Factors & Interest Rates

Fear Not the Rates…

July 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- There are no consistent relationships between Value, Size, Momentum and interest rates

- Applies to high and low and increasing and decreasing rate environments

- Investors shouldn’t be too concerned about factor exposure and rising rates, more about very low rates

INTRODUCTION

The direction of the S&P 500 and interest rates are likely the two most discussed topics in finance as trillions of dollars depend on their movements. Most people have some money in stocks, so can relate to the market ups and downs. The daily changes in interest rates are somewhat more abstract, although they affect anyone with a mortgage, consumer loan, or savings account. When it comes to factor investing market participants often question the impact of interest rates. In this short research note we will analyse the Value, Size, and Momentum factors and interest rates. Specifically, we will review how the factors perform in high and low and rising and decreasing interest rate environments.

METHODOLOGY

We will focus on the US equity market as it has the longest data series of high quality factor data available. We use factor data from Fama-French, where we build long and short portfolios based on the top and bottom 10%, and 10-year US interest rate data from FRED, which is available since 1962. The period is sufficient as it contains a complete cycle of rising and decreasing interest rates.

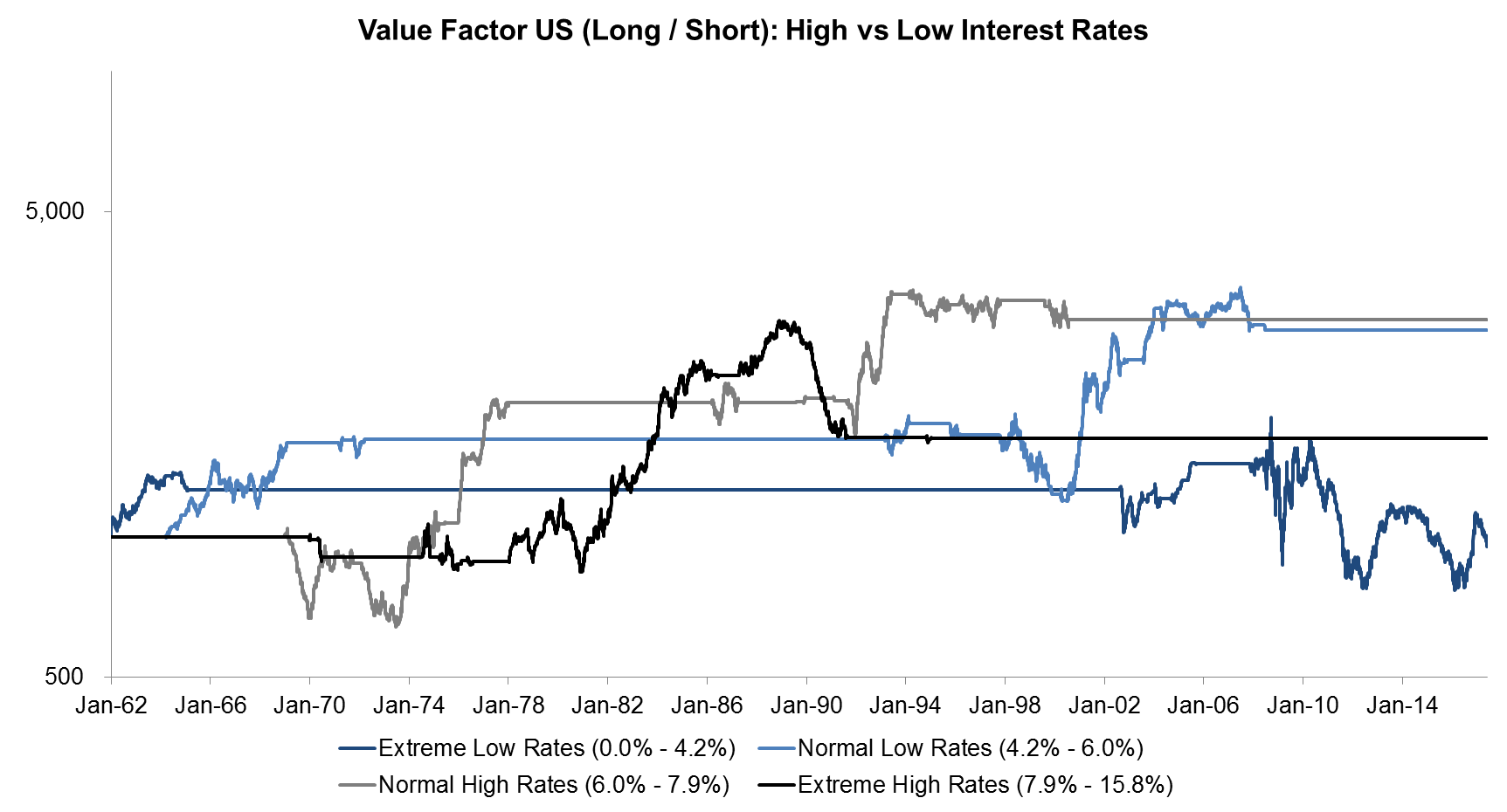

VALUE FACTOR US (LONG / SHORT) & INTEREST RATES

The chart below shows the performance of the Value factor (long / short) in the US in four different interest rate periods, which are categorised into extreme low, normal low, normal high, and extreme high interest rate environments. Market participants might consider Value as a risk-on strategy as buying cheap, risky stocks is done with more confidence in a low risk environment, where the economy shows strong growth and interest rates are more likely high than low as central bankers would have increased these to keep inflation in check. The analysis confirms this to a degree as Value does not perform well in an environment of extreme low rates, which tends to be a result of low economic growth and characterised more a more cautious investor sentiment (read Value US Sectoral Analysis) .

Source: Fama-French, FRED, FactorResearch

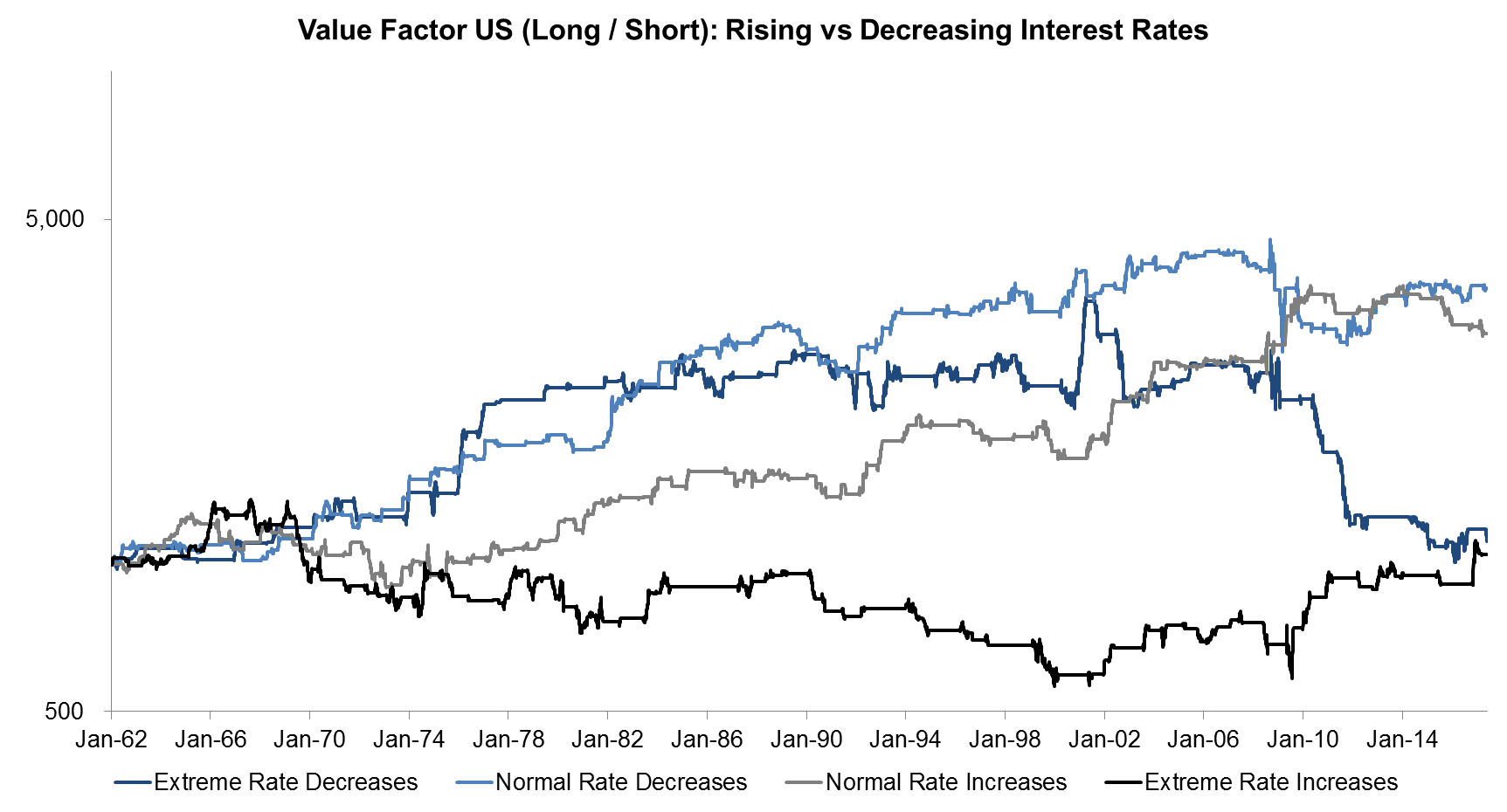

The next chart shows the performance of the Value factor in rising and decreasing interest rate environments. The periods are differentiated between slowly and rapidly rising and falling interest rates. There are no clear relationships, except that extreme interest rate changes do not seem favourable for the Value factor.

Source: Fama-French, FRED, FactorResearch

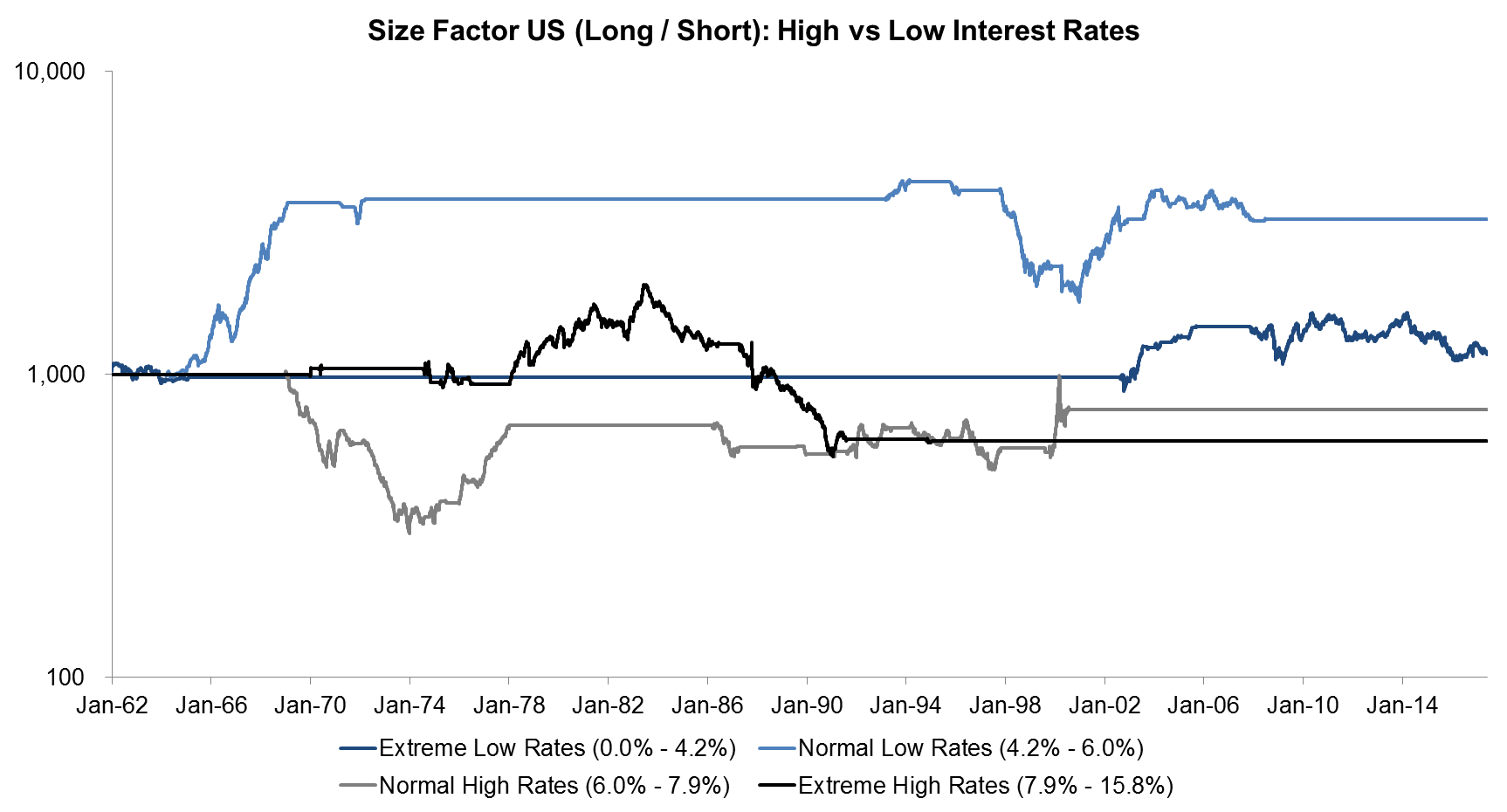

SIZE FACTOR US (LONG / SHORT) & INTEREST RATES

The chart below shows the performance of the Size factor (long / short) in the US in different interest rate periods, which does not indicate any consistent relationship between the factor and interest rates (read Size Factor).

Source: Fama-French, FRED, FactorResearch

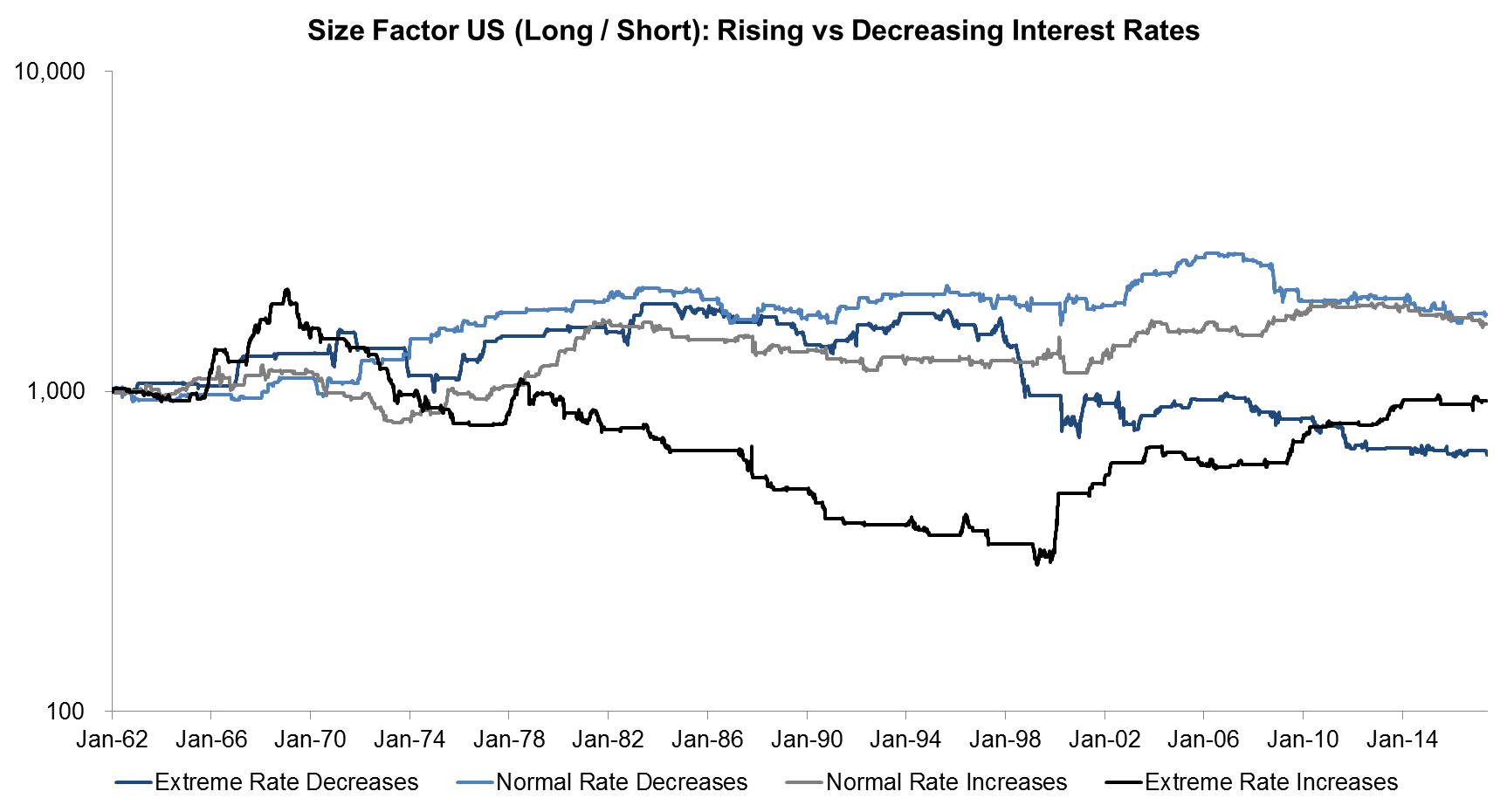

The next chart shows the performance of the Size factor in rising and decreasing interest rate environments. Similar to the analysis above, it’s difficult to conclude any concrete relationships, except perhaps that extreme rate increases are not favourable for the Size factor.

Source: Fama-French, FRED, FactorResearch

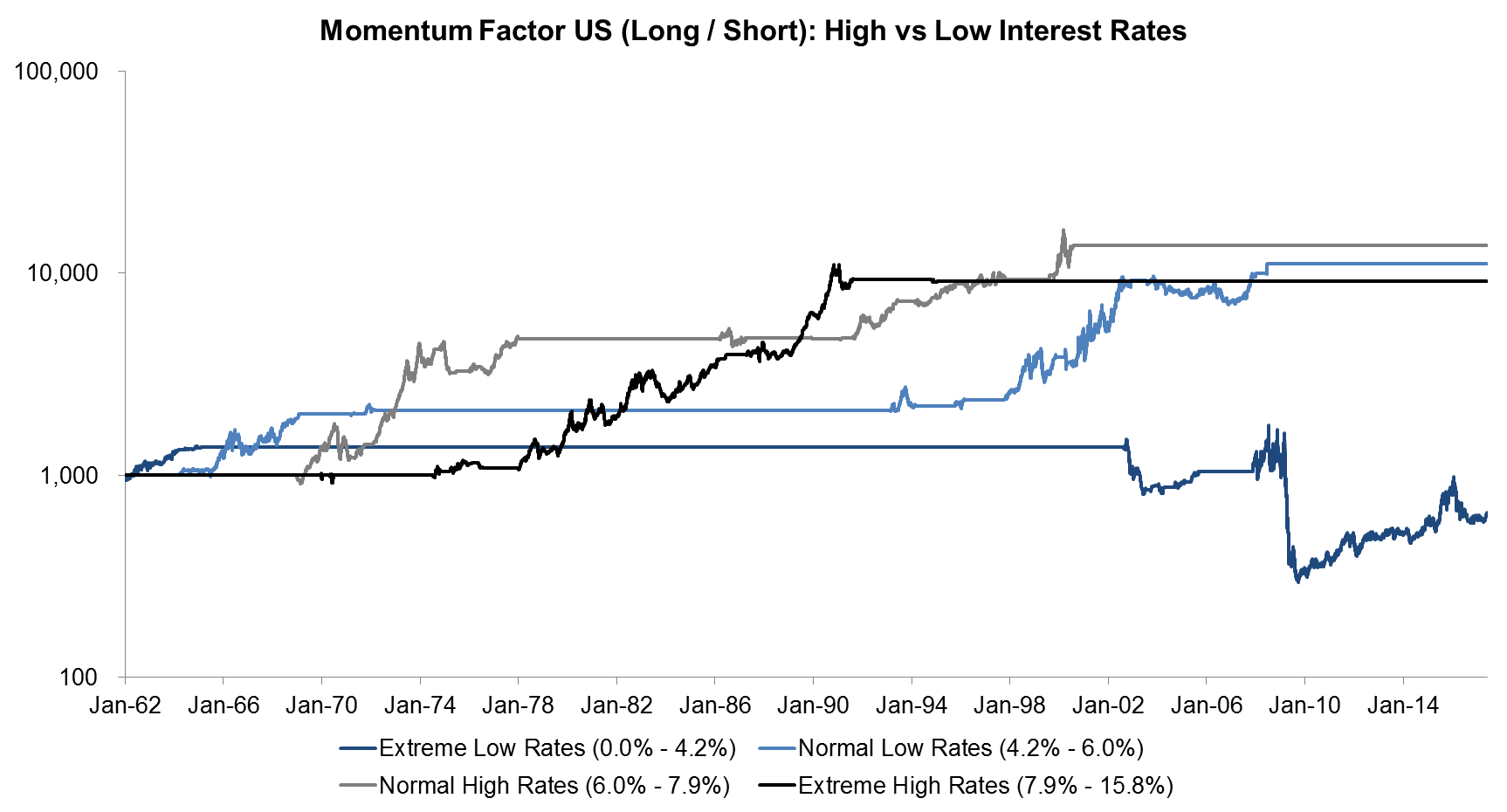

MOMENTUM FACTOR US (LONG / SHORT) & INTEREST RATES

The chart below shows the performance of the Momentum factor (long / short) in the US in different interest rate periods and the factor seems to be indifferent to the rate environment. Readers might argue that an environment of extreme low rates might be risky for Momentum exposure as it includes the Momentum crash of 2009, but this does not need to be structural. Japan had low rates for decades and there are no frequent Momentum crashes.

Source: Fama-French, FRED, FactorResearch

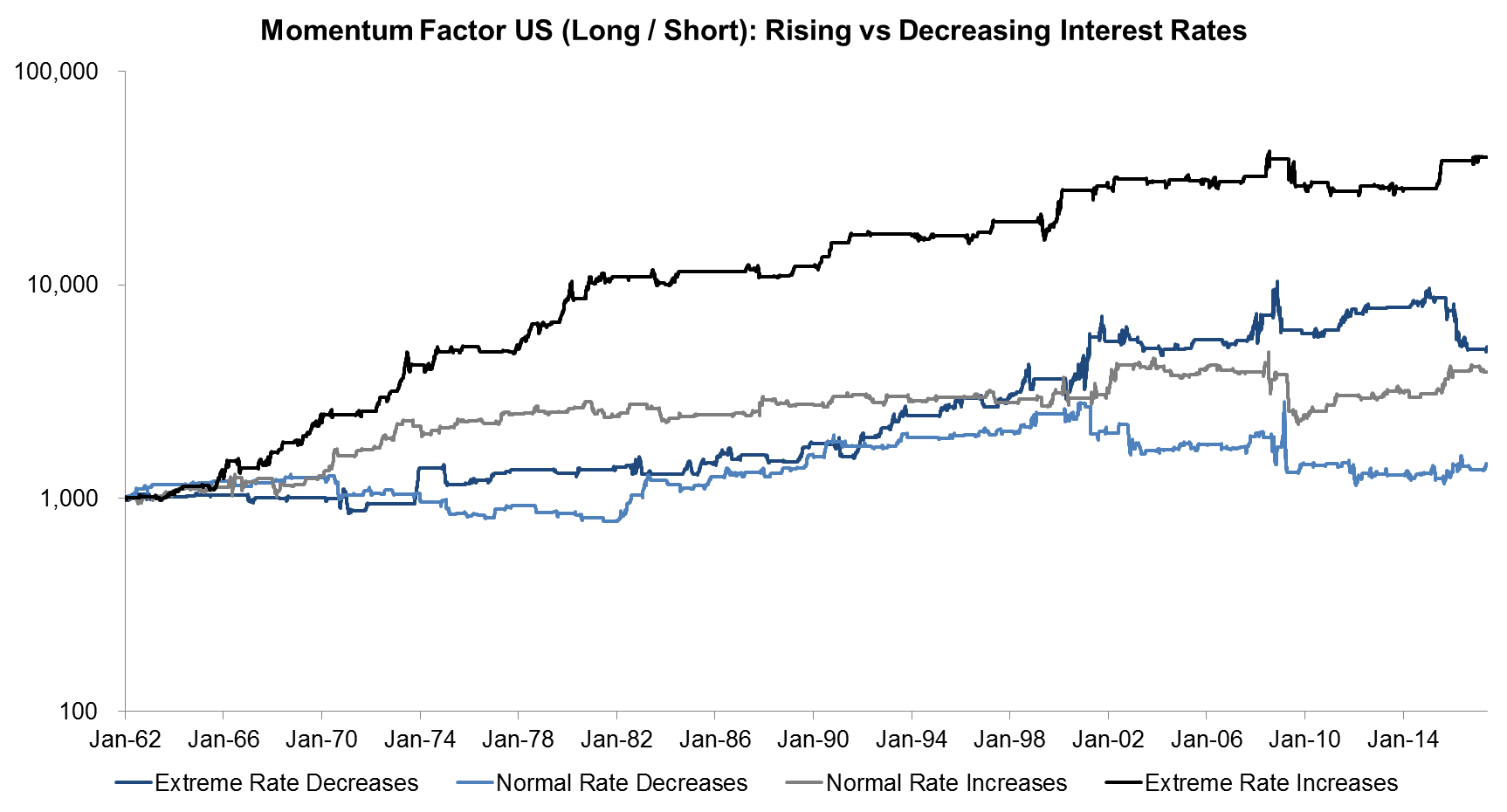

The next chart shows the performance of the Momentum factor in rising and decreasing interest rate environments. Interestingly periods where interest rates increased rapidly seem to be supportive for the factor performance, although most of these returns were generated before 1985, where rates were increasing quickly and factor performance was strong.

Source: Fama-French, FRED, FactorResearch

FURTHER THOUGHTS

This short research note shows that there are no consistent relationships between factor performance and interest rates, at least not for Value, Size, and Momentum in the US since 1962.

Given record levels of debt globally and poor demographics in most developed markets, the low interest rate environment might continue for the foreseeable future. Unfortunately this environment is the worst for the factors on average.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.