Hedged vs Unhedged International Equity Exposures

Should you hedge foreign currency exposures?

July 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- USD-hedged products have outperformed significantly recently

- However, history shows plenty of periods of USD weakness

- EM outperformance seems linked to USD weakness

INTRODUCTION

For U.S.-based investors, international equities offer compelling opportunities. The S&P 500 currently trades at a trailing price-to-earnings (P/E) ratio of 32.9x, significantly higher than the MSCI Europe at 22.6x and MSCI Japan at 16.3x. While valuation is an important metric, it is not the only one -earnings growth in the U.S. has outpaced that of other regions, which may help justify these elevated valuations.

Currency exposure is another key factor when investing internationally. The U.S. dollar has recently weakened against major currencies such as the euro, partly due to tariffs imposed by the U.S. government. But what if the dollar rebounds? In such a scenario, U.S.-based investors could face currency-related losses on their foreign equity holdings.

In this research article, we examine the implications of hedged versus unhedged international equity exposure from the perspective of a U.S. investor.

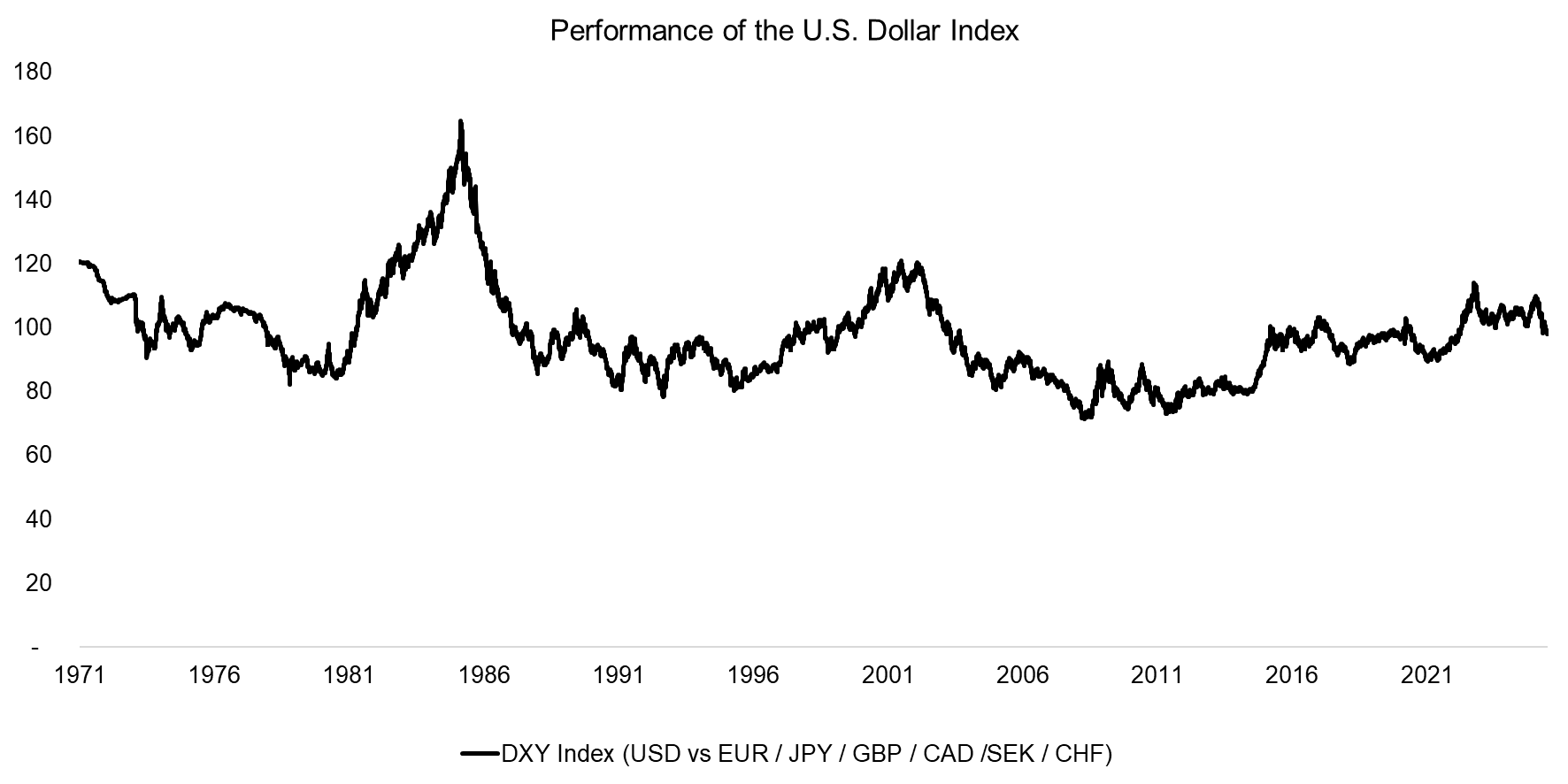

U.S. DOLLAR INDEX

The U.S. Dollar Index (DXY) is perhaps the most widely recognized measure of the U.S. dollar’s value. It tracks the dollar’s performance against a trade-weighted basket of six major currencies: the euro (58%), Japanese yen (14%), British pound (12%), Canadian dollar (9%), Swedish krona (4%), and Swiss franc (3%). Over the past 50 years, the DXY has fluctuated between a low of 71 and a high of 164 – moves that have had significant implications for the U.S. economy, particularly in terms of trade competitiveness.

The index peaked in the early 1980s, following the oil crisis of the 1970s, when the Federal Reserve raised interest rates above 15% to combat inflation. Its lowest point came during the Global Financial Crisis of 2008, as the collapse of the subprime mortgage market severely undermined confidence in the U.S. financial system and economy.

Source: Finominal

HEDGED VS UNHEDGED EQUITY EXPOSURES

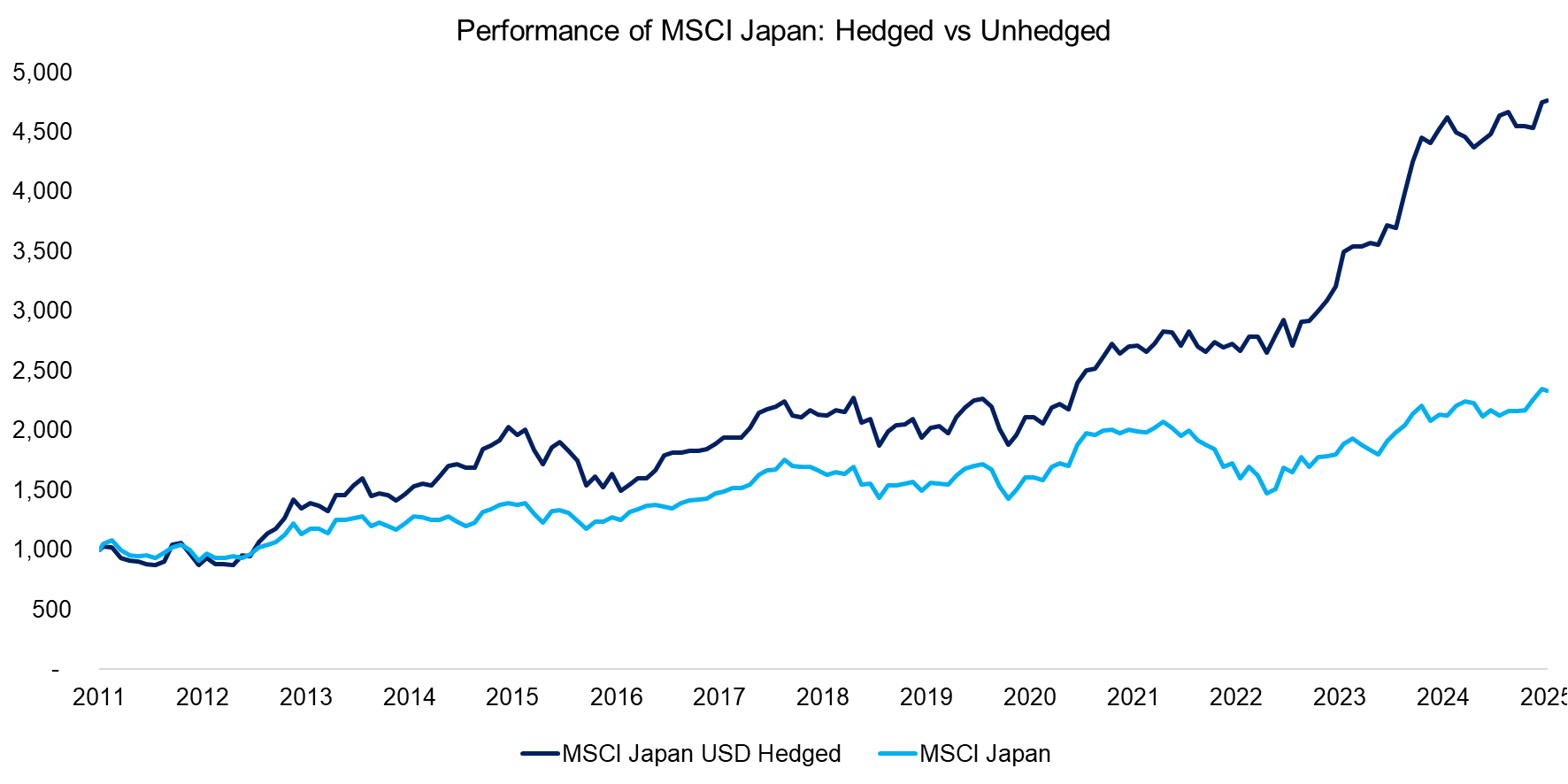

For decades, macro investors have bet against the Japanese yen, citing Japan’s shrinking population and record-high levels of public debt as long-term structural concern. Yet, despite these headwinds, Japanese yen has held up moderately well. However, Japanese stocks remain significantly undervalued – trading at nearly a 50% discount compared to their U.S. counterparts.

Given this valuation gap, why not consider Japanese equities through a USD-hedged ETF? A comparison between the unhedged MSCI Japan Index and its currency-hedged version reveals a striking performance difference: since 2011, the hedged index delivered a compound annual growth rate (CAGR) of 11.8%, nearly double the 6.2% return of the unhedged version. This highlights the potential benefit of mitigating currency risk when investing in Japan from a U.S.-based perspective.

Source: Finominal

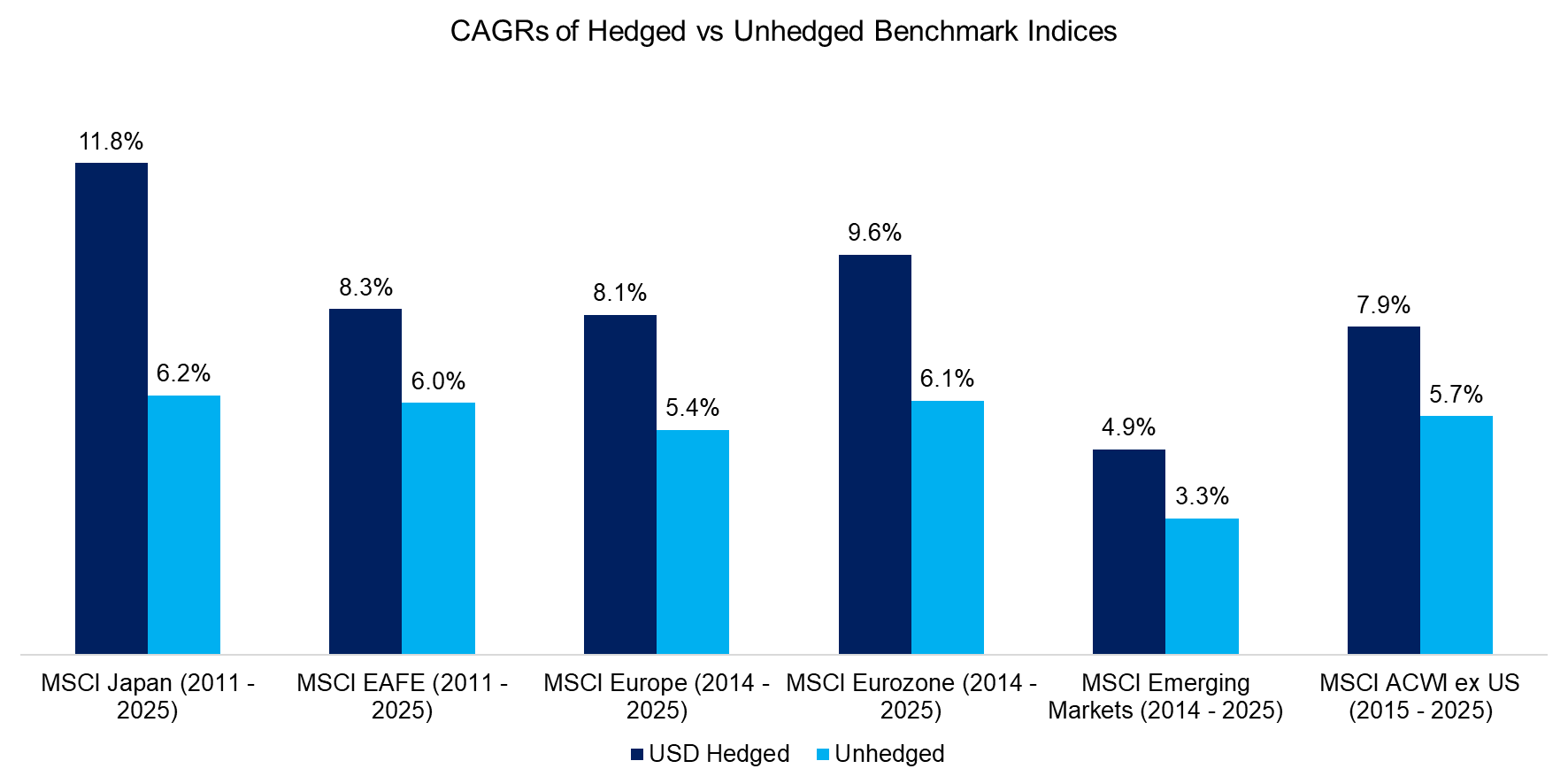

We calculate the CAGRs for various equity benchmarks – such as the MSCI EAFE and Eurozone indices – from 2011 to 2025. Across the board, the USD-hedged versions outperformed their unhedged counterparts. This outcome largely reflects the broad appreciation of the U.S. dollar against major currencies during this period.

Currency hedging is typically implemented through rolling forward contracts, which come with ongoing costs. Investors often assume these costs will offset most of the benefits, leaving reduced volatility as the primary advantage. However, in this case, the extent of dollar strength exceeded expectations, suggesting that markets may have underpriced the potential for such appreciation – leading to stronger-than-anticipated returns from hedged strategies.

Source: Finominal

OUTPERFORMANCE VS CAPITAL FLOWS

A strengthening or weakening U.S. dollar often signals shifts in the U.S. or global economic and financial landscape. For example, during financial crises, investors tend to retreat from emerging markets and seek safety in U.S. assets such as stocks or Treasury bonds. This raises an important question: is there a consistent relationship between equity markets and the U.S. dollar?

In fact, when we compare the rolling three-year relative performance of the MSCI Emerging Markets Index versus the MSCI USA Index to the inverted U.S. Dollar Index (DXY), a pattern emerges. Emerging markets tend to outperform when the dollar is weakening, and underperform when the dollar is strengthening. From this perspective, investors might consider expressing a view on the U.S. Dollar directly via long or short positions in the DXY itself, rather than emerging markets equities (read The Case Against EM Equities).

Source: Finominal

FURTHER THOUGHTS

While this analysis demonstrates notable gains from currency hedging foreign equity exposure, it is important to recognize that these results are based on a relatively short time frame during which the U.S. dollar was broadly appreciating. A longer-term perspective reveals many periods of dollar weakness, during which hedged strategies would have underperformed their unhedged counterparts.

Moreover, although currency views are common among investors, it’s worth noting the graveyard of FX-focused hedge funds – a testament to the challenges and unpredictability of forecasting currency movements.

RELATED RESEARCH

The Case Against EM Equities

Equity Factors & The Mighty US Dollar

Factor Exposure Analysis 115: Measuring International Exposures

What’s My International Exposure?

The Fallacy of Betting on the Best Stock Market

Thematic versus Momentum Investing

Stock Selection versus Asset Allocation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.