Hedging Market Crashes with Factor Exposure

No Factor is a Panacea, but all are attractive Diversifiers

October 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- None of the factors consistently generated positive performance during recent market crashes

- However, almost any factor exposure would have increased the risk-return ratio of an equity-centric portfolio

- Low Volatility and Mean-Reversion would have been most beneficial, Momentum least

INTRODUCTION

A long time ago in a galaxy far, far away…markets declined. On our world, supported by an empire of collaborating central banks, market declines also seem distant. The last drawdown in the S&P 500 of more than 10% occurred in January 2016. Since then markets globally have been steadily increasing while exhibiting record low levels of volatility, which is also reflected in many other asset classes. The main exception are cryptocurrencies, the current wild west of capital markets. This quiet period within the equity markets is an ideal time to reflect on what strategies protected capital during previous market crashes, as these will certainly occur again. In this short research note we will analyse how to protect an equity-centric portfolio against market crashes with factor exposure by looking at recent case studies.

METHODOLOGY

We’re going to focus on the six well-known factors (Value, Size, Momentum, Low Volatility, Quality & Growth) as well as short-term Mean-Reversion and focus on the S&P 500. The factors are constructed as beta-neutral long-short portfolios by taking the top and bottom 10% of the stock universe in the US and 5% for Mean-Reversion. Only companies with a minimum market capitalization of $1bn are considered and 10bps of transaction costs are included.

There is no standard definition for a market decline and we’re going to select arbitrarily some of the more meaningful market declines from the last 10 years.

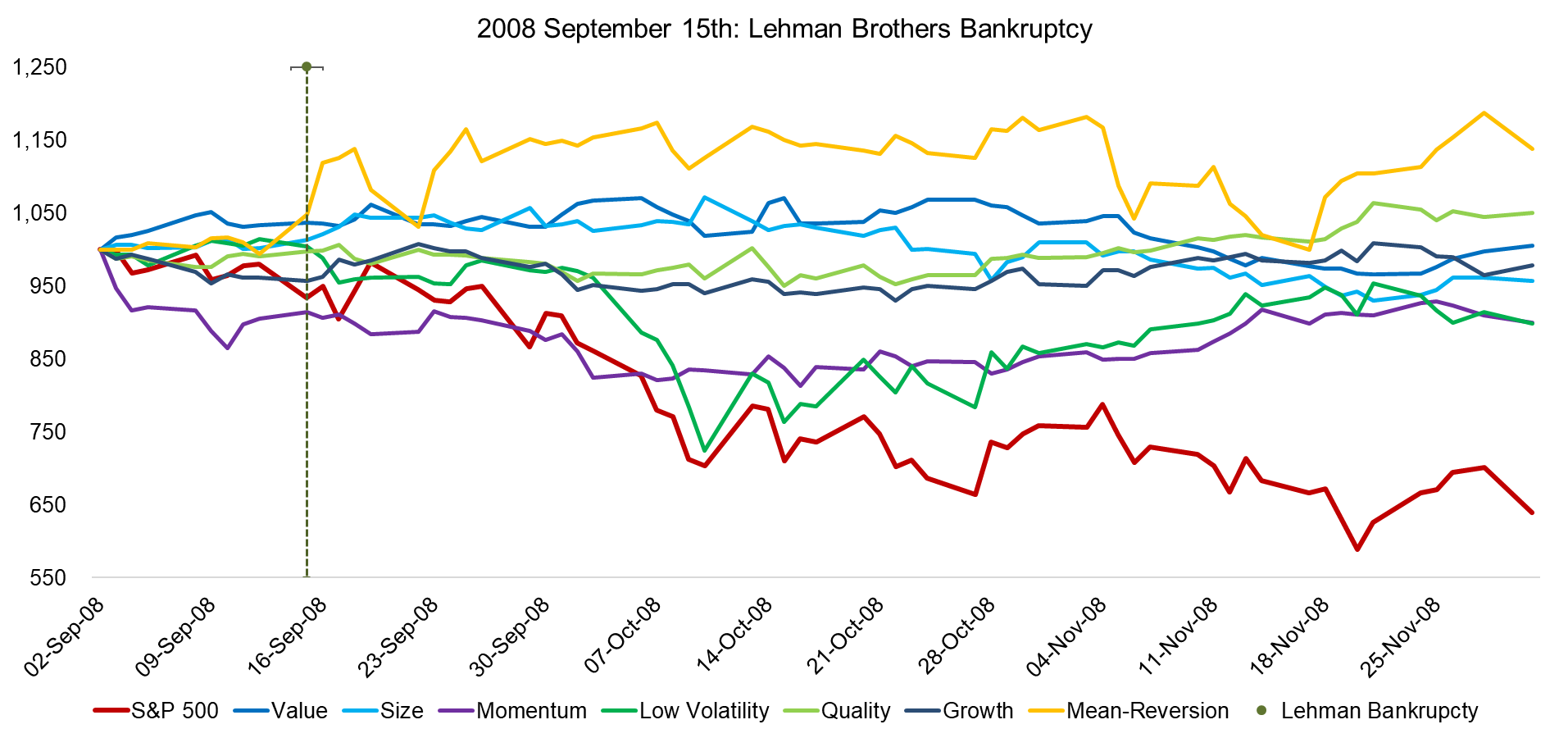

2008 SEPTEMBER: LEHMAN BROTHERS BANKRUPTCY

In less than one year it will be the 10-year anniversary of the Lehman Brothers bankruptcy, which was one of the key events that defined the Global Financial Crisis (GFC). The S&P 500 lost 41% from September to December 2008, which seems almost unbelievable from today’s perspective of extremely calm and rising markets. The chart below shows the performance of the S&P 500 and the factors. Given that these are constructed as beta-neutral long-short portfolios we naturally expect them to protect capital over that period. Intuitively investors might expect Quality to perform, however, the performance is rather flat. Low Volatility and Momentum lost significantly until October, but recovered thereafter. The only strategy that would have made money was Mean-Reversion, benefiting from high volatility (read Death, Taxes and Mean-Reversion).

Source: FactorResearch

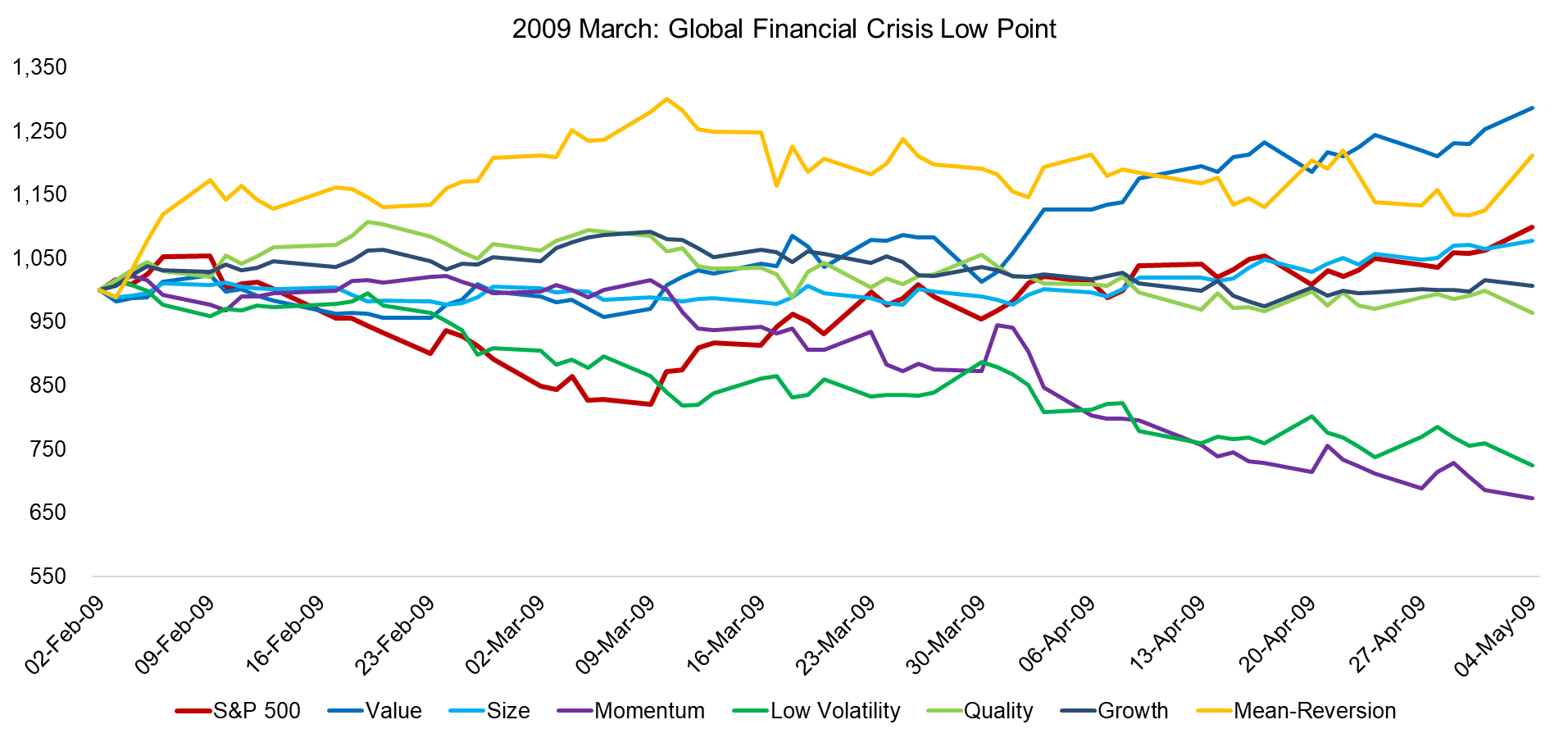

2009 MARCH: GLOBAL FINANCIAL CRISIS LOW POINT

The next chart shows the market losing 18% between February and March 2009, highlighting the low point of the S&P 500 during the GFC that was reached in the early days of March. Once the markets started recovering, Value did very well, while Momentum, having the opposite positions of Value at that point, started its well-known Momentum crash. Low Volatility shows an almost identical decline to Momentum, likely reflecting similar sector exposures.

Source: FactorResearch

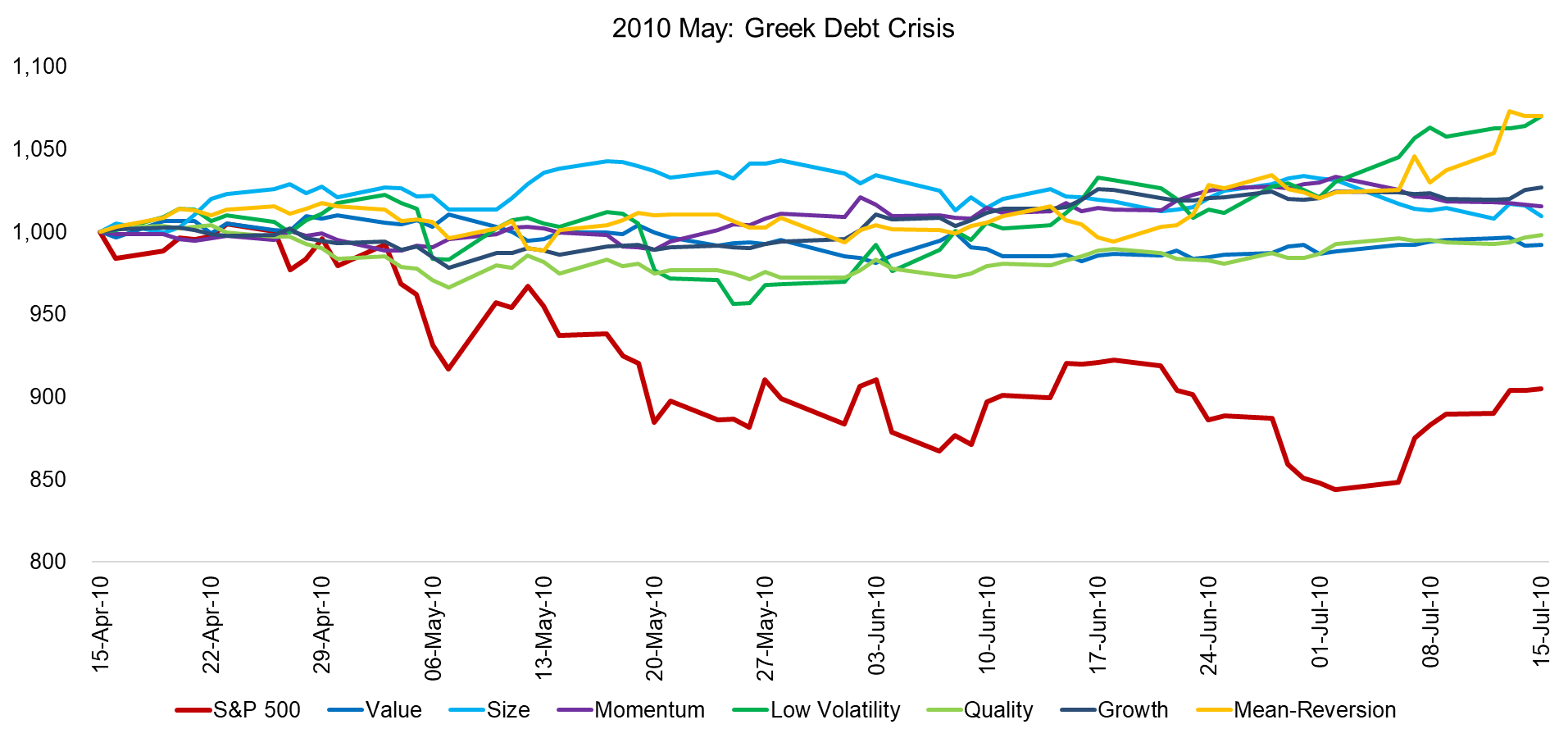

2010 MAY: GREEK DEBT CRISIS

The next interesting market decline was the Greek debt crisis in 2010, where the S&P lost 16% over a few months. The factor performance is relatively flat over that period and no factor did clearly distinguish itself.

Source: FactorResearch

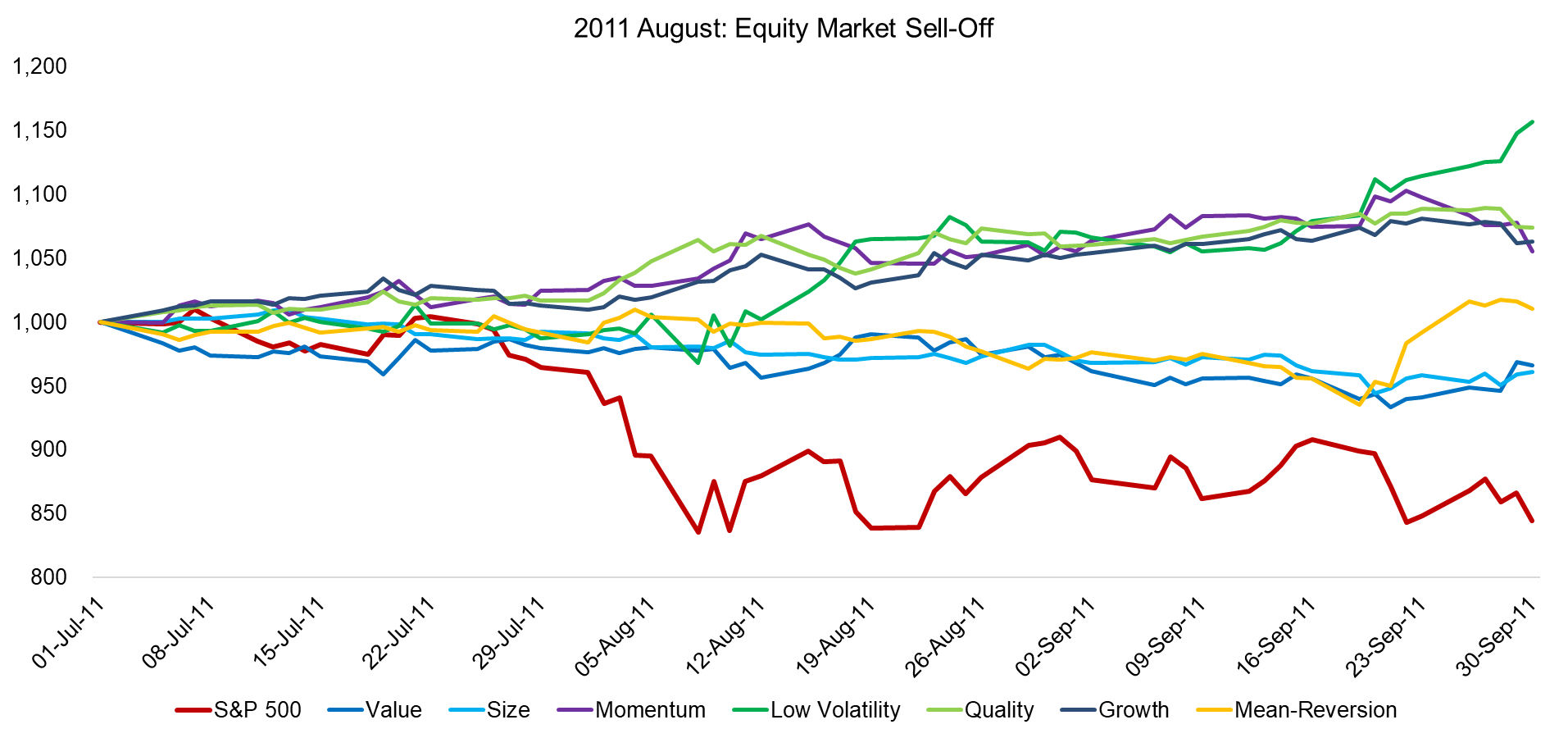

2011 AUGUST: EQUITY MARKET SELL-OFF

The S&P 500 sold off 16% in August 2011, which was explained by fears of contagion of the Greek debt crisis spreading to other European nations and by a credit down rating of the US. Over that period most factors generated flat or positive returns, with Low Volatility, Momentum, and Growth nicely off-setting the losses of the equity market.

Source: FactorResearch

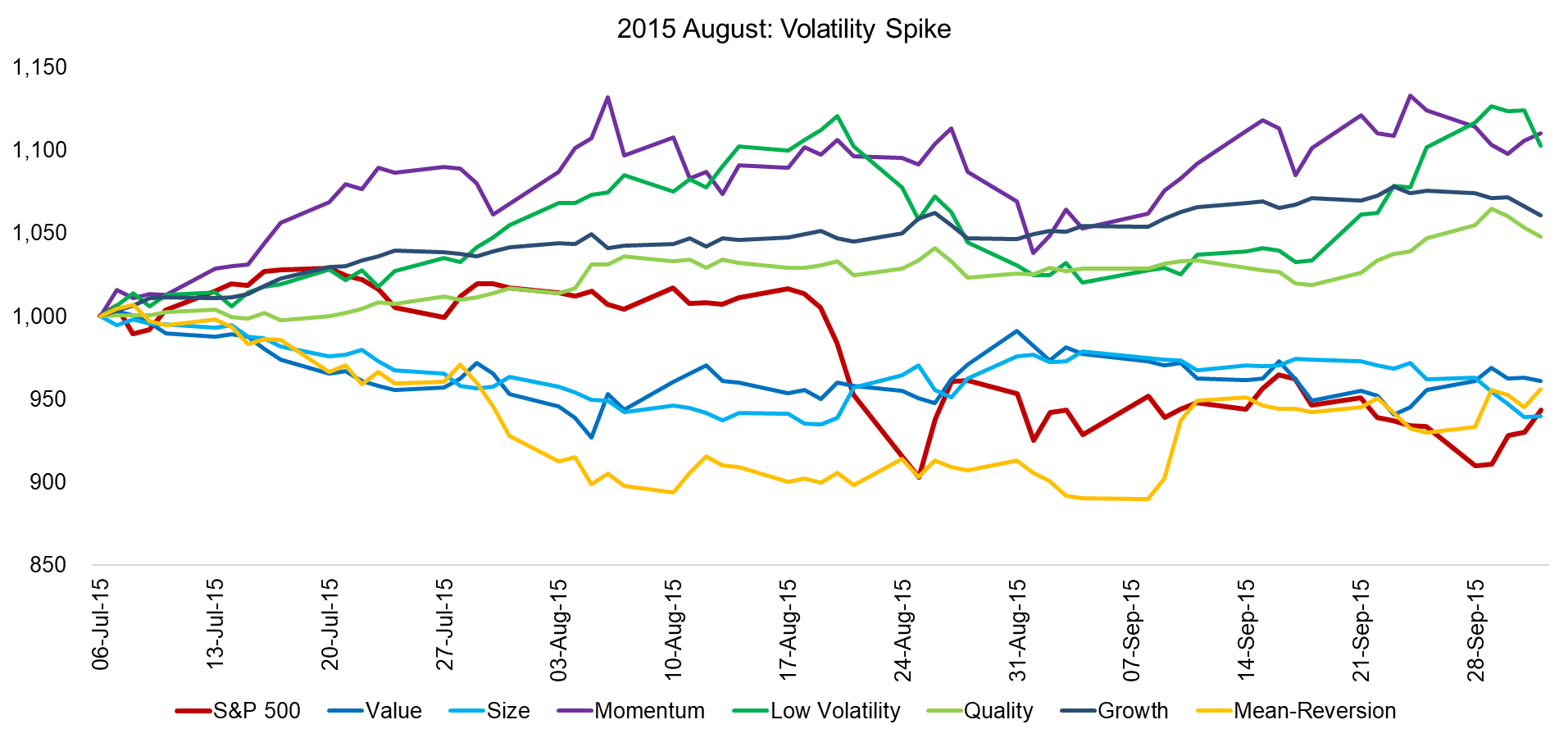

2015 AUGUST: VOLATILITY SPIKE

On 24th August 2015 the VIX spiked in trading to 53, a level last time seen in 2009, which was mainly attributed to concerns about a slowdown of economic growth in China. The S&P 500 lost 10% in that month and the factor performance was quite heterogeneous, with clear winners and losers.

Source: FactorResearch

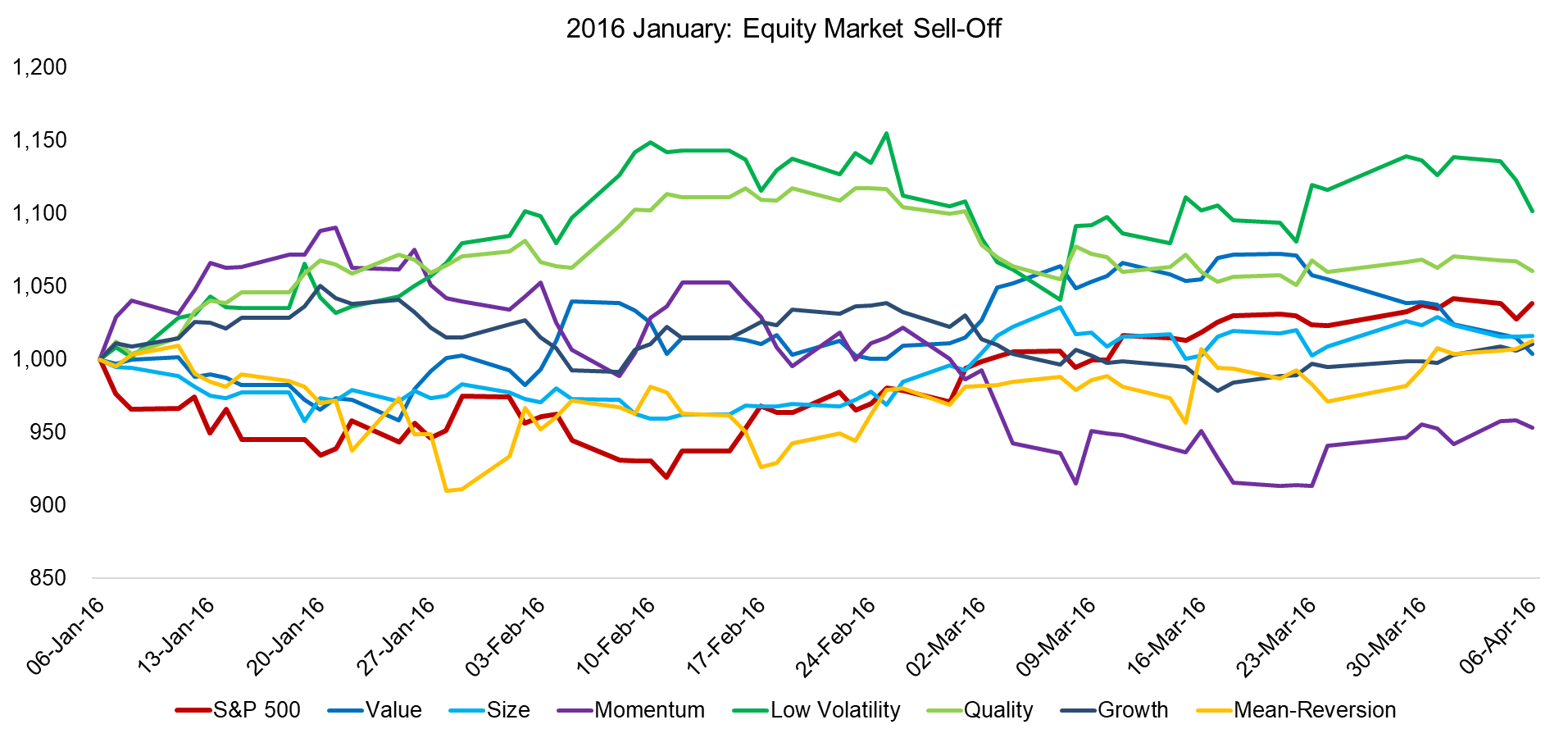

2016 JANUARY: EQUITY MARKET SELL-OFF

The S&P 500 sold off 8% in the first months of 2016 before quickly recovering. Investors were concerned about global economic growth, reflected in tumbling energy prices. The factor performance is quite mixed over that period and fairly volatile, reflecting a significant factor rotation that occurred once markets started recovering in February.

Source: FactorResearch

PROTECTING AN EQUITY PORTFOLIO WITH FACTOR EXPOSURE

The six case studies of market declines from the last 10 years show somewhat mixed results in terms of factor performance. Most factors protected capital, which is to be expected given that they are constructed as beta-neutral long-short portfolios, but there wasn’t one factor that consistently did well. Investors might have suspected Quality to take this role, but the results show otherwise (read Factors: Correlation Check).

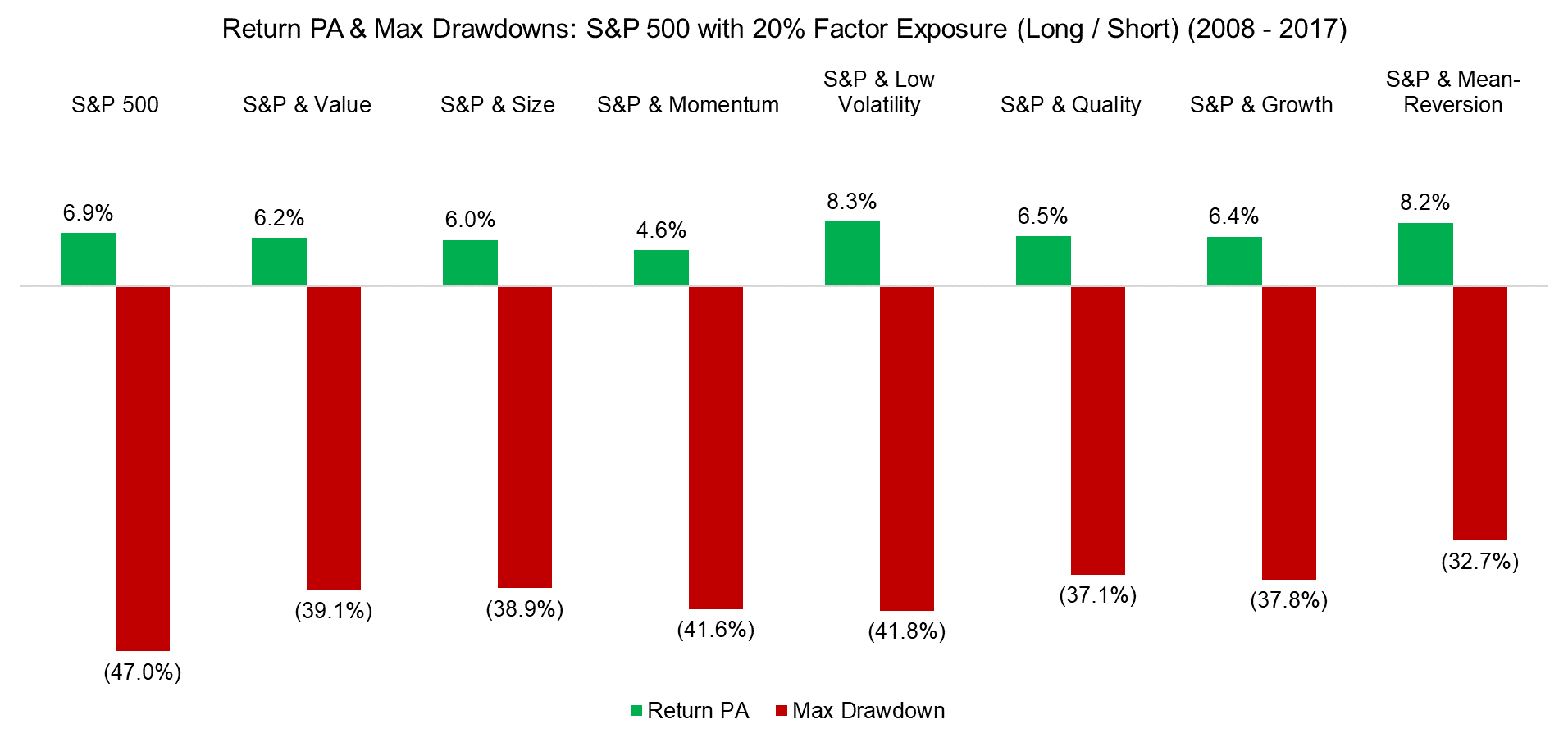

As a next step we will take an equity-centric portfolio and add 20% factor exposure. The chart below shows that the maximum drawdowns would have been reduced by adding any factor, but also at a price given that the returns of some of the combination portfolios are lower than that of the S&P 500 on a stand-alone basis. Exposure to Low Volatility would have generated the highest returns while Mean-Reversion would have reduced drawdowns by most.

Source: FactorResearch

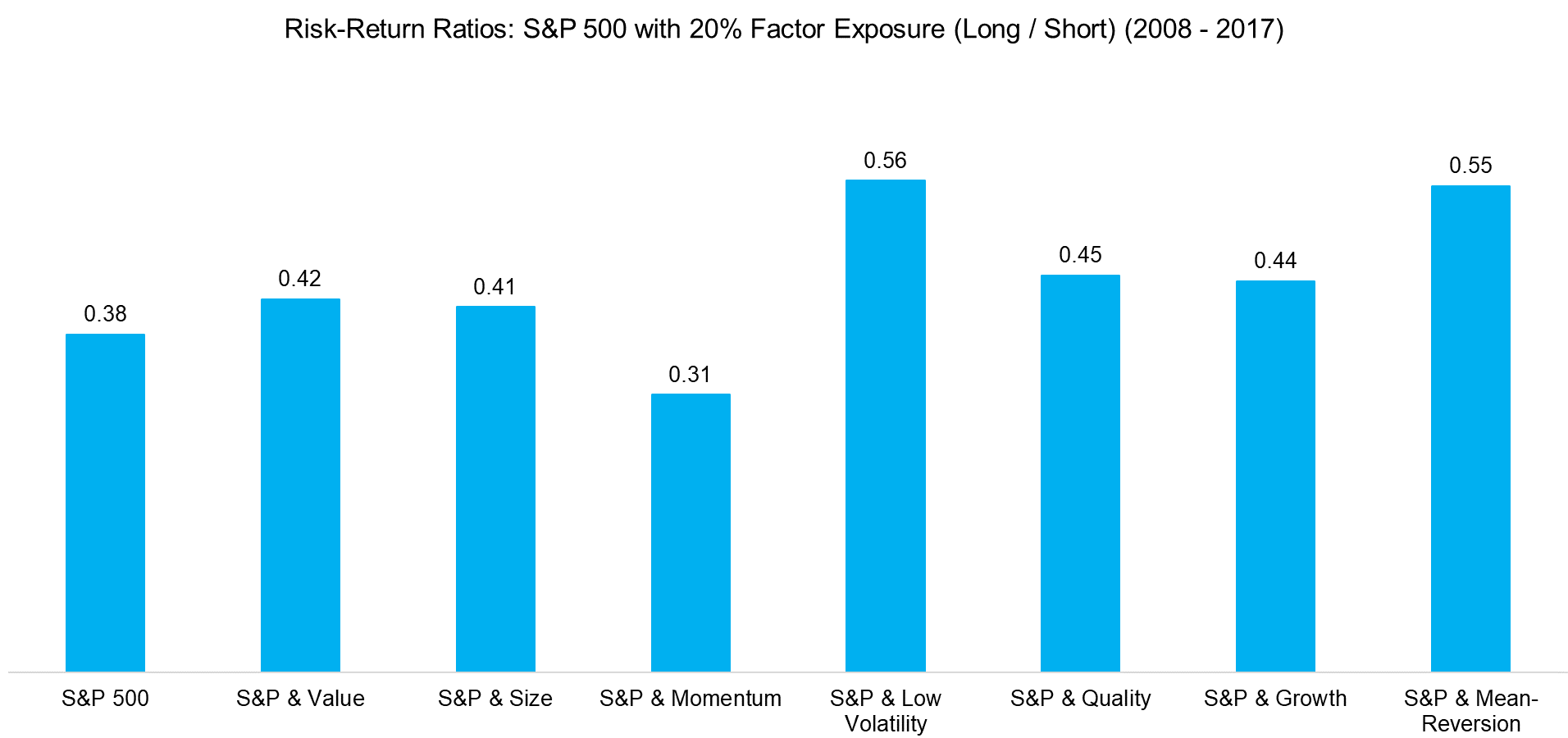

Analysing the risk-return ratios highlights that exposure to Low Volatility and Mean-Reversion would have increased the ratios by most. Aside from Momentum, which suffered the Momentum crash in 2009, all factors would have increased the risk-return ratio of the equity-centric portfolio.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that there isn’t one particular factor that consistently does well when markets crash. The short-term Mean-Reversion strategy might be most suited for this role given that it benefits from high volatility, but it’s not a panacea. However, nearly all factors improved the risk metrics, highlighting relatively easy achievable diversification benefits.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.