Getting Value Exposure from Non-Value Funds

Oil, financial, and China ETFs versus value funds

January 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The factor betas of value-focused ETFs range dramatically

- Non-value-focused funds can have high betas to the value factor

- However, these often come with large unintended bets

INTRODUCTION

While some investors are die-hard believers in value investing, others regard this more opportunistically and only occasionally seek exposure to this investing style. Perhaps cheap stocks have been outperforming, or the investor may regard the economic outlook as favorable for value over growth stocks. The number of reasons for allocating to value stocks is likely as large as the number of ways of defining them.

However, aside from asking when is a good time to allocate to cheap stocks, there is also the question of how to best achieve this. Investors have the choice between creating a portfolio by selecting cheap stocks themselves or paying a fund manager to do so. The former is cheaper, while the latter is easier.

Smart beta ETFs may be considered a compromise between the do-it-yourself approach and selecting an active mutual fund manager. Most of these ETFs track indices that clearly describe how stocks are selected and are cheaper than mutual funds. However, there are more than 50 smart beta ETFs focused on value stocks in the U.S. stock market, ranging from Vanguard’s Value ETF (VTV) which manages $104 billion and charges a 0.04% management fee to Roundhill’s Acquirers Deep Value ETF (DEEP) with $37m and a 0.80% management fee.

In this research article, we will explore a few considerations when evaluating value-focused smart beta ETFs and mutual funds, as well as funds that provide exposure to the value factor without having an explicit focus on cheap stocks.

FUNDS RANKED BY THE VALUE FACTOR

Investors consider multiple criteria when evaluating funds like the assets under management, fees, active share, portfolio concentration, and so on. Although obvious, a fund should be doing what its product name says, eg a smart beta value-focused ETF should provide exposure to the value factor.

We select five smart beta ETFs and one mutual fund that focus on value investing in this analysis. We run a factor exposure analysis using the S&P 500 and five long-short equity factors as independent variables, which include the value factor where stocks are selected based on a combination of price-to-book (P/B) and price-to-earnings (P/E) multiples.

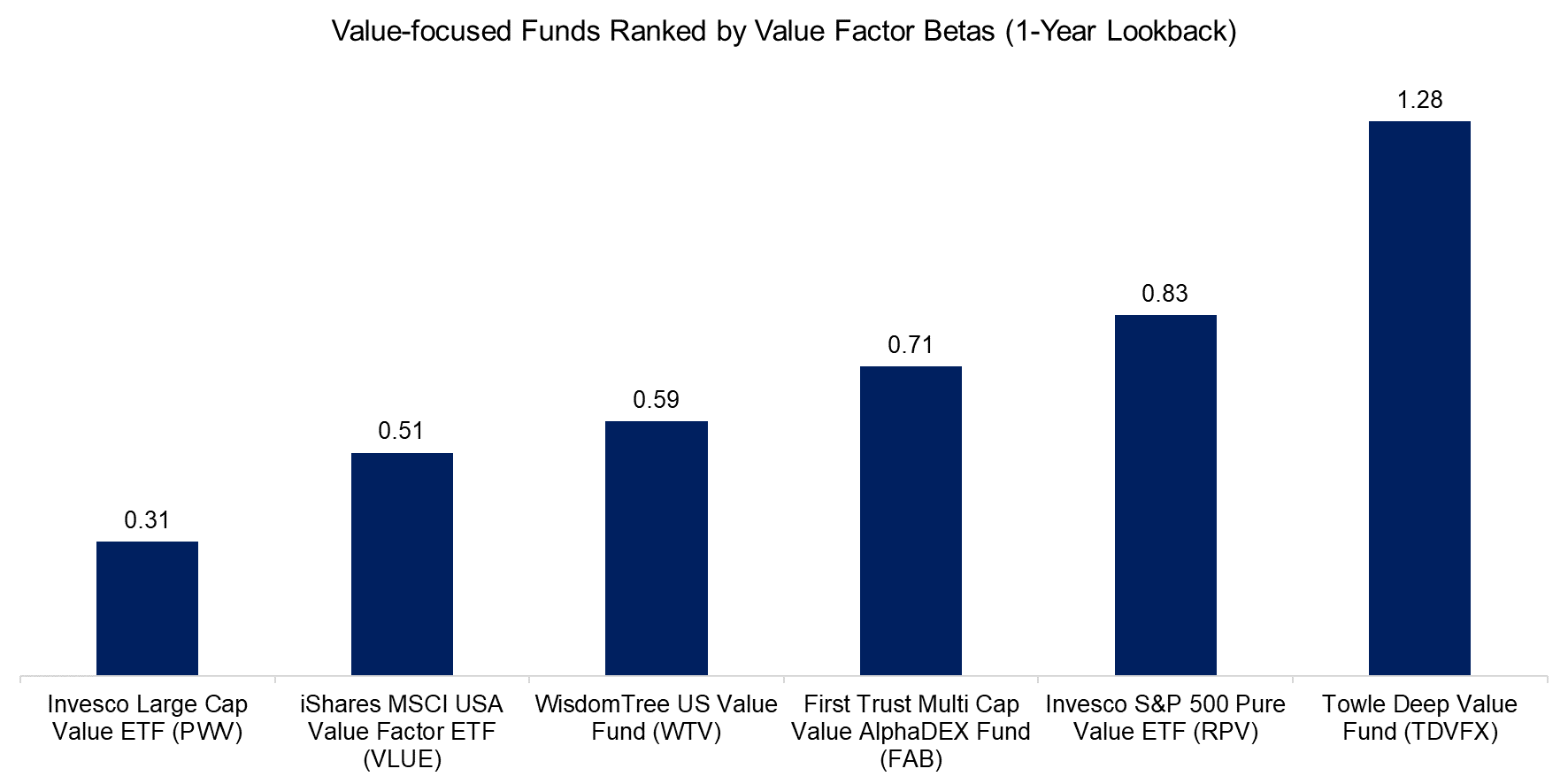

We observe that the betas to the value factor ranged from 0.31 for Invesco’s Large Cap Value ETF (PWV) to 1.28 for the Towle Deep Value Fund (TDVFX), using a one-year lookback in the regression analysis. Low factor betas are often explained by too diversified portfolios, but PWV has a concentrated portfolio of approximately 50 stocks, compared with 32 for TDVFX.

Smart beta ETFs tend to be much cheaper than mutual funds, but do not necessarily provide higher factor exposures as seen here. Investors can also calculate the ratio between factor betas and fees, which provides a factor score that measures the value-for-money proposition of funds (read Factor Scoring Smart Beta ETFs).

Source: Finominal

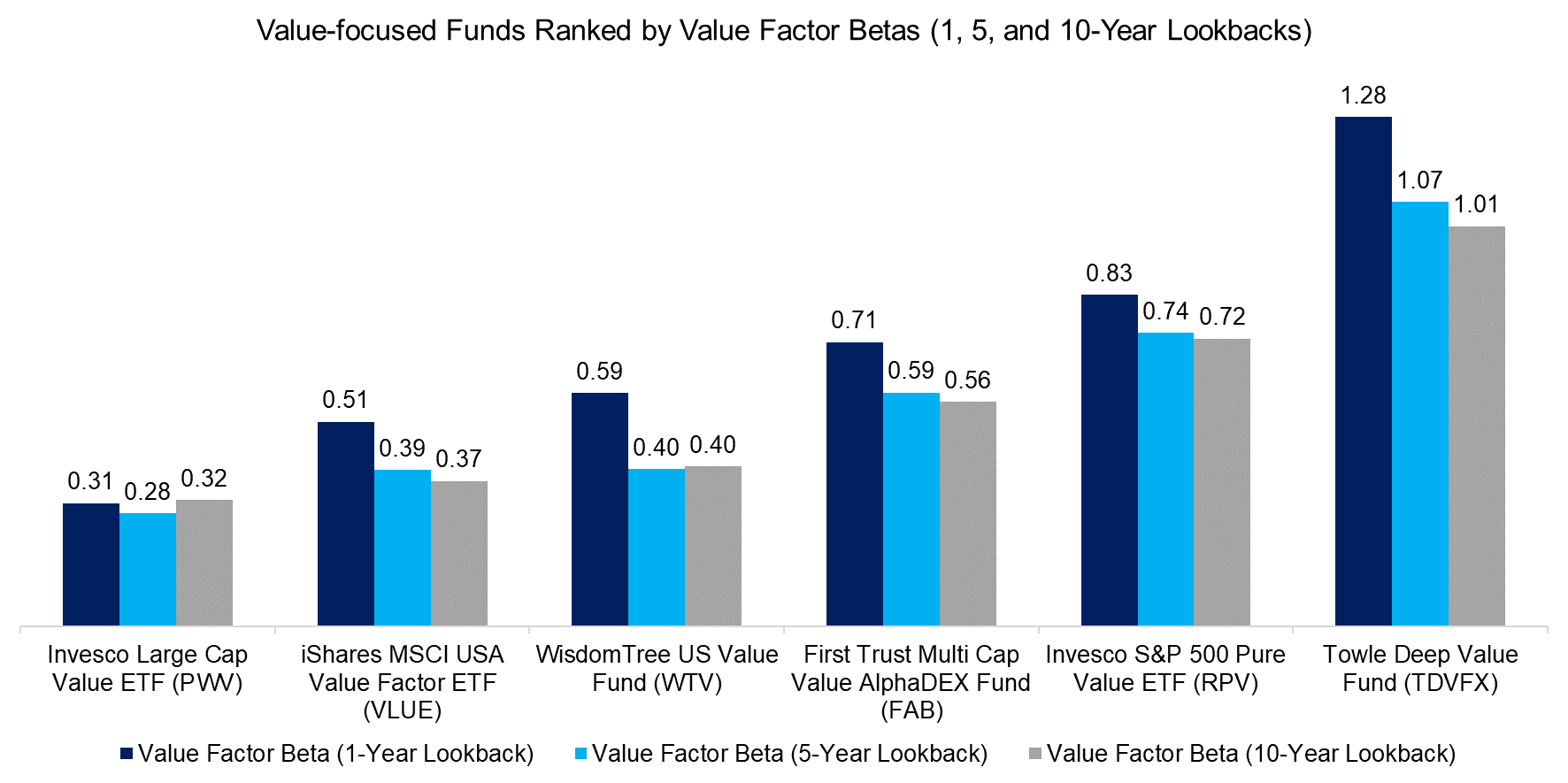

However, perhaps a lookback of one year is too short to evaluate the exposure of funds to the value factor, so we extend to lookback to five and ten years.

We observe that the betas to the value factor decline slightly for almost all funds, but the overall perspective does not change, which implies that one year with daily returns is sufficient for measuring factor exposures via a regression analysis.

Source: Finominal

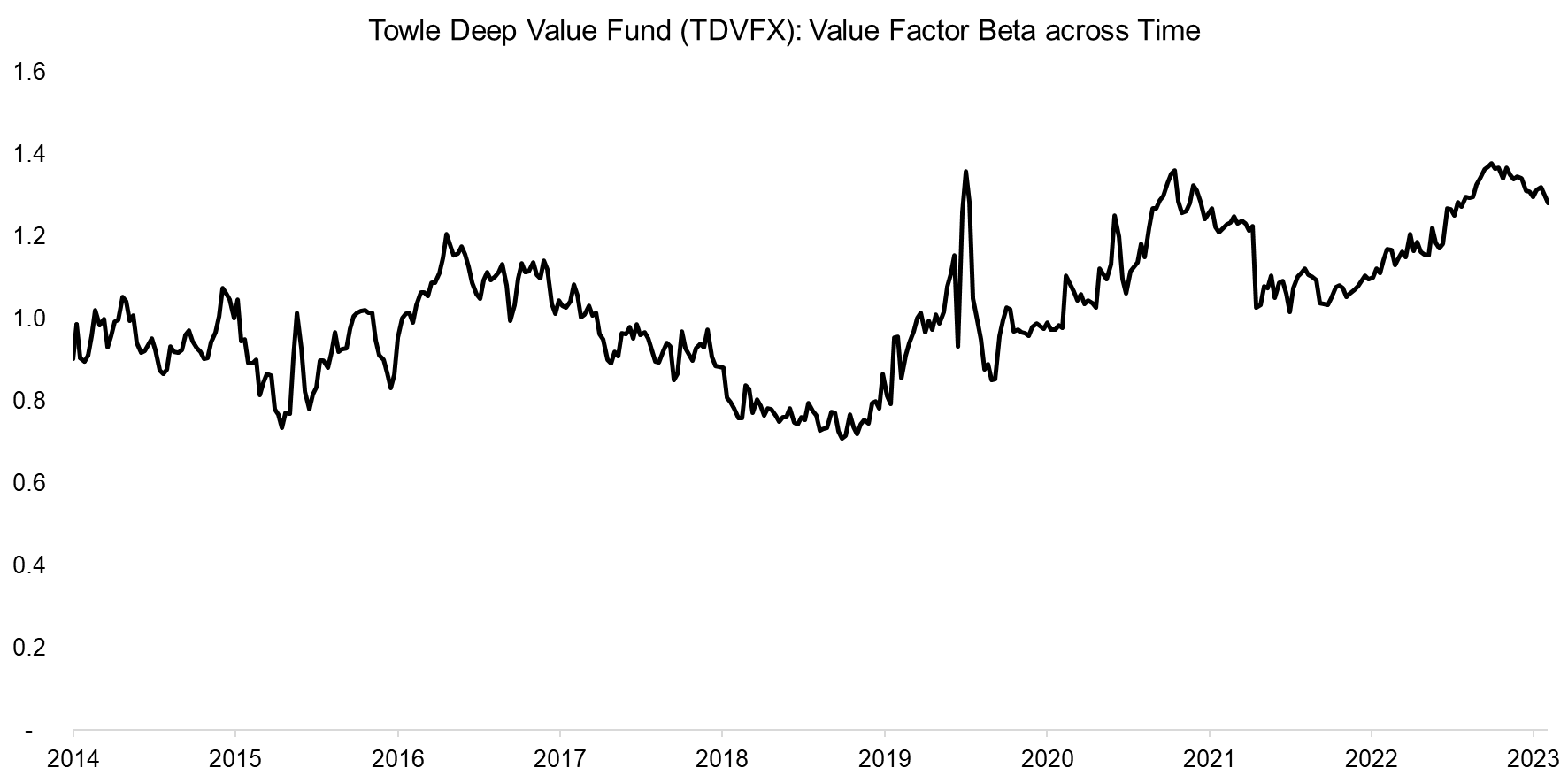

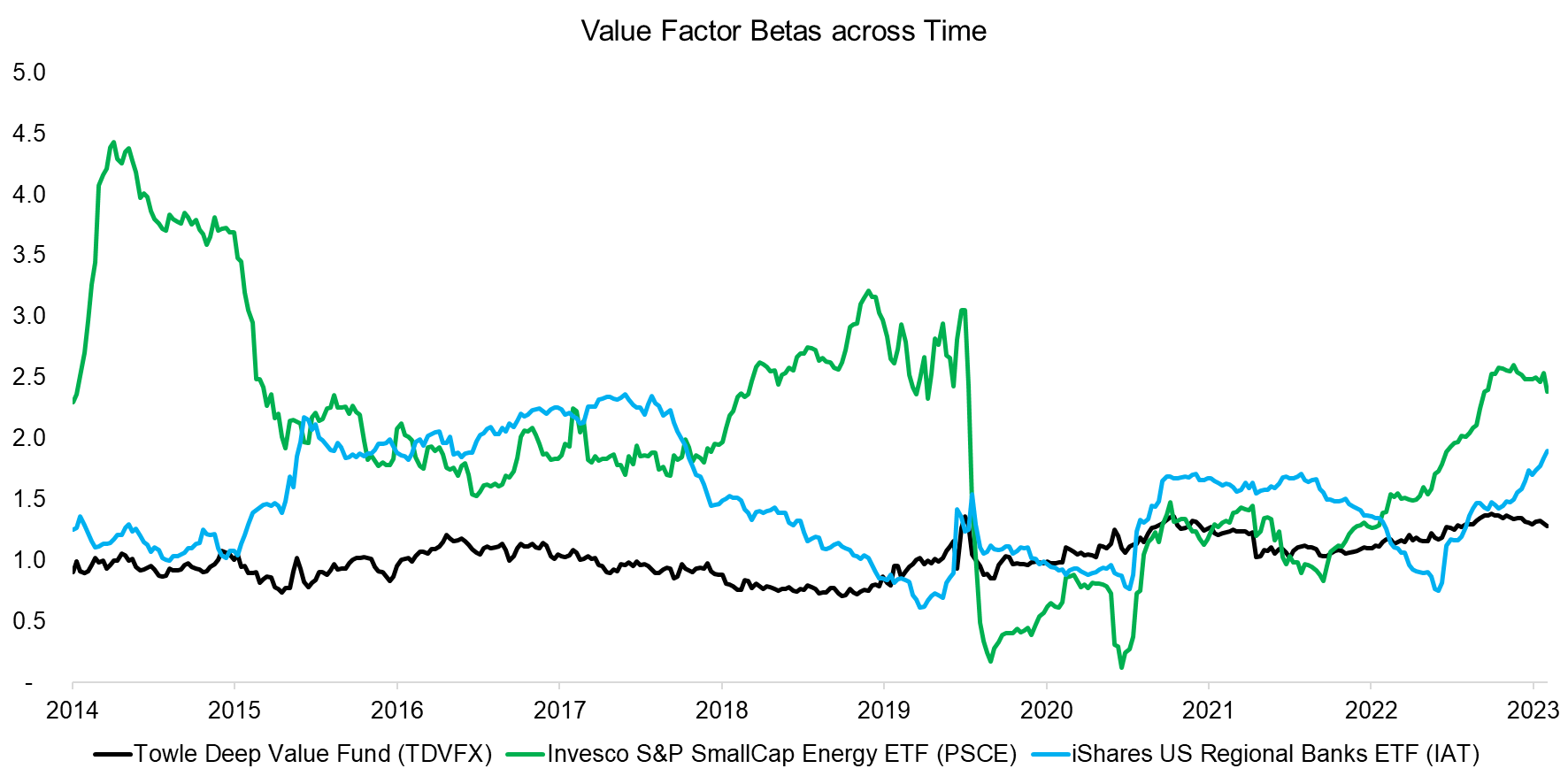

We can also review the beta to the value factor across time, where TDVFX shows a range between 0.8 to 1.4 in the period from 2014 to 2023. The beta did exhibit elevated volatility around the COVID-19 crisis in 2020, but this simply reflects the stock market’s volatility, so is not unusual.

Source: Finominal

VALUE FACTOR EXPOSURE FROM NON-VALUE FUNDS

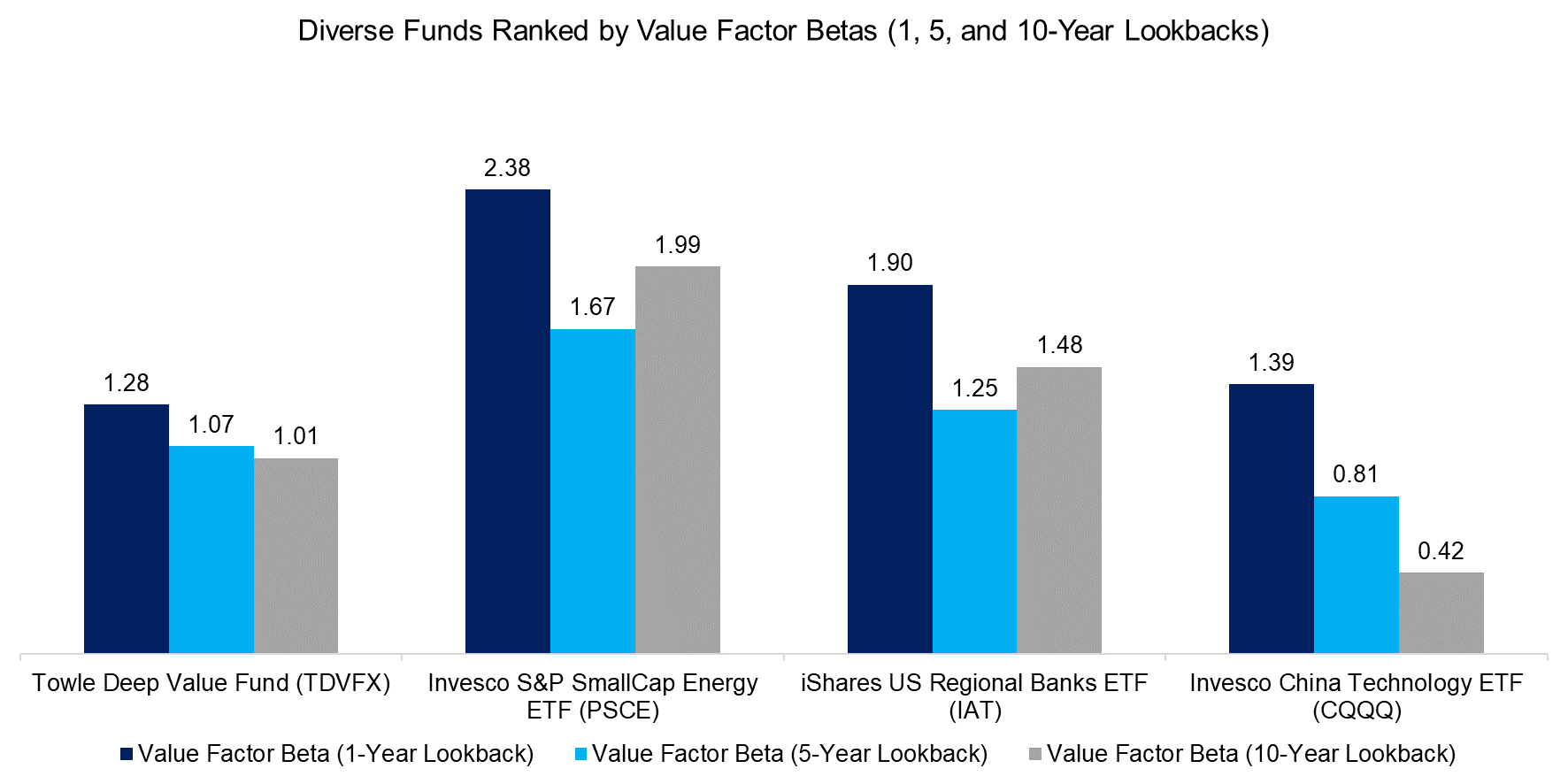

However, we often come across funds in our research that exhibit high betas to the value factor without being focused implicitly on cheap stocks. We will review three such ETFs, namely the Invesco S&P SmallCap Energy ETF (PSCE), iShares US Regional Banks ETF (IAT), and Invesco China Technology ETF (CQQQ), in the next part of this analysis.

First, we calculate the betas to the value factor with lookbacks ranging from one to ten years. We observe that all three of these ETFs had higher betas to the value factor than the value-focused TDVFX when using a one-year lookback, but the betas were only stable for the energy (PSCE) and U.S. regional bank (IAT) ETFs. In contrast, the beta for CQQQ declined from 1.39 to 0.42 when increasing the lookback period from one to ten years.

Source: Finominal

Could these non-value-focused ETFs be considered better value factor products, despite their different investment strategies?

One way to evaluate this is by reviewing the volatility of the beta to the value factor across time. We observe that the beta to the value factor of the energy ETF (PSCE) was much more volatile than that of the U.S. regional bank ETF (IAT) or the value fund (TDVFX). It seems that energy stocks were very cheap in the period from 2014 to 2015, which coincides with a crash of the oil price, but less cheap post the COVID-19 crisis in 2020, which was followed by the war in Ukraine and a rising oil price.

Source: Finominal

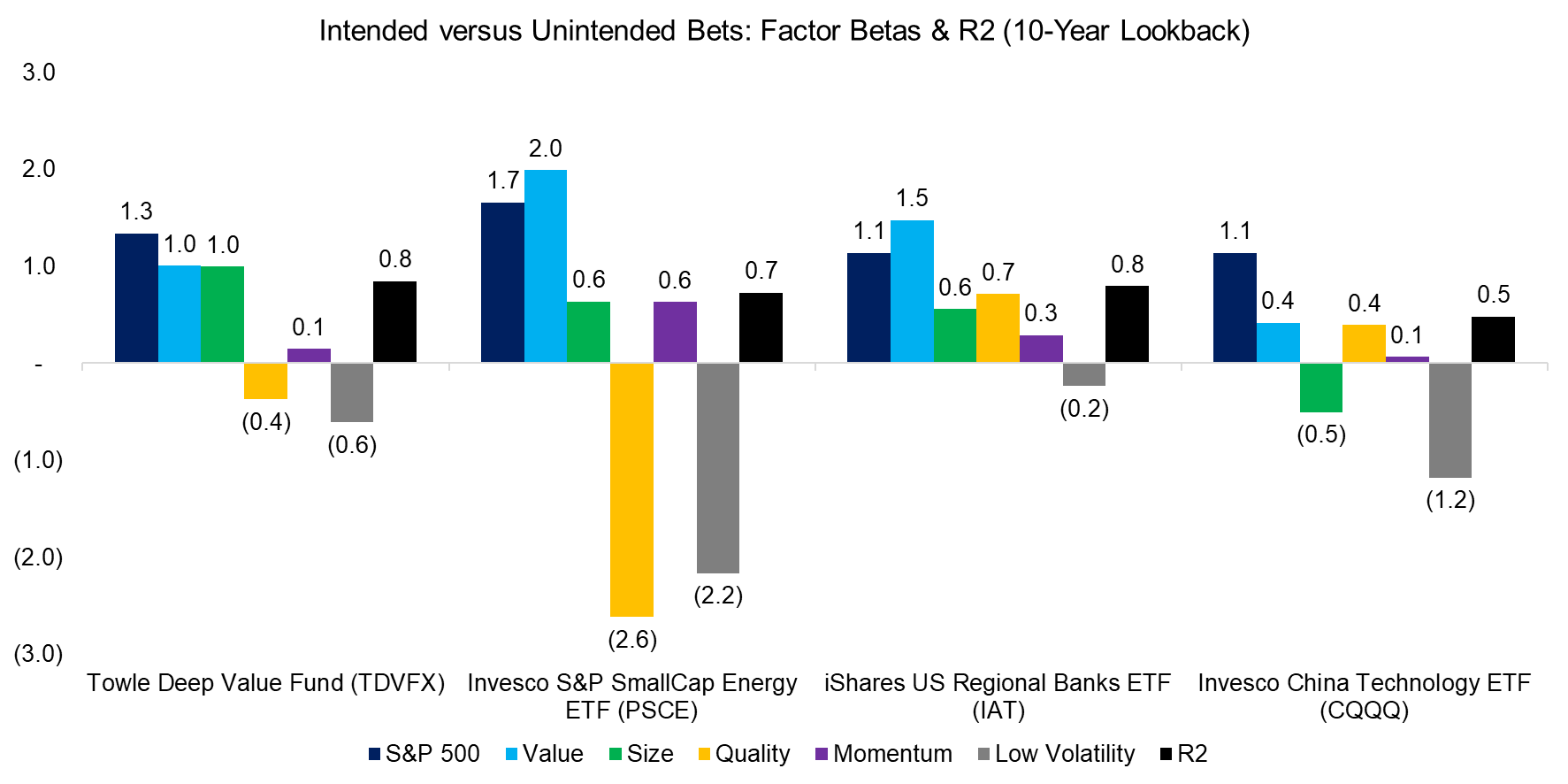

Finally, aside from a volatile factor beta, investors should also consider the unintended bets when selecting funds. The energy ETF (PSSCE) had significantly negative betas to the quality and low volatility factors, which is not unsurprising given that energy companies are often highly leveraged, feature low profit margins and volatile stock prices.

However, even the value-focused mutual fund (TDFVX) had significant positive and negative exposures to factors other than value, and arguably not less strong than those of the U.S. Regional Bank ETF (IAT). From this perspective, IAT could be considered as an alternative to value-focused funds. Given that most value funds are structurally overweight banks as they tend to trade lowly on P/B multiples, there is an overlap in the underlying portfolios.

Source: Finominal

FURTHER THOUGHTS

Although there are more than 50 smart ETFs focused on providing exposure to cheap stocks in the U.S., it is surprising that there are none that offer pure exposure to the value factor without unintended bets. It is not difficult to run an optimization process that reduces the exposure to other factors via the stock selection process, which would result in a more precise instrument for portfolio construction (read Factor Optimization).

RELATED RESEARCH

Growth ETFs: Performance & Factor Exposures

Factor Scoring Smart Beta ETFs

Replicating Funds via S&P 500 & Smart Beta ETFs

Benchmarking Smart Beta ETFs

An Anatomy of Smart Beta Value ETFs

ETFs, Smart Beta & Factor Exposure

Factor Exposure: Smart Beta ETFs vs Mutual Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.