Factor Olympics 2020

And the winner is…

January 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Momentum has been the clear winner across markets in 2020

- Value has been the laggard like in recent years

- Low Volatility ended a 10-year fantastic run

INTRODUCTION

We present the performance of five well-known factors on an annual basis for the last 10 years. We only present factors where academic research supports the existence of positive excess returns across market cycles and asset classes. Strategies like Growth might be widely-followed investment styles, but lack academic support to be considered a factor and are therefore excluded (read Factor Olympics Q3 2020).

METHODOLOGY

Our factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe and Japan, and 20% in smaller markets. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

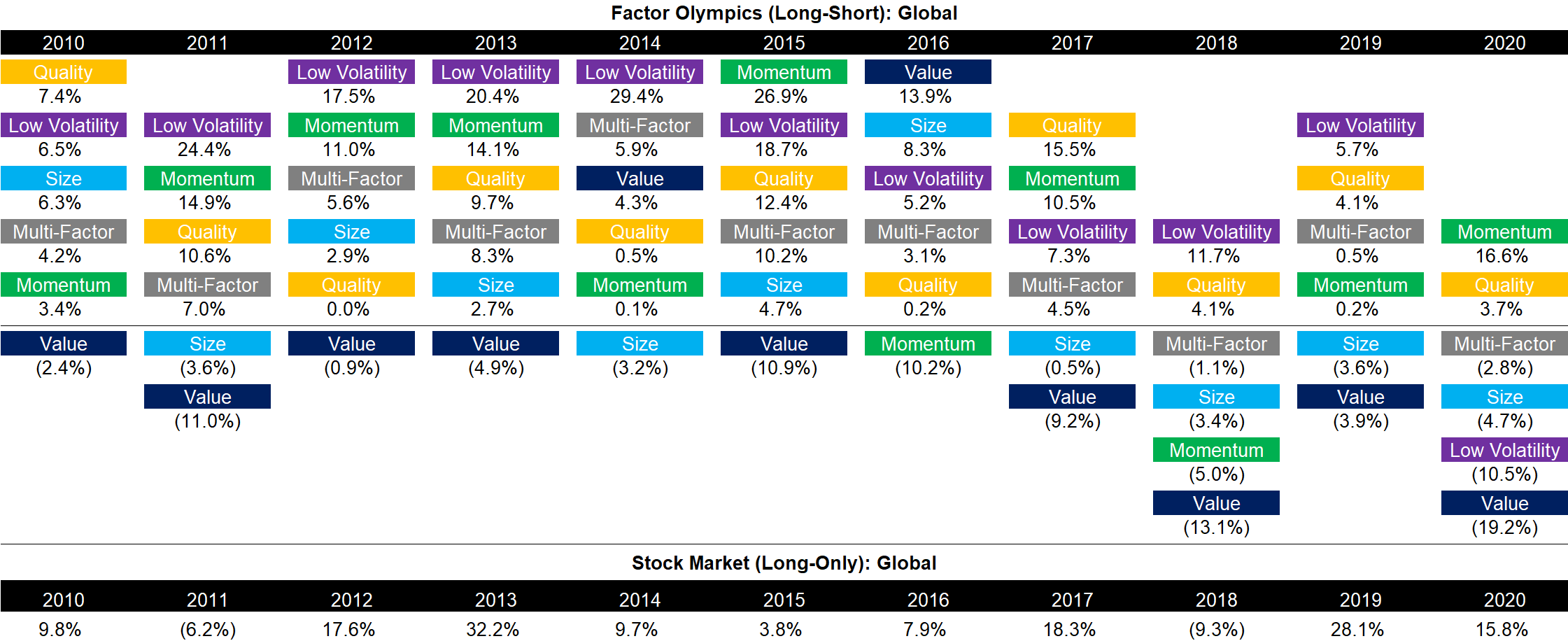

FACTOR OLYMPICS: GLOBAL

The table below shows the long-short factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from displaying the factor performance, the analysis highlights the significant factor rotation in terms of profitability from one year to the next, highlighting the benefits of diversified exposure.

However, even a diversified factor portfolio has not been particularly attractive when reviewing the returns of an equal-weighted multi-factor portfolio over the last three years. This poor performance gives frequent rise to the question if the excess returns of common equity factors like Value have been arbitraged away due to too much money pursuing factor investing strategies. However, there is very little data that supports this argument. In fact, the Value factor is trading at a multi-decade low based on a fundamental valuation and can be considered cheap and uncrowded rather than expensive and crowded.

Source: FactorResearch

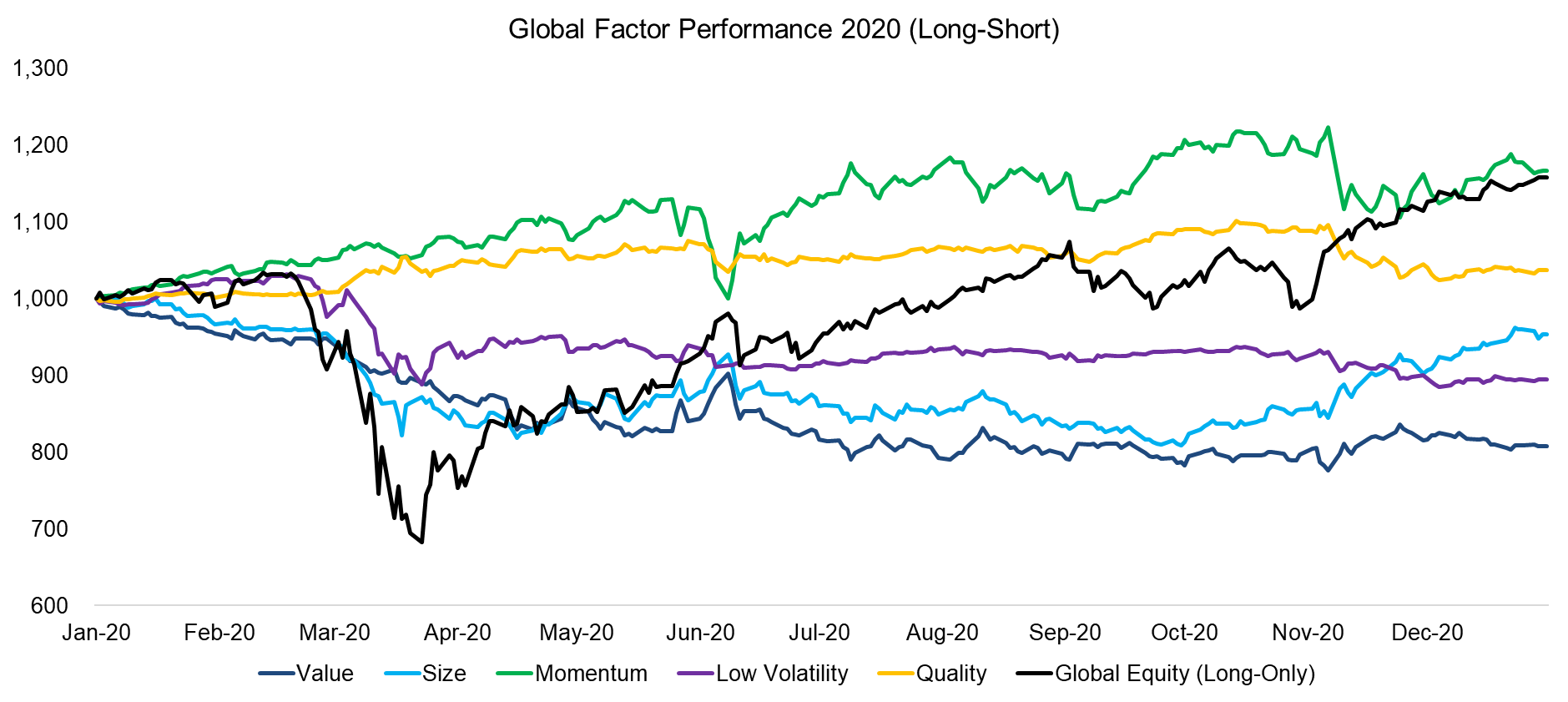

FACTOR PERFORMANCE 2020: GLOBAL

Despite all odds, global equity markets have recouped all losses from the first and second quarters of 2020 and ended the year positively with double-digit returns. However, in spite of the dramatic recovery and changes in our lifestyle, the trends in factor performance have continued to be relatively consistent throughout the year. It almost seems as there was no pandemic when looking at factors.

Momentum and Quality performed well before the onset of the COVID-19 crisis and have extended, partially accelerated, their positive returns since then. Similarly, cheap stocks are continuing to underperform with high consistency.

Small-cap stocks underperformed similarily to cheap stocks during the crisis, but recovered significantly in the fourth quarter. Low-risk stocks did not manage to recoup the losses generated at the beginning of the year.

Source: FactorResearch

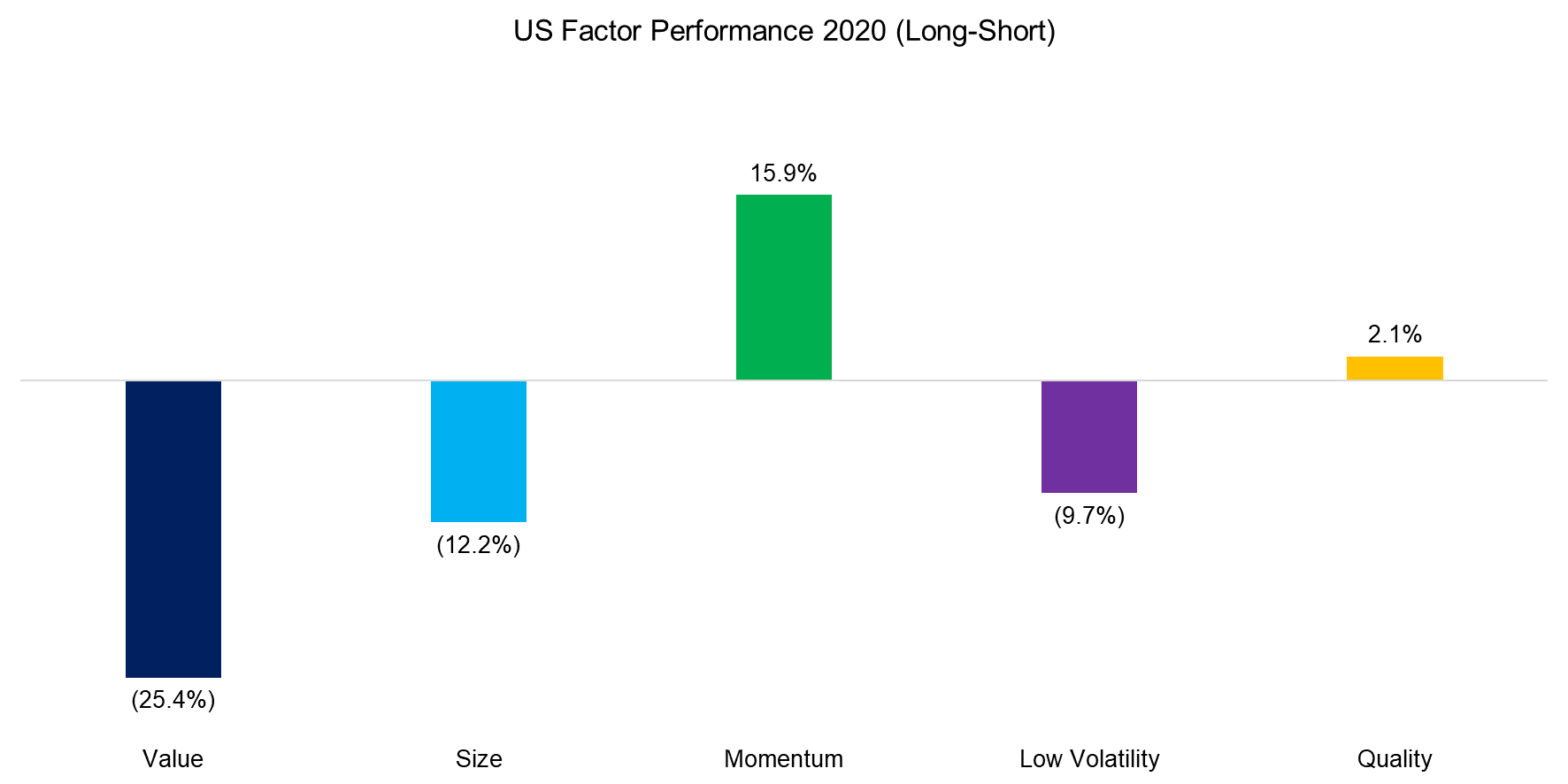

US FACTOR PERFORMANCE 2020

Global portfolios are significantly weighted towards the US, so it is not surprising that factor performance in the US and the global returns are much alike.

The dispersion of factor returns in the US has been high in 2020 with Momentum generating strong and Value exceptionally poor performance. Although it is easy to explain this performance by many technology companies like Zoom and Amazon, which are included in the long portfolio of Momentum and the short portfolio of Value, having fared better during the crisis than other businesses, it is worth recalling that this is a continuation rather than a new trend.

Low Volatility also performed poorly and likely disappointed investors as most expect this factor to outperform during a crisis. The poor returns can partially be attributed to the certain sector biases in the portfolio, i.e. long positions in unexciting, but low-risk sectors like real estate and short positions in more volatile sectors like technology. Being short Tesla or Netflix while long shopping center REITs was not helpful positioning for a pandemic, although that just reflects the nature of the portfolio construction.

Source: FactorResearch

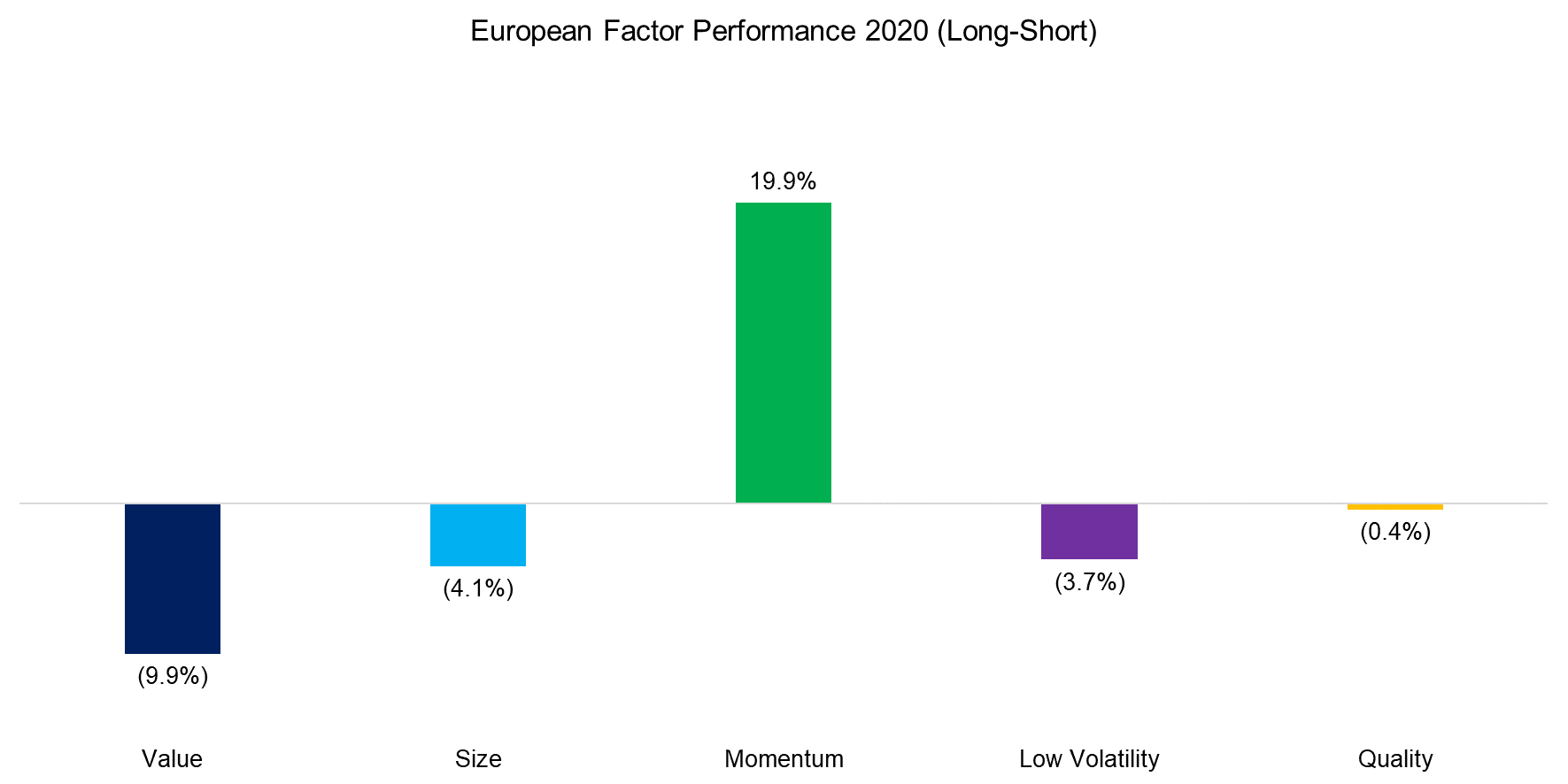

EUROPEAN FACTOR PERFORMANCE IN 2020

Factor performance in Europe is typically similar to the US in the direction of returns, which highlights that factors have the same performance drivers across markets.

2020 does not prove an exception and the performance of factors in Europe largely represents that of the US. It is interesting to observe that the Momentum factor had stronger returns in Europe than in the US despite Europe having a much smaller technology sector, e.g. the largest European technology company is the German software company SAP, which has a market capitalization of a mere $160 billion, compared to the trillions of Amazon or Apple. However, the factor performance can also be explained by the short portfolio, i.e. the losing stocks.

Source: FactorResearch

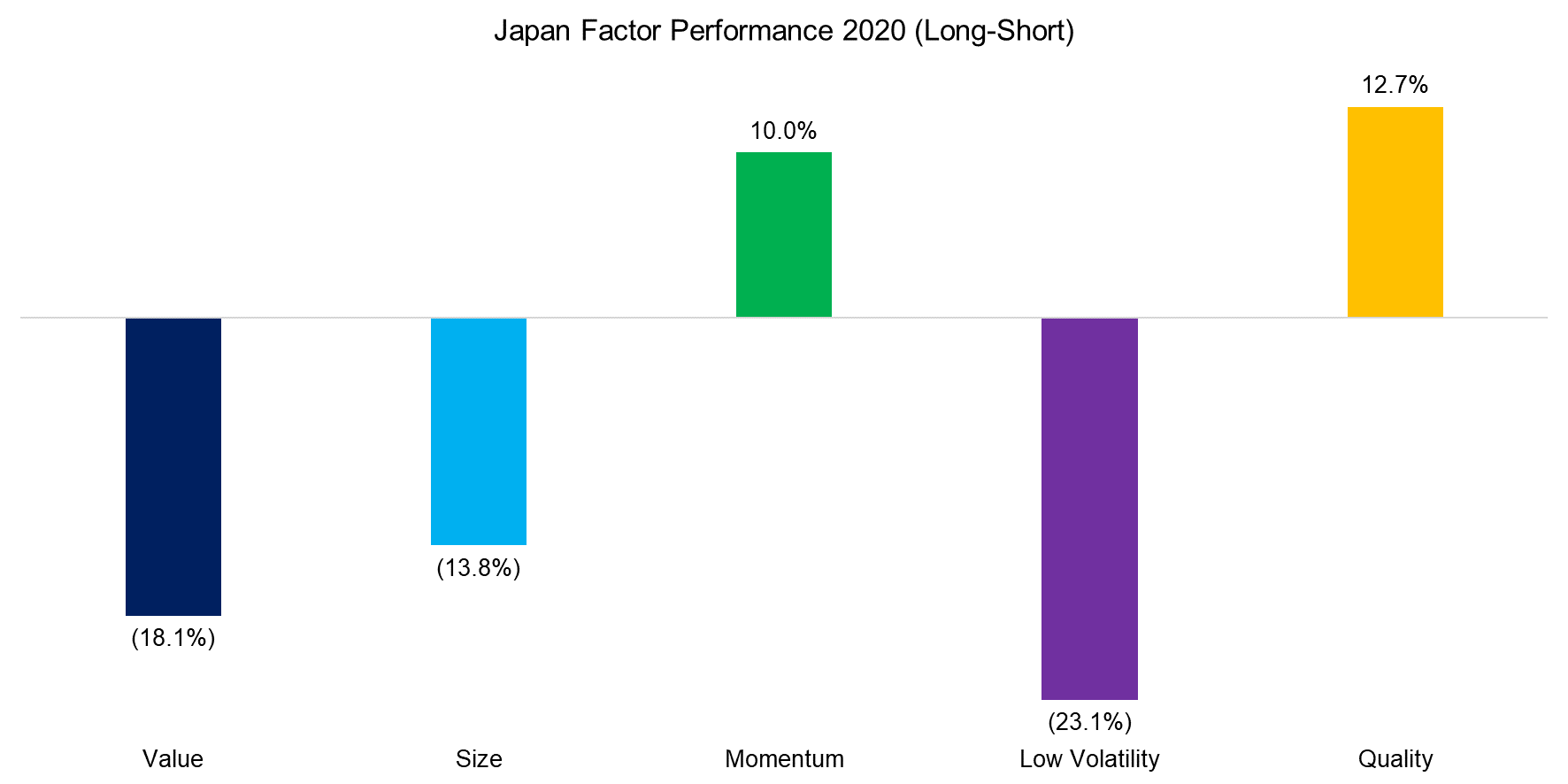

JAPAN FACTOR PERFORMANCE IN 2020

The long-term returns of common equity factors in the Japanese stock market have been lower than globally, but directionally the trends in performance were typically the same, e.g. Value in Japan mirrors Value globally.

The factor performance in Japan was even more dispersed than in the US and Europe in 2020 with all factors being up or down by more than 10%. If investors in the US were disappointed by the performance of the Low Volatility factor in 2020, then Japanese investors were likely even more dissatisfied given that it even underperformed the Value factor. Even though low-risk stocks offered capital protection characteristics in previous crises like during the GFC in 2008, it is worth mentioning that no strategy works all of the time.

Source: FactorResearch

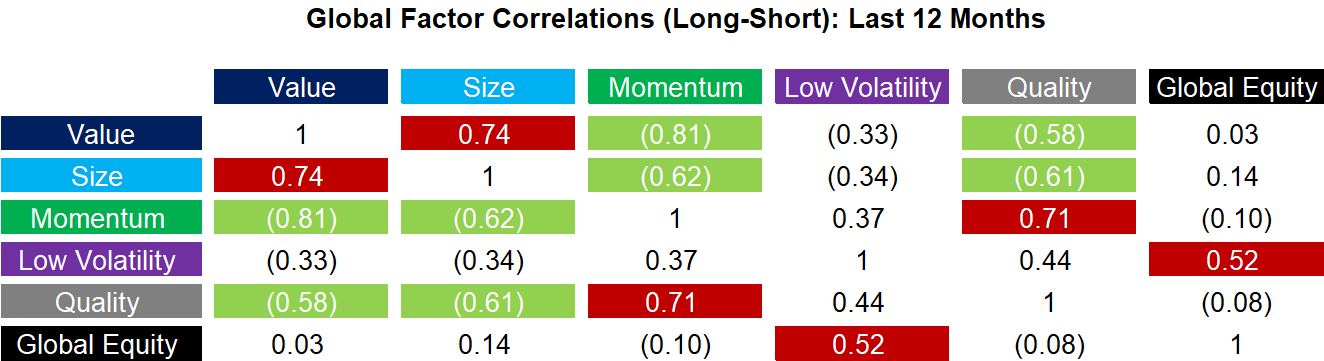

FACTOR CORRELATIONS

The correlation matrix below highlights the global one-year factor correlations based on daily data. As of the fourth quarter of 2020, we essentially observe two highly correlated factor groups: Value and Size versus Momentum and Quality. This correlation structure can be considered normal, e.g. Value and Momentum tend to be negatively correlated over time. However, the magnitude of the correlations is relatively high and should give investors pause for consideration if they have too much of the same exposure in their portfolios (read Factors: Correlation Check).

Source: FactorResearch

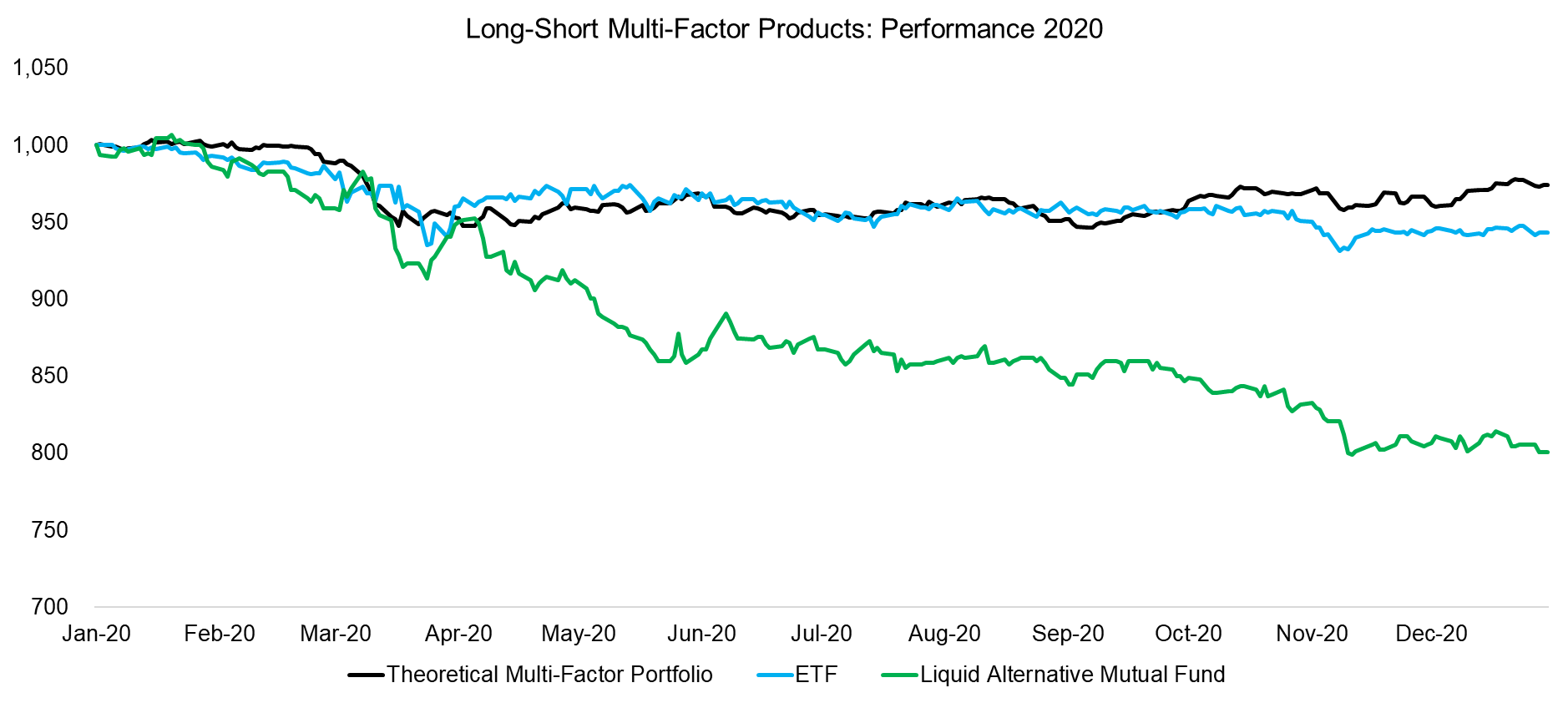

LONG-SHORT MULTI-FACTOR PRODUCTS

Finally, we analyze the performance of long-short multi-factor products, specifically one ETF focused on European equities and a liquid alternative mutual fund trading global equities. It is worth highlighting that we tracked four such products at the beginning of 2020, but two of these have been liquidated as investors redeemed most of their capital.

We observe that both products have been consistently losing money since the beginning of the year, similar to a theoretical long-short multi-factor portfolio, which is after transaction costs, but before product fees. The poor performance highlights that even diversifying across factors can lead to significant drawdowns over time. Factor investing is certainly not a free lunch.

Source: FactorResearch

FURTHER THOUGHTS

Reviewing the best-performing stocks of 2020 immediately highlights why this was a poor year for classic factor investing. We could take many stocks as case studies, but Tesla seems like the ideal poster boy. The stock is a large-cap, trades at exorbitant valuations, is extremely volatile, and the company features low or negative profitability. Stated differently, the stock has negative exposure to the Size, Value, Low Volatility, and Quality factors.

Naturally, this is only one stock and long-short factor portfolios are traditionally constructed equal-weighted, i.e. single positions should not matter that much. However, Tesla was up close to 600% in 2020 and a few other stocks with similar characteristics had equally impressive returns. Although these stocks contributed to the strong performance of Momentum, investors’ current infatuation with technology and growth also explains the pain in the other classic equity factors.

RELATED RESEARCH

The Value Factor’s Pain: Are Intangibles to Blame?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.