How Risky Are Value Stocks?

Challenging Value as a risk premium strategy

August 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The Value factor is often explained as representing a risk premium or a behavioral bias

- However, financial analysts regard cheap stocks as less risky than expensive ones

- Data shows that expensive stocks were riskier than cheap ones, which challenges the risk premium theory

INTRODUCTION

Which of the following two portfolios comprised of US stocks would you consider riskier?

- Portfolio A: Amazon, Autodesk, Qualcomm, Advanced Micro Devices, and Netflix

- Portfolio B: Prudential Financial, AIG, Molson Coors, HP, and Bank of New York

The first portfolio contains mainly technology stocks and might be considered more future-oriented, compared to the second portfolio that is heavy on financials and is somewhat representative of the old economy (sorry HP!).

Would you change your view on the riskiness of these two portfolios, if you knew that portfolio A has a median price-to-book multiple of 28.9x and price-to-earnings multiple of 123.0x, compared to 0.6x and 8.8x for portfolio B, respectively?

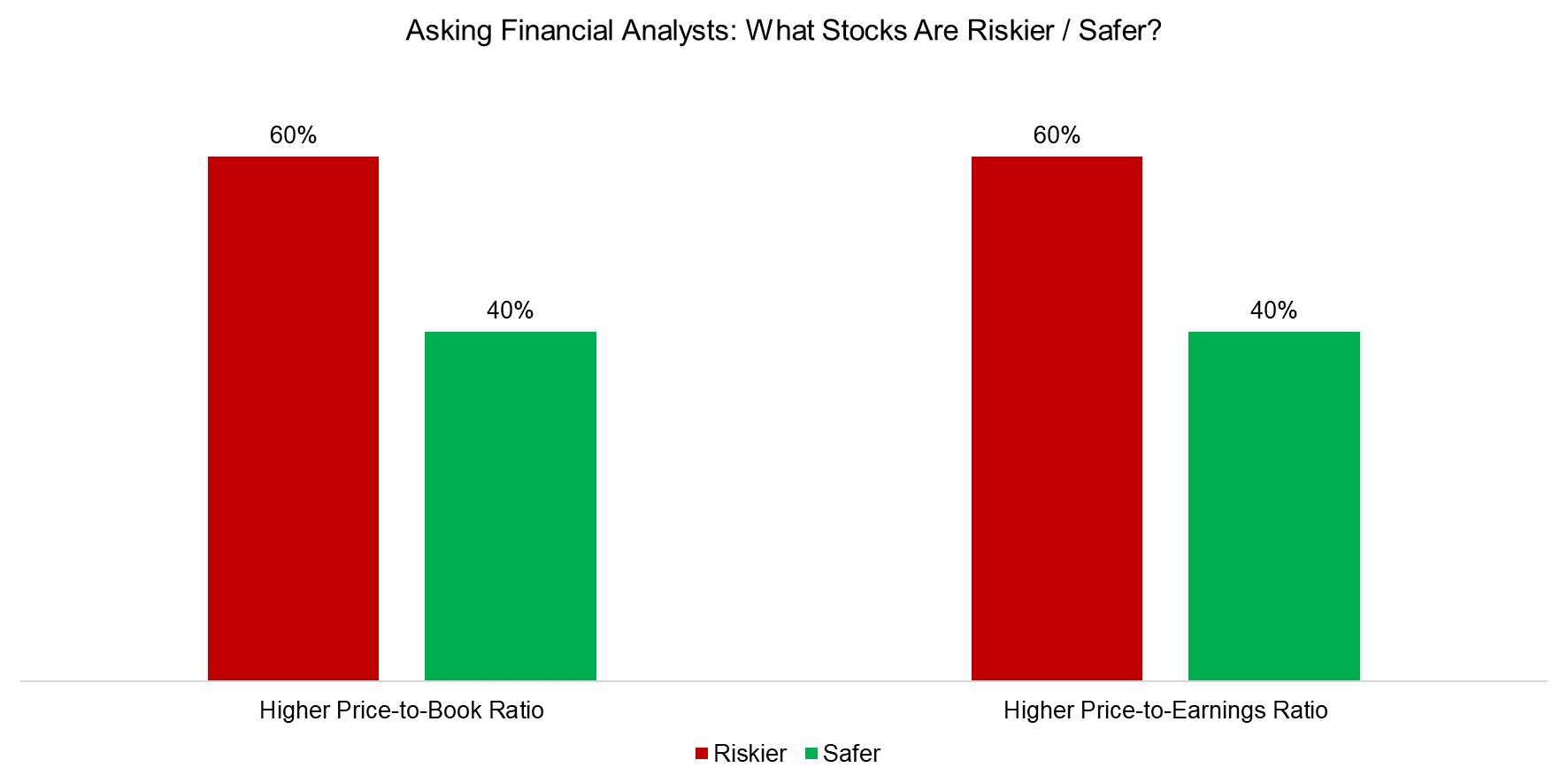

Joachim Klement, a London-based investment strategist, recently highlighted a research paper from Merkle and Sextroh that shows that financial analysts consider cheap stocks less risky than expensive ones, i.e. portfolio B over portfolio A. However, that poses a conflict with academic literature, where the excess returns from Value are frequently explained by the factor representing a risk premium. If Value stocks are less risky, how can it be a risk premium strategy?

Source: Merkle & Sextroh, FactorResearch

Cheap stocks are essentially companies in trouble, otherwise, they would not be trading at cheap valuations. These businesses might have a poor executive management team, lack a sound corporate strategy, experience declining sales and earnings, or have too much leverage on their balance sheets, all of which lead to increased bankruptcy risk. Often it is a combination of these issues, which results in poor share price performance and a consensus “Sell” rating by brokers. Holding these stocks is extremely unpleasant and emotionally challenging.

There are two widely accepted ideas in academia explaining why the Value premium exists. On the behavioral side, there is an extrapolation in expectations. Since cheap companies have been performing poorly, this pattern is expected (incorrectly) to continue (read Mapping My Mind: Value Factor).

On the other hand, the rational markets advocates argue that cheap stocks are risker companies. Given this, it is somewhat counterintuitive for financial analysts to consider cheaper stocks safer than expensive ones.

In this short research note, we will explore the riskiness of Value stocks.

CHEAP STOCKS OUTPERFORM EXPENSIVE ONES

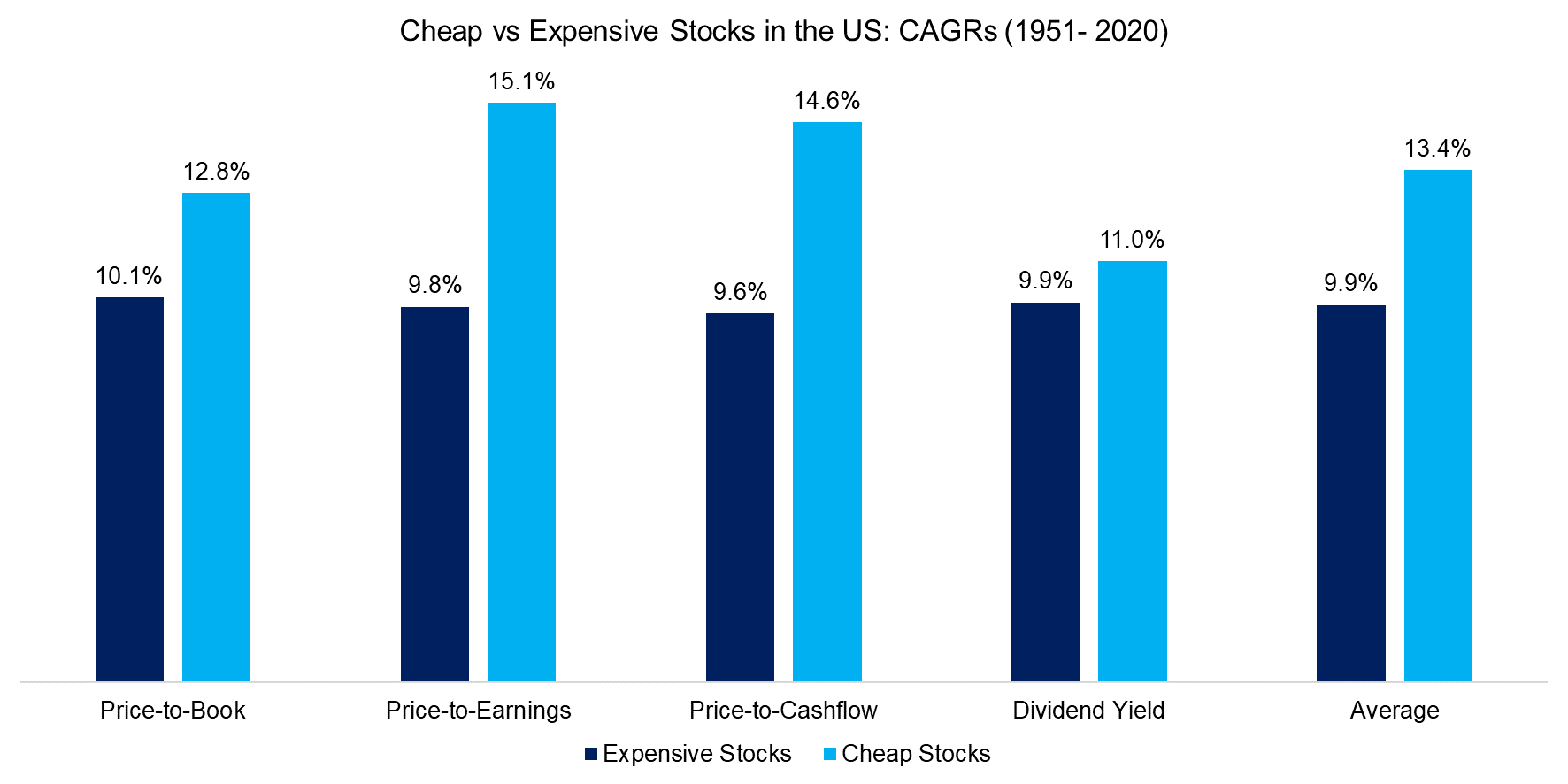

In this analysis, we use cap-weighted factor returns from the Kenneth R. French data library and focus on the top and bottom 10% of stocks in the US stock market ranked by price-to-book, price-to-earnings, price-to-cashflow, and dividend yield. Data is available since 1951 for all four metrics, so provides an approximately 70-year observation period (read Value Factor – Comparing Valuation Metrics).

Before we analyze the riskiness of cheap stocks, we will review their performance. We observe that cheap stocks substantially outperformed expensive ones on all four metrics over time, which highlights the foundation and enthusiasm for Value investing.

Unfortunately, this outperformance is not consistent and includes significant periods of underperformance, e.g. the most recent decade between 2010 and 2020 where the Value factor generated mostly negative excess returns. Detractors of Value investing would go to the extreme of proposing that the Value premium seen in the data was associated with a set of economic and financial conditions that no longer apply and therefore we should not expect the Value premium to return.

Source: Kenneth R. French Data Library, FactorResearch

HOW RISKY ARE VALUE STOCKS?

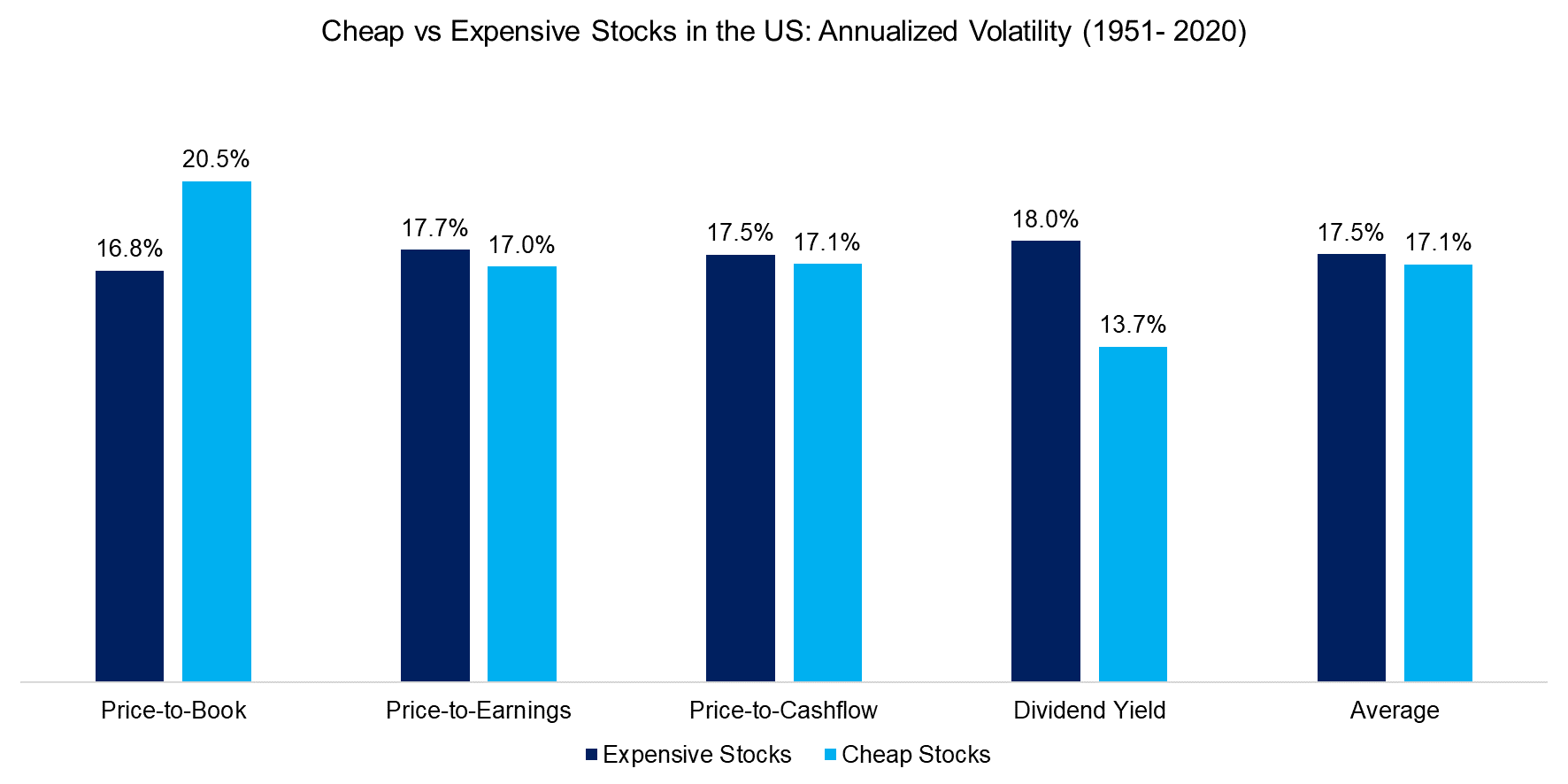

Given that cheap stocks represent troubled businesses, these should fail more often and be riskier, which should reflect in higher stock volatility. However, somewhat surprisingly, cheap stocks were less volatile on average than expensive ones over the period from 1951 to 2020.

The counterintuitive result is likely explained by looking at the extreme ends of the US stock market. In one corner, we have the cheapest stocks that are trading at very low valuations, which are only reached after an extended period of consistently negative newsflow, sentiment, and expectations. Wounds may be self-inflicted or inescapable due to belonging to an industry that is slowly but steadily decaying. Consider shopping center REITs that are being destroyed by the trend of online shopping, or think of 1990s companies that completely missed the chance to adapt to new technologies (anyone remembers Borders in the US?). The stock prices of these firms already reflect a large amount of bad news and the remaining investors holding those stocks are not easily shocked.

In the other corner, we have the most exciting and glitzy businesses of the US economy, which are trading at nose-bleeding high valuations. However, glamour stocks, like glamourous stars in Hollywood, often crash and burn when sentiment turns against them. There are plenty of examples, but the fall of the internet stocks in 2000 is a good case study as they declined rapidly and aggressively when investors realized most businesses had very little substance to them.

Source: Kenneth R. French Data Library, FactorResearch

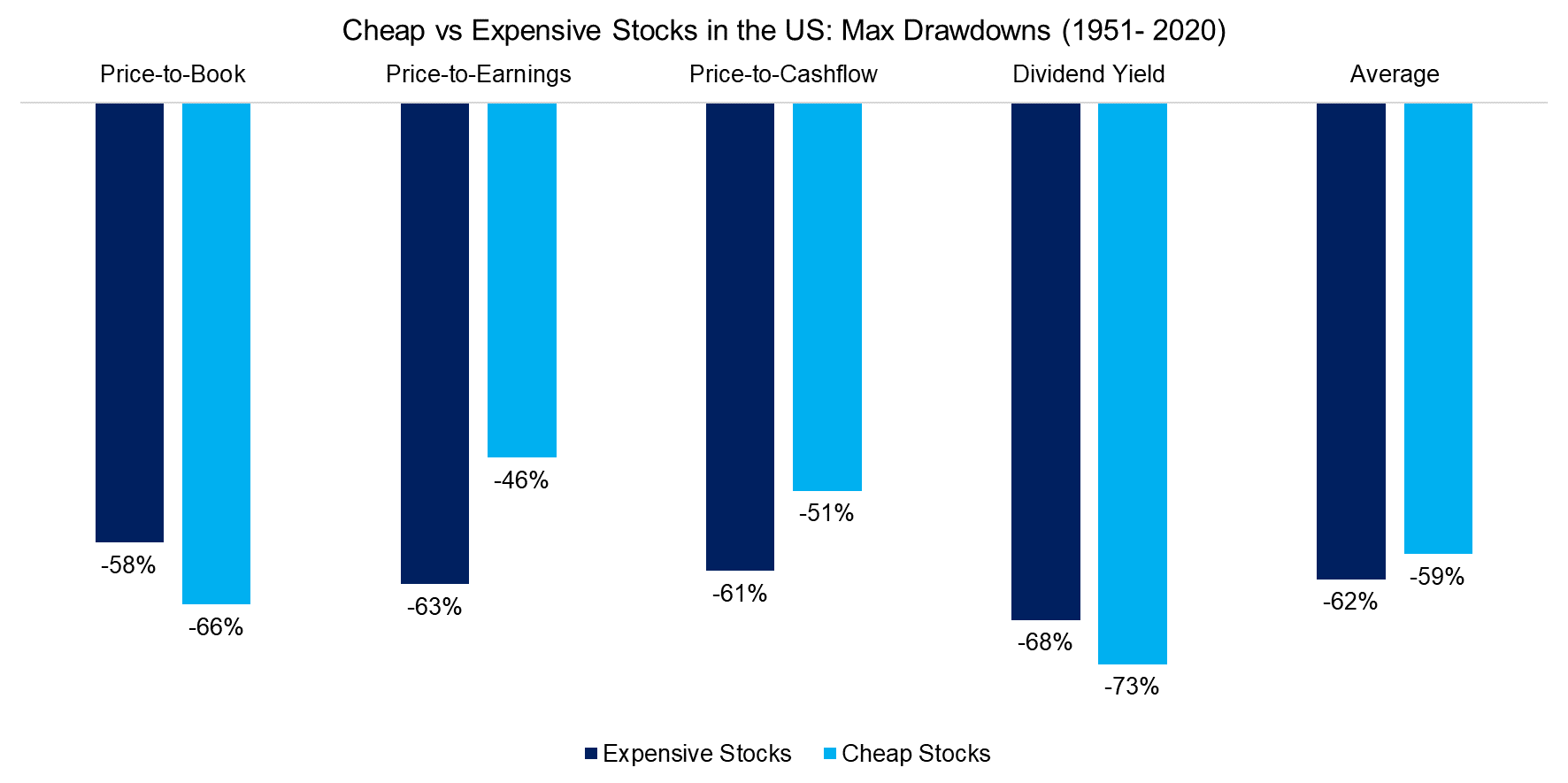

Finally, we calculate the maximum drawdowns over the approximately last 70 years, which highlights that cheap stocks experienced lower drawdowns than expensive stocks on average. It is worth highlighting that the maximum drawdown of the US stock market was 46%, which implies expensive stocks were considerably riskier than stocks in general, regardless of which Value metric was used in stock selection.

Given that cheap stocks generated high returns and had slightly lower volatility than expensive stocks, this results in higher risk-adjusted returns.

Source: Kenneth R. French Data Library, FactorResearch

FURTHER THOUGHTS

Given that cheap stocks are less risky than expensive ones, is the theory of the Value factor representing a risk premium wrong?

Not necessarily. We do know that at the average market level, cheap stocks were riskier than the entire stock market given higher volatility and larger maximum drawdowns during crisis times. Secondly, there were times before when cheap stocks significantly underperformed the stock market, e.g. during the tech bubble in 1999. An investor focused on Value investing is, therefore, hoping to be compensated for holding more risky stocks. There is a quasi-religious notion among Value investors that maintaining exposure will be rewarded with positive returns eventually.

However, we could then also argue that expensive stocks represent a different type of risk premium strategy given that they were even riskier than cheap stocks, which unfortunately creates confusion as the latter stocks underperform on average. In fact, any strategy that represents risk compared to a benchmark could be labeled a risk premium strategy, but academic research shows consistent, positive excess returns only from a handful of factors, e.g. Value or Momentum.

Based on our research efforts, we conclude that Value investors get compensated for holding extremely unpleasant stocks, which causes investors to have incorrect expectations and essentially represents a liquidity-providing strategy. In contrast, holding the most expensive stocks is usually exhilarating as these represent innovative businesses that are growing rapidly, and an activity for which investors are willing to pay a premium to participate.

RELATED RESEARCH

Improving the Odds of Value: II

REFERENCED RESEARCH

Value and Momentum from Investors’ Perspective (Merkle and Sextroh)

Value Is Not a Risk Premium (Joachim Klement)

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.