Factor Olympics Q4 2021

And the winner is…

January 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- 2021 was a year of moderate factor performance

- Value, Quality, and Low Volatility factors generated positive returns

- Momentum and Size were negative

INTRODUCTION

We present the performance of five well-known factors on an annual basis for the last 10 years. Specifically, we only present factors where academic research supports the existence of positive excess returns across market cycles and asset classes (read Factor Olympics Q3 2021).

METHODOLOGY

Our factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe, and Japan, and 20% in smaller markets. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

FACTOR OLYMPICS: GLOBAL RETURNS

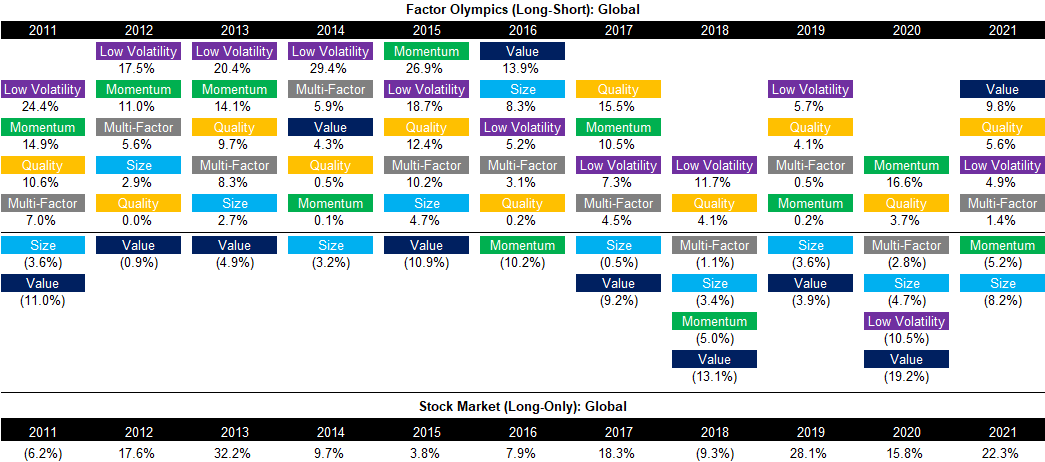

The table below shows the long-short factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from displaying the factor performance, the analysis highlights the significant factor rotation in terms of profitability from one year to the next, highlighting the benefits of diversified exposure.

The performance of an equal-weighted multi-factor portfolio was negative as of the end of the third quarter of 2021, but turned slightly positive as the Value, Quality, and Low Volatility factors all rallied in the fourth quarter. The returns of factors ranged between +10% and -10%, which is relatively moderate compared to previous years.

Source: FactorResearch

TRENDS IN GLOBAL FACTOR PERFORMANCE

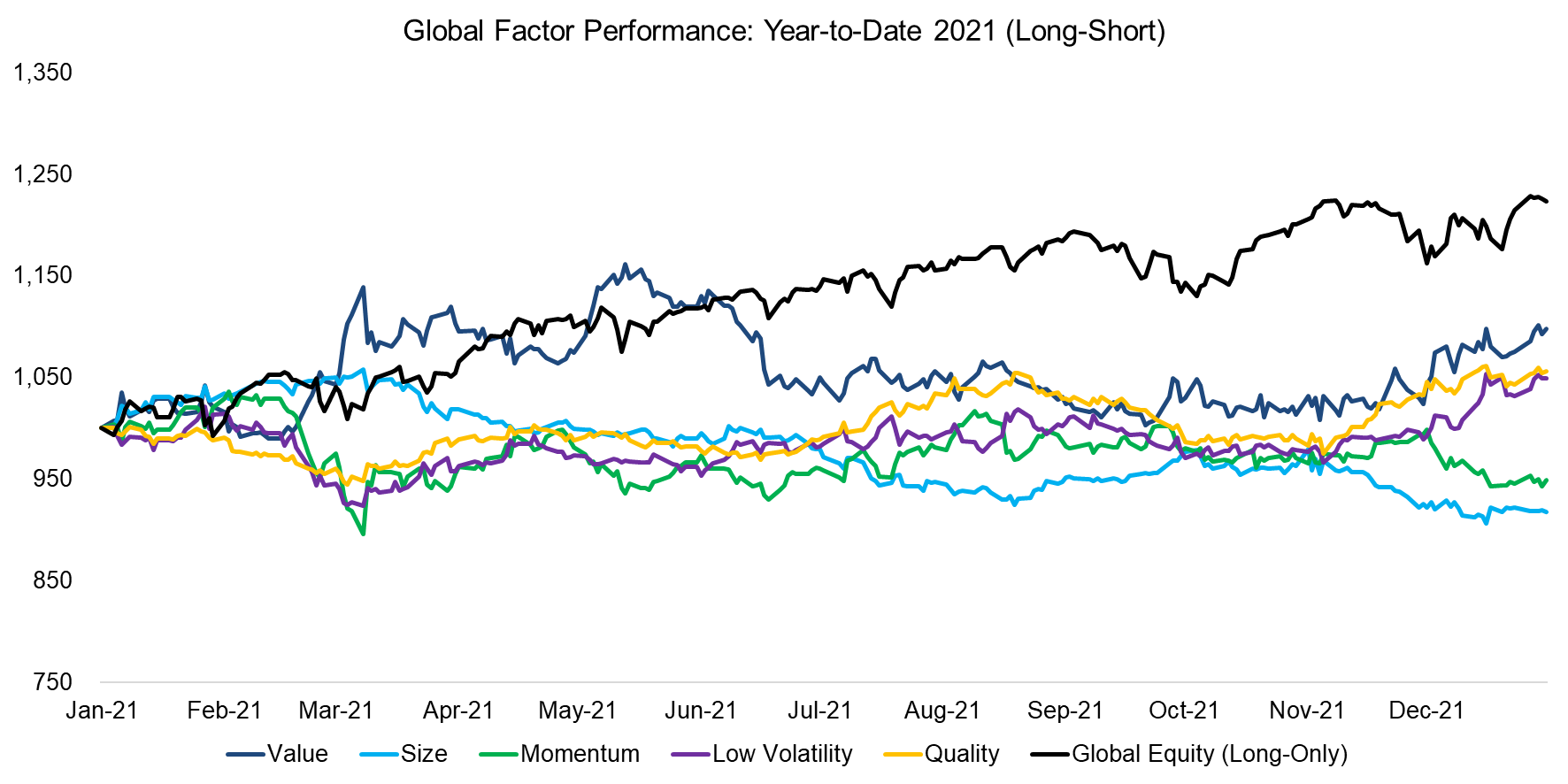

The triumvirate of Momentum, Low Volatility, and Quality factors dominated the previous decade. However, in 2021 the factor performance was different as Momentum was replaced by the Value factor, which is unusual given that cheap stocks are typically negatively correlated to high quality and low volatile stocks.

Furthermore, the Value and Size factors usually trend in the same direction, but behaved substantially differently in 2021 as cheap stocks generated the highest and small caps the lowest excess returns.

Source: FactorResearch

PERFORMANCE OF LONG-SHORT MULTI-FACTOR PRODUCTS

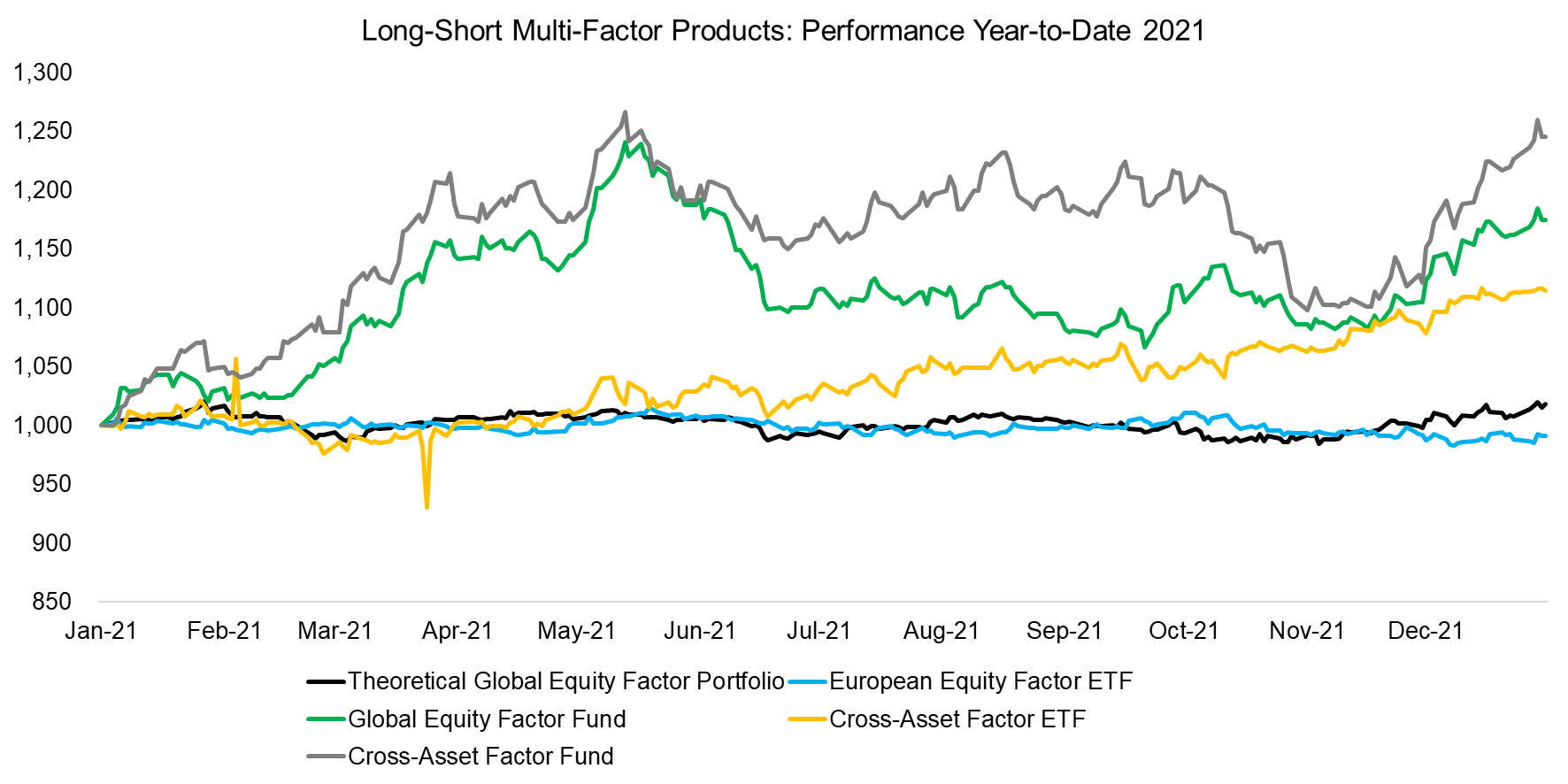

There are only a few liquid alternative mutual funds and ETFs that provide exposure to factors in the long-short format as seen in academic research. Given the poor performance of factor investing in recent years, many products were liquidated.

We highlight the performance of four surviving products and observe rather divergent performance in 2021. The Global Equity Factor and Cross- Asset Factor funds are from the same asset management company, and equities represents the largest allocation within the cross-asset fund, which explains why they are highly correlated. Their performance reflects a large exposure to the Value factor, which performed well in the first half and fourth quarter of 2021, but less well in the third quarter.

The European multi-factor equity fund generated similar returns to the theoretical multi-factor portfolio, which was essentially in 2021. Most interesting is the performance of the cross-asset ETF, which has started to generate relatively consistent returns throughout the year. The total return was slightly above 10% and is highly attractive for an uncorrelated strategy that offers diversification benefits, however, the assets under management have barely increased since the beginning of 2021.

Source: FactorResearch

SMART BETA EXCESS RETURNS

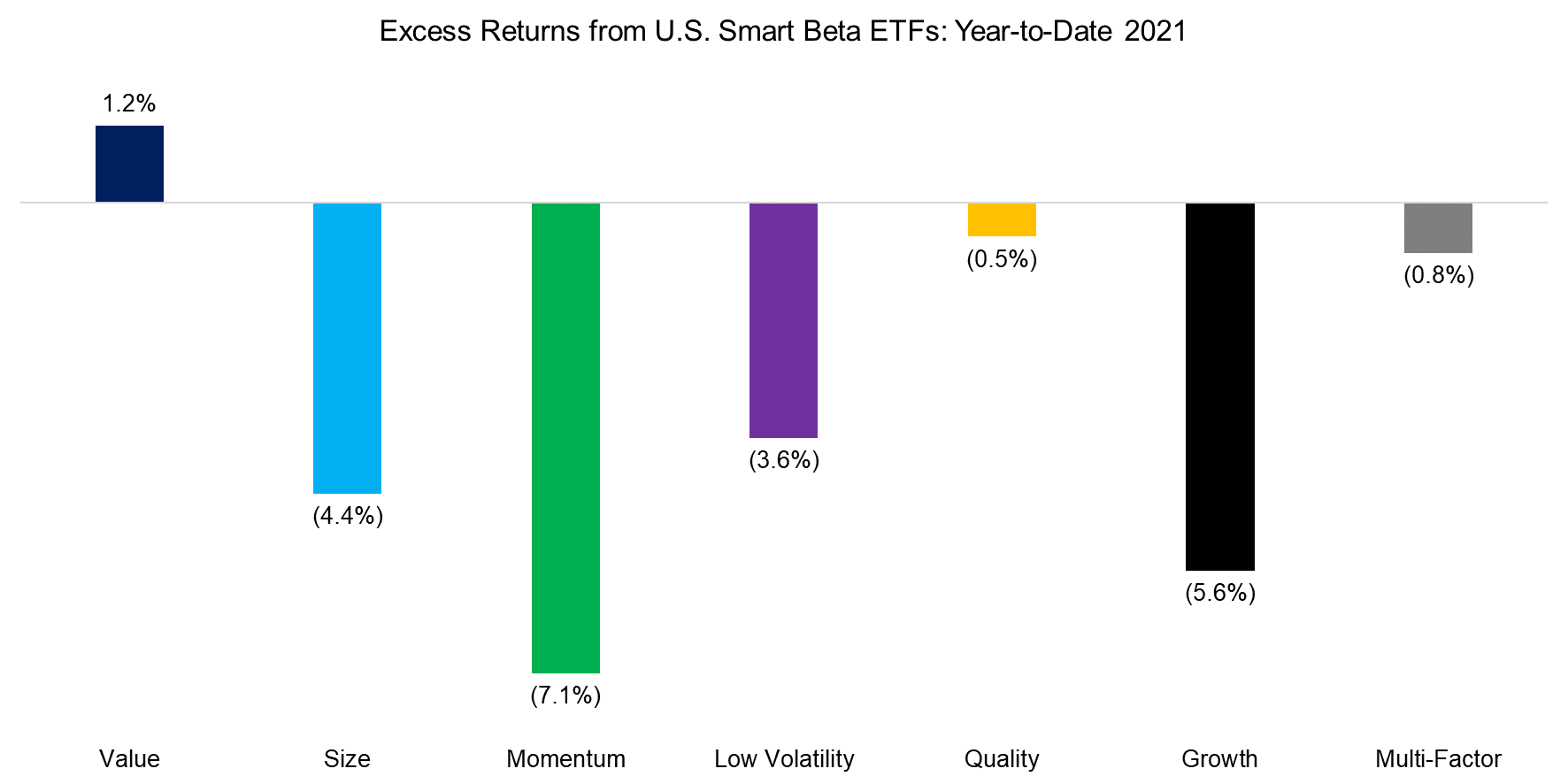

Although investors should allocate to factors constructed as long-short portfolios given that these offer high diversification benefits, most invest via long-only smart beta ETFs. Following the money, we highlight the excess returns generated from investing in smart beta ETFs in the US, which represents a universe of 160+ products and approximately $800 billion of assets under management (read Smart Beta: Broken by Design?).

The returns will naturally be somewhat different as long-short factor portfolios are constructed beta-neutral, i.e. there is a short portfolio and leverage is used to achieve beta-neutrality, and stocks are typically weighted equally. Smart beta ETFs are long-only and mostly weight stocks by their market capitalization.

The performance of the Value, Size, and Momentum factors were directionally the same in long-only and long-short factor investing in 2021. However, the trends were different for Quality and Low Volatility factors as these generated positive excess returns in long-short and negative excess returns in long-only portfolios. Although the short side of factors has been criticized in recent years, it can contribute value.

Source: FactorResearch

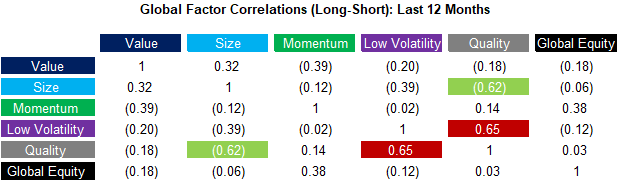

FACTOR CORRELATIONS

The correlation matrix below highlights the global one-year factor correlations based on daily data. As of the fourth quarter of 2021, we observe correlation clusters that are somewhat structural and have frequently shown in recent years. Value and Size were positively correlated, despite significantly different returns in 2021. The correlation of Momentum has to Low Volatility, and Quality has decreased, but Quality and Low Volatility stocks continue to be highly correlated.

Source: FactorResearch

FURTHER THOUGHTS

It is easy making the case that we are currently at the peak of the current market cycle, eg by pointing to the sale of an invisible rock NFT for $12,800. However, the same position could have been taken in 2017 when the Argentinian government sold 100-year bonds shortly after resolving its latest sovereign default. The good times can not continue forever, but short-term predictions are futile.

A more nuanced argument is that there has already been a change in the investment sentiment that is reflected in the factor rotation from momentum to value stocks. Equity markets finished strong in 2021, but the performance was generated by a few stocks rather than the majority, eg Apple is close to a market capitalization of $3 trillion and Microsoft is not far behind. In contrast, many COVID-19 darlings like Zoom, Peloton, or DocuSign are significantly below their highs.

Although it would be desirable for investors to start paying more attention to financing profitable ventures compared to investing in exciting but flawed business models, a factor or sector rotation sometimes heralds a market correction. The more excessive the party has been, the worse the hangover tends to be.

RELATED RESEARCH

Improving the Odds of Value Investing

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.