Factor Olympics: Q3 2017

And the Winner is…

October 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- 2017 is on track for a good year for factor exposure as most factors are positive

- Quality, Growth, and Momentum are headed for the winners podium

- Value is negative across regions, giving up all of last year’s gains

INTRODUCTION

We present the performance of six well-known factors on an annual basis for the last 10 years and the first three quarters of 2017. It’s worth mentioning that not all factors have strong academic support, e.g. Growth lacks a long-term track record of positive excess returns, however, is still a widely-followed investment style (read Factor Olympics: 1H 2017).

METHODOLOGY

The factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe and Japan and 20% in smaller stock markets. Portfolios rebalance monthly and include 10bps of transaction costs.

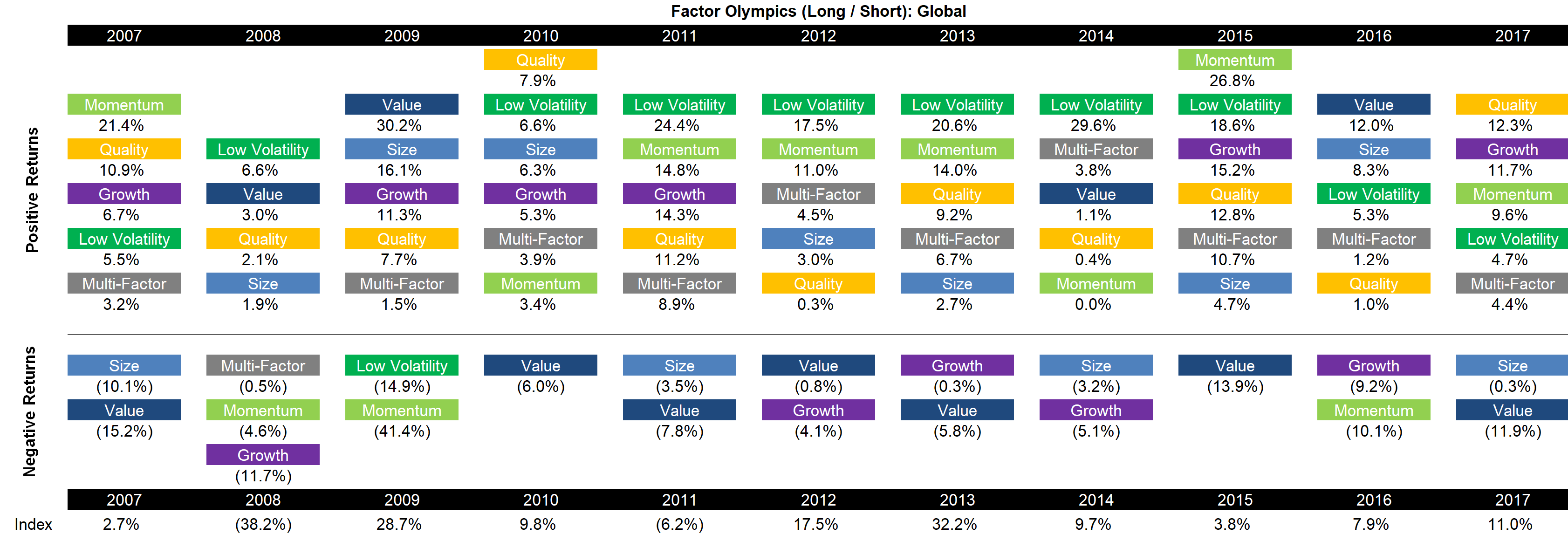

FACTOR OLYMPICS (LONG / SHORT): GLOBAL

The table below shows the factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from showing the factor performance the analysis highlights the significant factor rotation in terms of profitability from one year to the next, e.g. last year’s winners, Value and Size, are this year’s losers. Factor investing has been at its all-time high in 2017 in terms of popularity according to Google Trends, but factor selection and factor timing are challenging subjects.

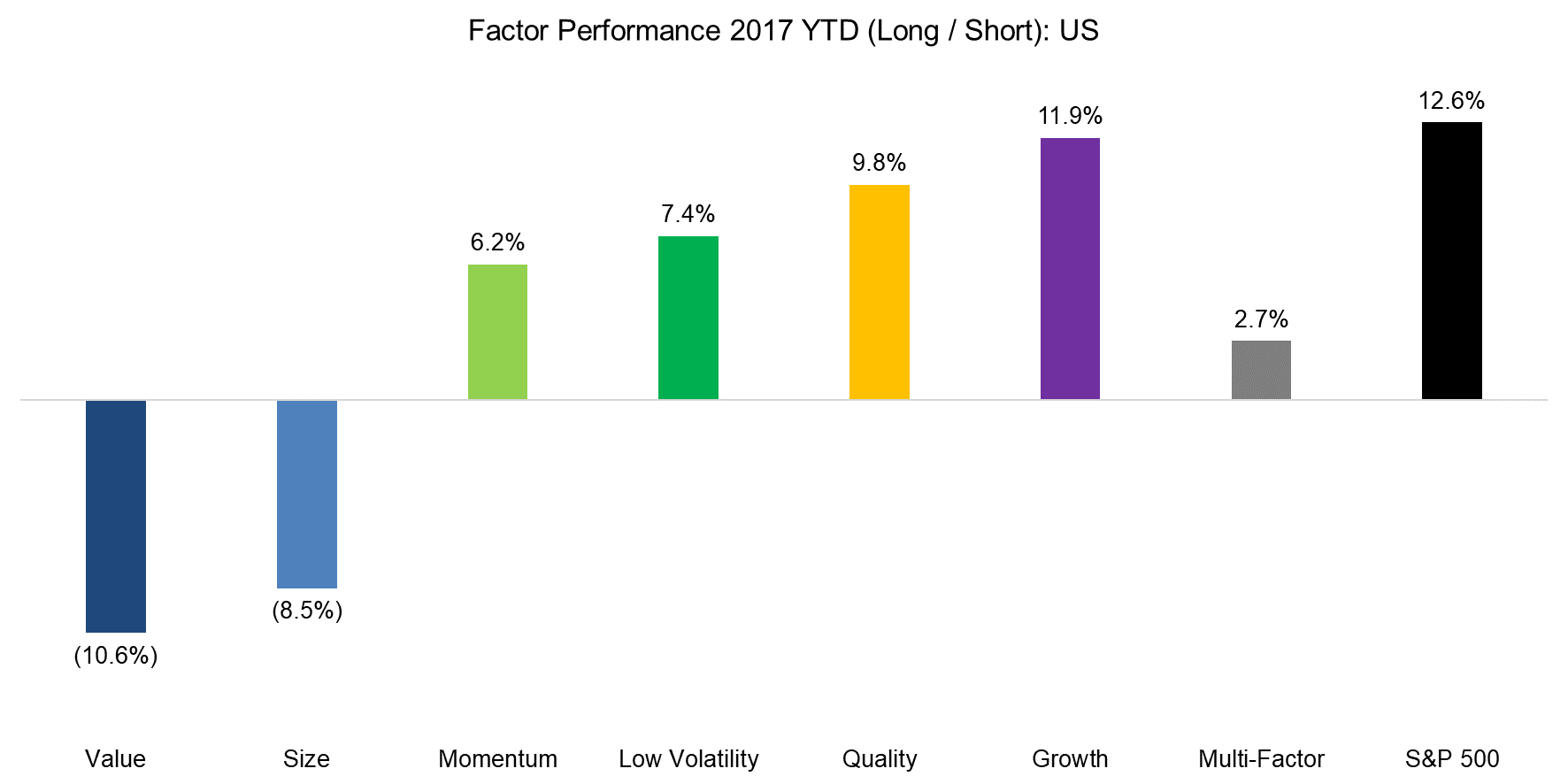

FACTOR PERFORMANCE 2017 YTD: US

The table above reflects the global factor performance and it’s interesting to analyse how homogeneous the performance is across regions. The global performance is significantly weighted towards the US, so it’s not surprising that factor performance in the US in 2017 is very similar to the global one.

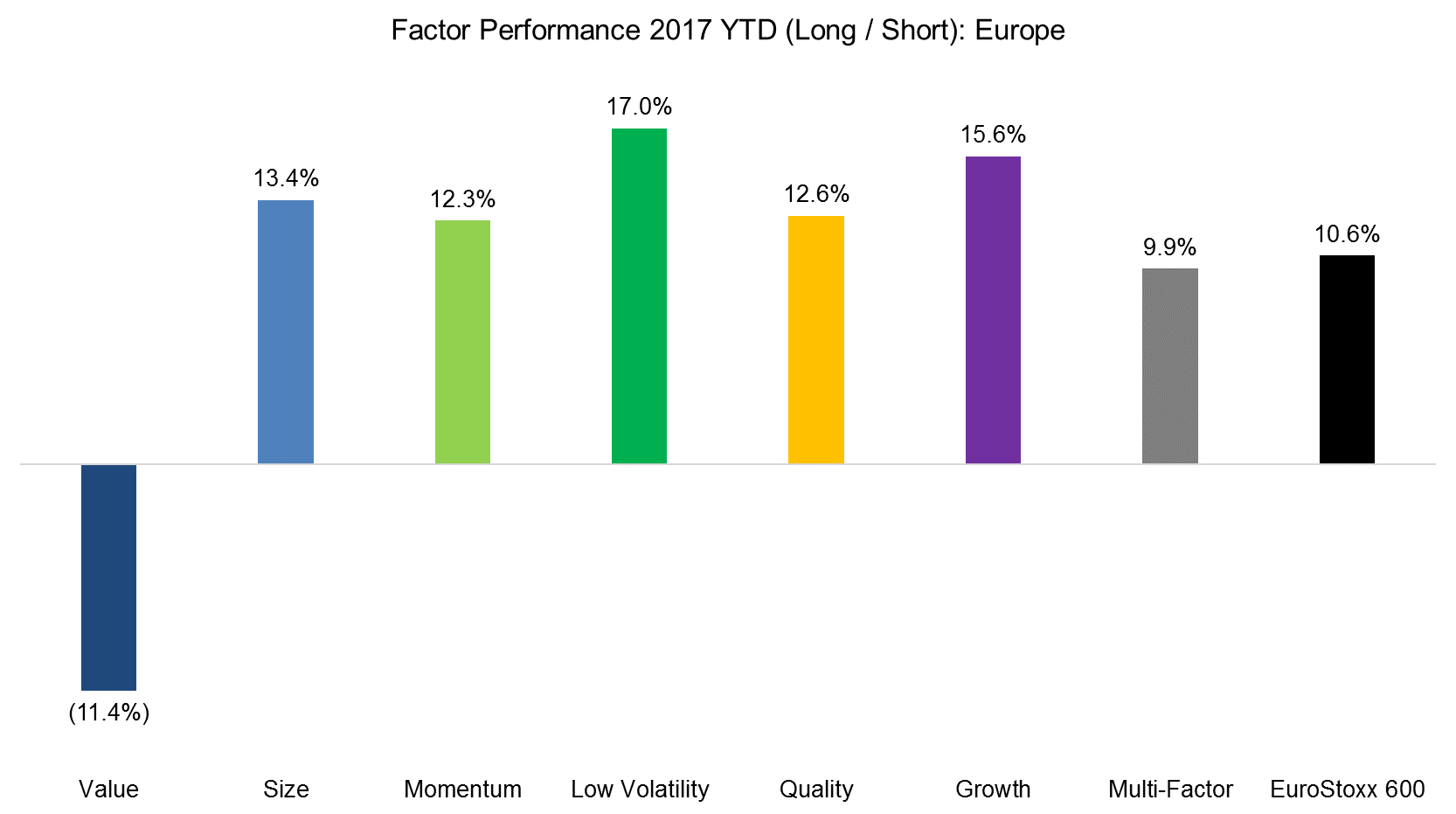

FACTOR PERFORMANCE 2017 YTD: EUROPE

The factor performance in Europe is similar to the US, except for Size, which was negative in the US, but is strongly positive in Europe, perhaps reflecting the more positive economic outlook for the region.

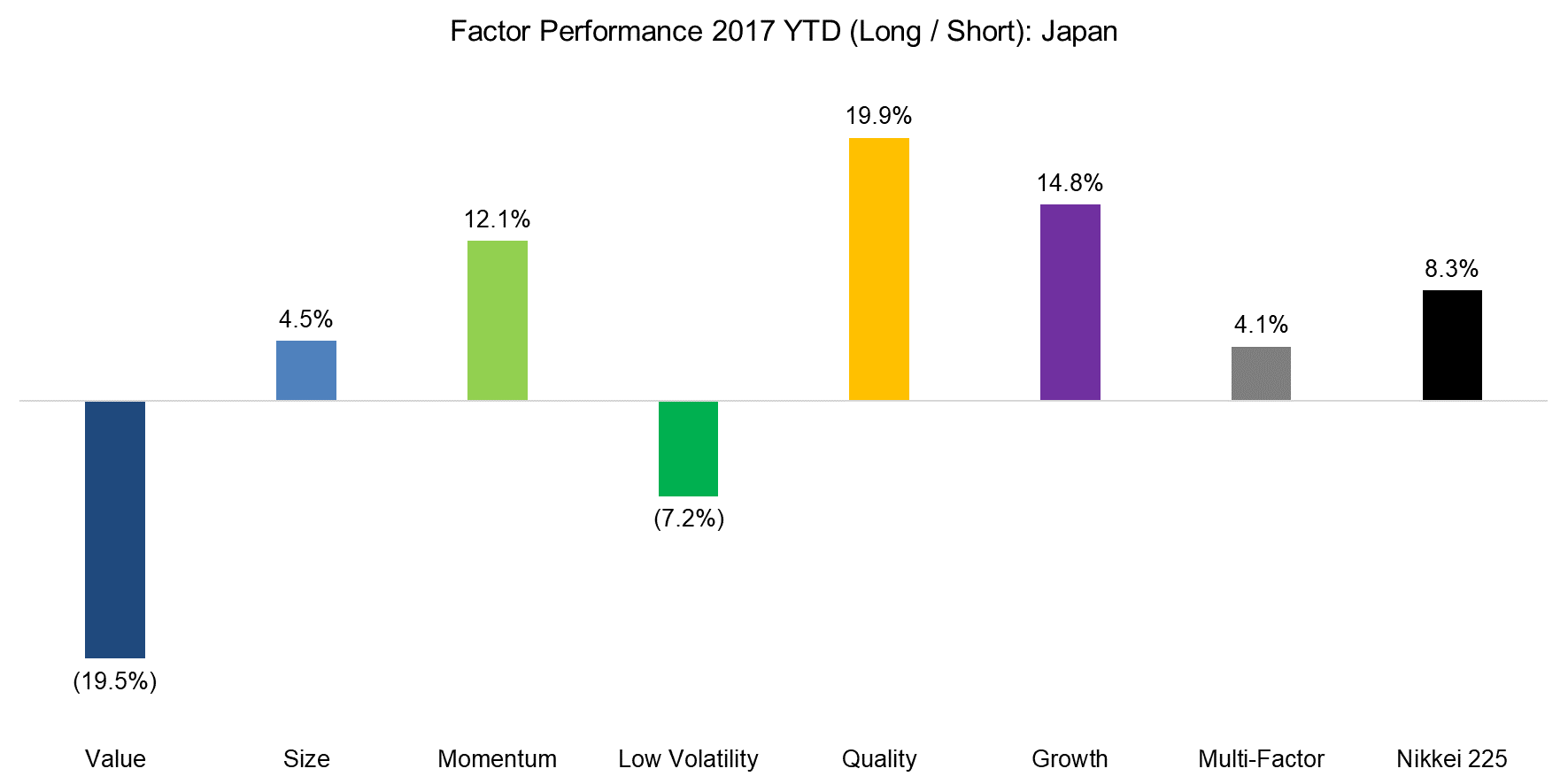

FACTOR PERFORMANCE 2017 YTD: JAPAN

Japan is often treated as a special case in the factor investing space as some strategies, e.g. Momentum, don’t work as well as in other countries. We noted in a previous report “Equity Factors in Japan” that although factor performance may be less strong, the trends are still roughly the same. In the chart below we can also observe that the factor performance in Japan is line with other markets, except for Low Volatility.

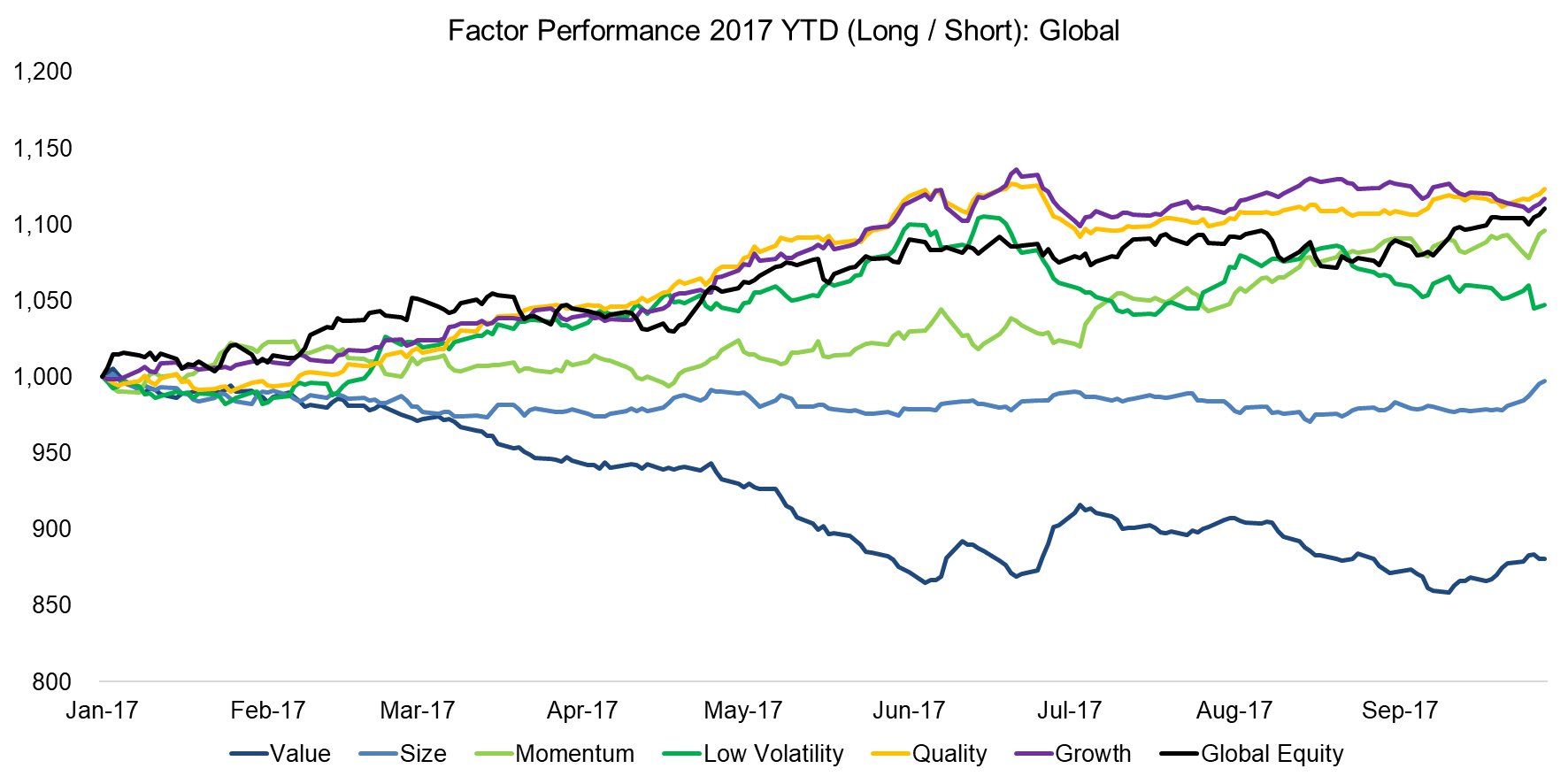

FACTOR PERFORMANCE 2017 YTD: PERFORMANCE CHART

The chart below shows the factor performance in 2017 and we can observe that Quality and Growth seem almost identical, which can be explained the Tech sector representing a significant percentage of the long portfolios in both factors. The Tech sector has shown strong growth in sales and earnings over the last few years and also features high profitability and low levels of debt compared to other industries, which explains why the sector is represented in the Quality and Growth factors.

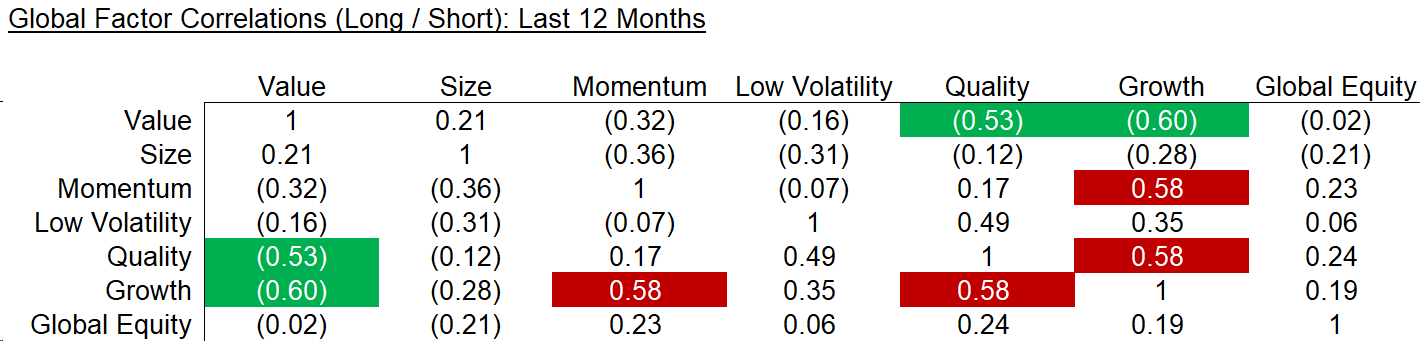

The correlation matrix below highlights the strong relationship between Quality and Growth, which might be considered a portfolio risk. If the Tech sector starts underperforming, this will likely have a negative impact for both factors. Value shows a strong negative correlation to both and may be attractive from a diversification perspective.

FURTHER THOUGHTS

Another interesting feature of factor performance in 2017 is the exceptionally low factor volatility, which reflects the low equity market volatility. The factor performance has been effectively flat for most factors since June and if the low volatility environment continues, then we’re unlikely to see any significant changes in factor performance until year end. If volatility picks up, then Q4 should become more interesting.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.