Factor Olympics Q1 2021

And the winner is…

April 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Q1 2021 featured a major factor rotation

- Value & Size, the losers of previous years, are leading the scoreboard

- In contrast, Momentum, Quality, and Low Volatility have generated negative returns

INTRODUCTION

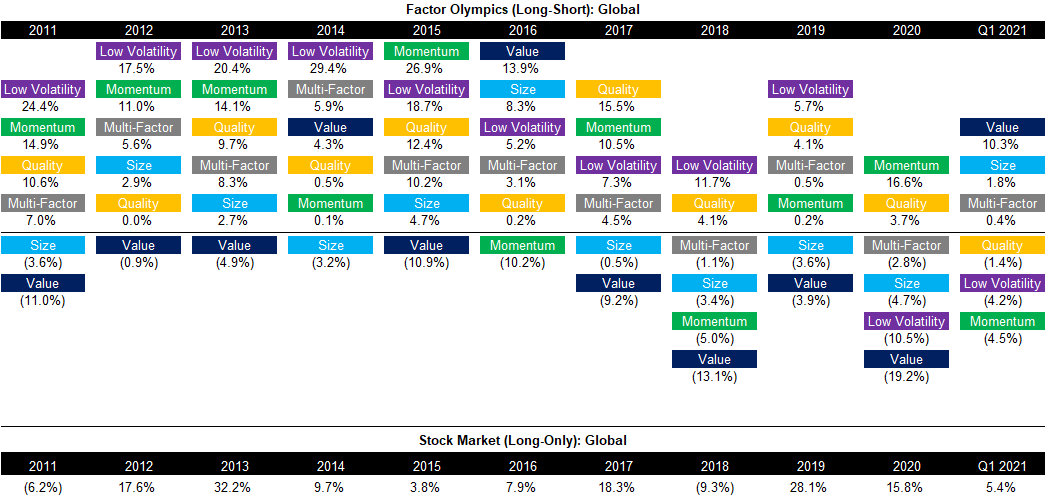

We present the performance of five well-known factors on an annual basis for the last 10 years. Specifically, we only present factors where academic research supports the existence of positive excess returns across market cycles and asset classes (read Factor Olympics 2020).

METHODOLOGY

Our factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe, and Japan, and 20% in smaller markets. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

FACTOR OLYMPICS: GLOBAL RETURNS

The table below shows the long-short factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from displaying the factor performance, the analysis highlights the significant factor rotation in terms of profitability from one year to the next, highlighting the benefits of diversified exposure.

However, even a diversified factor portfolio has not been particularly attractive when reviewing the returns of an equal-weighted multi-factor portfolio over the last few years. This poor performance gives frequently rise to the question if factor investing has become structurally unattractive based on its popularity and associated capital inflows.

However, there is very little data that supports this argument. In fact, the Value factor is trading at a multi-decade low based on a fundamental valuation and can be considered cheap and uncrowded rather than expensive and crowded.

Source: FactorResearch

TRENDS IN GLOBAL FACTOR PERFORMANCE

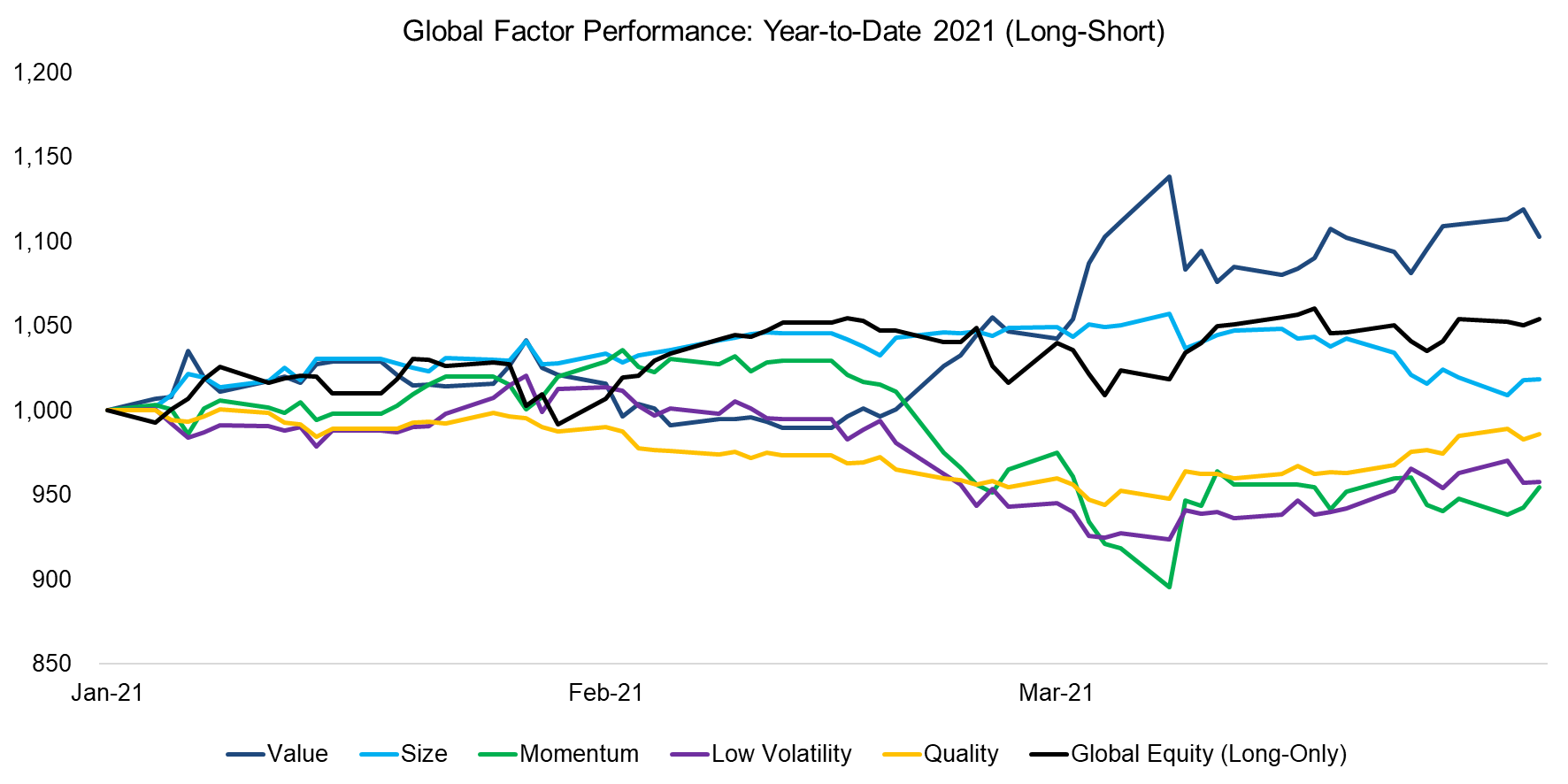

The first quarter of 2021 looks significantly different than the previous years as the Value and Size factors are leading in the performance scoreboard, while the former champions namely Momentum, Low Volatility, and Quality generated negative returns.

These trends are not surprising and simply mirror the global economic recovery based on the successful COVID-19 vaccination programs. Investors tend to buy cheap and small-cap stocks when they are less concerned about stock markets and the economy. This relationship can be measured by various ways, e.g. almost all of the Value factor’s positive returns in the US can be attributed to periods when the GDP was growing. In contrast, factor returns were negative when the economy was declining.

Source: FactorResearch

PERFORMANCE OF LONG-SHORT MULTI-FACTOR PRODUCTS

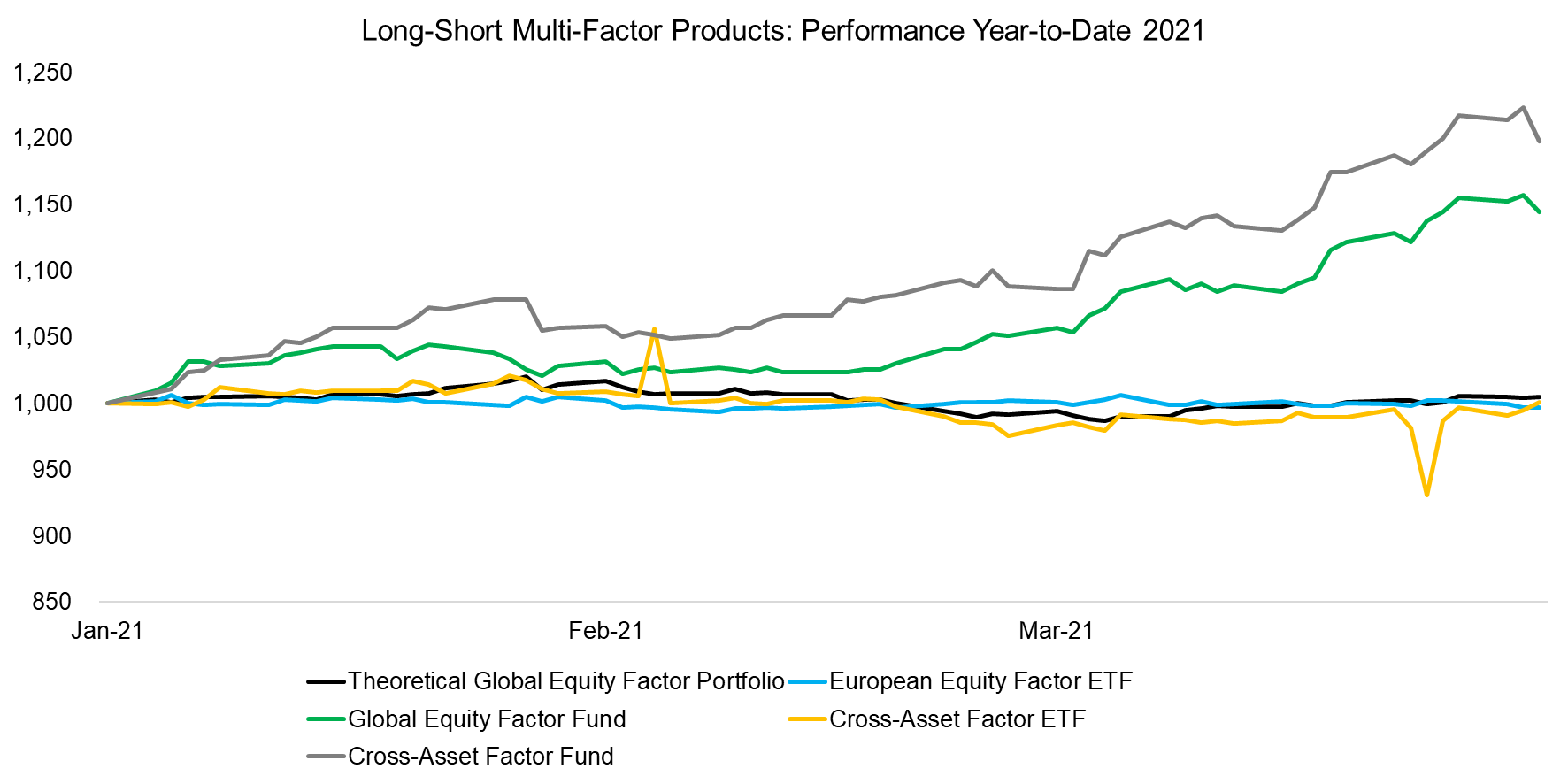

The poor returns in factor investing have led to the liquidation of many investment products that provided exposure to factors in the long-short format as seen in academic research. We highlight the performance of four surviving products that are available as ETFs and liquid alternative mutual funds to most investors.

We observe rather divergent performance across the products in the first quarter of 2021. The global equity factor product has performed significantly better than its European version, which is flat. The cross-asset factor fund is up almost 20%, although a similar themed ETF vehicle has generated a null return.

It is worth noting that the two well-performing products are from the same asset management company, a large and famous quant shop, and that equities represents the largest allocation within the cross-asset fund. In previous years these two products performed considerably worse than the others and the theoretical portfolio. The divergent returns are explained by different portfolio construction, although it is surprising that the trends are not more similar as they usually are.

Source: FactorResearch

SMART BETA EXCESS RETURNS

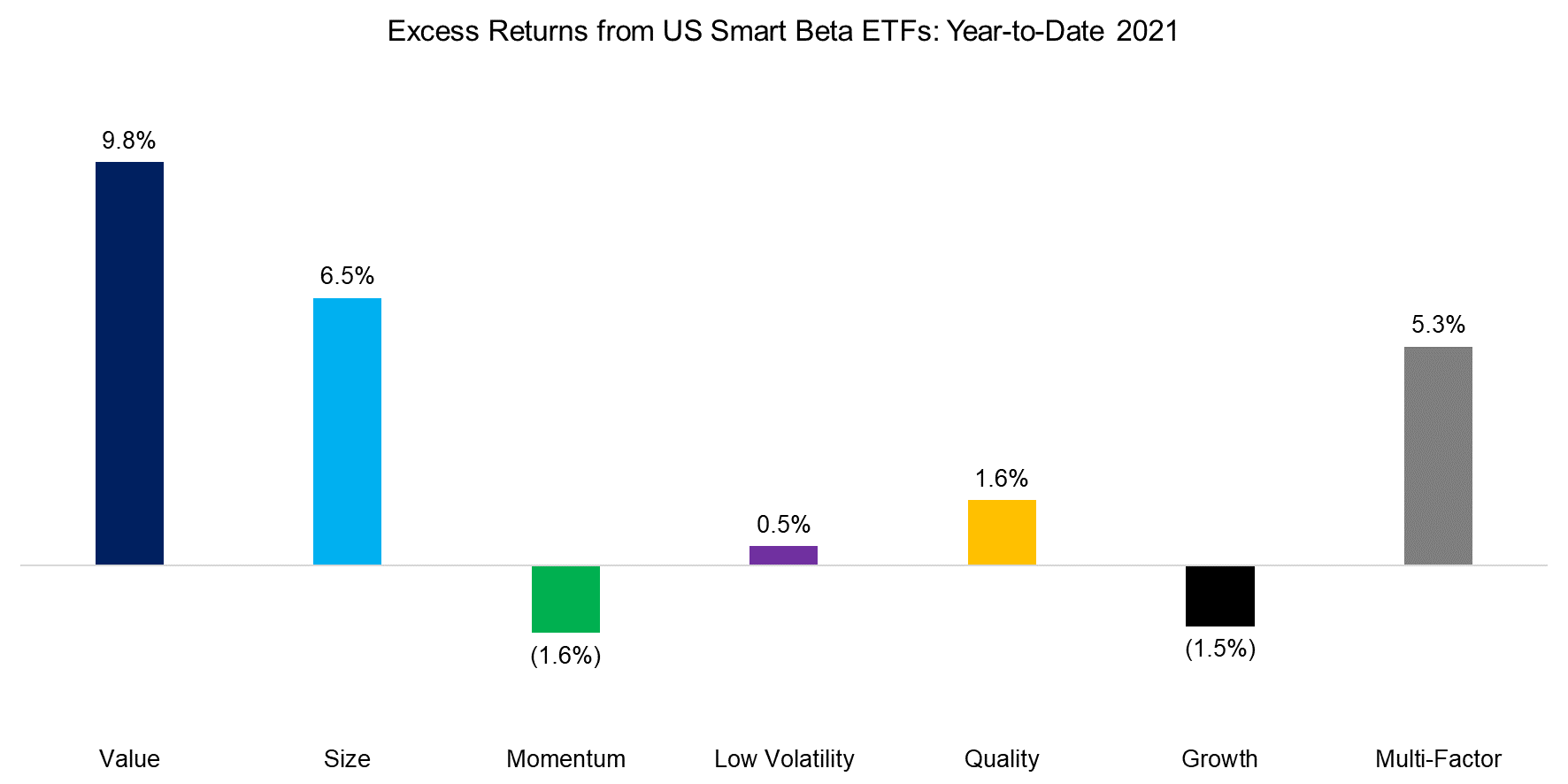

Although investors should allocate to factors constructed as long-short portfolios given that these offer high diversification benefits, most invest via long-only smart beta ETFs. Following the money, we highlight the excess returns generated from investing in smart beta ETFs in the US, which represents a universe of 170+ products and approximately $800 billion of assets under management (read Smart Beta or Smart Marketing).

We observe that the trends in performance from long-only factor investing were approximately the same as when allocating to long-short portfolios, as expected. The returns will naturally be somewhat different as long-short factor portfolios are constructed beta-neutral, i.e. there is a short portfolio and leverage is used to achieve beta-neutrality, and stocks are typically weighted equally. Smart beta ETFs are long-only and mostly weight stocks by their market capitalization.

Although growth is not a factor where academic research highlights positive excess returns over time, we have included the factor as it is a widely followed investment style. Investors have allocated as much capital to smart beta ETFs pursuing growth stocks as to ones pursuing value investing, despite the lack of empirical evidence for positive returns.

Source: FactorResearch

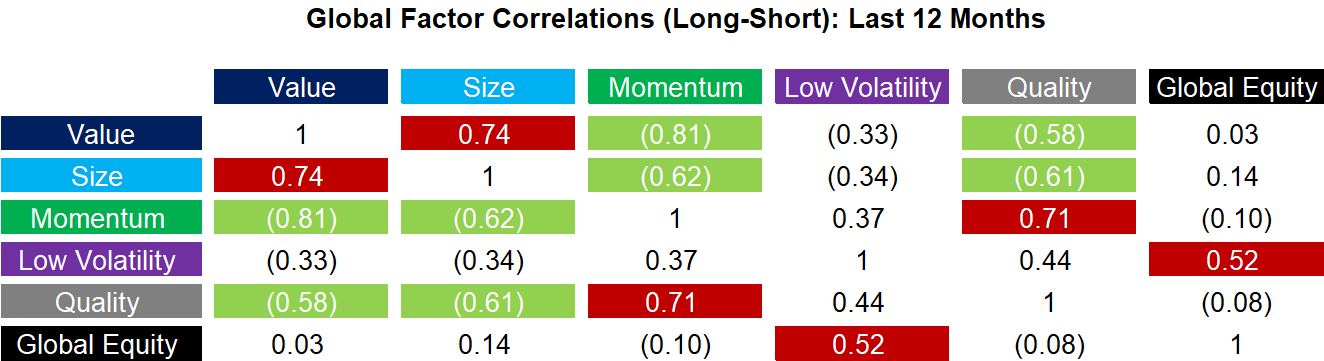

FACTOR CORRELATIONS

The correlation matrix below highlights the global one-year factor correlations based on daily data. As of the first quarter of 2021, we essentially observe two highly correlated factor groups: Value and Size versus Momentum and Quality. This correlation structure can be considered normal, e.g. Value and Momentum tend to be negatively correlated over time. However, the magnitude of the correlations is relatively high and should give investors pause for consideration if they have too much of the same exposure in their portfolios.

Source: FactorResearch

FURTHER THOUGHTS

The most frequent question in factor investing year-to-date is if the rotation to Value will fade again as in previous years. To increase the probability of making the right call, investors could wait for another nine months or so, and if performance is positive, make the case that there is momentum in the Value factor. There is research, including our own, that highlights momentum can be applied to factors as well as to any other asset class.

However, waiting so long could mean that investors miss out on attractive returns. The key driver of the value factor seems risk sentiment, which can be measured via different market-derived and economic variables, e.g. volatility, skewness, the yield curve, economic growth, etc. These shouldn’t be considered for timing the Value factor, but more for avoiding environments that are riskier for cheap stocks. Currently, most of these look favorable for the Value factor.

RELATED RESEARCH

The Value Factor’s Pain: Are Intangibles to Blame?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.