Finding Funds with Diversification Potential

Downside versus upside betas

May 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Downside betas do not help to identify diversifying strategies

- These need to be combined with upside betas

- Betas to the S&P 500 were more useful than betas to the VIX

INTRODUCTION

In our article Downside Betas vs Downside Correlations (read Downside Betas vs Downside Correlations) we contrasted the downside and upside betas of eight hedge fund types that are marketed as diversifying strategies. Unfortunately for investors, none of these offered attractive diversification features. Either they provided the same upside as equities, but also the same downside, or the downside risk was as much reduced as the participation in the upside.

In this article, we will screen the downside and upside betas of a wide range of ETFs and mutual funds and seek to identify ones with attractive diversification potential.

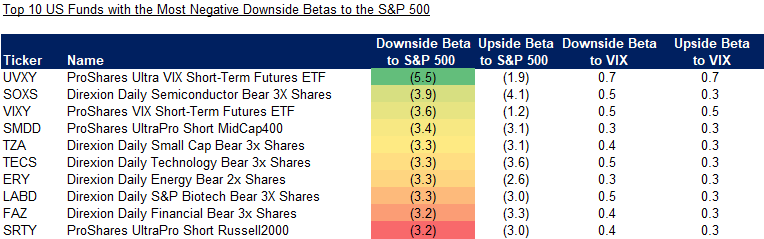

TOP 10 FUNDS WITH MOST NEGATIVE DOWNSIDE BETAS

First, we calculate the upside and downside betas of approximately 25,000 US-traded mutual funds and ETFs to the S&P 500 and VIX. For example, the downside beta to the S&P 500 is computed by only considering the days when the S&P 500 had negative returns. The lookback period is the last five years, which includes a bull market between 2018 and 2021, a crash in 2020, and a bear market in 2022.

Given that we want securities that offer diversification benefits, we initially focus on the funds with the most negative downside betas. These should increase when the S&P 500 is declining. However, selecting the top 10 funds highlights that these are all ETFs that go long the VIX or short sectors like semiconductors or market segments like the Russell 2000.

Adding such directional bets to an equities portfolio generates limited diversification benefits as they are too negatively correlated to the S&P 500, which is indicated by the strongly positive betas to the VIX. If an investor wants to reduce his equity risk, he would be better off simply selling equities and moving into cash.

Source: Finominal

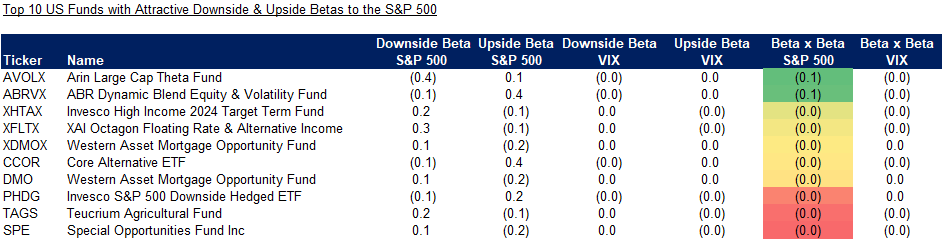

TOP 10 FUNDS WITH MOST ATTRACTIVE BETAS TO THE S&P 500

Next, we consider how to improve the fund selection process as simply selecting the ones with the most negative betas is not attractive.

We calculate the product of the downside and upside betas, which reduces the impact of directional bets. The resulting list of top 10 funds based on this criteria includes funds that are typically regarded as diversifying strategies, eg option-based and alternative products. The correlation to the S&P 500 is closer to zero rather than strongly negative.

Source: Finominal

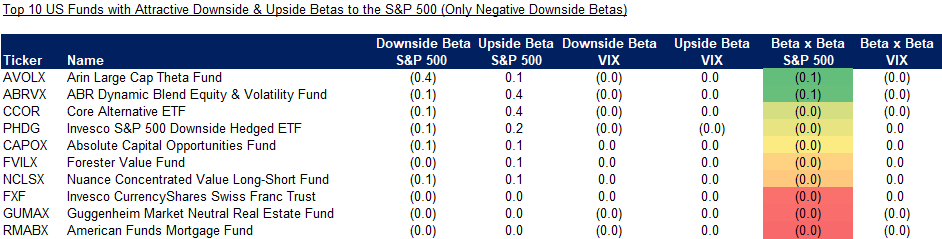

However, the list also includes funds with positive downside betas, which are not desirable from a diversification perspective. We add a filter to only consider funds with negative downside betas, ie funds that increase in value when the S&P 500 is declining.

This final list of funds includes diverse strategies and almost all are considered diversifying strategies. These funds do not offer the strongest downside protection, but a good combination between downside and upside beta. Ideally, they lose little or even make money in good times, but perform strongly on days when stocks go down.

Source: Finominal

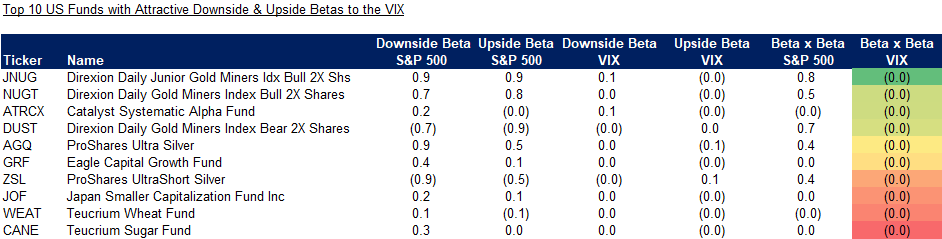

TOP 10 FUNDS WITH MOST ATTRACTIVE BETAS TO THE VIX

We replicate the previous analysis but use the VIX instead of the S&P 500. Volatility tends to increase when stocks decrease, so we are targeting funds with positive upside betas to the VIX. However, if we only sort by this metric, then the high-ranking funds will be directional ones like VIX ETFs, which are undesirable.

Given this, we calculate the product of the upside and downside betas again. The resulting list of the top 10 funds is dominated by commodity-focused products, but includes various kinds of exposures like gold, silver, wheat, and sugar.

Source: Finominal

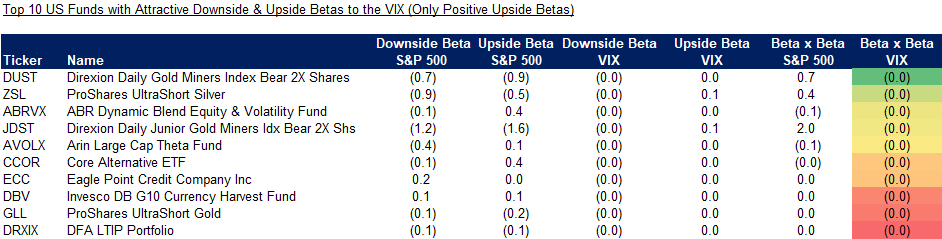

We can enhance the previous list by only including funds that have a positive upside beta to the VIX. Adding this filter creates an overlap with the funds selected on their betas to the S&P 500, which can be regarded positively.

Oddly enough, the list also includes ETFs that short gold miners, where investors might have assumed a long position as gold is typically regarded as a risk-off or safe haven asset. However, gold’s correlation to other asset classes is ever-changing and the correlation to the VIX was zero over the last five years.

Source: Finominal

MEASURING DIVERSIFICATION BENEFITS

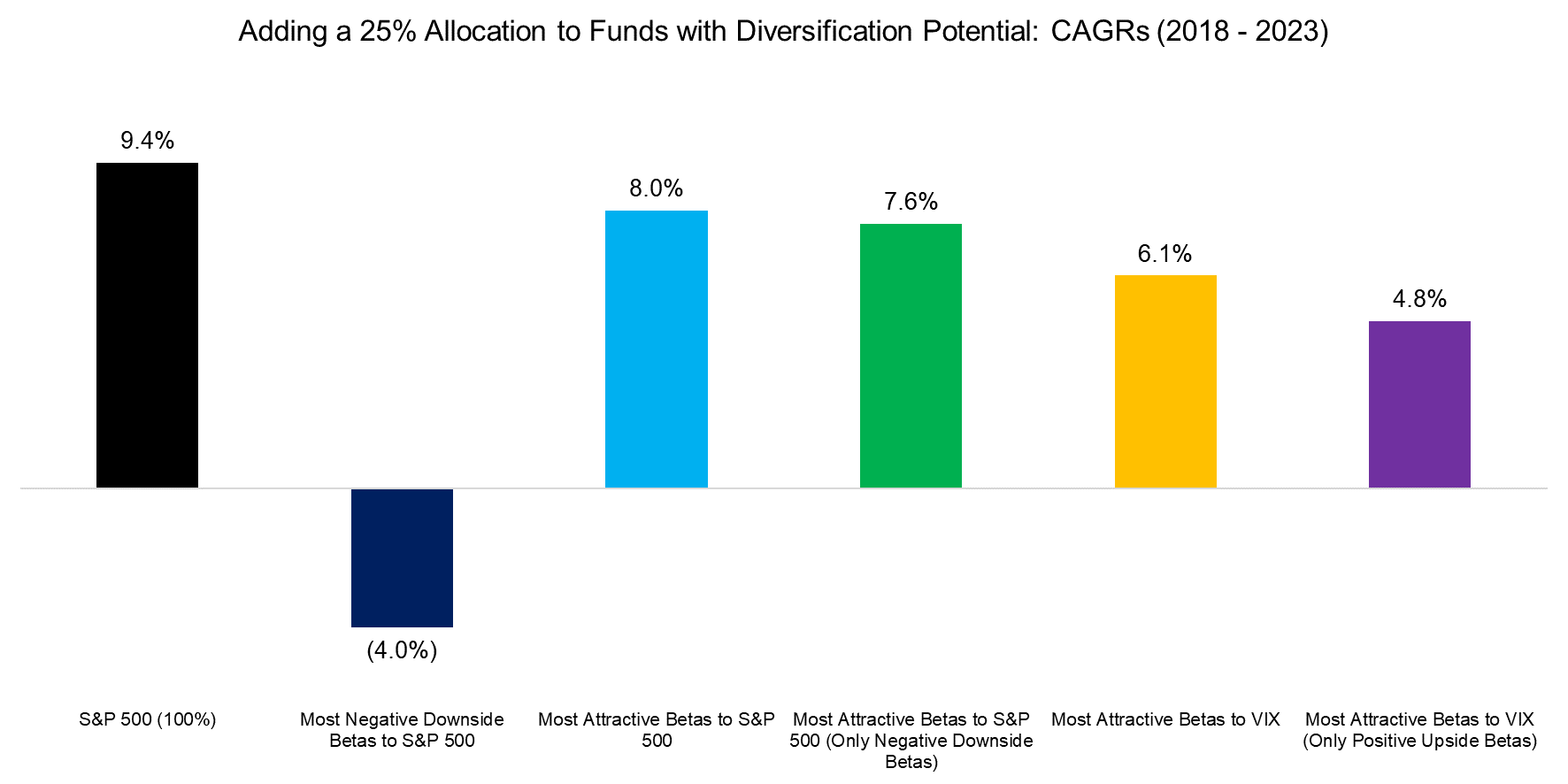

Finally, we test these five sets of funds by simulating adding a 25% allocation of either to a portfolio comprised exclusively of the S&P 500.

We observe that the CAGR would have decreased in all cases compared to the S&P 500 on a standalone basis. As expected, adding funds with large downside betas makes the least sense as these provide few diversification benefits, but reduce the return significantly. Adding such short-focused products would have completely consumed the positive contribution from the S&P 500 to the portfolio over the last five years given that some of these products feature leverage.

Source: Finominal

However, investors should not expect the absolute return to increase when adding diversifying strategies. Reducing risk and improving risk-adjusted returns are the core objectives.

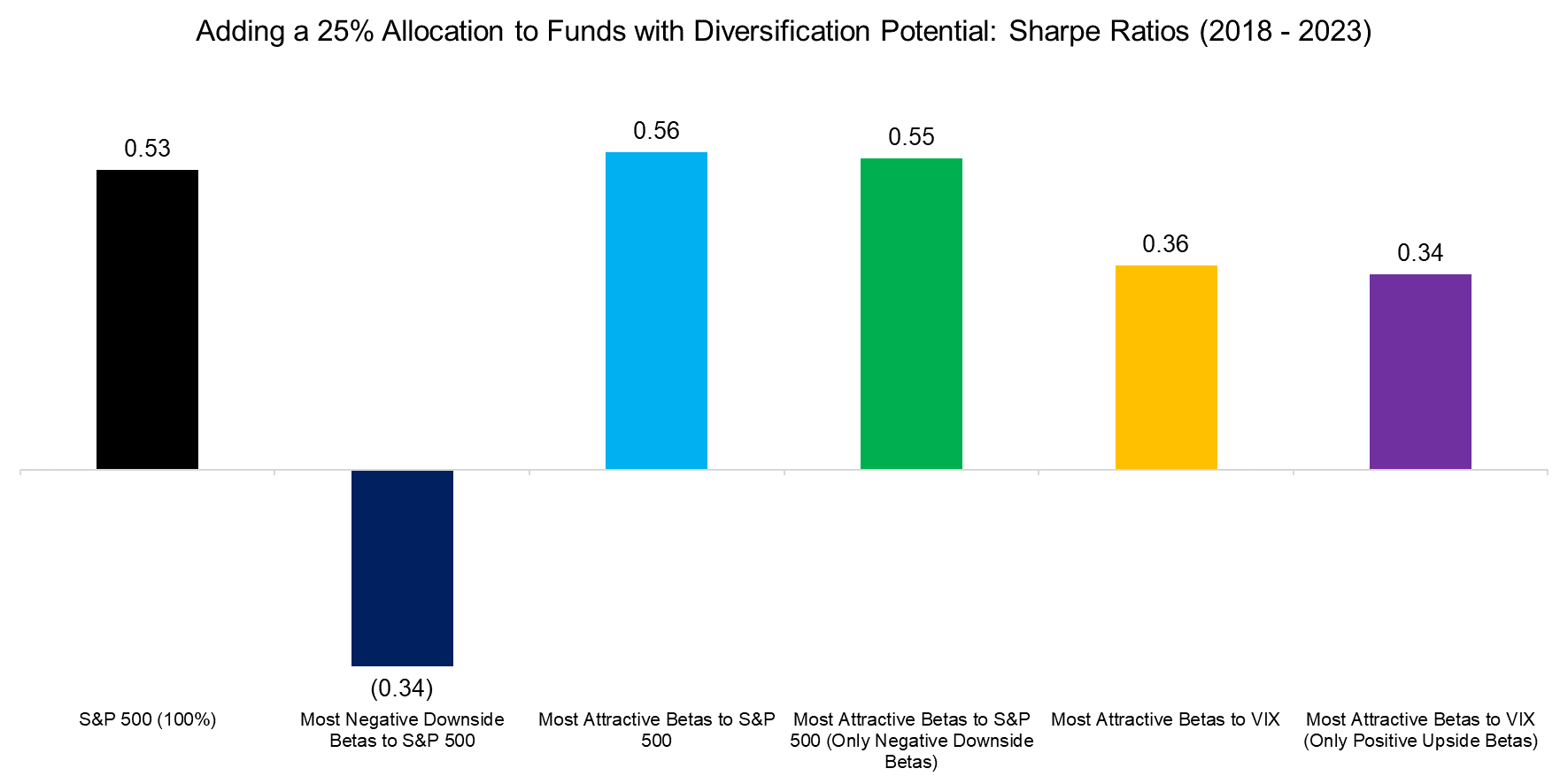

We observe that adding a 25% allocation to funds with the most attractive betas to the S&P 500 would have increased the Sharpe ratio compared to the S&P 500. In contrast, using the VIX instead of the S&P 500 would have generated fewer diversification benefits.

Source: Finominal

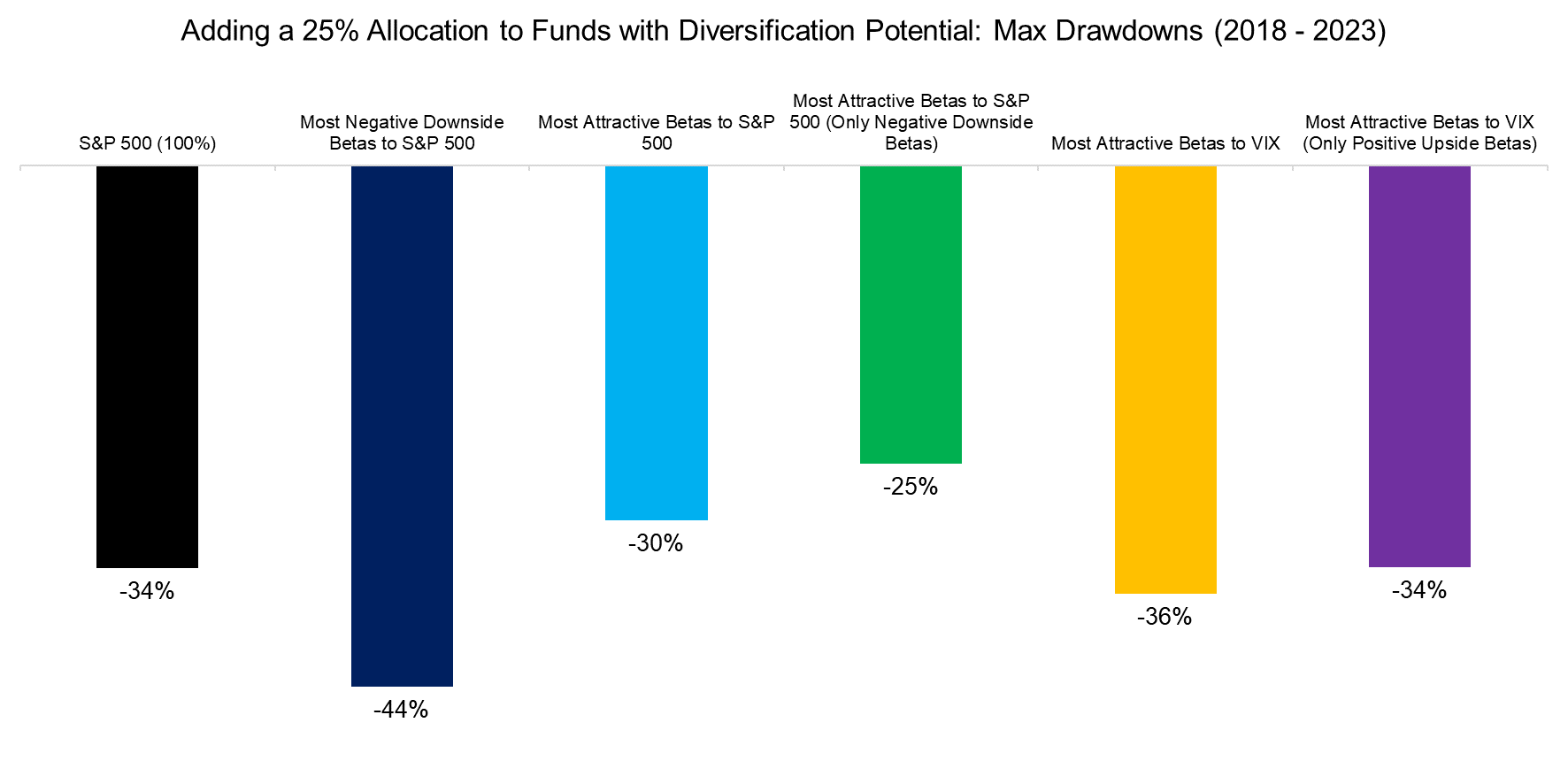

The diversification benefits can be seen most clearly when analyzing the maximum drawdowns, where adding funds with attractive & negative betas to the S&P 500 would have reduced the maximum drawdown from -34% to -25%, but while providing the same returns as the S&P 500 on a risk-adjusted basis.

It is worth highlighting that the -25% is the median maximum drawdown from adding the top 10 funds with attractive & negative betas, but every one of these funds would have achieved a similar result as the maximum drawdown ranged from -23% to -26% on a single fund basis.

Source: Finominal

FURTHER THOUGHTS

Some strategies like merger arbitrage are marketed as diversifying strategies, but their returns are only uncorrelated in good times. In the short periods when stocks crash, mergers fail, and the correlation to the stock market spike. Correlations are like icebergs, it is tough to spot how much ice there is underwater (read Equity & Bond Correlations – Higher than Assumed?).

It seems that upside and downside betas can be used as additional metrics for capital allocators to scrutinize such strategies. Diversification does not only apply to portfolio construction, but also due diligence.

RELATED RESEARCH

Downside Betas vs Downside Correlations

Upside versus Downside Stocks

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Are Alternative ETFs Good Diversifiers?

Market Neutral Funds: Powered by Beta?

Merger Arbitrage: Arbitraged Away?

Hedge Fund ETFs

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.