Factor Olympics: 1H 2017

And the Winner is…

July 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- 2017 seems to be a good year for factor exposure as most factors are positive

- Growth, Quality, and Low Volatility are headed for the winners podium

- Value is negative across regions

INTRODUCTION

We present the performance of six well-known factors on an annual basis for the last 10 years and first half of 2017 for all developed markets in an easily-digestible format. It’s worth mentioning that not all factors have academic support, e.g. Quality and Growth lack track records of structural profitability.

Aside from showing the factor performance these charts highlight the significant factor rotation in terms of profitability from one year to the next. Factor investing is at it’s all-time high in terms of popularity according to Google Trends, but factor selection and factor timing are challenging subjects (read Market Timing vs Risk Management).

METHODOLOGY

The factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe and Japan and 20% in smaller stock markets. Portfolios rebalance monthly and include 10bps of transaction costs (read Factor Construction: Beta vs $-Neutrality).

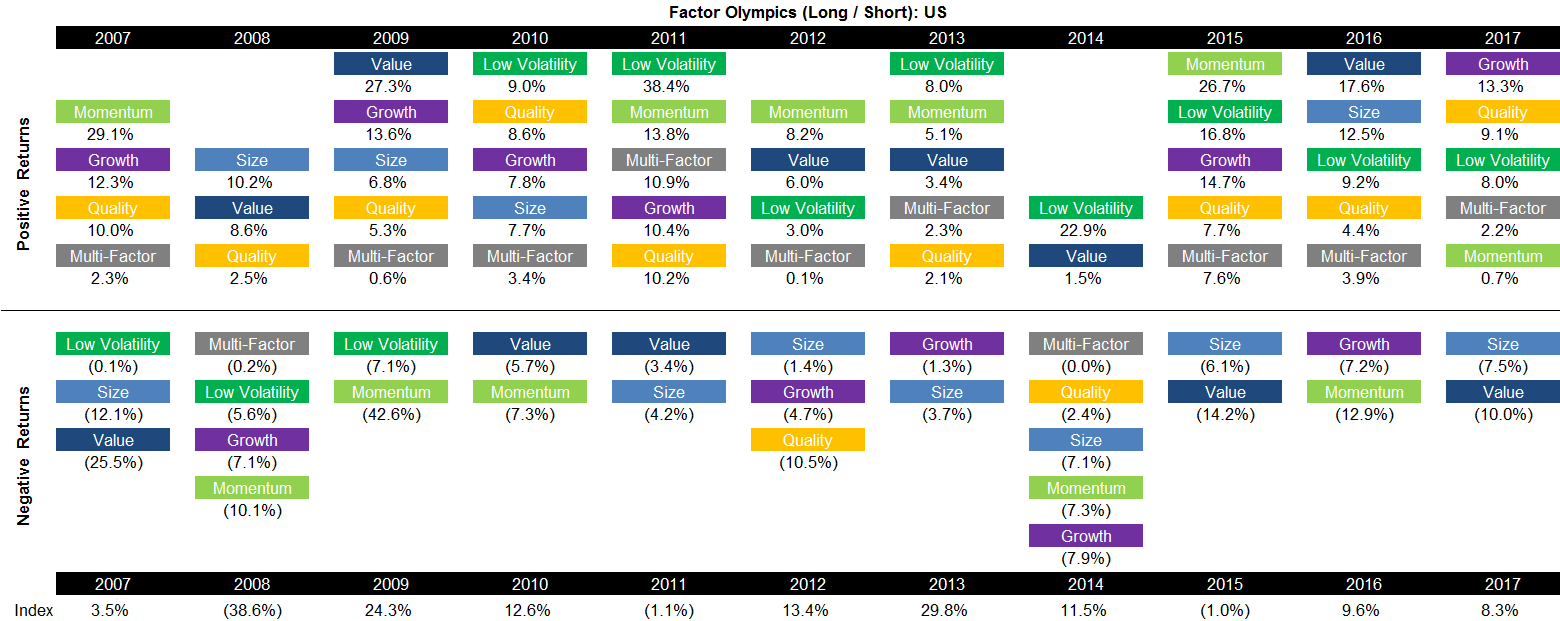

FACTOR OLYMPICS (LONG / SHORT): US

The chart below shows the factor performance for the last 10 years ranked top to bottom.

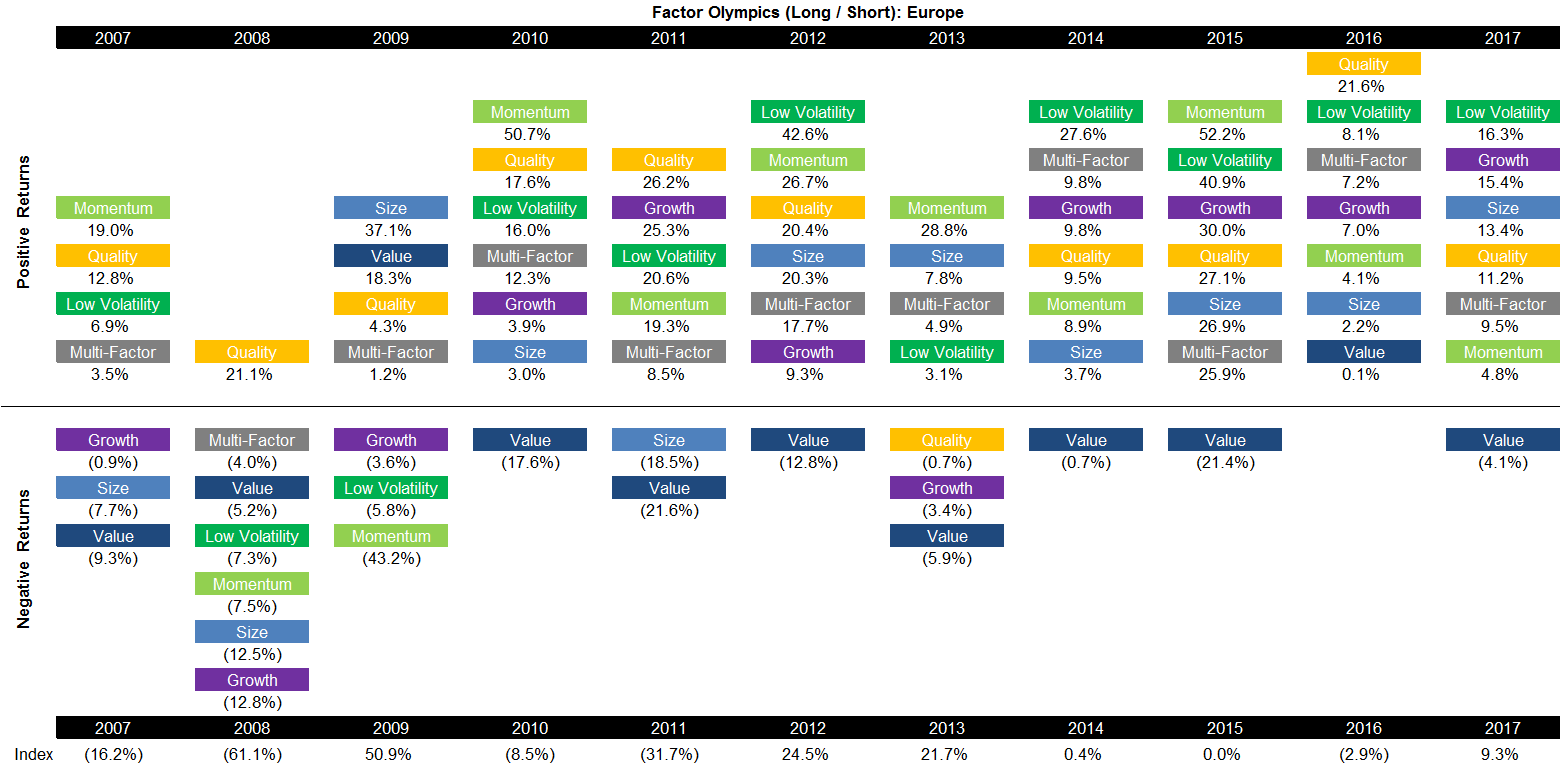

FACTOR OLYMPICS (LONG / SHORT): EUROPE

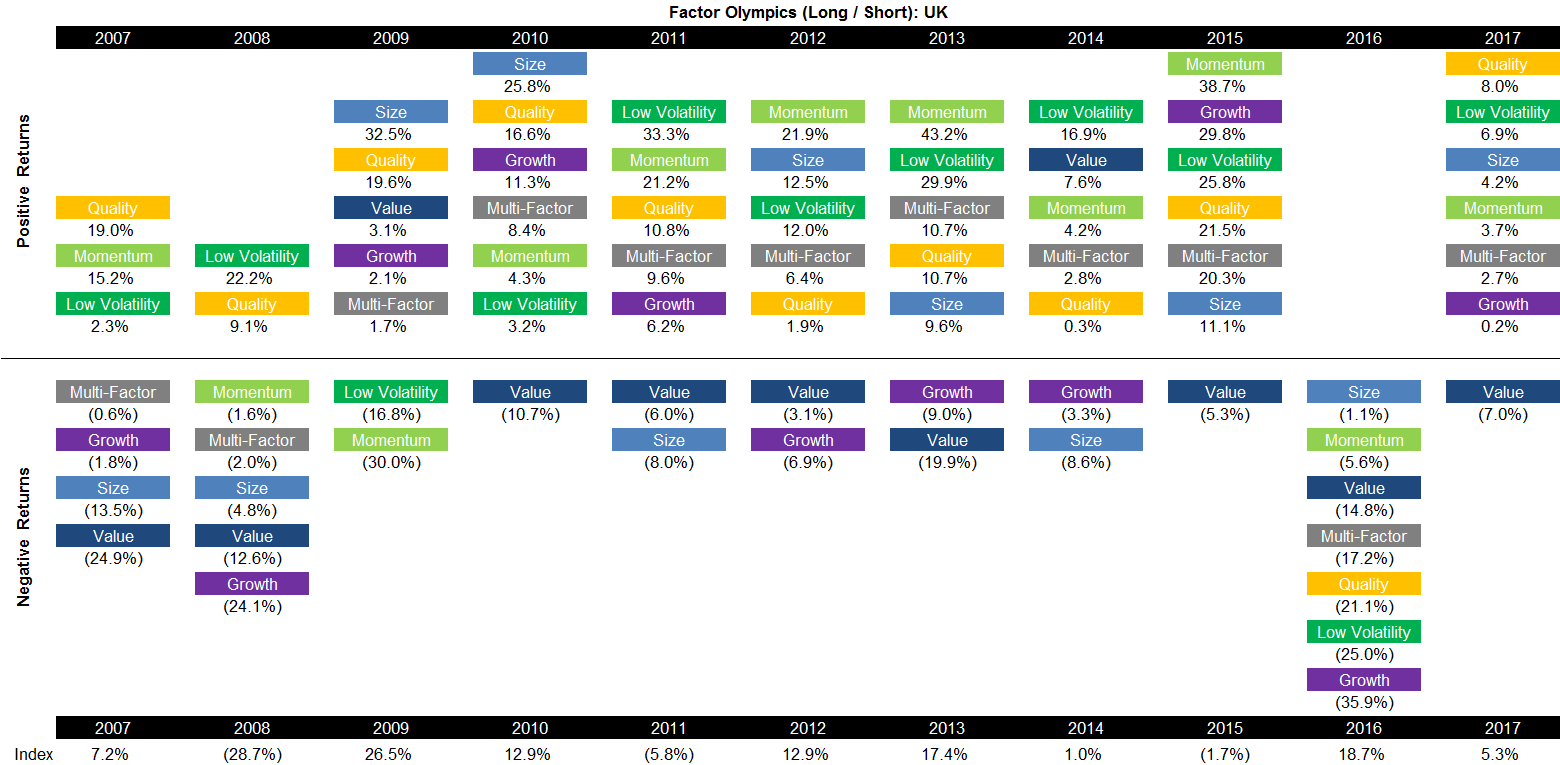

FACTOR OLYMPICS (LONG / SHORT): UK

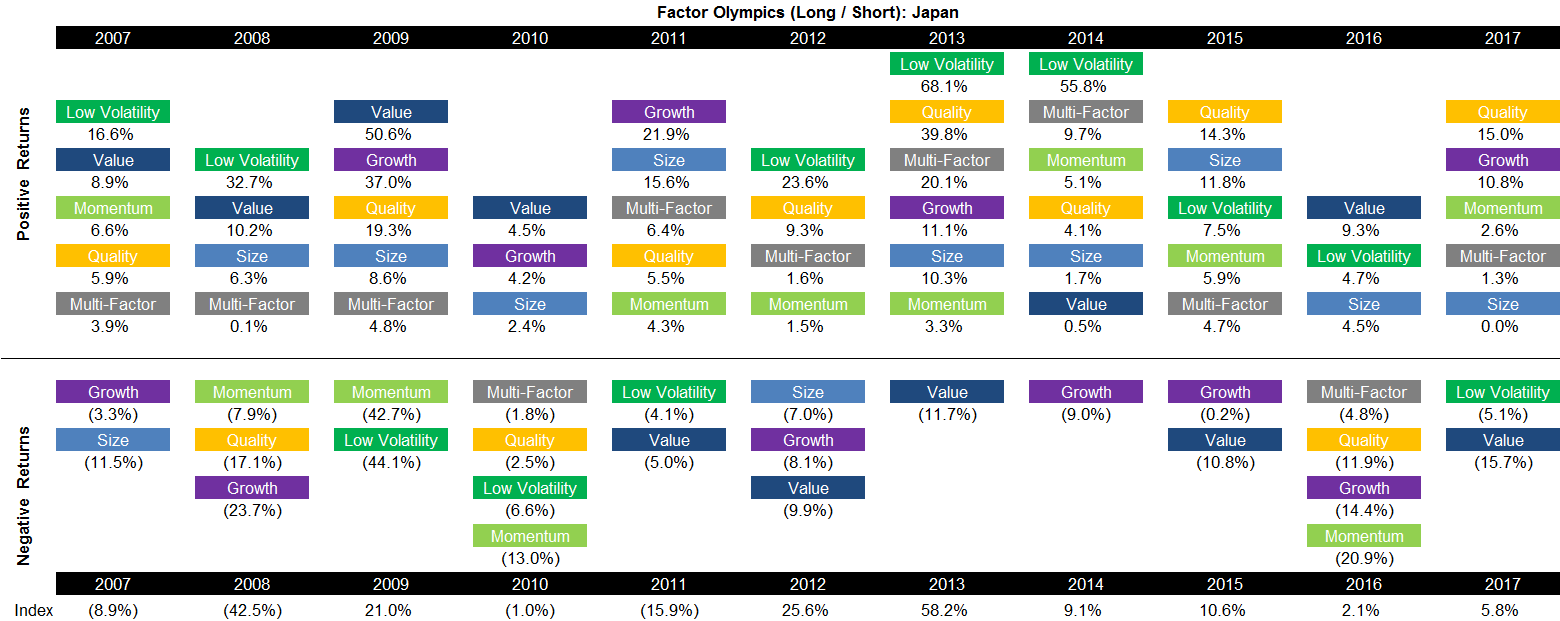

FACTOR OLYMPICS (LONG / SHORT): JAPAN

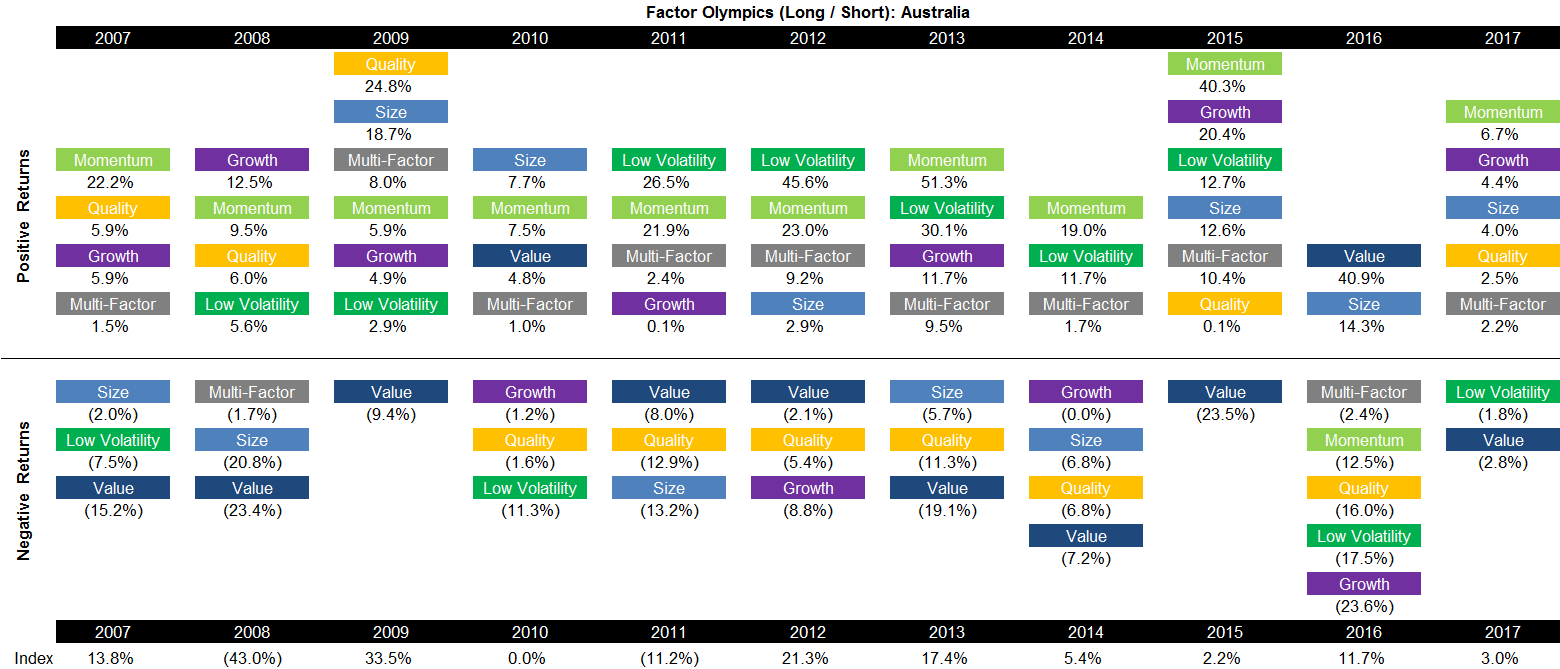

FACTOR OLYMPICS (LONG / SHORT): AUSTRALIA

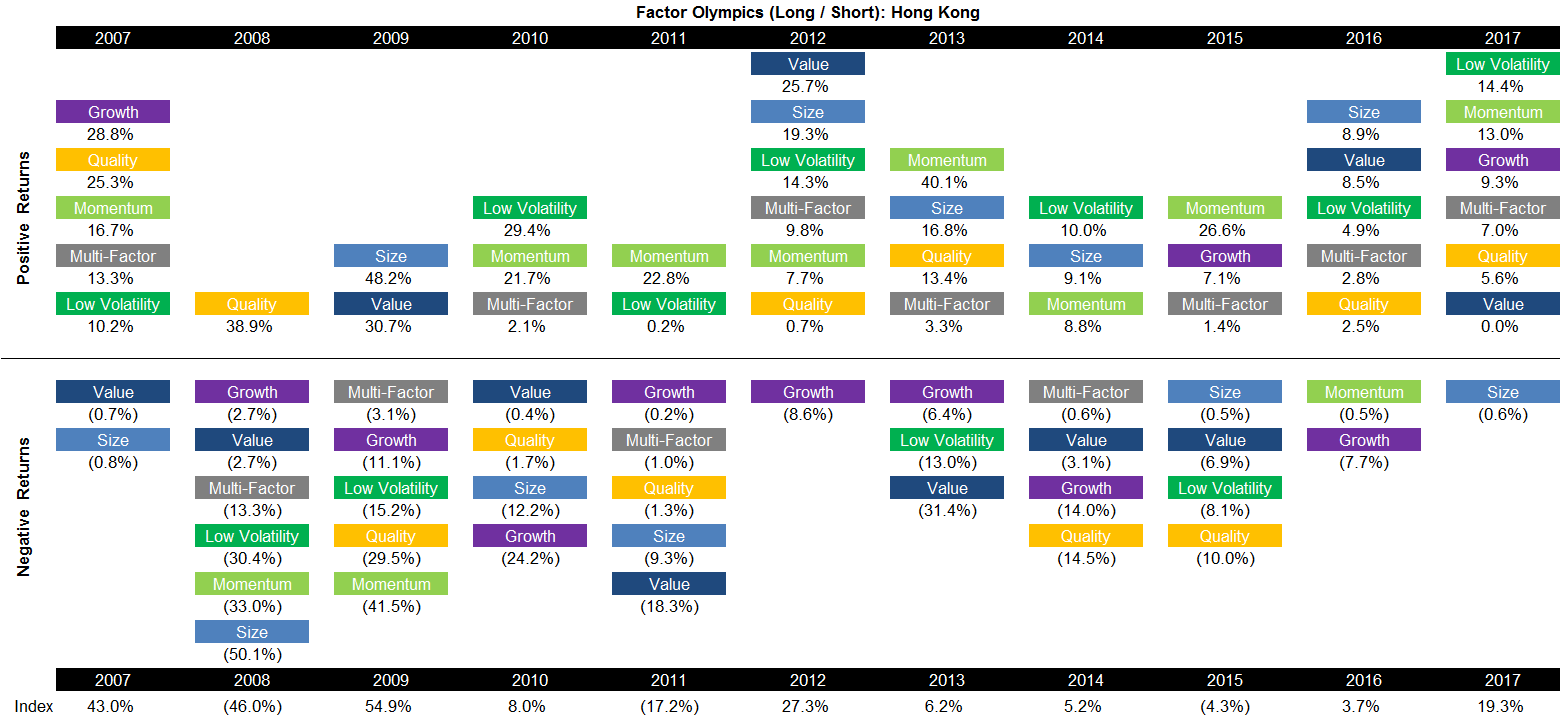

FACTOR OLYMPICS (LONG / SHORT): HONG KONG

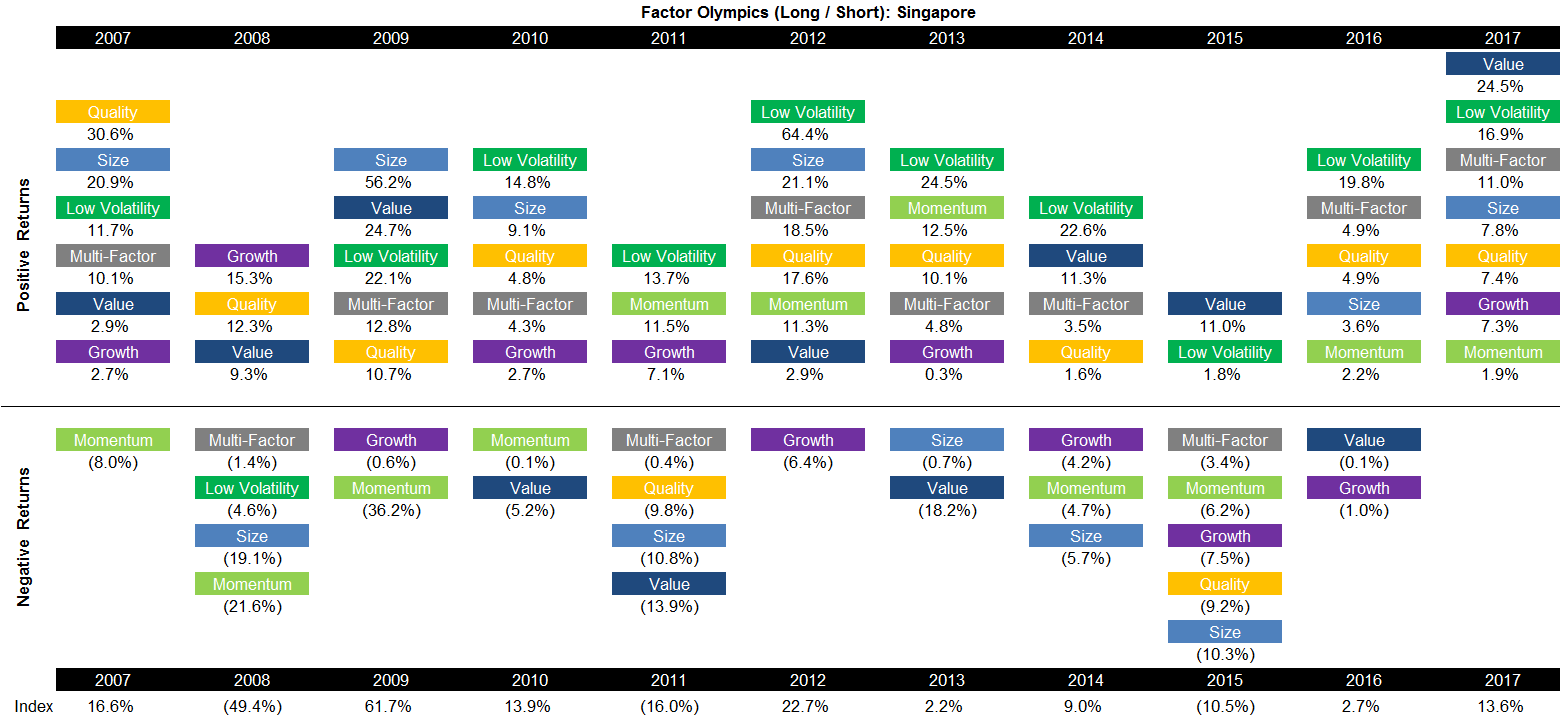

FACTOR OLYMPICS (LONG / SHORT): SINGAPORE

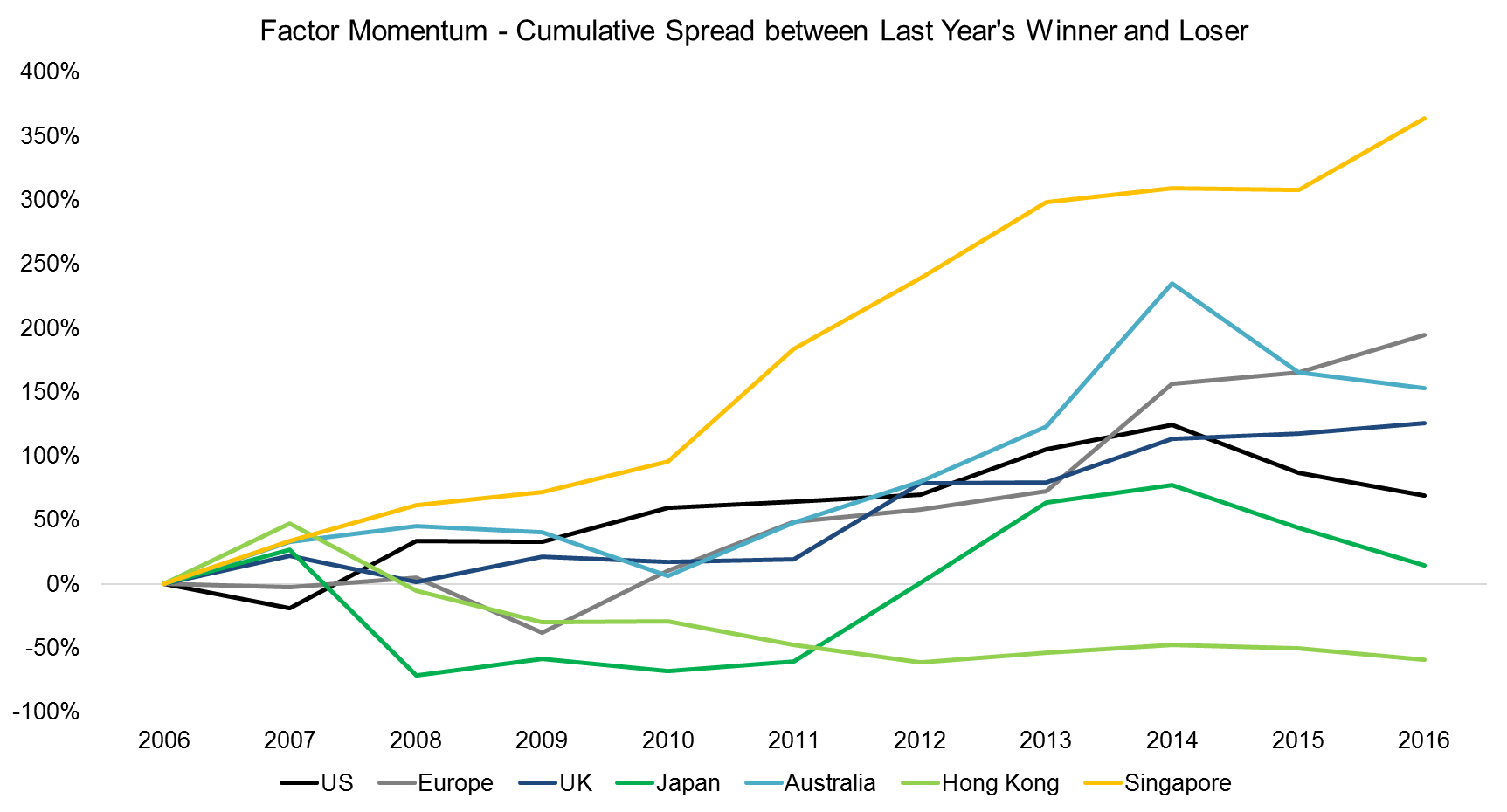

FACTOR MOMENTUM

It’s also worth investigating if we can observe factor momentum, i.e. we buy last year’s winner and compare it to the most negative factor for the same time period. Intuitively investors might expect mean-reversion to occur, however, the chart below shows that for most regions factor momentum worked as a strategy. Naturally it’s a very short observation period and statistically not very robust.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.