Factor Performance vs Portfolio Concentration – II

The more concentrated, the higher the returns, right?

December 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Smart beta returns vary significantly with portfolio concentration

- Betas and factor performance impact returns

- Value and momentum portfolios should be concentrated, others not

INTRODUCTION

In our recent research article, Factor Performance vs Portfolio Concentration, we showed that in the U.S. market, more concentrated long-only, stock-based portfolios benefited value and momentum strategies over the past 20 years. For other factors – such as growth, low volatility, quality, and size -the opposite held true: greater diversification delivered better results.

The simplest explanation for this pattern is that it merely reflects underlying factor performance. Value and momentum factors produced positive returns over the period, while the others did not. A more concentrated portfolio naturally amplifies factor exposures, and thus magnifies returns when those factor premia are positive.

A second explanation, however, is that portfolios exhibit different market betas. Low-volatility stocks, for example, typically have betas below one; a highly concentrated low-volatility portfolio would have an even lower beta, virtually ensuring underperformance in a bull market.

In this follow-up article on portfolio concentration, we explore how beta influences observed performance.

FACTOR PERFORMANCE VS PORTFOLIO CONCENTRATION

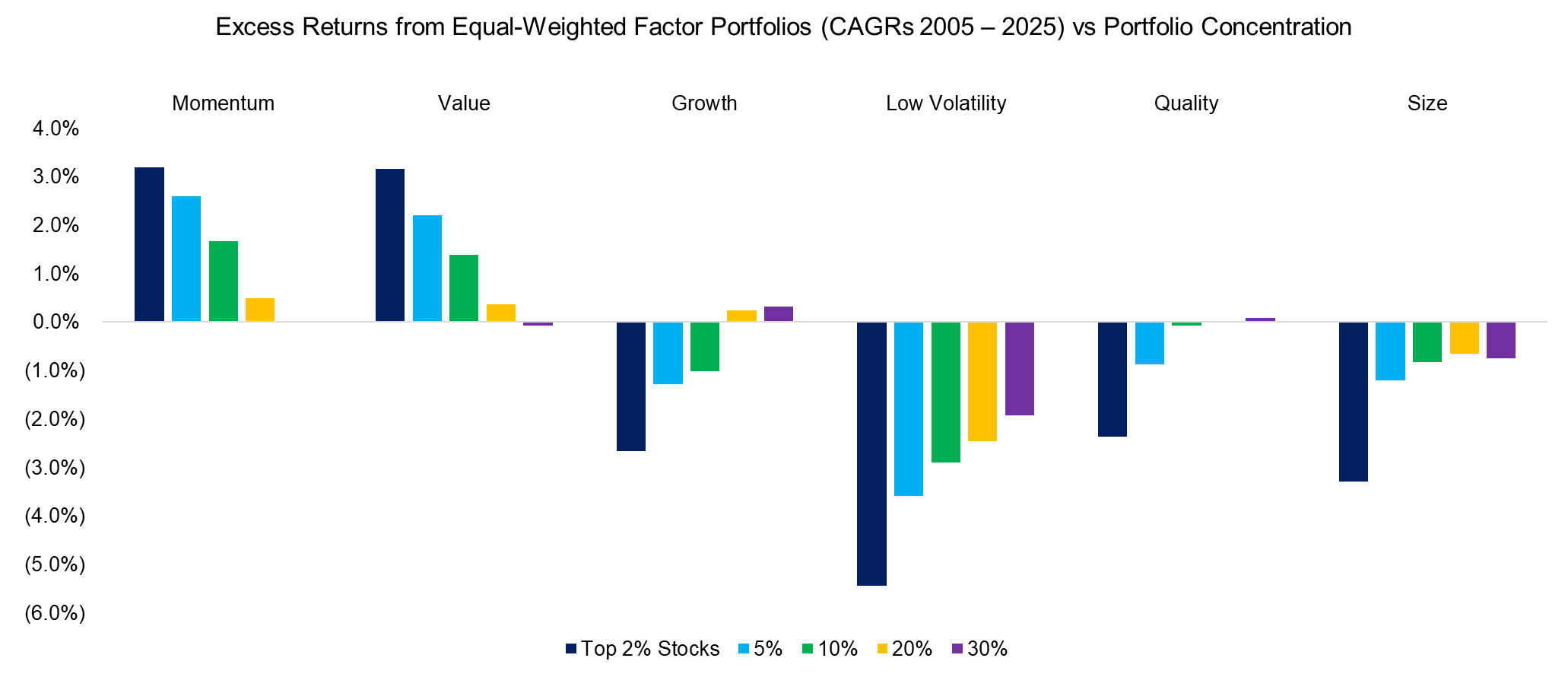

The chart below summarizes our previously published results, showing the excess returns of equal–weighted, factor-focused portfolios relative to the U.S. stock market from 2005 to 2025. For value and momentum, greater portfolio concentration was advantageous, while for the other four factors, broader diversification delivered better performance.

Source: Finominal

BETA ANALYSIS

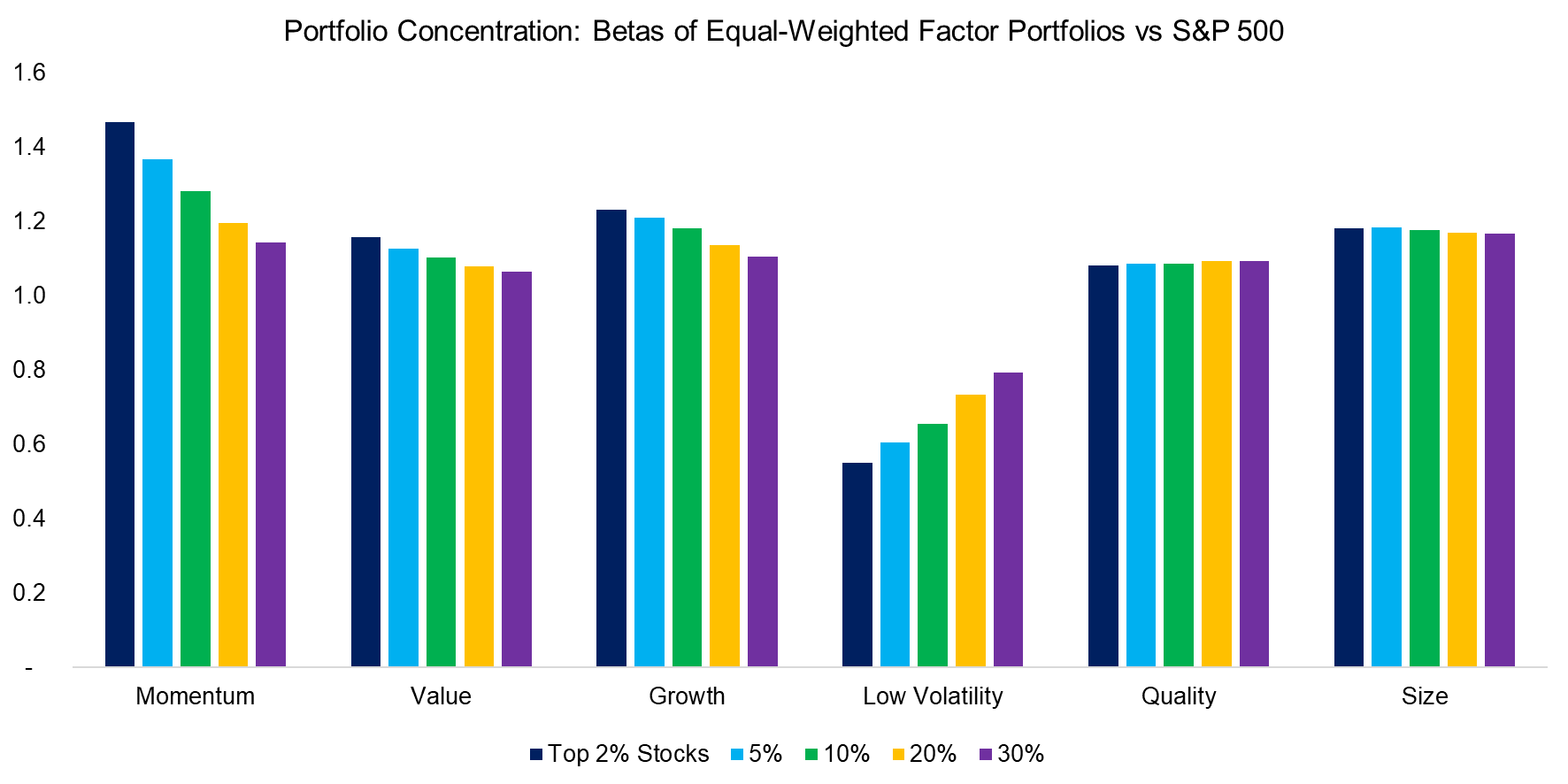

We calculate the betas of the factor-focused portfolios relative to the S&P 500. The results show betas above one for all factors except low volatility. For momentum, value, and growth, the most concentrated portfolios exhibit the highest betas. In contrast, for quality and small-cap (size), the difference in beta between the most concentrated and most diversified portfolios is minimal.

Low volatility stands out as the exception: all of its portfolios have betas below one, consistent with expectations for lower-risk stocks. The most concentrated low-volatility portfolio has a beta of 0.6, compared with 0.8 for the most diversified version.

Source: Finominal

BETA-ADJUSTED RETURNS

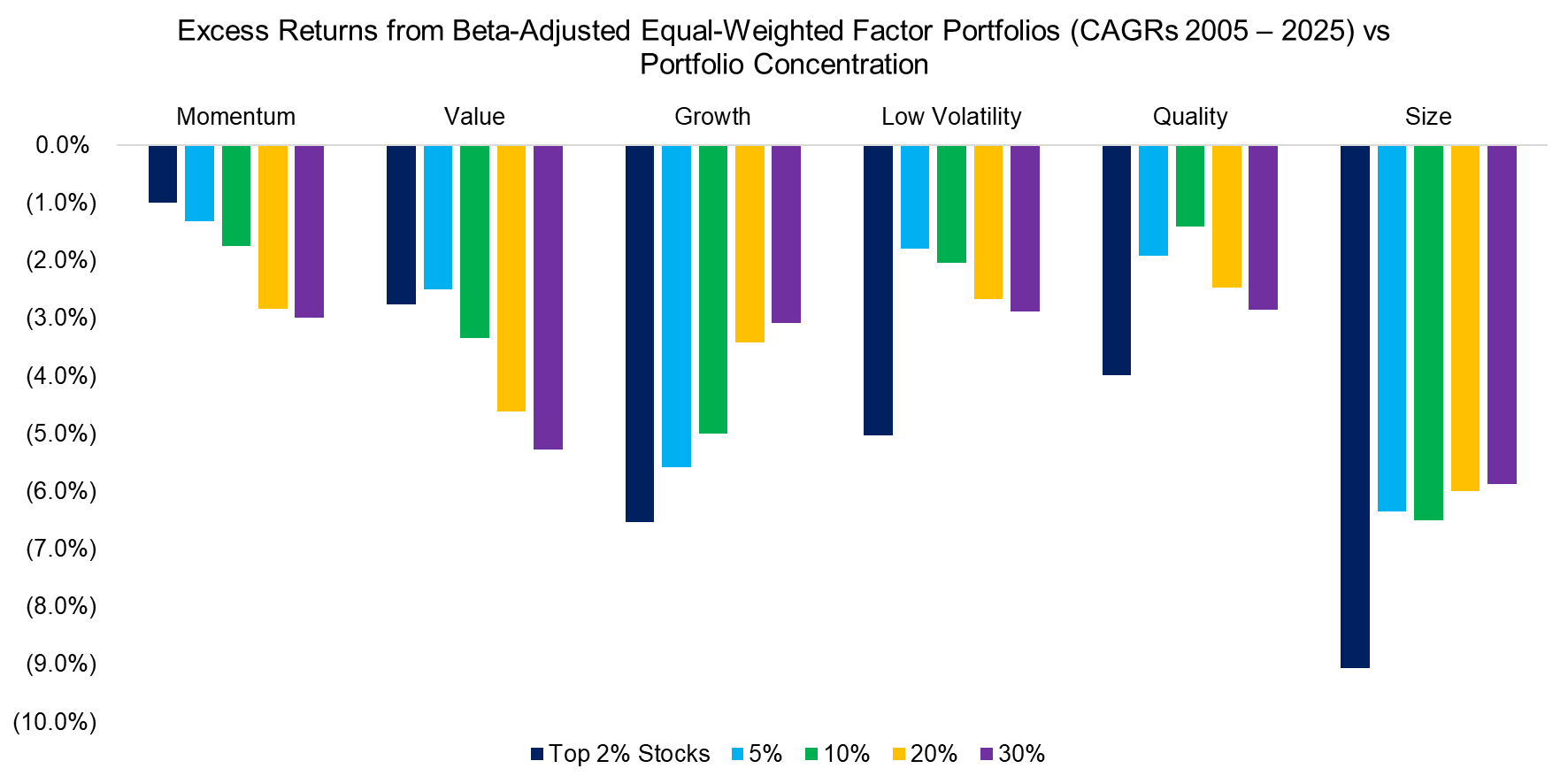

Next, we adjust the returns for beta, since beta naturally influences performance. A beta above one boosts returns in a rising market, whereas a beta below one – such as that of low-volatility stocks – dampens them.

Applying this adjustment has a significant negative impact on the equal-weighted factor returns, pushing their excess returns into negative territory over the past 20 years. This largely reflects the concentration of the U.S. market in a handful of dominant stocks, which receive equal weights in factor-focused portfolios – if they are included at all.

We also find that some earlier conclusions shift once beta is accounted for. For low-volatility and quality portfolios, maximum diversification is no longer optimal; instead, portfolios with moderate diversification deliver the strongest results.

Source: Finominal

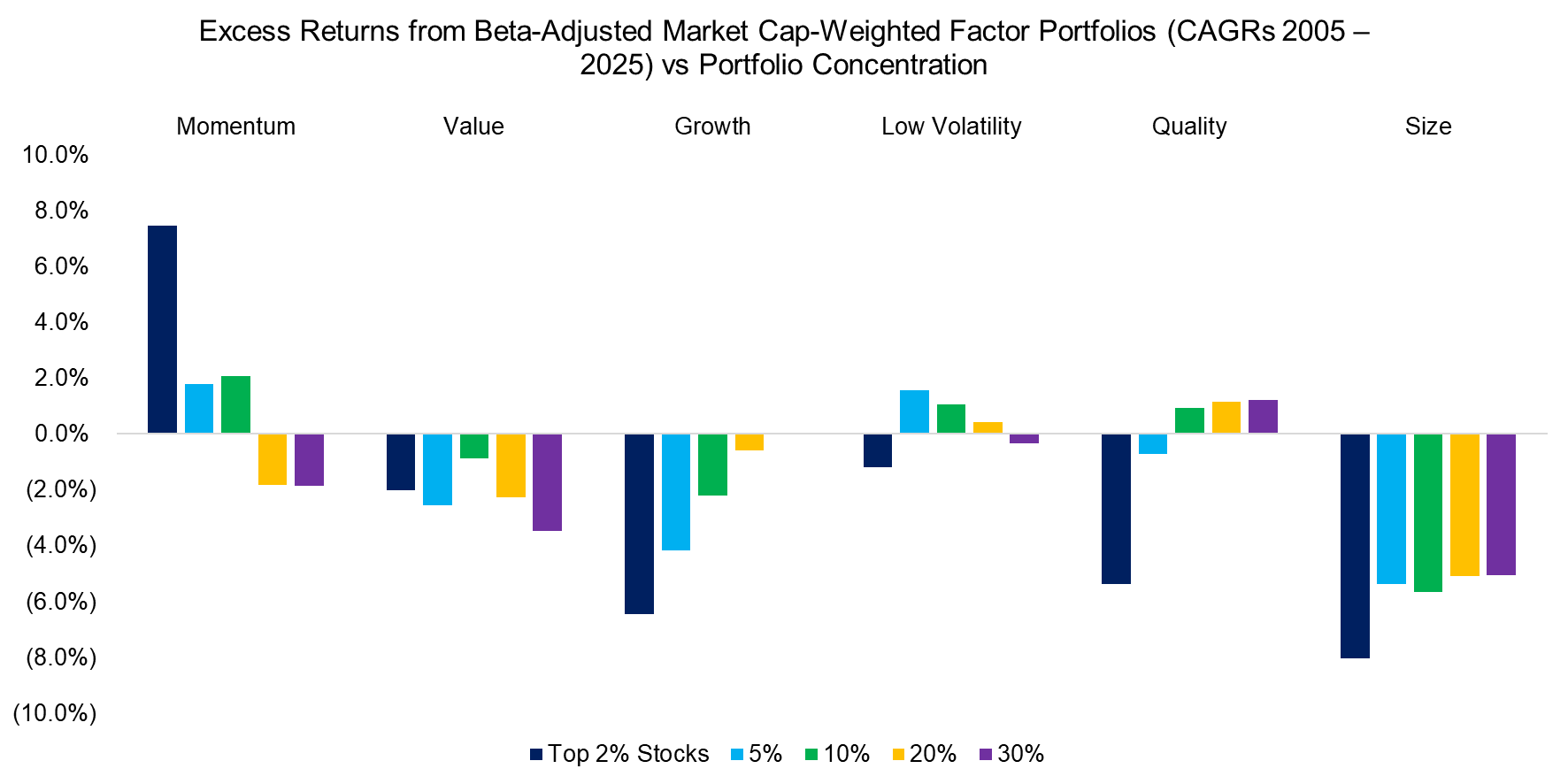

Up to this point, we have focused on equal-weighted factor-focused portfolios. While these may be theoretically appealing, most real-world investment products weight stocks by market capitalization. When we compute beta-adjusted returns for market-cap-weighted portfolios, excess returns improve across all factors.

However, this adjustment also alters several conclusions from our previous research. For most factors there is no longer a clearly optimal level of portfolio concentration – except for growth, where greater diversification remains preferable. And aside from momentum, highly concentrated portfolios offer no advantage for any factor.

Source: Finominal

FURTHER THOUGHTS

Should investors pursuing factor investing opt for concentrated or diversified portfolios?

While these portfolios exhibit different betas that influence performance, the underlying factor performance is ultimately more important. Academic research supports positive excess returns only for value and momentum factors, where higher portfolio concentration can be justified to maximize factor exposures. Quality and size are better suited for complementing value and momentum exposures. Low-volatility stocks offer higher risk-adjusted returns but not higher absolute returns, and their low beta can weigh on performance during bull markets.

One consistent takeaway across all analyses is that concentrated growth-focused portfolios underperform, which is ironic given that the largest smart-beta ETF is Vanguard’s Growth Index Fund (VUG) with over $200 billion in assets.

RELATED RESEARCH

Factor Performance vs Portfolio Concentration

Smart Beta ETF vs Customized Factor Portfolios

Smart Beta ETF Construction: High versus Low Factor Exposures

Factor Investing Is Dead, Long Live Factor Investing!

How Painful Can Factor Investing Get?

Combining Smart Beta Funds May Not Be Smart

Factor Construction: Portfolio Rebalancing

Factor Construction: Portfolio Scenarios

Smart Beta vs Factors in Portfolio Construction

Factor Returns: Small vs Large Caps

Factor Investing in Micro & Small Caps

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.