Hitting Home Runs with AI Investing?

Nope, back to practice.

July 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The survival rate of AI-focused ETFs is low

- The track record of AI ETFs is mediocre

- AI hedge funds struggle to outperform general hedge funds

INTRODUCTION

35% of Y Combinator’s cohort of startups in the first half of 2023 was focused on artificial intelligence (AI), which mirrors the enthusiasm of public market investors that have pushed up the stock prices of anything that involves AI. The market capitalization of NVIDIA, whose computer chips are needed for applying AI, has breached $1 trillion and its P/E multiple is north of 200x.

Using artificial intelligence for investing is an obvious application and many small and large asset management companies boast the claim to do so. We have reviewed the performance of funds using AI in their investment process in 2019, which has been largely disappointing (read AI, What Have You Done for Me Lately?).

However, this was almost four years ago, which can be considered a lifetime in the rapid evolution of technology. Computing power has become cheaper, computer scientists are more skilled and knowledgeable, and software like ChatGPT has emerged.

In this article, we will review the state of AI investing.

AI-FOCUSED ETFS

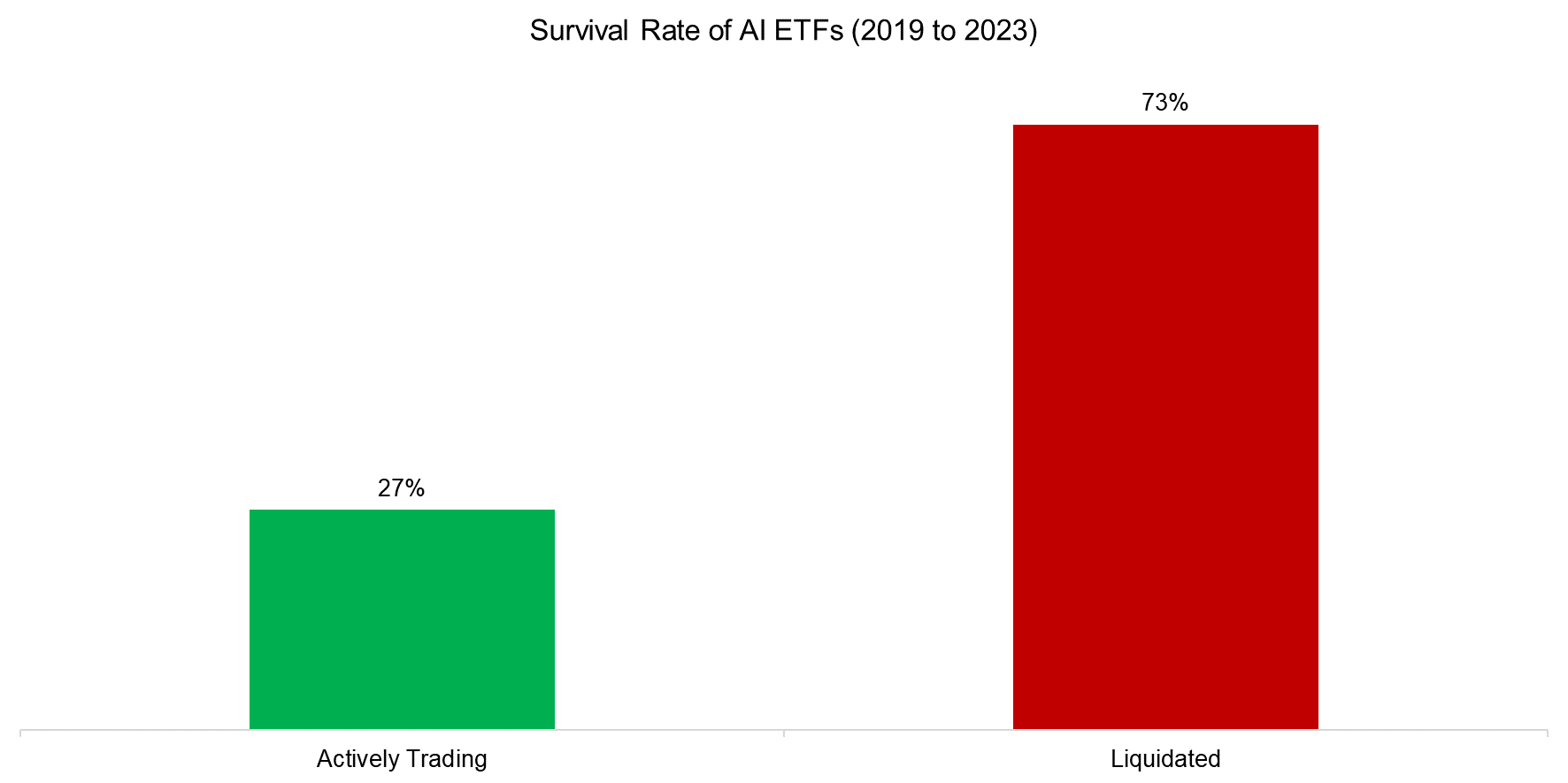

Chen & Ren published a paper on AI-focused mutual funds and ETFs in 2021, which included a list of 15 ETFs using AI in their investment processes. From those 15 ETFs that were trading in the US stock market, only 4 are still trading today while the rest has been liquidated. Although the ETF industry is known for launching and liquidating rapidly, this is not a good indication of the commercial success of AI-focused investment products (read An Anatomy of Thematic Investing).

Source: Finominal

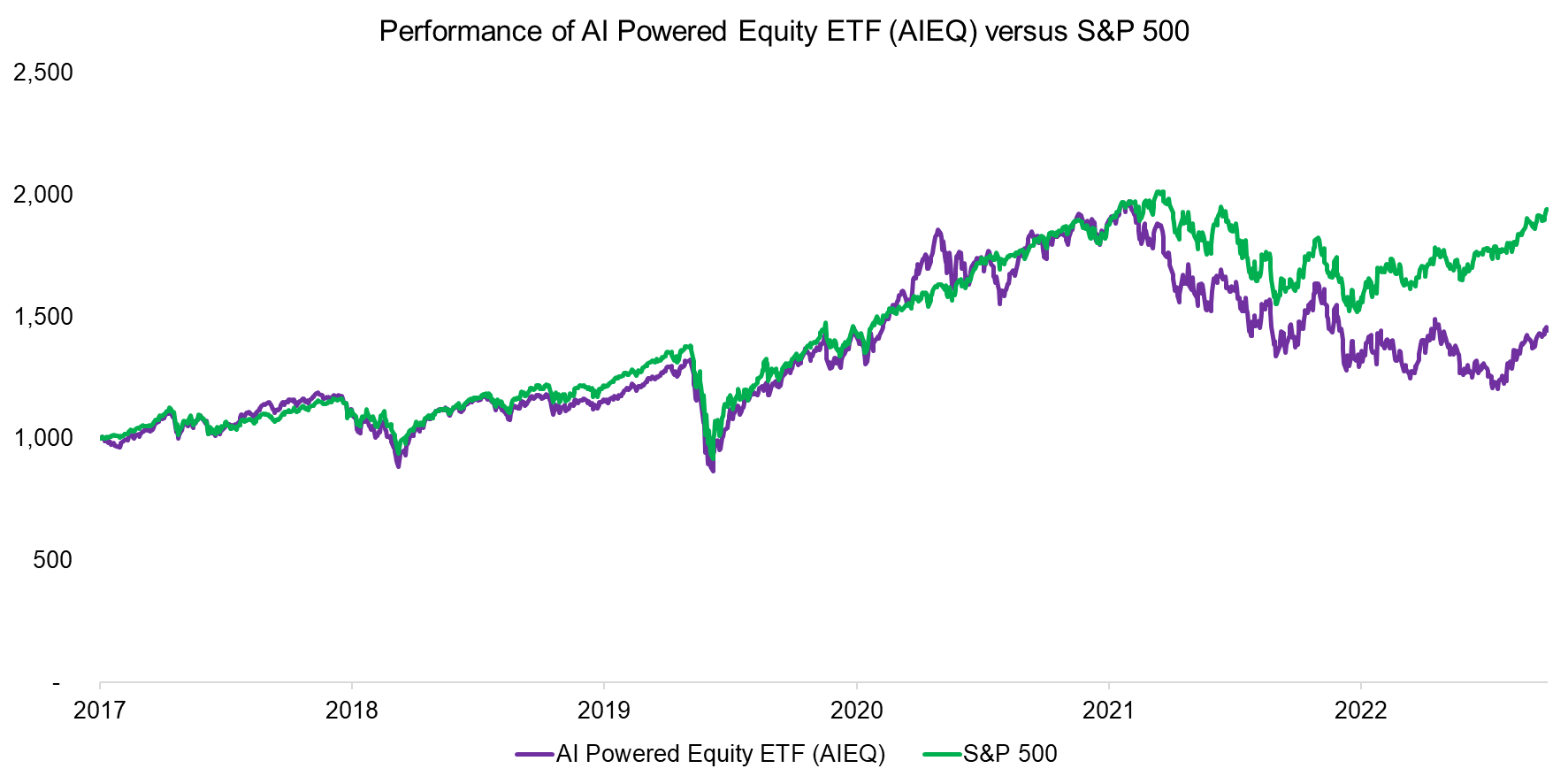

The largest AI-focused ETF trading in the US is WisdomTree’s US AI Enhanced Value Fund (AIVL) with $395 million of assets under management, but this represents a former dividend-focused fund that only changed its focus to AI in 2022. The next largest fund is AI Powered Equity ETF (AIEQ), which is managing $116 million and has reached its four-year track record.

However, AIEQ’s performance compared to its benchmark, namely the S&P 500, is anything but impressive, despite using IBM’s Watson, which equals to a “team of 1,000 research analysts, traders and quants working around the clock” according to the fund manager’s website. In the period between its launch in 2017 and 2021 the ETF basically tracked the benchmark index, and has underperformed substantially since then.

Source: Finominal

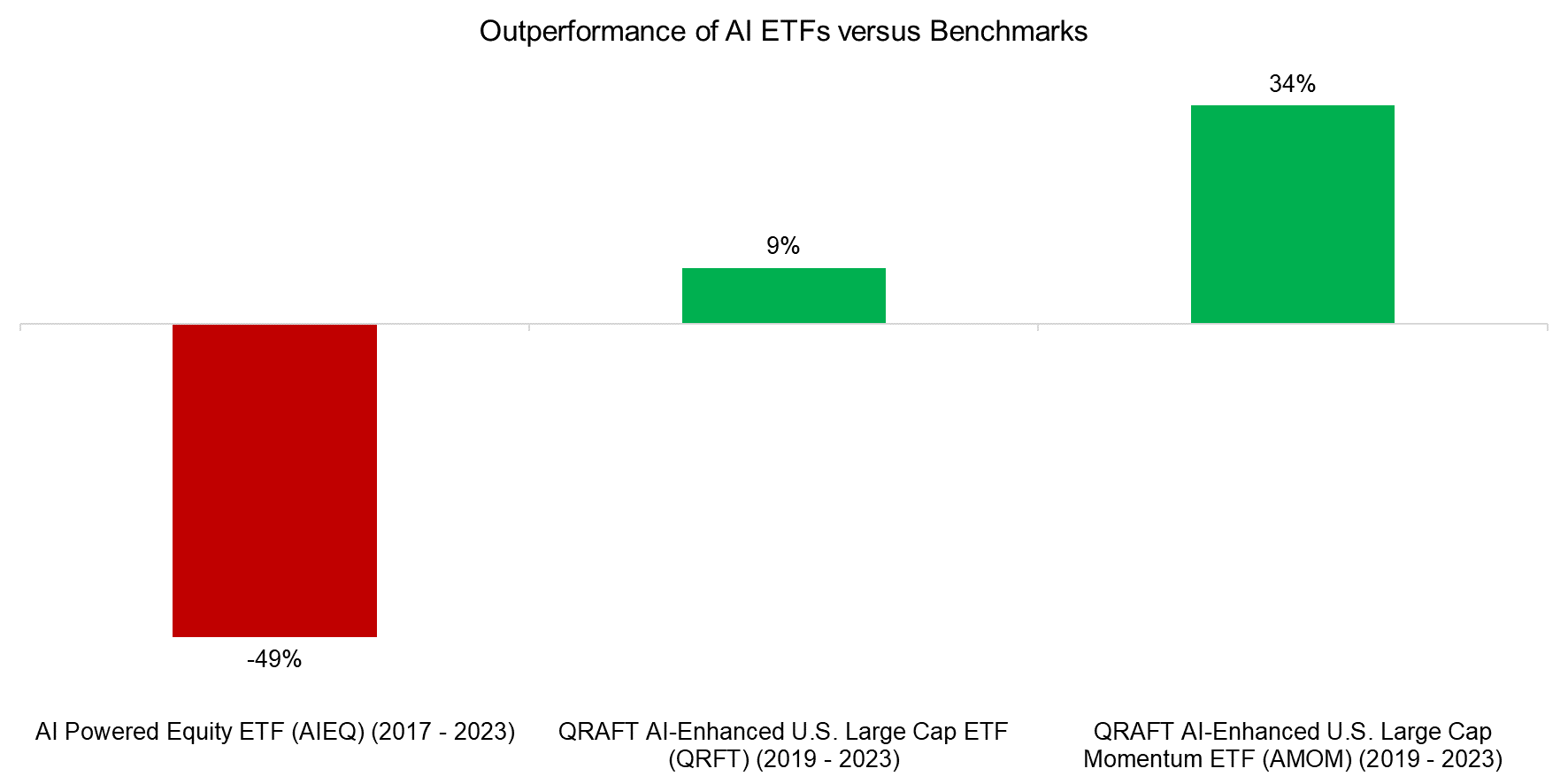

We can expand the performance analysis to other AI ETFs, although most have track records of less than three years, which makes their track records less useful. We observe that two products from Qraft Technologies outperformed their benchmarks since their launches in May 2019.

Source: Finominal

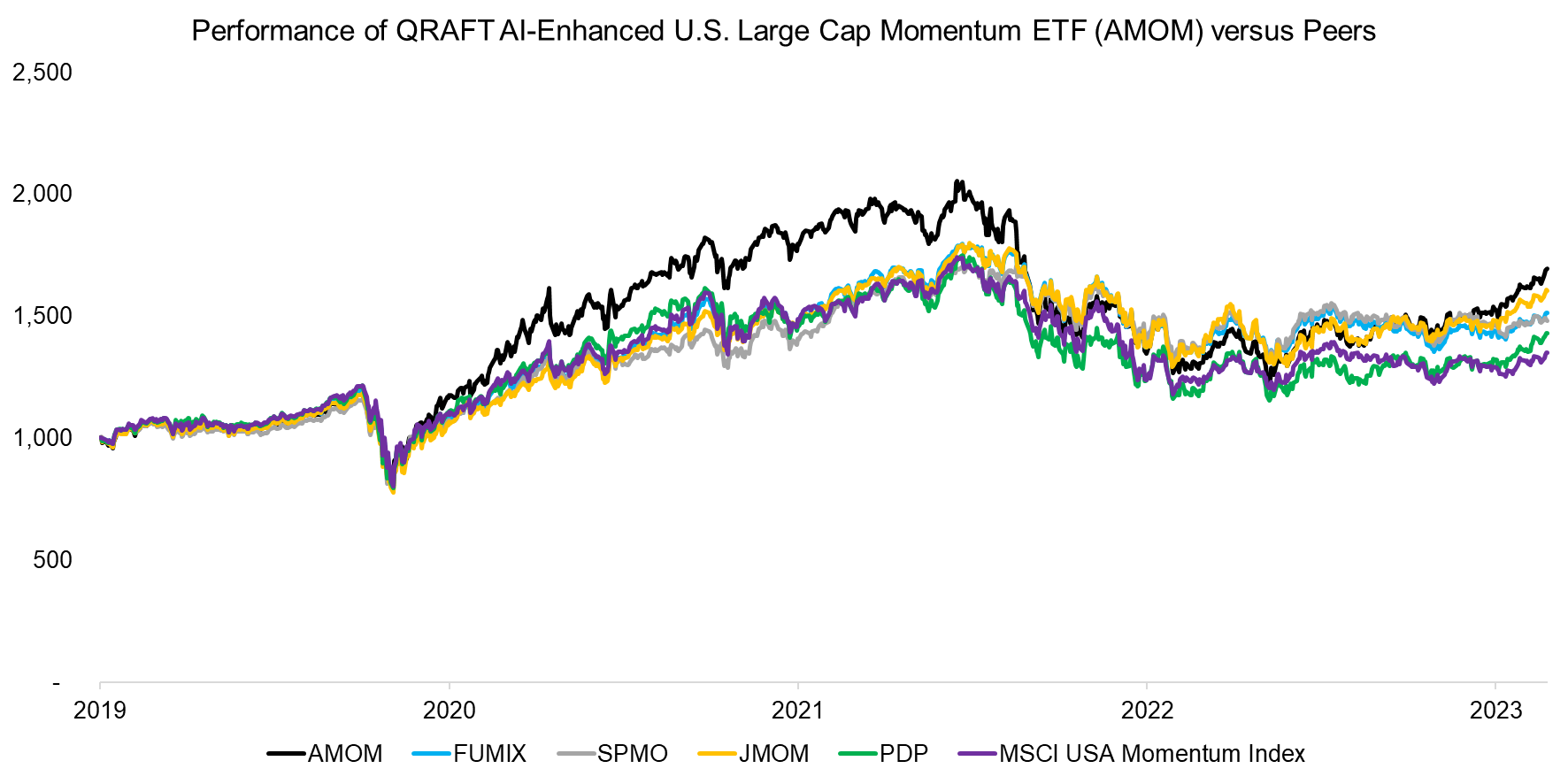

However, the performance of the QRAFT AI-Enhanced U.S. Large Cap Momentum ETF (AMOM) becomes less impressive when compared to its peers. It has generated the largest total return since its launch in May 2019, but the difference to Fidelity’s SAI U.S. Momentum Index Fund (FUMIX) or JPMorgan’s U.S. Momentum Factor ETF (JMOM) is marginal. There is certainly no consistent outperformance that could be expected from a superior stock selection process.

Source: Finominal

AI HEDGE FUNDS

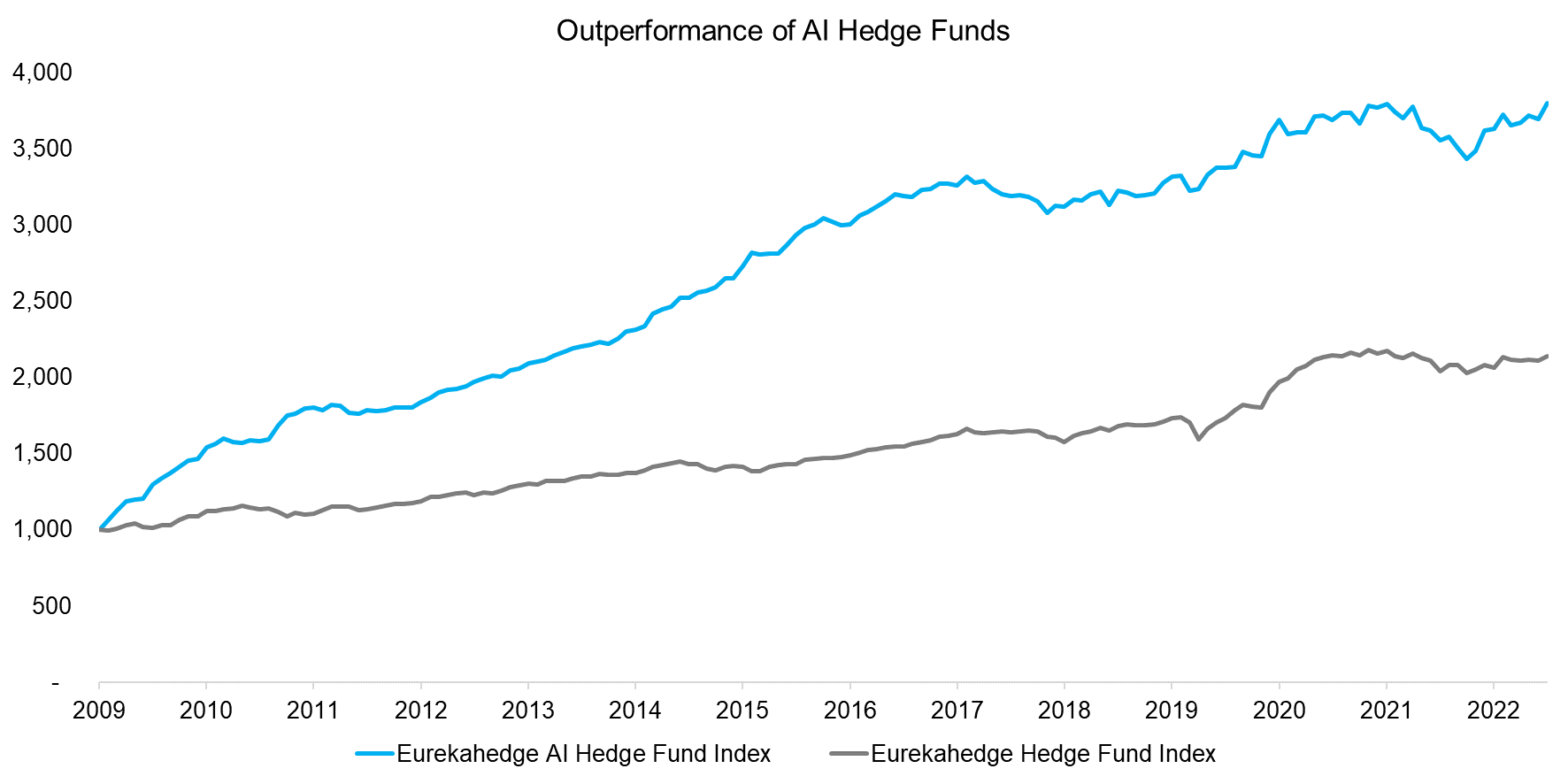

Perhaps AI technology needs to be less constrained than what is possible within an ETF to produce superior investment returns. Eurekahedge offers an index of AI-focused hedge funds that has a track record since 2009. We observe that these hedge funds generated significantly better returns than the average hedge fund.

Source: Finominal

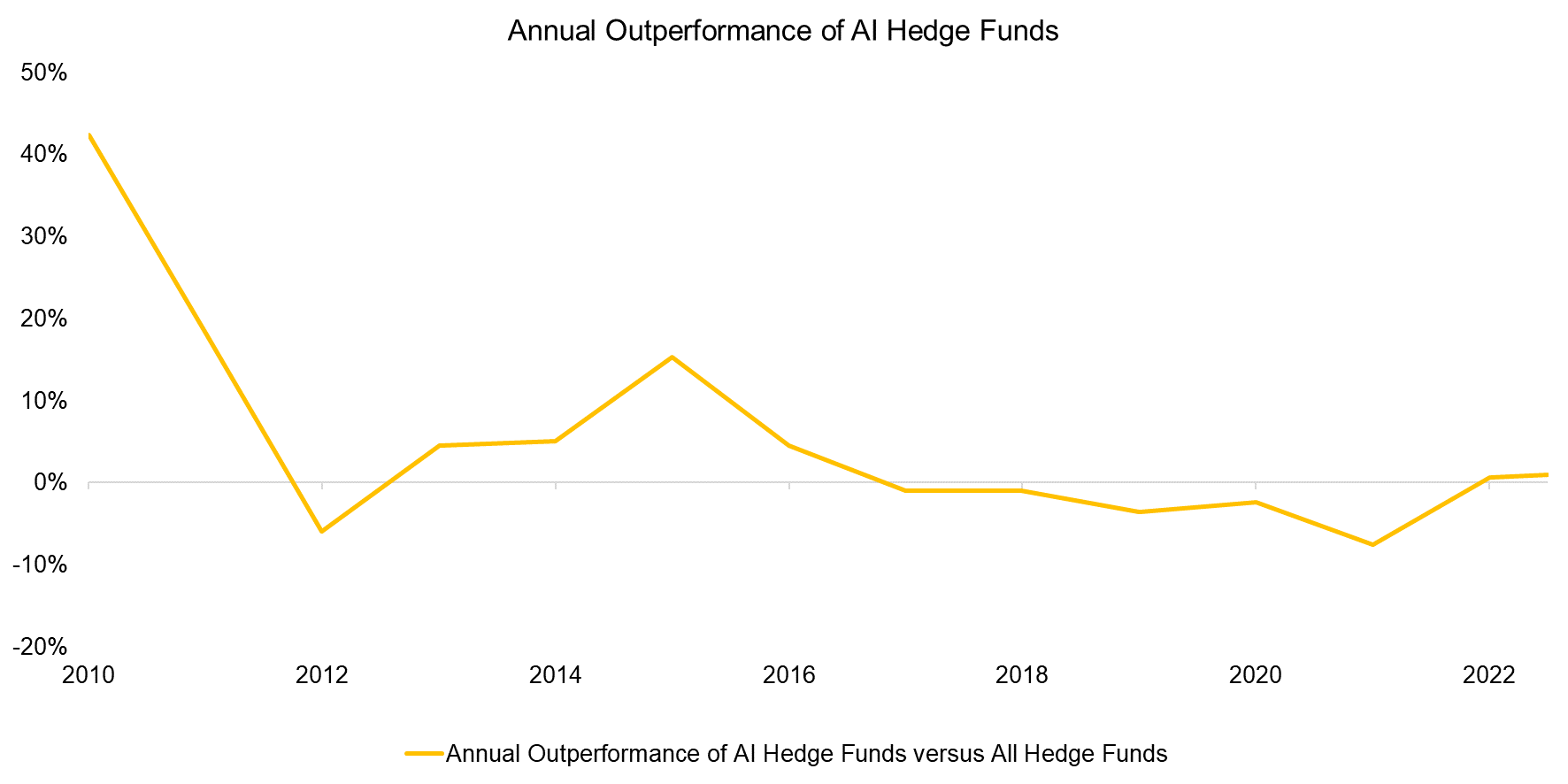

Unfortunately, the outperformance of the Eurekahedge AI Hedge Fund Index can be attributed to a couple of years post the index’s launch, when there was little AI technology available and few if any funds used AI in their investment processes. Eurekahedge allows fund managers to import their past track records, but only managers with good ones ask to the added to their database, which leads the returns to be inflated given survivorship bias.

If we consider the last five or ten years when hedge funds started to experiment and deploy artificial intelligence in security selection and portfolio construction, then the outperformance of the Eurekahedge AI Hedge Fund Index turns into underperformance.

Source: Finominal

FURTHER THOUGHTS

Although almost four years have passed since our initial analysis of AI-driven investing and technology advanced significantly since then, the performance of AI ETFs and hedge funds remains mediocre. Should we expect this to change?

AI can screen large data sets for patterns, digest new data quicker than any human, and work non-stop, which should enable it to generate alpha compared to fund managers that need to eat and sleep. However, financial data is not that large compared to other data sets and financial markets are exceedingly complex systems with lots of interrelated variables.

Furthermore, it is questionable if AI can evaluate changing market conditions soundly, eg low-yielding bonds in 2020 offered poor risk-reward characteristics, but looked great from a data perspective. Given this, the prospects for pure AI investing are unlikely to change, but the opportunity for AI-supported investing is great.

RELATED RESEARCH

Can AI Explain Company Performance?

Smart Money, Crowd Intelligence, and AI

AI, What Have You Done for Me Lately?

An Anatomy of Thematic Investing

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.