Factor Olympics Q1 2025

And the winner is…

April 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Momentum and low volatility maintain their winning streak

- Value rebounded from negative to positive, while quality moved in the opposite direction

- Several market-neutral multi-factor funds have hit all-time highs

INTRODUCTION

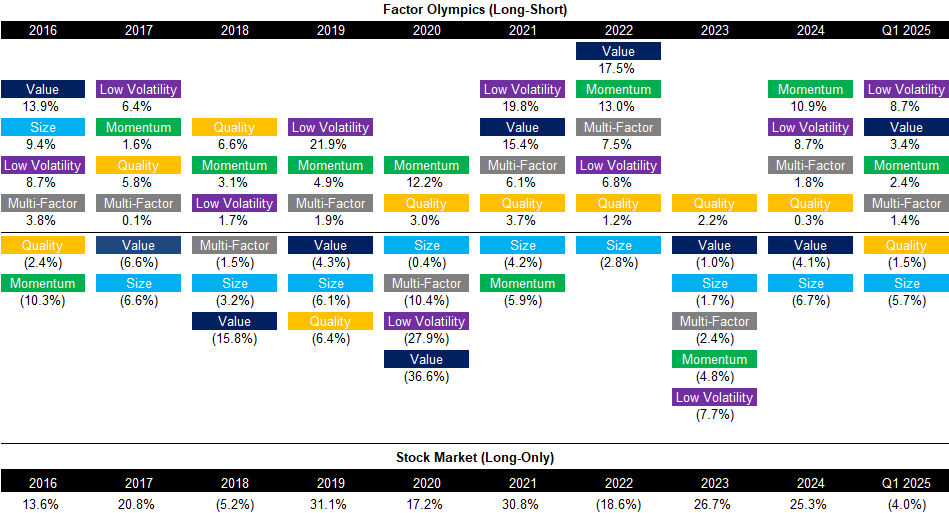

We present the performance of five well-known factors on an annual basis for the last 10 years. Specifically, we only present factors where academic research supports the existence of positive excess returns across market cycles and asset classes.

METHODOLOGY

Our factors are created by constructing long-short beta-neutral portfolios of the top and bottom 30% of stocks. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

FACTOR OLYMPICS: GLOBAL EXCESS RETURNS

The table below shows the long-short factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from displaying the factor performance, the analysis highlights the significant factor rotation in terms of profitability from one year to the next, highlighting the benefits of diversified exposure.

Low volatility and momentum factors have extended their winning streak from last year. In contrast, the quality factor shifted from positive to negative performance in the first quarter of 2025, while value moved in the opposite direction. Meanwhile, the size factor has posted negative returns in eight of the past nine years.

A theoretical portfolio providing equal-weighted exposure to all five factors would have generated 1.4% before management fees.

Source: Finominal

TRENDS IN GLOBAL FACTOR PERFORMANCE

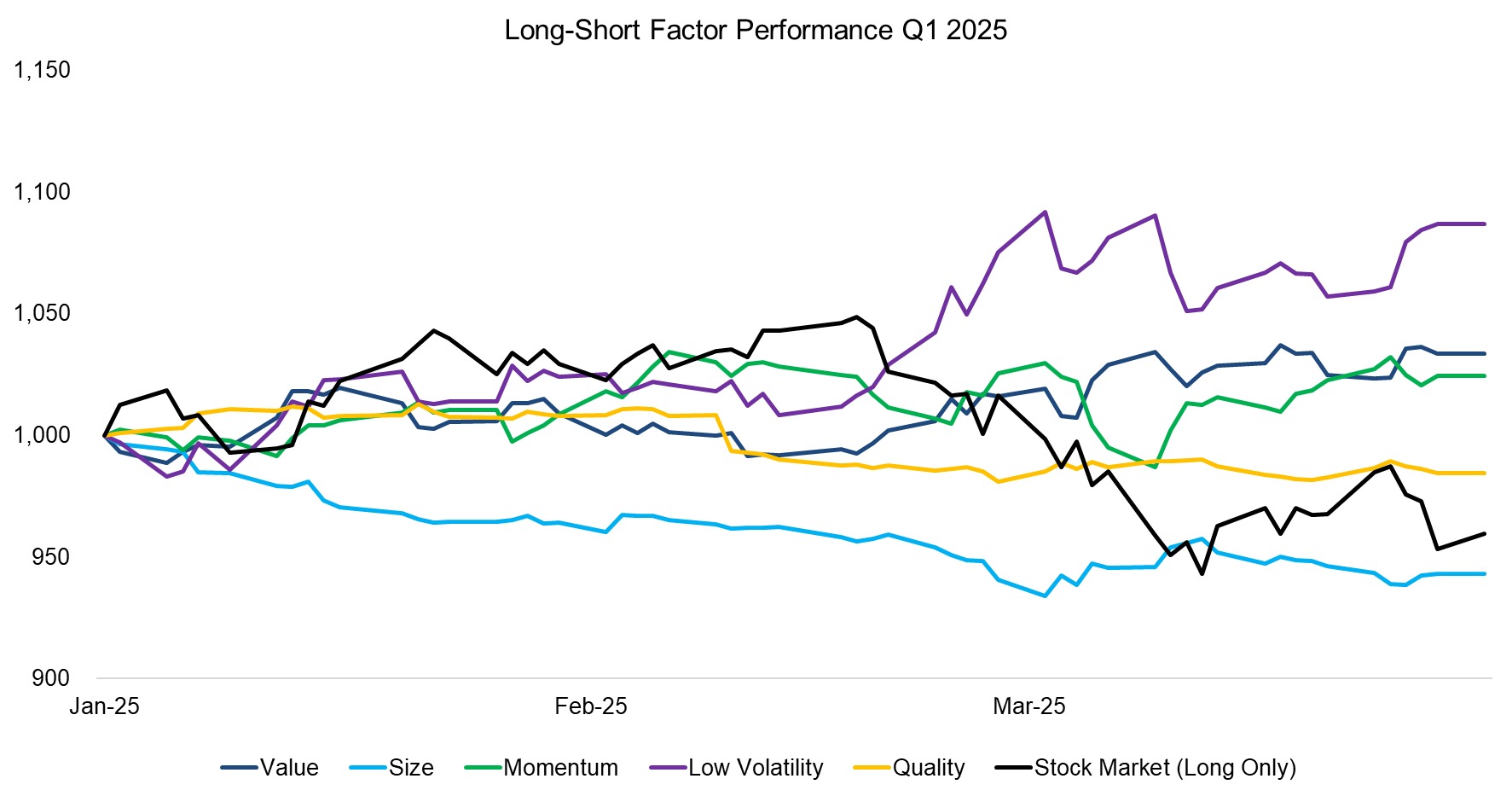

Factor performance in the first quarter of 2025 reveals two clear trends: low volatility has been steadily rising, particularly since the inauguration of the new U.S. government, while the size factor continues its consistently negative trajectory.

Source: Finominal

PERFORMANCE OF LONG-SHORT MULTI-FACTOR PRODUCTS

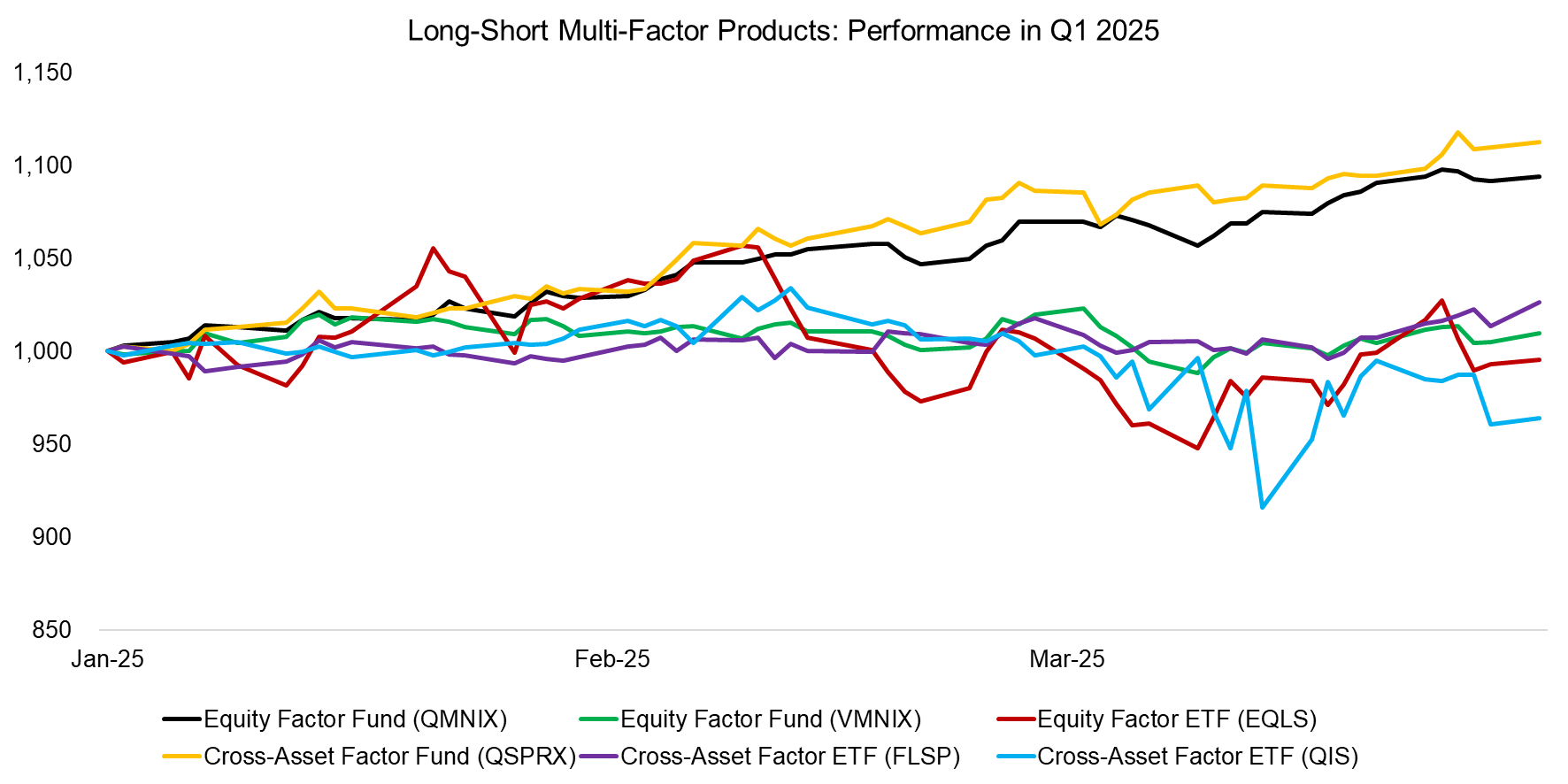

Only a handful of liquid alternative mutual funds and ETFs offer pure long-short factor exposure, as seen in academic research. Despite numerous fund liquidations over the past decade, Simplify Asset Management introduced two new products in 2023: the Simplify Market Neutral Equity Long/Short ETF (EQLS) and the Simplify Multi-QIS Alternative ETF (QIS), both designed to provide exposure to equity and cross-asset factors.

AQR’s Equity Market Neutral Fund (QMNIX) and Style Premia Alternative Fund (QSPRX) delivered approximately 10% returns in the first quarter of 2025, outperforming other products, which saw flat to negative returns.

Source: Finominal

SMART BETA EXCESS RETURNS

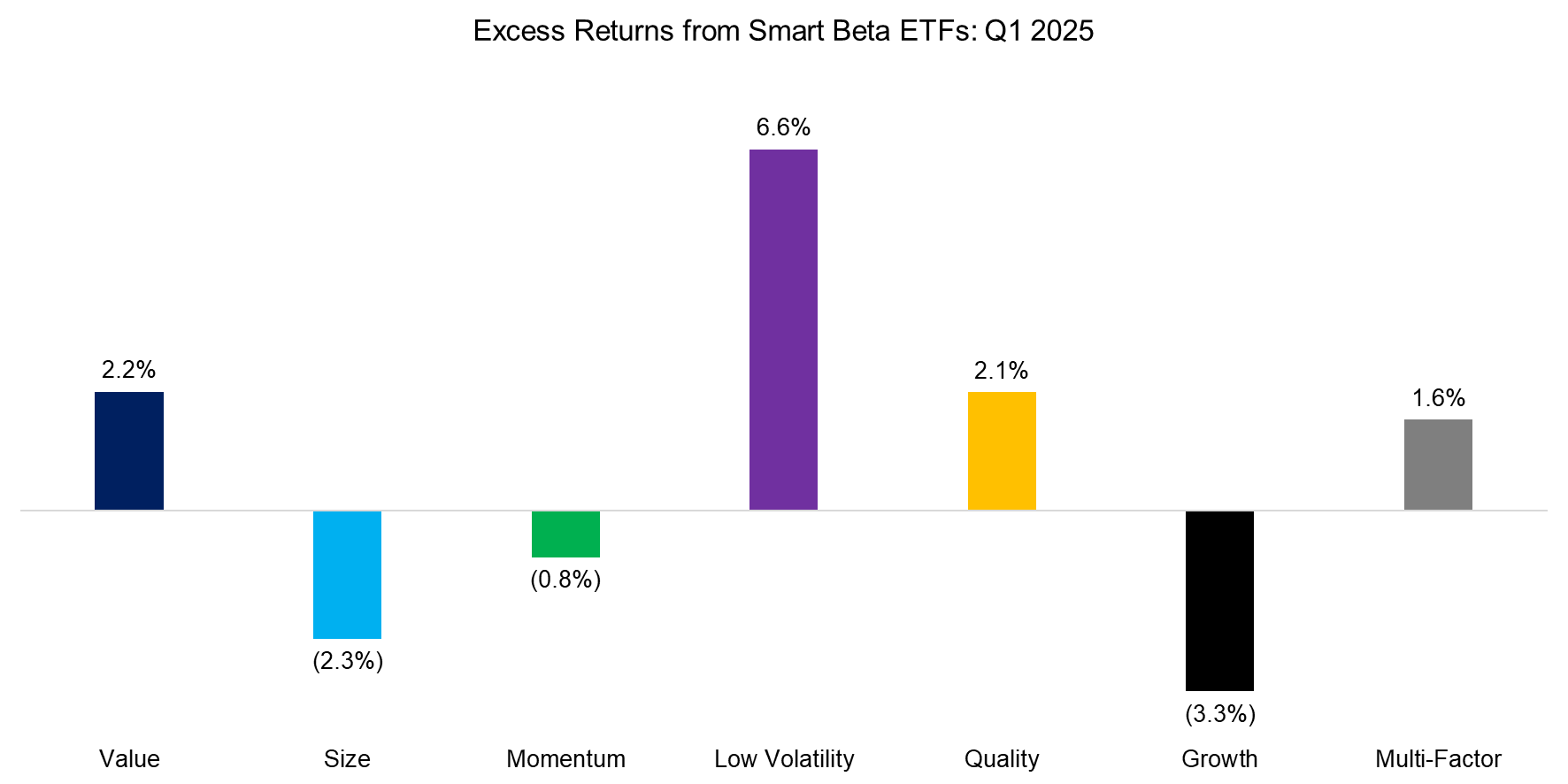

Although investors should allocate to factors constructed as long-short portfolios given that these offer high diversification benefits, most invest via long-only smart beta ETFs (read Smart Beta vs Alpha + Beta). Following the money, we highlight the excess returns generated from investing in smart beta ETFs in the US, which represents a universe of 160+ products and approximately $800 billion of assets under management. We also show the performance of the growth factor, which is popular with investors but is not associated with positive excess returns over time (read What Are Growth Stocks?).

We observe that there are some differences, but also some similarities between long-short and long-only factor investing. Value, small-cap, and low volatility-focused smart beta ETFs produced positive excess returns, mirroring the positive factor returns. However, opposite signs in returns are observed for momentum and quality funds (read Market-Neutral versus Smart Beta Factor Investing).

Source: Finominal

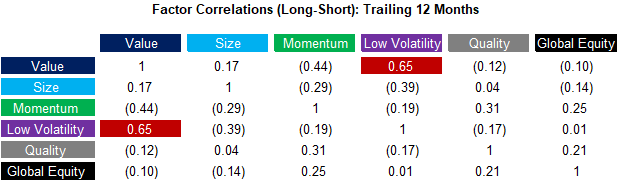

FACTOR CORRELATIONS

The 12-month factor correlations have become more extreme again, with low volatility and value showing a strong positive correlation – reminiscent of the tech bubble in 2000. As history showed, that bubble eventually burst, paving the way for strong performance in cheap, low-volatility stocks. While history may not repeat exactly, it often echoes.

Source: Finominal

FURTHER THOUGHTS

After a decade of skepticism toward factor investing, it’s refreshing to see multi-factor products like AQR’s Equity Market Neutral Fund (QMNIX) and Vanguard’s Market Neutral Fund (VMNIX) hitting new all-time highs. With their attractive, uncorrelated returns, these funds are well-suited for portfolio diversification in an environment of growing economic and political uncertainty.

RELATED RESEARCH

Market-Neutral versus Smart Beta Factor Investing

Improving Smart Beta Attribution Analysis II

Quality in Small versus Large-Cap Stocks

The Illusion of the Small-Cap Premium

Shorting Lousy Stocks = Lousy Returns?

Higher Volatility, Higher Alpha?

Outperformance Ain’t Alpha

Improving the Odds of Value Investing

The Value Factor’s Pain: Are Intangibles to Blame?

Smart Beta vs Alpha + Beta

How Painful Can Factor Investing Get?

GARP Investing: Golden or Garbage? II

Are Low-Risk Stocks Really Low-Risk?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.