Hedge Funds versus Hedge Fund Replication ETFs

Clones or cousins?

November 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Hedge fund replication ETFs have reasonably well replicated hedge fund index returns

- The CTA index replication is likely the most successful, merger arbitrage the worst

- However, it is questionable if these hedge fund indices are worth replicating

INTRODUCTION

Imitation is the sincerest form of flattery, but imitating is easier in some cases than others. There have been multiple startups that tried to copy LinkedIn’s success by launching similar business-oriented social networks, but almost all failed. In contrast, there are dozens of mutual funds and ETFs that provide the same access to the S&P 500.

The barriers to entry in the asset management industry are not particularly high, which explains why there are thousands of investment products competing for the attention and assets of investors. Innovative products are copied quickly and offered at lower fees, which makes it difficult to capture and maintain high market shares.

However, not all strategies can be copied easily. U.S.-focused private equity funds provide the same exposure to the U.S. economy as the S&P 500, but smoothened valuations of private assets are difficult to replicate in public markets, where mark-to-market accounting standards prevail (read Private Equity: Fooling Some People All the Time?).

There have been various attempts to replicate hedge funds given their high fees and offer these as ETFs to even retail investors. In this research note, we will evaluate hedge fund replication ETFs.

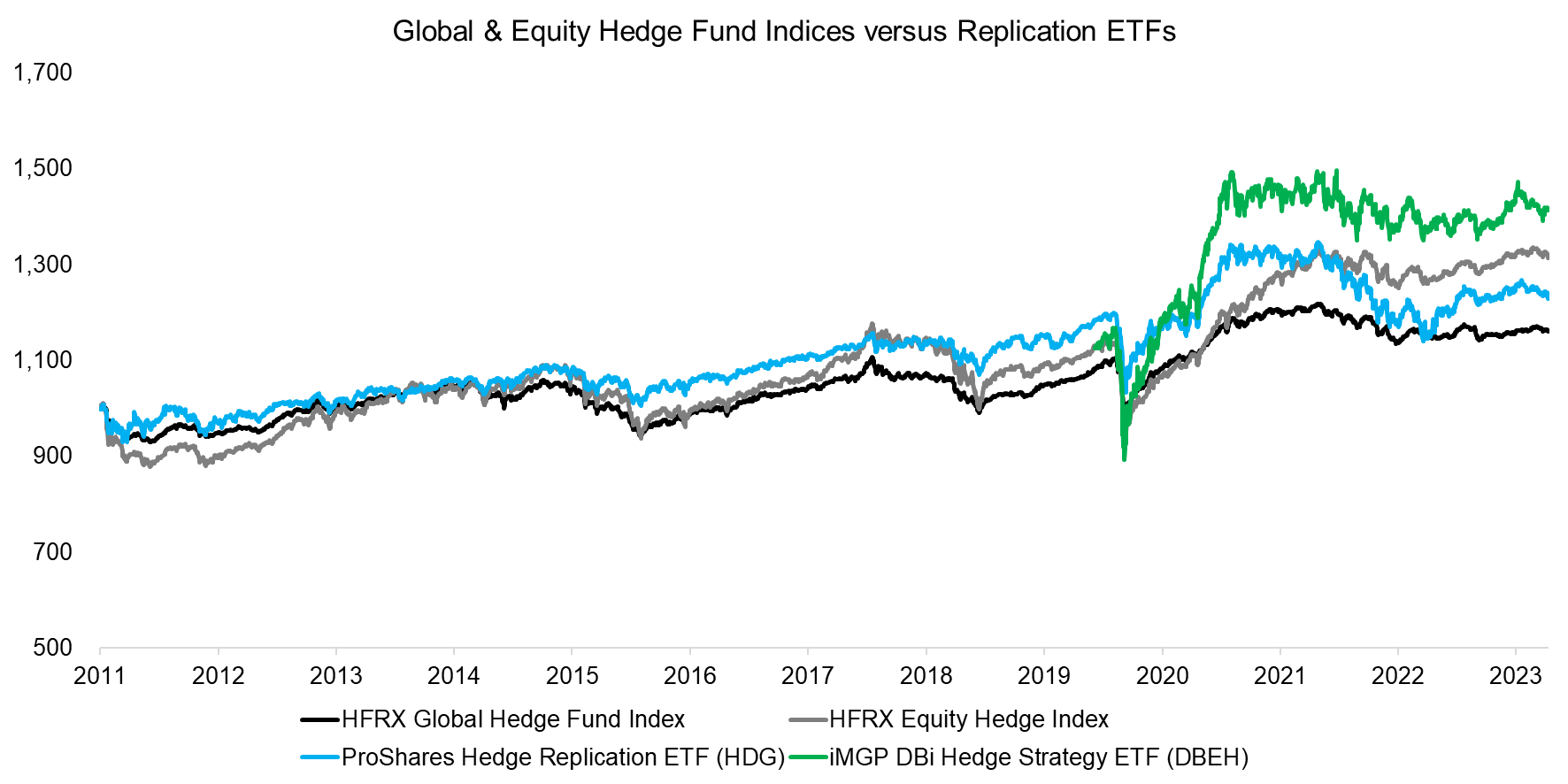

GLOBAL & EQUITY HEDGE FUND INDICES VERSUS REPLICATION ETFS

There are two ETFs that provide exposure to the broader hedge fund indices, namely the ProShares Hedge Replication ETF (HDG) and iMGP DBi Hedge Strategy ETF (DBEH). The former manages $32 million of assets and charges 0.95% per annum, compared to $33m and 0.85% per annum for the latter. Although these fees are high compared to plain-vanilla ETFs, they are low when contrasted to traditional hedge funds that typically charge more than 1.5% plus a performance fee.

HDG aims to replicate the Merrill Lynch Factor Model while DBEH seeks to provide the same exposure as a portfolio of 40 leading long-short equity hedge funds. We use the HFRX Global Hedge Fund Index and HFRX Equity Hedge Index as benchmark indices, and observe that HDG and DBEH approximately exhibited the same trends in performance. Their correlations range from 0.59 to 0.65 to the benchmarks.

Source: Finominal

MULTI-STRATEGY HEDGE FUND INDEX VERSUS REPLICATION ETFS

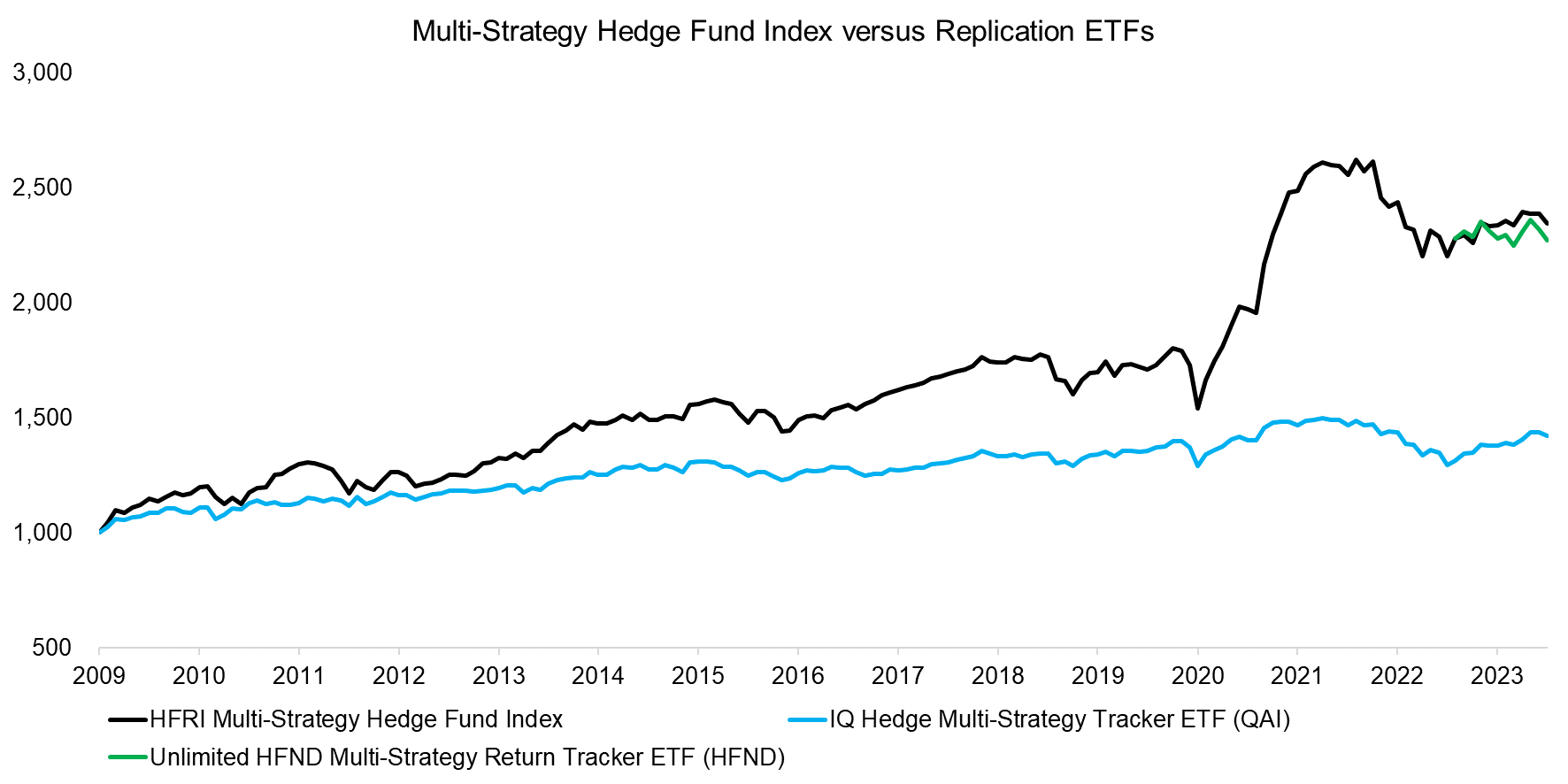

Multi-strategy hedge funds have become one of the most popular hedge fund types given the phenomenal returns of a few multi-strategy hedge funds like Millenium and Citadel in 2022. These funds combine multiple trading teams that should generate uncorrelated returns to each other and the stock market, therefore creating a consistent stream of alpha that offers diversification benefits to capital allocators.

The IQ Hedge Multi-Strategy Tracker ETF (QAI) has a track record since 2009, while the Unlimited HFND Multi-Strategy Return Tracker ETF (HFND) was launched last year. The former manages $600m of assets and charges 0.78% per annum, compared to $40m and 0.95% per annum for the latter.

The correlations of QAI and HFND to the HFRI Multi-Strategy Hedge Fund Index were approximately 0.8, although the total return of QAI was significantly below that of the benchmark index over its 14-year track record (CAGR of 6.0% versus 2.5% from 2009 to 2023) (read Multi-Strategy Hedge Funds: Jack of All Trades?). Having said this, the difference in return can partially be explained by hedge fund indices suffering from reporting and survivorship biases that overstate returns.

Source: Finominal

CTA INDEX VERSUS REPLICATION ETF

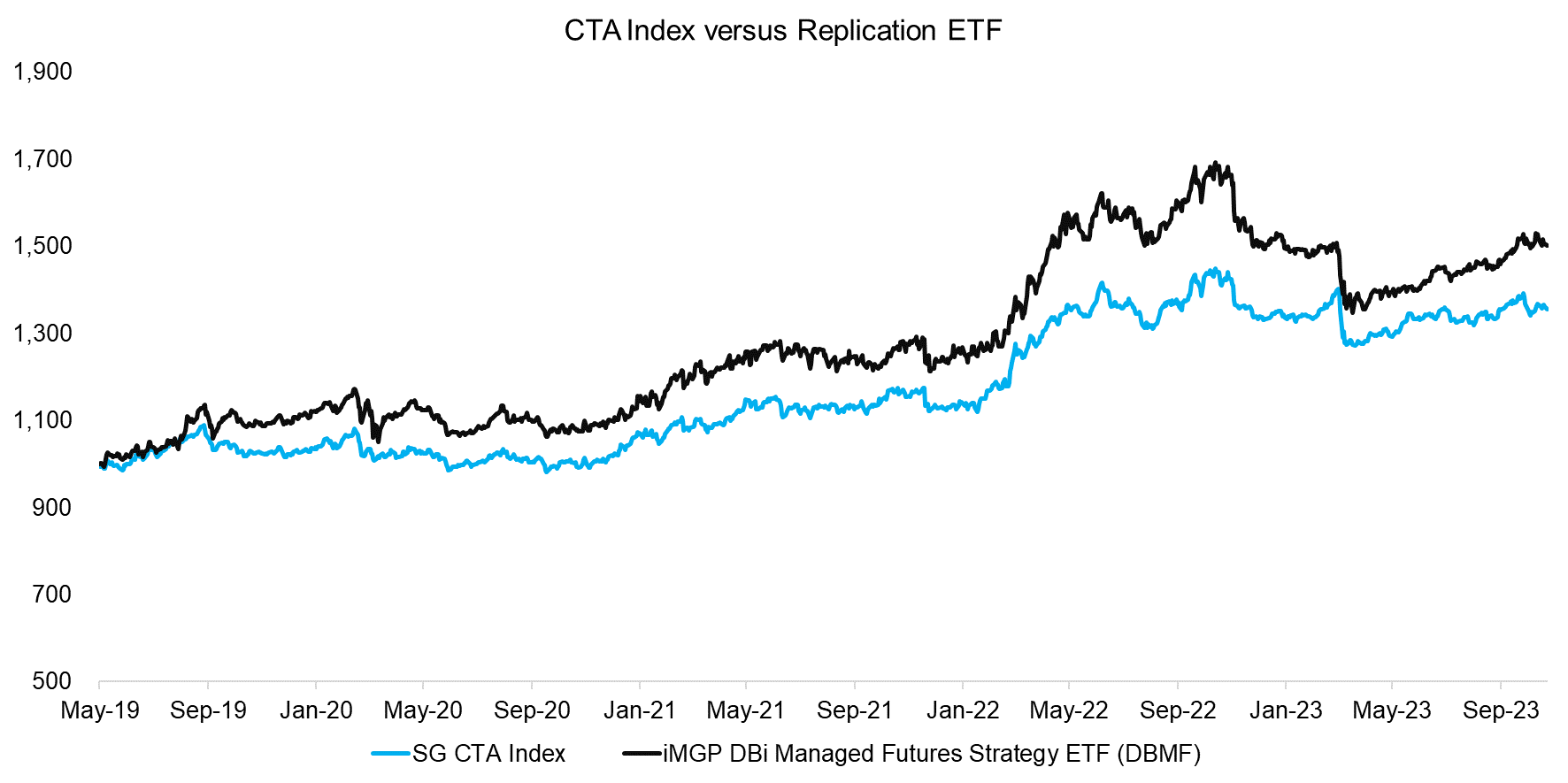

Similar to multi-strategy hedge funds, CTAs had a revival in 2022 as they generated positive returns when stocks and bonds simultaneously declined. There are a few managed futures ETFs, but only the iMGP DBi Managed Futures Strategy ETF (DBMF) aims to replicate the returns of the CTA industry. DBMF has become the largest alternative ETF with close to $1 billion of assets under management and charges 0.85% per annum.

We benchmark DBMF to the SG CTA Index, where the trends in performance were almost identical. The correlation was 0.67 in the period between 2019 and 2023, making this a good proxy for getting exposure to the average CTA (read CTAs vs Global Macro Hedge Funds and Managed Futures: The Empire Strikes Back).

Source: Finominal

MERGER ARBITRAGE INDEX VERSUS REPLICATION ETFS

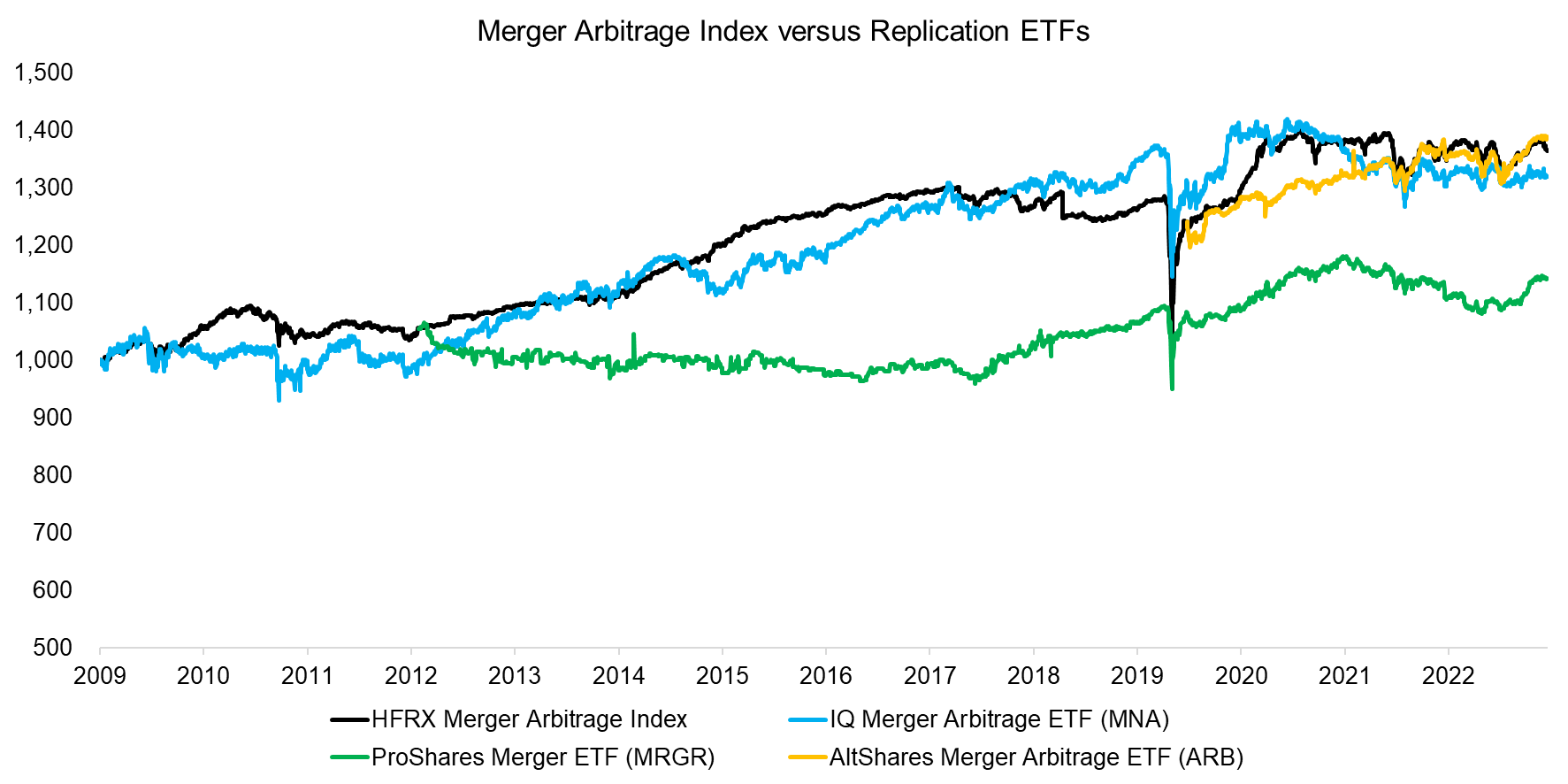

Finally, we compare the performance of three ETFs focused on merger arbitrage versus the HFRX Merger Arbitrage Index. The fees are almost the same at 0.75% to 0.77% per annum, but the IQ Merger Arbitrage ETF (MNA) dominates with $454 million of assets under management, compared to $26 million for ProShares Merger ETF (MRGR) and $73 million for AltShares Merger Arbitrage ETF (ARB).

However, the performance of these three ETFs was not very similar to that of the benchmark index, which is substantiated by low correlations ranging from 0.41 to 0.48 (read Merger Arbitrage: Arbitraged Away?).

Source: Finominal

FURTHER THOUGHTS

Considering these four hedge fund types, it seems that some strategies can be replicated reasonably well and offered to all investors via ETFs. However, it is questionable if these strategies should be replicated as all except CTAs represent diluted equity exposure (read Are Alternative ETFs Good Diversifiers? and Multi-Strategy Hedge Funds: Equity in a Different Shade?).

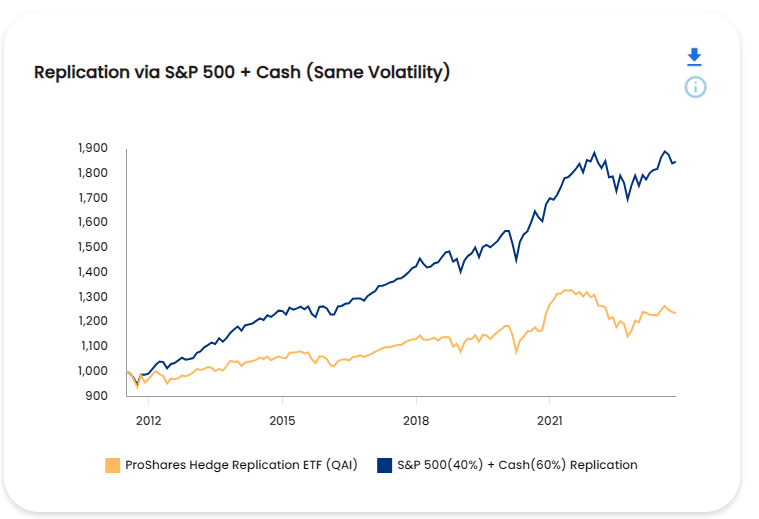

For example, the ProShares Hedge Replication ETF (HDG) features a 0.78 correlation to the S&P 500, which implies limited diversification benefits. Worse, a portfolio comprised of a 40% allocation to the S&P 500 and 60% to non-interest-bearing cash would have had the same volatility and same trends, albeit offered a much higher return since 2011.

Source: Finominal

Naturally, this simply underpins the fundamental problem of the hedge fund industry: generating alpha is hard, so little hedging is going on and investors are simply getting equity exposure in disguise.

RELATED RESEARCH

Are Alternative ETFs Good Diversifiers?

Liquid Alt Juggernauts: Worth their Salt?

Hedge Fund ETFs

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

CTAs vs Global Macro Hedge Funds

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Merger Arbitrage: Arbitraged Away?

Multi-Strategy Hedge Funds: Jack of All Trades?

Multi-Strategy Hedge Funds: Equity in a Different Shade?

Replicating Famous Hedge Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.