Garp Investing: Golden or Garbage?

Cheap Growth Stocks – Too Good to Be True?

March 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- GARP aims to combine Growth and Value investing

- GARP stocks have outperformed the market since 1989

- It is somewhat perplexing how well the strategy worked

VALUE VERSUS GROWTH

With their thousands of employees, suites of products, international reach, and legendary histories, General Electric (GE) and Amazon are true corporate empires. Of course, GE’s fortunes have lately been in decline while Amazon’s are ascendant. But the stocks of these two companies stand for more than just the old versus the new, they also represent a faceoff between two investment styles: Value and Growth.

Most investors are inclined towards Value, a preference backed by ample academic research. But these days picking GE, which trades at a significantly cheaper valuation than Amazon, would be challenging for most investors. The company has structural issues that are reflected in a declining share price and a slew of negative news stories, all of which would give one pause when considering the stock. Amazon has no such dilemmas and is decimating entire industries, secure in its status as the most valuable company on the planet.

Some investors have sought to bridge the Value-Growth divide through a hybrid strategy, opting for the Growth at a Reasonable Price (GARP) approach popularized by Fidelity manager Peter Lynch. But if Value creates positive excess returns as the research demonstrates, then Growth does largely the opposite, which would seem to cast doubt on GARP’s underlying logic. So how do GARP strategies perform in the US stock market? (read Improving the Odds of Value)

METHODOLOGY

Definitions of GARP stocks can vary but are generally based on the price-earnings (P/E) to growth ratio (PEG), which divides the P/E ratio by the growth rate. In our analysis, we derive the PEG from the P/E ratio from the last 12 months of earnings and the three-year growth rate of earnings. Stocks that exhibit a PEG ratio below 1 are classified as GARP stocks. We focus on all US stocks with market capitalizations greater than $1 billion. Indices are rebalanced monthly, each transaction incurs costs of 10 basis points (bps), and stocks are weighted by their market cap.

ANALYSING GARP STOCKS

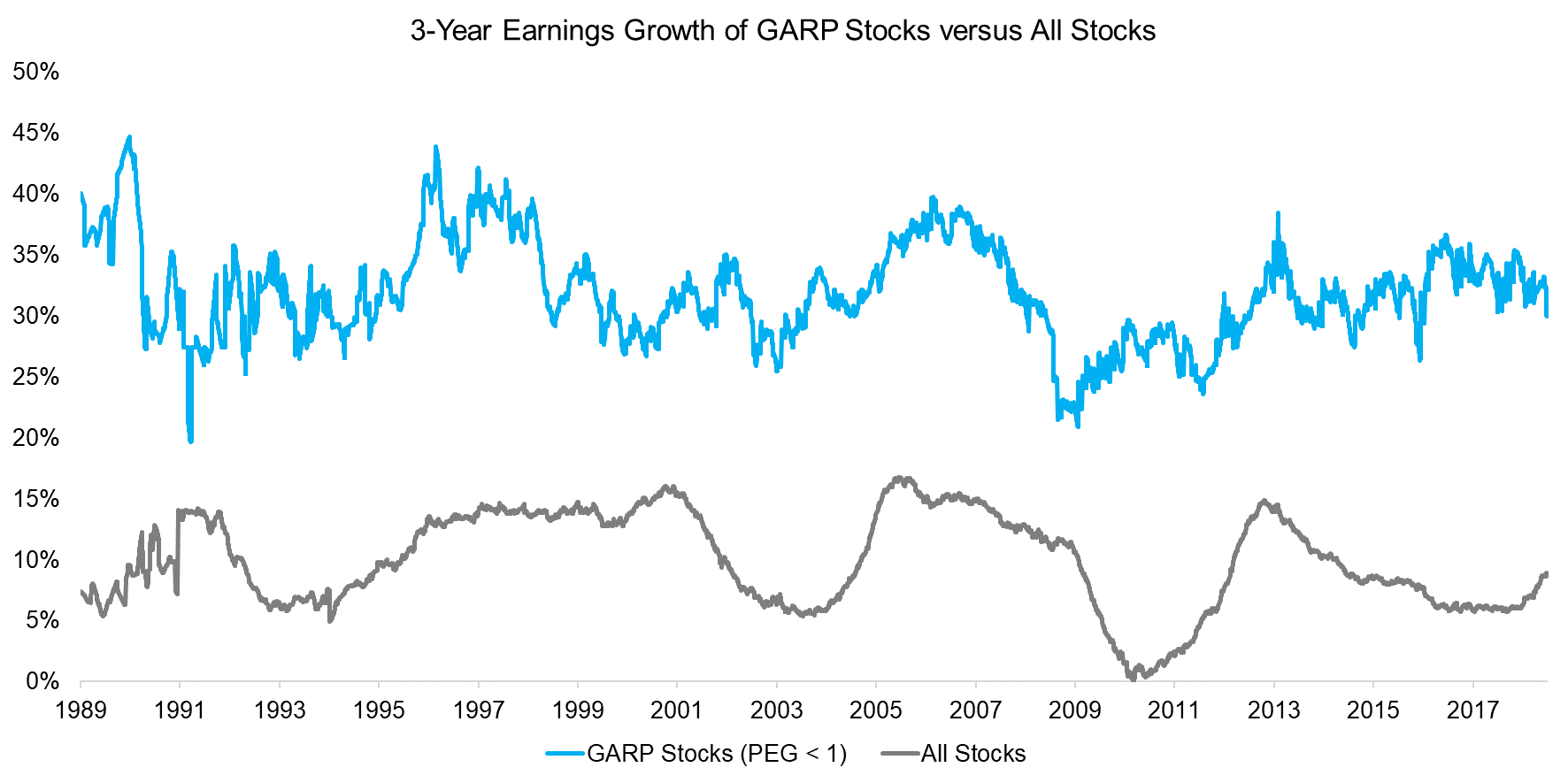

GARP stocks are selected by a combination of earnings growth and valuation. The idea is to identify those that sit somewhere between GE-like Value traps — cheap stocks with a bleak future — and overhyped and overvalued Growth stocks reminiscent of Amazon. Accordingly, we find that the earnings growth of GARP stocks is significantly above that of the market.

Source: FactorResearch

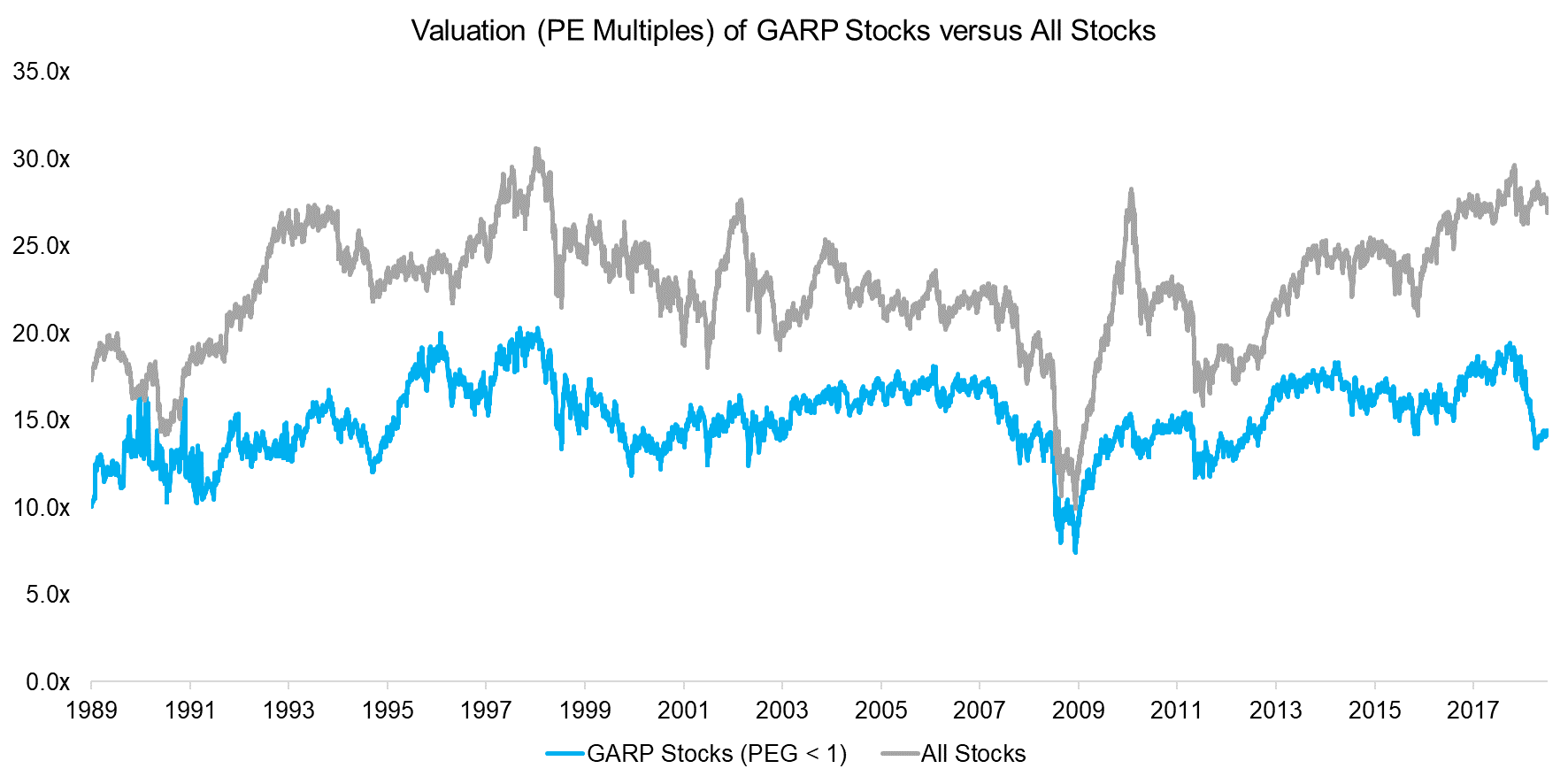

Not only do GARP stocks show higher earnings growth than the market, but they also have lower valuations. The analysis shows median rather than average P/E multiples, which explains why the benchmark P/E multiples of all stocks are less extreme at certain periods, for example, during the Tech bubble in 2000, than in similar capital market research.

Source: FactorResearch

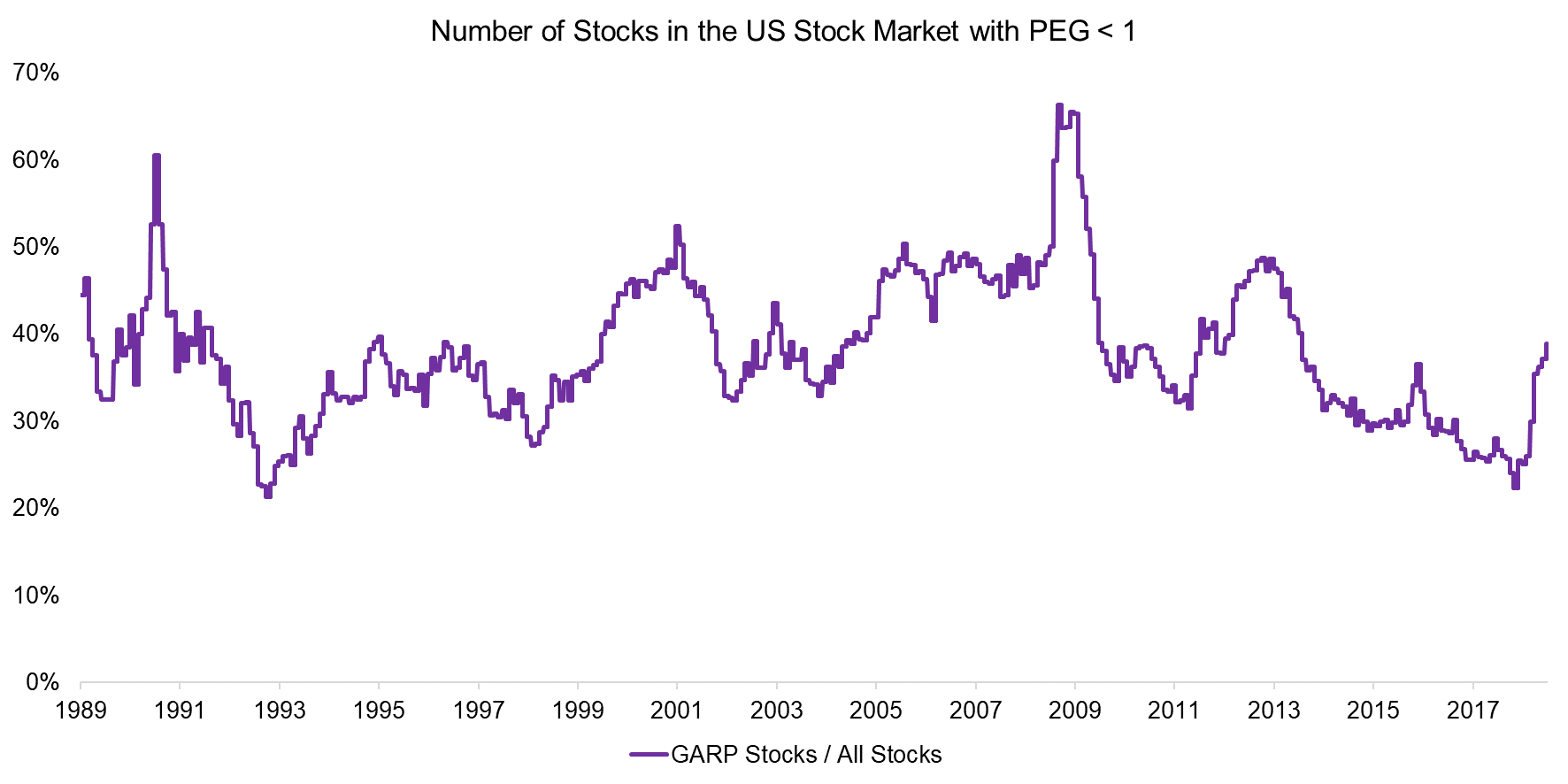

Does the stock market provide a sufficient number of companies that are growing earnings while trading at reasonable valuations? We find that on average 38% of all stocks exhibit a PEG ratio below 1, which is more than enough for security selection.

Source: FactorResearch

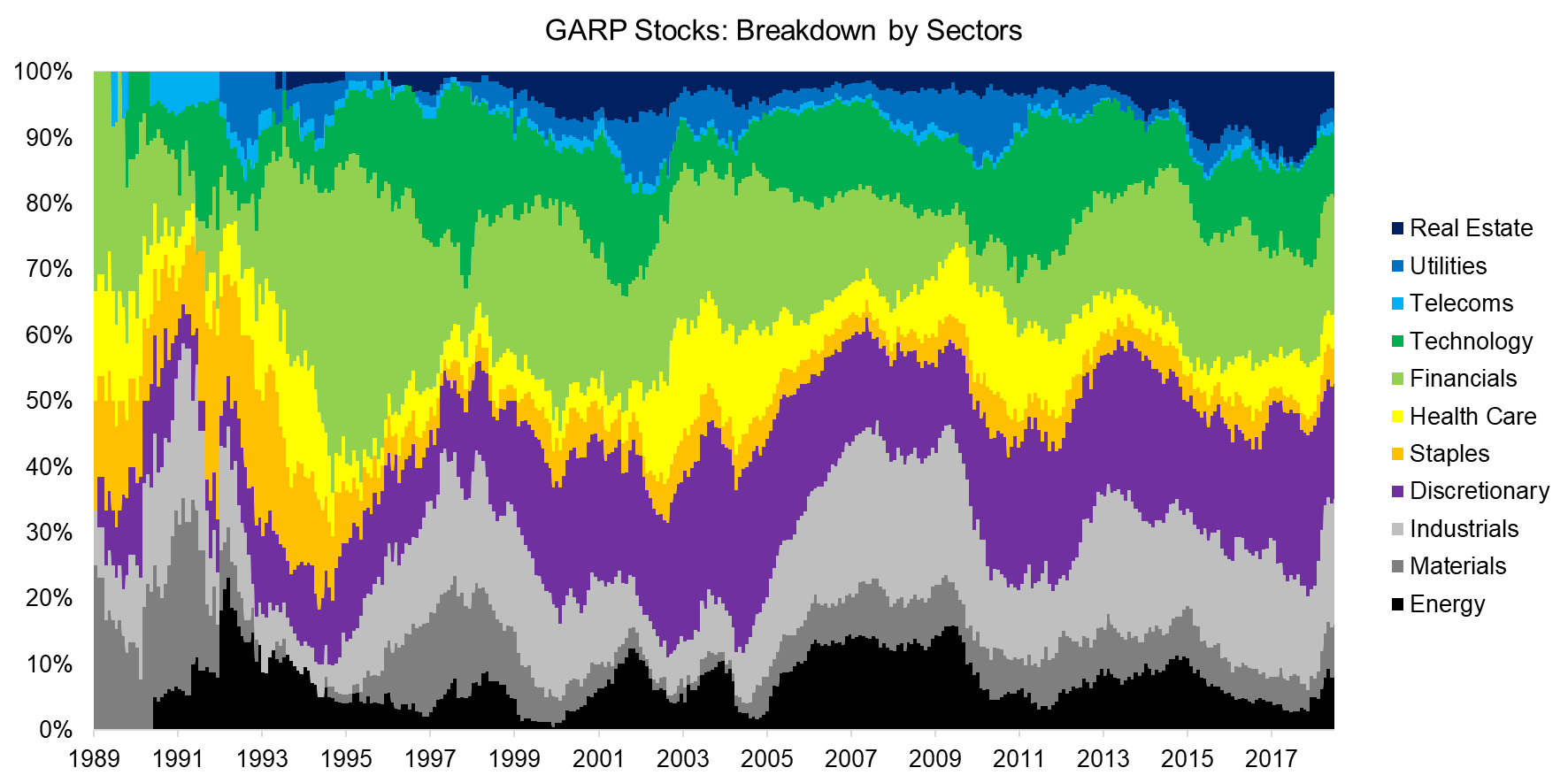

Broken down by sector, GARP stocks compose a relatively diversified universe. Some sectors, like Financials and Consumer Discretionary, contribute more stocks relative to the benchmark of all stocks, while Telecoms, Utilities, and Real Estate contribute less. The latter three are asset-heavy, exhibit only low earnings growth, and tend to trade at high P/E multiples given their bond-like features, so their PEG multiples rarely fall below 1.

Source: FactorResearch

GARP STOCKS VERSUS THE STOCK MARKET

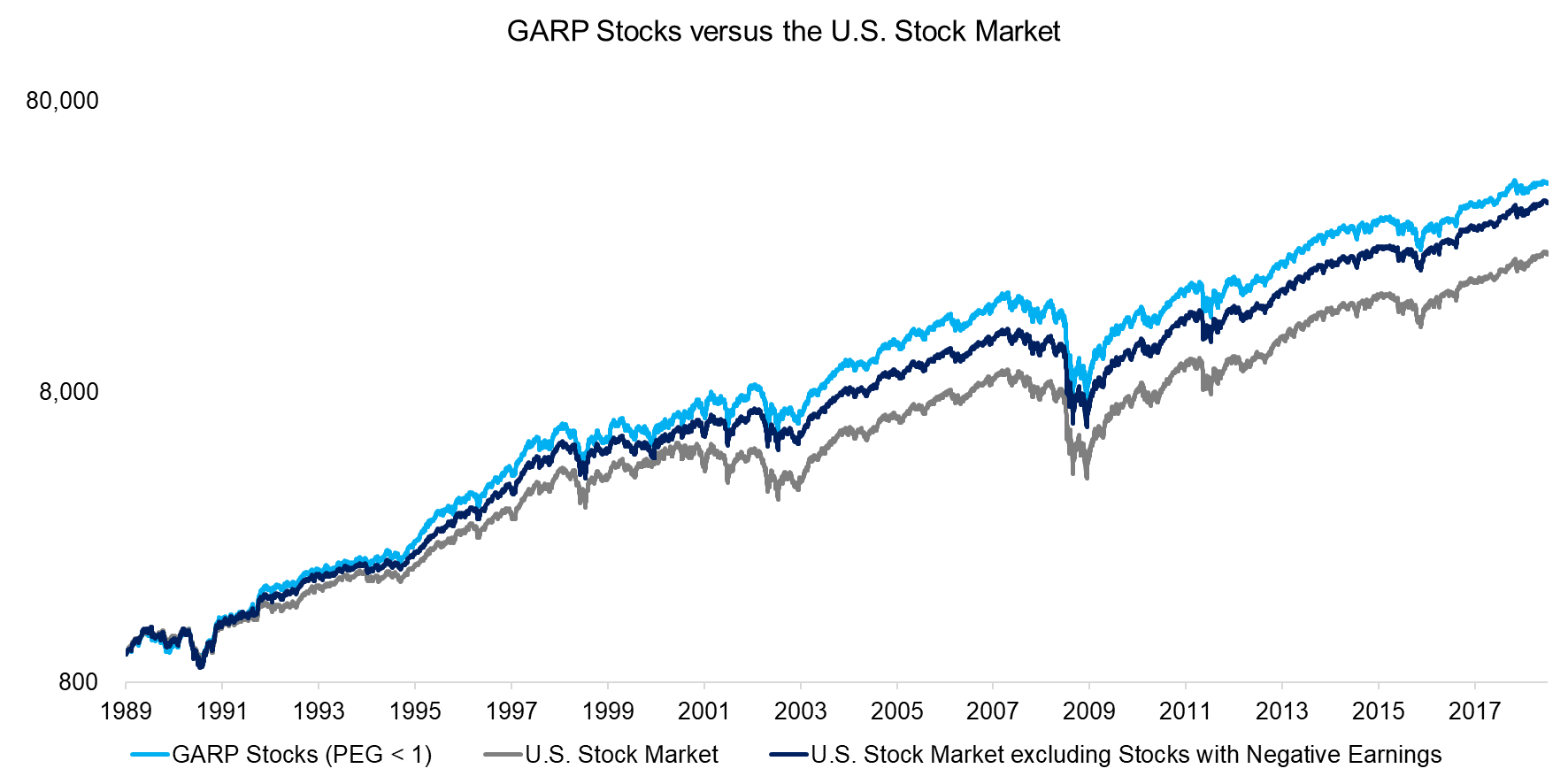

Investor interest in Value and Growth is driven by a desire to outperform the market. GARP stocks have indeed outperformed substantially since 1989. But that can be explained in part by simply excluding stocks with negative earnings. The PEG ratio calculation requires stocks to have positive earnings. When negative earnings stocks are filtered out, then theGARP stock outperformance declines substantially.

Source: FactorResearch

GARP – MORE LIKE VALUE OR MORE LIKE GROWTH?

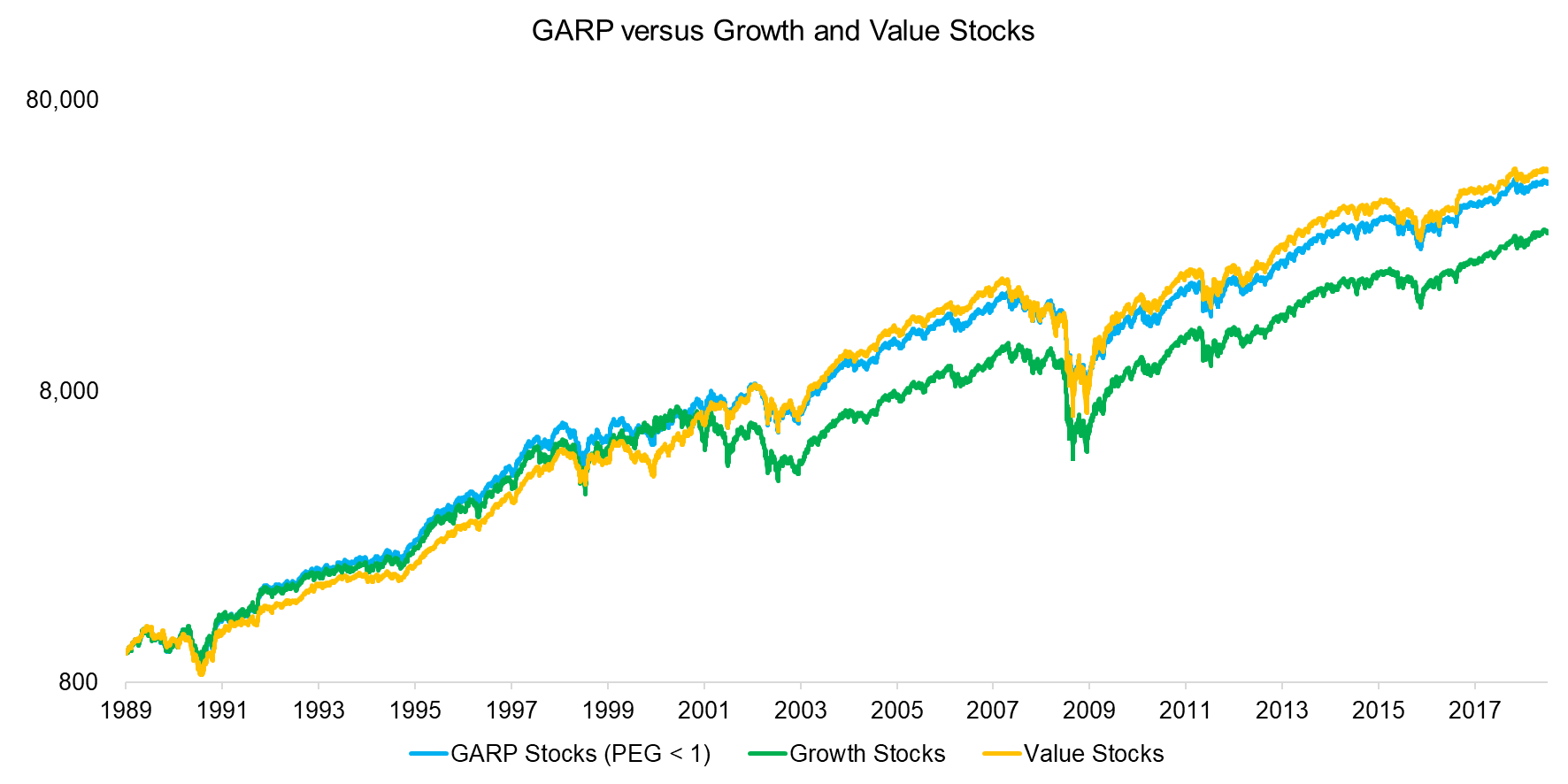

Since GARP combines Value and Growth investing, we can benchmark GARP stocks to their Value and Growth counterparts. Here we define Value as a combination of price-to-book and P/E multiples and Growth as a combination of the three-year sales and earnings growth (read Value Factor – Comparing Valuation Metrics).

According to the analysis, a GARP approach seems to extract the best of both investment styles. Between 1989 and 2001, GARP and Growth outperformed Value, especially during the Tech bubble between 1999 and 2001. However, when the Tech bubble imploded and Growth started to underperform Value significantly, GARP stocks behaved more like Value stocks.

Source: FactorResearch

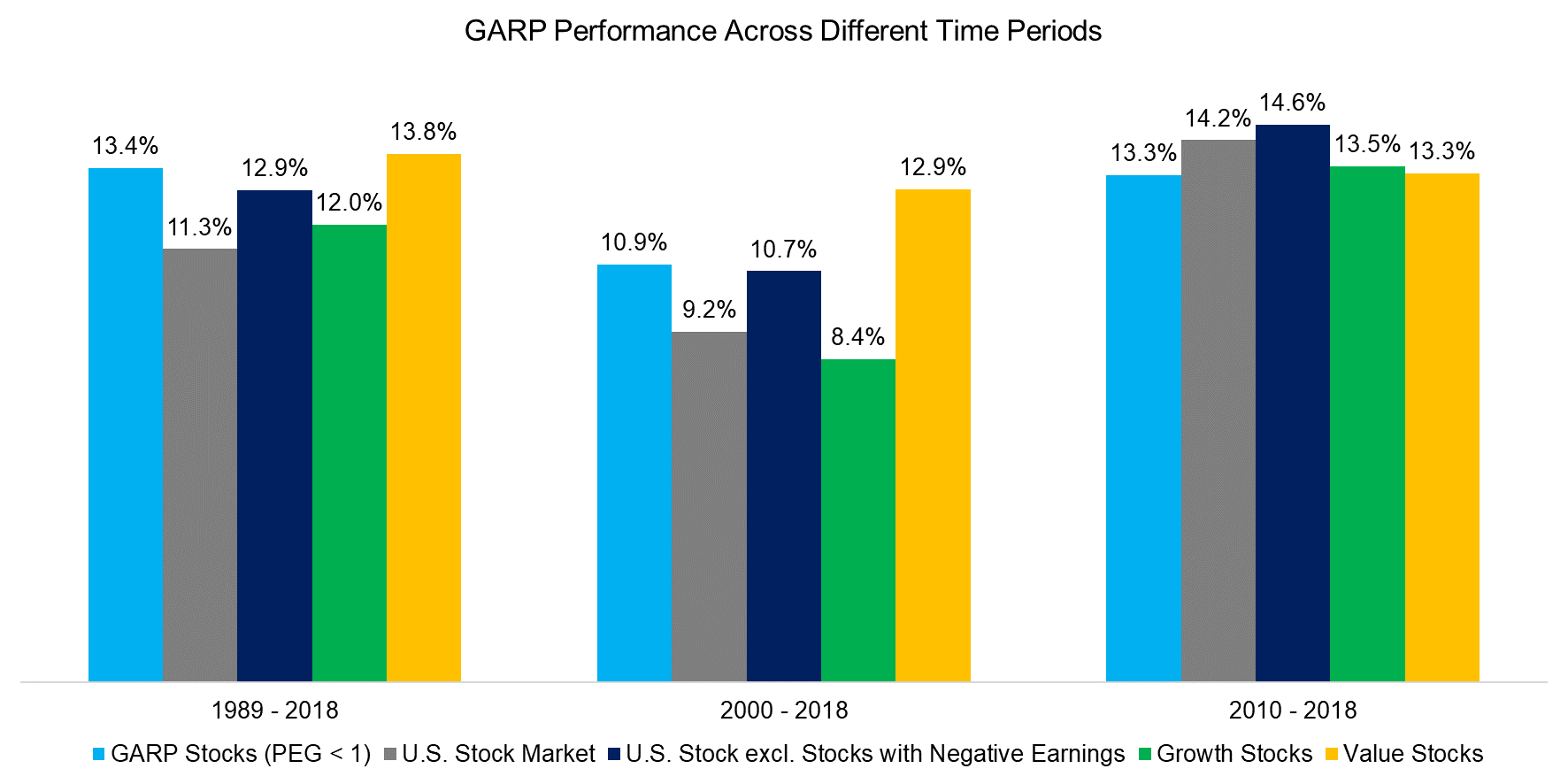

This data demonstrates that GARP was an effective strategy since 1989, though how effective depends on the time frame. If we rebase the portfolios in 2000, then a pure Value portfolio would have worked better. Rebase the portfolios in 2010, and the market would have generated the highest annual returns, especially if negative earnings stocks are excluded.

Source: FactorResearch

FURTHER THOUGHTS

Fusing Value and Growth has an intuitive appeal, but is somewhat at odds with academic research. Our results suggest a GARP approach can generate enviable results, although how enviable depends on the observation period.

Perhaps the strategy’s key benefit is forcing investors to adopt a systematic framework so they can allocate to exciting growth stories — the rising Amazons — albeit only when they are trading at reasonable valuations.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.