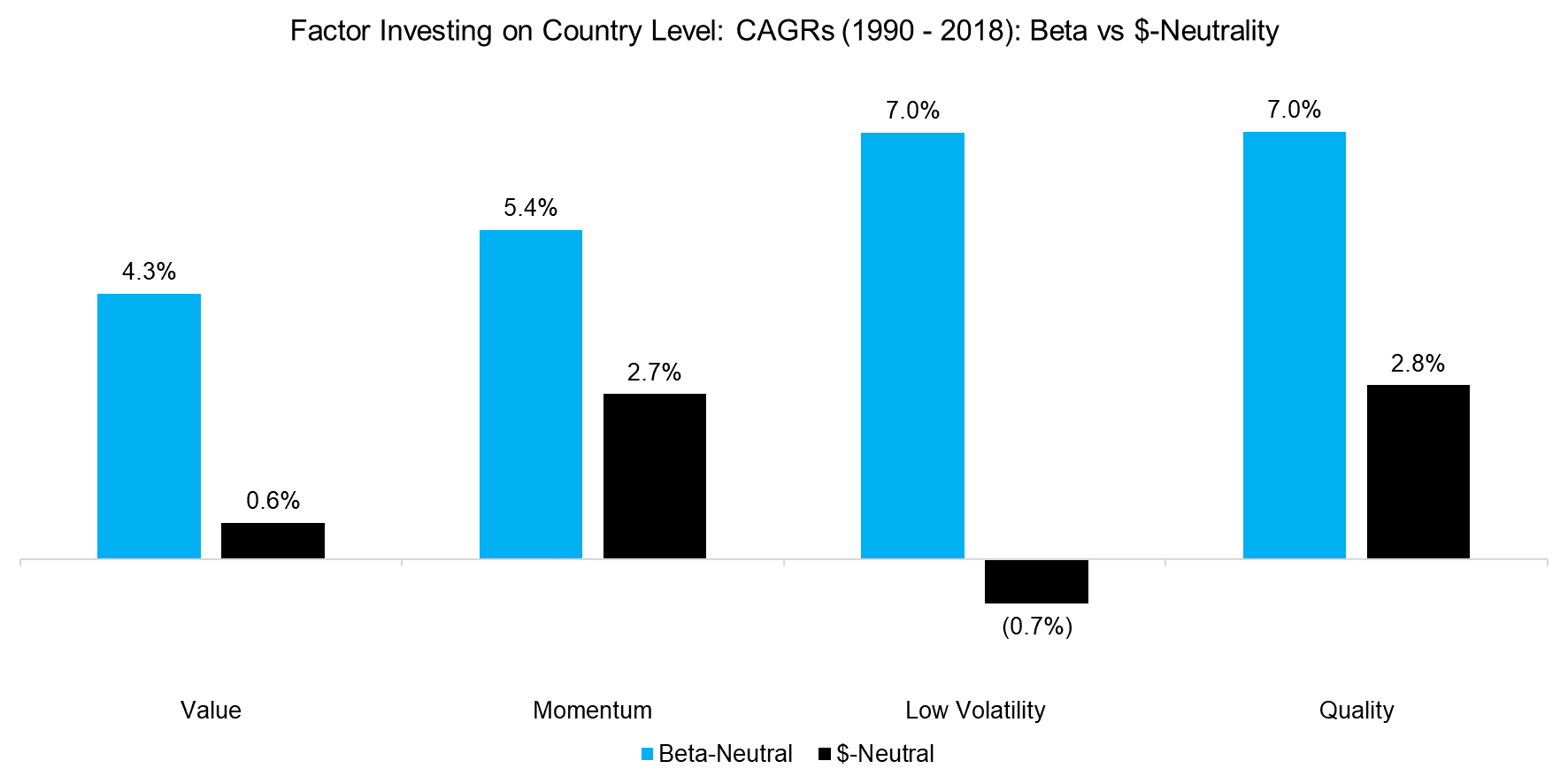

Investors that do not have access to leverage will find returns far less attractive when portfolios are constructed dollar-neutral, i.e. $100 allocation to the long portfolio and $100 allocation to the short portfolio. Achieving beta-neutrality is especially important for the Low Volatility factor as low-risk countries only outperform high-risk countries on a risk-adjusted basis.

Source: FactorResearch

MULTI-FACTOR INVESTING ON COUNTRY LEVEL

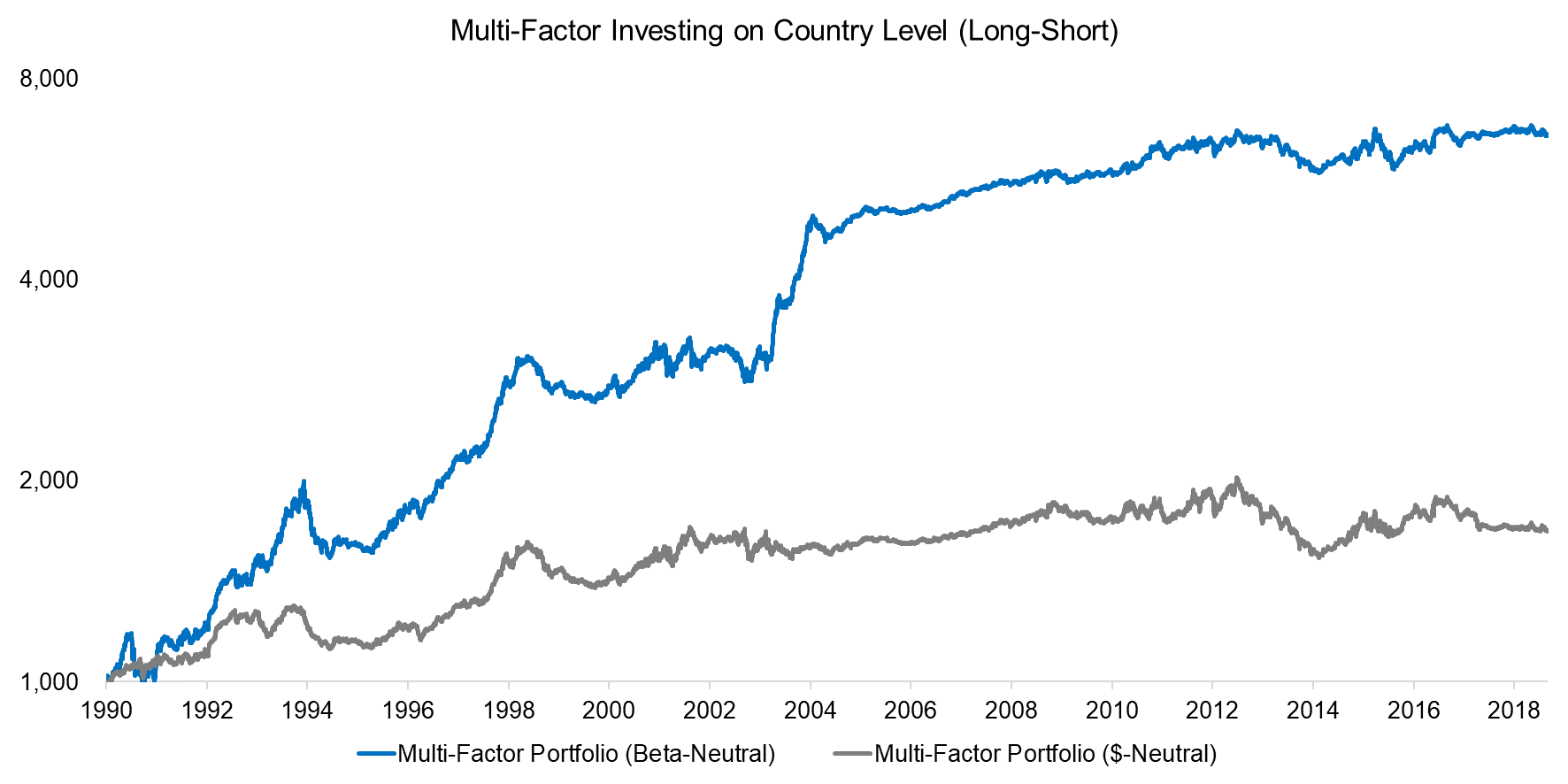

Given that single factors on country level exhibited highly cyclical performance with significant drawdowns, investors can combine these into a multi-factor portfolio. We observe that the performance of the multi-factor portfolio with equal weighting was relatively consistent with few and limited drawdowns. The returns during the global financial crisis between 2008 and 2009 were positive, which would have been attractive strategy characteristics for diversifying a classic equity-bond portfolio (read Factor Allocation Models).

However, the performance has been relatively flat since 2010, which partially mirrors the performance of multi-factor portfolios on single stock level. Factor performance seems to be driven by common drivers, regardless if portfolios are created on single stock or country level.

As expected, there is a meaningful difference between the beta-neutral and $-neutral portfolio, although the trends are almost identical. In contrast to corporate finance, there is magic in leverage.

Source: FactorResearch

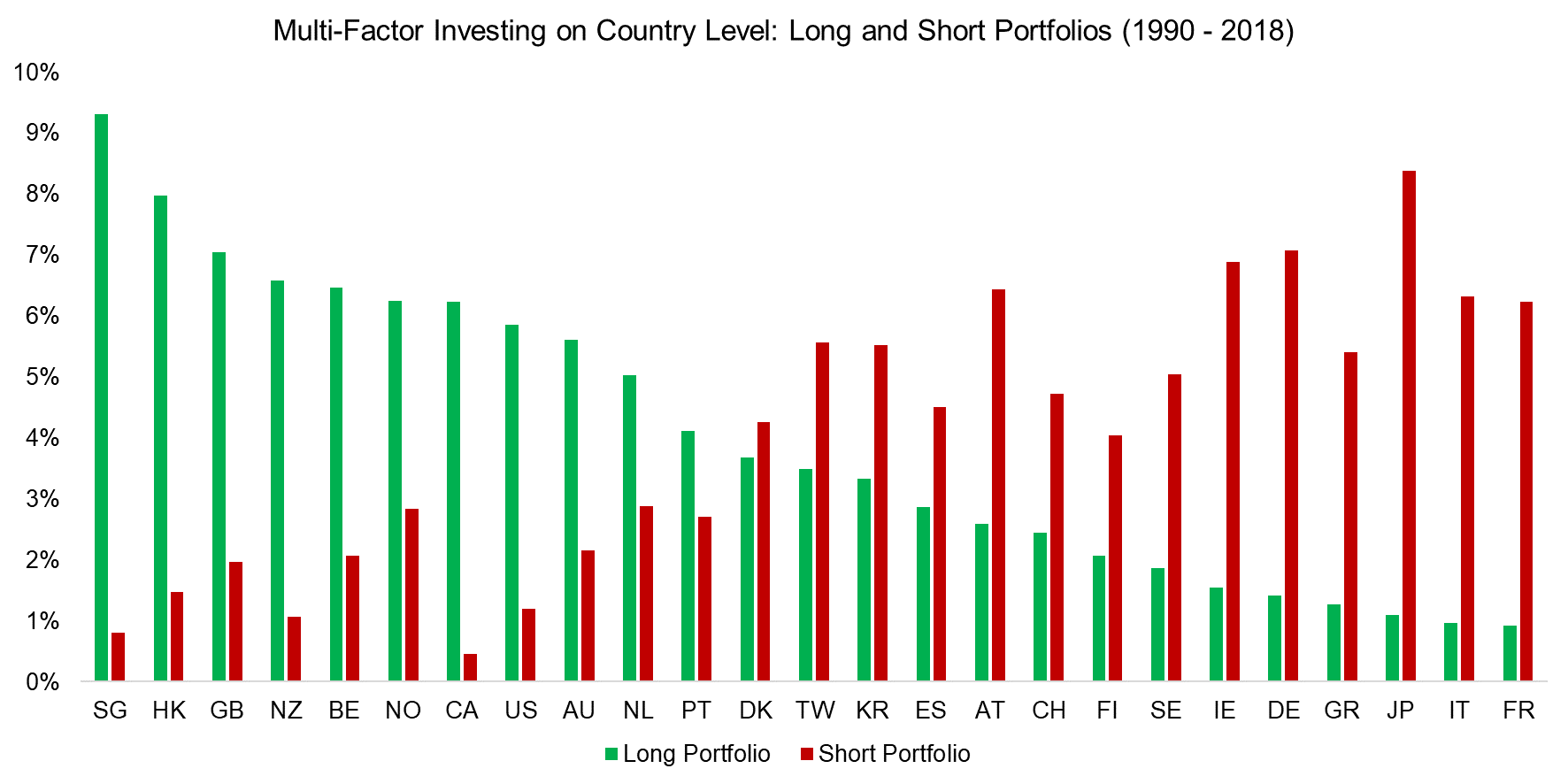

GREAT VERSUS UNAPPEALING COUNTRIES

Given the positive returns from factor investing on country level, it is interesting to analyze the portfolio. We observe structural biases to certain countries in the long and short portfolios over the last 30 years. The five countries most frequently ranked highly were Singapore (SG), Hong Kong (HK), Great Britain (GB), New Zealand (NZ), and Belgium (BE), while Japan (JP), Germany (DE), Ireland (IE), Austria (AT), and Italy (IT) were ranked least favorable.

It is somewhat challenging to discern a pattern in the portfolio distribution from an economic perspective. Countries like Japan or Italy had poor economic growth over the last three decades and featured prominently in the short portfolio, but so did Ireland, which has been called the Celtic Tiger due to strong GDP growth. The size of the country does not seem to have played a role as small countries are found in the long and short portfolios.

Source: FactorResearch

FURTHER THOUGHTS

Investors have been migrating away from single stocks to ETFs in recent years, which is a trend that is likely to continue. In a similar fashion, investors can consider migrating from single stock to country level for harvesting factor returns.

However, investors should not regard factor investing on country level as completely unrelated to what is happening on stock level. Some factors have the same trends in both universes, which indicates related sources of risk.

RELATED RESEARCH

Cheap versus Expensive Countries

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.