Equity Factors In Japan

Land of the Rising Alpha?

August 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Japan has unique characteristics from an economic perspective

- Factor performance in Japan mirrors global factor performance

- Debt & demographics seem to matter less than underlying factor drivers

INTRODUCTION

Japan is an unusual country from many perspectives – it has only close neighbours to the West of its coastline, was isolated for centuries, developed a unique culture and cuisine, and has had a shrinking population for a few years. The poor demographics led to low economic growth, too much debt, and extreme policies by its central bank, which is reflected in equity markets that have gone nowhere in the last 25 years. Unfortunately, the US and Europe now share some of these characteristics, i.e. declining populations (Europe) and record levels of debt (Europe & US). It’s therefore interesting to analyse the factor performance in Japan and consider implications for factor performance of markets that have become more similar to Japan, which we will do in this short research note.

METHODOLOGY

We’re going to analyse the five most well-known factors: Value, Size, Momentum, Quality, and Growth. Factor data is available since 2000 for Japan and Global ex-Japan, which is a combination of developed markets in the US, Europe, and Asia and weighted by the number of companies available in the stock universes. It’s worth highlighting that the weight of the US is approximately 61%. The factors are constructed as long-short portfolios by taking the top and bottom 10% of the stock universes in the US, Europe, and Japan while taking the 20% in other markets as there are less stocks available. Only companies with a minimum market capitalization of $1bn are considered and 10bps of transaction costs are included.

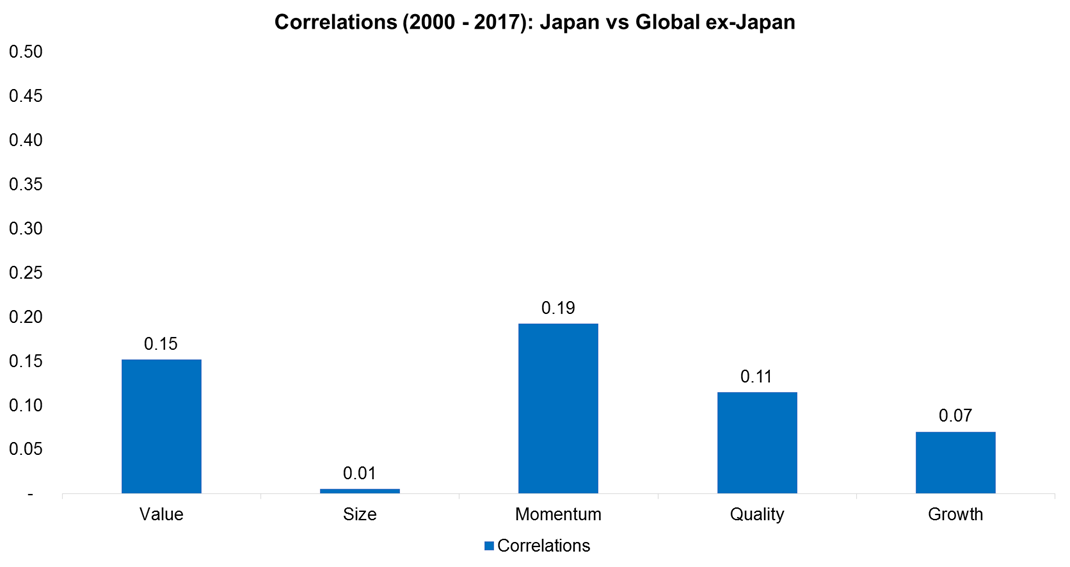

CORRELATIONS: JAPAN & GLOBAL EX-JAPAN

The chart below shows the daily correlations between the factors Japan and Global ex-Japan. We can observe low correlations across factors, which implies diversification benefits from combining factor exposure of different countries. An investor seeking exposure to the Value factor might notice the low correlation of Value Japan to Value Global ex-Japan of 0.15 and seek to combine these as theoretically they should generate returns independent of each other.

Source: FactorResearch

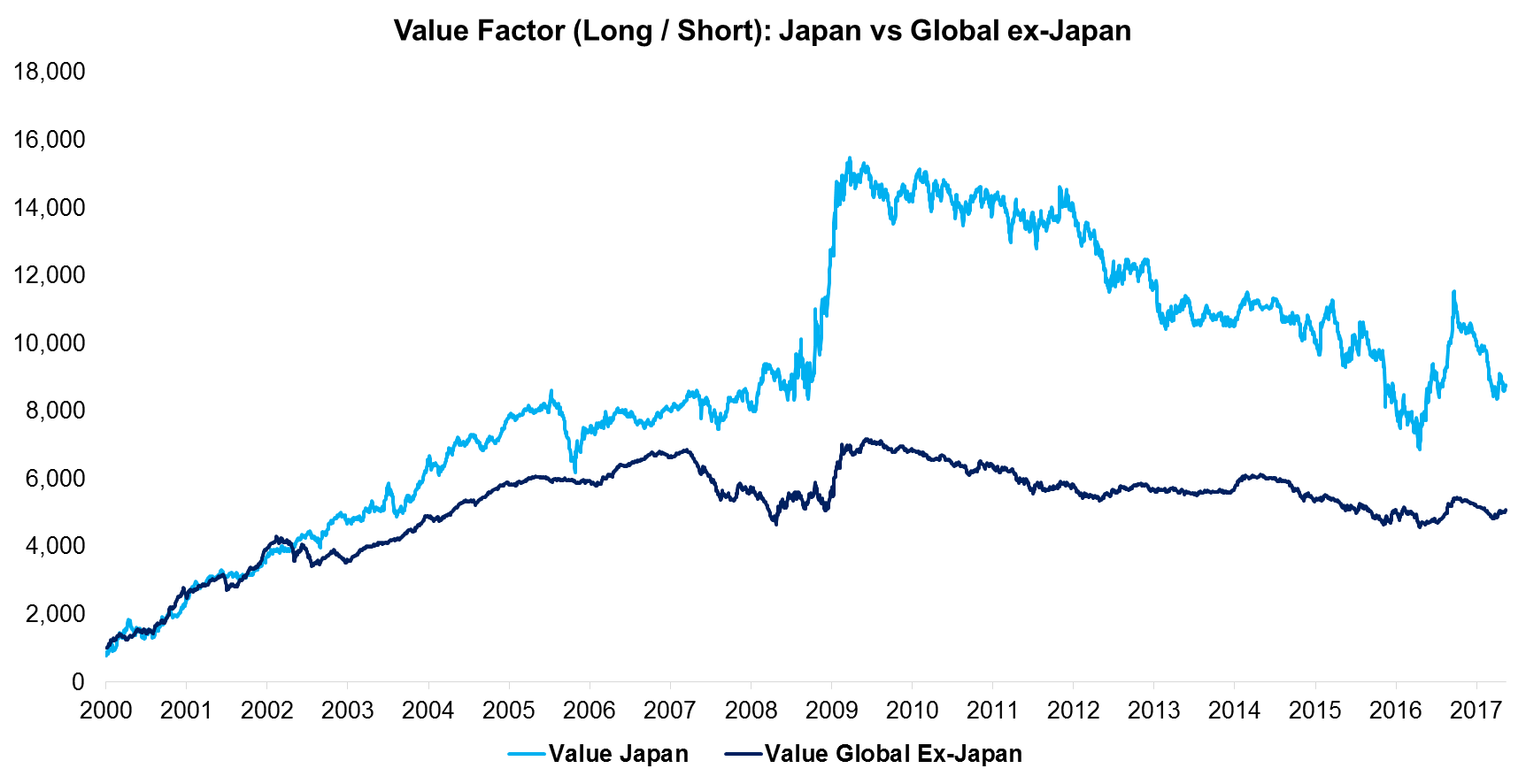

VALUE: JAPAN VS GLOBAL EX-JAPAN

The next chart shows the performance of the Value factor (long / short) for Japan and Global ex-Japan from 2000 to 2017. We can observe that Value in Japan outperformed its global benchmark, but interestingly the trend is almost identical, which highlights that investor preferences permeate across borders. The performance was strong from 2000, which represents the start of the Tech bubble implosion, to 2006. The factor does experience a drawdown in Japan and globally during the Global Financial Crisis, but also shows a strong recovery as markets recovered. Thereafter the performance has been poor with consistent negative returns from 2009 to 2017. It’s difficult to explain why Value has not performed well over the last few years, perhaps it simply reflects investor preferences for Quality and Growth stocks given the severity of the GFC.

Source: FactorResearch

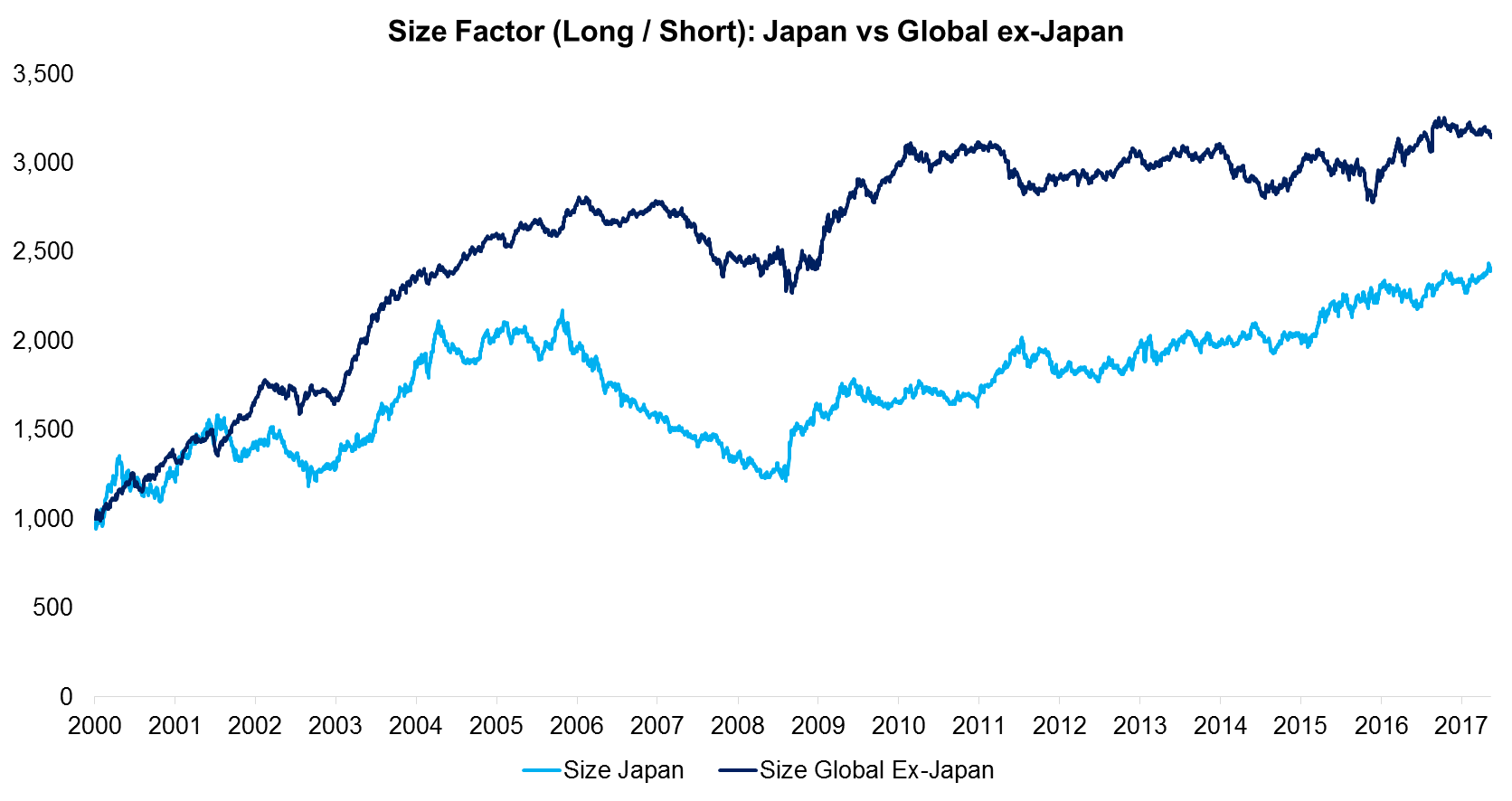

SIZE: JAPAN VS GLOBAL EX-JAPAN

The performance of the Size factor (long / short) Japan and Global ex-Japan show comparable trends over time, similar to the results of the Value factor. It seems like factor performance in Japan, despite the unique characteristics of the country, is just mirroring global trends. It also highlights that the correlations, which are low for Size, are overstating diversification benefits. If Size has strong negative returns in Global ex-Japan, then Size in Japan will likely show similar returns (read Size Factor).

Source: FactorResearch

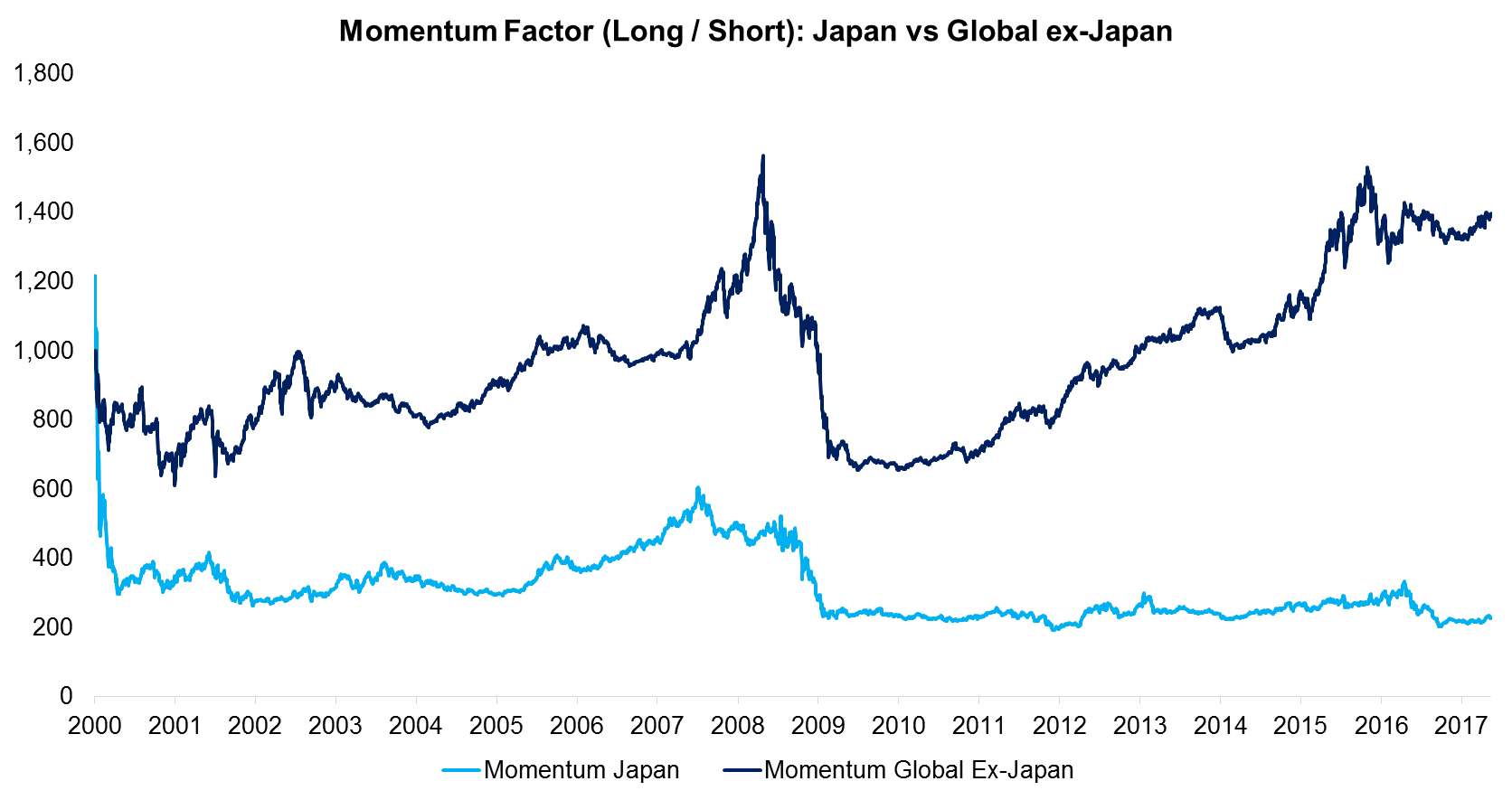

MOMENTUM: JAPAN VS GLOBAL EX-JAPAN

The chart below shows the performance of the (Price) Momentum factor (long / short) and we can observe a very flat profile for Japan compared to strong returns for Global ex-Japan. The weak performance of Momentum in Japan has been discussed widely in academic research and explanations are manifold. Our research indicates a strong relationship between Price and Earnings Momentum and that Price Momentum requires Earnings Momentum. The latter shows a weak performance in Japan, which could be attributed to the different ways that earnings are processed by the investor and analyst community. Despite the different magnitude in performance, we can still observe similar trends and inflection points, e.g. the Momentum factor crash in 2009.

Source: FactorResearch

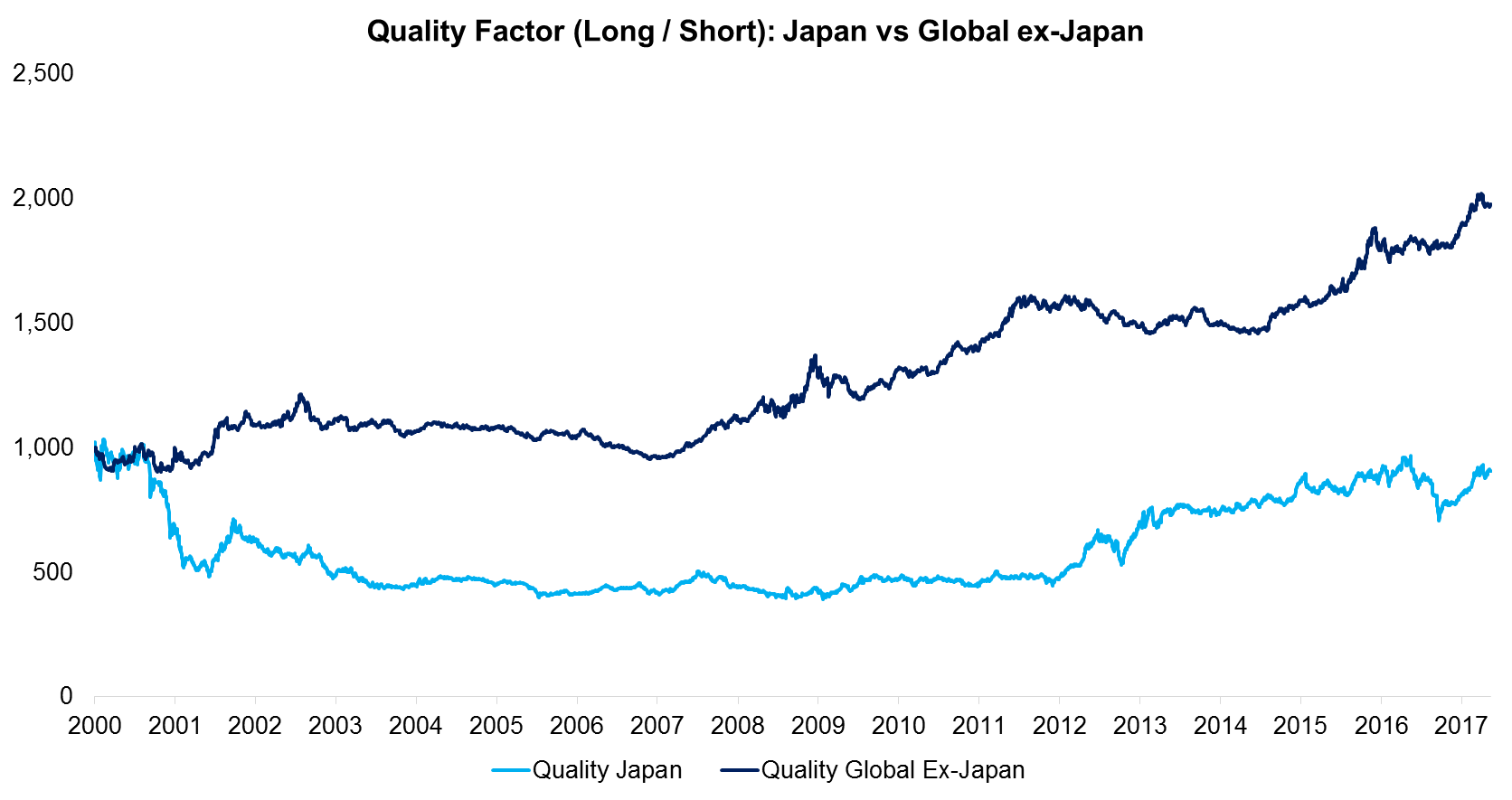

QUALITY: JAPAN VS GLOBAL EX-JAPAN

Our Quality definition is a combination of return-on-equity and debt-over-equity, which maximises the number of stocks in the universe as these metrics are available for all companies. Japan is interesting given that the country had low interest rates for the last two decades while Europe and US only recently started experimenting with this. It’s questionable if debt-over-equity, which focuses on the balance sheet strength of companies, is meaningful as a Quality metric if debt is so cheap. The chart below shows that the trends of the Quality factor are somewhat similar for Japan and Global ex-Japan, essentially the factor was flat or declining until the GFC and then started generating positive returns thereafter (read Quality Factor: How To Define It?).

Source: FactorResearch

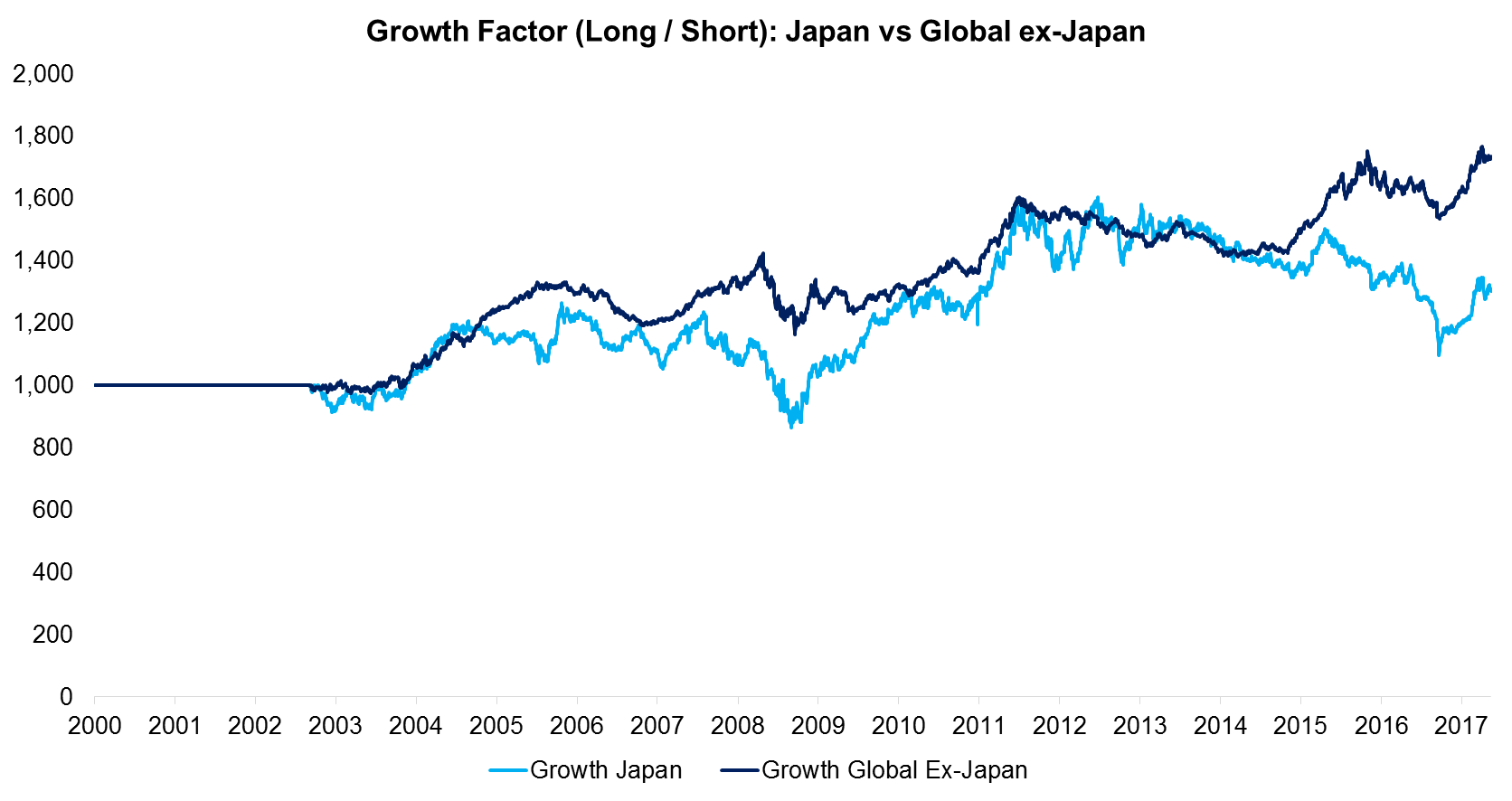

GROWTH: JAPAN VS GLOBAL EX-JAPAN

Given that Japan has experienced low economic growth for many years, investors might show a strong preference for Growth stocks. The chart below shows that the factor performance was effectively flat over the last 17 years, which might reflect the preference for Growth stocks and therefore a perpetual overvaluation. We can observe periods of similar trends when comparing Japan and Global ex-Japan, but also periods of different trends.

Source: FactorResearch

FURTHER THOUGHTS

This short note shows that factors in Japan mirror global factor performance, despite Japan having unique economic characteristics as a country that influence its stock market. The key take-away would be that poor demographics and record high levels of debt matter less than the underlying drivers of factor performance.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.