Factor Olympics Q3 2019

And the Winner is…

October 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most factors generated positive returns in Q1-3 2019

- Low Volatility produced the best and Value the worst performance year-to-date

- The factor rotation from Momentum into Value in Q3 was short-lived

INTRODUCTION

We present the performance of five well-known factors on an annual basis for the last 10 years. We only present factors where academic research highlights positive excess returns across market cycles and asset classes. Other strategies like Growth might be widely-followed investment styles, but lack academic support and are therefore excluded.

METHODOLOGY

The factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe and Japan, and 20% in smaller markets. Only stocks with a minimum market capitalisation of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

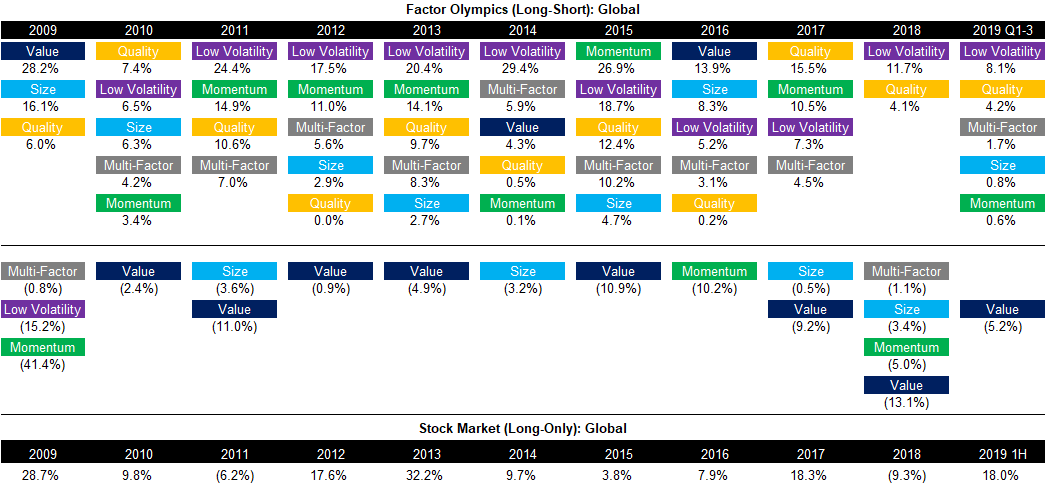

FACTOR OLYMPICS: GLOBAL

The table below shows the long-short factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from displaying the factor performance, the analysis highlights the significant factor rotation in terms of profitability from one year to the next.

Most common equity factors generated positive performance in the first three quarters of 2019, with only Value being negative. The performance leadership is similar to the last decade with the Low Volatility and Quality factors exhibiting the highest returns. Value continues to generate negative returns and the performance accumulates to what can be considered a lost decade for investors focused on buying cheap and selling expensive stocks.

Source: FactorResearch

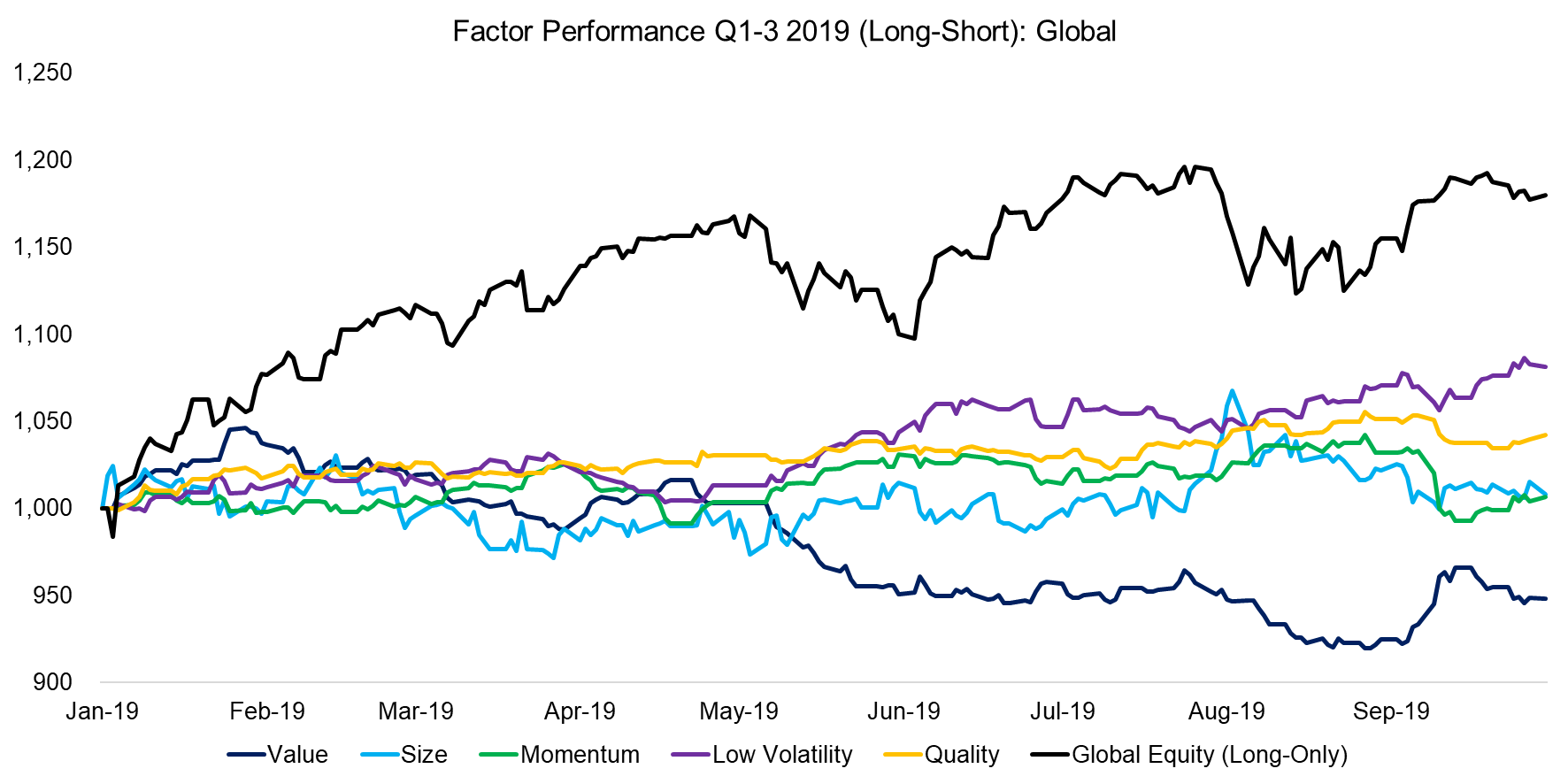

FACTOR PERFORMANCE Q1-3 2019: GLOBAL

Equity markets generated exceptionally strong positive returns in the first half of 2019, but were essentially flat during the third quarter. Market participants continue to be concerned that equity and bond markets have decoupled as highlighted by the US 10-year treasury bond trading at 1.7% and yield curve inversions, which are frequently associated with heralding recessions, while the S&P 500 is trading at close to its all-time high.

Some thoughts on the performance of the global long-short factors:

- Value & Low Volatility: There is no structural relationship between these two factors from a historical perspective, but in 2019 these behaved liked polar opposites, which was especially apparent from May onward, where Low Volatility generated strongly positive and Value significantly negative returns.

- There was a significant rotation from Momentum, Quality, and Low Volatility into Value in September 2019, but this was short-lived and it does not seem like a structural shift in trends has occurred.

- The Momentum factor has given up nearly all of the positive returns achieved year-to-date, which perhaps indicates that investors’ sentiment towards technology stocks, especially unprofitable ones, has become more cautious.

Source: FactorResearch

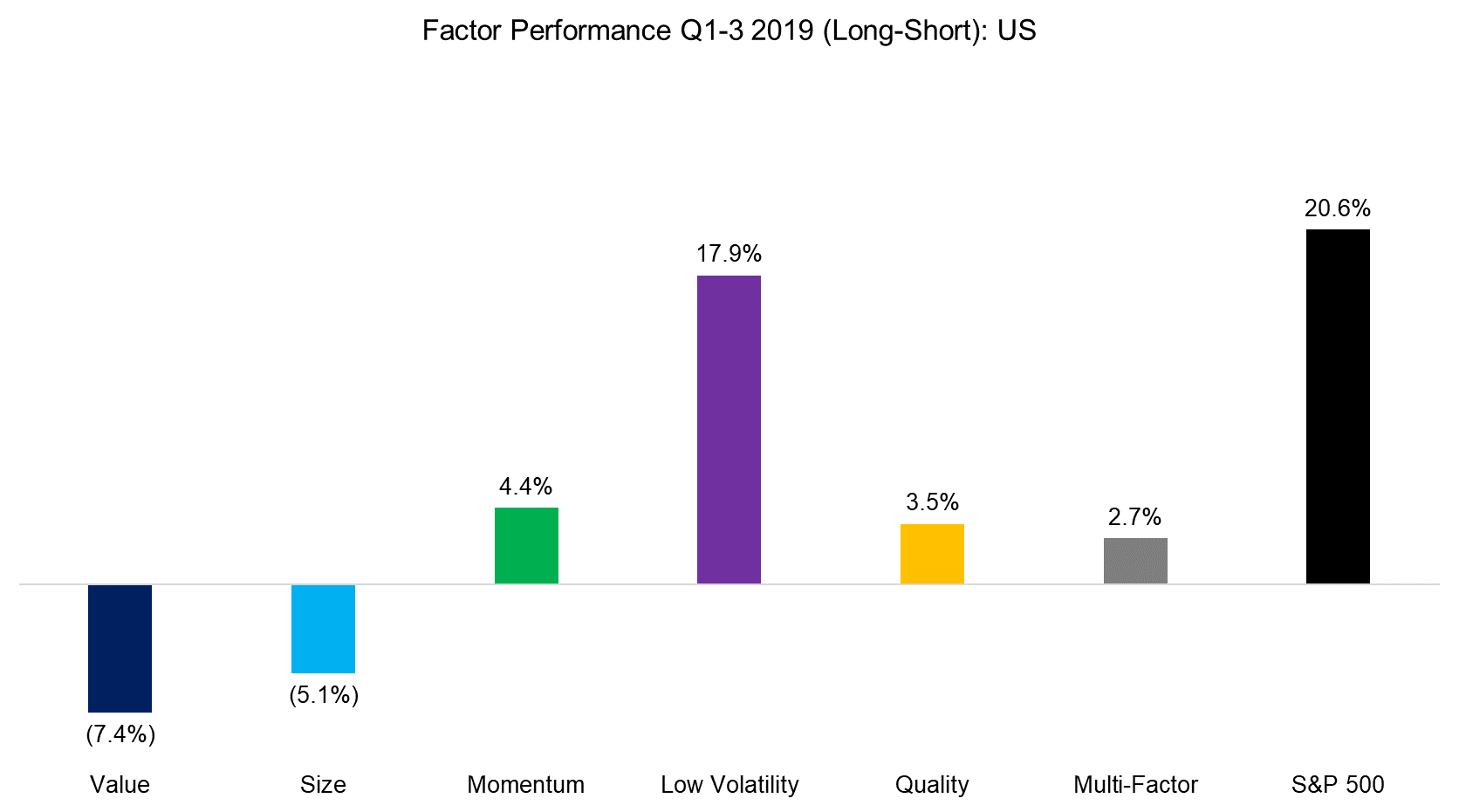

FACTOR PERFORMANCE Q1-3 2019: US

The global performance is significantly weighted towards the US, so it is not surprising that factor performance in the US is alike to the global returns.

The factor performance in the US is led by the Low Volatility factor, which can be partially explained by the interest rate sensitivity of the factor and the continuous decrease in bond yields that started in November 2018. The portfolio of the factor has overweights in stocks from sectors like real estate and utilities that are not particularly volatile and can be considered bond-proxies given the nature of their industries.

Source: FactorResearch

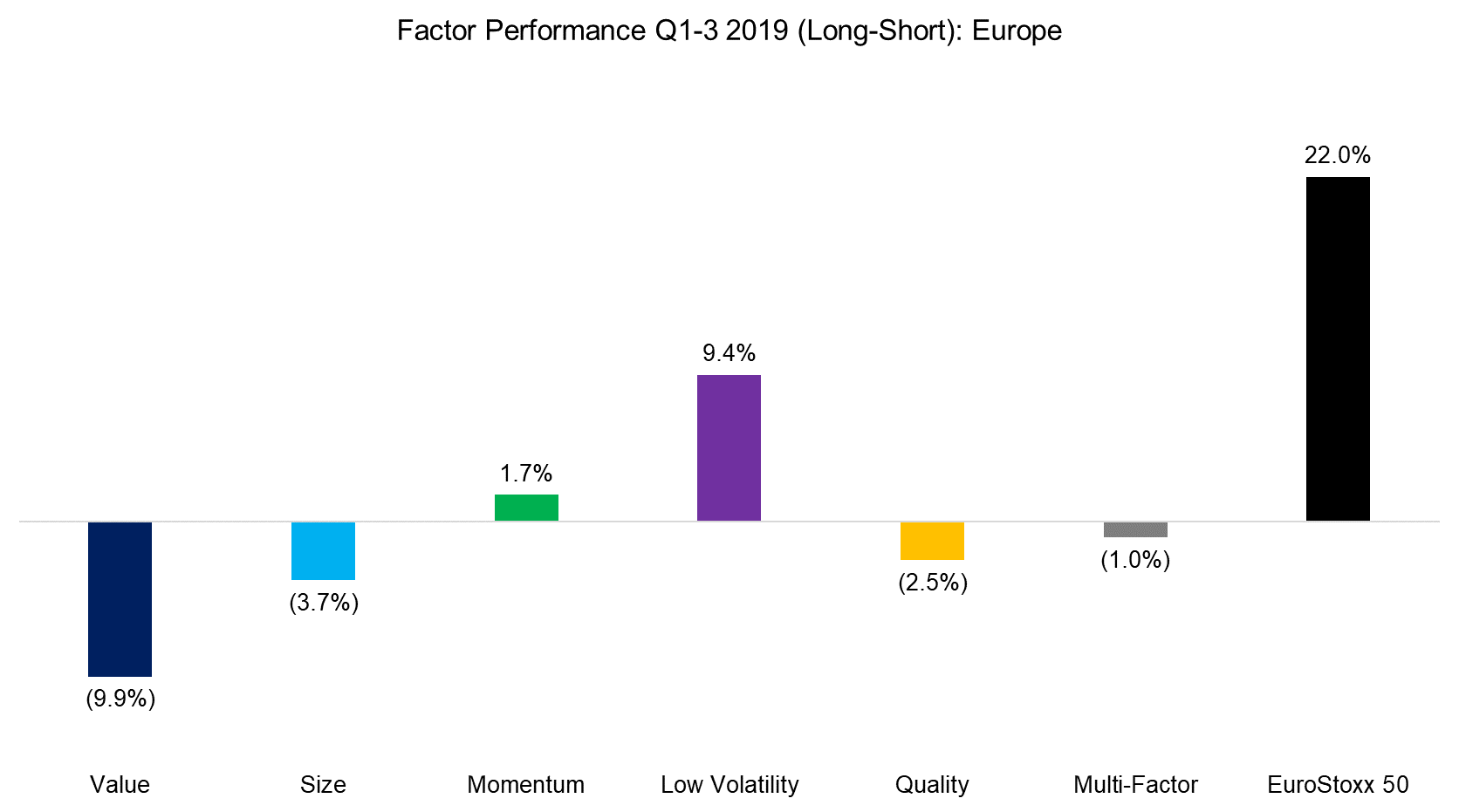

FACTOR PERFORMANCE Q1-3 2019: EUROPE

The factor performance in Europe is similar to the US in the direction of returns, which highlights that factors have the same performance drivers across markets. However, while a multi-factor portfolio generated positive returns in the US, it was negative in Europe. Only two out of five common equity factors generated positive performance.

Source: FactorResearch

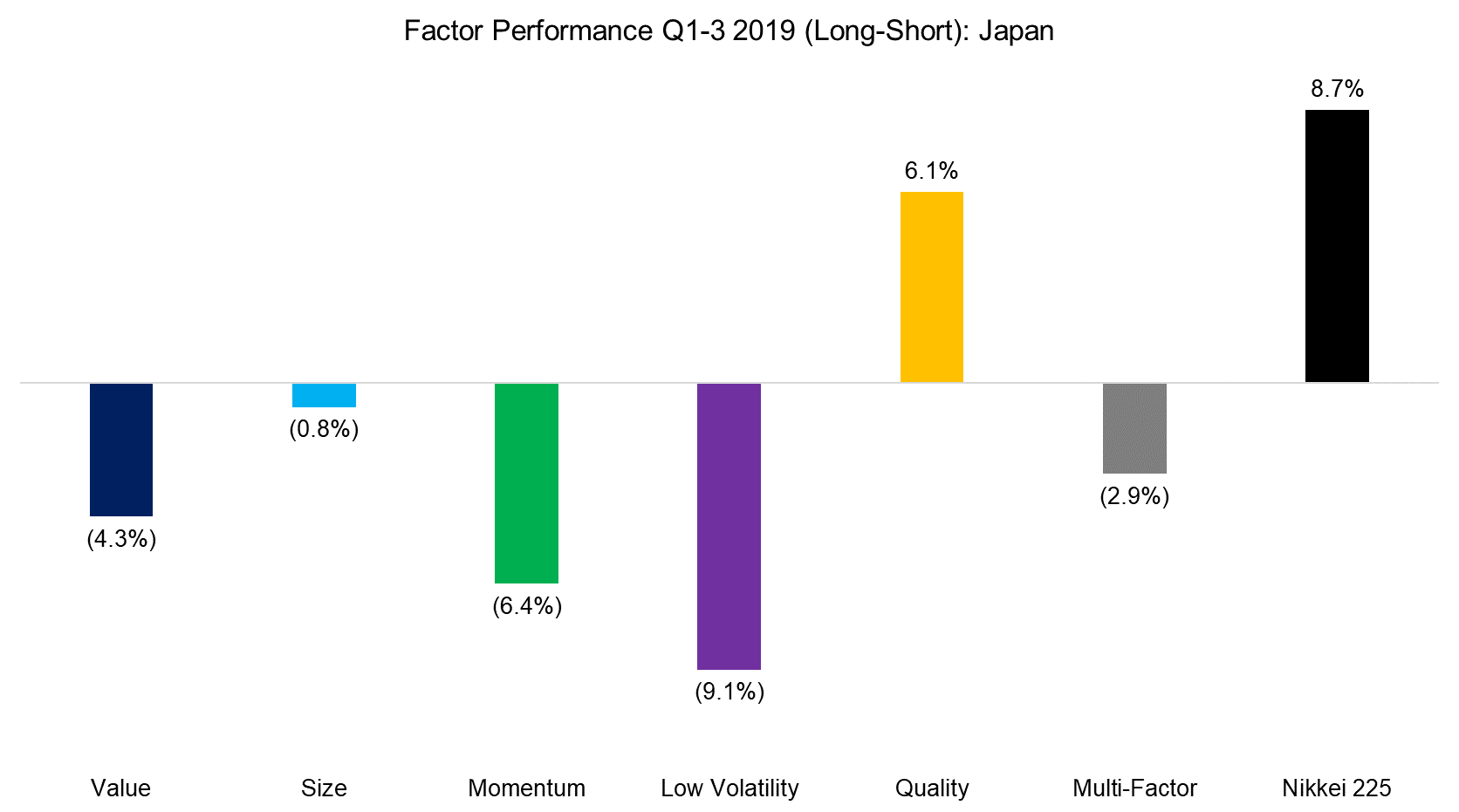

FACTOR PERFORMANCE Q1-3 2019: JAPAN

The long-term returns of common equity factors in the Japanese stock market have been lower than globally, but the trends in performance were typically the same, e.g. Value in Japan mirrors Value globally. However, in the first three quarters of 2019, the factor performance has been markedly different to that in US and European stock markets (read Equity Factors In Japan).

None of the common equity factors were positive, except for Quality. The difference to global markets is especially apparent for Low Volatility, which generated the strongest returns in the US and Europe, but the weakest in Japan. Perhaps the performance reflects that Japanese bond yields have reached zero decades ago and provide less tailwind for low-risk stocks than in other markets.

Source: FactorResearch

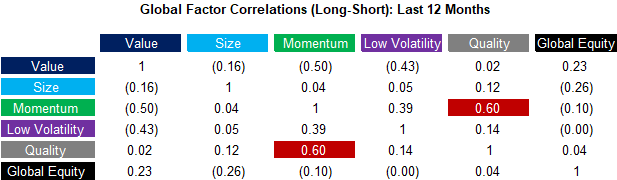

FACTOR CORRELATIONS

The correlation matrix below highlights the global one-year factor correlations. Some market commentators explained the recent factor rotation from Momentum to Value by extremely negative correlations. Although this might be correct when analyzing the factor correlations over the last few years, it does not hold if we extend the lookback to the last 20 years. For example, Value and Momentum currently exhibit a correlation of -0.5, but reached almost -0.9 during the global financial crisis in 2009 (read Factors: Correlation Check).

Source: FactorResearch

FURTHER THOUGHTS

Most investors pursuing factor investing have exposure to the Value factor and rejoiced when the factor, which has been declining since the end of the global financial crisis in 2009, quickly gained close to 10% in a few days at the beginning of September. Investors naturally hoped for a structural shift in trends and a long-term revival of the Value factor, but that does not seem to be the case yet.

It has been only a decade of underperformance for investors focused on buying cheap stocks. In comparison, the Size factor experienced a couple of 20+ year periods with consistently negative returns. Like the rock musician Randy Bachman sang: “You ain’t seeing nothing yet”.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.