Inflation-Themed ETFs: As Complicated as Inflation

Good proxies for inflation?

November 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Given the importance of inflation as a topic, there are surprisingly few inflation-themed ETFs

- The few available pursue differentiated strategies that result in heterogeneous portfolios

- The correlation of these ETFs to inflation has been relatively low

INTRODUCTION

Creating an investment framework is challenging as investing is complex and complicated. We need to educate ourselves about various wildly different asset classes and strategies, deal with frequently conflicting and contradictory financial and economic research, differentiate between theory and practical implementation, and carefully consider the emotional aspects that affect our buying and selling decisions.

As if that was not already difficult enough, theoretically, the objective of each investor should be to generate positive real returns, which adds an additional layer of complexity given that we need to account for inflation.

Over the last two decades, inflation was relatively low in the US and Europe and therefore has been mostly ignored by investors. However, in 2021 inflation reached levels unknown to the majority of investors active in financial markets today, e.g. consumer prices in the US rose 6.2% in October, which represents the steepest increase since 1990.

Given the popularity of ETFs, it is interesting to peruse the available options. However, somewhat disappointingly, there are only five inflation-themed ETFs in the US, ignoring ones that provide simple exposure to Treasury Inflation-Protected Securities (TIPS).

In this research note, we will explore these five inflation-themed ETFs (read Building an Inflation Portfolio Using Stocks).

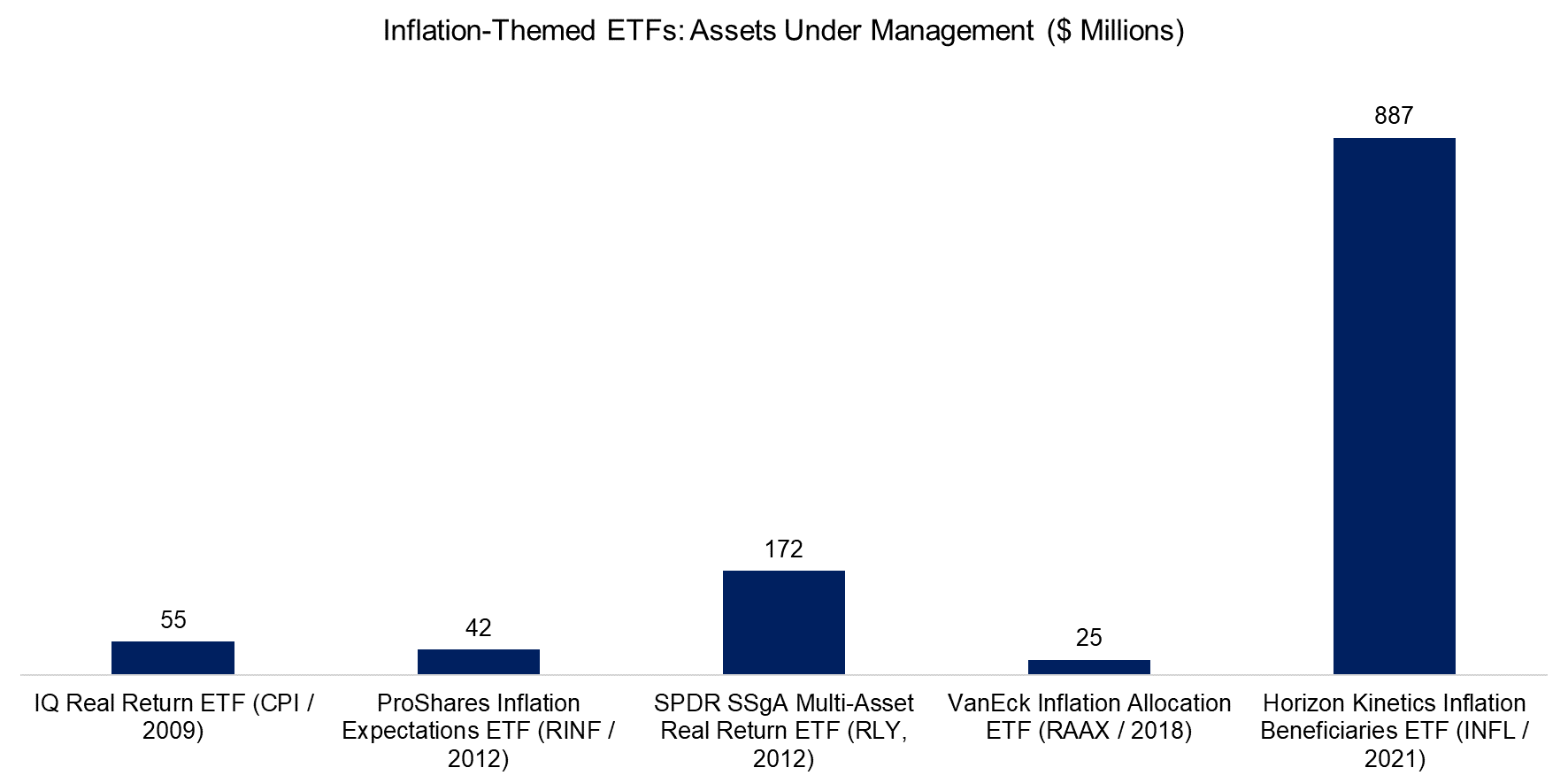

ASSETS UNDER MANAGEMENT

Searching for ETFs in the US that are focused on inflation results in only five products. The cumulative assets under management are only slightly more than $1 billion, which is surprisingly low given that inflation affects the portfolio of every investor. In comparison, TIPS ETFs manage almost $100 billion in assets.

Furthermore, almost all the assets can be contributed to the Horizon Kinetics Inflation Beneficiaries ETF (INFL) that was launched in 2021, so the assets in the decade before that were almost negligible. Perhaps investors did not care much about inflation before 2021, prefer to use other products like commodity or TIPS ETFs to hedge against inflation, or struggle with the strategies of these inflation-themed ETFs.

Source: FactorResearch

TOTAL EXPENSE RATIOS

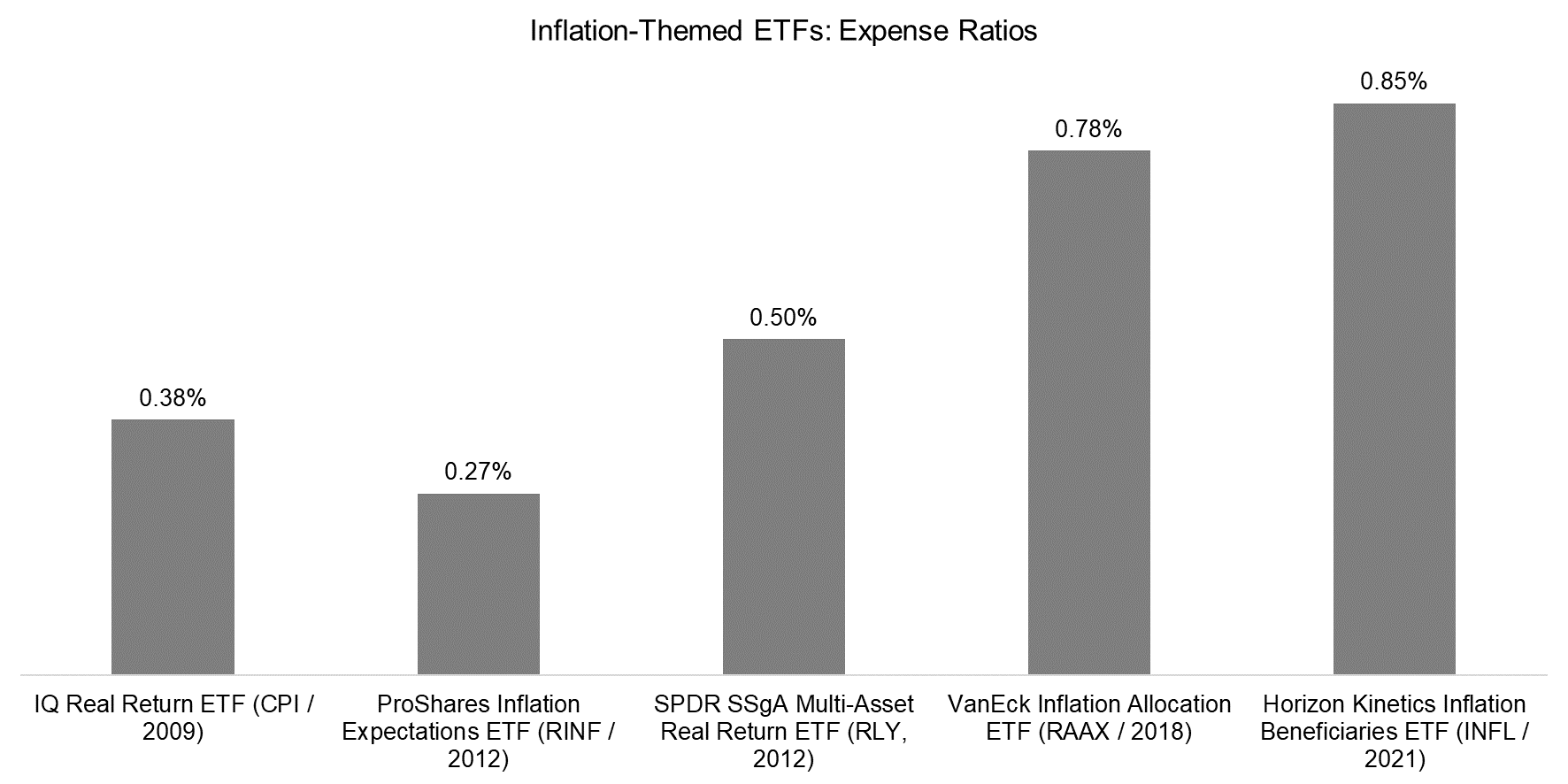

In the world of ETFs, the cheapest product often gathers the most assets, which explains the success of companies like Blackrock or Vanguard. However, this is slightly different in the world of thematic investing, where asset managers can charge higher fees for products with more sophisticated security selection processes and asset allocation schemes.

And indeed, Horizon Kinetics, the asset manager of INFL, has attracted the most assets while charging the highest fees with 85 basis points. It seems that ETF investors are willing to pay high fees for the right product.

Source: FactorResearch

PERFORMANCE

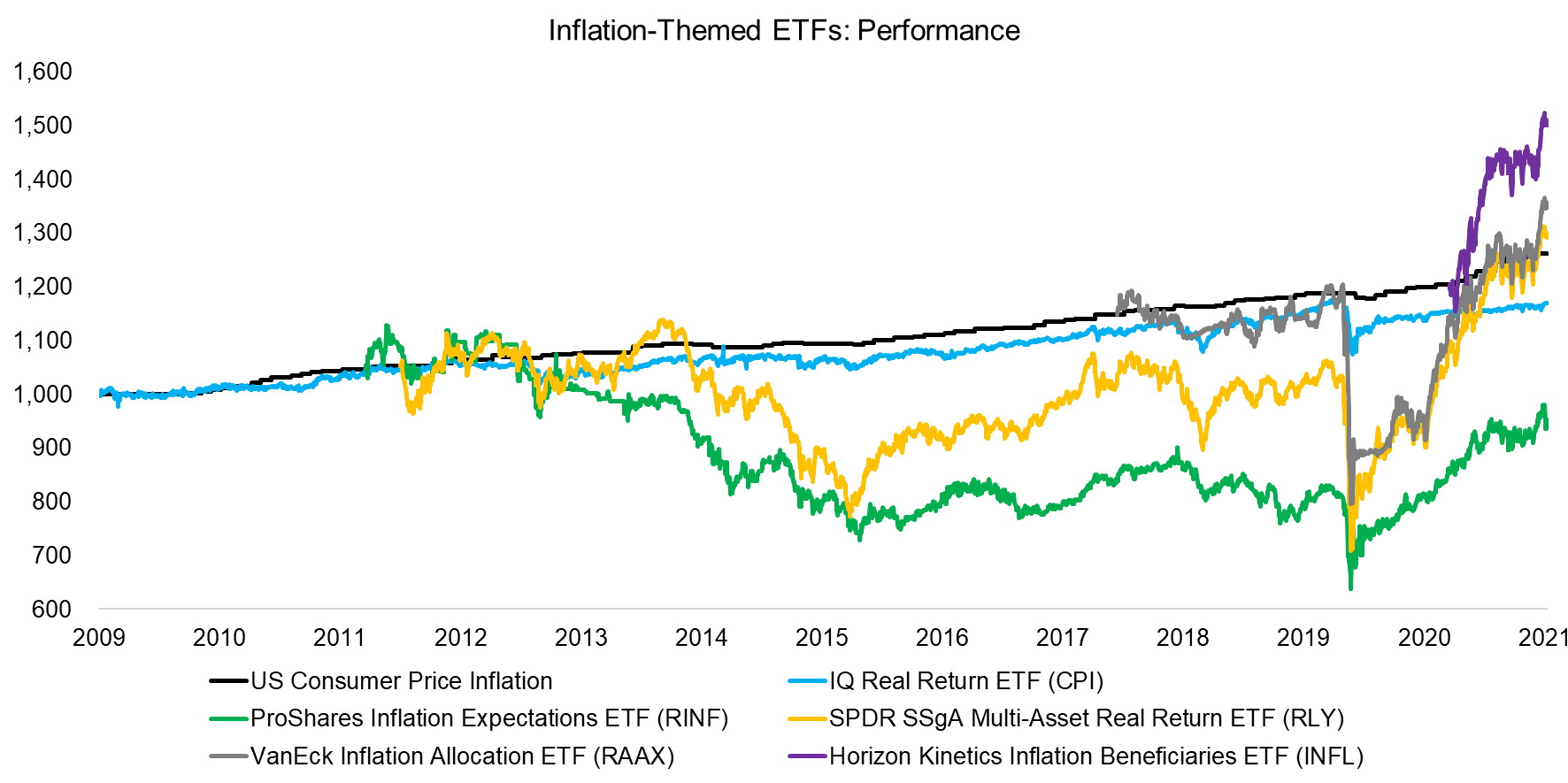

Next, we analyze the performance of these five ETFs and contrast these with the consumer price inflation in the US. We observe differentiated performance that can be attributed to heterogeneous strategies:

- IQ Real Return ETF (CPI): Aims to achieve a positive real return, i.e. returns above inflation. The product was launched in 2009, but has been unable to meet its objective as the return was slightly below the changes in the US consumer price index.

- ProShares Inflation Expectations ETF (RINF): This product aims to replicate inflation expectations, which were rather subdued since the launch in 2011, with the exception of 2020 and 2021, where inflation expectations have been rising.

- SPDR SSgA Multi-Asset Real Return ETF (RLY): Aims to achieve real returns, but has generated negative real returns in most years since its launch in 2012.

- VanEck Inflation Allocation ETF (RAAX): Aims to achieve real returns and has been much more volatile than the changes in the US consumer price index.

- Horizon Kinetics Inflation Beneficiaries ETF (INFL): Aims to achieve real returns and exhibited high volatility.

The most interesting aspect of analyzing the performance is that all products experienced drawdowns during the COVID-19 crisis, which hints at the exposures within the portfolios. US consumer prices declined during that period, but only by approximately 1%, compared to drawdowns of -5% for CPI, -9% for RINF, -21% for RLY, and -22% for RAAX. INFL was not launched yet.

Source: FactorResearch

BREAKDOWN BY ASSETS

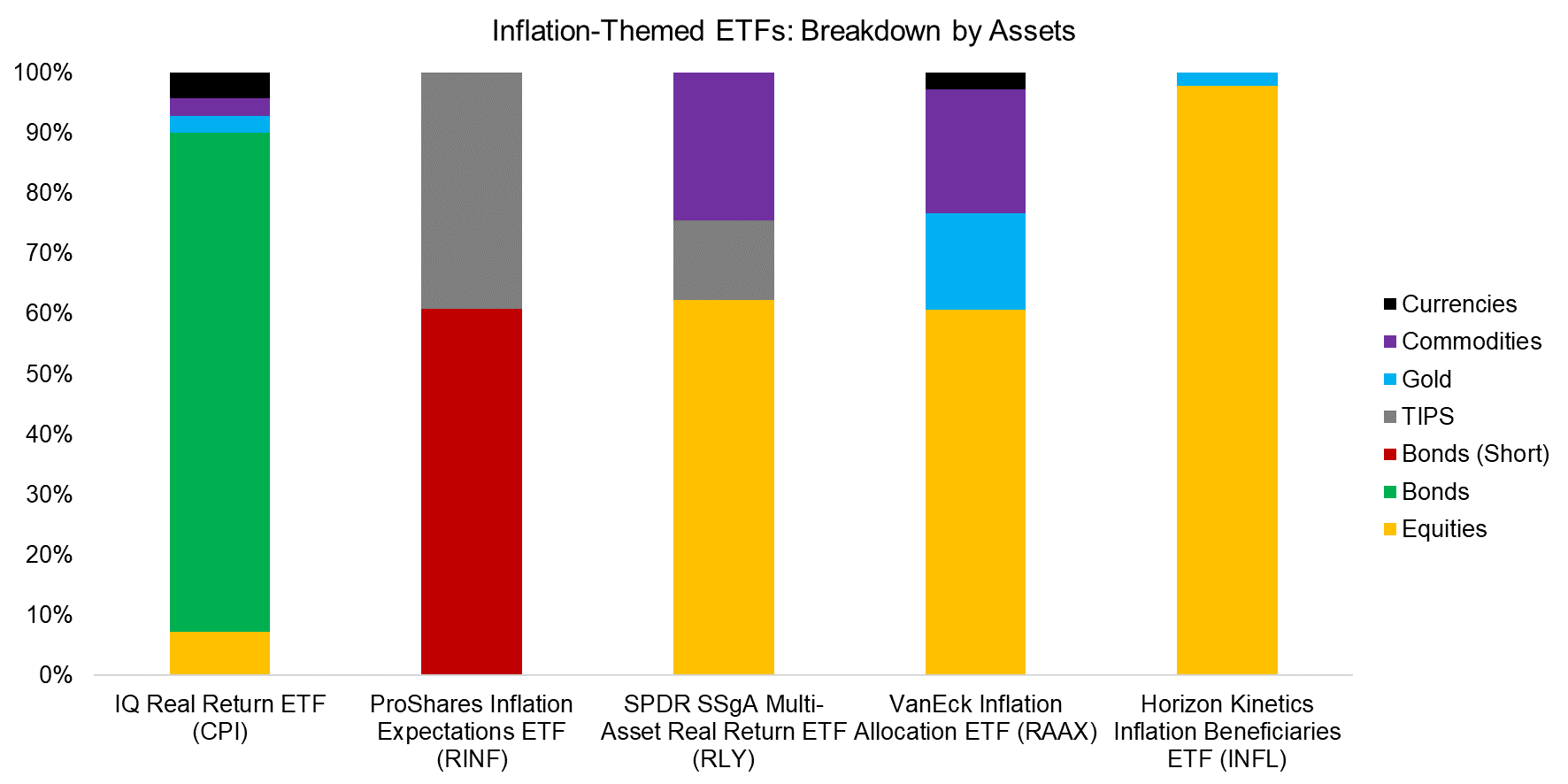

The heterogeneous performance is explained by different strategies that result in differentiated portfolios (read Building an Inflation Portfolio Using Asset Classes).

- CPI is largely a play on short-term US government bonds with a dash of commodities (oil), currencies (JPY), gold, and equities.

- RINF is a completely different animal and allocates to TIPS while shorting US Treasuries, in order to isolate inflation expectations.

- RLY invests primarily into equities (energy, real estate, materials), but also commodities and TIPS.

- RAAX has a similar asset allocation to RLY, but excludes TIPs, and has exposure to gold (directly and via gold miners) and even has a minor Bitcoin allocation.

- INFL focuses almost exclusively on stocks, specifically on companies they believe are inflation beneficiaries like stock exchanges, energy, and material companies.

Source: FactorResearch

CORRELATION TO INFLATION

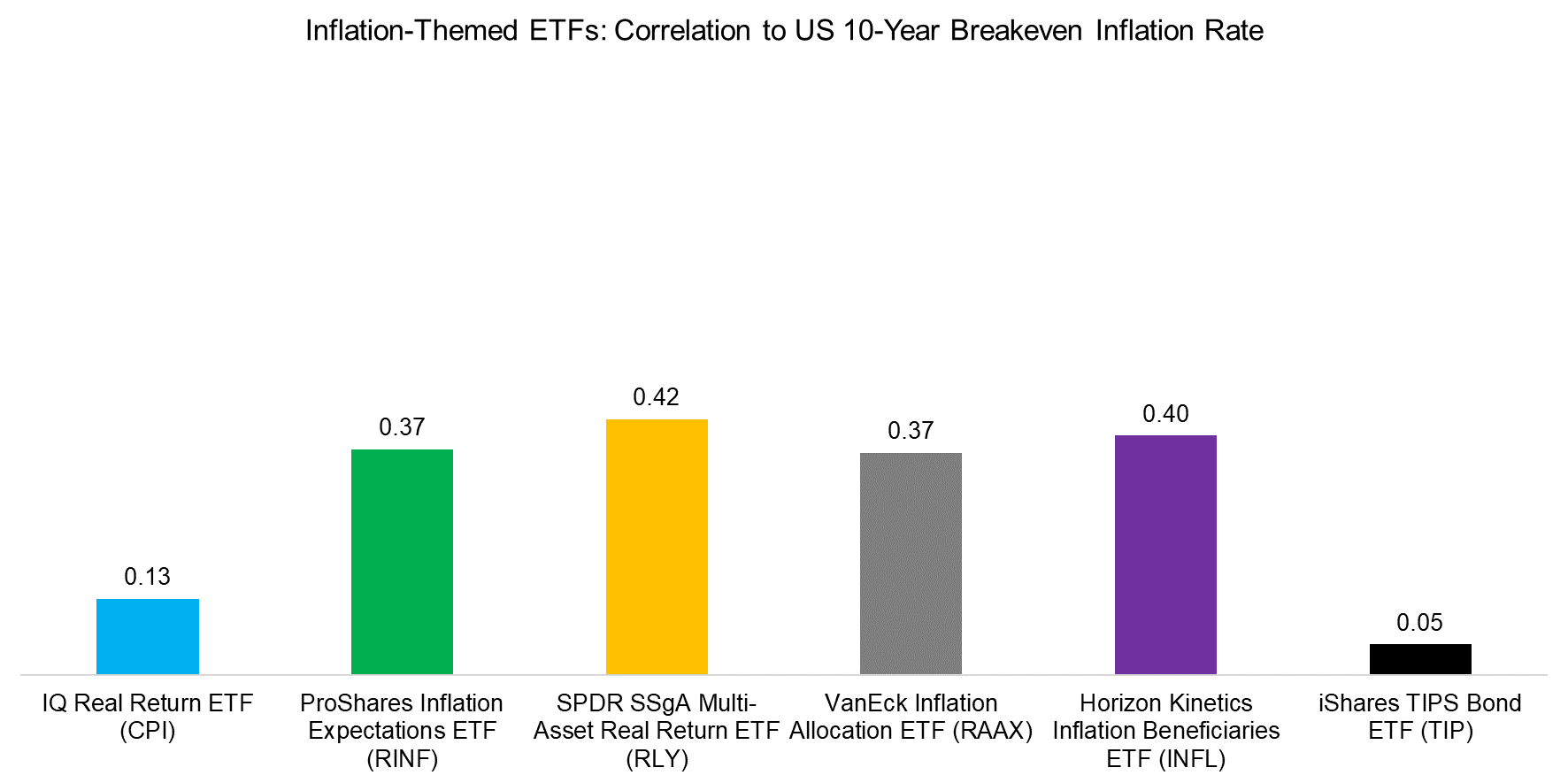

Although we refer to these five products as inflation-themed, they do not target to offer the actual inflation rate, but a return above that, or exposure to companies that should benefit from inflation. Given this, we observe low correlations of the ETFs to the US 10-Year breakeven inflation rate, which is a measure of the expected inflation and the only time series with daily data.

Treasury Inflation-Protected Securities (TIPS) are typically considered as providing direct exposure to inflation, but the correlation to expected inflation is even lower, which can be attributed to the time lag in the coupon calculation when adjusting for inflation.

Source: FactorResearch

FURTHER THOUGHTS

According to a recent survey by Natixis, global retail investors expect to earn 14.5% per annum on their portfolios, compared to 5.3% for more conservative professional money managers. These represent return expectations above inflation, ie real returns. Four of the ETFs from this analysis target positive real returns, but have largely failed to keep up with inflation, which was only about 2% per annum in the US in the recent decade.

Investors will likely struggle with higher levels of inflation as that represents a new market environment for most investors active today. The majority of portfolios are ill-equipped for high inflation and entire asset classes will become less attractive, eg low-yielding fixed income positions turn from assets into liabilities from a real return perspective.

However, given the limited number of inflation-themed products, this also represents an opportunity for asset managers to launch more innovative products that support investors aiming to preserve their wealth.

RELATED RESEARCH

Myth-Busting: Equities are an Inflation-Hedge

Myth-Busting: Money Printing Must Create Inflation

REFERENCED RESEARCH

Natixis Investor Survey 2021

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.