Factor Momentum

Chasing Factor Performance

August 2018. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The Momentum strategy can be applied to stocks, sectors, countries and factors

- Factor momentum shows positive excess returns across regions

- However, single-stock Momentum performance is comparable and less complex to implement

INTRODUCTION

We recently investigated applying the long-short Momentum strategy to sectors and countries in Europe, which revealed positive excess returns (“Sector versus Country Momentum“). Effectively, this simply means that performance chasing works, at least if implemented systematically. In addition to allocating to the best performing sectors or countries, investors also tend to chase the best performing investment strategies like Value or Growth. In this short research note we will investigate the application of the long-short Momentum strategy to factors, which we refer to as factor momentum.

METHODOLOGY

We focus on the Momentum strategy, which is defined as buying the winning and selling the losing factors, as measured by their performance over the last 12 months, excluding the most recent month (read Momentum Variations). The strategy is applied to a universe of 25 factors in the US, Europe and Japan. The factors can be broadly categorised into Value, Quality, Size, Growth and price-based metrics. The factor performance is calculated by creating beta-neutral long-short portfolios that select the top and bottom 10% of each stock market ranked by each factor. Only companies with a market capitalisation of larger than $1 billion are included. The portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points. The graphic below summaries the factor universe.

Source: FactorResearch

It is worth mentioning that not all factors have strong academic support, e.g. Growth lacks a long-term track record of positive excess returns; however, is still a widely-followed investment strategy.

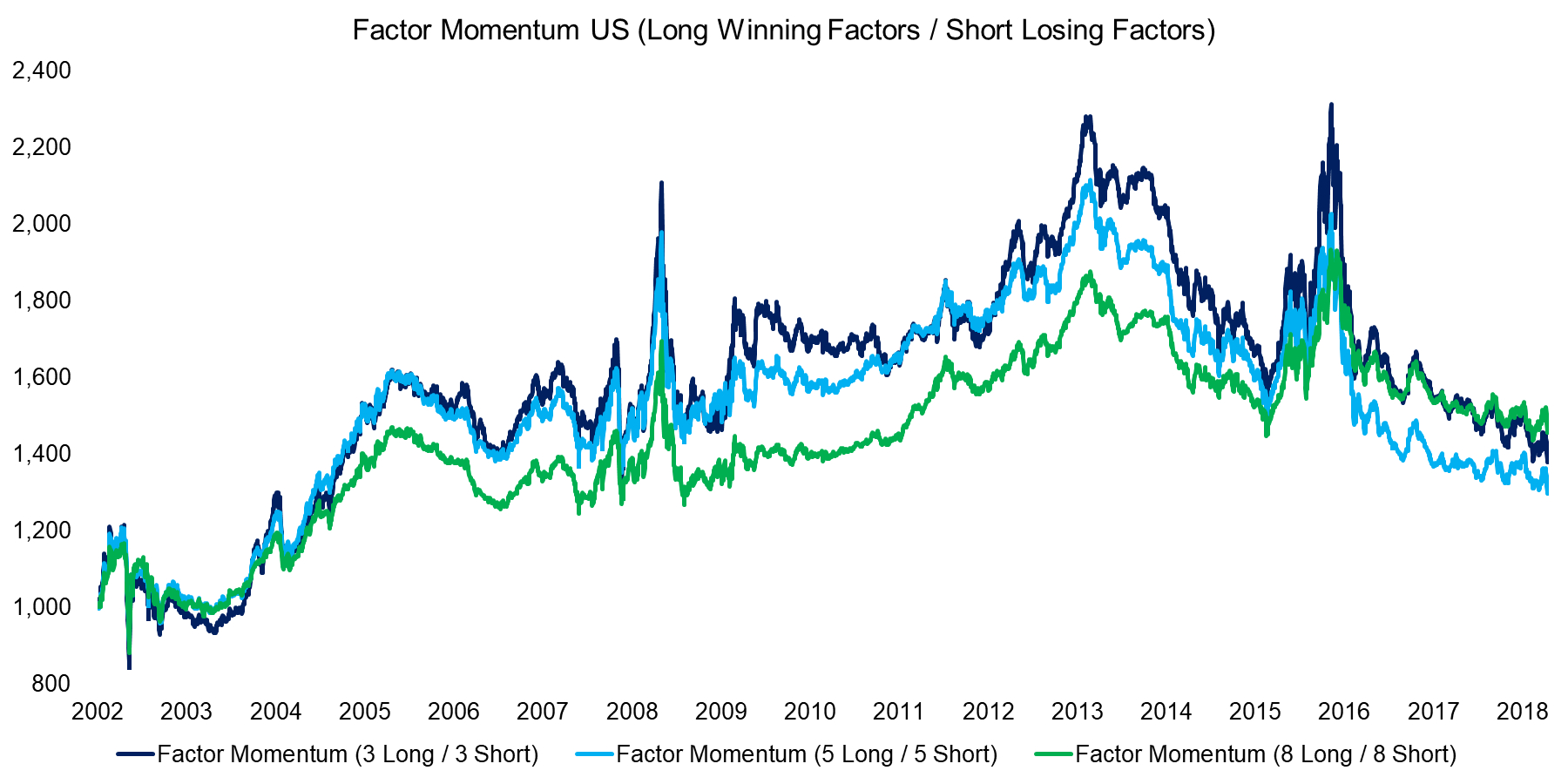

FACTOR MOMENTUM IN THE US

We initially focus on the US and analyse the performance of three factor momentum portfolios, which differ only by the number of factors included in the long and short portfolios. The chart below shows that the performance was positive from 2002 to 2018, but features high volatility and extreme peaks in 2008, 2013 and 2016. Although the number of factors in the portfolios vary, the trends in all three are almost identical, which likely indicates that a few factors dominate in terms of performance contribution.

Source: FactorResearch

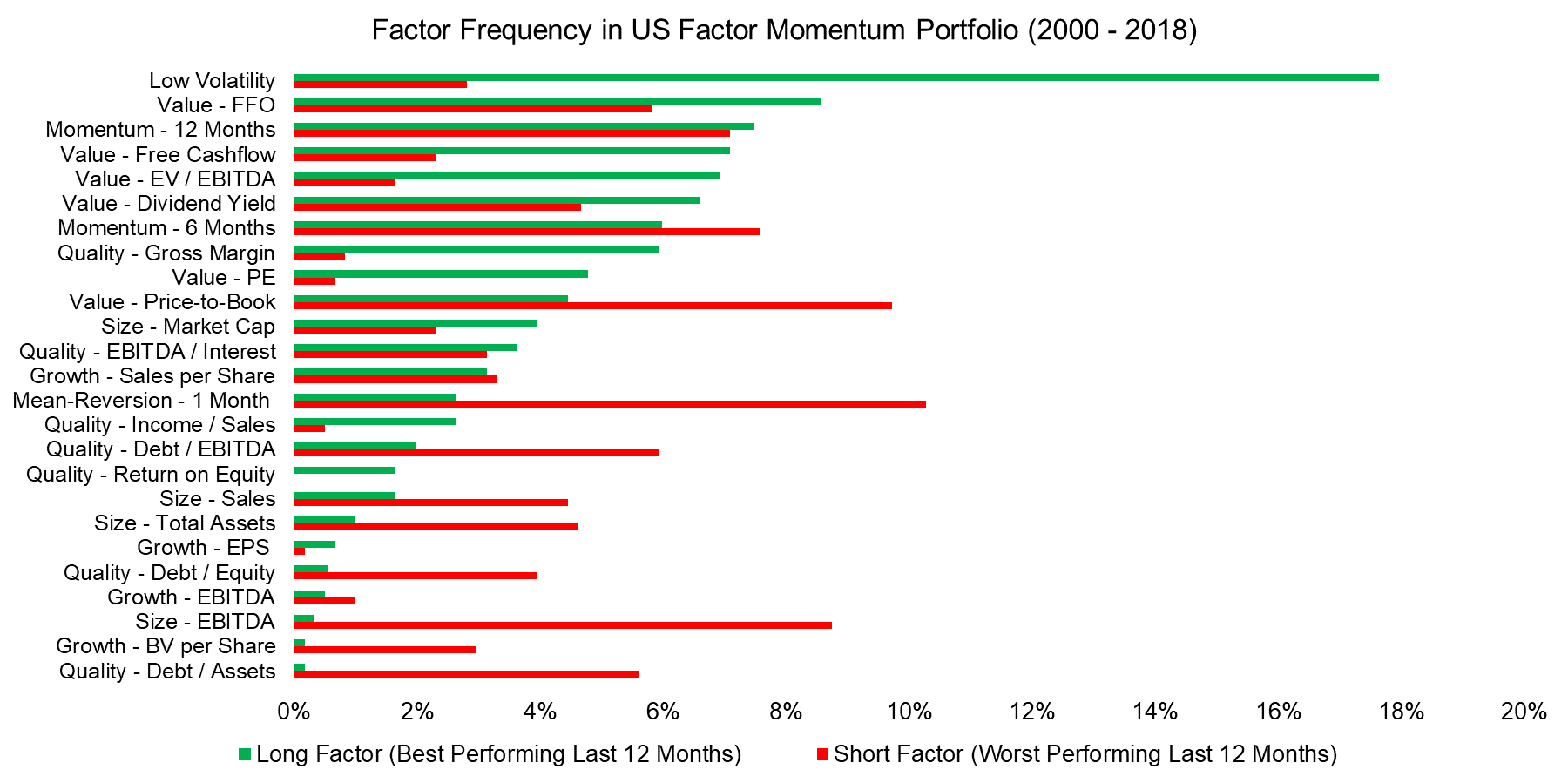

FACTOR MOMENTUM PORTFOLIO ANALYSIS

In addition to highlighting the performance, we can also analyse the portfolios over time. The chart below shows the allocation to factors in the US from 2000 to 2018, sorted highest to lowest for the long portfolio. We can observe that the Low Volatility factor was selected most frequently, which simply implies that the factor most often showed the strongest performance of all factors over a 12-month horizon and was therefore included in the long portfolio. Value factors also frequently appeared in the long portfolio while the short portfolio was mostly comprised of Quality, Growth and Size factors.

Although this perspective reflects that Value generated positive performance, in line with long-term academic research, it does depend on the observation window, e.g if measured from 2010 to 2018 Value factors would more frequently appear in the short portfolio as the performance was flat to negative.

Source: FactorResearch

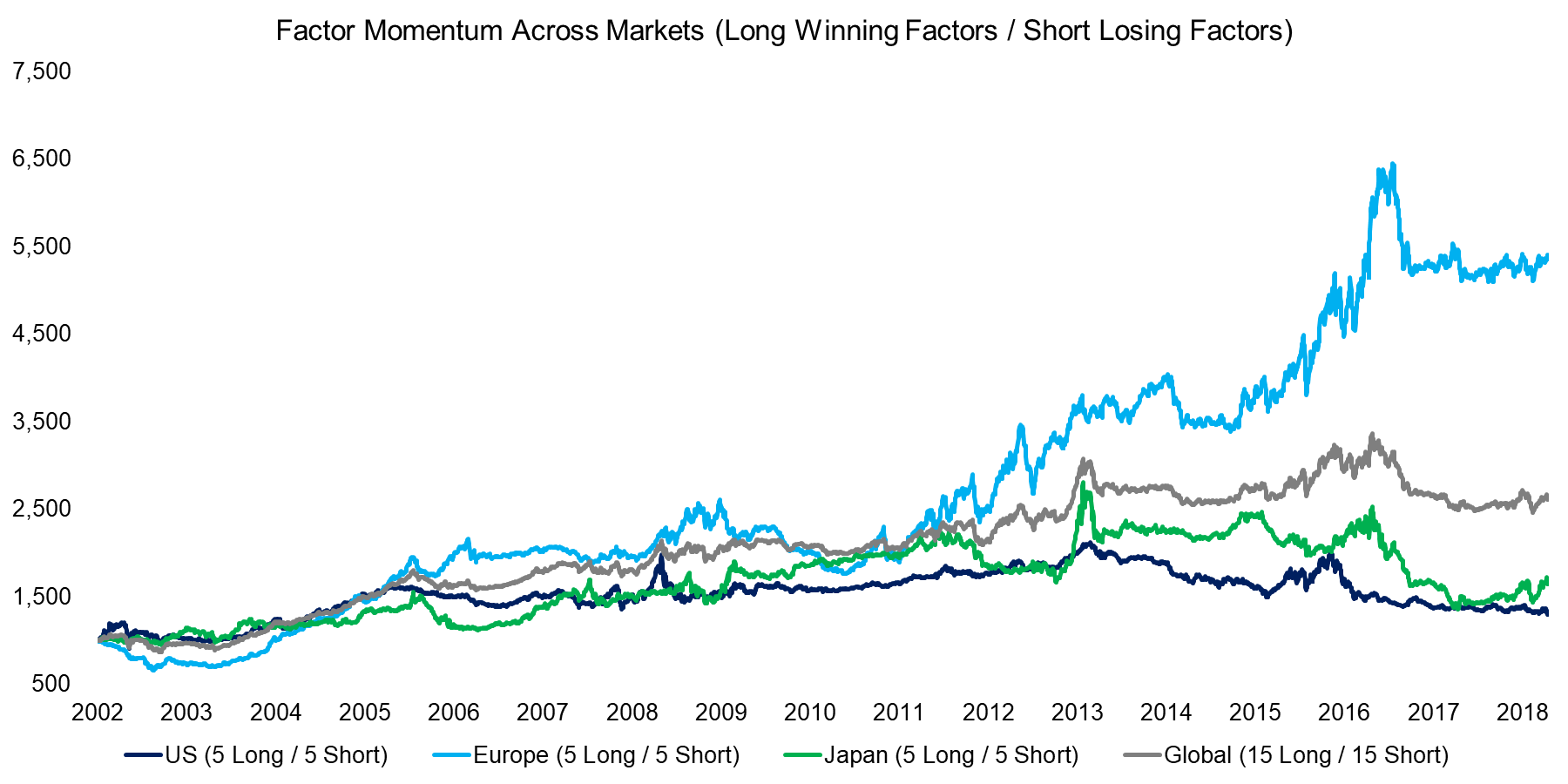

FACTOR MOMENTUM ACROSS MARKETS

We can expand the analysis to other markets, which reveals that factor momentum was particularly strong in Europe. It is interesting to note that the performance across markets shares some trends, which reflects similar underlying stock portfolios and global drivers of factor performance.

For example, all three factor momentum portfolios showed comparable performance between 2002 and 2006. During that period the Value factor, regardless how measured, performed strongly across markets for several years, which warranted its inclusion in the long side of the portfolio and resulted in a similar performance of factor momentum across regions. Identifying the global drivers of factor performance is a research area worth exploring.

Source: FactorResearch

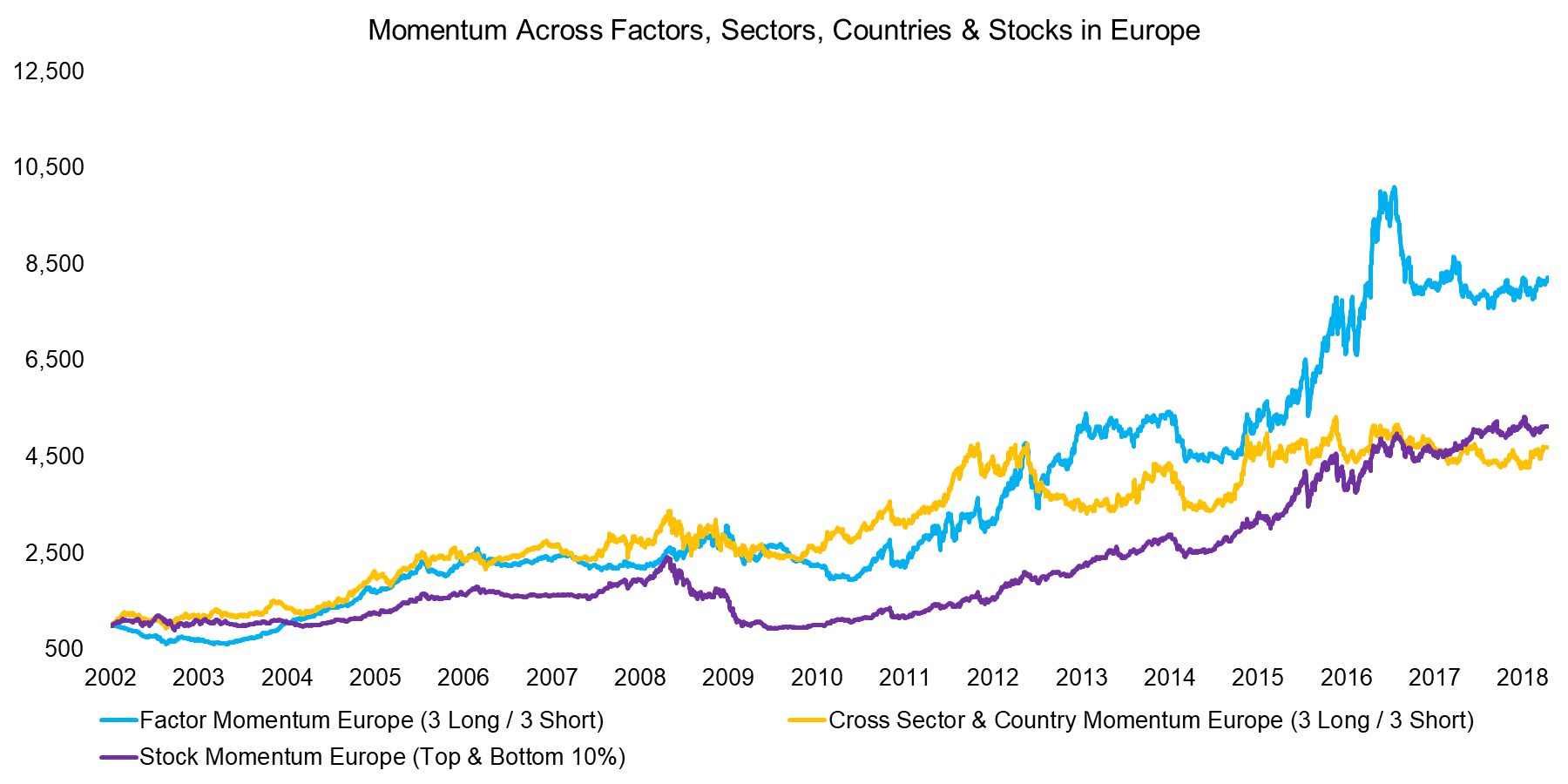

MOMENTUM ACROSS FACTORS, SECTORS, COUNTRIES AND STOCKS IN EUROPE

Finally, we compare factor momentum to the same strategy in two other universes in Europe: cross sector & countries and single stocks. All three universes ultimately comprise the same pool of approximately 600 European stocks and represent just different perspectives.

It might not be intuitive to compare factor momentum to single-stock momentum as factor momentum buys the winning and sells the losing factors while single-stock momentum buys the winning and sells the losing stocks. However, often the winning stocks represent a factor with strong positive performance and the losing stocks a factor with negative performance, therefore the performance profiles are roughly comparable.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that applying the Momentum strategy to factors would have generated positive excess returns, which is another confirmation of how effective Momentum is as a strategy. This version of Momentum can not be implemented directly as there are only a few long-short factors that are traded on exchanges, but the factors can be efficiently replicated via stock portfolios. However, the single-stock based Momentum factor coupled with a sound risk management framework to reduce Momentum crashes is likely more attractive and less complex to implement.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.