How Much Does a VC Need to Make?

Musing about venture capital return assumptions

December 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Venture capital funds are highly sensitive to exit multiples given the skewed ratio of winners vs losers

- The average venture capital fund has achieved the same return as the Nasdaq since 2001

- The growth expectations for startups increase significantly when assuming a market correction like in 2000

INTRODUCTION

The beauty of financial markets is that they continuously surprise, but some years are more extreme than others. In 2017 Argentina issued a 100-year bond that seemed surreal given that the country just emerged from a default a year earlier, and was anything but a credit-worthy model economy. However, compared to the transactions happening in crypto space in 2021, eg an invisible rock JPEG selling for $12,800 or a video game yacht for $650,000, the Argentinian century-bond seems almost like a sensible investment.

Most of these unusual transactions in recent years can be attributed to the low-interest rate regime that made trillions of bonds unattractive and investors looking for greener pastures. The venture capital industry has been one of the key beneficiaries of this theme as it promises high growth of capital in a low-growth world. The assets under management are at record highs, which is mirrored in the number of unicorns startups that breached 800 in 2021. The more money available to a venture capitalist, the more can be invested, the higher the valuation, the better the returns, and the flywheel spins. Until it breaks (read Venture Capital: Worth Venturing Into?).

In this research note, we will muse about the return assumptions of venture capital funds.

SEED-STAGE VENTURE CAPITAL FUNDS

The venture capital industry has, like all industries, its own terminology that evolves over time. The funds that invest in early-stage startups are also called seed funds and portfolios tend to be quite diverse. Some companies have found product-market-fit and are generating revenues, while others are still at the concept stage. The valuation for this type of startup has increased considerably in recent years, in line with the amounts of money they are raising, for what often is still an experimental business.

The traditional perspective is that out of ten investments, six will go bankrupt with all invested capital lost, three will break even but not generate any returns, and only one will be a winner. There is little reason to believe that this distribution has changed in recent years as the global economy is brutally competitive. Finding initial customers is difficult, creating a profitable business harder, and achieving consistently high profit margins very rare.

However, for a company that has created a product or service that its customers love, it has become quicker than ever to hit one million or even one billion in revenues given global distribution via the internet.

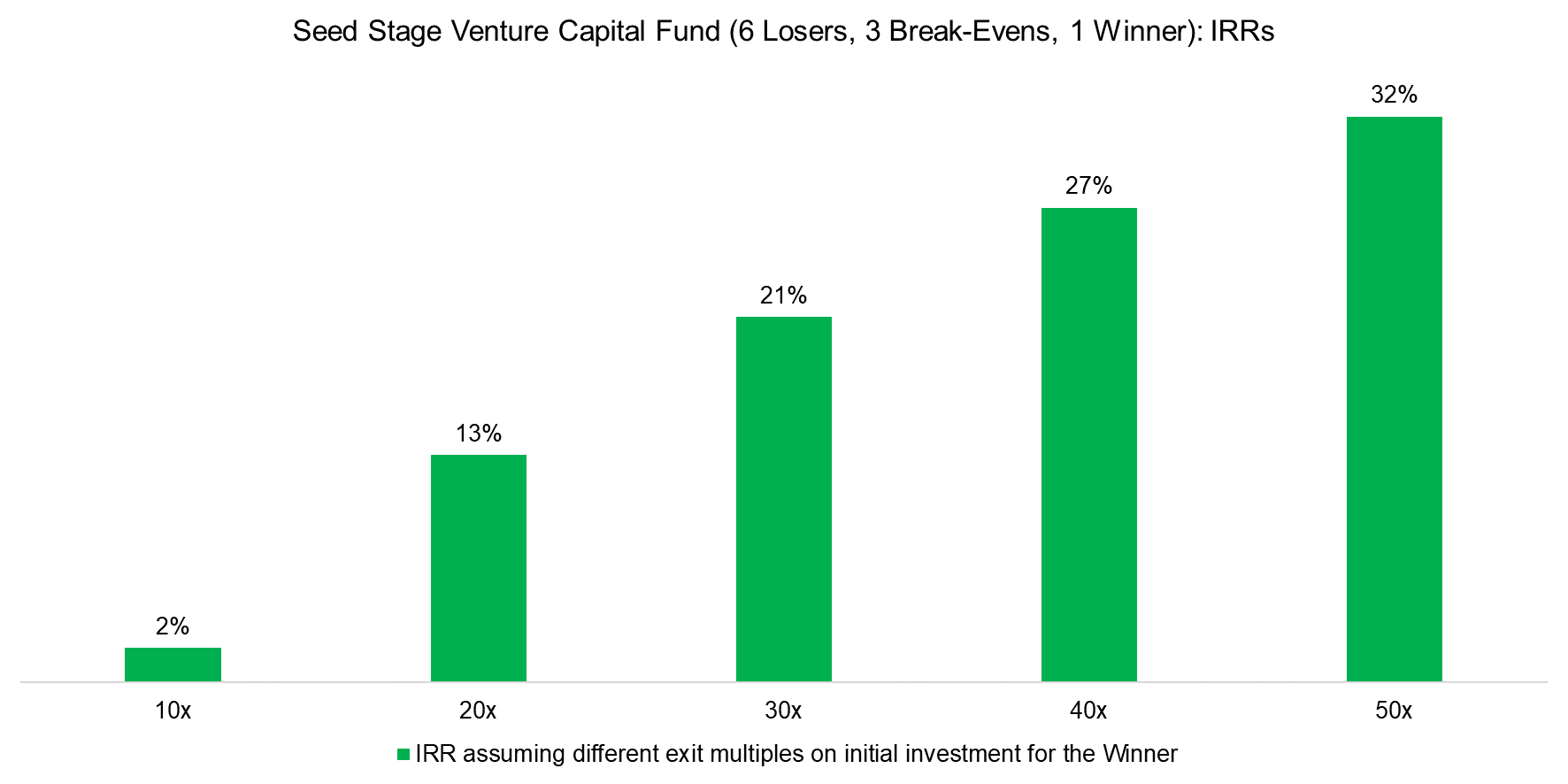

But it all depends on having such a winner in the portfolio. We can simulate the IRRs of a seed-stage venture capital fund by taking the traditional return perspective that assumes only one winner and vary the exit multiple on the initial investment. We assume a five-year fund term, 1.5% management fee, and 20% performance fee.

Such a scenario analysis highlights that the exit multiple has to be at least 30x for achieving a 20% IRR, which is probably too low given the risks of such early-stage venture capital funds. IRRs are only becoming attractive when hitting a 40x or 50x exit multiple.

Source: FactorResearch

SERIES B&C VENTURE CAPITAL FUNDS

A capital allocator might regard seed-stage venture capital as too risky as it mostly depends on one company achieving hyper-growth. We all know them – Airbnb, Uber, Coinbase, etc – however, there is no easy recipe for identifying them across market cycles.

Instead, an investor can choose to allocate capital to venture funds that invest at later stages that are labeled B or C series. At this stage, the startups have matured and offer a few quarters or years of financial operating history. It might not be profitable, but there is product-market-fit and revenue is being generated.

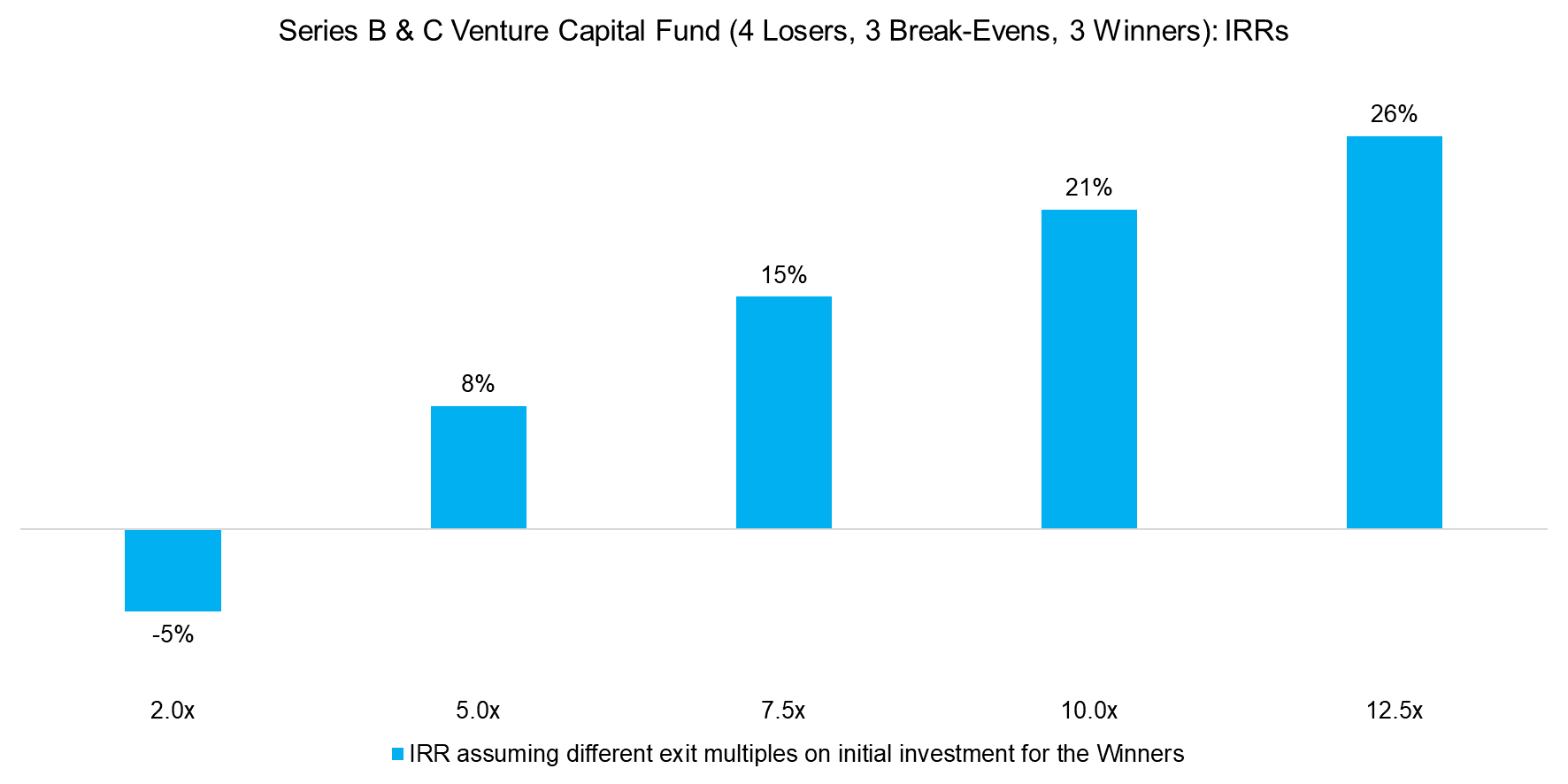

The probability of these startups going into bankruptcy has decreased compared to seed-stage ones, but it is still high. We repeat our IRR scenario analysis and assume that out of ten investments in a series B & C venture capital fund, four go broke, three break even, and three are winners.

However, we also need to assume lower exit multiples on the initial investment as these startups are less risky. A capital allocator is unlikely to settle for anything below a 20% IRR, which requires at least a 10x exit multiple on the three winners. Below that, returns are not particularly attractive.

Source: FactorResearch

LATE-STAGE VENTURE CAPITAL FUNDS

A capital allocator can further decrease the investment risk by focusing on late-stage venture capital, which typically focus on startups that are about to conduct an initial public offering. At this stage, the companies are relatively sophisticated organizations and they offer plenty of financial data to be analyzed. The likelihood of going bankrupt has reduced significantly but is not zero. IPOs fail all the time and companies run out of funding, especially during market downturns.

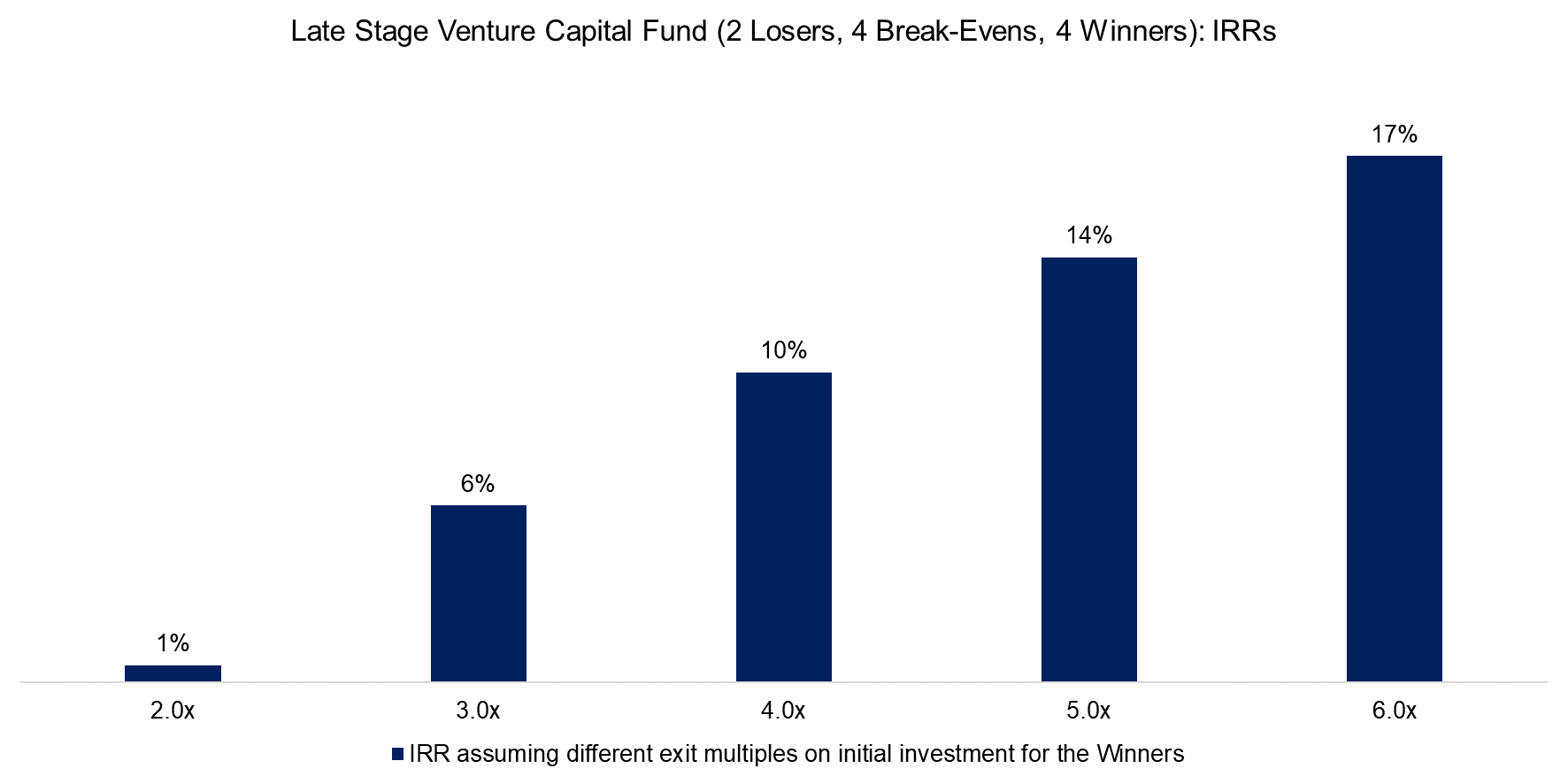

We assume that out of a late-stage venture capital portfolio consisting of ten companies, two will go broke, four will break even, and four will be winners. As outlined previously, the exit multiple on the initial investment continues to decrease as startups mature.

It is interesting that even a 5x exit multiple on the four winners would only produce a mid-teens IRR, which is comparable to the returns of private equity funds or the S&P 500, and probably too low given that venture capital is still riskier.

Source: FactorResearch

VENTURE CAPITAL RETURNS VS PUBLIC EQUITIES

Although venture capital has become more popular in recent years, it is questionable if that is based on animal spirits rather than rational investment decision-making.

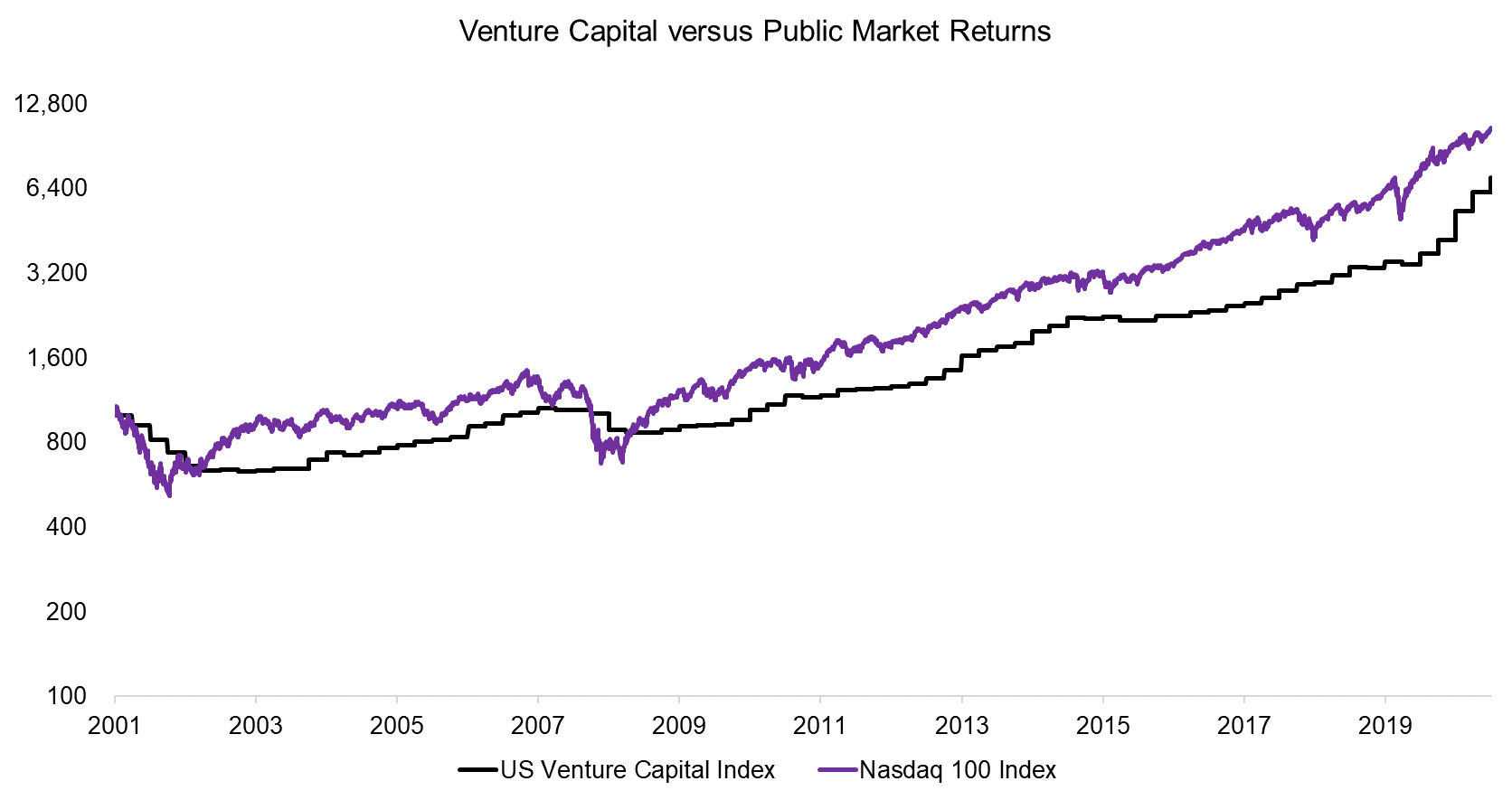

The average venture capital generates the same performance as the technology-focused Nasdaq index, but the former requires to lock up capital for years and pay high management and performance fees, while the latter is available as a product with daily liquidity at essentially zero cost.

Source: FactorResearch. The US Venture Capital Index is created using private market return data from Cambridge Associates.

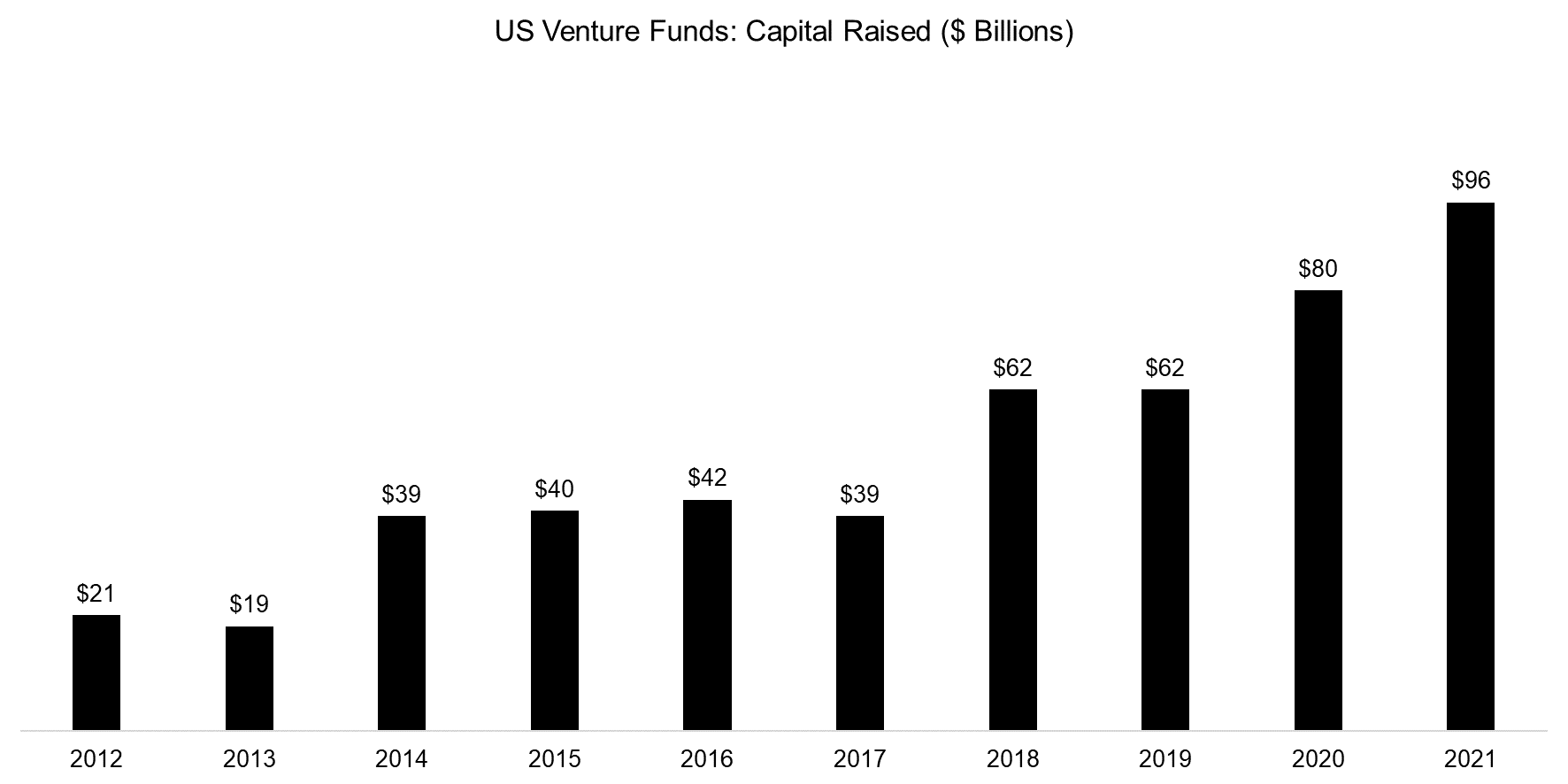

The mediocre returns of the venture capital industry are especially concerning when observing the significant increase in assets under management since the last decade. US venture capital funds have raised almost $100 billion in the first three quarters of 2021, which is a record amount.

Source: PitchBook, FactorResearch

TECH BUBBLE IMPLOSION

It is interesting to contemplate if there is a need for more capital in the venture capital industry, or if it will simply diminish the expected returns of the asset class given higher valuations. Although startups can evolve more quickly into large multi-national organizations given better technology and distribution possibilities today, it is questionable if the overall profit pool of the global economy has increased.

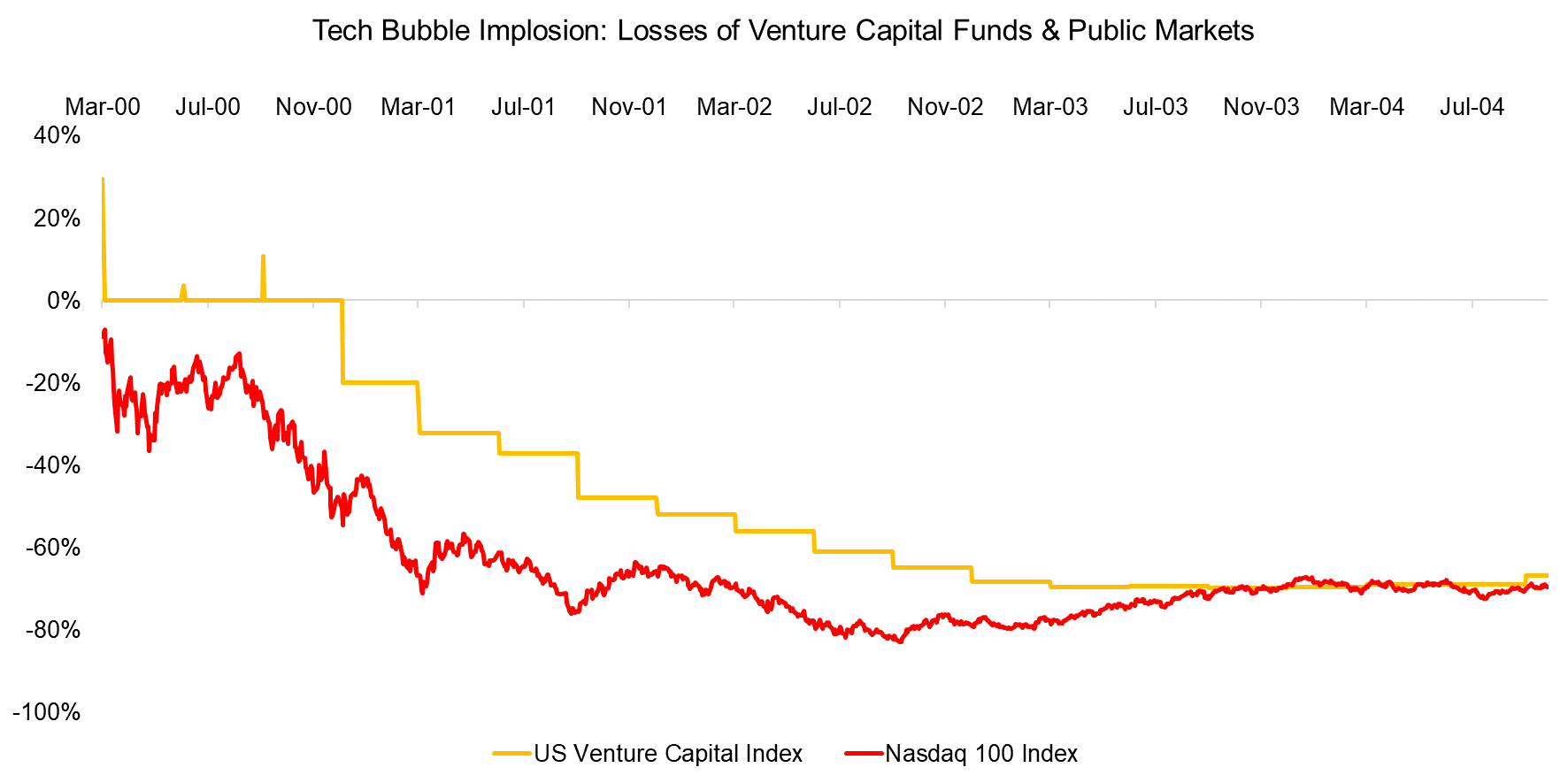

However, even if the returns of venture capital funds will remain attractive despite more assets under management, the industry will still experience busts and booms like all asset classes. It is worth recalling that the implosion of the technology bubble generated a 70% loss for the average venture capital fund, similar to the drawdown of the Nasdaq.

Source: FactorResearch

FURTHER THOUGHTS

It is difficult not comparing the status quo to the boom in technology stocks in 2000. Excessive valuations show in private as well as public markets, eg the electric car maker Rivian Automotive is trading at a $100 billion market capitalization, despite having generated zero sales (read How Crowded are Tech Stocks?).

Given the magnitude of exuberance, the next downward cycle is likely to be severe. Central banks and governments have increasingly been trying to support asset prices, but that will not work in perpetuity.

It is interesting to contemplate how to structure a venture capital portfolio to preserve and even grow capital in a downward cycle. A venture capitalist has to assume significantly lower valuation multiples in the year of the exit, eg instead of a 10x sales multiple for SAAS startups currently, the market would only pay a 5x sales multiple in year 5. However, the exit multiple on the invested capital can not change, eg should be greater than 40x for the winner of a seed-stage venture fund, as that is required to make the IRR of the fund attractive. Essentially, this means finding startups with even higher growth rates than currently required in order to compensate for the multiple compression. Instead of shooting for the moon, the VC needs to aim for the stars.

RELATED RESEARCH

Portfolio Construction in Venture Capital

Venture Capital: Worth Venturing Into?

ABOUT THE AUTHOR

Nicolas Rabener is the Founder of Finominal, which empowers investors with data and technology to analyze and improve their portfolios. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (100km Ultramarathon).