Growth ETFs: Performance & Factor Exposures

Neither performance nor factor exposures are desirable.

February 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Growth ETFs are not very differentiated, despite growth having various interpretations

- 34 out of 40 growth ETFs underperformed the stock market over the last 3 years

- Nor was the long-term performance attractive

INTRODUCTION

Factors like value or momentum are also called stock market anomalies as there should not be any repeatable investing process that allows investors to harvest excess returns given efficient markets. Yet, factor investing is backed by decades of theoretical and practical research.

However, there are only a handful of factors vindicated by research and growth is not one of them. In fact, most academics view growth stocks as expensive stocks, so such a factor should be associated with negative excess returns (read What Are Growth Stocks?). Oddly enough, investors have allocated more than $300 billion to growth ETFs, which can also be regarded as an anomaly as it basically requires betting against all the research.

It seems there might be good and bad anomalies in financial markets. So, how bad was it to invest in growth ETF?

In this article, we will explore the performance and factor exposures of growth ETFs.

UNIVERSE OF GROWTH ETFS

We focus on growth ETFs traded in the US stock market with a track record of more than three years, which is a universe of 40 products. These collectively manage $304 billion and charge an average management fee of 0.26%. The cheapest ones are available at a mere 4 basis points, while the most expensive costs 77 basis points.

There are an additional 45 ETFs with a growth focus that have been launched recently and have a track record of less than three years, but these cumulatively manage less than $5 billion of assets. Most of these are actively managed strategies and are essentially mutual fund conversions.

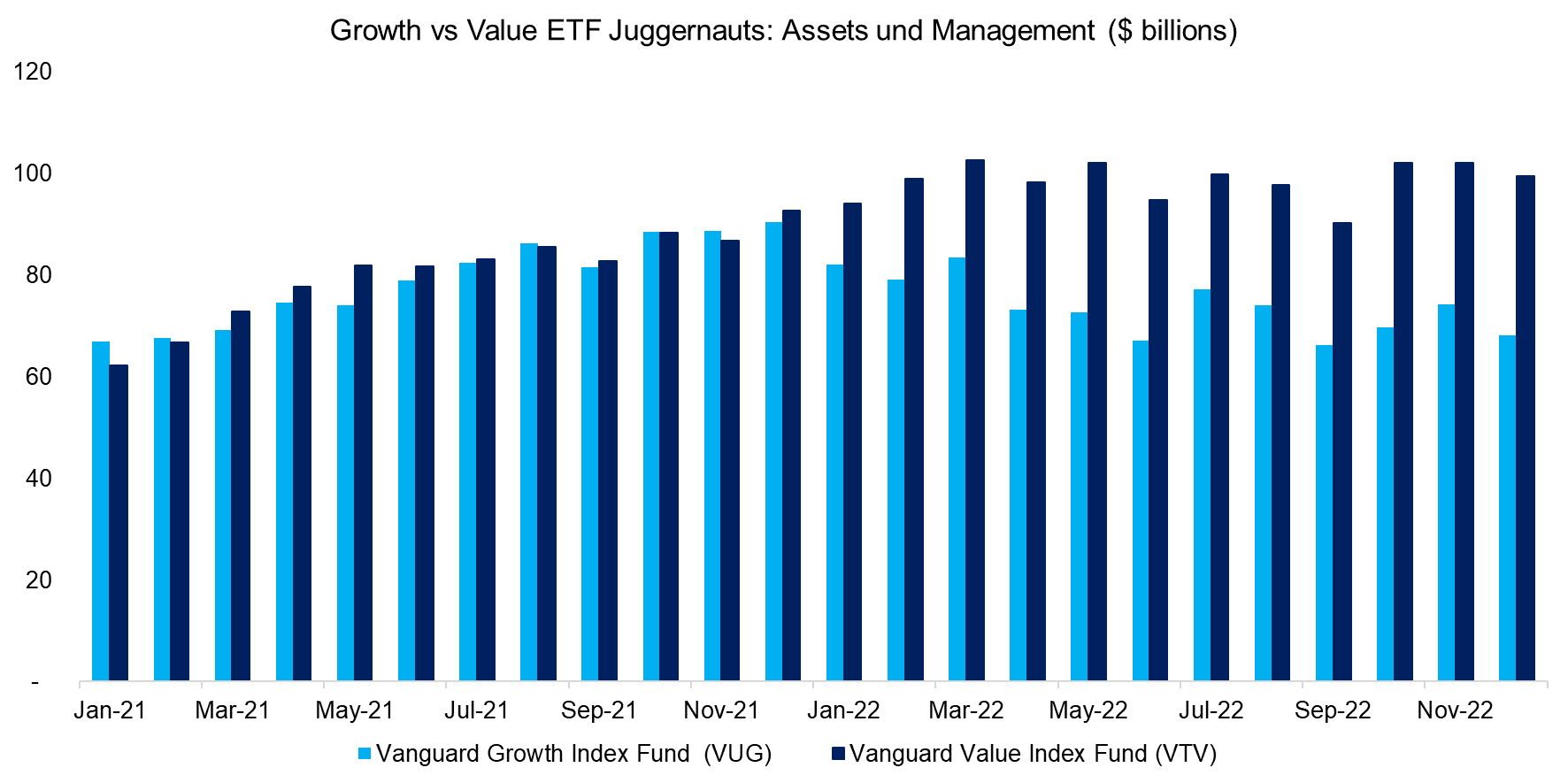

We can highlight the interest in growth ETFs by contrasting the evolution of the assets under management of the Vanguard Growth Index Fund (VUG) and the Vanguard Value Index Fund (VTV), which are the two largest ETFs of their smart beta categories. The former currently manages $68 billion, compared to $99 billion for the latter. The assets under management were almost identical at approximately $90 billion as of the end of 2021, but then growth stocks fell out of favor in 2022. The decline in assets of VUG can be attributed to redemptions as well as the significant decrease in market capitalizations of stocks like Amazon and Meta (read Growth: Factor Investing Sinning?).

Source: Finominal

FACTOR EXPOSURE ANALYSIS

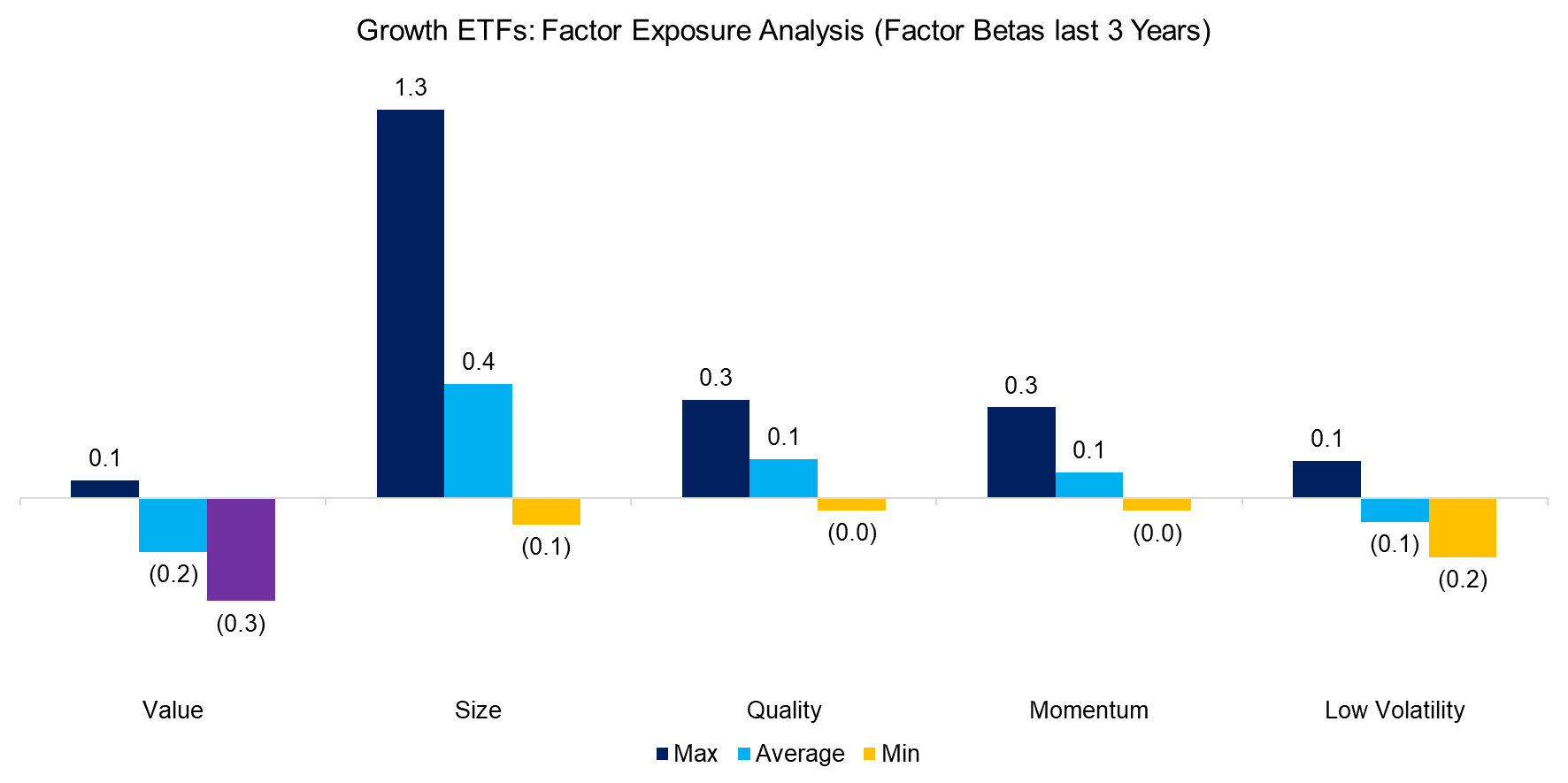

First, we run a simple factor exposure analysis on the universe of 40 growth ETFs. As expected, there is a minor negative beta to the value and low volatility factors, ie growth stocks tend to be expensive and volatile. The beta to momentum is positive, but low, which highlights that growth and momentum stocks are not the same. The positive exposure to the quality factor can be explained by many technology companies having low financial leverage, and some like Apple even being highly profitable.

Most surprising is the positive exposure to the size factor that is contributed by small-cap growth products. A typical way to slice historical factor returns from the Kenneth R. French data library is by small versus large market capitalization and value versus growth dimensions, which results in a two-by-two matrix.

However, the category small-cap & growth generated the worst return out of all four combinations in the period from 1926 to 2022, which should be considered when allocating to such products. The underlying issue is that small companies can achieve much higher revenue and earnings growth rates than large companies, but investors often get carried away by simply extrapolating the growth and driving valuations to excessive levels.

Source: Finominal

RISK CONTRIBUTION ANALYSIS

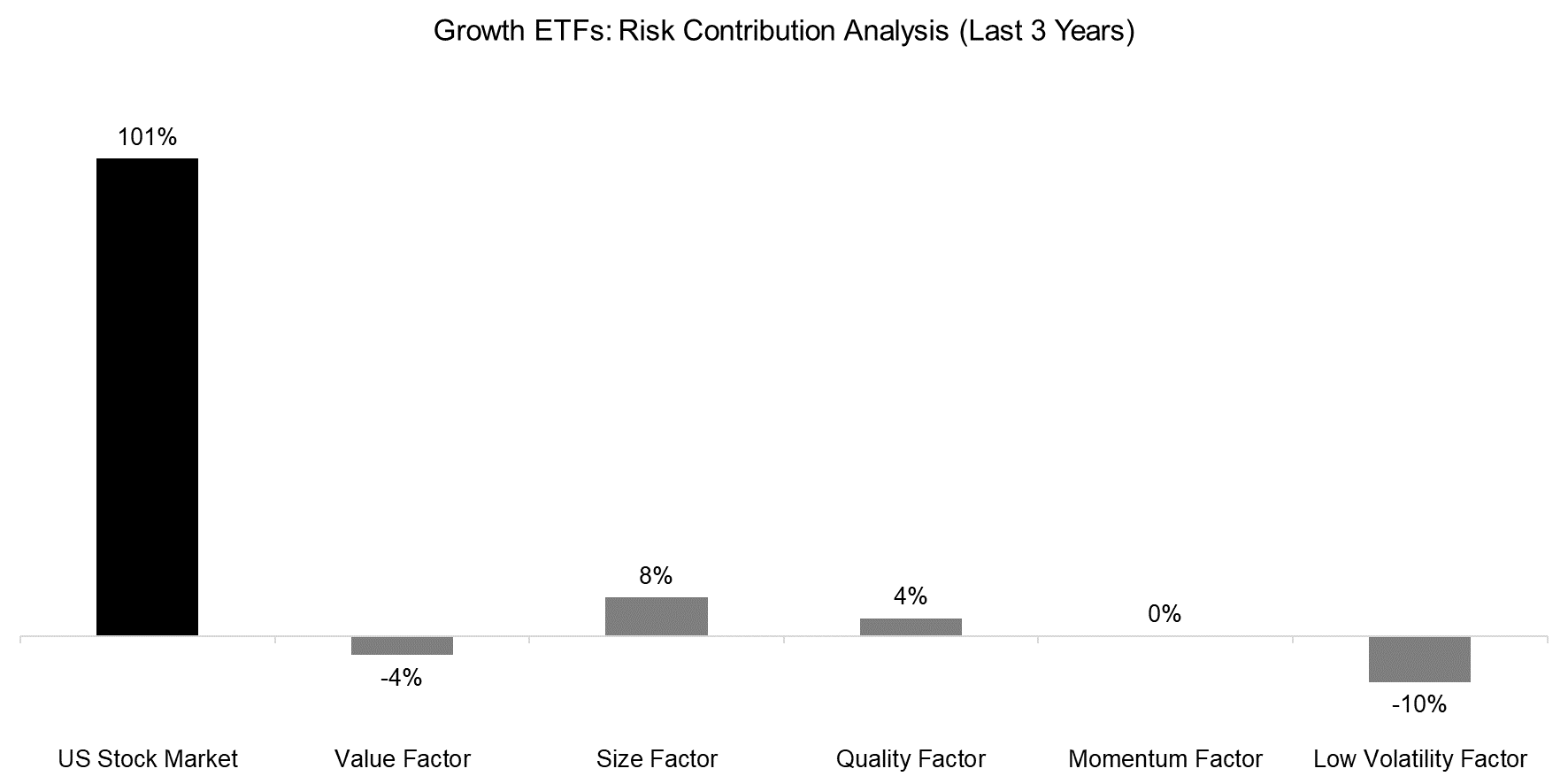

Although the growth ETFs exhibit a range of factor exposures, it is worth highlighting that these are still long-only products and do not provide pure exposure to the growth factor, which might be accomplished by a market-neutral portfolio comprised of long positions in high-growth and short positions in low-growth stocks.

Stated differently, almost all of the risk of growth ETFs can be attributed to the US stock market rather than factors.

Source: Finominal

PERFORMANCE BENCHMARKING

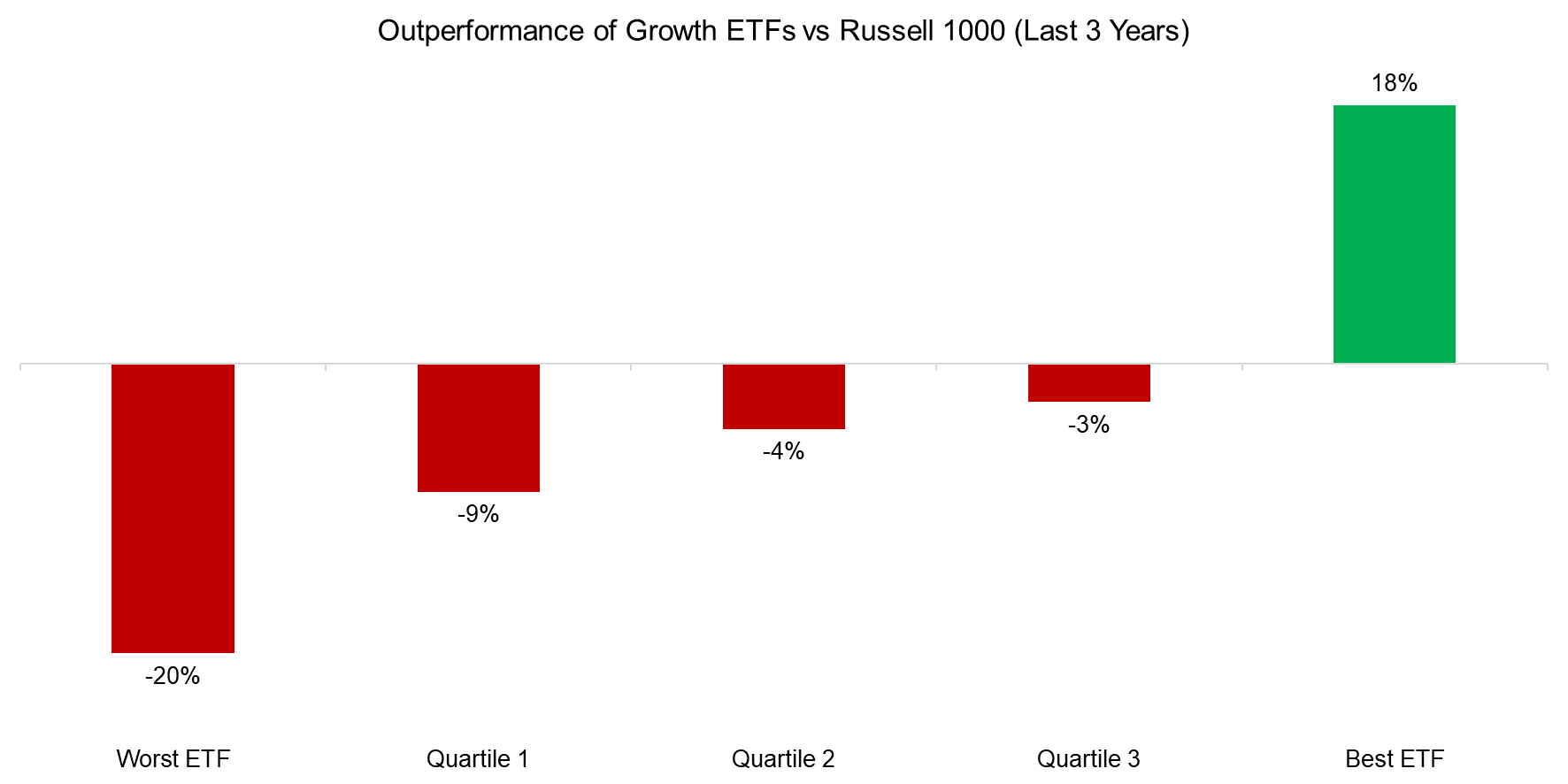

Next, we benchmark the performance of the growth ETFs versus the Russell 1000 over the last three years as most products are focused on selecting mid- to large-cap stocks. We observe that most products underperformed the benchmark and out of 40 products, only 6 managed to beat the Russell 1000. The best-performing ETF was Invesco S&P 500 GARP ETF (SPGP), which aims to select growth stocks at reasonable valuations.

Source: Finominal

Naturally, three years is a very short period for evaluating the performance of any investment product.

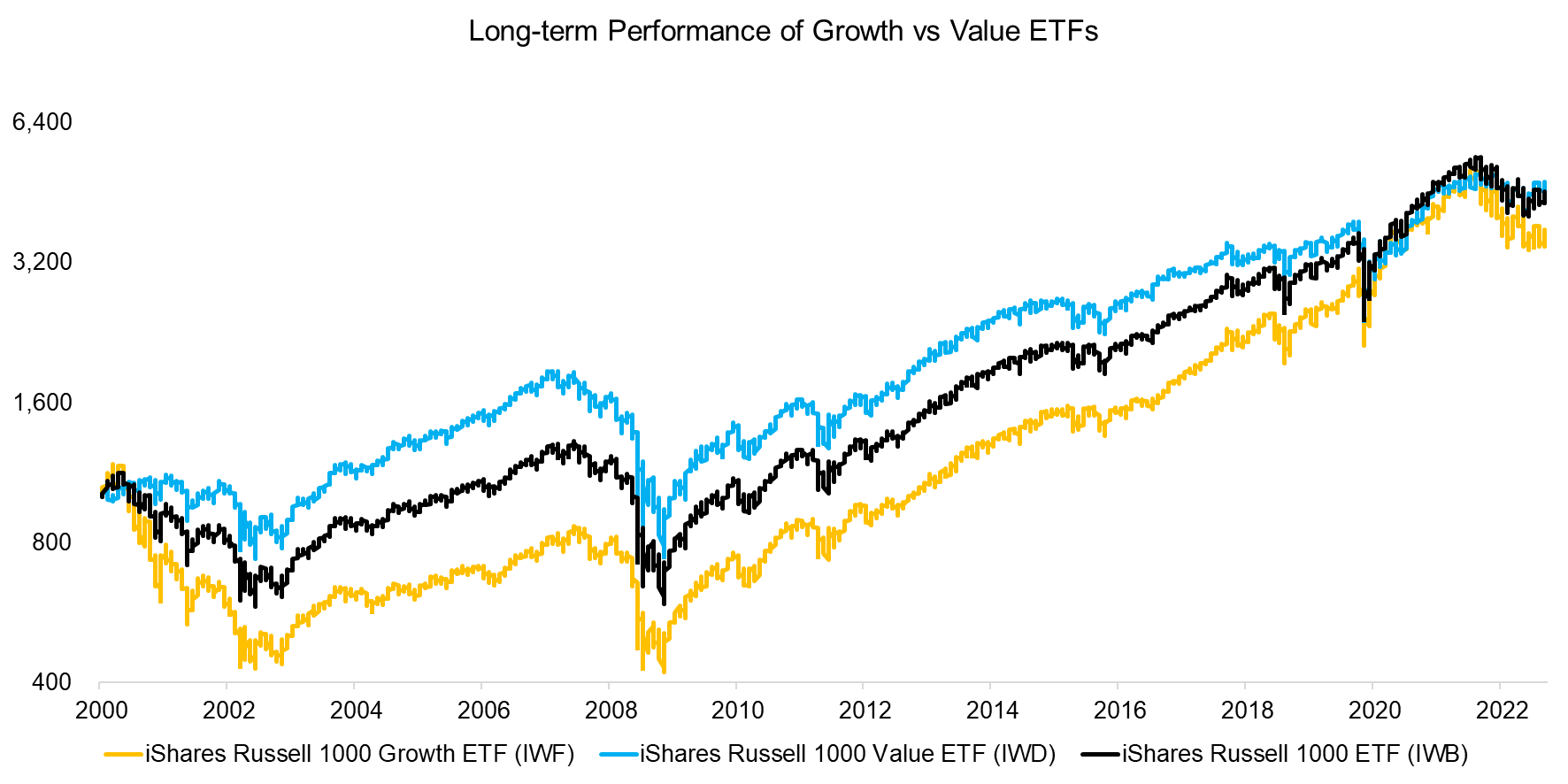

IShares has some of the oldest ETFs and we can compare the long-term performance of the iShares Russell 1000 Growth Index (IWF) versus the iShares Russell 1000 Index (IWB) and iShares Russell 1000 Value Index (IWD). We observe that IWF has underperformed both over the 20-year period since 2000.

It will be interesting to update this analysis in a couple of years as growth stocks underperformed the general stock market for quite a few years post the tech bubble implosion in 2000. As Mark Twain said, history never repeats itself, but it does often rhyme.

Source: Finominal

FURTHER THOUGHTS

Value investors found their redemption in 2022 as cheap stocks outperformed expensive ones after almost a decade of underperformance. However, other factors like momentum also did well, restoring some of the credibility that factor investing has lost in recent years.

Although it does not seem wise to purely select stocks on growth characteristics, it certainly can be used as a filter when combined with other factors. For example, we highlighted previously that buying growth stocks at reasonable valuations has generated attractive excess returns, but there are surprisingly few products in that space (read GARP: Golden or Garbage?), which seems like a missed opportunity for asset managers.

RELATED RESEARCH

What Are Growth Stocks?

Growth: Factor Sinning?

GARP: Golden or Garbage?

Improving the Odds of Value Investing

Low Vol-Momentum vs Value-Momentum Portfolios

Intregrated Value, Growth & Quality Portfolios

Improving the Momentum Factor

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.