Higher Volatility, Higher Alpha?

Theoretically, yes, practically, no

SUMMARY

- Intuitively fund managers should create more alpha when volatility is higher

- However, neither mutual nor hedge fund managers have been able to do so

- Likely explained by fund managers being less rational than assumed

INTRODUCTION

“However, a period of higher volatility is ‘a good environment for alpha generation and provides opportunities’.” – Robert Prince, CIO Bridgewater Associates, January 2023

“Above-par volatility regime likely to persist, an optimal equilibrium for hedge funds” – Societe Generale, June 2023

“Following the tightening of monetary policies, we now have a new macro regime characterized by greater volatility – which should also lead to better investing opportunities for hedge funds.” – Goldman Sachs, August 2023

The case for higher alpha at greater market volatility seems obvious – the more volatile markets are, the more irrational investors become. Greed and fear play out in quicker and more extreme cycles, allowing cool-headed fund managers or their machines to make a killing.

However, such nicely laid out theories fail in finance all the time. For example, taking higher risks is not always rewarded with higher returns as the low volatility factor demonstrates, where low-risk stocks outperform high-risk ones, at least on a risk-adjusted basis.

In this research article, we will explore the relationship between alpha and stock market volatility.

MUTUAL FUND ALPHA VERSUS VOLATILITY

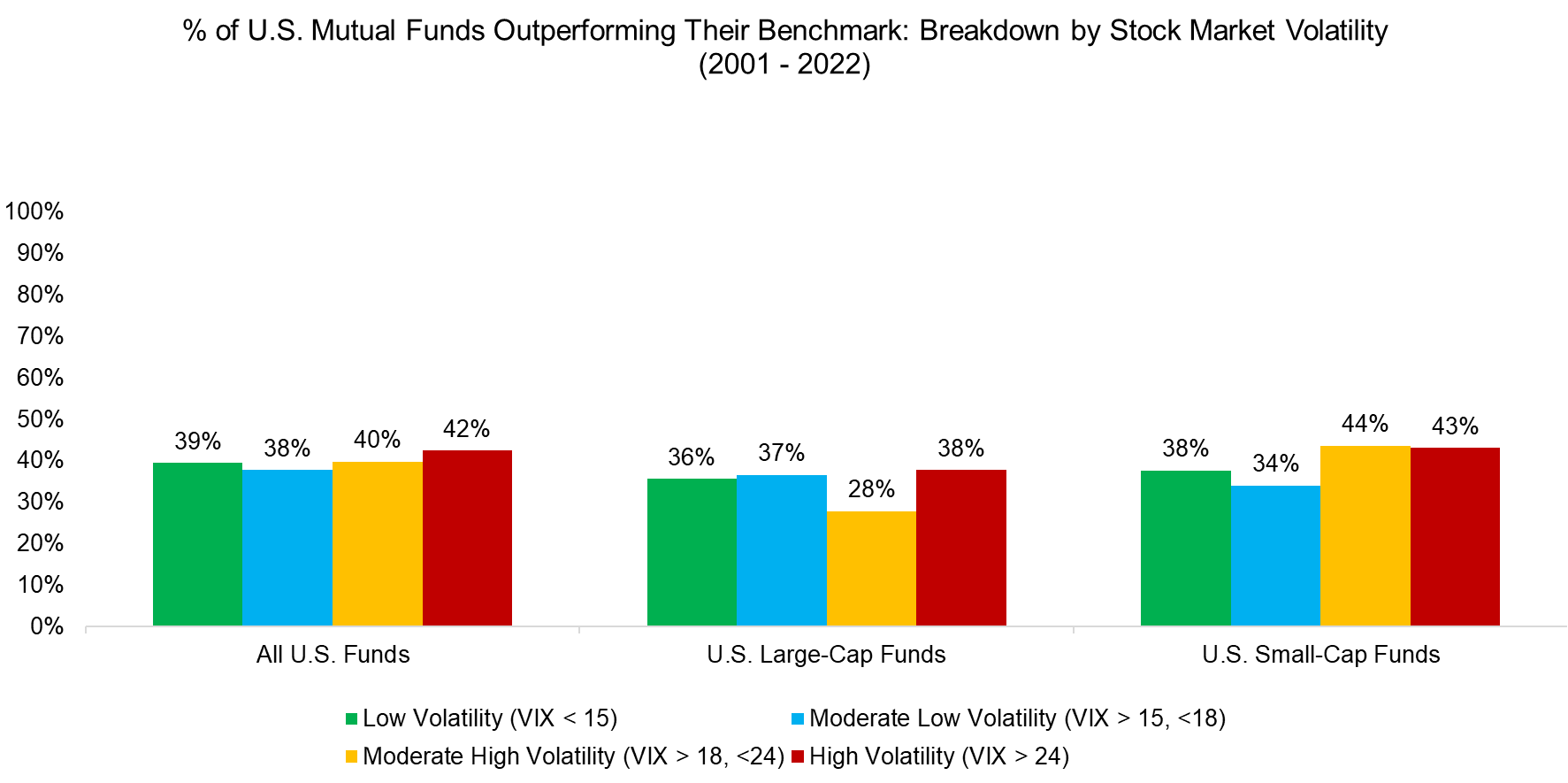

Initially, we focus on the alpha generation of mutual funds where data is sourced from the excellent S&P SPIVA Scorecards. These reports compare mutual funds to their benchmarks and compute the outperformance over various periods ranging from one to twenty years. We select three mutual fund categories, namely all U.S. funds, large and small-caps, and differentiate these by volatility regimes using the VIX index (read Volatility-based Equity Allocations).

Only approximately 40% of all U.S. mutual funds managed to beat their benchmarks in the period from 2001 to 2022, which highlights the challenge of creating alpha. Small-cap fund managers did marginally better than their large-cap brethren, which is expected given that the stocks of the S&P 500 are the most well-covered and researched stocks in the world.

However, more importantly, the outperformance did not vary much across the different volatility regimes. It seems that there are no more opportunities for fund managers to exploit when volatility is high than when it is low and this would support the trend that capital allocators are better off investing in passive index funds.

Source: Finominal

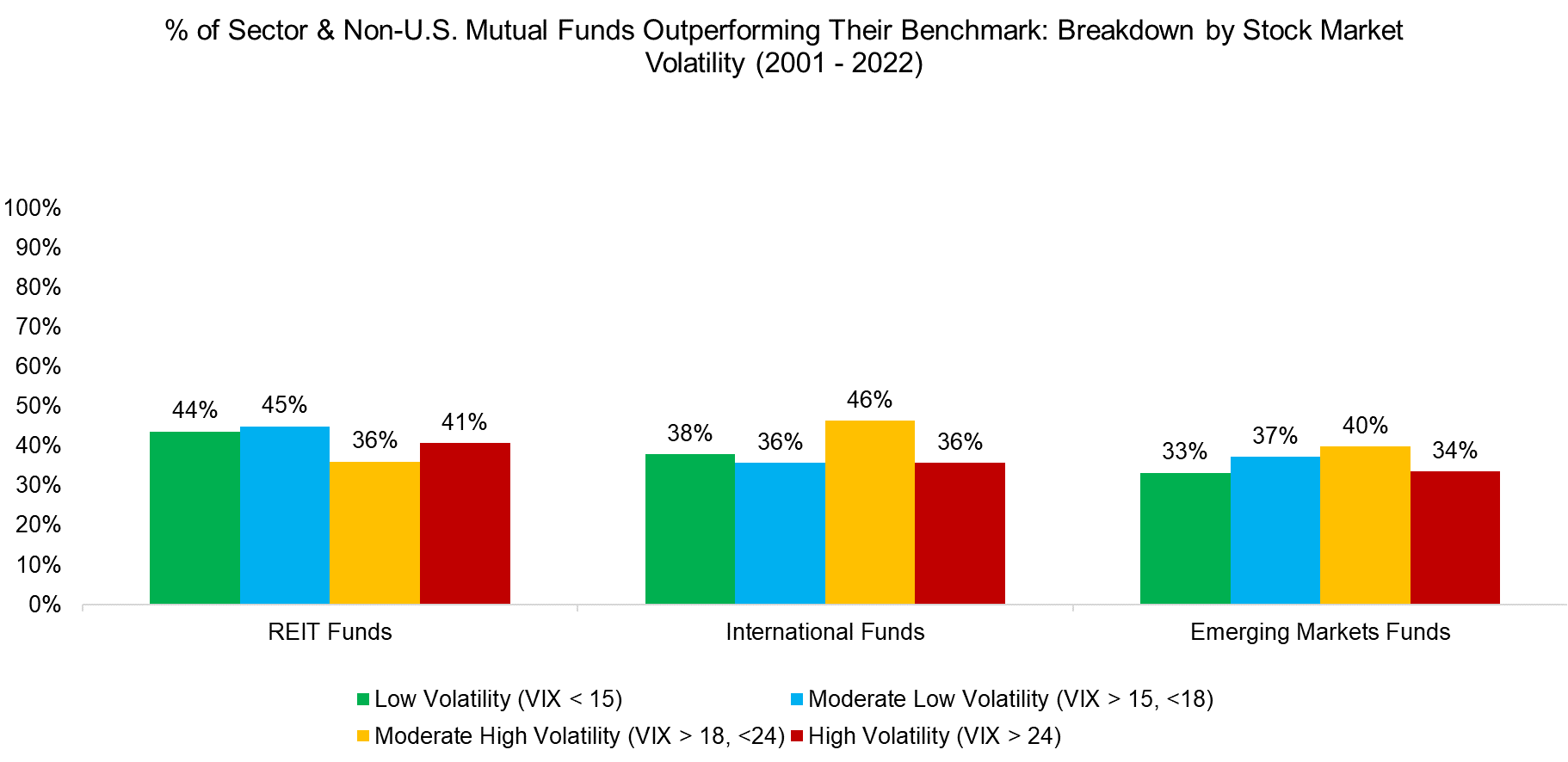

Having said this, perhaps the broad U.S. stock market is efficient, but there might be more opportunities in sectors or international markets. For example, the real estate investment trust (REIT) sector is quite different from the other sectors given that real estate is typically viewed as its own asset class and property investors use unique valuation metrics such as premium / discount to net asset values (NAVs) and funds from operations (FFO).

REIT fund managers should be able to exploit their sector expertise in times of market turmoil and generate alpha for their clients. However, reviewing the number of REIT funds that beat their benchmarks during the different volatility regimes highlights that fewer outperformed when volatility was high. It seems that either there are not more mispricings when markets are more volatile, or REIT fund managers are unable to exploit them for other reasons.

The results for international and emerging markets fund managers are similar, ie neither managed to generate significantly more alpha when stock markets were more volatile over the last 20 years (read Less Efficient Markets = Higher Alpha?).

Source: Finominal

HEDGE FUND ALPHA VERSUS VOLATILITY

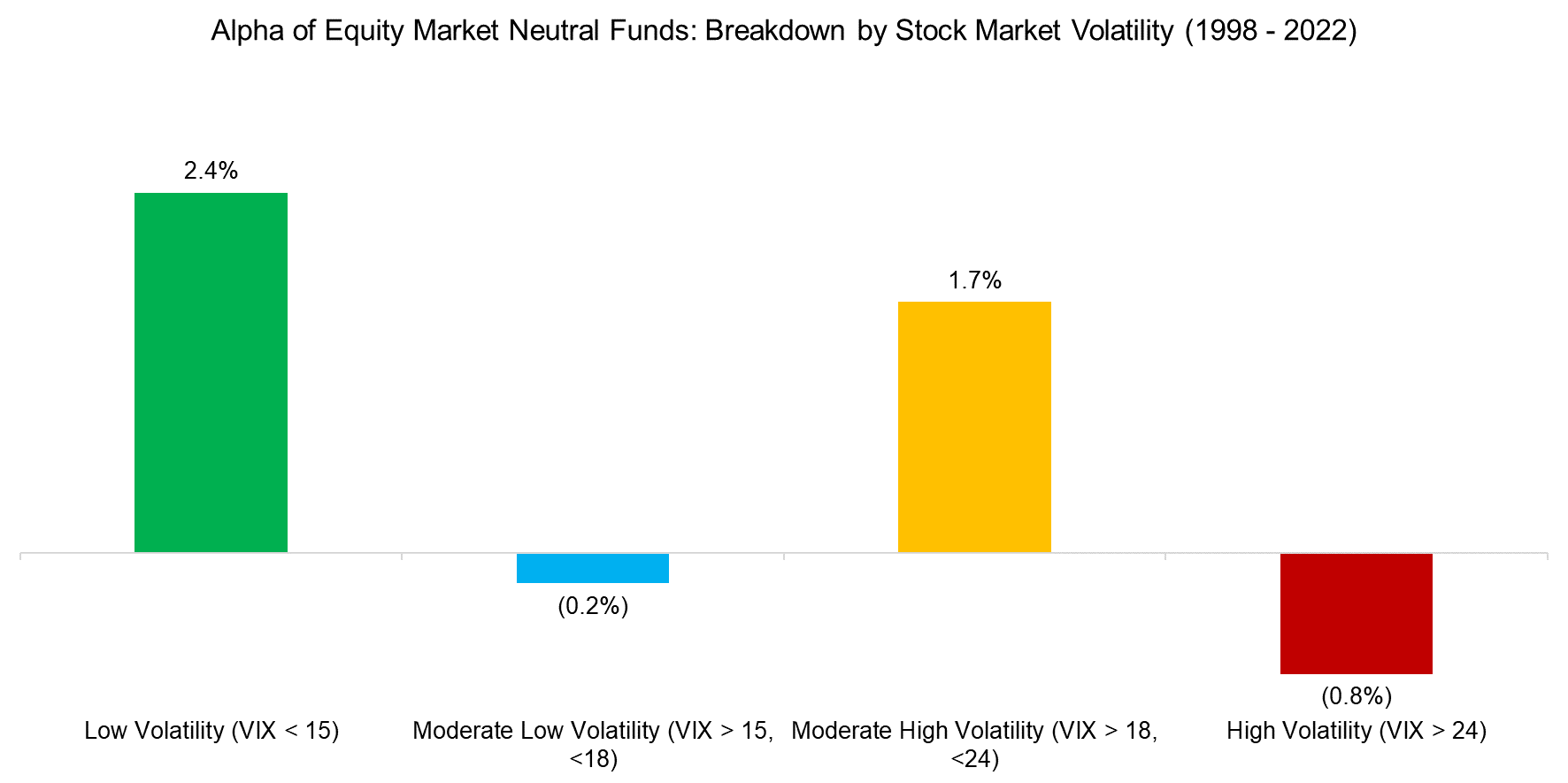

Finally, we look at the alpha generation capability of hedge fund managers, who are likely the most incentivized investment professionals given that their compensation is largely performance-driven. In contrast to private equity funds, there are no return hurdle rates, and strong performance directly results in a higher payout.

We use the Credit Suisse Equity Market Neutral Hedge Fund Index to measure hedge fund alpha as these funds should not have any market exposure. However, it seems that hedge funds generated the highest amount of alpha when the stock market volatility was at its lowest, and the lowest amount of alpha when volatility was at its highest (read Market Neutral Funds: Powered by Beta?).

Source: Finominal

FURTHER THOUGHTS

Retail investors do not have a Bloomberg terminal, do not have access to corporate management, can not speak with equity research analysts, and do not have all day to analyze stocks. So why are professional investors like fund managers unable to exploit this competitive advantage and outperform their benchmarks?

Well, fund managers likely generate alpha, but fees reduce this substantially. Then there are fewer retail investors trading on stock markets than historically, so professional investors are nowadays primarily playing against their peers, which is a much more difficult game to win consistently. Finally, fund managers are less rational than assumed in the finance literature (100-year Argentinian bond anyone?) and likely make the same mistakes as everyone else, especially during times of economic turmoil when their jobs are at risk.

RELATED RESEARCH

Outperformance Ain’t Alpha

Less Efficient Markets = Higher Alpha?

Alpha Generation: Equity Generalists vs Sector Specialists

Market Neutral Funds: Powered by Beta?

Volatility-based Equity Allocations

REFERENCED RESEARCH

SPIVA Scorecards

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.