Improving the Momentum Factor

Can Momentum Be Fixed?

May 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

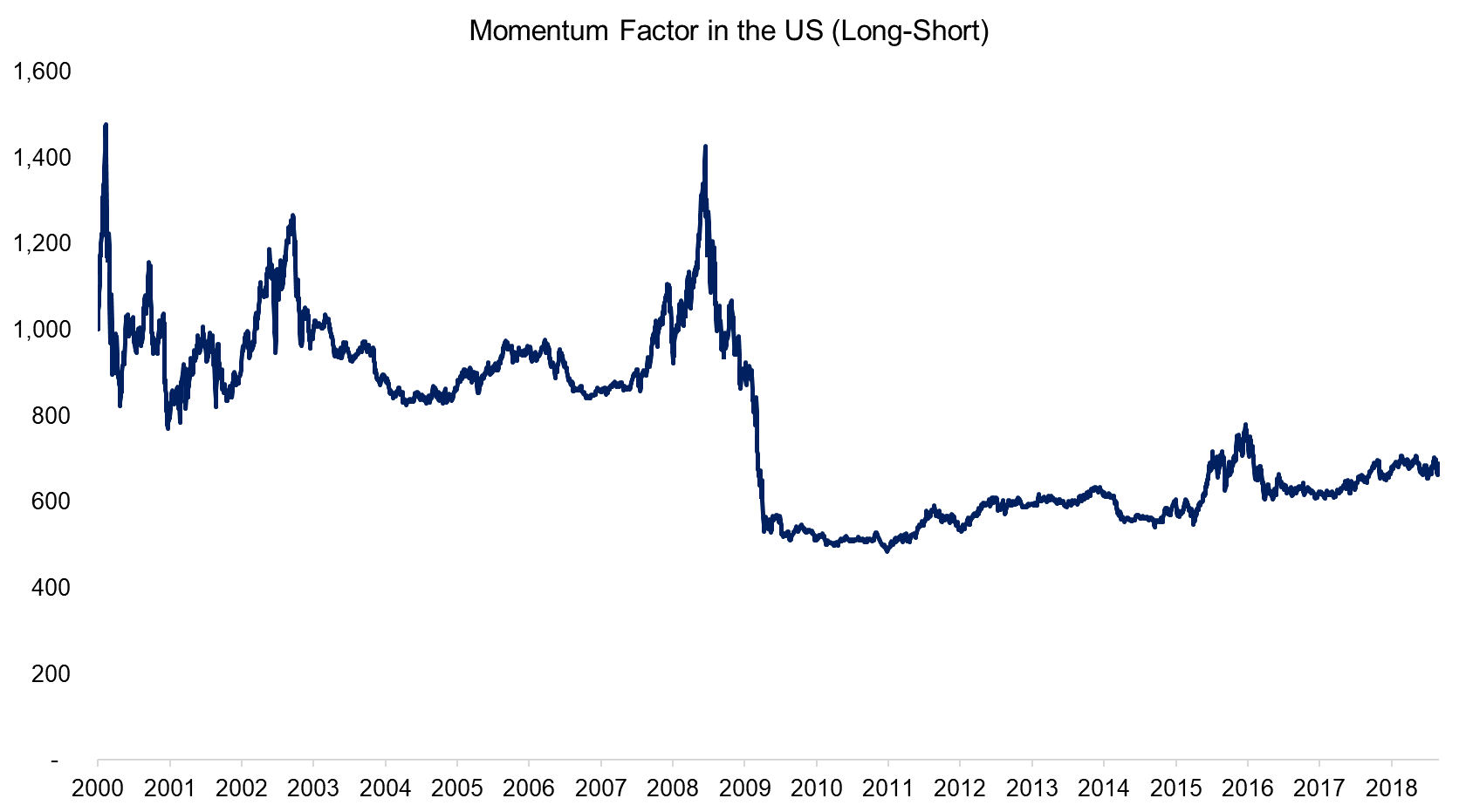

- The performance of the Momentum factor in the US has been poor since 2000

- Fundamental valuation spreads were ineffective for improving the performance

- Combinations with other factors and factor volatility filters would have yielded better results

INTRODUCTION

John H. Cochrane of the Hoover Institution at Stanford University described the ever-growing number of factors in the investment industry as the factor zoo in 2011. Taking the statement literally and assigning animals to factors is actually quite challenging. Value represents cheap stocks, but which animal is cheap?

The one factor that is likely the easiest to associate with an animal is Momentum as it is essentially represented by the chameleon. The Momentum factor buys winning and sells losing stocks, irrespective of what is driving the performance of these stocks. Like a chameleon that constantly changes its color to those of its environment, the factor portfolio adapts to the market. An alternative, perhaps less colorful perspective would be to consider Momentum as a meta-factor that mirrors the characteristics of Value, Low Volatility, or whatever factor is performing best at any given time.

Although these characteristics make Momentum attractive, the factor’s performance in the US stock market has been poor over the last two decades. The negative returns are partially explained by a severe factor-specific crash in 2009. In this short research note, we will investigate how to improve the performance of the Momentum factor in the US, or stated differently, make the chameleon great again (read Momentum Variations).

METHODOLOGY

We focus on the Momentum factor in the US stock market, which is defined as buying the winning and shorting the losing stocks. The long-short, beta-neutral portfolio is created by selecting the top and bottom 10% of stocks in the US stock market ranked by their 12-month performance, excluding the last month. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points.

MOMENTUM FACTOR IN THE US

The returns of the long-short Momentum factor since 1926 were significantly higher than those of Value or Size, based on data from the Kenneth R. French library. However, the data excludes transaction costs, which overstates returns as Momentum features a high portfolio turnover (read Equity Factors: Reducing Portfolio Turnover).

The performance of the Momentum factor over the last two decades has been disappointing, especially if we include transaction costs. There was a high level of volatility during the Tech bubble in 2000 as well as a severe crash in 2009 when stock markets recovered from the global financial crisis.

Source: FactorResearch

MOMENTUM FACTOR COMBINATIONS

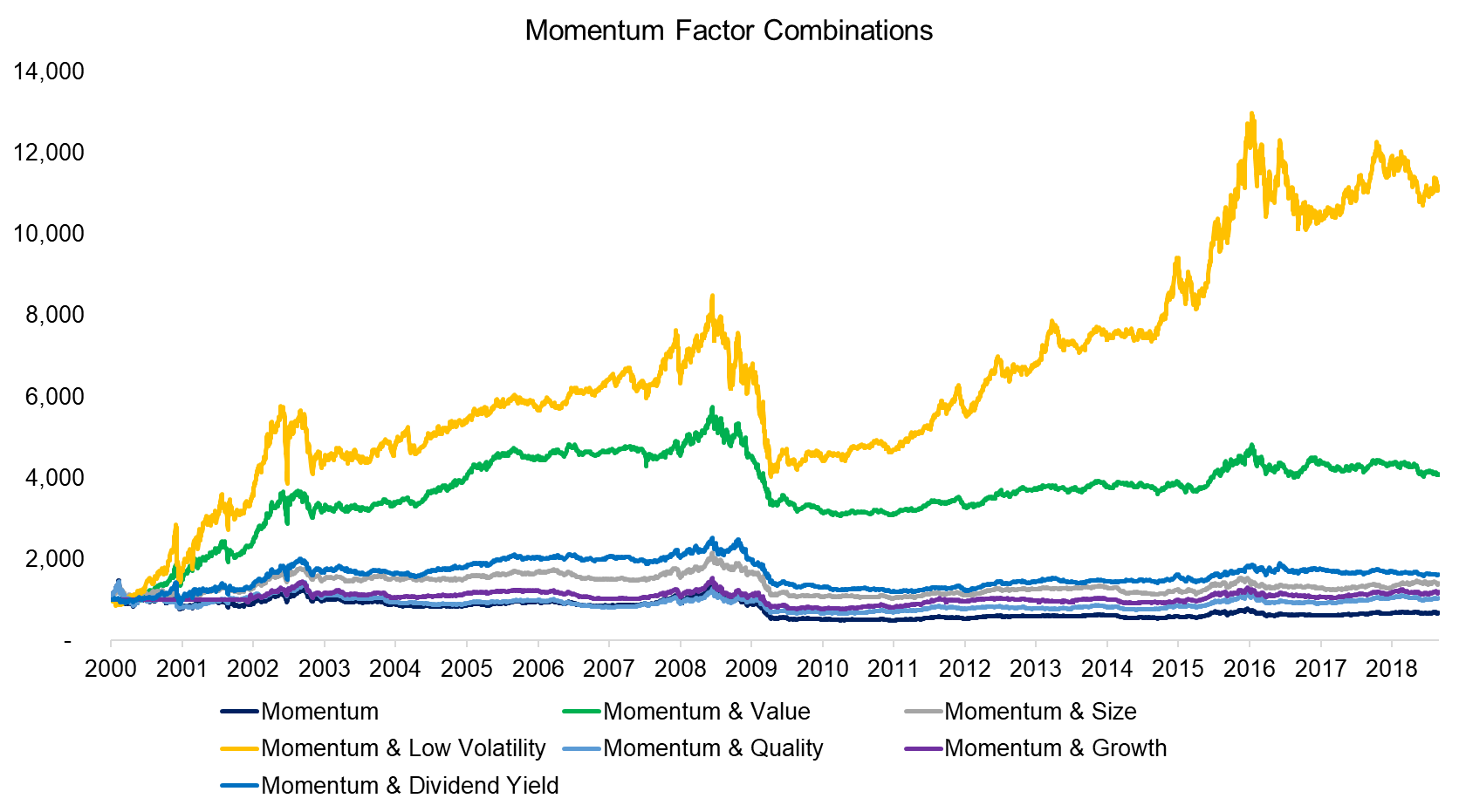

There are few free lunches in finance and diversification is one. Given this, investors may consider combining Momentum with another factor. For this purpose, we use the intersectional model, which ranks stocks by multiple metrics simultaneously, and show combinations with six other common equity factors.

We observe that all combinations led to higher returns than Momentum on a stand-alone basis, which reflects diversification benefits. The Low Volatility and Value factors improved performance most, but only partially reduced the crash in 2009.

Value and Momentum are frequently combined, backed by reasonable arguments. Buying cheap stocks that are performing strongly might indicate corporate turnarounds and helps to avoid value traps. Inversely, buying stocks that have performed well, but are priced reasonably, aids to bypass highly speculative companies.

Similar sound arguments can be made for combining Low Volatility and Momentum, however, there is also a risk of data mining. Low Volatility was the best performing factor over the last two decades and its inclusion would have improved any kind of multi-factor portfolio.

Source: FactorResearch

FUNDAMENTAL FACTOR VALUATION

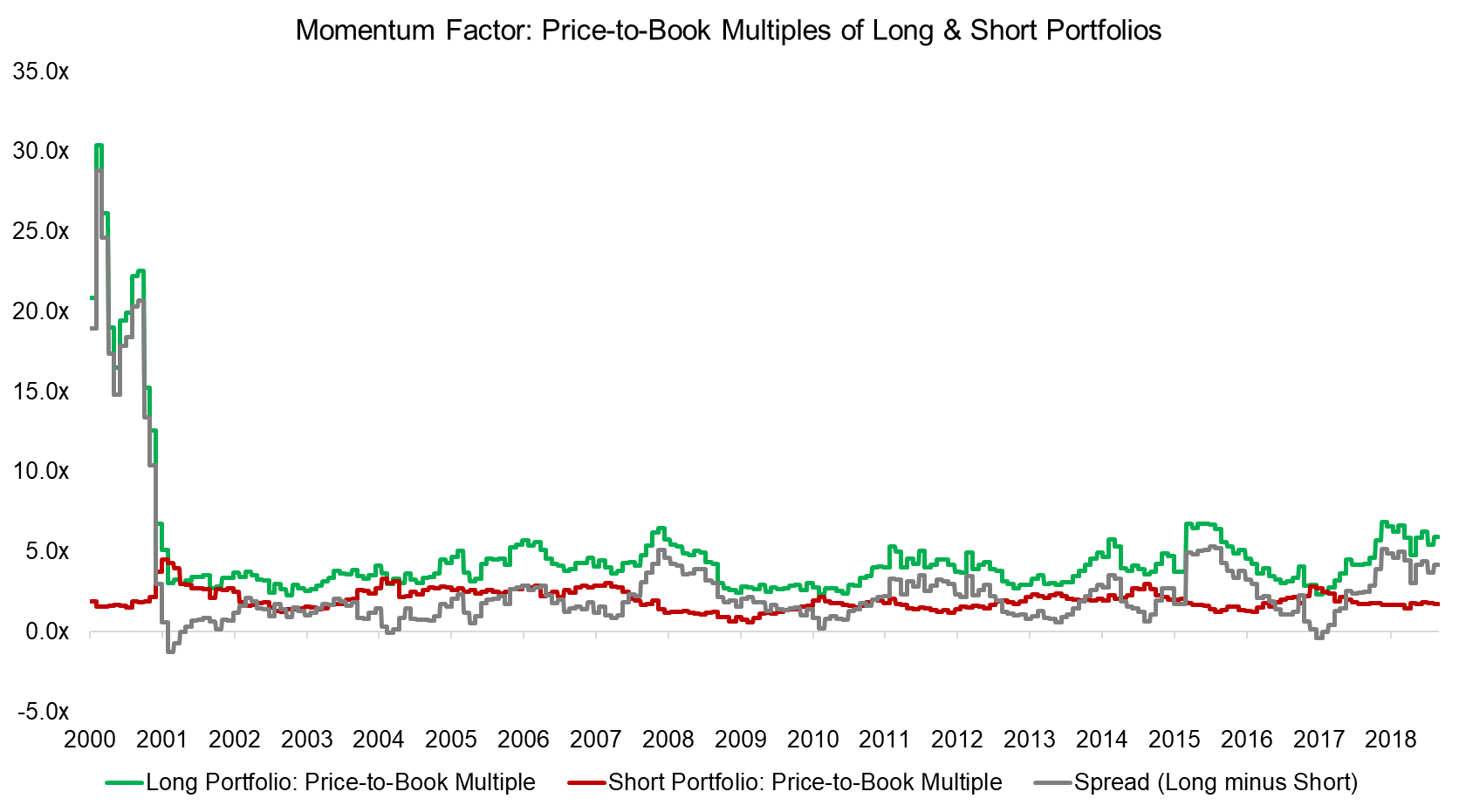

Although investors can combine Momentum with other factors, there is a risk of data mining. An alternative approach is to evaluate how expensive or cheap the Momentum factor is trading. If expensive, then investors might want to avoid exposure.

A factor is created via a long-short portfolio, which in the case of Momentum consists of the best-performing stocks on the long and worst-performing stocks on the short side. These two portfolios can be analyzed by fundamental valuation metrics like price-to-book multiples. The spread between these can be used for evaluating how expensive or cheap a factor is trading compared to its history. The more positive the spread, the more expensive.

We observe that the valuation spread was massively distorted by the tech bubble in 2000, where winning stocks traded at abnormally high price-to-book multiples. Since 2001 the spread has been less extreme with high points reached in 2008 and 2016. It is worth highlighting that the Momentum factor featured boom-and-bust cycles in both of these years.

Source: FactorResearch

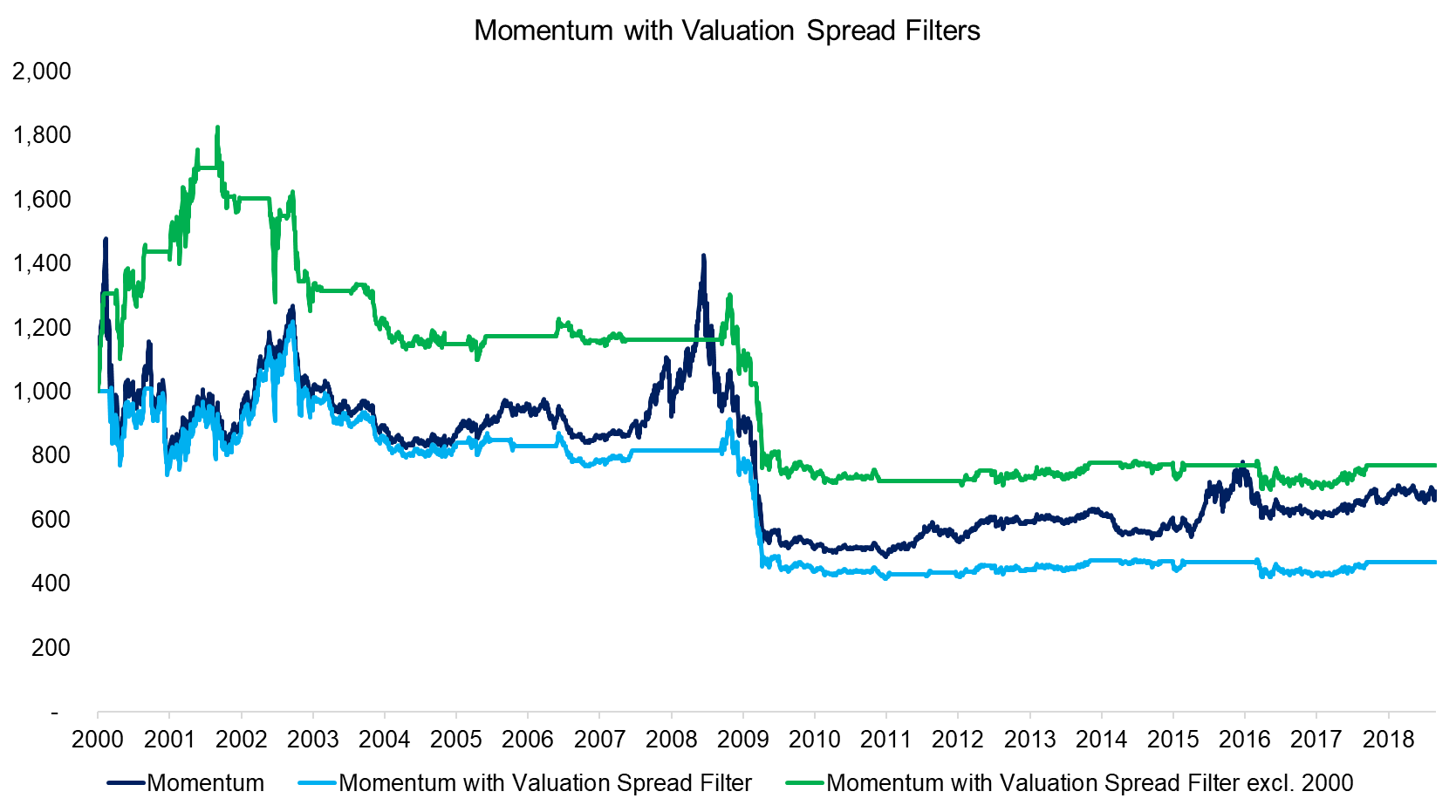

Investors might reason that if the factor is expensive, then the forward returns are unattractive, similar to evaluating single stocks on valuation multiples. We therefore create a filter that avoids exposure to the Momentum factor when the valuation spread is trading in the top quartile as measured on a rolling-forward basis to avoid any hindsight bias. Specifically, we create two filters, one from 2000 onwards and the other excluding 2000 as that might be considered an abnormal year due to the extreme valuations during the tech bubble.

We observe that applying valuation filters would not have improved the performance of the Momentum filter. There were plenty of periods with a zero allocation as the factor was trading expensive relative to its own history, but performance seems unrelated to valuation. These results are not unexpected as similar analysis for single stocks indicates only long-term relationships between valuations and forward returns.

Source: FactorResearch

FACTOR VOLATILITY FILTERS

Risk parity is a common allocation model for multi-factor portfolios, which results in lower weights for factors with high volatility and larger weights for factors with low volatility. The approach can be challenged as some factors like Value exhibit positive skewness that reflects in strong returns when volatility is high. However, the Momentum factor features negative skewness and higher volatility is likely to reflect in less attractive returns.

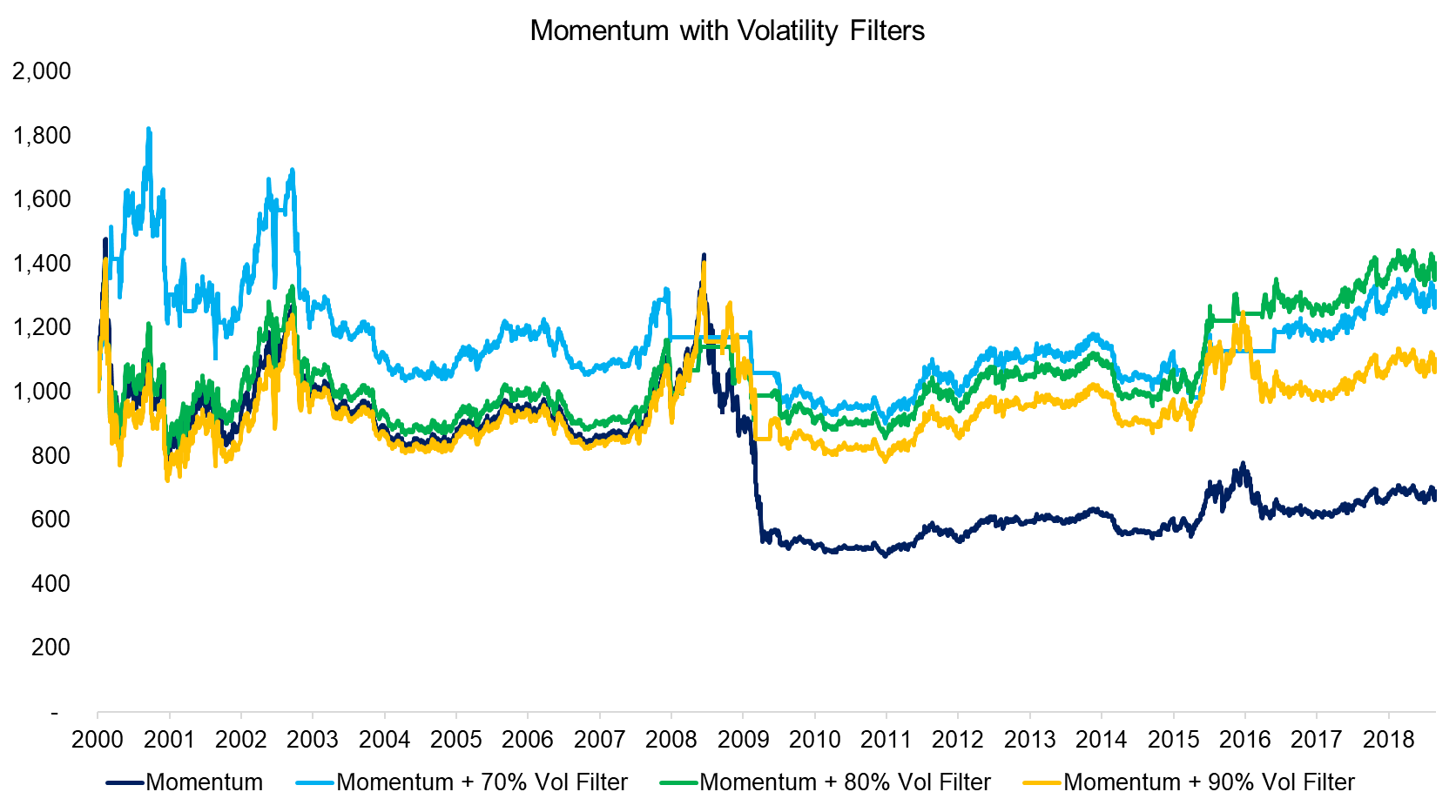

We create filters for reducing the allocation to the Momentum factor to zero at three different levels of factor volatility, which is measured on a rolling-forward basis to avoid any hindsight bias. We observe that the volatility filters would have improved the performance of the Momentum factor over the last two decades, which is partially explained by significantly reducing the crash in 2009. Furthermore, the drawdown in 2016 was also reduced, when the factor experienced a minor boom-and-bust cycle.

Source: FactorResearch

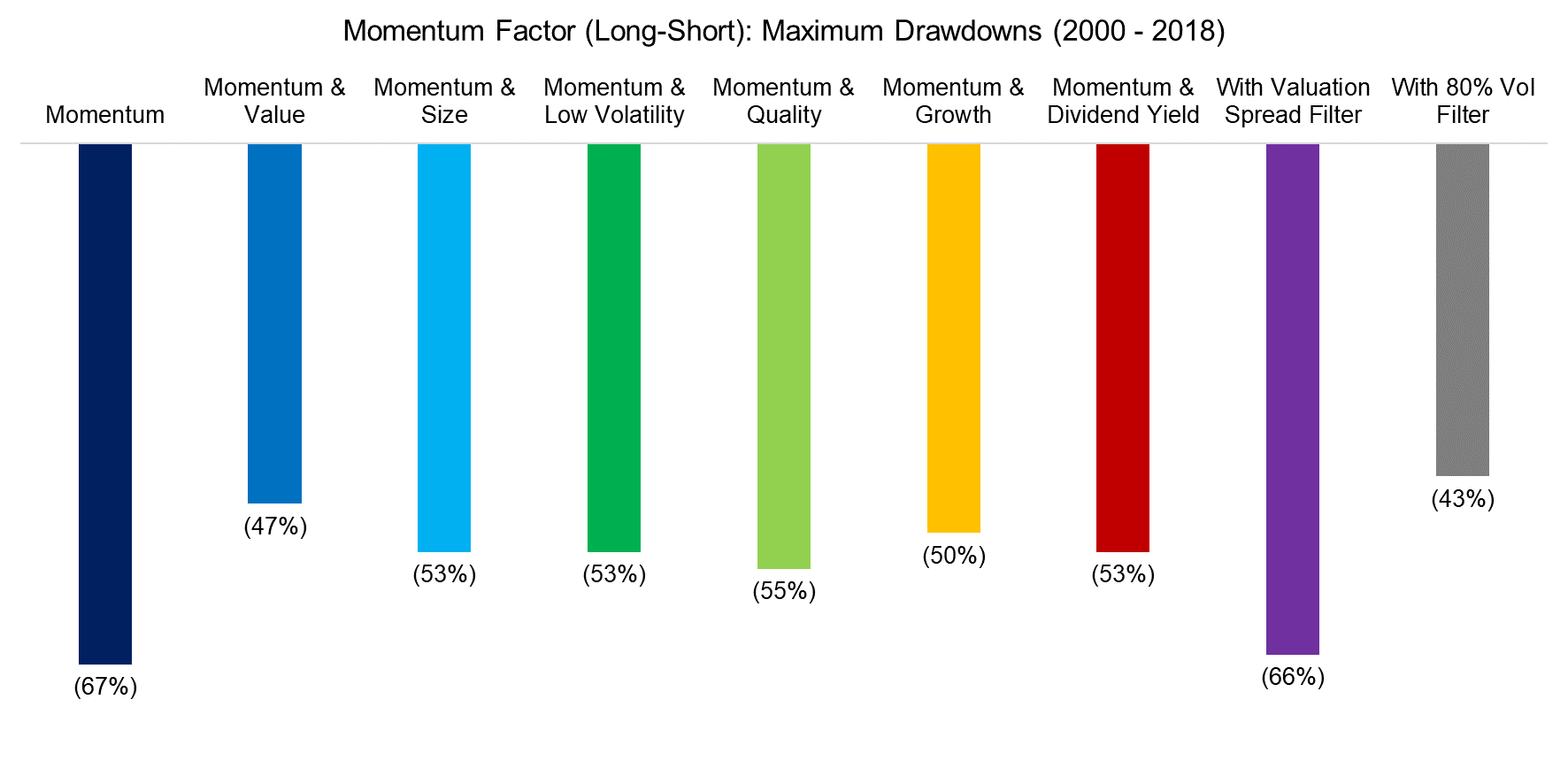

REDUCING THE MOMENTUM CRASH

Finally, we compare the maximum drawdowns reached in the last two decades and observe that diversification and volatility filters were most effective. It is interesting to note that although the combination of Momentum and Low Volatility generated the highest returns, it did not reduce the maximum drawdown more than other factor combinations. In contrast, combining Momentum and Value reduced the drawdown significantly, perhaps reflecting the low or negative correlation between these two factors.

Source: FactorResearch

FURTHER THOUGHTS

The Momentum factor has two issues: a recent lack of performance and an image problem. We highlight that the performance of Momentum can be improved by combining it with other factors or implementing a volatility filter. However, despite highly attractive long-term returns, investors have allocated magnitudes more capital to Value than to Momentum strategies. Partially this is explained by the simplicity of Momentum, which seems unappealing to many sophisticated investors. Naturally better performance would also lead to higher allocations, so these two issues are somewhat circular.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.