Factor Timing via Market Momentum

Does it work?

August 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Theoretically, investors allocate to risky stocks when bullish and defensive ones when bearish

- A simple stock market momentum model does not validate this

- Factor investing should be pursued across all market regimes

INTRODUCTION

There is little evidence that market timing works, but how about factor timing? We might be poor at predicting where the S&P 500 will be in three or twelve months, but should this not be easier for deciding on whether to bet on value or growth stocks?

Theoretically, investors should prefer risky stocks when the stock market is in a bull and defensive stocks in a bear market. Investors make style changes slowly, therefore we might be able to exploit such trends by measuring the momentum of the stock market. When the momentum is positive, buy cheap and small-cap stocks, when negative, buy high-quality and low-volatility stocks.

In this research article, we will exploit factor timing via stock market momentum.

U.S. FACTOR PERFORMANCE IN MARKET REGIMES

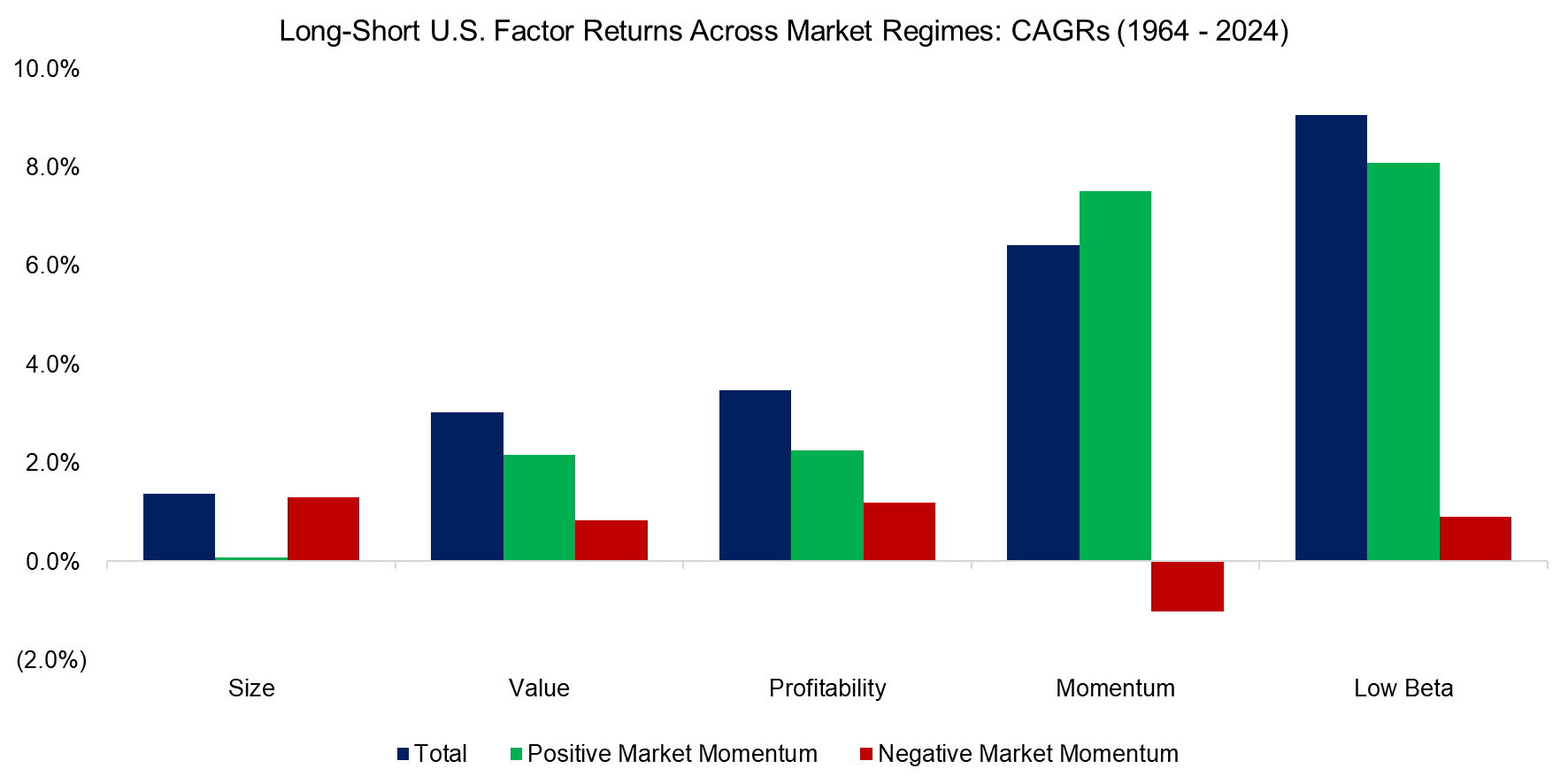

First, we evaluate the returns of five factors in the U.S. stock market by using the performance of the stock market as a signal. Long-short factor returns for the size, value, profitability, and momentum factors are sourced from the Kenneth R. French data library, while low beta factor returns are from AQR.

We create two portfolios for each factor based on the 12-month performance of the U.S. stock market, where one day delay is used for performance measurement and rebalancing occurs quarterly. One portfolio represents when the stock market performance was positive, and the other when negative. The U.S. stock market exhibited positive momentum of 77% of the days between 1964 and 2024.

We observe that the size factor generated the lowest and the low beta factor the highest CAGR over the 60 years. All factors except size generated higher returns when the stock market momentum was positive, but factor returns were even positive when the market momentum was negative, except for the momentum factor. Stated differently, factors generated almost always positive excess returns, regardless of how the stock market was performing.

Source: Finominal

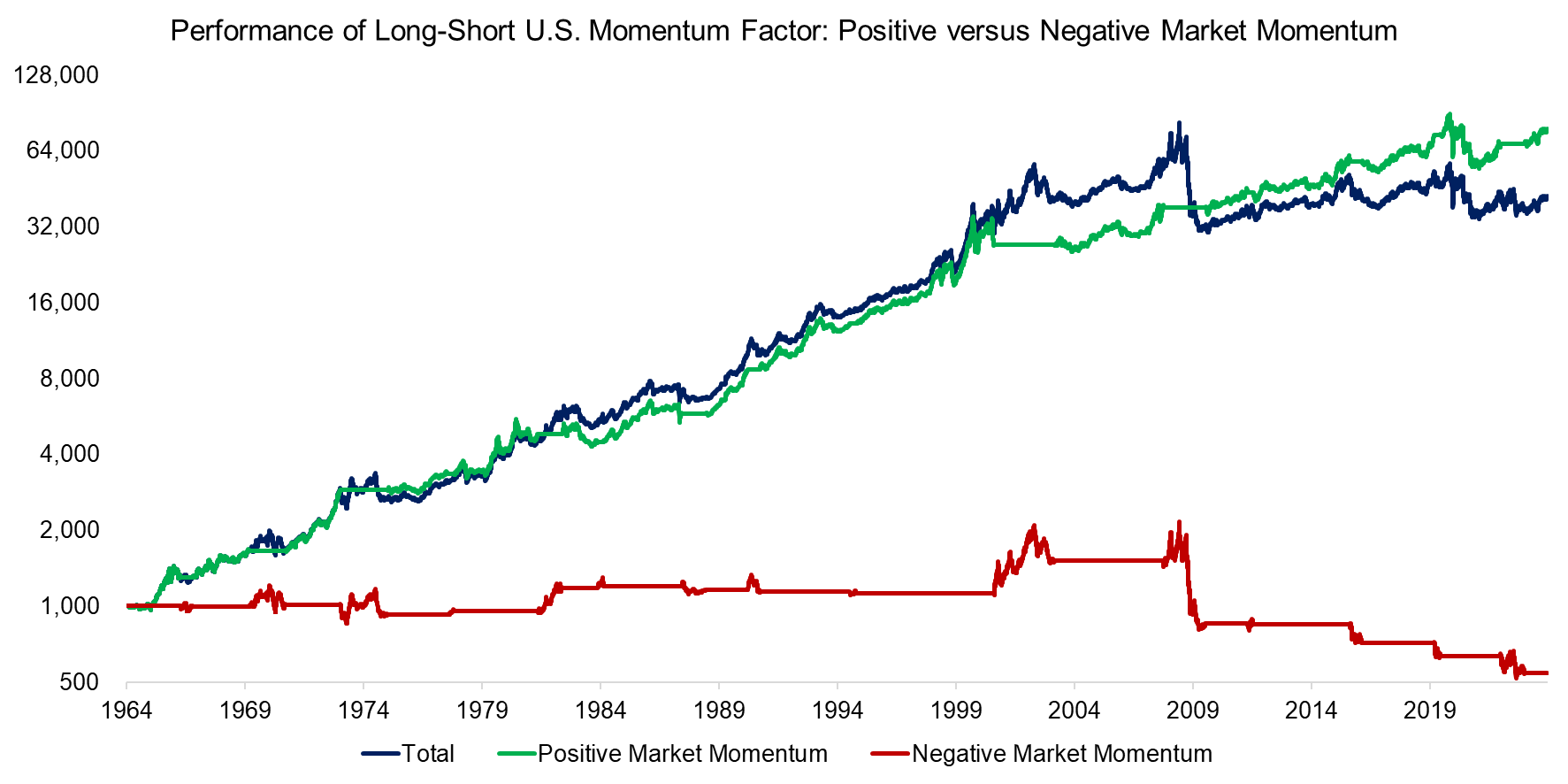

We investigate these results further by plotting the performance of the U.S. momentum factor and the two conditional scenarios. It seems that allocating to momentum when the market momentum was positive captured almost all of the excess returns and avoided the significant momentum crash during the global financial crisis in 2009.

In contrast, the momentum factor did not generate attractive returns when the market momentum was negative, especially since 2009 when negative market momentum led to consistent losses. Based on this, it seems that factor timing is possible and sensible.

Source: Finominal

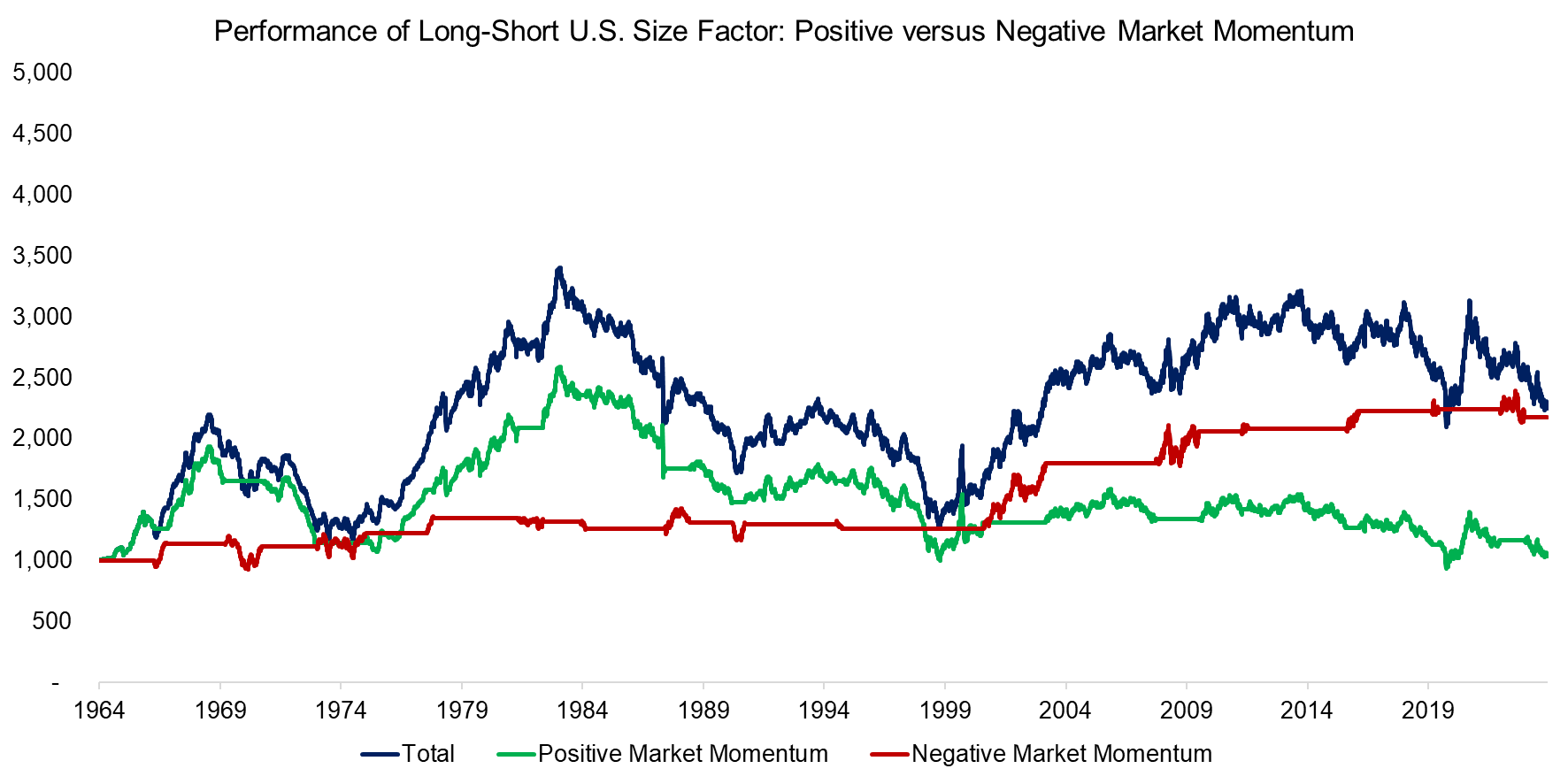

It is more difficult to interpret the performance of the size factor across the market regimes. The factor generated a negligible return and there were multiple cycles of small-caps falling in and out of favor. Intuitively, we would have expected that small-cap stocks perform better when the stock market momentum is positive as these are typically viewed as riskier than large-cap stocks, but the analysis shows the inverse (read The Illusion of the Small-Cap Premium).

However, although the analysis suggests allocating to small-caps when the stock market momentum is negative, this is based on only a few periods where this worked exceptionally well, e.g. during the tech bubble implosion in 2001 when small-caps staged a recovery. Is this sufficient data for a robust factor allocation model?

Source: Finominal

DEVELOPED MARKETS EX U.S. FACTOR PERFORMANCE IN MARKET REGIMES

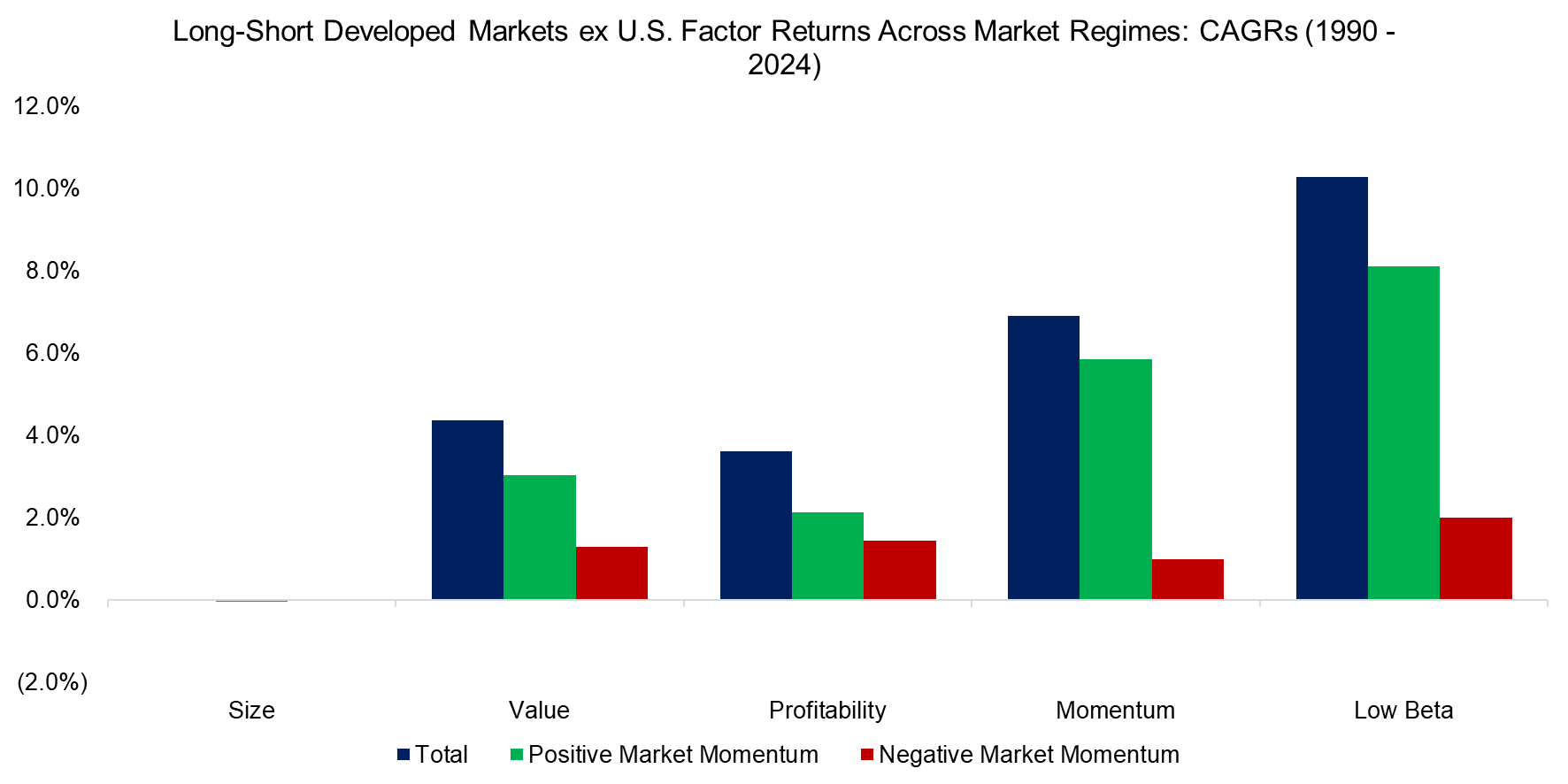

We switch the data set from the U.S. to developed markets excluding the U.S. to validate the allocation model further, where we have data from the same sources for the period between 1990 and 2024.

Again, we observe that the size factor generated the worst and the low beta factor the best return, and that almost all factors generated positive excess returns when the stock market featured positive or negative momentum, which does not suggest that investors should avoid factors when the market momentum is negative.

Source: Finominal

MULTI-FACTOR PERFORMANCE IN MARKET REGIMES

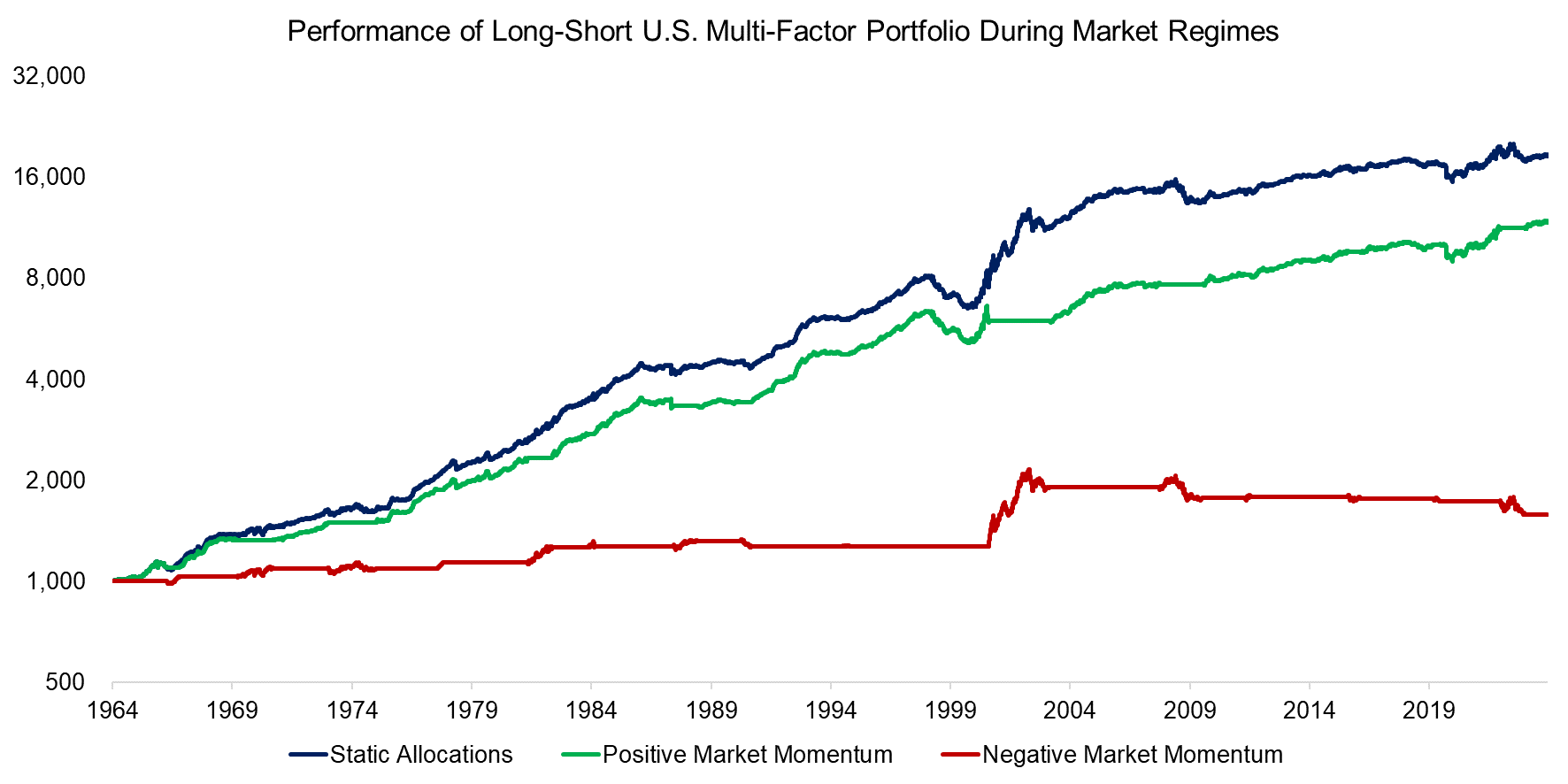

Finally, we create an equal-weighted portfolio of the five factors and two portfolios representing the market regimes. Most of the U.S. factor returns were generated when the market momentum was positive, but it would have been an error to avoid allocating to factors when the market momentum was negative.

Source: Finominal

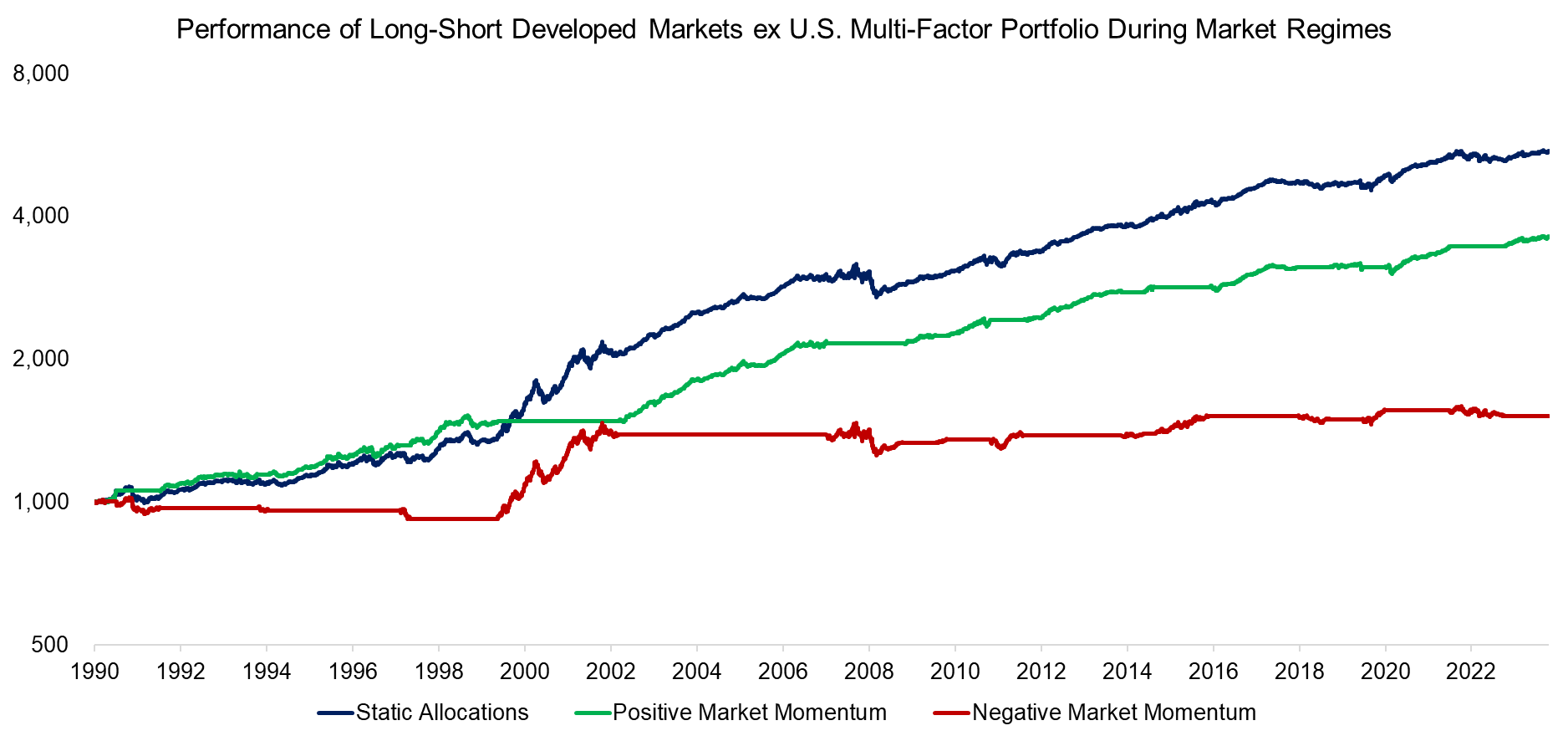

The performance of the multi-factor portfolios in developed markets excluding the U.S. shows an even clearer picture: the direction of the market momentum had little impact as excess returns were positive in both market regimes.

We should recall that markets were mostly positive throughout the last three decades, which explains why most factor returns seem to be generated when the market momentum was positive.

Source: Finominal

FURTHER THOUGHTS

Although the theory of allocating to risky stocks when markets are bullish and defensive stocks when bearish is alluring, this simple approach did not validate it. Naturally, there are many ways of defining risk sentiment, and our role as financial researchers is to evaluate all of them, hoping one day to find the one that works…

However, more sensible is to focus on factor risk management rather than factor timing, which are two related but not identical concepts. Ultimately, it is about trying to understand what drives investors to pursue certain styles and derive a sound risk management framework for that. It might not generate higher returns than simple factor exposures, but might help avoid factor crashes or decade-long periods of negative excess returns.

RELATED RESEARCH

Factor Investing Is Dead, Long Live Factor Investing!

How Painful Can Factor Investing Get?

Market Timing with Multiples, Momentum & Volatility

Market Timing vs Risk Management

Factors & Volatility-Based Risk Management

Factor Crowding Model

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.