Factor Exposure Analysis 107: Fixed Income Factors

AQR vs Robeco

SUMMARY

- Factor investing is less established in bond than in stock markets

- Comparing AQR & Robeco fixed income factors highlights significant differences

- Questionable whether equity-inspired or fixed-income factors are more appropriate

INTRODUCTION

A quant without data is like a ship without a sail. Naturally, data can be purchased from vendors like Bloomberg or FactSet, but many financial researchers lack the funding to do so. A Bloomberg terminal is priced at $24,000 per annum, but that does not provide access to the raw sets of fundamental and price data that a quant requires to run extensive backtests.

Fortunately, there are some professors like Professor Kenneth R. French at the Tuck School of Business at Dartmouth College that make their data library available to the public. Although this typically represents the research output rather than the input, it has helped thousands of financial researchers study financial markets, including this grateful author.

Similarly, some asset managers have started to offer their research output available for download as Excel files. AQR Capital Management, which was likely inspired by Professor French given the founder’s academic education at the University of Chicago, provides data sets for factor investing across asset classes. Robeco, another asset manager, has followed this approach.

Most researchers focus on factor investing in equity markets, but both AQR and Robeco offer data for bond markets as well, which is perhaps an underutilized free resource. In this research article, we will explore fixed income factors by comparing these two data sets.

FACTOR INVESTING IN FIXED INCOME

There are no standard definitions for factors across asset classes, although some are more heterogeneous than others. For example, momentum tends to be defined as the performance over the last 12 months, excluding the most recent one, which is applicable to stocks, bonds, currencies, and commodities. However, there are many ways of measuring the quality of a company or a bond, and is very much in the eye of the beholder.

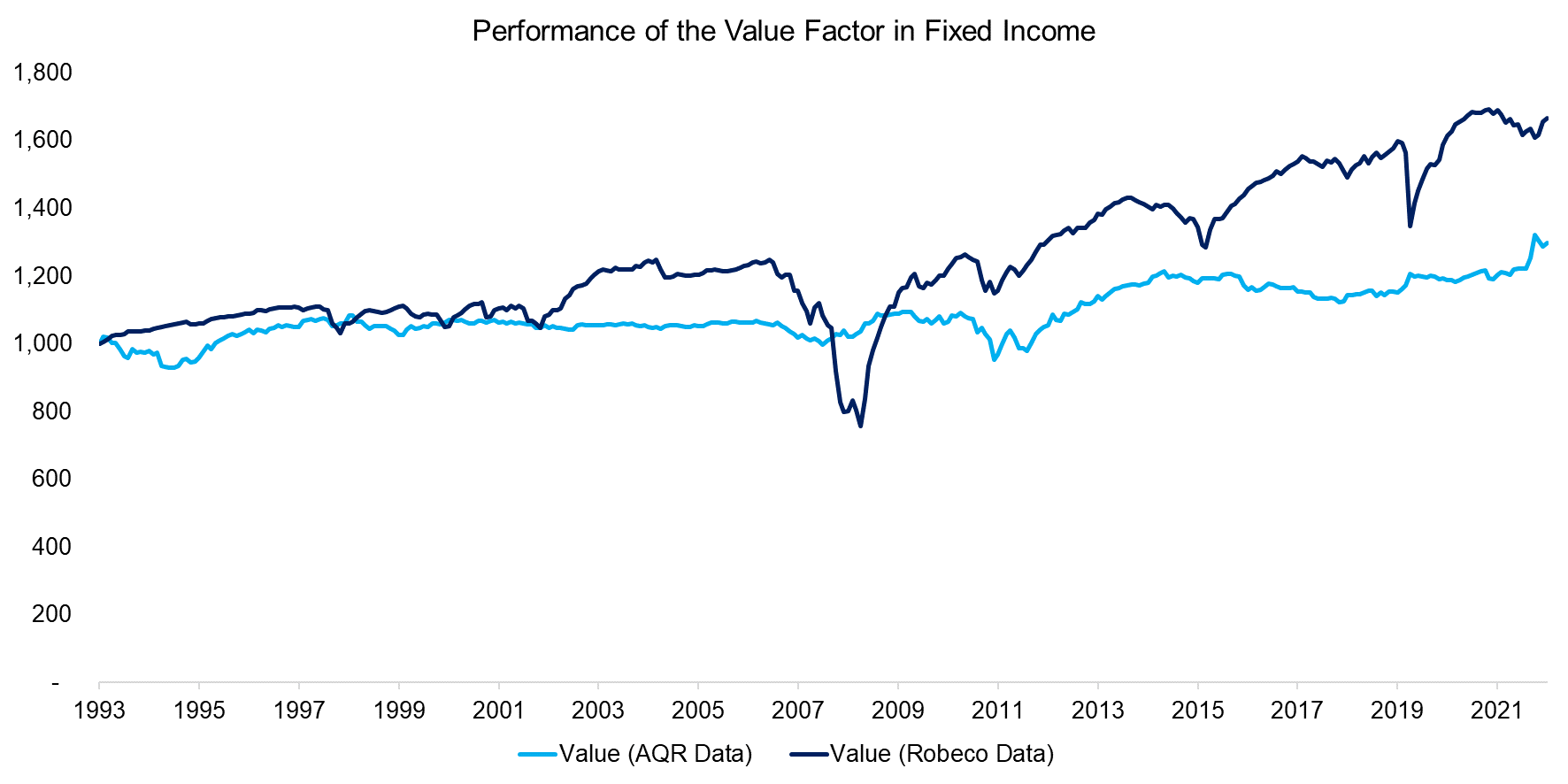

Factor definitions in fixed income are more heterogeneous than in equities, perhaps as a result of Professor Eugene Fama and Professor French setting certain standards. We can demonstrate this by comparing the performance of the value factor in fixed income between 1993 to 2022 using data from AQR and Robeco, which exhibited significantly different trends. The Robeco value factor exhibited a significant drawdown during the global financial crisis in 2009, which indicates exposure to bond and equity markets.

Source: Finominal

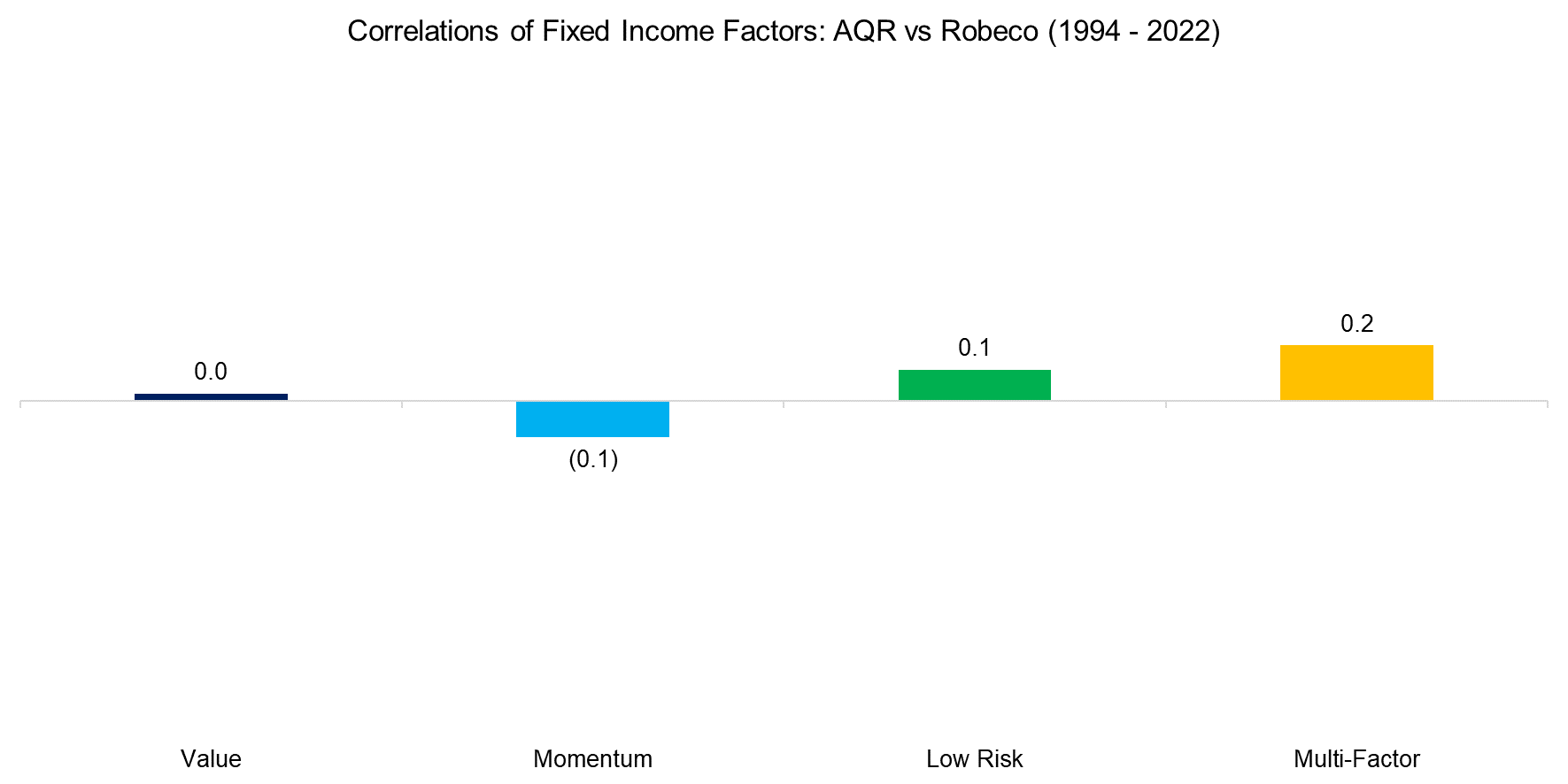

The correlation of the AQR and Robeco value factors in fixed income was zero between 1994 and 2022, similar to the correlations of momentum, low risk, and multi-style factors.

However, this is not only explained by different factor definitions, but also by the universe and portfolio construction. For example, for the value factor, AQR creates a long-short portfolio comprised of the bonds with the highest and lowest 10-year real bond yields. In contrast, Robeco differentiates between corporate and high-yield bonds, and then selects duration-matched treasuries for the short portfolio.

Although factors from AQR and Robeco both represent excess returns, they are not directly comparable.

Source: Finominal

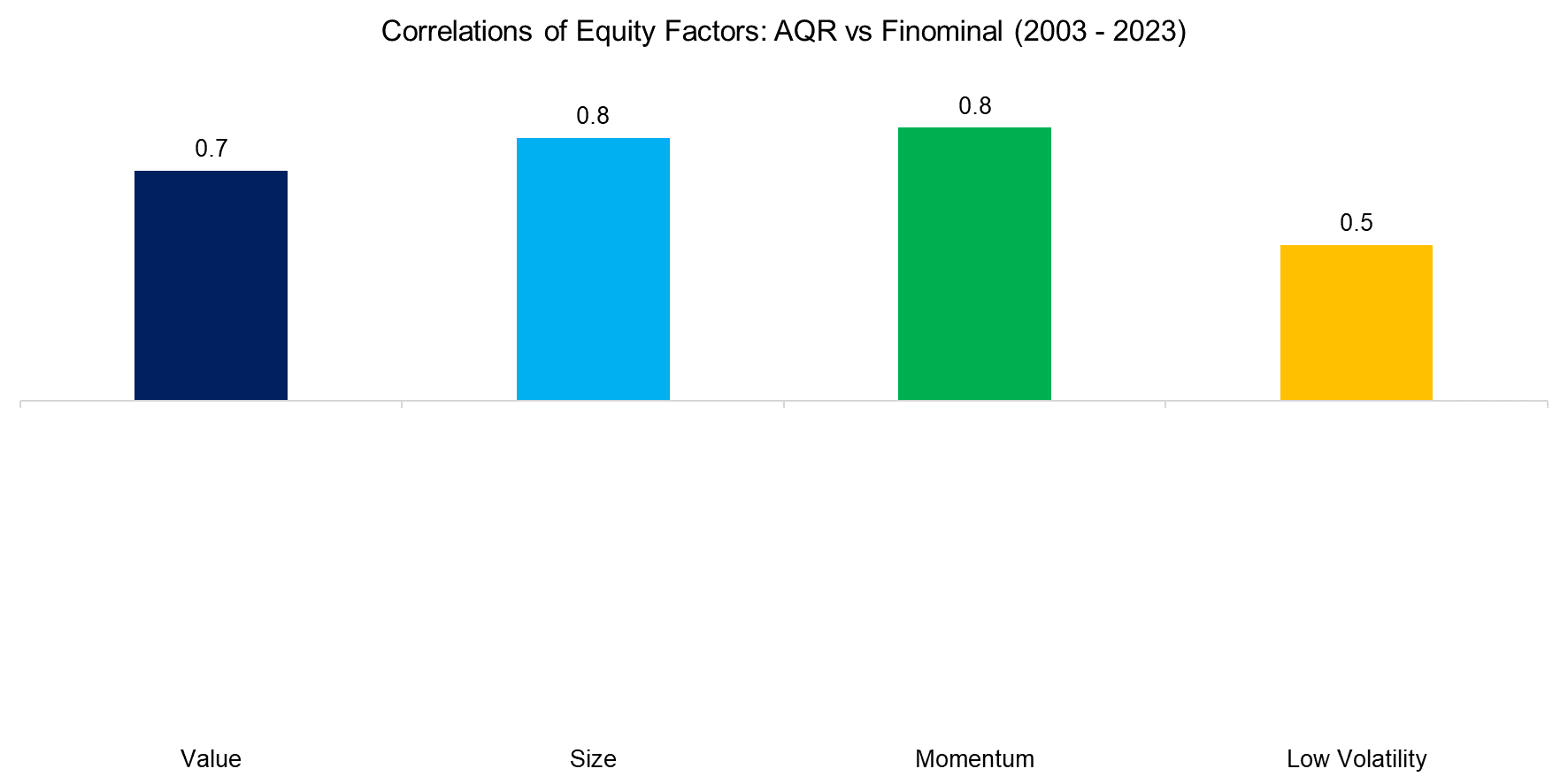

We can contrast the low correlations of fixed income factors to equity factors, where the correlations between AQR’s and Finominal’s are above 0.5 for four factors in the period between 2003 and 2023. The definitions, portfolio constructions, and stock universes are more homogenous. The low correlation for the low volatility factor is explained by AQR using beta in their stock selection process, while we use volatility.

Source: Finominal

FACTOR EXPOSURE ANALYSIS

If an investor wants to run a factor exposure analysis on a bond mutual fund, which factor data set should he use?

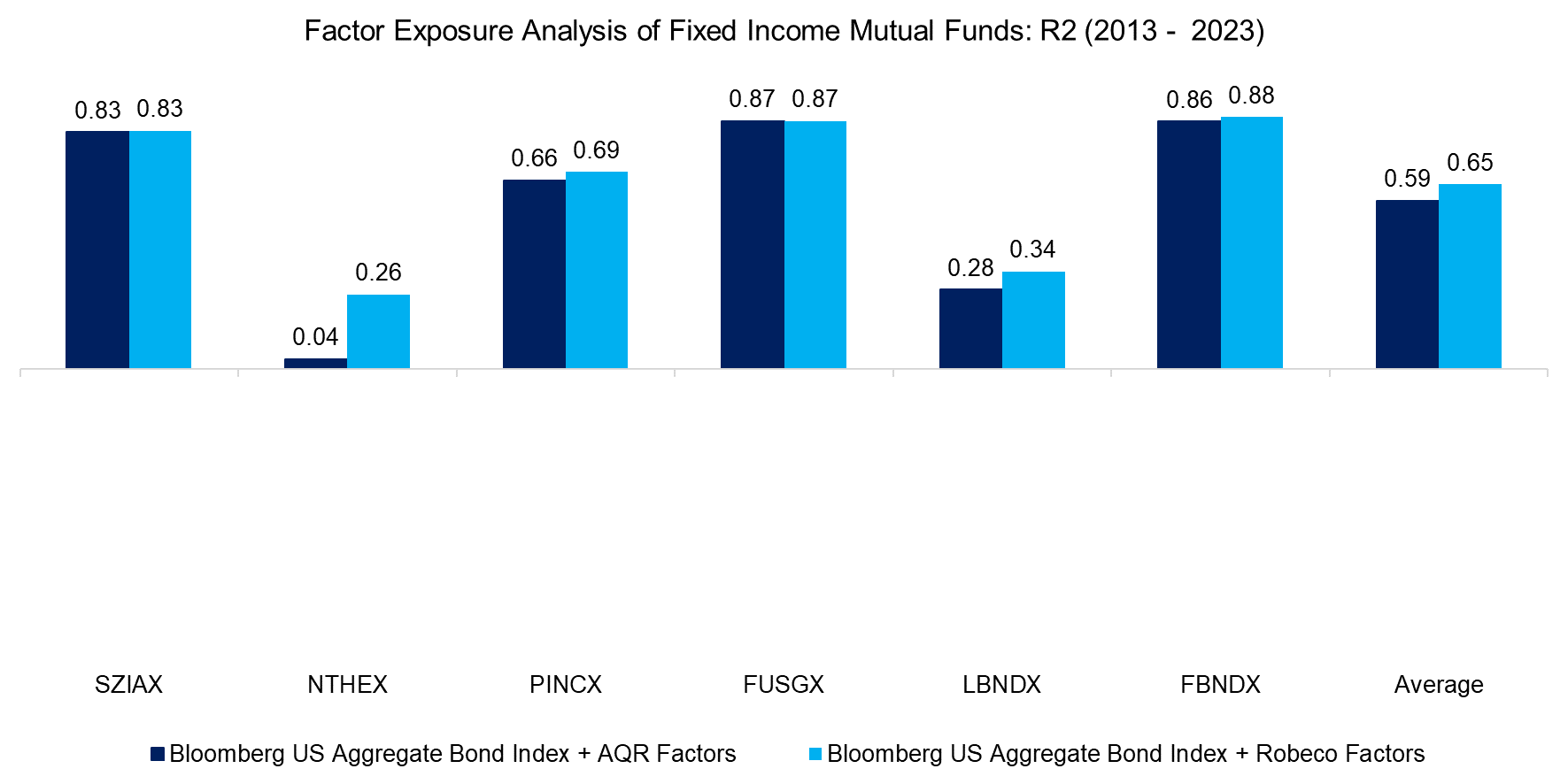

There is no correct answer to this question, but we can run a factor exposure analysis to highlight the differences. We select six US bond mutual funds that have a track record of at least 10 years and use the Bloomberg US Aggregate Bond Index and fixed income factors as independent variables. AQR’s factor data set includes value, momentum, carry, and defensive, while Robeco offers value, momentum, size, and low risk. We exclude multi-style factors.

We focus on comparing the R2 to evaluate the explanatory powers of these two data sets, where the average R2 was slightly higher for the Robeco factors with 0.65, compared with 0.59 for AQR factors (read Factor Exposure Analysis 104: Fixed Income ETFs).

Source: Finominal

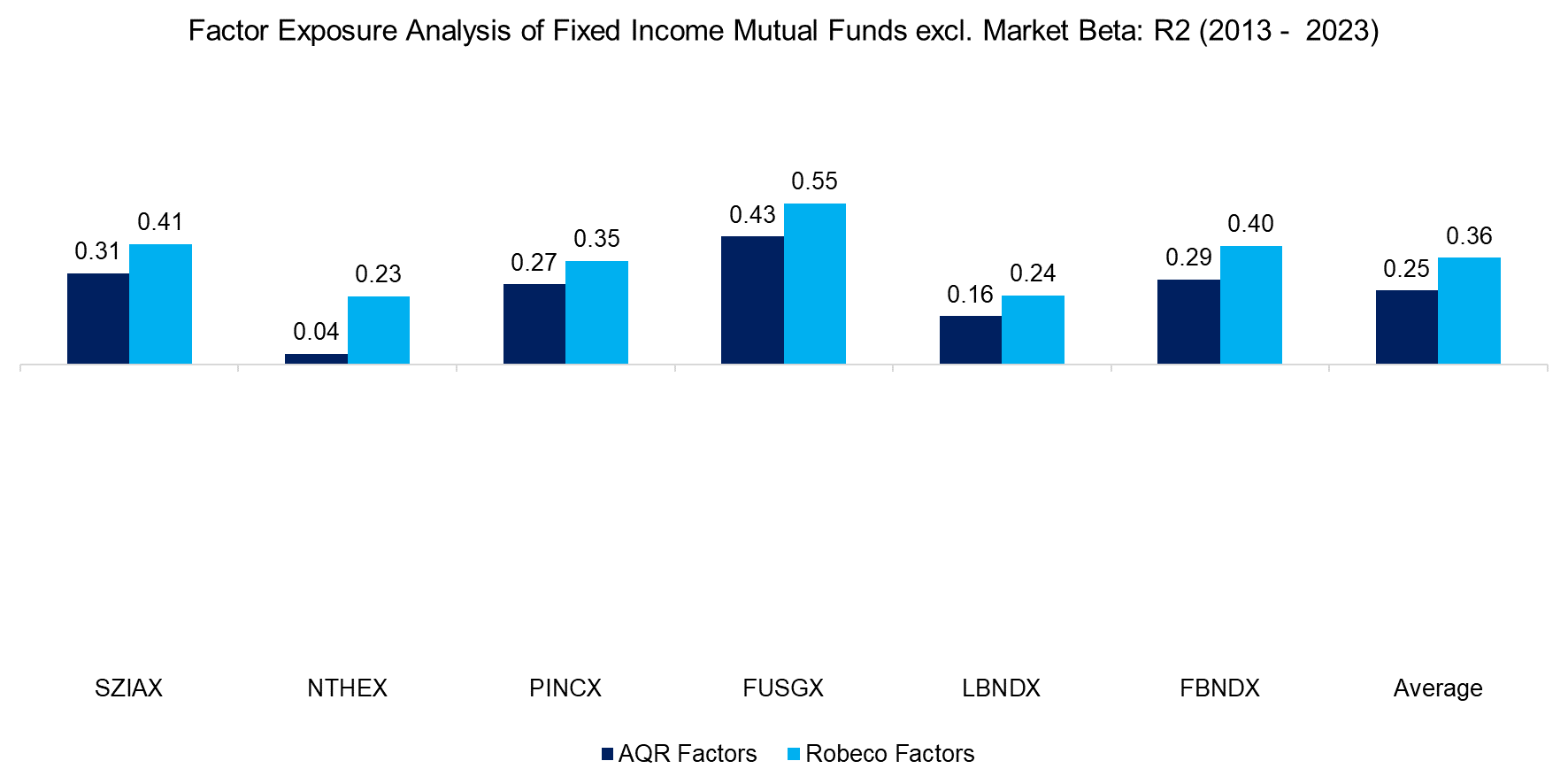

Next, we remove the bond market index and rerun the factor exposure analysis using only the independent variables that represent excess return time series.

We observe that the R2 was higher for all six bond mutual funds when using the Robeco data, but this is perhaps explained by these factors not being as market-neutral as the AQR set. Robeco’s value factor exhibited a significant drawdown during the global financial crisis in 2009 indicating residual bond market beta.

Source: Finominal

FURTHER THOUGHTS

Although the fixed income factors of AQR and Robeco differ, they are both based on the pioneering work from Fama & French and represent investment styles common in equity markets. Investors rank stocks by their valuation, performance, quality features, market capitalization, and so on (read Equity vs Bond Indices).

However, fixed-income investors focus more on credit spreads and duration when discussing bonds. Should investors add these two factors when conducting a factor exposure analysis on bond mutual funds? Or replace the equity markets-inspired factors with these two?

Another topic for another day.

RELATED RESEARCH

Factor Exposure Analysis 104: Fixed Income ETFs

Smart Beta Fixed Income ETFs

Equity vs Bond Indices

Analyzing Floating Rate ETFs

How Much Can You Lose with Bonds?

60/40 Portfolios Without Bonds

Inflation-Linked Bonds for Inflationary Periods?

Bonds & The Invisible Thief

REFERENCED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.