Hedging via Managed Futures Liquid Alts

Exploring Low-Cost, Tradable CTAs

September 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Managed futures strategies provided attractive diversification benefits during the financial crisis

- The strategies have become available as mutual funds and ETFs

- Mutual funds provide the same exposure as private vehicles, ETFs do not

INTRODUCTION

The mafia and the hedge fund industry share some characteristics. Both are powerful, intransparent, and create little value for society. Naturally the mafia is a criminal organization while the only “criminal” element of hedge funds are the high fees they are charging for their services.

However, there are pockets within the hedge fund universe that differentiate themselves. Managed futures are often considered part of the industry, but these products rank relatively high on transparency and have more moderate fees. Furthermore, they tend to offer good liquidity terms and are specifically designed to provide high diversification benefits, in contrast to many classic hedge fund strategies like long-short equity that feature elevated correlations to stock markets.

In recent years managed futures strategies have become available as liquid alternative mutual funds and even ETFs, which makes them more accessible for investors. However, it is questionable if these strategies provide the same risk-return profile when offered in public versus private vehicles (read A Horse Race of Liquid Alternatives).

In this short research note, we will investigate managed futures mutual funds and ETFs.

MANAGED FUTURES INDUSTRY

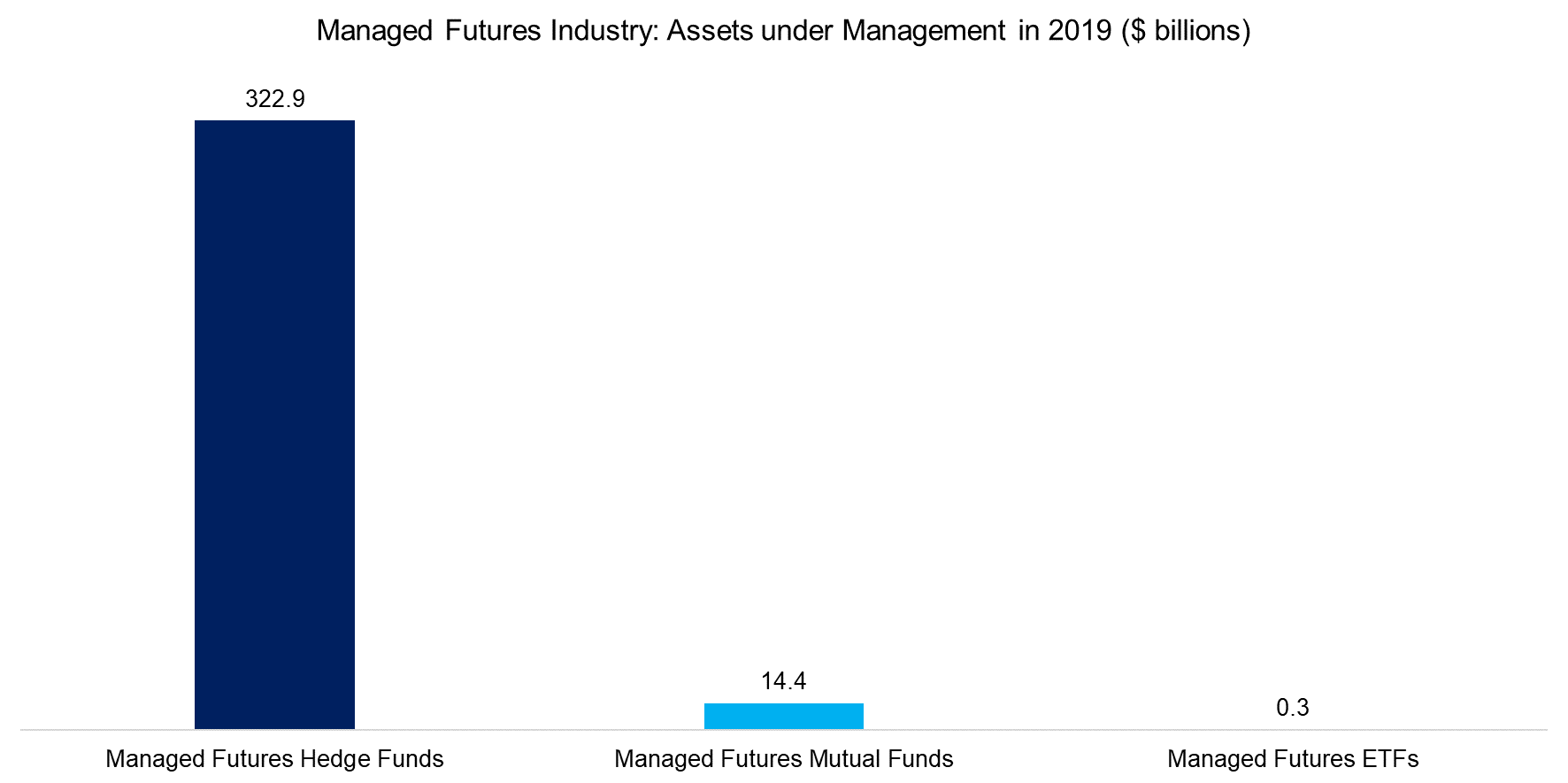

Investors have allocated slightly above $3 trillion to hedge funds, but not increased allocations in recent years as there was little to zero alpha generation. Managed futures comprise about 10% of the universe or roughly $300 billion, an allocation that has similarly remained almost constant since 2010 (read Hedge Fund ETFs).

The strategy has become available in mutual fund and ETF formats after the global financial crisis, but these have only captured a negligible amounts of assets. It is worth highlighting that the top three managed futures mutual funds have a 60% market share and the top three ETFs more than 90%, highlighting the dominance of a few firms in the liquid alternative space.

Source: BarclayHedge, MorningStar, ETFdb.com, FactorResearch

MANAGED FUTURES VS S&P 500

Managed futures are also known as commodity trading advisors (CTAs) or more broadly as trend following funds. The strategy consists of capturing up and down trends across asset classes. A portfolio might be long the 10-year US bond, long the CAD/JPY, short lean hogs, long gold, and so on. Given the diversified nature of such a portfolio, it tends to exhibit a low correlation to major asset classes like equities and bonds.

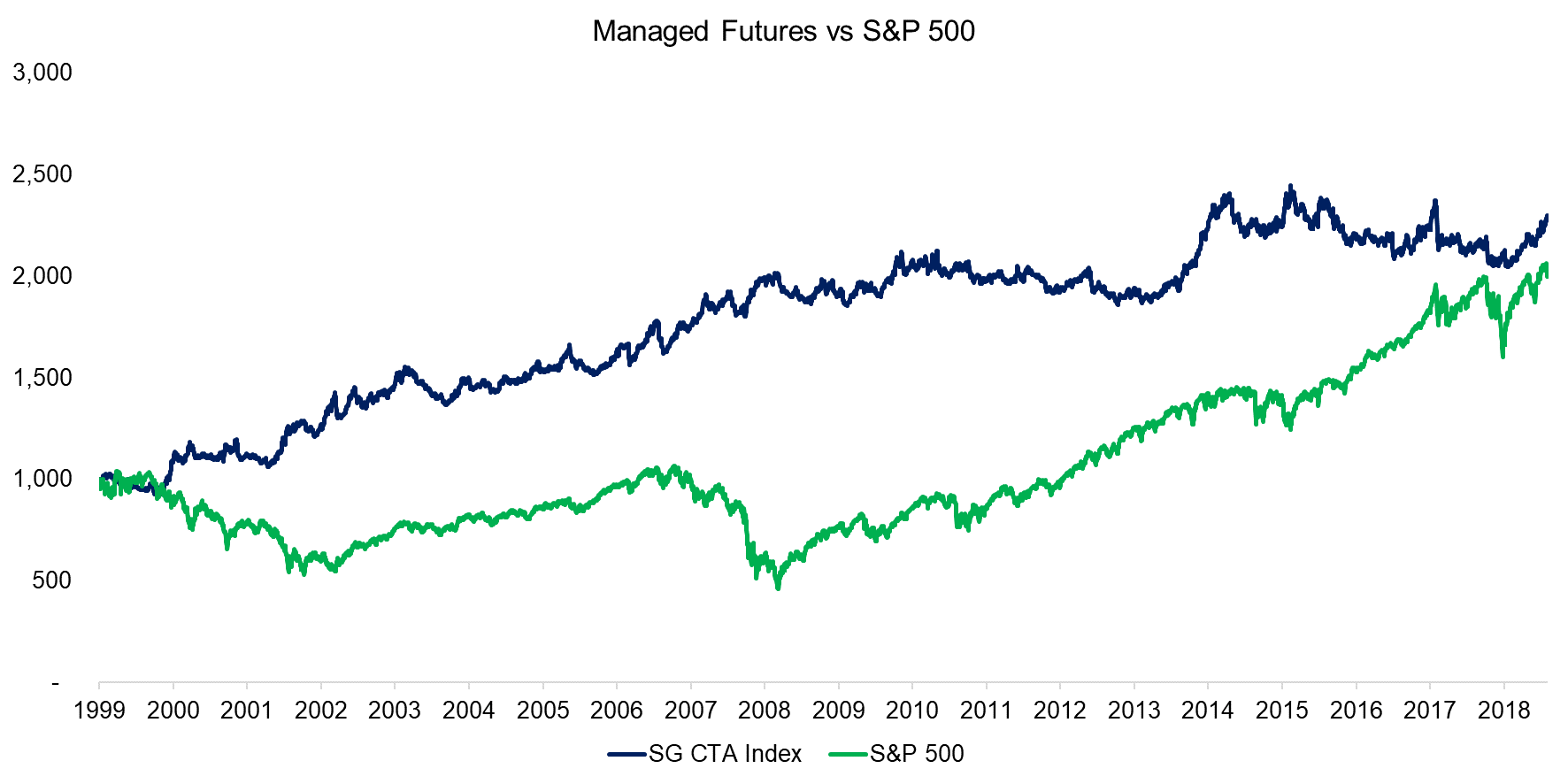

SG’s CTA Index is one of the industry benchmarks and provides daily data for an equal-weighted portfolio of some of the largest managed futures funds. The portfolio is rebalanced annually and currently has 20 constituents. The performance can be characterized as a relatively consistent upward trend from 1999 to 2010 and then flat to downward trending with one strong upward movement in 2014 thereafter.

Comparing the performance of the SG CTA Index to that of the S&P 500 highlights the uniqueness of the strategy as there seems no relationship between both indices. The correlation was -0.1 from 1999 to 2019, which makes managed futures attractive for equity investors from a diversification perspective.

Source: SG, FactorResearch

PORTFOLIO PROTECTION VIA MANAGED FUTURES

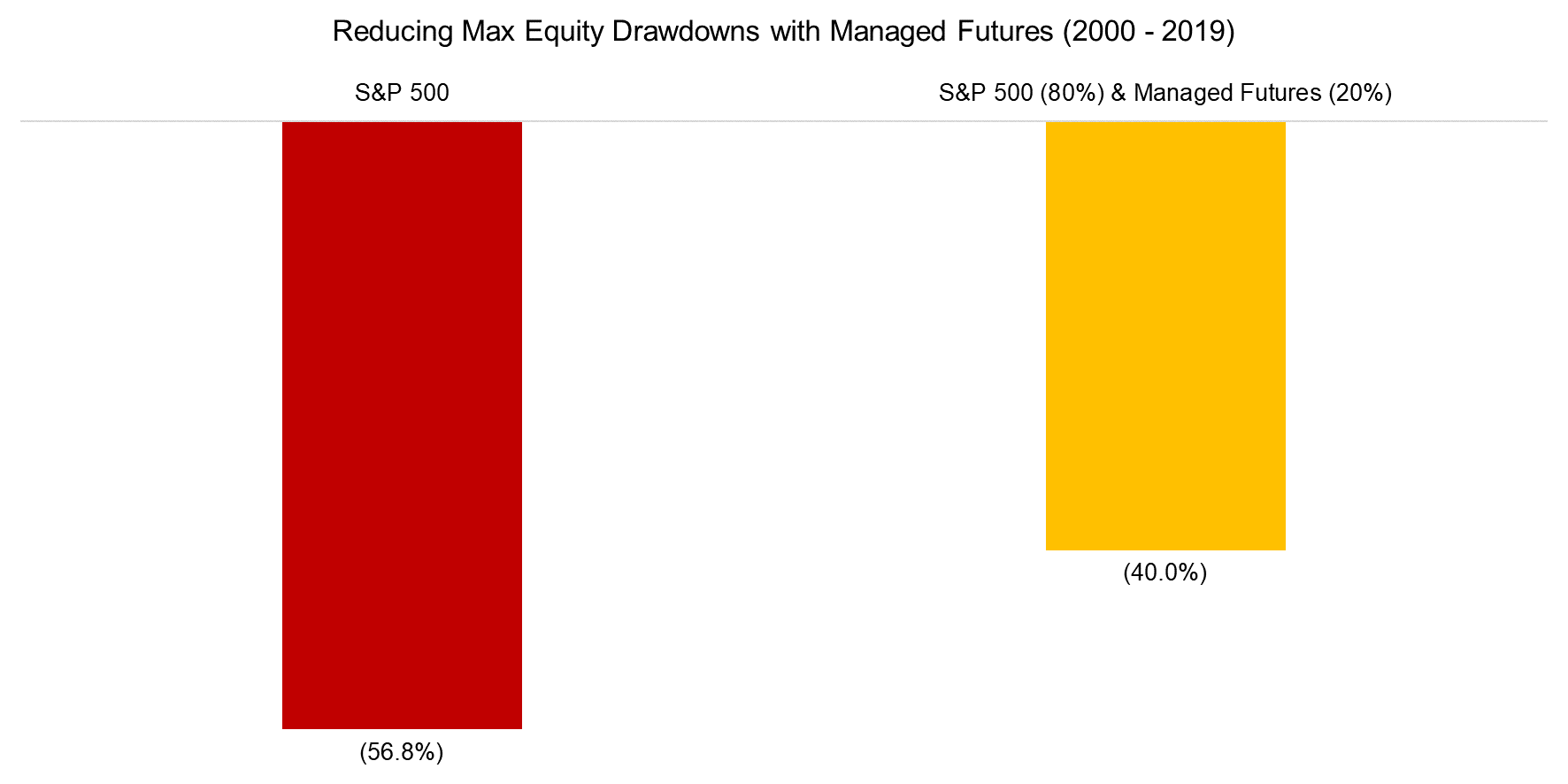

Managed futures strategies became popular after the global financial crisis as they generated positive returns in 2007 and 2008 when stock markets crashed. The S&P 500 had a maximum drawdown of 57% during that period, which would have been reduced to 40% with a 20% allocation to managed futures.

Source: FactorResearch

MANAGED FUTURES MUTUAL FUNDS & ETFS

Given the success of protecting capital during the financial crisis and the demand for these thereafter, managed futures asset managers started offering these strategies as mutual funds and ETFs. Although investors benefit from more accessible vehicles, they should pay close to attention to fees as these range widely. The most expensive managed futures mutual fund currently charges 3.24% per annum, which is even above hedge fund management fees. However, there are a few that charge only performance fees and all ETFs feature fees below 1.0%.

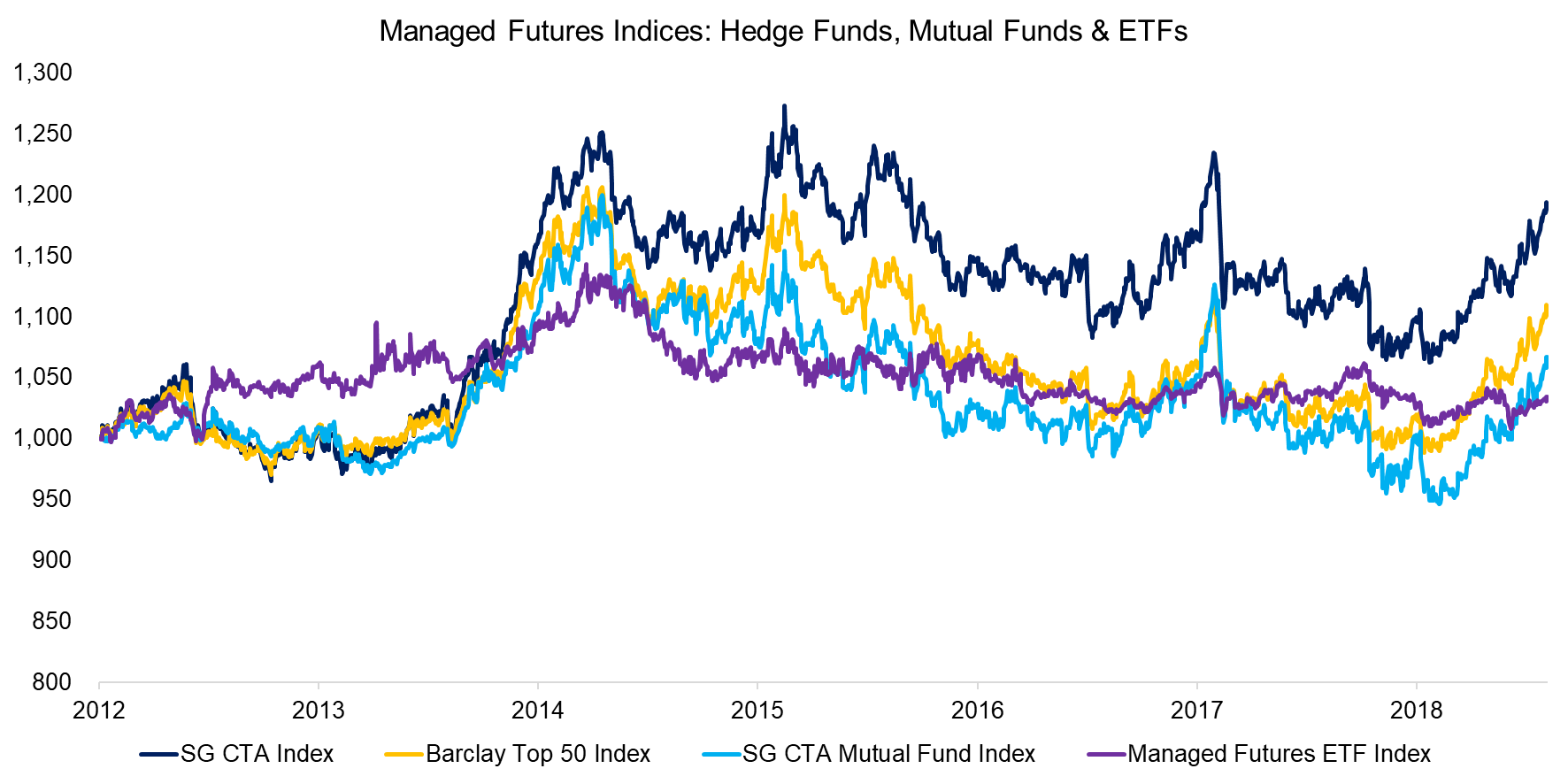

However, it is questionable if the publicly available managed futures funds can offer the returns of their private brethren. We benchmark the mutual funds and ETFs to the SG CTA and Barclay Top 50 indices, which highlights that mutual funds replicated the returns well and essentially provide the same exposure. The performance is slightly lower, but that might be explained by higher fees. The average management fee is 1.66% for the mutual funds, which is more than what the constituents of the SG CTA and Barclay Top 50 indices charge.

Although ETFs are attractive from a fee perspective, they have not been able to replicate the returns of managed futures strategies effectively. It is worth noting that there are currently only five ETFs on the market and two of these were launched in 2019, which is a small universe where one ETF with a differentiated strategy can easily distort the index performance.

Source: FactorResearch

PORTFOLIO PROTECTION VIA MANAGED FUTURES MUTUAL FUNDS

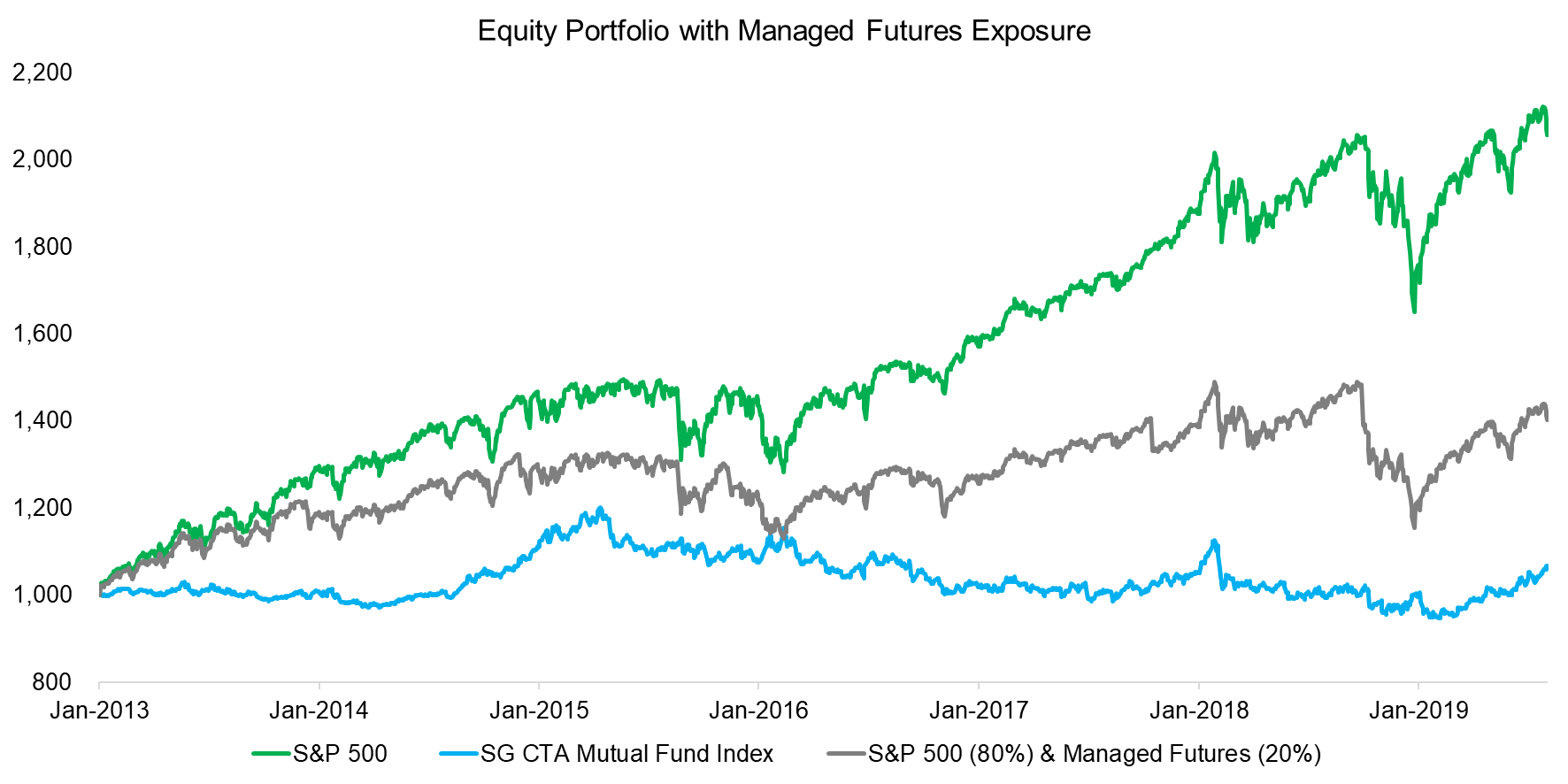

Given the low correlation to equities and availability as mutual funds, it could be argued that managed futures should be a staple in portfolios. Unfortunately the performance since 2013 has been rather flat while the S&P more than doubled in value. Allocating 20% to managed futures with annual rebalancing would have significantly reduced the total return of an equity portfolio, which made the strategy less attractive to investors and explains the lack of growth in assets under management.

Source: SG, FactorResearch

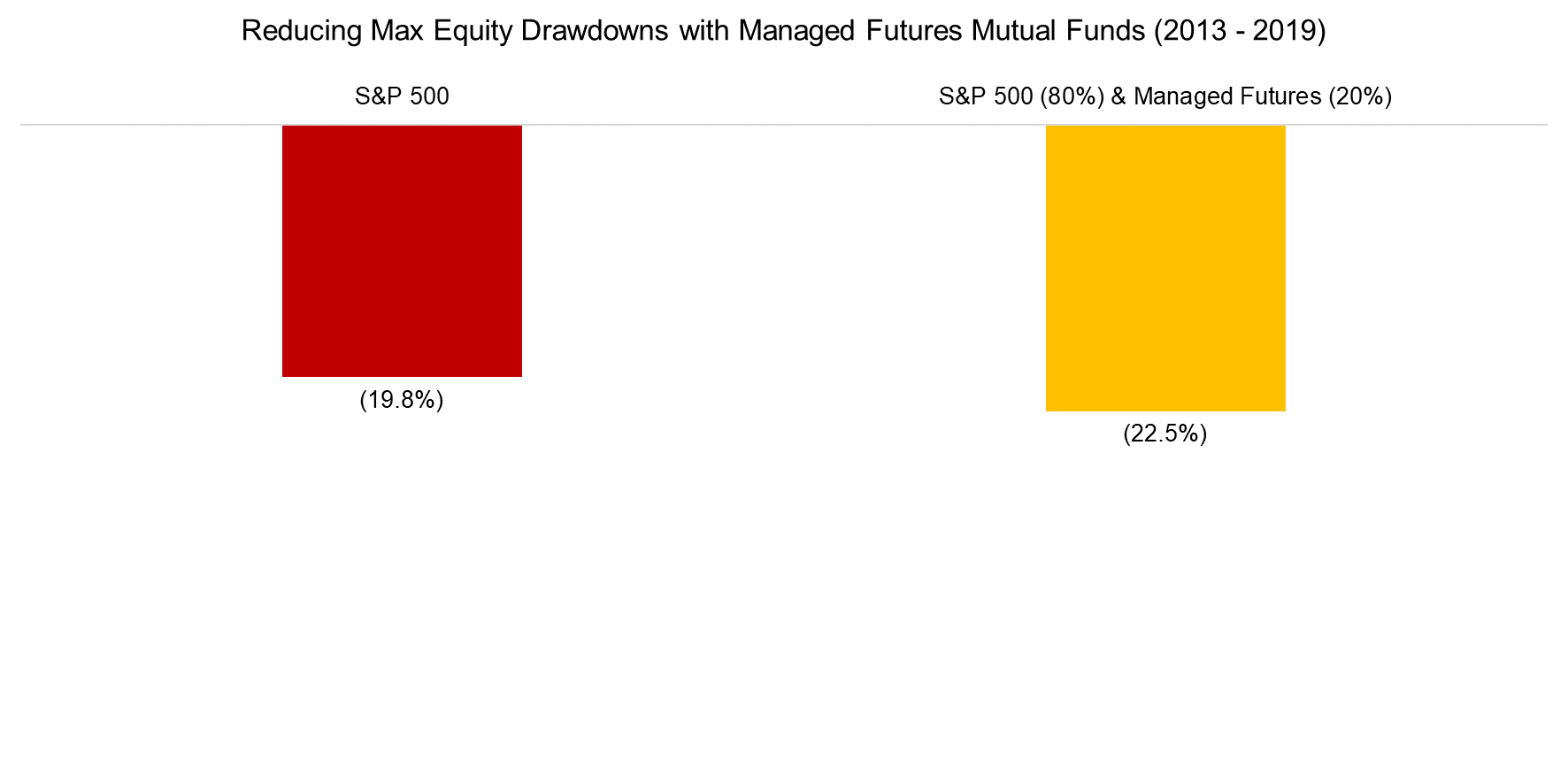

However, investors should argue that the total return is a secondary and risk reduction the primary goal. The largest drawdown since 2012 occurred in December 2018, where the S&P 500 decreased by 20% due to concerns of a global economic slowdown, the trade war between the US and China, as well as anxiety about the Fed’s monetary policies.

Although the correlation of managed futures and stock markets was close to zero during that period, managed futures were simultaneously trending lower and therefore unable to provide the desired diversification benefits.

Source: FactorResearch

FURTHER THOUGHTS

Investors benefit from managed futures strategies being available in more accessible formats, but are likely to be dissatisfied with the performance since the global financial crisis. Many reasons have been provided for the inability of fund managers to capture trends or the lack thereof, but no consensus has been established.

However, some asset managers have extended backtesting results to two centuries to soothe investor concerns. The results show similar stretches of declining and flat returns, which highlights that the last few years were no abnormality.

If there is an abnormality, then it is more likely the US stock market, which exhibited much higher risk-adjusted returns in recent years than over the last century. Investors should not try time an allocation to managed futures or chase performance. Investing in a managed futures strategy should be considered like purchasing car insurance – there is a premium to pay, but you do not want to drive without it.

RELATED RESEARCH

Replicating Famous Hedge Funds

Liquid Alternatives: Alternative Enough?

REFERENCED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.