Factor Olympics Q2 2021

And the winner is…

July 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The Q1 2021 factor rotation into Value and Size has reversed

- Value is the only factor with positive performance in 1H 2021

- Momentum has generated the most negative returns

INTRODUCTION

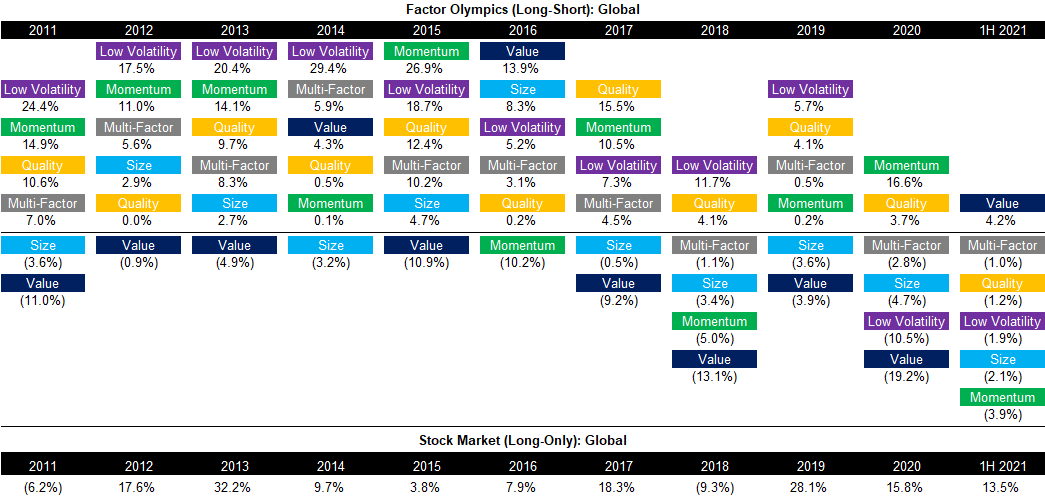

We present the performance of five well-known factors on an annual basis for the last 10 years. Specifically, we only present factors where academic research supports the existence of positive excess returns across market cycles and asset classes (read Factor Olympics Q1 2021).

METHODOLOGY

Our factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe, and Japan, and 20% in smaller markets. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

FACTOR OLYMPICS: GLOBAL RETURNS

The table below shows the long-short factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from displaying the factor performance, the analysis highlights the significant factor rotation in terms of profitability from one year to the next, highlighting the benefits of diversified exposure.

However, even a diversified factor portfolio has not been particularly attractive in recent years when reviewing the returns of an equal-weighted multi-factor portfolio, which has also generated a negative performance in 1H 2021. Given that all factors except Value made losses, this is not particularly surprising.

Source: FactorResearch

TRENDS IN GLOBAL FACTOR PERFORMANCE

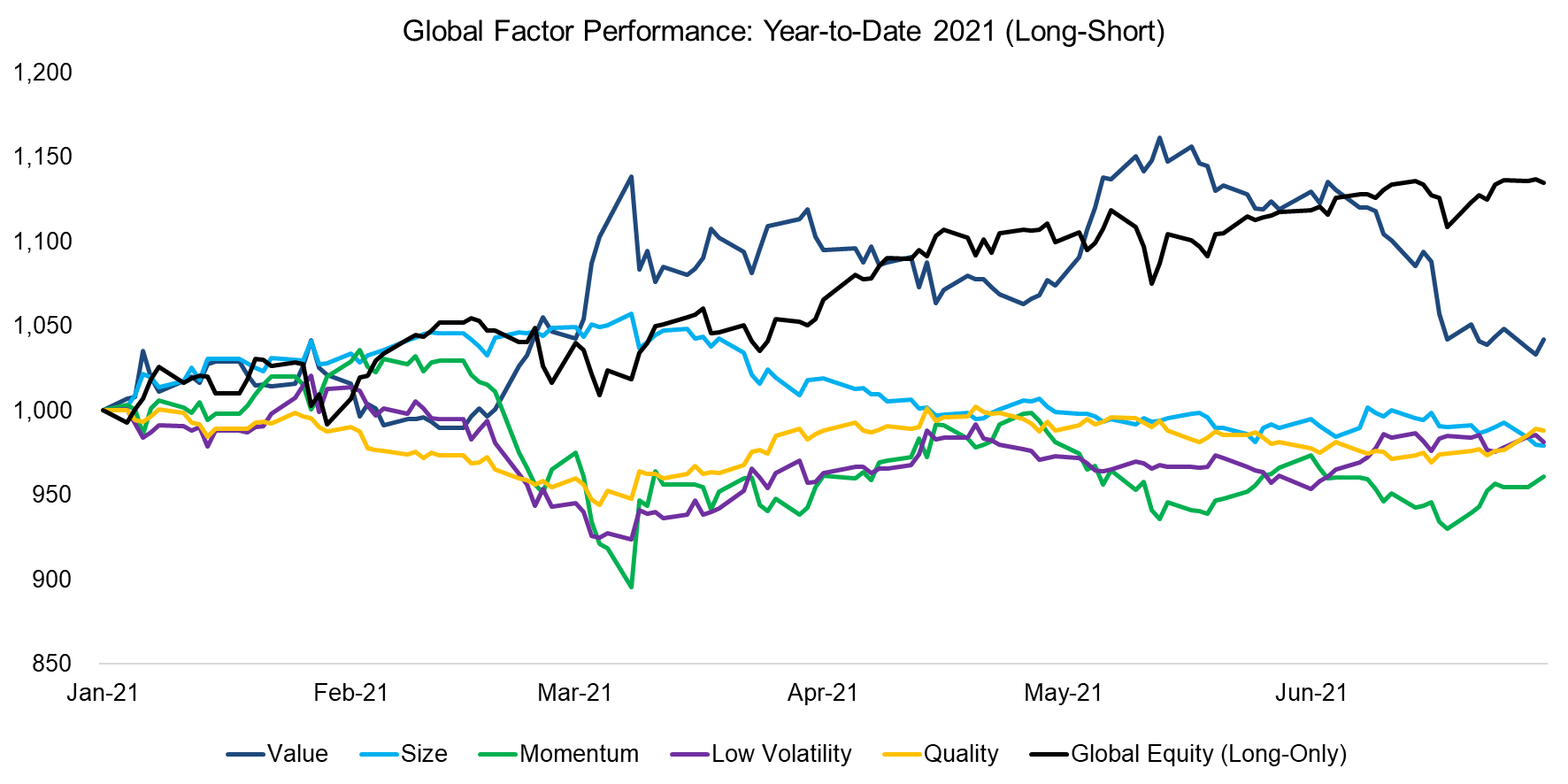

The first quarter of 2021 started differently than in previous years as Value and Size produced strong, positive returns, where the increased interest in these two factors was primarily attributed to the strong global economic recovery from last years’ crisis.

However, investors’ enthusiasm for small stocks fizzled out quickly, and even cheap stocks gave up a significant amount of their year-to-date returns. The Fed’s communication on potential interest rate hikes in 2022 likely explains the lower enthusiasm for riskier stocks, which perform best when economic growth and inflation are increasing.

It is interesting to note that investors have not simply traded Value for Momentum, Low Volatility, or Quality, as these factors did not generate strong returns when cheap stocks underperformed in the second quarter of 2021. It seems that investors have reallocated capital to other investment styles, perhaps Growth or Dividend Yield.

Source: FactorResearch

PERFORMANCE OF LONG-SHORT MULTI-FACTOR PRODUCTS

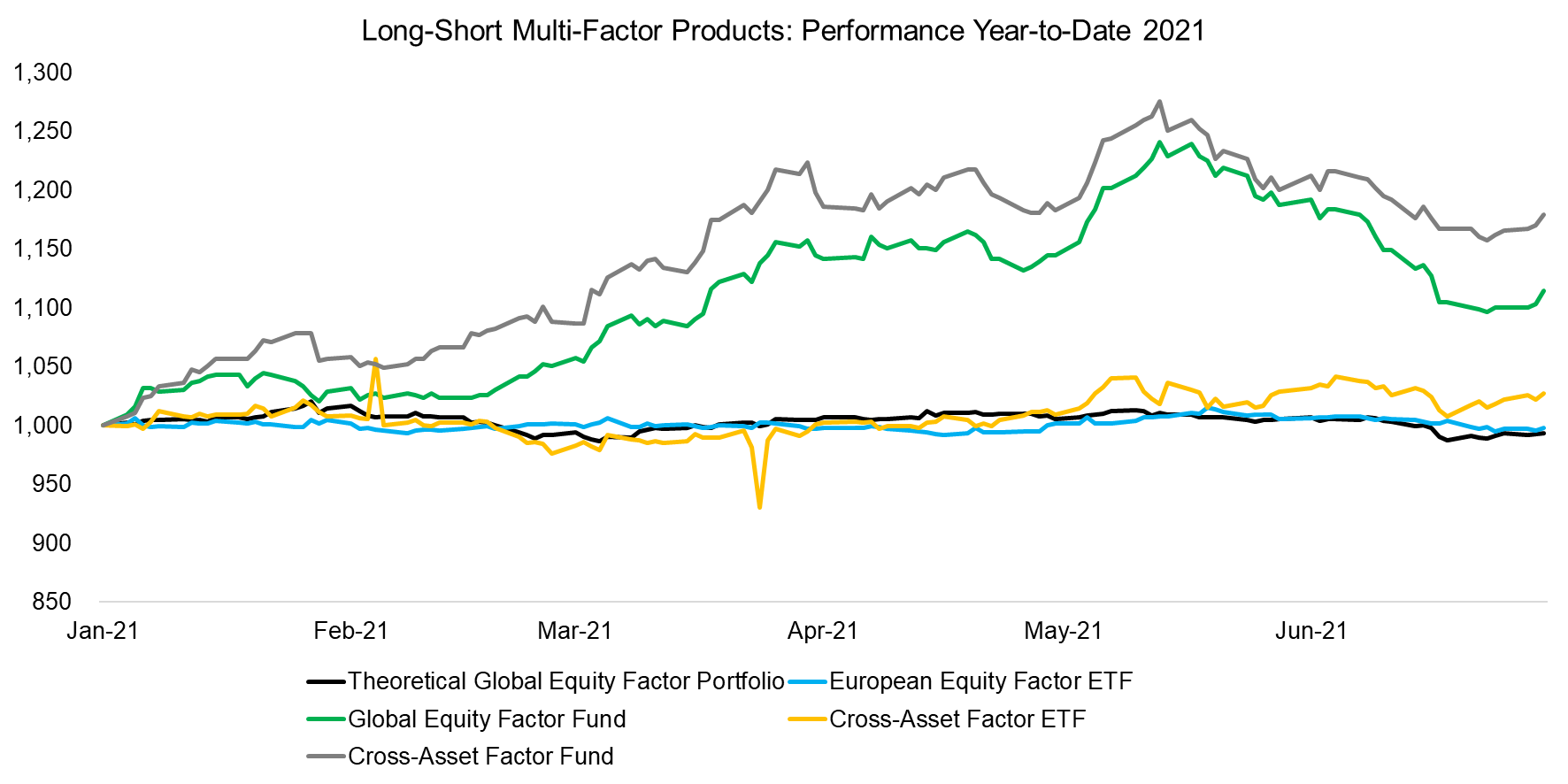

There are only a few liquid alternative mutual funds and ETFs that provide exposure to factors in the long-short format as seen in academic research. Given the poor performance of factor investing in recent years, many products were liquidated.

We highlight the performance of four surviving products and observe rather divergent performance in the first half of 2021. The Global Equity Factor and Cross- Asset Factor Fund are from the same asset management company, and equities represents the largest allocation within the cross-asset fund, which explains why they are highly correlated. Their performance reflects a large exposure to the Value factor, which performed well in Q1, but less well in Q2 of 2021.

The other two products generated similar returns to the theoretical multi-factor portfolio, which was essentially zero in the first half of 2021. Their volatility was also exceptionally low, which could make them substitutes for fixed-income products.

Source: FactorResearch

SMART BETA EXCESS RETURNS

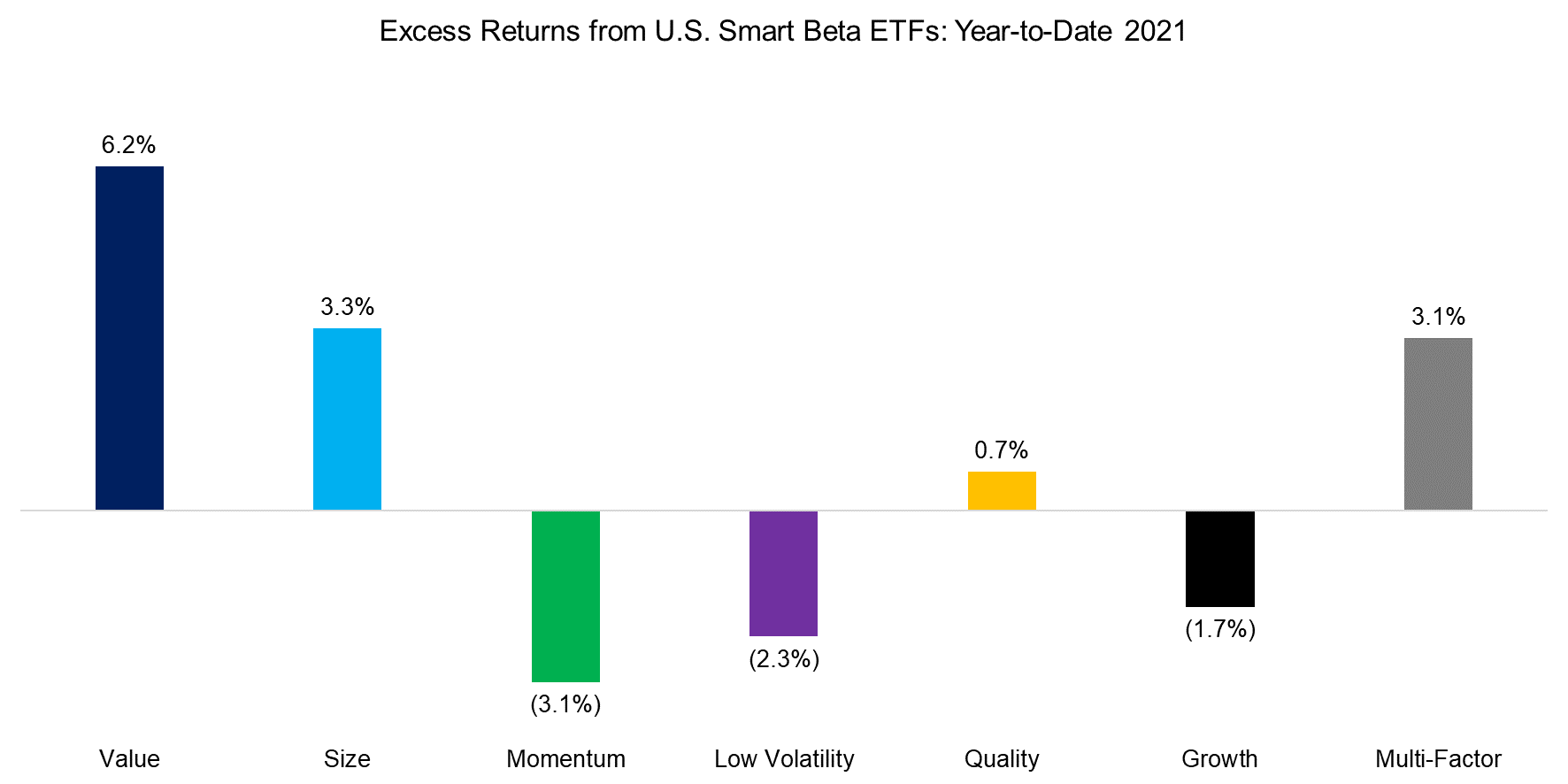

Although investors should allocate to factors constructed as long-short portfolios given that these offer high diversification benefits, most invest via long-only smart beta ETFs. Following the money, we highlight the excess returns generated from investing in smart beta ETFs in the US, which represents a universe of 170+ products and approximately $800 billion of assets under management (read ETFs, Smart Beta & Factor Exposure).

The returns will naturally be somewhat different as long-short factor portfolios are constructed beta-neutral, i.e. there is a short portfolio and leverage is used to achieve beta-neutrality, and stocks are typically weighted equally. Smart beta ETFs are long-only and mostly weight stocks by their market capitalization.

We observe that the trends in performance from long-only factor investing were approximately the same as when allocating to long-short portfolios, except for the Size factor. Value smart beta ETFs generated the highest excess returns.

Source: FactorResearch

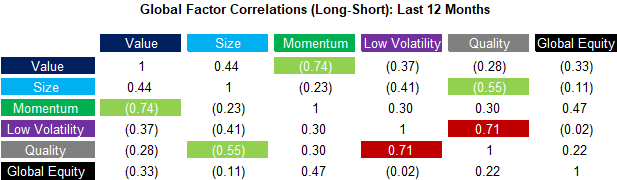

FACTOR CORRELATIONS

The correlation matrix below highlights the global one-year factor correlations based on daily data. As of the first half of 2021, we essentially observe a strongly negative correlation between Value and Momentum, as well as a highly positive correlation between Low Volatility and Quality. The former correlation is structural, while the latter is temporary.

Source: FactorResearch

FURTHER THOUGHTS

In theory, asset managers that offer long-short factor products have a significant opportunity to gather assets in the coming years as investors are searching for fixed-income alternatives. Trillions are invested in instruments and strategies that are far less attractive given low bond yields. Long-short factor products are uncorrelated to equities given beta-neutrality, can be constructed to feature low volatility like bonds, and are widely supported by academic research.

In practice, it is tough for any strategy to compete as a fixed-income alternative. The asset class went through a 40-year bull market that is fresh in investors’ minds, is easy to understand, and feels safe given the backing of governments and corporates. The poor performance of common equity factors in recent years does not help, so it will likely take time before any significant allocation changes will occur.

RELATED RESEARCH

Improving the Odds of Value Investing

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.