Factor Performance vs Portfolio Concentration

The more concentrated, the higher the returns, right?

December 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- More concentrated portfolios generated higher excess returns for value & momentum stocks

- In contrast, higher diversification was beneficial for other factors like quality and growth

- It is difficult to explain this, but has consequences for multi-factor portfolio construction

INTRODUCTION

Factor investing appears to be the only strategy for outperforming the market over the medium to long term. Intuitively, the more concentrated a portfolio, the greater the potential for outperformance. This idea has been reflected in recent years by the launch of several smart beta ETFs with highly concentrated holdings – for example, the John Hancock Disciplined Value Select ETF (JDVL) holds just 40 stocks.

On the other hand, some funds take a much more diversified approach. The DFA Dimensional US Targeted Value ETF (DFAT), for instance, includes nearly 1,500 stocks – roughly half of the U.S. equity market.

The trade-off is clear: extreme concentration introduces firm-specific risk, while excessive diversification can dilute factor exposures. So, where does the sweet spot lie? And do more concentrated portfolios consistently deliver superior performance across all factors? Let’s dive in.

FACTOR PERFORMANCE VS PORTFOLIO CONCENTRATION

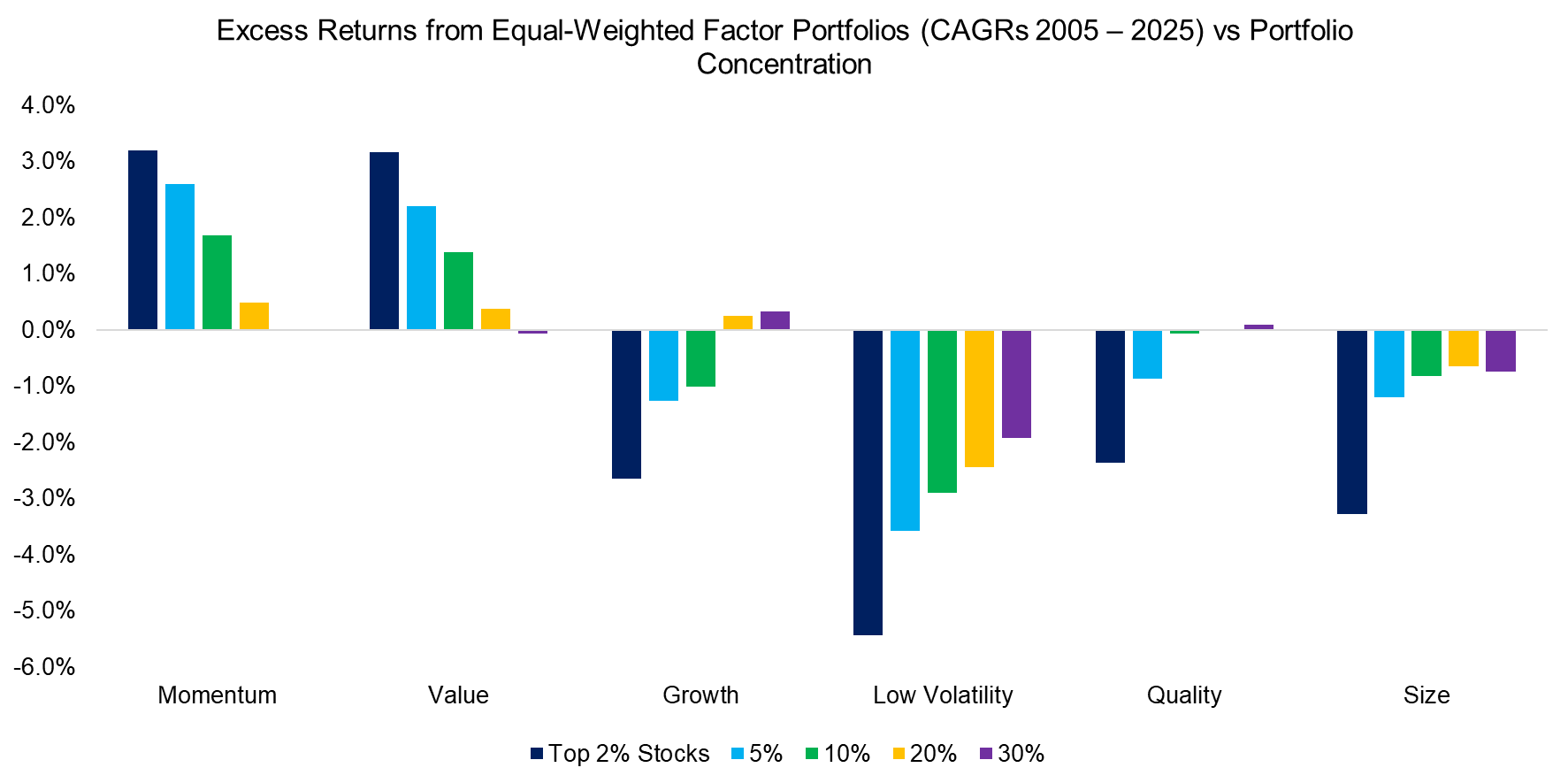

We focus on the U.S. stock market and construct six portfolios based on standard factor definitions: momentum, value, growth, low volatility, quality, and market capitalization. Stocks are weighted equally, portfolios are rebalanced monthly, with 10 basis points of transaction costs deducted, and only stocks with a minimum market capitalization of $1 billion are included in the investible universe.

For each factor, we create portfolios selecting the top 2%, 5%, 10%, 20%, and 30% of stocks. The top 2% stock portfolio was comprised of 25 stocks in 2005 and 43 stocks in 2025, compared to 376 respectively 643 stocks for the top 30% portfolio. Then we subtract overall market returns to calculate factor excess returns.

Between 2005 and 2025, we find that positive factor excess returns occurred only for value and momentum, consistent with academic research. Interestingly, the excess returns for these two factors increased with portfolio concentration. In contrast, for growth, low volatility, quality, and market capitalization, greater diversification tended to produce better results.

Source: Finominal

EQUAL VS MARKET CAP WEIGHTING

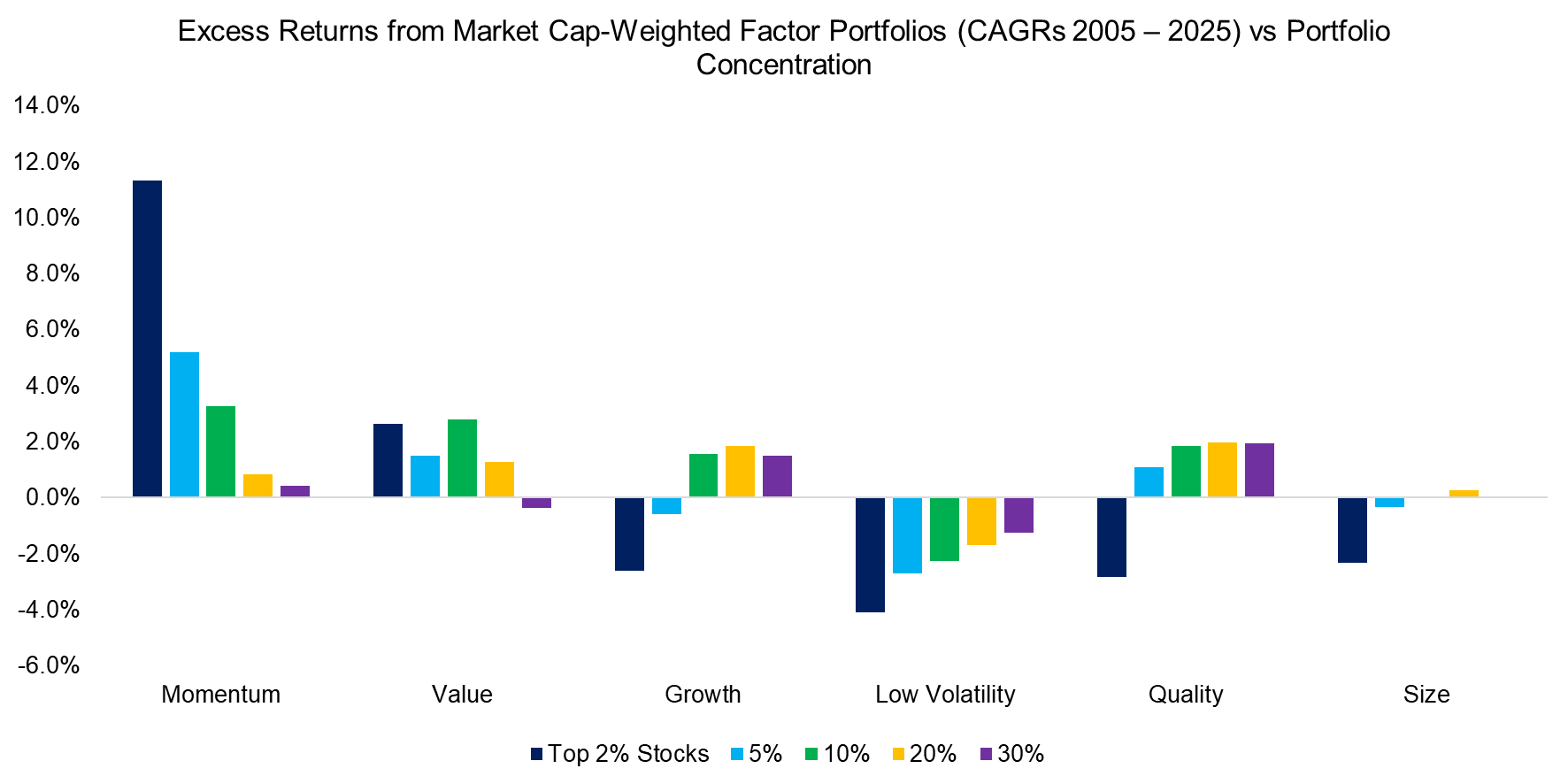

We modify the portfolio construction method by shifting from equal weighting to market capitalization weighting. This adjustment significantly increases excess returns across all six factors and even pushes the growth and quality factors into positive territory. Part of this improvement can be attributed to the weak performance of the size factor over the past two decades.

However, the relationship between factor performance and portfolio concentration remains unchanged: greater concentration continues to benefit momentum and value, while it detracts from the performance of the other factors.

Source: Finominal

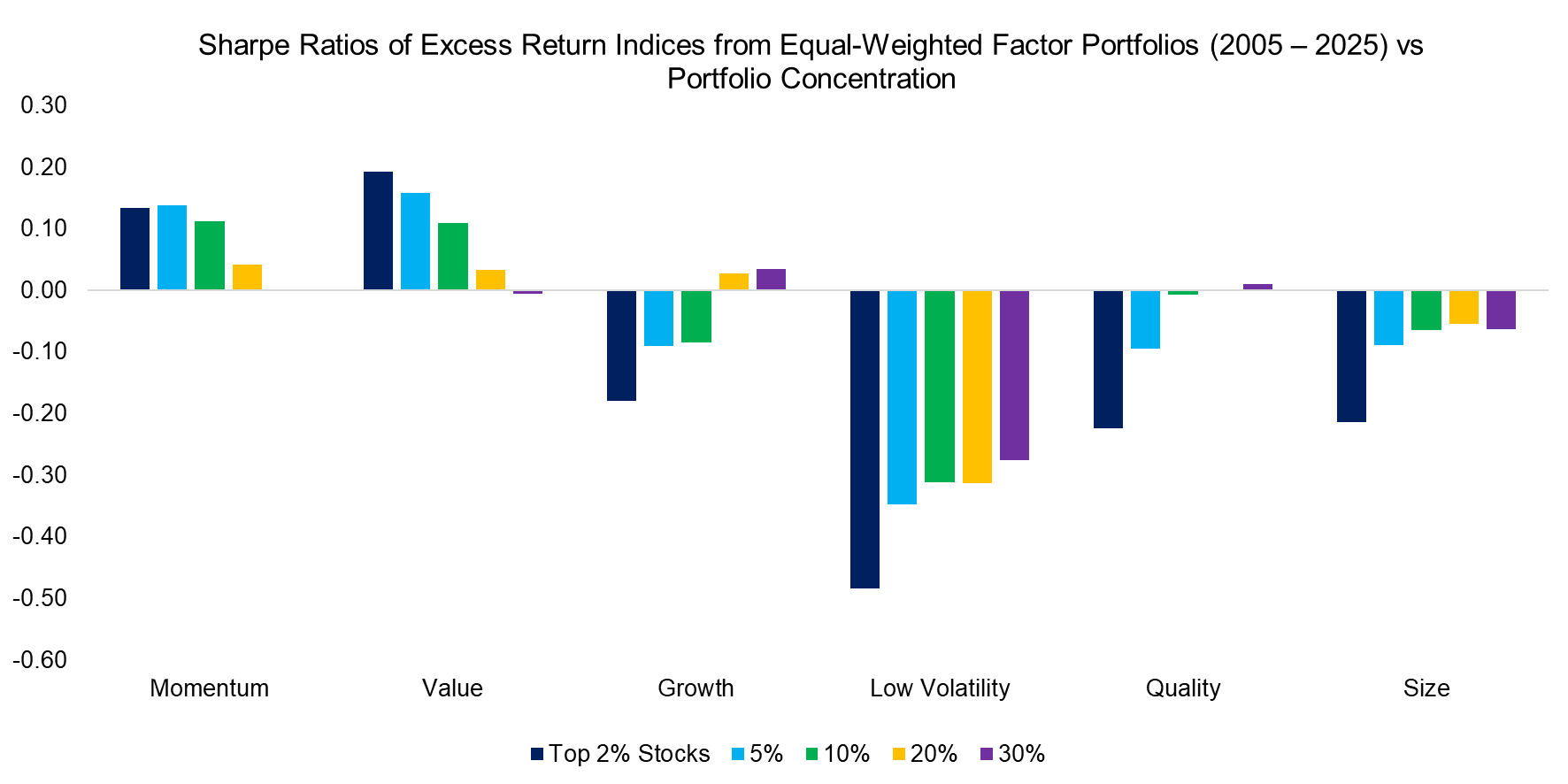

SHARPE RATIOS

Greater portfolio concentration increases idiosyncratic company risk, which should, in theory, lead to higher volatility. This might suggest that the superior excess returns of more concentrated momentum and value portfolios are less appealing once adjusted for risk. However, when we calculate the Sharpe ratios, the results once again confirm that higher concentration remains advantageous for these two factors.

Source: Finominal

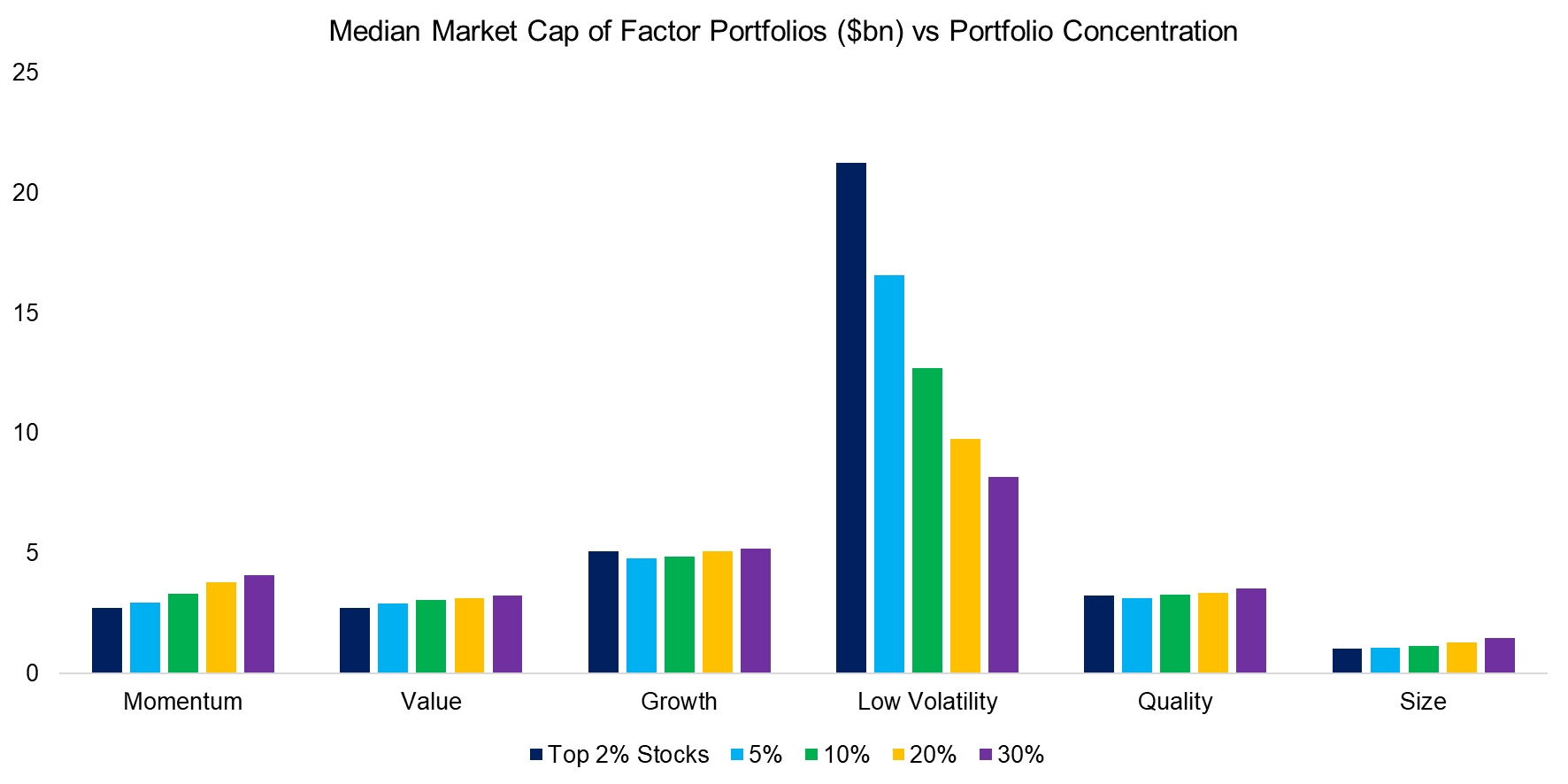

MARKET CAPITALIZATION

Finally, we examine the differences in market capitalization across the various portfolios. For momentum, value, and size factors, more concentrated portfolios tend to have stocks with smaller median market capitalizations. In contrast, growth and quality portfolios show little to no variation in median size across concentration levels. In contrast, for the low volatility factor, the median market capitalization actually decreases as the portfolio becomes more diversified, which is intuitive as large companies tend to be more stable than smaller ones.

Source: Finominal

FURTHER THOUGHTS

There appears to be a clear relationship between factor performance and portfolio concentration, though the pattern is not consistent across factors. Fewer holdings lead to stronger factor exposures and higher excess returns – a dynamic that holds true for value and momentum. But why doesn’t this apply to other factors? Why do investors tend to fare better holding a broad basket of high-quality or high-growth stocks rather than concentrating on just the top few?

There is no simple explanation, but the highest-growth or highest-quality stocks are often the most expensive, and elevated valuations tend to dampen future returns. Similarly, the most extreme low-volatility stocks typically have betas well below one, which can act as a persistent drag on excess returns in bull markets. And small-cap stocks, another classic factor, have struggled to outperform in recent decades.

These findings carry important implications for the design of factor-based strategies. Portfolio concentration should align with the characteristics of each factor. While this principle is straightforward for single-factor products, it becomes far more complex when constructing multi-factor portfolios, where trade-offs between concentration, diversification, and factor balance must be carefully managed.

RELATED RESEARCH

Smart Beta ETF vs Customized Factor Portfolios

Smart Beta ETF Construction: High versus Low Factor Exposures

Factor Investing Is Dead, Long Live Factor Investing!

How Painful Can Factor Investing Get?

Combining Smart Beta Funds May Not Be Smart

Factor Construction: Portfolio Rebalancing

Factor Construction: Portfolio Scenarios

Smart Beta vs Factors in Portfolio Construction

Factor Returns: Small vs Large Caps

Factor Investing in Micro & Small Caps

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.